1. Introduction

The internet has promoted a huge development in productivity and deeply changed the way people live and produce. The emergence of Internet finance and traditional finance both promote and provide numerous investment opportunities. Digital currencies have also begun to show up, including virtual currencies such as Amazoncoin, FacebookCredits, and cryptocurrencies like Bitcoin and Libra. This paper is aimed at providing insightful knowledge and a summary of cryptocurrencies. It uses the qualitative research method to collect data in the form of images and words and summarizes and compares the differences between cryptocurrencies and central bank digital currencies and their current regulatory conditions. It also compares the different national central bank digital currencies. The paper illustrates the risks they are facing today and summarizes the status quo of their development. Through these generalizations and deductions, some good policy suggestions are provided to CBDC and its future development is clearly forecasted.

2. Private Digital Currency

Private digital currency is designed and issued by market institutions or individuals, but it is not represented by central bank debt and is not legal tender. It mainly includes cryptocurrencies such as Bitcoin, Ethereum, and Libera. Cryptocurrency is an electronic cash system, and it can facilitate transfers between users without a central repository or financial intermediary. They are unregulated by any government [1]. It is empowered by blockchain technology and the transaction records are irreversible, with tons of information and also recorded in blocks. As of 2022, there are more than 2000 cryptocurrencies in existence, with a total market capitalization of $983.72 billion. (CoinMarketCap). Moreover, the price of cryptocurrencies has been volatile, which would cause rampant investment speculation and instability in the financial market.

2.1. Key Features of Global Private Cryptocurrency

Because cryptocurrency is a means of exchange and value issued by private institutions and is not legal tender, there are some specific features for them in order to differentiate it. First of all, decentralization reduces costs and improves efficiency. It performs bookkeeping in the form of a blockchain and verifies transaction signatures according to keys, both private and public. This form can eliminate the need for intermediaries and reduce the cost of transactions, which can improve the efficiency of transactions. Secondly, the reliability brought by the consensus algorithm Finally, encryption algorithms provide security. The features of cryptocurrency are decentralized and anonymous without national sovereign credit endorsement. The value of cryptocurrency fluctuated largely. People can use cryptocurrencies to send and receive money on their digital devices, and the transaction costs are lower than traditional methods. The barriers of entry are low, and the transfer is securer and faster [2]. Bitcoin is one of the most famous cryptocurrencies in the world. It was launched in 2009, and it is created and traded using blockchain technology, which is a distributed ledger and a shared database in order to save large amounts of data. Bitcoin technology ensures that online transactions are secure, efficient, and free of third-party interference [3]. Ethereum was first proposed in 2014, and it became the second-largest cryptocurrency by market value. It can be used to create and secure digital technology by anyone, and it is a programmable network with many applications. Both Bitcoin and Ethereum are open-source projects, and they are not operated by a single individual. However, they have different abilities to construct and execute smart contracts. Ethereum is known as the world's first programmable blockchain, but the Bitcoin blockchain was created to support the Bitcoin cryptocurrency only. Stablecoins are cryptocurrencies that are tied to reserve assets like commodities and currency. Libra was created by Facebook and it is a stablecoin, which means it is backed by a basket of assets, including government debt securities and major currencies. Tether was born in 2014, and it became a vital attempt by the private sector to address the high volatility of Bitcoin. Tether became the most popular stablecoin with the largest market share; it is pegged 1:1 with the dollar and it is totally backed by Tether’s reserves.

Table 1:Difference between private digital currencies.

Libra | Bitcoin | Tether | |

Underlying technology | Blockchain( Alliance chain) | Blockchain( public chain) | Blockchain (public chain) |

Governance structure | The Libra Association is governed collectively by its members(currently 28 members, and expected to increase to 100 in the future) They are also technically governed “nodes” | The entire system governs itseld (each Bitcoin holder is technically a governance “node” | Tether Limited is absolutely central to the issuance process and is also responsible for the management of reserve assets |

Support of asset | 1:1 anchors Basket of currencies | NONE | 1:1 anchors the dollar |

Delivery system | Double layer Libra Association issues coins, dealers buy and sell from the association, and Libera Association makes and sells | Single layer Developer mining | Single layer Issued by Tether Limited, customers buy coins directly from them, and Tether Limited creates and sell coins of 1:1 equivalent value according to customer demand |

Circulation system | Dealers sell and redeem to users | Transaction between holders | Transaction between holders Exchange other digital currencies for Tether |

Main purpose | Payment and cross-border payment It may have aaset preservation function | Speculation Illegal purpose (dark web black market, hidden assets) Payment, cross-border payment (rare scenario) | Digital currency realization Payment, cross-border payment Means of hedging risks in digital currency volatility |

Electronic money refers to a monetary system that replaces cash transactions with electronic bookkeeping such as Apple Pay, Paypal, and Google Pay. Digital currencies are like cyber cash, which can be owned and spent using electronic wallets. A virtual currency is a currency that can be used to purchase goods and services in a virtual space. It functions as a medium of exchange and a unit of account. It is controlled by its creators and accepted by a specific virtual community, and it is not issued by banks. As a result, virtual currencies can be easily influenced by price swings due to a lack of regulation.

1.1. Regulatory Attitudes toward Cryptocurrency in Different Countries

Countries have different attitudes towards the regulation of cryptocurrencies. Financial stability might be threatened due to the decentralized nature of private cryptocurrencies, which might cause the cautious attitude of regulators in various countries. Some countries tend to set up relevant laws and regulations, and some countries strictly prohibit the development of cryptocurrency domestically, but some countries hold positive attitudes towards it. To be more specific, China and Russia regard private digital currency as virtual goods with strict regulation. For example, China treats Bitcoin as a commodity and investment good, but some other countries, such as the United States and Russia, treat Bitcoin as currency.

America and the United Kingdom regard private digital currency as non-legal digital currencies, allowing issuance and transactions. Japan and Germany trade private digital currency as a legal means of payment and positively support its development. The Financial Services Agency officially issued operating licenses to 11 digital currency operating institutions and built regulations for digital currency dealers. ([4] Korea enacted the law to define cryptocurrency as virtual asset service providers and trading platforms require business licenses in order to operate in South Korea.

3. Central Bank Digital Currency (CBDC)

A CBDC is a digital form of central bank money that is widely available to the general public and is issued based on national credit. It is a digital currency denominated in national account units and represents the liability of the central bank. It would be the safest digital asset for the public without associated credit and liquidity risk. [5] It is a new electronic form of money that both financial institutions and the public can own in their possession. It can be used for transactions between person-to-person, person-to-business, and business-to-business, which is an improvement over cash. It can also reduce the risks of the usage of digital currencies in their current form. There are two forms of CBDC, which include retail CBDC and wholesale CBDC, according to whether they are intended for use by the public. Retail CBDC is available for public use, and it provides the public with new ways of payment in order to expand users. Wholesale CBDC must open accounts at central banks and is aimed at financial institutions, mainly used to settle large amounts of payments between banks. It uses blockchain-efficient clearing technology to improve the efficiency of the financial system, reduce costs and liquidity risks, and enhance security.

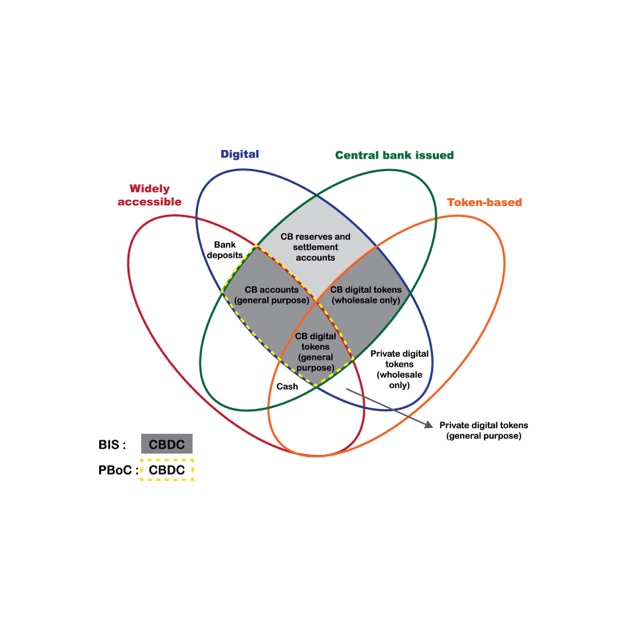

Below shows the taxonomy of money named the money flower in the form of a Venn-diagram [6]. It focuses on the combination of four main properties, which include accessibility, technology, issuer, and form. There are two basic technologies of money, which refer to tokens or stored value or accounts [7]. Moreover, cash and some other digital currencies are token-based, but others are account-based, such as balances in reserve accounts and some forms of commercial bank money.

Fig. 1:The money of flower: A taxonomy of money [6].

1.2. The Functions of CBDC

First of all, CBDC can provide faster payment methods and reduce costs. It is easily accepted by the public compared to private digital currency because CBDC can reduce the cost of agents and improve the efficiency of payments. It provides people with a more convenient and cheaper means of cross-boarder payment and enhances the internationalization of domestic currency [7]. Secondly, CBDC is able to improve the transmission channel of momentary policy and also enhance its effectiveness. Also, the application of distributed accounting technology can promote the flattening of the digital currency transaction intermediary of the central bank, which can increase the liquidity of financial markets. Moreover, CBDC is beneficial for the implication of financial regulation and reduces the possibility of economic crimes because CBDS are issued centrally, which can leave transaction records through distributed accounting technology. This can conduct anti-money laundering and reduce the possibility of economic crimes with the help of big data analysis.

1.3. The Global Development of CBDC

According to the Atlantic Council, there will be 45 types of retail CBDC, 7 types of wholesale CBDC, and 52 types of mixed CBDC in the world in 2022. Nearly 80% of the world’s central banks failed to have laws or legal frameworks to issue digital currencies. However, many central banks, such as the US Federal Reserve, the European Central Bank, and the Bank of England, have made substantial progress in introducing CBDC. The Bahamas launched the Sand Dollar in 2020, becoming the first country in the world to officially launch CBDC. According to BIS, 10 countries have officially launched and operated CBDC and 15 countries are in the process of piloting. 24 countries are in the process of research and development. However, CBDC projects in 12 counties have been halted. CADcoin in Canada, RSCcoin in the UK, as well as Ubin in Singapore, are all state-led digital currencies. Besides, Jam-dex in Jamaica, E-Naira in Nigeria, Sand Dollar in the Bahamas, and Dcash in the Eastern Caribbean have already become CBDC in their countries. To conclude, countries with small economies and developing countries are more flexible in the development of CBDC, while developed countries with large economies have more slow progress in the development of CBDC.

4. Difference Between CBDC and Cryptocurrency

Because of the highly volatile nature and the value of cryptocurrencies fluctuating, financial stress is caused, which will affect the overall stability of an economy. In contrast, CBDC is controlled by a central bank and it can guarantee consumers and businesses a stable means of exchanging digital currency. The value of CBDC is based on the fiat currency of countries. Cryptocurrencies fail to have a central regulating authority and they rely on a decentralized system in order to log transactions and create new units [8]. Also, any type of investing activity or hoarding is prohibited in CBDC because it can only be used for payments and some other monetary transactions. Cryptocurrencies, on the other hand, can be used for both payment and speculation. Because CBDCs are fiat, they are more stable than cryptocurrencies. However, cryptocurrencies are private, trustless, and decentralized, so both of them have advantages for different needs. The government might use CBDCs to reduce the influence of stablecoins.

5. Future Development Trends and Policy Suggestions

For private digital currencies, there are more regulations in the financial markets, which means they would be more stable in the future. Although there are many benefits of CBDC among the public, challenges have also come with the development of CBDC. It inevitably has a certain impact on the existing payment and banking industries. Central banks need to consider using CBDC to promote equal competition and improve the overall diversity and efficiency of the industries. Moreover, central banks need to protect the personal information of their clients because CBDC cannot become totally anonymous. This would affect the reliability of CBDC. Also, CBDC requires a complete set of operational frameworks to achieve a long-term and stable operation, and it is necessary to prevent cypher threats and attacks in order to protect personal information. Also, the Multiple CBDC Bridge is a wholesale CBDC co-creation project that can deliver real-time, safer, and cheaper payments and settlements across borders.

6. Conclusion

In conclusion, private digital currencies such as cryptocurrencies are vital to the financial market because they offer desirable investment opportunities both now and in the future. Besides, payments and transactions can become faster, which can improve efficiency. The introduction of CBDC has had a significant effect on the banking system. It provides large risks because the potential economic disruption could outweigh the desired, but mostly untested benefits. At present, most countries and regions are open to the application of blockchain technology. However, it is difficult to predict the impact of the uncertainty and disruption of blockchain technology on the financial system, so guidance and regulation need to be strengthened. Countries should accumulate and adjust their regulatory strategy when facing the development of blockchain in the financial system in order to find an acceptable way to adapt to the change in the future. However, more data can be found in order to support some conclusions, and there is not enough research on the value change of each private digital currency, so this part will be studied in the future.

References

[1]. Afzal, Ayesha. “Cryptocurrencies, Blockchain and Regulation: A Review.” THE LAHORE JOURNAL OF ECONOMICS 24.1 (2019): 103–130. Web.

[2]. Understanding Central Bank Digital Currencies (CBDC) By Orla Ward Sabrina Rochemont

[3]. Kaplanov, Nikolei M. “Nerdy Money: Bitcoin, the Private Digital Currency, and the Case against Its Regulation.” SSRN Electronic Journal, 2012.

[4]. Sun, Xiaoyue, and Miaomiao Xu. Analysis of the Development Status of Global Blockchain.

[5]. “Money and Payments: The U.S.Dollar in the Age of Digital TransformationJanuary 2022.”Federalreserve.gov

[6]. Cœuré, B., Loh, J., 2018. Central Bank digital currencies 34. https://www.bis.org/cpmi/publ/d174.pdf

[7]. Ba, Shusong, et al. “The Development Status and Trend of Global Digital Currency.” https://doi.org/10.19647/j.cnki.37-1462/f.2020.11.001.

[8]. Casting Light on Central Bank Digital Currency Tommaso Mancini-Griffoli, Maria Soledad Martinez Peria, Itai Agur, Anil Ari, John Kiff, Adina Popescu, and Celine Rochon

Cite this article

Zhang,X. (2023). Studies on Current Situation of Private Digital Currency and Central Bank Digital Currency. Advances in Economics, Management and Political Sciences,8,54-59.

Data availability

The datasets used and/or analyzed during the current study will be available from the authors upon reasonable request.

Disclaimer/Publisher's Note

The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of EWA Publishing and/or the editor(s). EWA Publishing and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content.

About volume

Volume title: Proceedings of the 2nd International Conference on Business and Policy Studies

© 2024 by the author(s). Licensee EWA Publishing, Oxford, UK. This article is an open access article distributed under the terms and

conditions of the Creative Commons Attribution (CC BY) license. Authors who

publish this series agree to the following terms:

1. Authors retain copyright and grant the series right of first publication with the work simultaneously licensed under a Creative Commons

Attribution License that allows others to share the work with an acknowledgment of the work's authorship and initial publication in this

series.

2. Authors are able to enter into separate, additional contractual arrangements for the non-exclusive distribution of the series's published

version of the work (e.g., post it to an institutional repository or publish it in a book), with an acknowledgment of its initial

publication in this series.

3. Authors are permitted and encouraged to post their work online (e.g., in institutional repositories or on their website) prior to and

during the submission process, as it can lead to productive exchanges, as well as earlier and greater citation of published work (See

Open access policy for details).

References

[1]. Afzal, Ayesha. “Cryptocurrencies, Blockchain and Regulation: A Review.” THE LAHORE JOURNAL OF ECONOMICS 24.1 (2019): 103–130. Web.

[2]. Understanding Central Bank Digital Currencies (CBDC) By Orla Ward Sabrina Rochemont

[3]. Kaplanov, Nikolei M. “Nerdy Money: Bitcoin, the Private Digital Currency, and the Case against Its Regulation.” SSRN Electronic Journal, 2012.

[4]. Sun, Xiaoyue, and Miaomiao Xu. Analysis of the Development Status of Global Blockchain.

[5]. “Money and Payments: The U.S.Dollar in the Age of Digital TransformationJanuary 2022.”Federalreserve.gov

[6]. Cœuré, B., Loh, J., 2018. Central Bank digital currencies 34. https://www.bis.org/cpmi/publ/d174.pdf

[7]. Ba, Shusong, et al. “The Development Status and Trend of Global Digital Currency.” https://doi.org/10.19647/j.cnki.37-1462/f.2020.11.001.

[8]. Casting Light on Central Bank Digital Currency Tommaso Mancini-Griffoli, Maria Soledad Martinez Peria, Itai Agur, Anil Ari, John Kiff, Adina Popescu, and Celine Rochon