1. Introduction

There is a saying that “cash is king.” Cash and its equivalents are very crucial to the health and growth potential of a business. Cash position and cash flows are important indicators of the liquidity and solvency of a business. As solvency and liquidity are important for the general health and the valuation of a business, they are extremely crucial when businesses are facing challenges. Either financial distresses caused by illiquidity or economic distress caused by insolvency can bring a business down to the point of bankruptcy. While economic distress requires real solutions like business remodeling or managerial and operational changes, financial distress can be largely avoided by good cash management.

The seemingly straightforward question would be: “how much cash should we hold on to hand”, but this is more complicated than we think. According to Professor Wilcox from Haas, “While cash is less productive than other business assets, more cash can reduce cost and risks of business liabilities [1]”. Insufficient cash leaves a company in adverse conditions in terms of its liabilities, and an excessive amount of cash on hand is a waste of its financial potential.

Managing cash well is key to a business’s survival and growth, and forecasts of future operating and cash positions are the basis for cash management. In the following section, I would limit the analysis of cash management and its effects to a specific context and understand its use as well as limitations in the case study of AMC Entertainment. My objective would be to analyze its cash position and changes in cash flows in the past five years, looking into the reasons behind it and how COVID-19 plays a role in it, and finally, provide a forecast of its future survival and growth.

2. A Case Study of AMC

2.1. Background

During the pandemic of COVID-19, entertainment and service businesses have seen the largest challenge in decades. Following the lockdown, restriction orders, stay-home policy, and social distancing that lasted for more than one year, many of the traditional

Entertainment and service businesses had to shut down and face the fact that there would be very little operating income. AMC Entertainment Holdings is an American movie theater chain that has the largest share of the U.S. theater market, thus a good representative of the businesses that are most impacted by Covid-19.

In March 2020, AMC announced the temporary closure of all its theaters nationwide following local, state, and federal guidelines, in response to the intense outbreak of the pandemic [2]. When it reopens in several months, the world is not the same. Public health and safety become the biggest concern of the state and local government as well as the general citizens. Going out for a movie is no longer a simple way to entertain, but also a potential exposure to the virus. Thus, AMC must leave many of its seats empty to maintain proper social distancing and spend more on the intensified cleaning protocols.

The situation is dire, and AMC’s survival is at stake. However, they perform a good cash management strategy that allows it to go through this phrase and sustain its operations till now. They see a steady recovery, but it remains unknown if they can strive for growth in the post-pandemic era through its operational and cash management strategies.

2.2. Financial Statements Observation and Analysis

This part would be a financial analysis of AMC based on its 10-K reports from the past 5 years. All the data used in the text or used to generate the graphs presented below are derived from the 10-K statements of AMC in 2017, 2019, and 2021, on the official website of the U.S. Security and Exchange Commission [3][4][5].

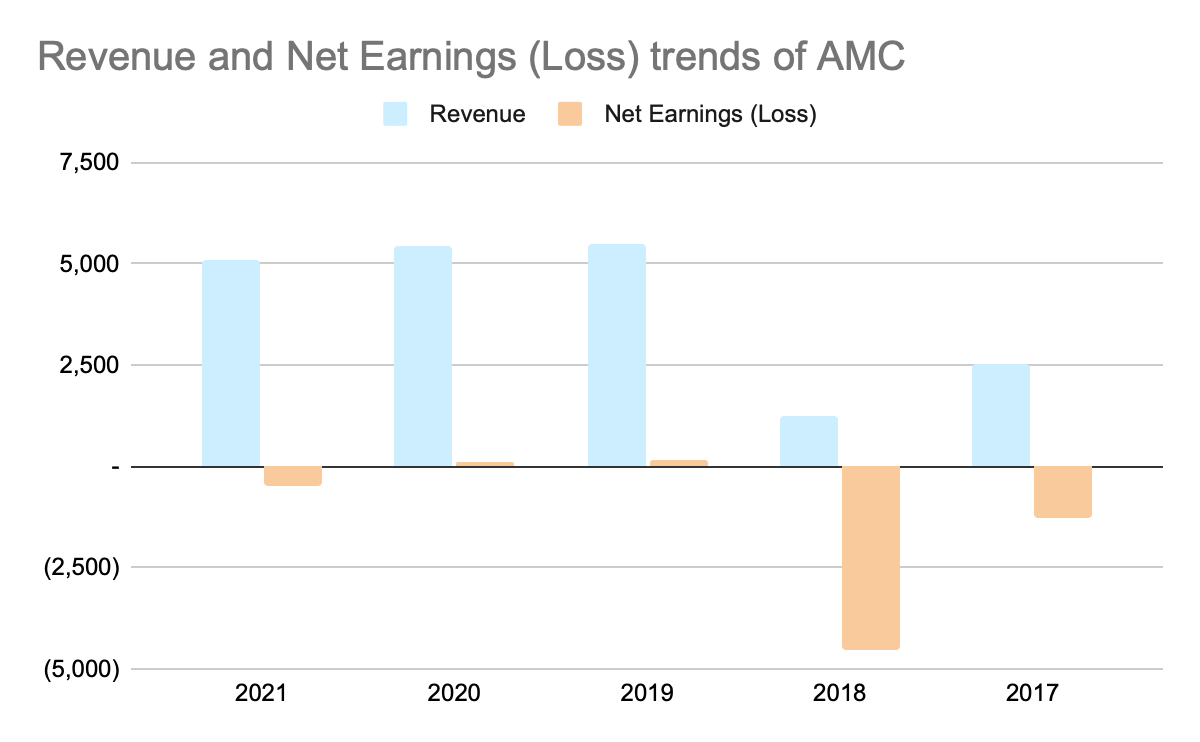

From their financial reports from 2017 to 2021, we have seen a sudden decrease in Revenue and net earnings following the outbreak of COVID-19. In 2020, its revenue drops to less than 25% of 2019 and less than 30% of the average from 2017 to 2019. The revenue somehow bounced back in 2021 but is still less than half of the revenue in 2018 and 2019.

While not always operating at gains, AMC maintains a rough balance in loss and gain throughout the past 5 years. It reaches rock bottom in 2020 when the net loss reaches 4589. Like the revenue, it recovered in 2021 following the end of stay-home orders and while theaters reopened, but it didn't reach the operating situation before the pandemic. Even before the pandemic, AMC is not operating in a very profitable situation, it would need to make changes to its strategy in the future to boost sales and increase revenues, perform cost reduction, or restructure assets and liabilities to improve its financial structure to boost the health and growth of the business in the long-term. However, Covid-19 triggers the upfront financial pressure and makes the need for changes and improvements imminent.

Figure 1: The change of revenue and net earnings(loss) of AMC Entertainment from 2017-2021, data drawn from the 10-K statements from SEC’s website.

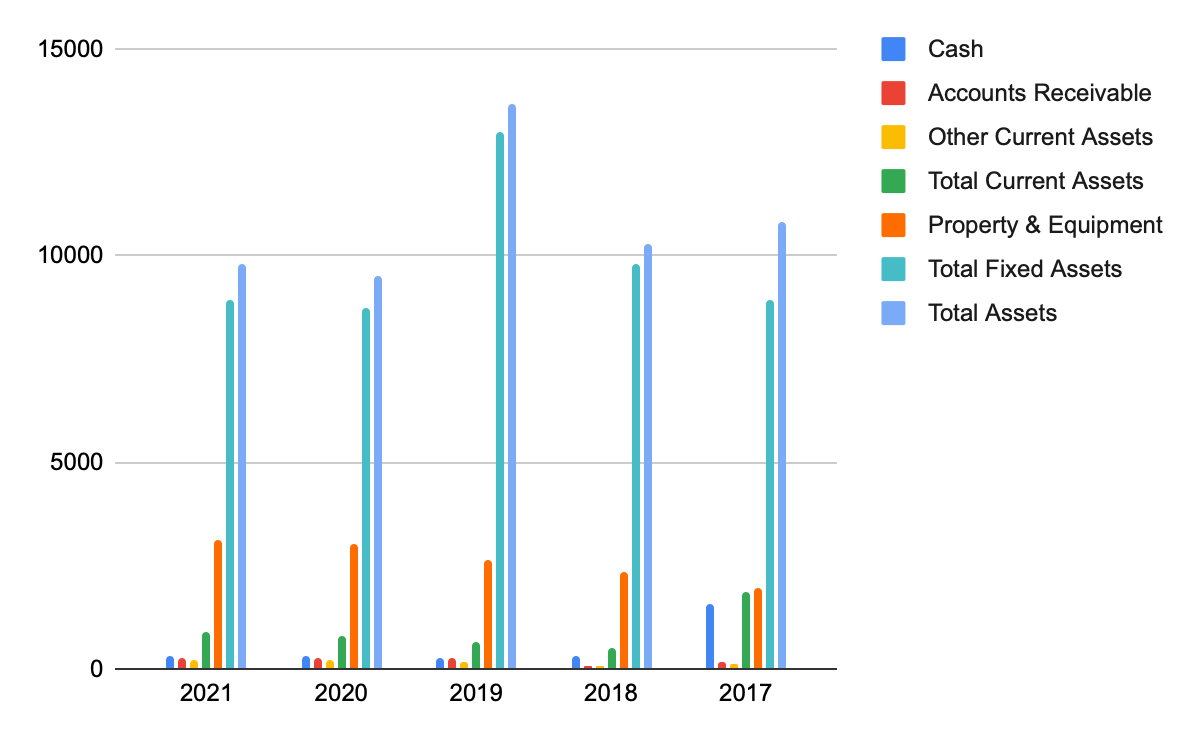

However, AMC’s cash positions show a different pattern. It has been in a steady place over the past few years, including 2020, during the outbreak of COVID-19, but has seen a dramatic increase in the year 2021.

As we can see in Fig.2, while its accounts receivable and total assets followed the trends of its revenues, its properties and equipment decreased steadily over the five years, and total current assets yield a different trend. Such a difference is triggered by a sharp increase in cash, which is not in accordance with its income and net earnings. Naturally, we would assume a company has more cash outflows than inflows when its general condition deteriorates, but AMC’s cash management strategy yields a different result.

Figure 2: Accounts receivable portion of the generalized balance sheets (yearly reports) of AMC Entertainment from 2017-2021, data drawn from the 10-K statements from SEC’s website.

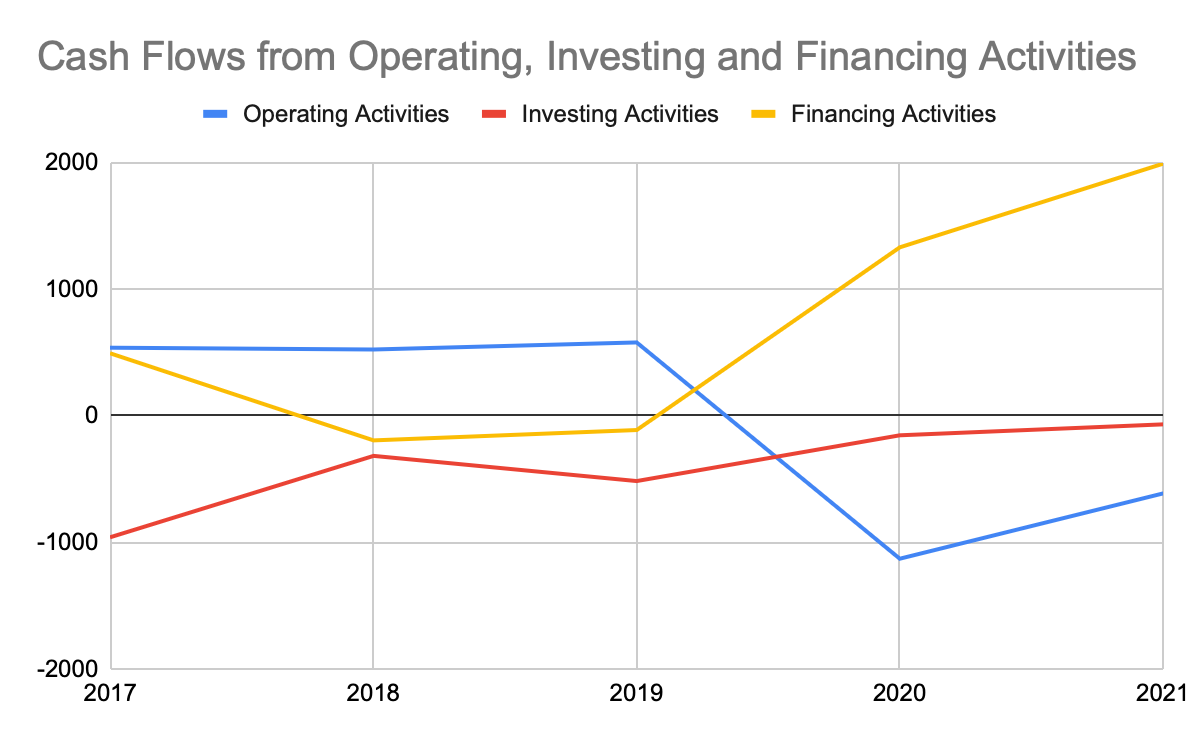

Figure 3: Cash flows from operating, investing and financing activities of AMC Entertainment from 2017-2021, data drawn from the 10-K statements from SEC’s website.

To figure out the reasons behind the changes in cash positions, we must study the statements of cash flows. From the pattern of revenue and net income, it is safe to conclude that operating activities might not be able to provide the cash that leads to this huge difference, since there are very little cash inflows and much more cash outflows contributed by operations when covid breaks out. Since the deterioration in revenue and net income signals no extra cash provided by the operating activities (if not more is used in this section), the increase must source out to either in-vesting activities or financing activities. Since the cash flows from investing activities of AMC are mainly determined by its Mergers and Acquisitions of other theaters, it consists of cash outflows throughout the past 5 years. However, during the pandemic, the economy is in a recession, and business cycles are in contraction, so it would be natural for AMC to pause its expansion, cutting the expense of mergers and acquisitions.

The increase in cash position is largely due to the extra cash inflows from financing activities, as we can see in Fig 3. While Net cash provided by operating activities supports our observation of the changes in revenue and net income, Net cash provided by financing activities signals an additional source of cash inflow. AMC has been trying to obtain cash through its financing activities to cover up its loss and cash outflows in operating activities during the pandemic, and this action has not only kept its cash position positive but even increased it in 2021, in the aftermath of the huge outbreak of COVID-19. If AMC has not sought out this extra cash inflow through its financial operations, it would encounter a cash shortage, which would make the situation more adverse during the challenges brought by the pandemic, and probably this is the key to how AMC was able to survive and recover from the COVID.

2.3. AMC’s Cash Management Strategy

When cash flows in because of financing activities of a company, it would be either equity financing or debt financing. In this case, AMC’s extra cash inflow is funded by equity. More specifically, the sharp increase in cash position is mainly due to cash inflows from the issuance of Class A common stock.

In 2020 and the start of 2021, AMC’s performance as well as its stock reaches an all-time bottom, as a result of Covid-19. Judging from its huge loss in income and the compounding debts it has accumulated since before the pandemic, whether it receives enough funding to maintain its liquidity and solvency status is the key factor of its survival.

While AMC entertainment was struggling on the verge of bankruptcy, they became a good target for the meme stock buyers. Since late 2020, there is a rise in the so-called “meme stock”. Following the lockdowns of Covid-19’ as well as the prevalence of low-commission-fee investing apps like Robinhood, the cult-like activity of building hype around heavily shorted stocks through discussions in online forums (like Reddit) and social media emerges. After the success of the first meme stock, GameStop, AMC becomes another ideal meme stock option for individual investors, retail investors, and day traders on Reddits and Wallstreetbets, who creates a huge demand for AMC stocks and an increase in the stock price as well as the company’s valuation at the beginning of 2021 (as shown in the graph below). AMC’s CEO Adam Aron makes good use of this hype of the meme stock buyers and issues more common stocks to exchange cash in May and June, raising over $587 million [7]. Adam Aron uses this cash to repurchase much of its debt in the following September to rid AMC of the liquidity problem on hand by lot [8].

When cash flows in because of financing activities of a company, it would be either equity financing or debt financing. In this case, AMC’s extra cash inflow is funded by equity. More specifically, the sharp increase in cash position is mainly due to cash inflows from issuance of Class A common stock.

3. Industry Future Implications

3.1. AMC’s Future Implications

There are several positive outlooks of AMC. Its revenue rebounds, reaching a 103% increase compared to that of 2020, as theaters reopen. While the implicit impacts of Covid-19 drag on, its direct impacts are becoming lower and lower. More people are going back to the cinema, but not as much as before the pandemic.

Cineworld filed for bankruptcy in September, since the sluggish recovery of its sales cannot cover the financial stress of the company [9]. They are the second-largest cinematic theater chain and the biggest rival of AMC in the industry. On one hand, the reduction in competition could drive more demand for AMC and boost its sales. On the other hand, the failure of the second-large company in this industry makes people wonder if the whole industry is unavoidably decaying. Adam Aron has expressed optimism after this incident on August 19, claiming that AMC is going in the contrasting direction of Cineworld, but the reality might not be as promising as he fore-saw.

Although meme stock buyers saved AMC from being bankrupt, their hype doesn't last long. The stock price of AMC continues to fall---it reaches 9.07 dollars yesterday, while its peak of it in June was as high as 60 dollars. Now it almost reaches the level before the pandemic and would probably fluctuate around the level before the covid. As shown in the graph below.

Figure 4: AMC stock price since January of 2020 till August 2022, drawn from Yahoo Finance.

In the advanced talk with the Wall Street Journal, Adam Aron said the next goal of AMC would be debt restructuring [10]. In this way, AMC could refinance the part of its debts with the highest interest rate, and therefore significantly decrease the interest rate overall and so is its interest expense. When the cost of borrowing decreases, AMC would enjoy more liquidity and more flexibility towards financial pressures in the long run.

While this is a good strategy, it is not going as smoothly as Adam Aron forecasted. The Apes, individual investors of AMC, have taken control of major shares of AMC. They would not easily allow AMC to dilute their shares. According to the advanced talk of AMC and the wall street journal, last year, “AMC twice failed to win shareholder approval of new equity issuances as apes fretted about dilution” [9]. Since the major shares are now in hands of the Apes, it might be hard for AMC to issue more stocks to gain the cash for paying the debt outstanding with high-interest rates. To alleviate the financial pressure, AMC can still negotiate with their landlords to delay their rental dues, until they are back on their feet.

Through Adam Aron’s strategy, AMC might keep operating and not go bankrupt, since its operating situations are getting better, and the economic pressure of the industry somehow eases as the lockdown is over and vaccines are popularized. With the drop in its interest rate and thus the decrease in interest expense, AMC’s financial status should be healthier.

3.2. Industry Future

The traditional movie theater chain is not only facing financing pressure, but also economic pressure.

The lockdown, restrictions, and stay-home orders from last year led to the breakdown of revenue and income, and thus the decrease in the ability to refinance debts, as we saw in the case of AMC entertainment and Cineworld. This compromised liquidity status, or financial distress, can be eased by several financial solutions. The common ones are debt restructuring, the sale of assets, and looking for new funding. Normally it is hard to get more funding from investors when the company is in a compromised situation, not to mention the debt overhang problem, where the burden of debt is too large for companies to achieve new funding. Luckily, with the unprecedented rise of meme stocks, AMC entertainment becomes a big benefactor of this option. However, meme stock is a phenomenon with some entertainment nature that is not entirely understandable with traditional investment logic, so other firms in the industry might not be this lucky.

While financial distress can be eased by financial solutions, economic distress needs real solutions. The traditional movie theaters are facing so much real economic distress. Many of them are problems that existed way before but were exacerbated by the pandemic. A major cause would be the rise of streaming media like Netflix, Disney+, Amazon Prime, HBO and so on. These media platforms give the customers a more money and time-efficient way to access movies. Because of the pandemic, many blockbusters around this period have chosen to distribute by these channels instead of actual cinemas. While more customers are used to the online-streaming platforms, they might be more reluctant to switch back to cinemas, even after the outbreaks of the pandemic die down. Not to mention that the idea to avoid unnecessary exposure due to the covid still exists in many people’s minds.

Not only Cineworld, but also several smaller companies in the industry, such as Studio Movie Grill, Pacific Theatres, Cinemex, and Alamo Drafthouse, filed for bankruptcy in the aftermath of Covid-19, not only due to illiquidity but also because of the slow recovery of box office due to all this economic distress. This is truly a winter for the Cinema industry. To survive, they would need to perform good cash management and debt restructuring, like AMC, to solve the illiquidity problem on hand, and to revise its business model and operation strategy in the long run.

Watching a movie nowadays might not be a cost-effective, time-effective, or the safest way to entertain, compared to using the online-streaming platforms, but there is a virtue and cultural value in doing this. Sometimes, consumer values these meanings, and different customers choose the lifestyles they want, not necessarily always the easiest or most cost-effective ones. After all, one of the most original motivations for the individual investors that brought meme stock is a rebellious attempt to preserve the industries that are decaying as technology and business models evolve. Dreams and memories of the good old times mean more to the customers of the entertainment business than other areas. With proper adjustment and management, I believe movie theaters would survive.

4. Conclusion and Suggestion

4.1. Conclusion

This paper is a case study of AMC and some generalizations of its implication for the cinema industry. In the introduction, this paper expresses the motivations to study AMC, as well as the cinema industry and some generalized background of how the pandemic brought changes to the cinema industry. As a good representative of the traditional entertainment business that is most suspectable to changes brought by covid-19, AMC’s survival serves as a good target to analyze how cash management strategies related to the growth and survival of a business. The second part of this paper specialized in the case study of AMC and explains observations in its financial reports from 2017 to 2020 in detail, with special regard to its cash management strategy and reasons behind the changes in its cash position. AMC utilizes its stock surge due to the rise of meme stocks and Ape, the individual investors of AMC, to issue stocks and generates an astounding amount of cash. They use this cash to refinance some of their outstanding liabilities with the highest interest rates to decrease the interest expense in the future and restore their liquidity status. In part three, this paper brings up the future implications of AMC’s strategy, and meme stocks, and generalizes the implications to the industry. While both AMC and other firms in the cinema industries face economic pressures and financial pressures, AMC survives but many others do not. The industry is recovering in the aftermath of the Covid, but it might not be able to reach its operation status before the covid, due to the rise of online streaming platforms and remaining concerns of public health, just like AMC. However, that doesn't mean these industries would demise with the passage of time because entertainment businesses exist not only for financial gains or technological advancement but also the sensational and cultural values.

References

[1]. Personal Website of Professor Jim Wilcox, http://faculty.haas.berkeley.edu/wilcox/?_ga=2.206449424.2080349664.1664168495-179347176.1664168495, last accessed 2022/09/18.

[2]. AMC Theatres. (2020) Exciting news from AMC Theatres. https://www.amctheatres.com/covid-19-update, last accessed 2022/09/18.

[3]. AMC Entertainment Holdings, Inc. Form 10-K 2021. March 1, 2022. U.S Securities and Exchange Commission. Retrieved on August 30, 2022. Retrieved from https://www.sec.gov/ix?doc=/Archives/edgar/data/0001411579/000155837022002577/am c-20211231x10k.htm

[4]. AMC Entertainment Holdings, Inc. Form 10-K 2019. February 28, 2020. U.S Securities and Exchange Commissi-on. Retrieved August 30, 2022. Retrieved from https://www.sec.gov/ix?doc=/Archives/edgar/data/0001411579/000141157920000027/am c -20191231x10k.htm

[5]. AMC Entertainment Holdings, Inc. Form 10-K 2017. March 1, 2022. U.S Securities and Exchange Commission. Retrieved on August 30, 2022. Retrieved from https://www.sec.gov/Archives/edgar/data/1411579/0001411579180000 14/c 579-201712 31x10k.htm, last accessed 2022/09/18.

[6]. Yahoo Finance, https://finance.yahoo.com/chart/AMC, last accessed 2022/09/18.

[7]. New York Times. AMC cashes in on meme stock mania, raising $587 million. June 3, 2021. Retrieved on September 18, 2022. Retrieved from https://www.nytimes.com/2021/06/03/business/amc-meme-stock.html

[8]. CNBC. How AMC rode the meme stock rally to revitalize its business. January 26, 2022. Retrieved on September 18, 2022. Retrieved from https://www.cnbc.com/2022/01/26/how-amc-rode-the-meme-stock-rally-to-revitalize-its-business.html

[9]. Wall Street Journal. Cineworld files for Chapter 11 after sluggish ticket sales. September 7, 2022. Retrieved on September 18, 2022. Retrieved from https://www.wsj.com/articles/sluggish-ticket-sales-drag-regal-owner-cineworld-into-chapter-11-11662562917?page=1

[10]. Wall Street Journal. AMC in advanced talks to refinance debt as meme stock luster fades. January 25, 2022. Retrieved on September 18, 2022. Retrieved from https://www.wsj.com/articles/amc-in-advanced-talks-to-refinance-debt-as-meme-stock-luster-fades-11643121676?page=2

Cite this article

Qiu,Y. (2023). The Financial and Strategy Analysis of Cinema Industry, A Case Study of AMC. Advances in Economics, Management and Political Sciences,14,289-296.

Data availability

The datasets used and/or analyzed during the current study will be available from the authors upon reasonable request.

Disclaimer/Publisher's Note

The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of EWA Publishing and/or the editor(s). EWA Publishing and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content.

About volume

Volume title: Proceedings of the 2nd International Conference on Business and Policy Studies

© 2024 by the author(s). Licensee EWA Publishing, Oxford, UK. This article is an open access article distributed under the terms and

conditions of the Creative Commons Attribution (CC BY) license. Authors who

publish this series agree to the following terms:

1. Authors retain copyright and grant the series right of first publication with the work simultaneously licensed under a Creative Commons

Attribution License that allows others to share the work with an acknowledgment of the work's authorship and initial publication in this

series.

2. Authors are able to enter into separate, additional contractual arrangements for the non-exclusive distribution of the series's published

version of the work (e.g., post it to an institutional repository or publish it in a book), with an acknowledgment of its initial

publication in this series.

3. Authors are permitted and encouraged to post their work online (e.g., in institutional repositories or on their website) prior to and

during the submission process, as it can lead to productive exchanges, as well as earlier and greater citation of published work (See

Open access policy for details).

References

[1]. Personal Website of Professor Jim Wilcox, http://faculty.haas.berkeley.edu/wilcox/?_ga=2.206449424.2080349664.1664168495-179347176.1664168495, last accessed 2022/09/18.

[2]. AMC Theatres. (2020) Exciting news from AMC Theatres. https://www.amctheatres.com/covid-19-update, last accessed 2022/09/18.

[3]. AMC Entertainment Holdings, Inc. Form 10-K 2021. March 1, 2022. U.S Securities and Exchange Commission. Retrieved on August 30, 2022. Retrieved from https://www.sec.gov/ix?doc=/Archives/edgar/data/0001411579/000155837022002577/am c-20211231x10k.htm

[4]. AMC Entertainment Holdings, Inc. Form 10-K 2019. February 28, 2020. U.S Securities and Exchange Commissi-on. Retrieved August 30, 2022. Retrieved from https://www.sec.gov/ix?doc=/Archives/edgar/data/0001411579/000141157920000027/am c -20191231x10k.htm

[5]. AMC Entertainment Holdings, Inc. Form 10-K 2017. March 1, 2022. U.S Securities and Exchange Commission. Retrieved on August 30, 2022. Retrieved from https://www.sec.gov/Archives/edgar/data/1411579/0001411579180000 14/c 579-201712 31x10k.htm, last accessed 2022/09/18.

[6]. Yahoo Finance, https://finance.yahoo.com/chart/AMC, last accessed 2022/09/18.

[7]. New York Times. AMC cashes in on meme stock mania, raising $587 million. June 3, 2021. Retrieved on September 18, 2022. Retrieved from https://www.nytimes.com/2021/06/03/business/amc-meme-stock.html

[8]. CNBC. How AMC rode the meme stock rally to revitalize its business. January 26, 2022. Retrieved on September 18, 2022. Retrieved from https://www.cnbc.com/2022/01/26/how-amc-rode-the-meme-stock-rally-to-revitalize-its-business.html

[9]. Wall Street Journal. Cineworld files for Chapter 11 after sluggish ticket sales. September 7, 2022. Retrieved on September 18, 2022. Retrieved from https://www.wsj.com/articles/sluggish-ticket-sales-drag-regal-owner-cineworld-into-chapter-11-11662562917?page=1

[10]. Wall Street Journal. AMC in advanced talks to refinance debt as meme stock luster fades. January 25, 2022. Retrieved on September 18, 2022. Retrieved from https://www.wsj.com/articles/amc-in-advanced-talks-to-refinance-debt-as-meme-stock-luster-fades-11643121676?page=2