1. Introduction

1.1. Background

In the mobile phone market, every player is under great pressure from competitors and tries their best to satisfy customers' needs. Now people's preference for mobile phones is gradually changing and fashionable and cheap mobile phones such as OPPO are also attractive. In recent years, OPPO has maintained a high level of market share in the international mobile phone market, and its "friends" like Vivo and Realme have also surged in the past two years, occupying more and more mobile phone market shares. This is because, for most software, there is no difference between high-level brand phones and other phones when using them. Hence price has become one of the decisive criteria for most people and more and more people are becoming price sensitive. Mobile phones like OPPO have become the first choice for these people. Following this trend, such mobile phone brands are very likely to influence the mobile phone market in the future.

1.2. Related Research

Xun analyzed OPPO's marketing strategy and made suggestions. OPPO has clear target customer groups and its design is stylish and meets the needs of most young customers. But to achieve long-term success in the highly competitive mobile phone market, the author suggests that its strategy should be changed as the market environment changes, such as with the introduction of 5G and 6G [1]. Kang pointed out that OPPO's advertising strategy was one of the important reasons for it being at the forefront of the mobile phone market in the early days. OPPO's advertising strategy accurately locates the target group, and the novel advertising words help it establish its unique brand image. It's "fast charging, slow power consumption" feature has attracted most people who pursue the practicality of mobile phones, and its sales have surged to the forefront of the Chinese mobile phone market in a few years [2]. However, Jin et al. highlighted the three major disadvantages of OPPO as a young mobile phone brand compared to well-known brands. First of all, the main technology in OPPO is very new. Some other technology is still in the very costly R&D stage. Compared with those well-known brands, OPPO's core chips and software development capabilities are not mature enough. Secondly, OPPO's marketing activities are too single. It should not only focus on cost-efficient but focus on making itself different. Third, OPPO lacks a strong brand image. The author suggests that while improving internal capabilities, we can increase advertising investment. Innovation is the right way to get OPPO out of the predicament [3]. Yoloan et al. described the changes in OPPO's strategies under the influence of COVID-19. COVID-19 has had a great impact on the mobile phone industry, making competition even more intense. Compared with XIAOMI, OPPO has taken a more effective approach. It has expanded a variety of sales channels and developed a variety of product lines, covering the low, medium and high-end markets. In addition, COVID-19 has not affected OPPO's investment in research and development, and managers are committed to developing new technologies, focusing on 5G/6G, AR and artificial intelligence [4]. Yusuf concludes that innovation and a good brand image have a significant impact on purchasing decisions. At the same time, it is necessary to do market research and understand customer needs. Such improvement and innovation can effectively stimulate the interest of consumers [5].

Ha stated that the mobile phone industry is one of the most competitive industries. Each brand will compete in terms of price, design, technology, etc., especially the core technology (software, hardware). The author believed that the future preference of the mobile phone market will no longer be high-end products, but cheap phones. At the same time, customers' pursuit of technology is also growing [6]. Kabeyi analyzed the internal and external forces in the mobile phone market and gave some advice on how to be competitive in such a fast-growth industry. He believed that players in such a market are difficult to survive because they have to keep investing in innovation to ensure their technology is not outdated. At the same time, suppliers have strong bargaining power over some companies because suppliers provide core hardware such as core chips. Therefore, the author pointed out that mobile phone companies should not only adopt effective marketing strategies to gain competitiveness but also have their core technologies [7]. Nakagawa analyzed the changes in China's mobile phone market by introducing the concept of "business ecosystem". He pointed out that to compete in the Chinese mobile phone market, players must compete not only at the company level but also at the business ecosystem level. Overall, telecom common carriers are relatively weak, while network service companies will dominate in the future [8]. Xing emphasized that the introduction of a "global value chain strategy" is an important reason for the success of the Chinese mobile phone market. OPPO is one example. This strategy is dedicated to finding value points on a global scale and forming a value-added chain. At the same time, a variety of innovative activities allow Chinese mobile phones to have their characteristics and lead the fashion trend [9]. Liu et al. made some research on the internationalization strategy of OPPO mobile phones. Overseas markets are an important source of OPPO's sales. The author pointed out that OPPO's success overseas has three factors: international production, international marketing and international service. OPPO focuses on the utilization of local resources and formulates local-specific strategies based on different regions to meet customer preferences [10].

1.3. Objective

The study mainly discusses the future development of the Chinese mobile phone brand OPPO and makes some suggestions. This paper will first use the SWOT model to show some internal or external factors of OPPO in the current market condition. Then the mobile phone market environment is analyzed and some predictions and suggestions on the future development of OPPO are made.

2. SWOT Analysis

The SWOT model can help analyze internal and external factors which may influence its future growth. For its strength, OPPO has a stylish design, and the combination of multiple colors is in line with the aesthetics of young people. At the same time, OPPO has low-end, mid-range, and high-end mobile phones. For some price-sensitive people such as students, OPPO is a good choice. In addition, OPPO's advertising is also memorable [2]. With the support of big data, the content can directly target its potential customers, and the advertisement is equipped with a complete service process that combines advertising and actual marketing. OPPO also uses many patented technologies, the most famous of which is VOOC flash charge which is very useful and makes OPPO different from others.

For the weakness, OPPO has low brand value and brand loyalty. When changing phones, customers have low switching costs, and it is hard for OPPO to have a stable customer group. This makes OPPO hard in competition with big brands such as Apple. In addition, most components are not produced by OPPO itself, and the sales may be subject to its supply chain [7]. This problem is fatal when expanding.

In the future, OPPO also has many development opportunities. It can try different business segments, covering the needs of female customers and middle-aged customers. At the same time, OPPO can expand the markets of other types of electronic derivatives such as Bluetooth TVs to achieve product diversification. Plus, expanding the sales channel could help OPPO achieve flexible marketing.

In such a high-pressure mobile phone market, OPPO faces pressure from many aspects. The mobile phone industry has a low threshold, a huge number of competitors make the industry very sensitive and every player suffers great pressure from others. Outside the industry, OPPO is restricted by local regulation such as the COVID-19 regulation in China which limit its sales to a great extent.

3. Fundamental Analysis & Prediction

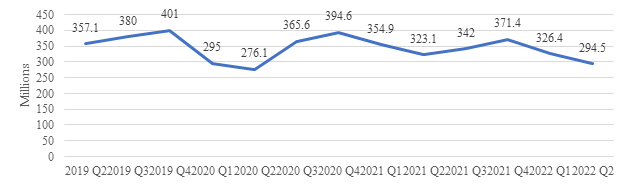

Figure 1: Global mobile phone shipments [11].

In 2020 Q1 and Q2, due to the impact of the epidemic, the global mobile phone market shipments dropped significantly. In the following quarters, global mobile phone shipments returned to normal levels. However, global mobile phone shipments declined in Q2 Q1 2022 and 2022 Q2, the shipment is 294.5 million which is the first time below 300 million after the pandemic. The expected recovery from COVID-19 failed. This is because there is a lot of uncertainty in the global economy. The Ukraine crisis has caused consumers to lose confidence in purchases, and the pressure from inflation offset the expected recovery in sales from COVID-19 [12]. In addition, China's "zero tolerance" policy for the epidemic has slowed down its economy, and some Chinese mobile phone brands (OPPO, VIVO, etc.) are subject to restrictions. For OPPO, in 2022 Q2, its global market shipments decreased by 8.7% QoQ and 16% YoY [11].

In the next few years, the global mobile phone market will be expected to drop a little. But in the long run, the transition from 4G to 5G/6G will be a good opportunity for the international mobile phone market. At the same time, the Chinese government already has countermeasures to stimulate the Chinese economy, which will be a good change.

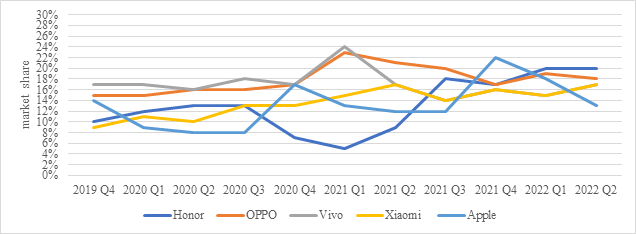

Figure 2: China mobile phone market share [13].

OPPO has always been in the top two in the Chinese market in the past two years [14]. After re-adjusting the product line and releasing new products of the Reno series, its sales in China increased. Huawei's recession has given OPPO a great opportunity, and most of Huawei's market share is divided up by OPPO, Vivo and Xiaomi. However, in 2020 Q4, Honor was separated from Huawei achieved a dramatic increase during the second half of 2021, and in 2022 Q2, Honor occupied first place in the Chinese market [13]. It re-established the relationship with the suppliers and retailers, which caused huge pressure on OPPO, and in the future, it is very likely for Honor to replace Huawei's position as the dominant player in the Chinese mobile phone market. Now is an important time for OPPO. If it can compete with Honor in terms of technology, price and supply chain, OPPO will remain on top in the Chinese market.

4. Suggestions

For OPPO, it is worth noting that it is not a listed company. In the future, OPPO is also not suggested to be listed. And there are many reasons why going public is not suggested. First of all, OPPO has strong channels and sufficient cash flow, and it does not need financing. OPPO's managers have always attached great importance to profits, which makes OPPO one of the most profitable mobile phone companies in China. This strategy satisfies almost all stakeholders, so it is not very important for OPPO to go public or not. Secondly, the ownership relationship of OPPO is complex. Many shareholders, such as employees and agents, hold shares of OPPO. Once listed, the management will easily lose control of the company. Because in the secondary market, there must be someone who deliberately buys small and scattered stocks wants to become the major shareholder and control the company. This is not what managers in OPPO want to see. Thirdly, its financial statements do not need to be disclosed, and the public can only analyze its financial situation by speculating. When the company experiences a decline, the company can only choose to disclose favorable information and will not face much pressure from outside. Meantime, in the highly competitive mobile phone market, it is important to hide some key financial data, such as cost of sale, because financial data can reflect a company's operation, structure, policy and many other aspects. If OPPO is listed and its financial status is disclosed, its future strategy will be easily predicted, and competitors are likely to take countermeasures. OPPO, not unlike Xiaomi which has business in many fields, only focuses on the mobile phone market, so, if OPPO phones take a hit, the company's survival will be threatened. Fourth, OPPO only does mobile phone business and such a company usually has a low valuation. Since the valuation standard of such a mobile phone company is similar to that of a manufacturing enterprise, which is relatively low and the future development of such a mobile phone company is always not highly expected. And the P/E ratio of these mobile phone companies is always less than that of other internet enterprises. At the same time, the existing shareholders of OPPO can receive a lot of dividends every year, and its internal share price is also maintained at a very high level. However, if this share price goes into the public market, it will not be accepted in the secondary market. Therefore, OPPO doesn't have to be listed. Finally, enterprises that are not listed will not be subject to too much supervision, and their management operation can always be maintained in their comfort zone. Without supervision and restrictions, OPPO can plan products for long-term benefits instead of achieving short-term performance for the sake of high stock prices.

However, not being listed will also inhibit OPPO from expanding the market. In contrast, Xiaomi, which has been listed for a long time, has enough money to develop other markets such as new energy vehicles and other electronic equipment derivatives through financing. As for OPPO, it only focuses on the mobile phone market and its revenue only comes from mobile phones. Hence, if the mobile phone design in one year does not meet the public's aesthetic, its income will decline greatly. This is fatal for OPPO in such a highly competitive mobile phone market.

OPPO should develop some new products and expand various sales channels in such a fast-growing mobile phone market. Now more and more people prefer mid-range mobile phones instead of low-end mobile phones, and China is slowly moving out of low-cost models [6]. To meet this trend, medium-end and high-end mobile phones, such as OPPO Find X2, should be the target areas. During COVID-19, OPPO lost many sales because they put much attention on offline stores. The managers should be aware of it and expand other channels.

Compared with some famous mobile phone brands such as apple, OPPO lacks customer loyalty and has low brand value. The current marketing strategy of OPPO has not explored the potential requirements of customers. Hence customers have low switching costs and do not rely on OPPO too much. If OPPO wants to remain on the top in the mobile phone market for a long time, it is inevitable to establish a loyal customer group and unexpectedly attract customers [5].

Moreover, the managers in OPPO need to expand their investment in overseas markets, especially in the European market. In the European market, the market share on Huawei in the European market has dropped sharply due to external pressure and for OPPO, it is an opportunity. In 2022, Realme and OPPO are the fourth and fifth largest mobile phone brands in the European market, and the annual growth rate of Realme's shipment is as high as 177%. In the next few years, although it is difficult for OPPO (including Realme) to surpass Xiaomi, they are very likely to have the ability to compete with Xiaomi in terms of market share.

5. Conclusion

OPPO is greatly affected by the external environment and internal supply and it is difficult for OPPO to influence the international mobile phone market in the next five years. But once these problems are solved, the potential of OPPO will be great. In general, Samsung, Xiaomi and Apple will still lead the mobile phone market in the next five years if there is no unpredictable event. Huawei is difficult to rise to the top 5 in the next few years, but Honor is likely to occupy a place in the mobile phone market with rapid growth in the future. As China's top mobile phone brand, OPPO also has some market shares in the global market, but as mentioned above, it is difficult for OPPO to replace Samsung and Apple. However, the strong rise of Realme also brings new opportunities. If combined OPPO, Realme and OnePlus as the "OPPO group mobile phones" brands, it is very likely to challenge Xiaomi's position in the global market in the next five years.

References

[1]. XUN, H. (2018). The study of oppo mobile phone marketing strategies (Doctoral dissertation, SIAM UNIVERSITY).

[2]. Kang Miao. (2017). Advertising and marketing Strategy of Oppo mobile phone. Business Economics (3), 3.

[3]. Jin, Z. Y., Saif, M. B., Kee, D. M. H., Al Basis, G., Quttainah, M. A., Afifah, A., ... & Huang, Q. (2020). A Miss-step of Innovation and Marketing Strategies Plan: Can OPPO Find a Way Out? International Journal of Accounting & Finance in Asia Pasific (IJAFAP), 3(3), 89-97.

[4]. YOLOAN, M., Timbuleng, J. A., & Korompis, M. J. A. (2020). THE MARKETING STRATEGY OF OPPO AND XIAOMI SMARTPHONE DURING COVID-19 PANDEMIC (Case Study March-July 2020) (Doctoral dissertation, UNIVERSITAS KATOLIK DE LA SALLE).

[5]. Yusuf, A. (2021). The Influence of Product Innovation and Brand Image on Customer Purchase Decision on Oppo Smartphone Products in South Tangerang City. Budapest International Research and Critics Institute-Journal (BIRCI-Journal, 2 (1), 472–481.

[6]. Ha, N. (2016). Smartphone industry: The new era of competition and strategy.

[7]. Kabeyi, M. J. B. (2018). Michael porter’s five competitive forces and generetic strategies, market segmentation strategy and case study of competition in global smartphone manufacturing industry. IJAR, 4(10), 39-45.

[8]. Nakagawa, R. (2013). The Rapid Growth of The Smartphone Market in China and The "Business Ecosystem". Ritsumeikan International Studies, 25(3), 219-229.

[9]. Xing, Y. (2020). Global Value Chains and the Innovation of the Chinese Mobile Phone Industry. East Asian Policy, 12(01), 95-109.

[10]. Huimin Liu & Wei Liu (2021). Research on the internationalization strategy of Chinese smartphone enterprises -- A case study of OPPO mobile phone. Science and Technology Information, 19(9), 4.

[11]. Global Smartphone Market Share: By Quarter: Counterpoint Research. (2022). Retrieved 16 September 2022, from https://www.counterpointresearch.com/global-smartphone-share/

[12]. ABOUT - Counterpoint Research. (2022). Retrieved 16 September 2022, from https://report.counterpointre-search.com/posts/report_view/Outlook/3019

[13]. China Smartphone Market Share: By Quarter: Counterpoint Research. (2022). Retrieved 16 September 2022, from https://www.counterpointresearch.com/china-smartphone-share/

[14]. Oppo emerges as top smartphone maker in China in January 2021, Huawei loses steam: Report - ET Telecom. (2022). Retrieved 16 September 2022, from https://telecom.economictimes.indiatimes.com/news/op-po-emerges-as-top-smartphone-maker-in-china-in-january-2021-huawei-loses-steam-report/81349382?redirect=1

Cite this article

Wang,Y. (2023). Discussion and Suggestions on Future Growth of OPPO. Advances in Economics, Management and Political Sciences,14,27-33.

Data availability

The datasets used and/or analyzed during the current study will be available from the authors upon reasonable request.

Disclaimer/Publisher's Note

The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of EWA Publishing and/or the editor(s). EWA Publishing and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content.

About volume

Volume title: Proceedings of the 2nd International Conference on Business and Policy Studies

© 2024 by the author(s). Licensee EWA Publishing, Oxford, UK. This article is an open access article distributed under the terms and

conditions of the Creative Commons Attribution (CC BY) license. Authors who

publish this series agree to the following terms:

1. Authors retain copyright and grant the series right of first publication with the work simultaneously licensed under a Creative Commons

Attribution License that allows others to share the work with an acknowledgment of the work's authorship and initial publication in this

series.

2. Authors are able to enter into separate, additional contractual arrangements for the non-exclusive distribution of the series's published

version of the work (e.g., post it to an institutional repository or publish it in a book), with an acknowledgment of its initial

publication in this series.

3. Authors are permitted and encouraged to post their work online (e.g., in institutional repositories or on their website) prior to and

during the submission process, as it can lead to productive exchanges, as well as earlier and greater citation of published work (See

Open access policy for details).

References

[1]. XUN, H. (2018). The study of oppo mobile phone marketing strategies (Doctoral dissertation, SIAM UNIVERSITY).

[2]. Kang Miao. (2017). Advertising and marketing Strategy of Oppo mobile phone. Business Economics (3), 3.

[3]. Jin, Z. Y., Saif, M. B., Kee, D. M. H., Al Basis, G., Quttainah, M. A., Afifah, A., ... & Huang, Q. (2020). A Miss-step of Innovation and Marketing Strategies Plan: Can OPPO Find a Way Out? International Journal of Accounting & Finance in Asia Pasific (IJAFAP), 3(3), 89-97.

[4]. YOLOAN, M., Timbuleng, J. A., & Korompis, M. J. A. (2020). THE MARKETING STRATEGY OF OPPO AND XIAOMI SMARTPHONE DURING COVID-19 PANDEMIC (Case Study March-July 2020) (Doctoral dissertation, UNIVERSITAS KATOLIK DE LA SALLE).

[5]. Yusuf, A. (2021). The Influence of Product Innovation and Brand Image on Customer Purchase Decision on Oppo Smartphone Products in South Tangerang City. Budapest International Research and Critics Institute-Journal (BIRCI-Journal, 2 (1), 472–481.

[6]. Ha, N. (2016). Smartphone industry: The new era of competition and strategy.

[7]. Kabeyi, M. J. B. (2018). Michael porter’s five competitive forces and generetic strategies, market segmentation strategy and case study of competition in global smartphone manufacturing industry. IJAR, 4(10), 39-45.

[8]. Nakagawa, R. (2013). The Rapid Growth of The Smartphone Market in China and The "Business Ecosystem". Ritsumeikan International Studies, 25(3), 219-229.

[9]. Xing, Y. (2020). Global Value Chains and the Innovation of the Chinese Mobile Phone Industry. East Asian Policy, 12(01), 95-109.

[10]. Huimin Liu & Wei Liu (2021). Research on the internationalization strategy of Chinese smartphone enterprises -- A case study of OPPO mobile phone. Science and Technology Information, 19(9), 4.

[11]. Global Smartphone Market Share: By Quarter: Counterpoint Research. (2022). Retrieved 16 September 2022, from https://www.counterpointresearch.com/global-smartphone-share/

[12]. ABOUT - Counterpoint Research. (2022). Retrieved 16 September 2022, from https://report.counterpointre-search.com/posts/report_view/Outlook/3019

[13]. China Smartphone Market Share: By Quarter: Counterpoint Research. (2022). Retrieved 16 September 2022, from https://www.counterpointresearch.com/china-smartphone-share/

[14]. Oppo emerges as top smartphone maker in China in January 2021, Huawei loses steam: Report - ET Telecom. (2022). Retrieved 16 September 2022, from https://telecom.economictimes.indiatimes.com/news/op-po-emerges-as-top-smartphone-maker-in-china-in-january-2021-huawei-loses-steam-report/81349382?redirect=1