1. Introduction

This paper mainly introduces four types of strategies, momentum investing, comparing PEG ratios, merger arbitrage strategy, and market neutral trade. The background of the eight films selected in this paper will be introduced first. Then, this paper will present detailed progress, including stock price tendency, results, and future improvements. Finally, a comparison is also made in this paper, which can deliver the feasibility of each strategy base on the four pairs of trades made. It also introduces how a manager new to stocks makes a decision and the results obtained and sums up a strategy that is most suitable for beginners to invest.

2. Literature Review

In a related article [1], the author argues that momentum investing theory has been discovered by academia for more than 20 years. However, there is still much confusion and debate about its effectiveness and use as a practical investment tool. So, in this article, the authors aim to clear up much of the confusion by documenting what we know about momentum and refuting many of the often-repeated myths. Using results from widely circulated academic papers and an analysis of simple publicly available data, they highlight ten myths about momentum and refute them.

In this paper [2], the authors and their team examine whether momentum profits existed in the UK between 1977 and 1998. The analysis shows significant momentum profits in UK equities' total sample and accounting subsample. Analysis of subperiod results, seasonal effects, and momentum profit persistence confirm the robustness of the results. It is also found that serial correlation of common factors and delayed price responses to common factor realizations do not explain momentum profits. The author concludes that the momentum effect stems from the lack of market response to the sector or company-specific information. It is an essential and independent phenomenon in UK equity returns.

In another article [3], the authors find that profitability research on stock return momentum strategies has been very frequently mentioned and used over the past ten years. The author also discussed the empirical results and research methods. Decompose momentum returns to find the driving forces behind the momentum effect. Furthermore, various explanations for momentum effects are summarized. Moreover, several recent papers examining the profitability of momentum strategies by institutional investors explicitly considering transaction cost estimates have also been mentioned.

An article related to PEG ratios claims that a reasonable PEG level for a given growth rate also depends on the length of the rapid growth period, the long-term sustainable growth rate, and the discount rate [4]. The author founds that high earnings growth rates usually justify high P/E ratios. As a result, many analysts have turned to the price-to-earnings ratio to growth, or PEG, to control this relationship in recent years. However, the PEG ratio is not a constant that can be used to determine the value of the stock. In contrast, the reasonable PEG versus growth rate plot is U-shaped for a wide range of parameter values. As a result, the PEG levels of 1.0 or 1.5 that analysts sometimes cite are harder to justify than some might think.

In a similar article [5], the author found that individual investors and professional fund managers always use the most popular investment strategies: PE and peg ratio-based. Then, the author examines the robustness of this abnormal finding in an expanded sample over a subsequent period. The findings suggest that fixed-currency investing remains a profitable investment strategy, and its reach extends beyond the realm of growth stocks. Additionally, the author documents peg-based strategies' risk profile, which may be counterintuitive to most value investors.

Although in this article, this strategy of merger arbitrage does not yield a high return value, in another article [6], the authors cite several academic articles exploring the basis and performance of merger arbitrage to demonstrate the value of this strategy. Furthermore, he mentioned in the article that while merger arbitrage has proven to provide valuable returns on risky assets, academia supports various theories about the basis of M&A activity and the returns generated by various forms of merger arbitrage. Therefore, this article again proves the feasibility of the merger arbitrage strategy.

Another article examines the profitability of Chinese merger arbitrage strategies [7]. It also investigated whether the target company had conducted insider trading on the Chinese stock market prior to the announcement of the takeover offer. In this article, the authors used 22 experimental samples from January 2002 to December 2006. The findings suggest that investors have no opportunity to profit from a post-announcement long strategy. Furthermore, the pre-announcement price surge was followed by negative post-announcement returns, suggesting insider trading. It mainly studies whether the strategy of merger arbitrage in China's stock market has average profitability.

Similarly, another article gives the profitability of merger arbitrage in Australia [8]. In the article, the authors examine the risk-adjusted profitability of Australian merger arbitrage. They used a sample of 193 merger arbitrage strategies from January 1991 to April 2000. They found that merger arbitrage produced statistically and economically significant excess risk-adjusted returns before transaction costs, and the risk-adjusted returns were no longer statistically significant. Furthermore, compare its data with the United States. Evidence suggests that merger arbitrage in Australia is a market-neutral investment strategy. It also reflects the feasibility of M&A arbitrage and makes a detailed comparison of different situations.

Another article examines various forms of merger arbitrage from cash and stock transactions [9]. Moreover, by carefully evaluating the likelihood and period of perfection, merger arbitrage can yield appropriate returns in different market environments. Because hedge funds tend to be market neutral, it is increasingly difficult for traditional portfolio managers to hide behind a comparative performance matrix (such as the S&P 500) during periods of market flatness or decline (such as 2000-2002). As a result, traditional portfolios will be forced to change. Therefore, this article is another legitimate discussion of merger arbitrage.

While another article details equity market neutral strategy [10], the authors argue that equity market neutral strategies offset long and short positions in similarly mispriced securities. The article discusses in detail the profit information of stock managers when using this strategy during the economic downturn or recovery and its detailed operation methods. They are considered close cousins of long/short strategies, the critical difference being the degree of systemic risk managers are willing to take. It also analyzes the investment potential of market-neutral strategies. It brings a market-neutral manager's sharing, including specific methods on how his company obtains the benefit/risk trade-off in market-neutral strategies.

3. Background

3.1. Company

In this paper, different trade will be investigated, covering 8 firms.

IS is an Israeli software company that focuses on developing app monetization and distribution technologies. SYM is an American robotics warehouse automation company. VIVHY, a French mass media company owned and controlled by Vivendi, has a film library in excess of 5,000 films. ORAN is a French multinational telecommunications corporation. Teledyne Technologies Incorporated is an American industrial conglomerate. CSGP is a Washington, DC-based provider of information, analytics and marketing services to the commercial property industry in the United States, Canada, the United Kingdom, France, Germany, and Spain. HKD is a technology company of AMTD IDEA Group. AMTD is an investment holding company which engages in strategic investments

3.2. Stock Price Tendency

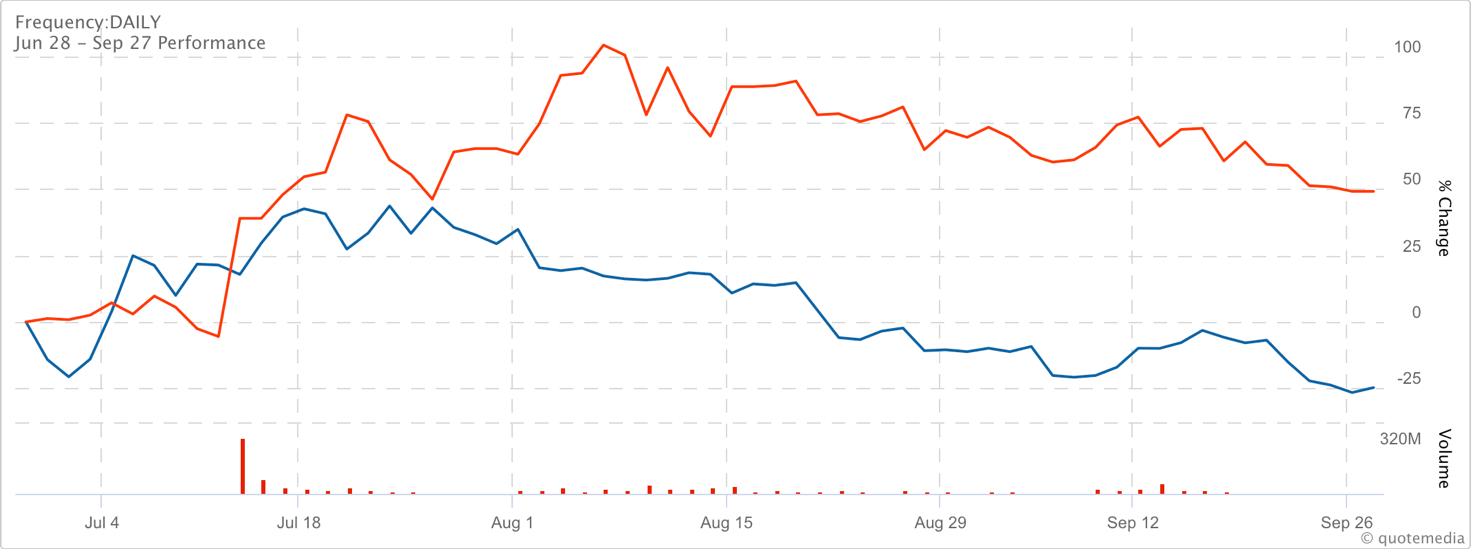

Figure 1: The stock price trend for IS and SYM in last three month. The red line represent IS, and the blue line represent SYM.

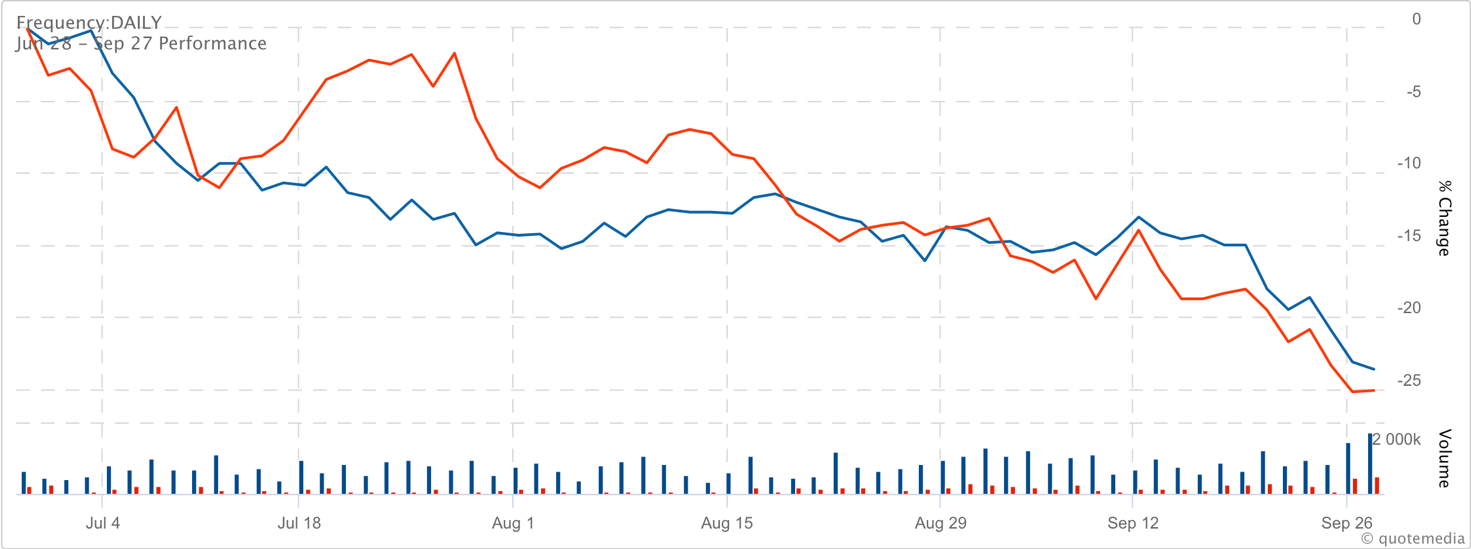

Figure 2: The stock price trend for VOVHY and ORAN in last three month. The red line represents VIVHY, and the blue line represent ORAN.

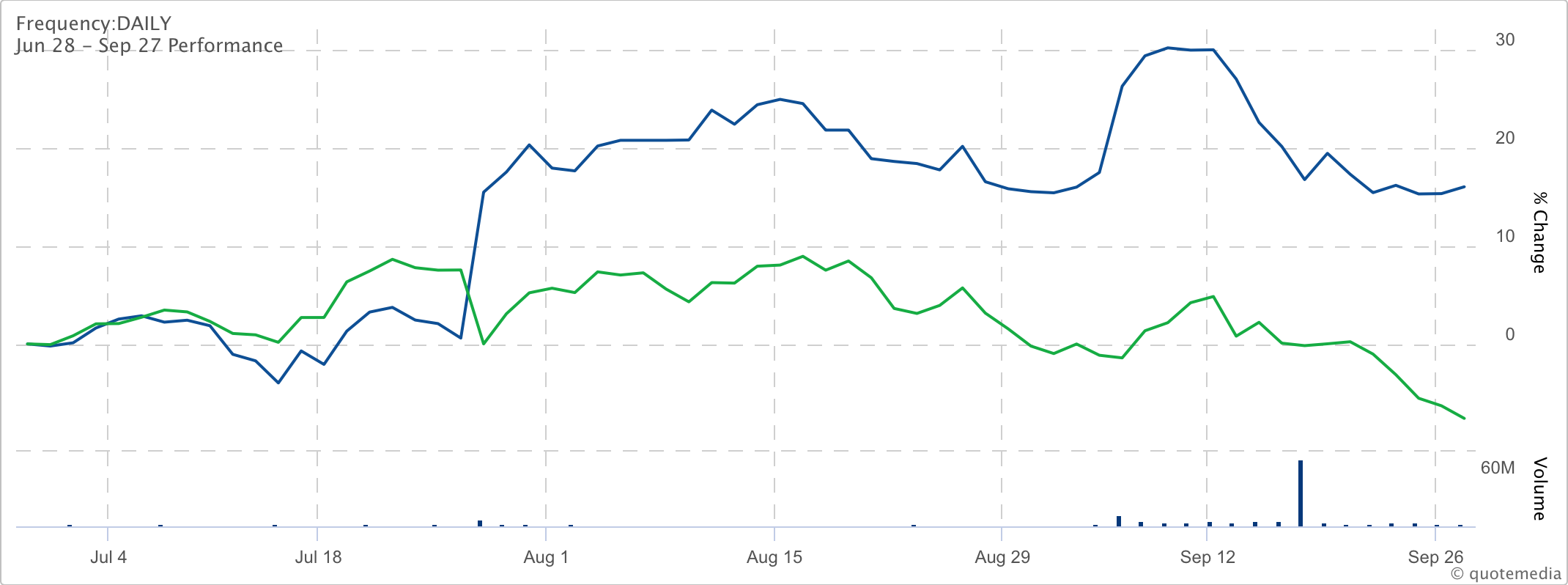

Figure 3: The stock price trend for CSGP and TDY in last three month. The green line represents TDY, and the blue line represent CSGP.

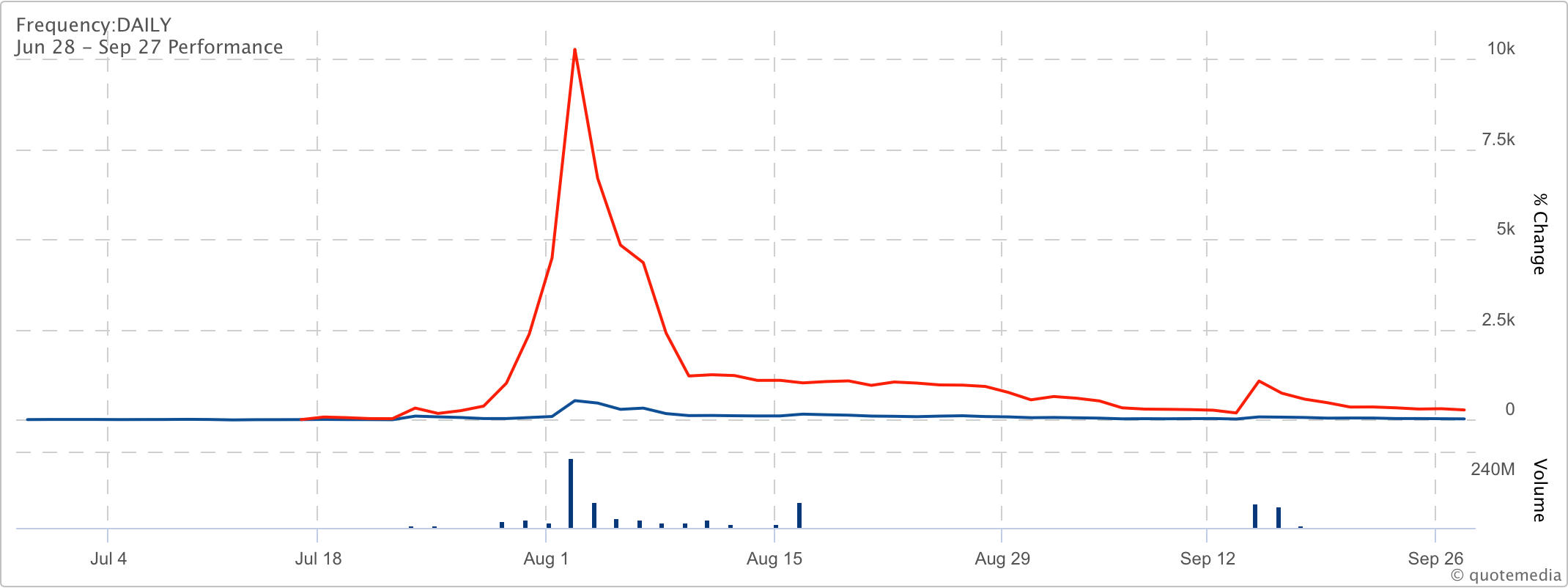

Figure 4: The stock price trend for AMTD and HKD in last three month. The blue line represents AMTD, and the red line represent HKD.

Source: all the data are from Stock track [11].

4. Strategy

There are 4 strategies occur in these portfolios. Momentum investing [12], Merger arbitrage strategy, Market nature trade and comparing PEG ratios.

4.1. Momentum Strategy

The momentum strategy is about comparing the changes in price for the last five days/ 15 days/ 1 month. In the portfolio, the chosen price is the moving average price for the last five days to compare with the current price (the price when I brought the stock). If the moving average price is higher than the current price, we should not buy the stock. If the moving average price is lower than the current price, we should buy this stock.

In the momentum investing strategy, the action is long IS and short SYM. The price for IS is 3.87, and the moving average price for the last five days is 3.81. So, according to the strategy, the action should be long for this stock. For SYM, the buying price is 18.6, and the moving average price for the last five days is 18.818. Therefore, shorting this stock should be the action.

4.2. Merger Arbitrage Strategy

Merger arbitrage strategy is long the target stock and short the bidder’s stock. There are always mergers in the reality, so the key in this strategy is to pay close attention to the news and get the latest news to make a decision [13].

According to Seeking Alpha: “France's Canal Plus Group (OTCPK: VIVHY) is in advanced talks to take over the film, TV, and pay TV units of incumbent French telecom Orange (NYSE: ORAN), Variety reports.” [14]. In the merger arbitrage strategy, the stock of VIVHY Group is brought and shorted the stock of ORAN. This idea is based on the merger arbitrage strategy. The quantity of one is chosen due to the easiness of comparing and the direct feedback.

4.3. Market Neutral Trade

Market neutral trade is when beta equals zero for the entire portfolio. Every firm has a unique beta, which measures the risk of the stock. Higher beta always brings more risk but higher benefits. Therefore, in this strategy, if a stock is bought with a high beta, then another stock with a lower beta should be shorted. And establish this equation:

\( Beta A* Quantity A+ Beta B* Quantity B= 0.\ \ \ (1) \)

The action is long CSGP and short TDY for a market-neutral trade strategy. According to this equation:

\( 0.86 * 127907 - 1.1 * 100000 = 0. \ \ \ (2) \)

Then the appropriate contracts will be calculated. The 0.86 and 1.1 in the equation refer to the stock's beta used by the strategy.

4.4. PEG Ratios

The PEG ratios are the price earnings ratio divided by the growth rate. Just like beta, every stock has different PEG ratios. If the PEG ratio is higher than 1, then short the stock, if the PEG ratios is smaller than 1, then invest the stock.

The strategy includes the action of long HKD and short AMTD. The PEG Ratio for HKD is according to the equation:

\( \frac{319.54}{36.19}\%*100 = 0.883.\ \ \ (3) \)

The PEG Ratio for AMTD is:

\( \frac{1.15}{0.69}\%*100 = 1.66.\ \ \ (4) \)

Therefore, the PEG ratios of the two companies are obtained.

5. Result

5.1. Data and Reasons

The total return of momentum investing is -62.5, which means the strategy is failed in this experiment. This strategy failed because the investor paid too much attention to price differences but forgot to look at the whole tendency. As the stock price tendency indicates, this stock has declined for a month. Therefore, the investor should not take long this stock in a short period.

Table 1: The details for momentum investing.

Symbol | Long/ Short | Qty | Cur | Price Paid | Last Price | Return | %return |

IS | Long | 100 | USD | 4.85 | 4.03 | -82.5 | -17.01 % |

SYM | Short | 100 | USD | 16.20 | 16.40 | 20 | 1.23% |

The total return for the merger arbitrage strategy is -0.4. This result is because the investor did not fully access the information and lacked careful consideration as these two companies are just partial mergers. Therefore, this portfolio failed.

Table 2: The details for merger arbitrage strategy.

Symbol | Long/ Short | Qty | Cur | Price Paid | Last Price | Return | %return |

VIVHY | Long | 1 | USD | 10.17 | 9.61 | -0.56 | -5.51% |

ORAN | Short | 1 | USD | 10.53 | 10.37 | 0.16 | 1.55% |

The return of market neutral trade is 212086.96. However, the quantity calculated for this trade is not available in reality as it has quantity limits. Moreover, although this combination gives the highest return, which is the main reason this portfolio is defined as successful and invests the most, this combination lacks the possibility of practice.

Table 3: The details for market neutral trade.

Symbol | Long/ Short | Qty | Cur | Price Paid | Last Price | Return | % return |

CSGP | Long | 127907 | USD | 72.93 | 74.71 | 227674.46 | 2.44% |

TDY | Short | 25000 | USD | 399.42 | 400.05 | -15587.5 | -0.16% |

The total return for comparing the PEG ratios strategy is 196.7. The two companies that were chosen belong to the same group; the D in IDEA stands for AMTD Digital Inc. According to the news, IDEA is now supporting this subsidiary. Furthermore, IDEA is constantly disintegrating itself. This combination follows the PEG ratio principle and considers the company's primary operation mode. So, it is a good combination.

Table 4: The details for comparing PEG ratios.

Symbol | Long/ Short | Qty | Cur | Price Paid | Last Price | Return | % return |

HKD | Long | 10 | USD | 189.1 | 192.27 | 31.7 | 1.68% |

AMTD | Short | 100 | USD | 3.9 | 2.25 | 165 | 42.31% |

6. Comparison

Comparing all the strategies made in this paper, the most efficient and feasible one is comparing the PEG ratios [15]. This method accurately conveys the buying ability of the stock while avoiding extreme cases. Unlike another method, which compares the moving average price for the last five days, it may change the stock price suddenly for special reasons, such as a sudden depression or a sell-off in a company's stock. Therefore, the conclusion is inaccurate and will significantly affect people's decision-making. Unlike a Market-neutral trade Strategy, achieving conditions is tedious and complex.

Furthermore, the figures may not match the actual purchasing power in reality frequently. Merger arbitrage is a great strategy, but mergers are not always buying. Objectively, the condition is rarely reached. Moreover, this strategy is relatively simple for beginners to use. As it only requires the data from the firm itself. The only thing required when using this strategy is dealing with the numbers. Therefore, it is a clear and straightforward way to make decisions that will not be distracted by other firms.

7. Conclusion

As a result, comparing the PEG ratio is the best strategy after comparison which is easy to practice in reality. However, this article is only a brief description of these four strategies. The company's operating conditions also affect the comparison results and cannot be generalized. Different strategies have different application methods depending on the company's choice and timing.

The further strategy for this momentum investing is to sell them to minimize the losses or increase the quantity shorted in the strategy. Because as the data indicates, SYM brings some profit. Therefore, this portfolio may get some returns if the investor increases the amount for SYM in the future.

For merger arbitrage strategy is to redo it, look for other mergers, or completely abandon these stocks.

The future strategy for market nature trade is to sell this stock, as it lacks feasibility. However, this practice proves that the market nature strategy is feasible if the investor has enough initial funding.

The trades based on comparing PEG ratios are successful. However, to improve the returns, the future improvement might be to shift the focus to long the HKD because the other stock does not seem to have much to fail in the future.

References

[1]. Asness, Clifford, et al. "Fact, fiction, and momentum investing." The Journal of Portfolio Management 40.5 (2014): 75-92.

[2]. Lui W, Strong N, Xu X. The profitability of momentum investing[J]. Journal of Business Finance & Accounting, 1999, 26(9‐10): 1043-1091.

[3]. Swinkels L. Momentum investing: A survey[J]. Journal of Asset Management, 2004, 5(2): 120-143

[4]. Arak M, Foster R W. PEG ratios: What makes sense? [J]. The Journal of Investing, 2003, 12(2): 19-24.

[5]. Schatzberg J D, Vora G. PEG investing strategy: A revisit[J]. Quarterly Journal of Finance and Accounting, 2009: 5-22.

[6]. Yang T, Branch B S. Merger arbitrage: evidence of profitability[J]. The Journal of Alternative Investments, 2001, 4(2): 17-32.

[7]. Tuan J, Hsu J C, Zhang J, et al. Merger arbitrage profitability in China[C]//International Conference on Management Science and Engineering, Press of Harbin Institute of Technology. 1995.

[8]. Maheswaran K, Yeoh S C. The profitability of merger arbitrage: some Australian evidence[J]. Australian Journal of Management, 2005, 30(1): 111-126.

[9]. Block S B. Merger arbitrage hedge funds[J]. Journal of Applied Finance, 2006, 16(1)

[10]. Beliossi G. Market neutral strategies[J]. The Journal of Alternative Investments, 2002, 5(2): 93-96.

[11]. StockTrack, https://www.stocktrak.com

[12]. Grundy, Bruce D., and J. Spencer Martin. "Understanding the nature of the risks and the source of the rewards to momentum investing." The Review of Financial Studies 14.1 (2001): 29-78.

[13]. Kirchner, Thomas. Merger arbitrage: how to profit from global event-driven arbitrage. John Wiley & Sons, 2016.

[14]. Seeking Alpha Homepage, https://seekingalpha.com/news/3858590-canal-plus-in-advanced-talks-to-acquire-orange-media-groups-variety, last accessed2022/7/20

[15]. Easton, Peter D. "PE ratios, PEG ratios, and estimating the implied expected rate of return on equity capital." The accounting review 79.1 (2004): 73-95. LNCS Homepage, http://www.springer.com/lncs, last accessed 2016/11/21.

Cite this article

Yu,J. (2023). The Best Investing Strategy for Beginners. Advances in Economics, Management and Political Sciences,14,250-257.

Data availability

The datasets used and/or analyzed during the current study will be available from the authors upon reasonable request.

Disclaimer/Publisher's Note

The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of EWA Publishing and/or the editor(s). EWA Publishing and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content.

About volume

Volume title: Proceedings of the 2nd International Conference on Business and Policy Studies

© 2024 by the author(s). Licensee EWA Publishing, Oxford, UK. This article is an open access article distributed under the terms and

conditions of the Creative Commons Attribution (CC BY) license. Authors who

publish this series agree to the following terms:

1. Authors retain copyright and grant the series right of first publication with the work simultaneously licensed under a Creative Commons

Attribution License that allows others to share the work with an acknowledgment of the work's authorship and initial publication in this

series.

2. Authors are able to enter into separate, additional contractual arrangements for the non-exclusive distribution of the series's published

version of the work (e.g., post it to an institutional repository or publish it in a book), with an acknowledgment of its initial

publication in this series.

3. Authors are permitted and encouraged to post their work online (e.g., in institutional repositories or on their website) prior to and

during the submission process, as it can lead to productive exchanges, as well as earlier and greater citation of published work (See

Open access policy for details).

References

[1]. Asness, Clifford, et al. "Fact, fiction, and momentum investing." The Journal of Portfolio Management 40.5 (2014): 75-92.

[2]. Lui W, Strong N, Xu X. The profitability of momentum investing[J]. Journal of Business Finance & Accounting, 1999, 26(9‐10): 1043-1091.

[3]. Swinkels L. Momentum investing: A survey[J]. Journal of Asset Management, 2004, 5(2): 120-143

[4]. Arak M, Foster R W. PEG ratios: What makes sense? [J]. The Journal of Investing, 2003, 12(2): 19-24.

[5]. Schatzberg J D, Vora G. PEG investing strategy: A revisit[J]. Quarterly Journal of Finance and Accounting, 2009: 5-22.

[6]. Yang T, Branch B S. Merger arbitrage: evidence of profitability[J]. The Journal of Alternative Investments, 2001, 4(2): 17-32.

[7]. Tuan J, Hsu J C, Zhang J, et al. Merger arbitrage profitability in China[C]//International Conference on Management Science and Engineering, Press of Harbin Institute of Technology. 1995.

[8]. Maheswaran K, Yeoh S C. The profitability of merger arbitrage: some Australian evidence[J]. Australian Journal of Management, 2005, 30(1): 111-126.

[9]. Block S B. Merger arbitrage hedge funds[J]. Journal of Applied Finance, 2006, 16(1)

[10]. Beliossi G. Market neutral strategies[J]. The Journal of Alternative Investments, 2002, 5(2): 93-96.

[11]. StockTrack, https://www.stocktrak.com

[12]. Grundy, Bruce D., and J. Spencer Martin. "Understanding the nature of the risks and the source of the rewards to momentum investing." The Review of Financial Studies 14.1 (2001): 29-78.

[13]. Kirchner, Thomas. Merger arbitrage: how to profit from global event-driven arbitrage. John Wiley & Sons, 2016.

[14]. Seeking Alpha Homepage, https://seekingalpha.com/news/3858590-canal-plus-in-advanced-talks-to-acquire-orange-media-groups-variety, last accessed2022/7/20

[15]. Easton, Peter D. "PE ratios, PEG ratios, and estimating the implied expected rate of return on equity capital." The accounting review 79.1 (2004): 73-95. LNCS Homepage, http://www.springer.com/lncs, last accessed 2016/11/21.