1. Introduction

Luckin Coffee was accused of creating fake sales and fraudulently obtaining investors’ money through a broken business model. With the admit from the coffee chain that millions of its sales have been fabricated over the past quarters, Luckin Coffee was delisted. There are various financial analyses based on Luckin Coffee’s past statements and data, but there is not much organizational structural analysis based on its failed performance. Moreover, as Luckin turned inboard in China, the revenues have grown rapidity. It is worth to compare the corporate governance between two modes. This paper first introduces the background information of Luckin Coffee’s fake sales, then analyzes its internal organizational structure and revenue, and finally analyzes the quick ratio, current ratio, and solvency ratio. By using the quantitative method, this paper mainly aims at analyzing the ratios and indicators in the financial statements. For example, the quick ratio and current ratio help state the liquidity of Luckin Coffee, and the profit margin ratio represents its profitability. Solvency ratio can best explain why it is unable to meet its long-term debt obligations. The paper would fill the blank of updating research on the changes in Luckin Coffee’s organizational chart and profitability structure in recent two years. The comparison between Luckin Coffee’s delisting and its current condition would give a hint to many of Chinese companies that are dedicated to entering the US market.

2. Organizational Structure Defects of Luckin Coffee

2.1. The Fraud Opportunity Offered by the Dual-Class Share Structure

Luckin Coffee's Dual-Class Share Structure can help start-up teams take control of the company, but because its management is mostly former executives from China Car Rental, its regulatory mechanism is useless [1][2]. A good internal control system and corporate governance structure are important cornerstones to ensure that enterprises maintain long-term competitiveness.

The structure of a company like Luckin Coffee, in which the chairman has a super right, will cause the chairman's arbitrary authority within the company, making the supervisory board useless [2][3]. Deficiencies in the company's internal control system are the "fertile ground" for financial fraud. The excessive concentration of equity caused by the Dual-Class Share Structure increases the risk of financial fraud in the enterprise.

Dual-Class Share Structure leads to excessive management power and increases the cost of oversight from outside shareholders [3]. When the marginal cost of external shareholders supervising the company is greater than the marginal benefit, the external shareholders as "rational people" tend to relax their supervisory responsibilities to the company, making the regulatory mechanism ineffective and exacerbating the problem of "insider control" [2]. One of Luckin Coffee's two independent directors has also worked for companies with financial fraud on several occasions, forcing the public to be skeptical of Luckin Coffee's performance of its duties as outside directors [4]. In addition, the irrational application of the dual shareholding structure will infringe on the rights and interests of external shareholders and minority shareholders. When management is too powerful and lacks effective external oversight, the dual-Class Share Structure becomes a tool for management to seek its own interests and deprive other shareholders of their rights. In the case of Luckin Coffee, the members of the former Shenzhou car rental management team had more than 50% of the shares and more than 70% of the voting rights, not only having an absolute right to speak among the directors, but also basically grasping the actual operating control of the company, facilitating its fraudulent behavior [2].

2.2. The Introduction of Online Sales That Might Facilitate Fraud

Under the Internet hybrid sales model, enterprises rely on the Internet and algorithm support, and use information systems as platforms to collect, collate, and apply all kinds of business data generated in business activities [5]. Therefore, compared with the traditional marketing model, this model has more stringent requirements for the information system of the enterprise. Behind the financial fraud of Luckin Coffee, the risks of this type of business model are fully shown [6]. When the defects of the enterprise information system are exploited by people with undesirable intentions, and the company's internal control system cannot effectively constrain this from happening, the counterfeiter can change the information such as commodity sales volume by artificially manipulating the background data and carry out data fraud. Vulnerabilities in information systems mask the fraud of those involved and make subsequent reviews more difficult [2].

Luckin Coffee's ordering service is all based on online. Coupled with the operability of the information system, enterprises can artificially increase sales through "interval order number", background modification of the number of orders for a single order and other behaviors. In addition to changing sales data, with the help of the Internet hybrid sales model, enterprises may also have falsified procurement, warehousing data and other misconduct [6].

3. Revenue of Luckin Coffee

As of the end of September 2019, before being shorted by Muddy Waters [8], Luckin Coffee reached 3680 stores (increased by 209%), 30.7237 million trading customers (increased by 413%), 9.3397 million monthly average trading customers (increased by 397%), and 44.2446 million monthly average product sales (increases by 470%), with the trend of rapid development, quickly emerged in the industry competition and occupied a leading edge. Both the total number of stores and the revenue per store (revenue/number of stores) showed significant growth in the second and third quarters of 2019. Generally speaking, the revenue of new stores has a period of climbing, and the revenue of single stores can still be achieved while the new stores continue to expand, indicating that the revenue growth rate of old stores is even faster.

During the same period, Starbucks' revenue per store in Asia Pacific continued to grow, with little quarterly volatility [7]. In the third quarter of 2019, Luckin announced that the single store revenue was about 42% of Starbucks. The average price of Luckin coffee was 11 yuan, and the average price of Starbucks single cup was 30 yuan, which meant that the number of cups sold by Luckin Coffee was 1.2 times higher than that of Starbucks, and in the case of considering the difference in the area of Luckin stores (average 20-60 square meters, most of which are quick pick-up stores) and Starbucks stores (average 200 square meters), Luckin's sales were too hot.

However, other financial indicators seem to contradict this surge in revenue [8]. Luckin Coffee's revenue and inventory growth in the second quarter of 2019 were nearly 90% and 21.05%, respectively. In the third quarter, revenue increased by 69.23% and total inventory decreased by 8.69%, showing a downward trend. In general, in the process of continuously expanding the size of stores and increasing the number of transactions and operating income, it is necessary to allocate a continuous increase in inventory quantity. However, Luckin Coffee slowly increased the inventory scale, and even showed a decreasing trend, which can reflect the loopholes in financial data from the side, in other words, the phenomenon of false increase in sales revenue does exist in Luckin Coffee's business activities.

4. The Liquidity of Luckin Coffee

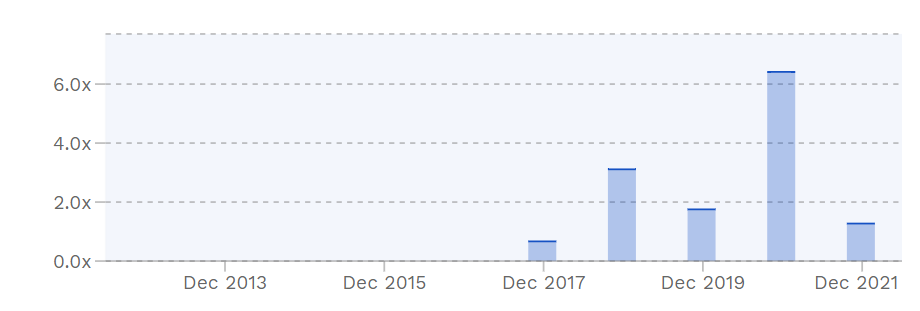

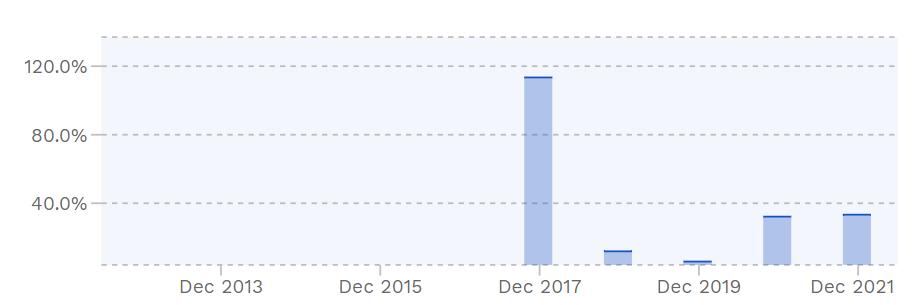

Judging from Luckin Coffee's quarterly reports before 2020, Luckin Coffee's cash reserves are relatively abundant. At the end of the third quarter of 2019, the Company had cash and equivalents of $631 million and total current assets of $889 million. The Company's short-term bank borrowings were $1.39 million, current liabilities were $210 million, and the current ratio was 4.23. Such high liquidity is one of the reactions of Luckin's inventory anomaly.

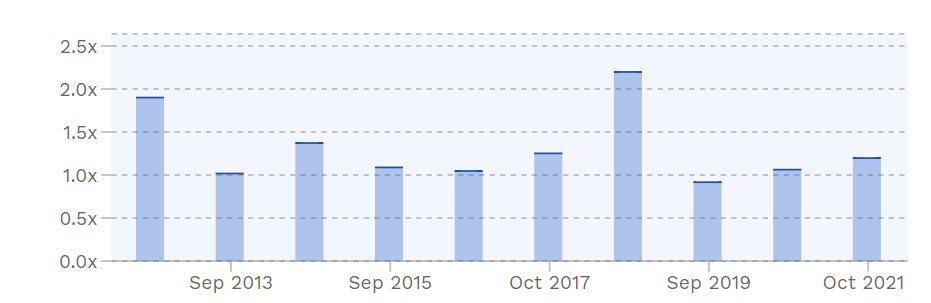

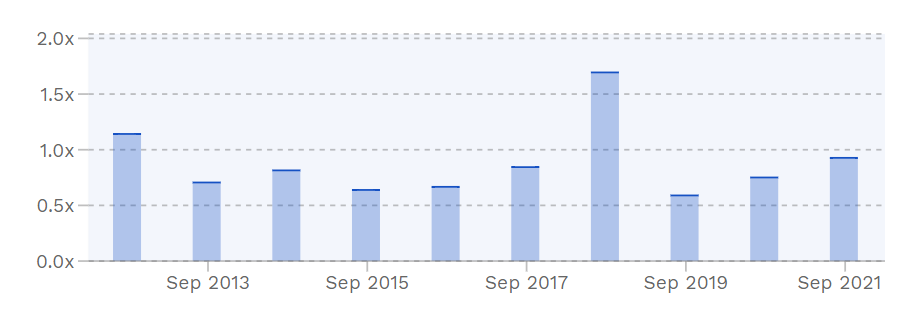

During the same period (before 2020), the Starbucks liquidity ratio fell first and then rose, showing an overall fluctuating trend. The highest current ratio was approximately 2.2 times in fiscal year 2018 and the lowest current ratio was approximately 1.05 times in fiscal year 2016. From the perspective of the quick ratio, during the reporting period, the Starbucks quick ratio took the lead in falling and then rose, showing an overall upward trend. The maximum speed ratio is about 1.95 times in fiscal year 2018 and the lowest speed ratio is about 0.9 times in fiscal year 2015.

|

|

Figure 1: Current Ratio of LKNC.Y and SBUX (Data source: finbox.com). | |

|

|

Figure 2: Quick Ratio of LKNC.Y and SBUX (Data source: finbox.com). | |

5. The Solvency of Luckin Coffee

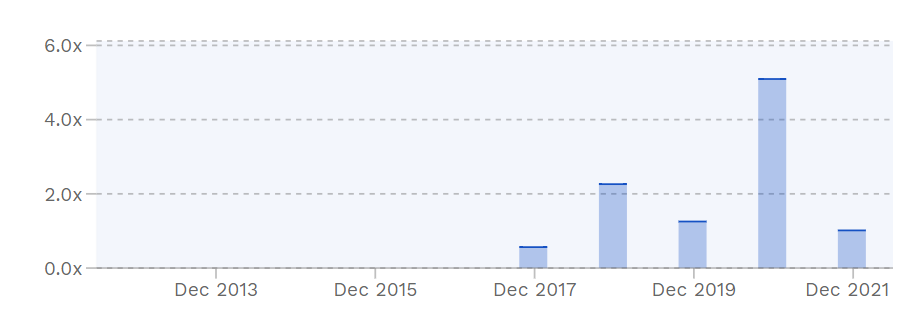

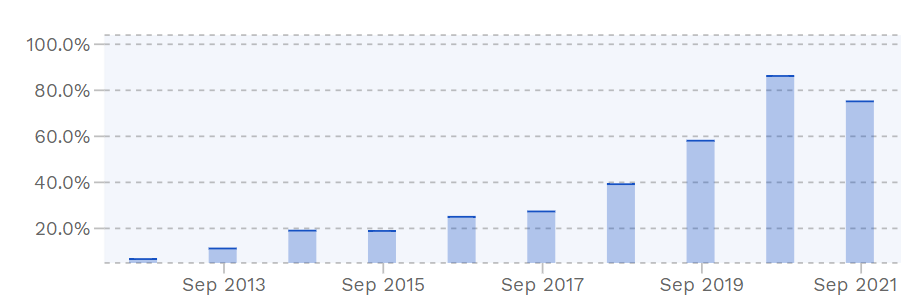

Luckin Coffee has been showing an expansionary growth trend before it was shorted, exceeding the industry average. The liquidity of the company's assets and short-term solvency have gradually increased. Luckin Coffee's asset-liability ratio in 2017 was 33%. Compared with 115% in 2018, it shows that the financial risk is relatively high. When cash flow is insufficient, the capital chain breaks. If the debt is not repaid in a timely manner, it will lead to the bankruptcy of the enterprise. As a start-up, insufficient profitability and too fragile solvency are likely to lead to the company's operations in trouble.

Compared to other global restaurant chains that also operate coffee chains and are also listed on the U.S. stock market, such as McDonald's (NYSE:MCD), which owns the coffee chain McCafé, and The International Company of Restaurant Brands (NYSE:QSR), which owns Canada's national coffee brand Tim Hortons, Starbucks' gearing ratio was at its lowest before 2017, at 62% as of 2017. As of 2018, Starbucks' gearing ratio rose to 95%. The gearing ratio soared to 132.4% in 2019, driven in part by a sudden increase in deferred revenue (Nestlé's $7 billion in royalties advances) and a significant increase in long-term liabilities [9].

|

|

Figure 3: Debt / Total Equity of LKNC.Y and SBUX (Data source: finbox.com). | |

6. The Survival of Luckin Coffee under the Impact of Covid-19

Luckin appears to be recovering from financial scandals [10]. In the first quarter of 2022, the company's performance indicators continued to grow steadily, and the total net income reached 3.2987 billion yuan, an increase of 72.4% over the same period of 2021 of 1.9 billion yuan. 615 new stores were opened, and the operating profit margin continued to improve, with same-store sales in self-operated stores increasing by 41.2%, and the profit margin at the store level of self-operated stores reaching 30.6%. The earliest Luckin Coffee adopted the direct operation model, in order to ensure the quality of products and the standardization of services. After the thunderstorm, Luckin Coffee accelerated the pace of opening up the franchise. It took 0 franchise fee and achieved revenue through the sale of drinks, machinery, and equipment. The gross profit was proportionally drawn when it reached a certain amount. Through the inquiry of Luckin's 2021 annual report, the number of franchise stores increased by 753. Operating income increased by 1.306 billion yuan, an increase of more than 3 times year-on-year. In addition, the price is also an important reason for the improvement of Luckin Coffee's profit. In December of 2021, the price of drinks in hundreds of stores was raised by 3 yuan. Its single item has increased from 9.97 yuan in the fourth quarter of 2019 to the current 15.24 yuan.

These figures stand in contrast to Starbucks' previous announcements. Last week, Starbucks, the world's largest coffee chain, handed over its fiscal third quarter results and stressed that it was plagued by the epidemic in the Chinese market. During the Period, Starbucks' net income in China decreased by 40% to US$544.5 million (approximately RMB 3.693 billion) and same-store sales decreased by 44% [11].

7. Conclusion

To conclude, the dual shareholding structure and the new retail model based on the Internet and mobile payment have facilitated Luckin Coffee's financial fraud. Luckin Coffee's management structure has natural flaws. The dual shareholding structure increases the opportunity for major shareholders to commit fraud and increases the risk of corporate financial fraud. Enterprises should construct an equity structure that meets the needs of the company's development, while ensuring the effectiveness of the design and operation of the internal control system.

The Internet hybrid sales model adopted by Luckin Coffee is based on the traditional business model, combining the application of the Internet, big data, AI analysis and other technologies. Compared with the traditional model, the Internet hybrid sales model can provide consumers with a more efficient and targeted experience. However, this model also has shortcomings, and the irrational application of new technologies and the lack of necessary constraints have facilitated the counterfeiting of enterprises.

Judging from the financial data before the storm in the past, Luckin Coffee's most likely way to falsify it is through fictitious orders and revenues, but not actually producing the goods in the order, which is roughly in line with the speculation in the Muddy Waters report [8]. One clue is the almost unchanged inventory. Only fictitious customer orders can simultaneously exaggerate the revenue of a single store, the gross profit margin, and the average daily sales volume of a single store, while the inventory data has not changed. Luckin's liquidity and solvency and other indicators are also better than Starbucks. But the basis of these financial analyses has lost its meaning because of management's fraud.

However, with the changes in management and reconciliation with creditors, Luckin Coffee appears to have resumed its escalation after the storm. Luckin Coffee still retains the potential to challenge the industry giant Starbucks in the Chinese market. In the post-COVID-19 pandemic era, Luckin Coffee seems to be recovering faster than other competitors. Whether it can become the leading brand of coffee in China still needs further observation, and the author will continue to focus on this Chinese coffee brand that has survived fraud and the pandemic in the future study.

References

[1]. Daily, I. B.: Luckin Coffee Tries To Clean House Amid New Evidence In Fraud Probe. Investor’s Business Daily (2020).

[2]. Xi, C., Huang, Y.: Are U.S.-Listed Chinese Firms a Minefield? A Board Perspective. Papers (2021). https://ssrn.com/abstract=3841843.

[3]. Peng, Z., Yang, Y., Wu, R.: The Luckin Coffee scandal and short selling attacks. Journal of Behavioral and Experimental Finance (34), 100629 (2022). https://doi.org/10.1016/j.jbef.2022.100629。

[4]. Cao, Q.: Empirical Study on Financial Fraud of Luckin Coffee. IEEE Xplore (2020). https://doi.org/10.1109/ICEMME51517.2020.00184.

[5]. Wei, S.: Analysis of Marketing Innovation Under the New Retail Mode-Taking “Luckin coffee” as an Example. E3S Web of Conferences (235), 01074 (2021). https://doi.org/10.1051/e3sconf/202123501074.

[6]. Guan, W., Lu, S.: Exploring the Causes and Countermeasures of the Disorder of Internal Control of Enterprises with Money-burning Marketing Model--Take Ruixing Coffee’s Financial Fraud as an Example. Frontiers in Economics and Management (2021). https://doi.org/DOI: 10.6981/FEM.202108_2(8).0047.

[7]. Kumar, N., Mittal, S. M., Chu, S. E.: Starbucks in China: An undisputed leader? (2020). https://cmp.smu.edu.sg/ami/article/20200603/starbucks-china-undisputed-leader.

[8]. Muddy Waters: Luckin Coffee: Fraud + Fundamentally Broken Business (2020). https://cdn.gmtresearch.com/public-ckfinder/Short-sellers/Unknown%20author/Luckin%20Coffee_Anonymous.pdf.

[9]. Reuters: Nestle to pay $7.15 billion to Starbucks to jump-start coffee business. CNBC (2018). https://www.cnbc.com/2018/05/07/nestle-to-pay-7-point-15-billion-to-starbucks-in-coffee-tie-up.html.

[10]. Gu, Z., Qi, B., Zhao, Y.: Why Luckin Coffee Survived After Its Scandal? Proceedings of the 2021 3rd International Conference on Economic Management and Cultural Industry (ICEMCI 2021). https://doi.org/10.2991/assehr.k.211209.410.

[11]. Titanium Media.: Starbucks China’s Revenue Falls 40% in Fiscal Q3_the_coffee_sales (2022). www.sohu.com. https://www.sohu.com/a/574283683_116132.

Cite this article

Zhu,Z. (2023). Solutions to Corporate Governance in Improving the Existing Business Model in Luckin Coffee. Advances in Economics, Management and Political Sciences,10,238-243.

Data availability

The datasets used and/or analyzed during the current study will be available from the authors upon reasonable request.

Disclaimer/Publisher's Note

The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of EWA Publishing and/or the editor(s). EWA Publishing and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content.

About volume

Volume title: Proceedings of the 2nd International Conference on Business and Policy Studies

© 2024 by the author(s). Licensee EWA Publishing, Oxford, UK. This article is an open access article distributed under the terms and

conditions of the Creative Commons Attribution (CC BY) license. Authors who

publish this series agree to the following terms:

1. Authors retain copyright and grant the series right of first publication with the work simultaneously licensed under a Creative Commons

Attribution License that allows others to share the work with an acknowledgment of the work's authorship and initial publication in this

series.

2. Authors are able to enter into separate, additional contractual arrangements for the non-exclusive distribution of the series's published

version of the work (e.g., post it to an institutional repository or publish it in a book), with an acknowledgment of its initial

publication in this series.

3. Authors are permitted and encouraged to post their work online (e.g., in institutional repositories or on their website) prior to and

during the submission process, as it can lead to productive exchanges, as well as earlier and greater citation of published work (See

Open access policy for details).

References

[1]. Daily, I. B.: Luckin Coffee Tries To Clean House Amid New Evidence In Fraud Probe. Investor’s Business Daily (2020).

[2]. Xi, C., Huang, Y.: Are U.S.-Listed Chinese Firms a Minefield? A Board Perspective. Papers (2021). https://ssrn.com/abstract=3841843.

[3]. Peng, Z., Yang, Y., Wu, R.: The Luckin Coffee scandal and short selling attacks. Journal of Behavioral and Experimental Finance (34), 100629 (2022). https://doi.org/10.1016/j.jbef.2022.100629。

[4]. Cao, Q.: Empirical Study on Financial Fraud of Luckin Coffee. IEEE Xplore (2020). https://doi.org/10.1109/ICEMME51517.2020.00184.

[5]. Wei, S.: Analysis of Marketing Innovation Under the New Retail Mode-Taking “Luckin coffee” as an Example. E3S Web of Conferences (235), 01074 (2021). https://doi.org/10.1051/e3sconf/202123501074.

[6]. Guan, W., Lu, S.: Exploring the Causes and Countermeasures of the Disorder of Internal Control of Enterprises with Money-burning Marketing Model--Take Ruixing Coffee’s Financial Fraud as an Example. Frontiers in Economics and Management (2021). https://doi.org/DOI: 10.6981/FEM.202108_2(8).0047.

[7]. Kumar, N., Mittal, S. M., Chu, S. E.: Starbucks in China: An undisputed leader? (2020). https://cmp.smu.edu.sg/ami/article/20200603/starbucks-china-undisputed-leader.

[8]. Muddy Waters: Luckin Coffee: Fraud + Fundamentally Broken Business (2020). https://cdn.gmtresearch.com/public-ckfinder/Short-sellers/Unknown%20author/Luckin%20Coffee_Anonymous.pdf.

[9]. Reuters: Nestle to pay $7.15 billion to Starbucks to jump-start coffee business. CNBC (2018). https://www.cnbc.com/2018/05/07/nestle-to-pay-7-point-15-billion-to-starbucks-in-coffee-tie-up.html.

[10]. Gu, Z., Qi, B., Zhao, Y.: Why Luckin Coffee Survived After Its Scandal? Proceedings of the 2021 3rd International Conference on Economic Management and Cultural Industry (ICEMCI 2021). https://doi.org/10.2991/assehr.k.211209.410.

[11]. Titanium Media.: Starbucks China’s Revenue Falls 40% in Fiscal Q3_the_coffee_sales (2022). www.sohu.com. https://www.sohu.com/a/574283683_116132.