1. Introduction

Making decisions without sophisticated information gathering and systematic analysis is a strategy known as heuristics that is unknowingly used by many people. Although it may not be optimal or perfect, it is usually sufficient to achieve the goal at hand. To draw and keep underwriting business, why do experts report more optimistic growth estimates for equity offerings? Analysts' overly optimistic future growth projections are the most evident in companies issuing both debt and equity. Why are traders often influenced by analysts? This study will mainly focus on the effect of the availability heuristic on people's behavior in economics. In this paper, we can understand why it affects investment decisions, consumers' judgments on defective products, and by examining how it affects the moral importance of topics to better comprehend the ethical judgment process. This article can also use the availability heuristic to prevent people from making irrational economic decisions. It can make people aware of the availability of inspiration and make them consciously consider the whole picture before making a decision.

2. Description of Availability Heuristic

People evaluate a group's frequency or the likelihood of an event based on how quickly examples or incidences come to thought. For instance, one may estimate the likelihood of a heart problem in middle-aged adults by thinking back on similar incidents among their friends [2]. Following the concept of heuristics, numerous research has looked into how usability affects judgment and decision-making (e.g. [3]). The availability heuristic describes how the precautionary principle functions by illuminating why certain threats are highlighted while others are disregarded. The availability heuristic also reveals a great deal about how people perceive risk differently in different groups, cultures, and even countries. [4].

3. Three Applications of Availability Heuristic in Economics

3.1. Investment Decision

The first application is in the investment decision. Two categories of economic analysts who produce measurable predictions and administrators who make investment choices studied by Lee and other colleagues for their growth forecasting behavior [5]. They saw the business cycle as consistent with certain type of economic conduct that is boundedly reasonable. In the first hypothesis, they related the implications of the usability heuristic through the growth forecasts of analysts to the business cycle. First hypothesis: The business cycle is systematically linked to the bias in analysts' growth projections. Particularly, once the economy is growing and when it is declining, growth estimates will be particularly optimistic and pessimistic, respectively. Then they made more specific hypotheses. Hypothesis 2: Current performance ought to have a bad correlation with prediction mistakes if the availability heuristic influences analysts' long-term growth estimates. Hypothesis 2A: The present performance should have a negative correlation with realized growth if the availability heuristic is a factor in management's investment decisions. Hypothesis 3: If the availability heuristic accurately describes the long-term forecasting behavior of analysts, realized forecast errors in the future ought to be systematically related to historical growth realizations. Hypothesis 4: By combining analysts' growth projections with any forecast bias drivers found by the availability heuristic, growth prediction accuracy is increased.

They concentrate on the kind and level of bias in growth projections. They specifically look at the effect of important firm-specific traits of historical growth on predicted departures from the business cycle utilizing the behavioral theoretical model from the earlier parts. They utilize former prediction error as a measure of forecasting bias, which is congruent with the literature on the topic. They calculate the estimation error as the real growth less the matching forecast, as was previously explained. Therefore, optimism is indicated by a negative (mean) forecast error. From table 1, for the whole sample during the business cycle, panel A provides data on growth predictions, related realizations, and forecast errors. They give these figures as percentages since they are rate of growth. The panel's mean prediction error is not zero, according to the null hypothesis, which is rejected at the usual level of significance. In instance, in line with earlier research, the negative average (median) prediction error is 6.77 (4.23), demonstrating the reliability of growth estimates throughout the whole sample period of 1982–1998.

Changing the subject to the forecasting error behavior of various BCS, it is shown that in BCS 1, 2, and 4, overconfidence predominates. Considering that these BCS are part of the economic boom cycle, the growth forecast for the economic expansion phase is too positive. Even at BC3, which includes the contraction, the growth forecast seems optimistic. The mean (median) prediction error was −1.38(−0.78). However, the difference test of mean and median shows that the prediction error of BC3 is significantly smaller than that of the other three subperiods. In panel B, they provide the median and mean predicted errors year by year. Note that, with the exception of 1991, 1992, and 1993–1993, the mean and average predict inconsistencies in BC3 are consistently negative. The average and median standard errors at this time were quite close to zero. Many other statistics are shown in the research done by Lee and other people to show how the availability heuristic affect the long-term growth predictions.

Table 1: Long-term EPS growth compared to expectations. [5]

Panel A: Long-term EPS Increase by Economic Cycle: Forecast vs. Actual | |||||

Long-Term EPS Growth | Overall | Business Cycle | |||

1 | 2 | 3 | 4 | ||

Realized | 7.09 | 4.97 | 3.49 | 11.41 | 7.30 |

7.46 | 6.06 | 4.14 | 10.22 | 7.94 | |

Forecast | 13.80 | 13.07 | 12.06 | 12.68 | 15.77 |

12 | 12.5 | 11.55 | 12 | 14 | |

Forecast Error | -6.77 | -8.06 | -8.60 | -1.38 | -8.56 |

-4.23 | -4.92 | -6.4 | -0.78 | -5.07 | |

Past | 13.98 | 8.46 | 10.56 | 10.45 | 20.46 |

10.3 | 8.53 | 8.52 | 7.93 | 14.01 | |

Number of Observations | 10,424 | 1,286 | 2,501 | 2,516 | 4,121 |

Table 2: Panel B: year-by-year long-term EPS growth: forecast versus actual.

Year | No. of Observations | Long-Term EPS Growth | |||

Realized | Forecast | Forecast Error | Past | ||

1982 | 437 | 3.80 | 13.10 | -9.24 | 12.11 |

4.96 | 13 | -5.39 | 11.78 | ||

1983 | 409 | 4.69 | 12.59 | -7.86 | 7.27 |

6.37 | 12 | -4.62 | 7.90 | ||

1984 | 440 | 6.40 | 13.49 | -7.09 | 5.89 |

7.13 | 12.5 | -4.72 | 5.62 | ||

1985 | 469 | 8.59 | 12.86 | -4.30 | 7.51 |

7.79 | 12 | -3.16 | 6.75 | ||

1986 | 466 | 6.75 | 12.32 | -5.57 | 10.62 |

6.37 | 12 | -4.72 | 8.95 | ||

1987 | 485 | 2.36 | 11.90 | -9.50 | 9.17 |

3.68 | 12 | -6.73 | 7.62 | ||

1988 | 528 | -1.13+ | 11.67 | -12.84 | 11.60 |

1.16+ | 11 | -9.19 | 9.64 | ||

1989 | 553 | 1.81+ | 11.69 | -9.94 | 13.40 |

2.59 | 11 | -7.26 | 10.09 | ||

1990 | 569 | 8.51 | 11.74 | -3.32 | 13.78 |

6.82 | 11 | -2.99 | 10.73 | ||

1991 | 636 | 12.36 | 12.38 | -0.24+ | 11.33 |

10.48 | 11 | -0.28+ | 9.16 | ||

1992 | 639 | 12.33 | 12.84 | -0.60+ | 8.99 |

10.5 | 12 | -0.2+ | 6.68 | ||

1993 | 672 | 12.10 | 13.60 | -1.58+ | 7.99 |

11.45 | 12 | -0.18+ | 5.46 | ||

1994 | 734 | 10.30 | 14.59 | -4.34 | 13.93 |

10.11 | 12.82 | -2.32 | 8.50 | ||

1995 | 801 | 8.96 | 14.59 | -5.77 | 17.22 |

9.11 | 13 | -3.01 | 12.03 | ||

1996 | 781 | 9.11 | 15.39 | -6.41 | 22.45 |

9.18 | 13.75 | -3.73 | 15.06 | ||

1997 | 857 | 5.44 | 16.59 | -11.20 | 23.33 |

6.2 | 15 | -7.47 | 15.95 | ||

1998 | 948 | 3.78 | 17.23 | -13.55 | 24.13 |

5.00 | 15 | -10.42 | 16.72 | ||

All investment choices are based on growth expectations, thus these expectations have a significant impact on economic activity. To sum up, they discovered that analysts' predictions of companies' long-term growth in per-share earnings have a tendency to be somewhat upbeat during economic expansions and rather pessimistic during recessions. This result is in line with the availability heuristic, suggesting that when forecasters project long-term growth, they tend to give the condition of the economy too much weight [6]. If both groups of individuals are subject to the identical usability heuristic, then the link between prediction and real investment behavior is indicated to be consistent. The analytical findings support the assertion that analysts' and managers' constrained rational conduct in growth forecasting is compatible with the idea that they don't fully understand how expectations and investment choices lead to business cycles.

3.2. Advertising and Marketing

Folkes investigated how the availability heuristic affects consumers' judgment on defective products. In the study, the subjects were asked to determine the likelihood of the items. being faulty. In this regard, subjects were given distinctive scenarios and brand names for the products. Consumers' predictions of defective product can shift as a result of unstable elements, according to research on changing causal locations, controllability, and stability. Therefore, as there is some instability in a product it will cause the consumer to be more confident that the product will fail again than if it fails because of stability. For example, a refrigerator that stops working because of a power failure will make consumers more confident that the product will fail again than a dishwasher that stops working because the product is defective. Stability affects the choice of remedy in the event of product failure. Stable attribution leads consumers to prefer refunds to conversions over unstable causes. However, trajectory also affects correction. When a product fails for business-related issues as opposed to consumer-related issues, refunds are preferred. Since distinctive scenarios and brand names remained in the minds of the subjects, they perceived these products as risker by being influenced by the availability heuristic [7].

The availability heuristic also occurs when companies recall their defective products too. Jarell & Peltzman found that companies suffered major losses when defective drugs and automobile manufacturers withdrew these products from the market. They found that not only the companies producing these products, but also those companies adversely affected their competitors and ultimately the whole sector. Therefore, when a defective product is recalled from the market, this situation has a negative place in the minds of both the consumers who purchase these products and the shareholders who invest in these companies. As the news about defective products makes bad connotations for investors, they are kept in their minds due to the availability heuristic and so investors react accordingly. Advertisements use investors' behavioral biases in processing information. The increase in advertisements increases the visibility and value of a company among investors. When investors see a company in advertisements on a continuous basis, they tend to think that the probability of the company’s growth will be high. This leads to an increase in the price of the stock.

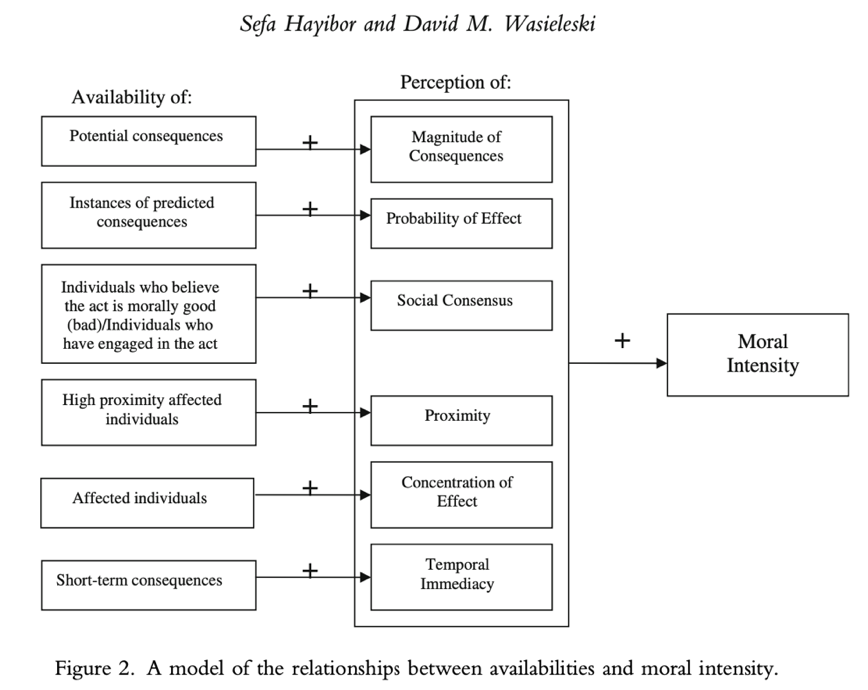

3.3. Ethical Decision-making and Moral Intensity

Through its impact on the moral severity of issues, the availability heuristic influences the ethical decision-making process. The strength of a moral necessity with respect to a problem is known as its moral intensity. Relationships between availabilities and moral intensity are shown in Figure 1. Numerous individual, organizational, and environmental elements are taken into consideration by the four-step interactionist framework of ethical decision-making. They decided that focusing on the scope of the effects and societal agreement served as a suitable starting point to investigate the impact of utility-ability heuristics on moral strength. They also concentrated on a single ethical issue: youth drinking, as an issue with clear ethical implications, and, given the sample of students we used, as an issue with which our subjects would be familiar. Both studies used survey methodology to measure availability and subjects' perception of the moral strength component. They made two hypotheses to study.

Figure 1: A mathematical model of the connections between moral intensity and availability [8].

The study project, which comprises of two empirical investigations, is the first to look at how cognitive heuristics affect how strong a person feels about their moral character. By examining two features of moral problems, the scope of the effects and societal agreement, they initially wanted to know if someone could quickly recall examples of repercussions linked with an activity, perhaps impacting how morally serious a conduct was considered to be. They next investigated if there was any relationship between the perceived moral courage of the activity and a person's capacity to quickly recall other persons who shared that belief or who had engaged in that behavior [8]. According to their results, increasing the accessibility of the aforementioned occurrences might be one method to promote awareness of the moral gravity of ethical dilemmas. Opinions of the situation's size and overall moral character of the consequences of an action are amplified by an increase in the availability of serious consequences associated with it. The mechanisms used to make ethical decisions are impacted by this heightened moral intensity. Similar to this, our findings imply that the existence of individuals who think a certain course of conduct is morally incorrect should boost the impression of societal consensus and, thus, the moral strength as a whole. If managers can rise employees' acceptance of each of these phenomena, then, in theory, the likelihood of making ethical decisions should increase. In short, managers have the ability to put plans, rules, or processes into practice.

4. Conclusion

This study mainly focuses on analysis of the effects of the availability heuristic in economics. In conclusion, the availability heuristic is a psychological phenomenon that exists in almost every industry, but especially in finance [9]. It is observed that investors are exposed to availability heuristics due to factors they are familiar with and bring to their attention. As a result, they make irrational decisions. Besides, advertisements use investors' behavioral biases in processing information. The increase in advertisements increases the visibility and value of a company among investors. Additionally, the availability heuristic's use will have an impact on moral intensity in general. In order to encourage moral conduct among employees, managers should endeavor to make difficult problems appear more morally serious. This would hopefully discourage employees from acting unethically. There are extensive applications to suggest that availability will increase the probability of an event by the things that they are familiar with. People should be aware of the weakness of this heuristic in their procedure for determining decisions. The possibility of bias in the availability heuristic decision depends on the characteristics of the problem and the ability of the person to retrieve and process information. A proper understanding and use of the availability heuristic can lead to more accurate estimates. However, there are some limitations. Firstly, this article only presents the method of reading and analyzing the articles which is not comprehensive enough [10]. Another limitation is that in the last application the authors' use of student samples in collecting data was a limitation.

References

[1]. Kahneman, Thinking fast and slow, 110-115

[2]. Tversky & Kahneman, Judgment under Uncertainty: Heuristics and Biases, 1974, p. 1127

[3]. Jacoby, Kelley, Brown, & Jasechko, 1989; Oppenheimer, 2004; Schwarz et al., 1991; Taylor & Thompson, 1982; Watkins & LeCompte, 1991

[4]. Cass R. Sunstein, The Availability Heuristic, Intuitive Cost-Benefit Analysis, and Climate Change, 77 Climatic Change 195 (2006).

[5]. Byunghwan Lee, John O'Brien & K. Sivaramakrishnan (2008) An Analysis of Financial Analysts' Optimism in Long-term Growth Forecasts, The Journal of Behavioral Finance, 9:3, 171-184

[6]. Quantitative Finance and Economics, 6(1): 54–82.

[7]. VALERIE S. FOLKES, Recent Attribution Research in Consumer Behavior: A Review and New Directions, 9-10

[8]. Sefa Hayibor, David M. Wasieleski, Journal of Business Ethics (2009) 84:151–165

[9]. SIJIA MENG, Availability Heuristic Will Affect Decision-making and Result in Bias, 2017,4-5

[10]. Kübilay, B., ARDAHAN ÜNİVERSİTESİ İİBF DERGİSİ (2022) 4(1): 68–74

Cite this article

Zhang,J. (2023). A Survey of Availability Heuristics in Behavioral Economics and Its Application Analysis. Advances in Economics, Management and Political Sciences,10,306-311.

Data availability

The datasets used and/or analyzed during the current study will be available from the authors upon reasonable request.

Disclaimer/Publisher's Note

The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of EWA Publishing and/or the editor(s). EWA Publishing and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content.

About volume

Volume title: Proceedings of the 2nd International Conference on Business and Policy Studies

© 2024 by the author(s). Licensee EWA Publishing, Oxford, UK. This article is an open access article distributed under the terms and

conditions of the Creative Commons Attribution (CC BY) license. Authors who

publish this series agree to the following terms:

1. Authors retain copyright and grant the series right of first publication with the work simultaneously licensed under a Creative Commons

Attribution License that allows others to share the work with an acknowledgment of the work's authorship and initial publication in this

series.

2. Authors are able to enter into separate, additional contractual arrangements for the non-exclusive distribution of the series's published

version of the work (e.g., post it to an institutional repository or publish it in a book), with an acknowledgment of its initial

publication in this series.

3. Authors are permitted and encouraged to post their work online (e.g., in institutional repositories or on their website) prior to and

during the submission process, as it can lead to productive exchanges, as well as earlier and greater citation of published work (See

Open access policy for details).

References

[1]. Kahneman, Thinking fast and slow, 110-115

[2]. Tversky & Kahneman, Judgment under Uncertainty: Heuristics and Biases, 1974, p. 1127

[3]. Jacoby, Kelley, Brown, & Jasechko, 1989; Oppenheimer, 2004; Schwarz et al., 1991; Taylor & Thompson, 1982; Watkins & LeCompte, 1991

[4]. Cass R. Sunstein, The Availability Heuristic, Intuitive Cost-Benefit Analysis, and Climate Change, 77 Climatic Change 195 (2006).

[5]. Byunghwan Lee, John O'Brien & K. Sivaramakrishnan (2008) An Analysis of Financial Analysts' Optimism in Long-term Growth Forecasts, The Journal of Behavioral Finance, 9:3, 171-184

[6]. Quantitative Finance and Economics, 6(1): 54–82.

[7]. VALERIE S. FOLKES, Recent Attribution Research in Consumer Behavior: A Review and New Directions, 9-10

[8]. Sefa Hayibor, David M. Wasieleski, Journal of Business Ethics (2009) 84:151–165

[9]. SIJIA MENG, Availability Heuristic Will Affect Decision-making and Result in Bias, 2017,4-5

[10]. Kübilay, B., ARDAHAN ÜNİVERSİTESİ İİBF DERGİSİ (2022) 4(1): 68–74