1. Introduction

The rapid penetration and widespread use of new financial technologies have not only promoted the development of the banking industry but also brought it new challenges. To keep up with the development trend of the times, fintech accelerates the digital transformation of the banking industry. In this paper, the concept and the history of fintech are introduced first. Then, through the comparative analysis and literature research, the current stage of fintech application in the banking industry is explained from two perspectives: the underlying technology of fintech and investment. The representative technologies of fintech, such as artificial intelligence, data mining, big data, and cloud computing, are introduced in detail and their role in the banking industry is also analysed. Finally, the digital transformation in banks is analysed using a case study. This paper can provide a theoretical basis for the banking industry and promote its development and improvement. It affords a detailed introduction to the transformation of the banking industry with the help of fintech, giving inspiration to its future innovation and transformation.

2. Background Information

2.1. The Concept of Fintech

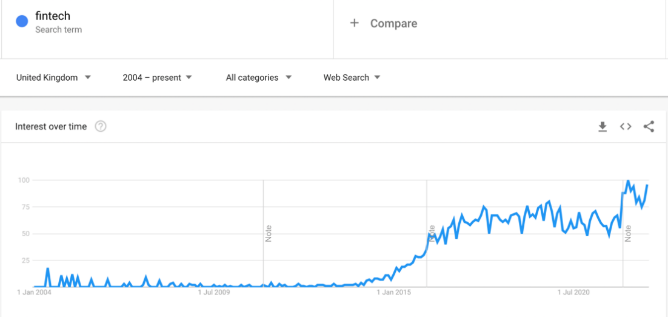

The term fintech was first coined in the early 1990s by John Reid, the Chairman of Citibank, in the context of the group's 'Smart Card Forum' alliance [1]. However, it is only in recent years that fintech has become popular (see Figure 1 for more details). Fintech offers many different services to different industries, such as mobile payment processing in banks, robot investing, and cryptocurrencies. As fintech continues to develop and be used today, international organisations and academics at home and abroad have defined fintech. However, the use of fintech in different scenarios is often inconsistent, so there is as yet no single definition. According to the Financial Stability Board (FSB), fintech refers to financial innovation driven by emerging frontier technologies such as artificial intelligence, big data, blockchain, and cloud computing.

Specifically, the creation of emerging business models, the application of new technology, and the appearance of new product services have significantly impacted financial markets and the supply of financial service businesses. Douglas W. Arner et al. argued that fintech refers to the use of technology to deliver financial solutions [2]. Schueffel P. provided a comprehensive review of around 200 papers that refer to fintech and ultimately attempted to define a new financial industry by applying semantic analysis to the application of technology to improve financial activities [3]. In summary, fintech is a portmanteau of the words 'finance' and 'technology'. 'Finance' is the economic activity of adding value to money by financing money itself, such as issuing and repatriating money, taking and paying deposits, and buying and selling foreign exchange. ‘Technology’ is the scientific solution to theoretical problems and the technical solution to practical problems. Therefore, in this paper, fintech is defined as the innovation of technology, so as to solve the problems faced by traditional finance [4].

|

Figure 1: The search volume of fintech on Google from 2004 to present (Source: Google Trends). |

2.2. The Leading Role of Technology in the Banking Industry

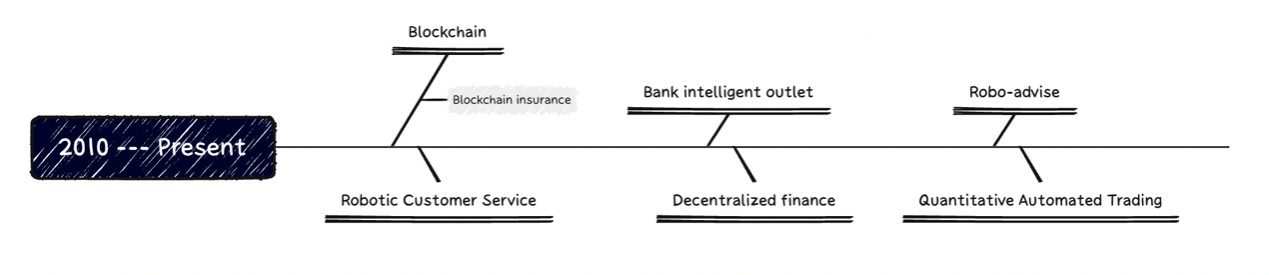

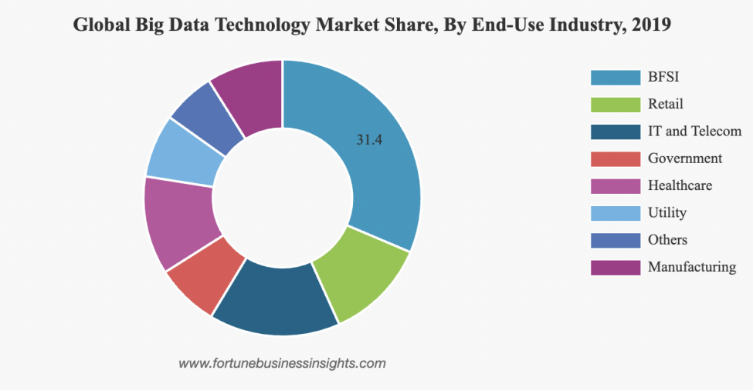

Technology has been a vital cornerstone driving the banking industry for centuries. The successful application of financial technology has often led to technological innovation in general economic scenarios. Starting with the oldest counter-entry cards, the birth of electronic computers in the 1940s and 1950s led to the gradual electronification and automation of banking operations, with ATMs and POS machines being typical products of this phase. After the 2000s, internet technology developed at a rapid pace and became popular, with banks using internet and mobile terminal channels to migrate their offline business online. The user scale and usage rate of online banking in China have induced a long-term upward trend since 2008 (see Figure 2 for details) [5]. The financial sector's face recognition payment system was also a biometric technology born during that period and deeply applied to various life scenarios. With the advent of the big digital era, the banking industry has gradually started to seek digital transformation and entered a high-speed development phase of fintech integration and upgrading (see Figure 3).

Figure 2: Scale of Internet banking users and Internet banking usage rate in China (Source: Wind, China Merchants Securities).

|

Figure 3: Fintech's rapid growth phase from 2010 to present. |

3. Current Development of Fintech in the Banking Sector

This section provides a comparative analysis of the underlying financial technologies in different regions and the level of investment in fintech in the banking sector, thereby understanding the development of the fintech sector in the banking industry in recent years.

3.1. Underlying Financial Technologies

Globally, countries have made financial technology innovation an essential strategic objective to enhance international competitiveness and maintain national security. They have also formulated corresponding strategic plans and policies. In terms of artificial intelligence in the fintech segment, the US and Europe are world leaders in the development and application of AI technology. The US has always focused on the research and development of technology in this area and has been at the forefront of AI research. This is also due to the government's support, which has laid a strong foundation for AI research and development in the US. In addition, the 2020 regional report on global AI patent publications shows that North America has the highest number of patent publications [6]. Artificial intelligence technologies are bringing great changes to various fields. According to a study by data analytics provider IRI 2020, China and the US lead the way in terms of AI research and development, spending $622 billion and $599 billion, respectively. Countries such as Japan, Germany, India, and South Korea are also investing a large amount of money in research in this area [7]. In short, the US and Europe are early and strong in research and development in the field of fintech; but the huge market brought by the vast population base in the Asia Pacific region and the large amount of funding invested in the field of fintech in recent years have contributed to its rapid development.

3.2. Fintech Investments

Scott Woepke, former head of global financial service strategy at Acxiom, said "Bank-tech partnerships are not just a new trend. They are the new core competency of financial institutions. As the number of partners grows, the structure continues to evolve. Fintech, large technology companies, co-branders and others, whose collaboration with marketing, sales, and customer service has become particularly important." In 2018, Cornerstone conducted a survey of bank executives and found that only 1 in 5 thought that fintech collaboration was crucial in their overall business strategy. Then two years later in 2021, nearly half of the respondents said that collaboration made sense [8]. Thereby, for larger commercial banks, the integration and collaboration with fintech are becoming a fundamental form of innovation. Fintech can improve banks' workflows as well as their infrastructure, enhancing their efficiency and banking effectiveness. The inclusion of fintech partners facilitates the expansion of the bank's business scope and enhances user experience and satisfaction.

In the US, bank investment in fintech is also extremely elevated. The average annual investment in the banking sector for the fintech sector is growing from $2.3 million in 2019 to $9.68 million in 2021 [9]. Driven by the background of the era of big data, more and more US banks focus on the application of banking fintech and also regard fintech partners as a strong driving force for the growth of the banking industry. In the recent Statistical Report on the Development of the Internet in China released by the China Internet Information Center (CNNIC), it was revealed that by June 2022, the size of China's Internet users exceeded 1 billion, having reached 1.051 billion and that the Internet penetration rate was approximately 75%. This environment is undoubtedly an ideal breeding ground for thriving the fintech industry. In addition, China is a world leader in fintech development and has the world's most dynamic fintech company. Ant Group (a subsidiary of Chinese technology company Alibaba Group) is the world's most valuable fintech entity with a value of US$150 billion in 2020. This market capitalisation is more than four times higher than the second-ranked fintech company (valued at $36 billion by Stripe) [10].

In such a favourable environment, China's major banks are also following the direction of the times and seeking innovation and transformation, thus increasing their investment in the direction of financial technology. As of 2020, ICBC has invested nearly 2.38 billion RMB in fintech, followed by China Construction Bank with 2.21 billion RMB. The agricultural Bank of China came in third with an investment of nearly 1.83 billion RMB [11]. Secondly, five banks in China have invested more than 1 billion RMB in fintech, which shows that banks are focusing on fintech development and that fintech is also conducive to the competitiveness of the banking industry and its sustainable and prosperous development.

4. Fintech-related Technical Support

Today's smart financial technology is driven by technologies represented by artificial intelligence, big data, cloud computing, etc. to bring disruptive changes to the development of the financial market. With artificial intelligence as the core technology and big data analysis as the basis. This section will focus on the related technologies and analyze their application in banking scenarios.

4.1. Artificial Intelligence

Artificial intelligence is a discipline that studies computers to simulate human behaviour and thinking, so that computers have the ability to execute, perceive, learn and reason, and make decisions. With advances in computer vision, machine learning, natural language processing, robotics, and biometrics, AI has made great strides in fintech. Nowadays, more and more artificial intelligence robots appear in bank business halls to provide customers with intelligent customer service, business guidance, and other services. While improving service quality and efficiency reduces the bank's operating costs. Specifically, intelligent robots integrate multiple artificial intelligence technologies such as speech recognition, language understanding, deep learning, and face recognition. The intelligent robots can communicate with customers and provide them with professional answers. They can also help the bank lobby manager to guide customers who come to handle businesses and guide the different businesses handled by customers. Secondly, the intelligent robot identifies customers through its biometric function, extracts customer information from the bank data lake, and provides precise customized services. This can significantly reduce the pressure of manual services and improve service efficiency and accuracy while reducing costs.

4.2. Data Mining

Data mining is an interdisciplinary and diversified technical field, including database technology, statistics, machine learning, visualization, and high-performance computing. Due to high data density and high-quality characteristics, data mining technology has been widely used in commercial banks. Banks at home and abroad have also set up data warehouse application departments to carry out important work such as data mining and data extraction. For example, according to the newly compiled guest script, the monthly newly compiled customer information of each branch of the bank is extracted. This is conducive to the rational analysis of the bank's business scale and business capabilities within the bank. Secondly, data mining can also carry out intelligent marketing to customers. Analyze customer needs to establish customer portraits and match products to achieve personalized product recommendations and precise marketing.

4.3. Big Data

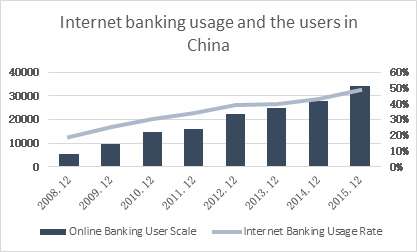

The National Science Foundation (NSF) has defined Big Data as large, diverse, complex, longitudinal and/or distributed data sets generated from instruments, sensors, Internet transactions, email, video, clickstreams and/or all other digital sources [12]. De Mauro and colleagues argue that Big Data represents a large, fast, and diverse information asset requiring specific technologies and analytical methods to transform it into a valuable product [13]. The global market for Big Data has also been increasing in recent years and is expected to reach US$116.07 billion by 2027 [14]. Figure 4 illustrates the market share of big data in the financial sector and other sectors in 2019. Banking, financial services and insurance (BFSI for short) is the sector with the highest rate of big data adoption. The application of big data will not only broaden the business development of banks but also help commercial banks to innovate their products. The widespread use of big data in the banking industry also contributes to improving customer satisfaction and optimising banks' internal management, thus enhancing their core competitiveness.

|

Figure 4: Global big data technology market share, by end-use industry, 2019 (Source: www.fortunebusinessinsights.com). |

4.4. Cloud Computing

Cloud computing is not a single technology. In fact, it is a product of the convergence of traditional computer and network technologies, such as distributed computing, parallel computing, utility computing, network storage, virtualisation, load balancing and other developments [15]. Cloud computing has revolutionised the development of today's banking industry by enabling more flexible and convenient aggregation of computing-based businesses for more efficient and closer multi-party collaboration. In the retail business of banks, cloud computing services play an important role in product sales, branch services, account information and many other areas. For example, cloud computing can be used for one-stop product marketing, where customers can access all financial products released by all banks and other financial institutions through a unified interface across different channels (Internet banking, mobile apps, or other channels) and purchase the required financial products with any bank card they hold.

5. Case Studies of Digital Transformation

Banks have also started to explore digital transformation in response to the call of the times. ICBC, for example, is using financial technology to help digital transformation in four areas: digital ecology, digital technology, digital infrastructure and digital genes. So far, the results have been remarkable, and the response has been good. One of the cases is building digital halls to help with digital insights in branches. Building digital showrooms and smart halls is undoubtedly a powerful tool in banks' digital transformation. Through the panoramic view of the branch, the surrounding resources score, the radar navigation for account expansion, the GBC fund undertaking, the intelligent comparison of branches, the potential customer function, the credit card area and other platform functions, the digital hall transforms the complex resource information and performance indicators of the branch into simple values displayed by dimensions in a "one-click" manner, so that the strengths and weaknesses of the branch's operation and development can be clearly seen. The platform provides a clear view of the branch's strengths and weaknesses. It provides an entry point for outlets to understand their operational status fully and gives full play to the positive effects of big data in empowering grassroots management strategies and enhancing the competitiveness of outlets. The digital lobby operation will fully play its data-driven role, thoroughly combining core technologies such as data introduction, data mining, data analysis and visualisation. The value of data will be used to guide the marketing direction of the bank, combining product sales with branch characteristics and planning marketing strategies for different branch characteristics. The digital lobby system has gained a high level of attention from the industry after it was put into production. The head office of the Industrial and Commercial Bank of China has gained a comprehensive understanding of the construction of the system and has introduced it, with plans to promote it across the bank. The main results so far are: achieving full coverage of users: after the digital hall platform was officially launched, more than 1,000 platform users were opened for the whole bank, and 100% coverage of branch users was achieved, with the branch user activity rate reaching 96.1%. High effectiveness in account expansion: During the development stage of the digital hall platform, the Group Customer Financial Services Department relied on the platform data to sort out the business cooperation between the central and municipal enterprises, institutional interbank customers and small and medium-sized enterprises and institutions of ICBC Beijing Branch, establish a list of target customers and push the enterprises and institutions to market and expand. As a result, more than 300 new settlement accounts were opened, 260 million RMB of new public deposits were made, 39 new payroll accounts were created, 32 new credit accounts were created, and 13.48 million RMB of loans were placed. It also achieved a breakthrough in new business development for 127 existing customers, adding more than 20 new business cooperation items such as digital RMB, corporate wealth management, letters of credit and bank cards, effectively enhancing the product coverage of existing customers (Case from internal information of ICBC).

6. Conclusion

In the era of fintech, technology has revolutionised traditional forms of finance and brought a great impact on banks. Fintech is currently becoming a booster for the transformation of commercial banks. Commercial banks must reposition their business philosophy and operation methods, and apply technologies such as artificial intelligence, data mining, big data, and cloud computing to the transformation of their businesses. Therefore, it is important to study the transformation of commercial banks facilitated by technology in the context of financial technology. This paper is based on a study of the domestic and international literature on fintech and digital transformation in the banking industry. It illustrates and analyses the current situation of commercial bank transformation and points out the problems in the transformation process of commercial banks in various regions and the extent of penetration of fintech in the banking industry. The paper selects a case study of the digital transformation of the famous Chinese bank ICBC. The author also analyses its typical transformation measures and summarises its transformation practices to provide some development ideas for the innovative transformation of the banking industry in the context of fintech. Given that fintech is still a new thing and the author's knowledge of it is relatively insufficient, this paper only discusses the development of fintech in the banking industry from a theoretical perspective, and the depth of its research needs to be further deepened. In the subsequent research and study, the author will continue to dig deeper into the research direction and issues, striving for a more in-depth exploration of the transformation of commercial banks with the help of fintech.

References

[1]. Puschmann, T.: Fintech. Bus Inf Syst Eng 59, 69-76 (2017). https://doi.org/10.1007/s12599-017-0464-6.

[2]. Douglas, W., Arner, J.B., and Ross P.B.: Fintech and Regtech in a Nutshell, and the Future in a Sandbox, Research Foundation Briefs 3(4), (2017). Available at: https://www.cfainstitute.org/en/research/foundation/2017/fintech-and-regtech-in-a-nutshell-and-the-future-in-a-sandbox?s_cid=ppc_RF_Google_Search_fintechandRegTech%20.

[3]. Schueffel, P.: Taming the Beast: A Scientific Definition of fintech. Journal of Innovation Management 4(4), 32-54 (2016).

[4]. Arner, et al.: The Evolution of fintech: A New Post-Crisis Paradigm. University of Hong Kong Faculty of Law Research Paper, No.47, (2015).

[5]. Cha, H.H.: Scale of Internet Banking Users and Internet Banking Usage in China (2016). Available at: https://www.hanghangcha.com/industry.

[6]. Stanford University Human-Centered artificial Intelligence. Artificial Intelligence Index Report 2021, 182 (2021). Available at: https://aiindex.stanford.edu/wp-content/uploads/2021/11/2021-AI-Index-Report_Master.pdf.

[7]. Statista. In-depth: Artificial Intelligence 2021, 11 (2021). Available at: https://www.statista.com/study/50485/in-depth-report-artificial-intelligence/.

[8]. RON SHEVLIN. (2022). THE STATE OF THE UNION IN Bank-fintech Partnerships. pp.4. Available at: https://synctera.com/blog/the-state-of-the-union-in-bank-fintech-partnerships (Accessed: 15 September 2022)

[9]. Shevlin, R.: The State of the Union in Bank-fintech Partnerships. 7 (2022). Available at: https://synctera.com/blog/the-state-of-the-union-in-bank-fintech-partnerships.

[10]. Girling, W.: Fintech Magazine. 68-82 (2020). Available at: https://fintechmagazine.com/magazine/december-2020.

[11]. Chen, W.G.: 2021 Industry Overview on the Application of Artificial Intelligence in the Banking industry in China, 29 (2021). Available at: https://pdf.dfcfw.com/pdf/H3_AP202105061490139649_1.pdf?1620338007000.pdf.

[12]. National Science Foundation. Core Techniques and Technologies for Advancing Big Data Science & Engineering (BIGDATA) (2012). Available at: https://www.nsf.gov/publications/pub_summ.jsp?ods_key=nsf12499.

[13]. De Mauro A, Greco M, Grimaldi M, editors. What is big data? A consensual definition and a review of key research topics. AIP Conference Proceedings 1644, 97 (2015). https://doi.org/10.1063/1.4907823.

[14]. Fortune Business Insights. Market research report (2020). Available at: https://www.fortunebusinessinsights.com/enquiry/request-sample-book/big-data-technology-market-100144.

[15]. Zhang, L.Y.: Cloud Computing Applications in Commercial Banking. Master's thesis, Nanjing University of Posts and Telecommunications (2015). https://kns.cnki.net/KCMS/detail/detail.aspx?dbname=CMFD201601&filename=1016046426.nh.

Cite this article

Zhu,Z. (2023). The Role of fintech in the Innovation and Transformation of the Banking Industry. Advances in Economics, Management and Political Sciences,16,9-16.

Data availability

The datasets used and/or analyzed during the current study will be available from the authors upon reasonable request.

Disclaimer/Publisher's Note

The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of EWA Publishing and/or the editor(s). EWA Publishing and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content.

About volume

Volume title: Proceedings of the 2nd International Conference on Business and Policy Studies

© 2024 by the author(s). Licensee EWA Publishing, Oxford, UK. This article is an open access article distributed under the terms and

conditions of the Creative Commons Attribution (CC BY) license. Authors who

publish this series agree to the following terms:

1. Authors retain copyright and grant the series right of first publication with the work simultaneously licensed under a Creative Commons

Attribution License that allows others to share the work with an acknowledgment of the work's authorship and initial publication in this

series.

2. Authors are able to enter into separate, additional contractual arrangements for the non-exclusive distribution of the series's published

version of the work (e.g., post it to an institutional repository or publish it in a book), with an acknowledgment of its initial

publication in this series.

3. Authors are permitted and encouraged to post their work online (e.g., in institutional repositories or on their website) prior to and

during the submission process, as it can lead to productive exchanges, as well as earlier and greater citation of published work (See

Open access policy for details).

References

[1]. Puschmann, T.: Fintech. Bus Inf Syst Eng 59, 69-76 (2017). https://doi.org/10.1007/s12599-017-0464-6.

[2]. Douglas, W., Arner, J.B., and Ross P.B.: Fintech and Regtech in a Nutshell, and the Future in a Sandbox, Research Foundation Briefs 3(4), (2017). Available at: https://www.cfainstitute.org/en/research/foundation/2017/fintech-and-regtech-in-a-nutshell-and-the-future-in-a-sandbox?s_cid=ppc_RF_Google_Search_fintechandRegTech%20.

[3]. Schueffel, P.: Taming the Beast: A Scientific Definition of fintech. Journal of Innovation Management 4(4), 32-54 (2016).

[4]. Arner, et al.: The Evolution of fintech: A New Post-Crisis Paradigm. University of Hong Kong Faculty of Law Research Paper, No.47, (2015).

[5]. Cha, H.H.: Scale of Internet Banking Users and Internet Banking Usage in China (2016). Available at: https://www.hanghangcha.com/industry.

[6]. Stanford University Human-Centered artificial Intelligence. Artificial Intelligence Index Report 2021, 182 (2021). Available at: https://aiindex.stanford.edu/wp-content/uploads/2021/11/2021-AI-Index-Report_Master.pdf.

[7]. Statista. In-depth: Artificial Intelligence 2021, 11 (2021). Available at: https://www.statista.com/study/50485/in-depth-report-artificial-intelligence/.

[8]. RON SHEVLIN. (2022). THE STATE OF THE UNION IN Bank-fintech Partnerships. pp.4. Available at: https://synctera.com/blog/the-state-of-the-union-in-bank-fintech-partnerships (Accessed: 15 September 2022)

[9]. Shevlin, R.: The State of the Union in Bank-fintech Partnerships. 7 (2022). Available at: https://synctera.com/blog/the-state-of-the-union-in-bank-fintech-partnerships.

[10]. Girling, W.: Fintech Magazine. 68-82 (2020). Available at: https://fintechmagazine.com/magazine/december-2020.

[11]. Chen, W.G.: 2021 Industry Overview on the Application of Artificial Intelligence in the Banking industry in China, 29 (2021). Available at: https://pdf.dfcfw.com/pdf/H3_AP202105061490139649_1.pdf?1620338007000.pdf.

[12]. National Science Foundation. Core Techniques and Technologies for Advancing Big Data Science & Engineering (BIGDATA) (2012). Available at: https://www.nsf.gov/publications/pub_summ.jsp?ods_key=nsf12499.

[13]. De Mauro A, Greco M, Grimaldi M, editors. What is big data? A consensual definition and a review of key research topics. AIP Conference Proceedings 1644, 97 (2015). https://doi.org/10.1063/1.4907823.

[14]. Fortune Business Insights. Market research report (2020). Available at: https://www.fortunebusinessinsights.com/enquiry/request-sample-book/big-data-technology-market-100144.

[15]. Zhang, L.Y.: Cloud Computing Applications in Commercial Banking. Master's thesis, Nanjing University of Posts and Telecommunications (2015). https://kns.cnki.net/KCMS/detail/detail.aspx?dbname=CMFD201601&filename=1016046426.nh.