1. Introduction

In today's era of abundant financial products, bond investment has become a relatively mainstream and stable investment method. The cited literature is mainly about the connection between the bond market and the economic market and the basic characteristics of the bond market. This paper mainly includes these articles: Gilmore, Lucey& Boscia. These authors study the linkage patterns of a set of 20 government bond market indices in developed countries in North America, Europe and Asia and get the conclusion that the linkage pattern of the government bond market index will have an impact on portfolio diversification returns [1]. Chy & Kyung. The authors examine the impact of bond market transparency on the use of debt covenants in bank lending, and the findings suggest that information in bond transactions can reduce information risk for banks when entering into debt contracts [2]. Miyakoshi & Shimada. The author conducts research and data mining on the correlation between stock returns and bond returns in various countries, and points out that financial globalization has resulted in an increase in the returns of stocks and bonds to a certain extent [3]. Yao, Sun & Gao. This paper studies the transaction records of financial institutions in China's interbank bond market and finds that shaping the network structure is very important for the integrity of the bond market [4]. Liu & Qi. Based on the background of COVID-19, This essay explores the adoption of proper economic policies to revive the stock and bond markets and comes to the conclusion that fiscal policy and monetary policy have more favorable effects on the stock market and bond market, respectively [5]. Kadıoğlu, & Frömmel. Analyzing whether there is evidence of various bond prices, and this article concludes that fund manager compensation can serve as evidence of manipulation [6]. Wahidin, Akimov, & Roca. This paper examines the impact of bond market developments on economic growth in selected countries in the context of the financial crisis. It was concluded that the change between the bond market and economic situation was adversely affected by the financial crisis [7]. Abuelfadl & Yamani. In an event research paradigm, this article examines the effects of currency news on global government bond markets using a sample of 27 nations and 63 currency news releases. These results demonstrate a large currency information spillover into bond markets [8]. Pagnottoni, Spelta & Pammolli. This paper examines the self-regulating ability of bond markets in the context of SARS-CoV-2 and concludes that bond markets have less ability to adjust prices than stock markets after receiving an unavoidable economic shock [9]. Tran & Uzmanoglu. This article looks at how investors are adjusting bond market pricing strategies in the face of COVID-19 and concludes that COVID-19 developments may increase bond pricing by reducing local economic activity [10].

These literatures are mainly based on the basic characteristics of the current bond market and its connection with other economic factors, and makes other functional assumptions about the bond market. To some extent, the bond market can have an impact on the economy and the market, and to a certain extent, investors can avoid future risks through the information provided by the bond market. The literature on the bond market and the economy is relatively rich, mainly including the influence and changes of bond interest rates of different maturities and how to cite examples to judge that there is a certain connection between the bond market and the economy.

This article will focus on the use of bond markets to reflect overall economic conditions. Through this research, investors can not only observe the market trend through the interest rates of bonds of different maturities, and make choices for their next investment decisions, but also enhance the functionality of the financial market and strengthen the connection with the economic market. Thus Questions raised through this article - Why is the bond market useful? Can bond rates be used as an indicator of overall market economics? -Then introduces the types of bonds and bonds with different interest rates, summarizes the different changing patterns of long-term and short-term bonds and whether the relationship between the two will have an impact on the economy; The interest rate on term bonds can reflect the current economic conditions in the market, so the bond market is useful.

The remaining of this paper is structured as follows. Section 2 Introduces the different kinds of bond including various term and maturity. Section 3 analyses Interest rate of different maturity bonds. Section 4 discusses Whether the risk of interest rate can be made for indicators to measure and role out the non-systematic risk for the investors or companies. Section 5 proposes how to face with the risk.

2. Kinds of Bonds

The topic of the article is about why the bond market is useful. To author’s perspective, the term structure of interest rate not only can help the investor to update value of investment opportunity, but also can provide the information to the economy as a indicator. There is a common sense that the term structure of interest rate is an essential factor in bond market. If somebody as an investor, the investor can use the term structure of interest rate to update the value which attach to an investment opportunities. But author suppose that this reason is not the only one factor could make bond market is useful or is not the only advantage for using term structure of interest rate. Maybe, whether the term structure of interest rate can provide the information to the economy as an indicator?

Actually, the bond can be divided into two kinds of bond based on the different maturity typically and simply (table 1). Long term bond and short term bond. If an investor holds a long term bond, this means that investors who invest in long-term bonds will only receive cash at the end of the bond's maturity date, which also means that the cash liquidity of long-term bonds is poor, but as the maturity grows, the bond's return The interest rate will also increase accordingly; on the contrary, the liquidity of short-term bonds is strong, and investors can quickly get their cash back, but the corresponding interest rate will be lower [11]. When the long-term bond interest rate and the short-term bond interest rate are the same, it means that the market is currently in a state of volatility, and the overall economic situation can not be made a judgment clearly whether the whole economic situation in the market will attain a stable growth tendency or a declined tendency.

Table 1: the sort of bonds and the maturity of bonds.

Sort of bonds | Long maturity | Short maturity |

government bonds | 5-30 years | 6 months-1 year |

financial bonds | 2-5 years | 3 months-1 year |

corporate bonds | 1-53 years | 3 months-1 year |

3. Interest Rate of Bonds

The interest rate of long-term bonds is higher than that of short-term bonds, which shows that current investors have confidence in the bond market, and long-term bonds will bring higher returns. But suppose that if the interest rate of long-term bonds is lower than that of short-term bonds, it means that the holders of short-term bonds can obtain more returns than long-term bond holders while the funds are liquid. Correspondingly, due to the market investment Those who are more pessimistic about the short- and medium-term market economic expectations have led to a large influx of funds into the long-term bond market. Long-term bond interest rates will progressively decrease due to the market's increased demand for them, though, and the market will then be in the opposite situation, which is not favorable for economic growth.

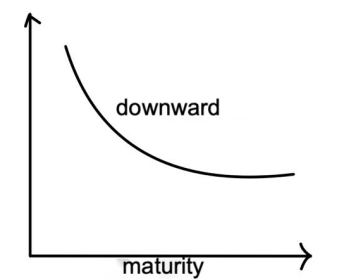

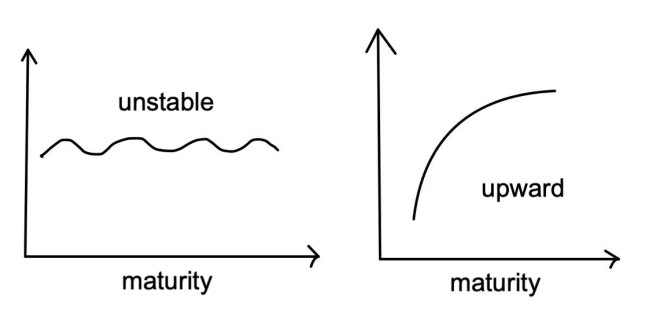

A compilation of these three scenarios can be presented to support the author's viewpoint. There are three main types of the word "interest rate structure."

Upward—The normal and unquestionable state of the economy and the development of trends arise from the fact that interest rates on long-term bonds are higher than those on short-term bonds. The theoretical action is about investing the long-term bond could have a more acceptable benefit in revenue than the short-term bond when these two kinds of bonds’ maturity has been over.

Downward sloping—compared to long-term rates, short-term yields are greater. Although the short-term bond’s revenue could more considerable than the long-term bond’s revenue, the whole market economic situation may has the possibility to occur the recession. On the contrary, the author’s opinion is that this situation can be regard as an opportunity to let investors avoid the risk in making investments.

Unstable—When faced with a situation where long-term bond rates and short-term bond rates have similar or almost the same values, such a phenomenon indicates that the future direction of the economic situation will become vague and unpredictable, so it is unstable.

4. Interest Rate Risk of Bonds

Interest rate risk exists when interest rates value is unstable and undulated. The interest rate risk can be made the essential factor to make a difference on the market value. Rising interest rate risks may cause declining bond prices and vice versa because of the inverse link between interest rates and bond prices. Interest rate risk affects bond values and is a concern for all bondholders. It's important to remember that bond prices fall when interest rates rise, as was already said. On the other side, bond prices normally rise when interest rates fall. As interest rates decrease and the market releases new bonds with lower yields than older fixed-income instruments, investors are less likely to buy new bonds. Consequently, the value of older bonds with higher yields tends to increase.

Actually, the interest rate of different maturity bonds’ tend and change can be an essential factor to make the judgement for investors or company’s managers who have ability to catch the opportunities to diversify the risk (figure 1). For the investment managers of some large companies, the significance of a normal market is that the long-term interest rate value of bonds is greater than the short-term interest rate value of bonds. The company's investment managers have reason to believe that the investment bond market has good prospects to buy. Corresponding long-term bonds and make appropriate investments; if they observe in advance that most short-term bonds in the bond market have higher interest rates than long-term bonds, this shows that most investors are not optimistic about the future development prospects of the bond market. At the same time, it will continue to bring about a certain degree of economic recession in the follow-up process. For the company, the economic recession caused by interest rate changes will affect the company's target customers to reduce the purchase and use of the company's products and services to a certain extent, thus affecting the company. At the same time, this is not conducive to the company's long-term holding of long-term bonds purchased before. It should sell long-term bonds at the right time and rationalize asset allocation to avoid risks.

|

|

Figure 1: different situation between interest rate and economic situation. | |

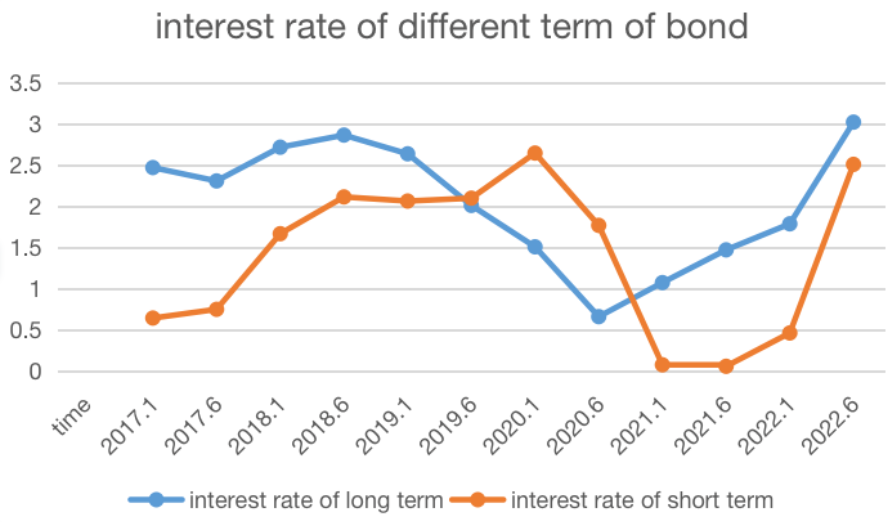

Taking the 6-month term bonds and 10-year bonds of U.S. Treasury bonds as an example (as shown in figure 2), and obtaining their 5-year historical data, we can find that the long-term interest rate of U.S. Treasury bonds in 2020 is lower than the short-term interest rate, which also shows that the development of the COVID-19 virus. The American economic situation was hit, and when the economy recovered, the long-term interest rate returned to a level higher than the short-term interest rate. According to the influence of COVID-19, most long-term bond rates are lower than short-term bond rates, illustrating the current investment environment in the market that is influenced by outsiders. The influence of factors has led to the deterioration of the market investment environment. From this, it can be seen that the term structure of interest rate can be used as an indicator of the state of the economy.

Figure 2: 6-month term bonds and 10-year bonds of U.S. treasury bonds.

5. The Strategy to Resolve the Risk of Interest Rate

Bond default is a crucial factor for investors and businesses to take into account when engaging in bond investment activities since it continues to influence investment risk. When bondholders fail to pay the required interest or principal, for creditors, such a similar act is called default. Bond defaults are possible for individuals, companies and even entire nations. For creditors, default risk is an important factor. Defaults subject borrowers to legal claims and may restrict their access to credit in the future. A bond default for a nation could increase that nation's overall economic strain and impede its long-term economic growth. In addition, pertinent laws are required to address the negative consequences of bond defaults. For instance, Puerto Rico defaulted in 2015 after making only a $628,000 payment to settle a $58 million bond. Hurricane Maria's damage in 2017 made the island's economic and debt situation worse. In the biggest bankruptcy in American history, Puerto Rico announced intentions in 2019 to reduce its debt from $129 billion to approximately $86 billion. The bankruptcy filing was permitted by a provision that Congress passed in 2016. A Financial Oversight Commission was established under the Puerto Rico Oversight, Regulation, and Economic Stabilization Act (PROMESA) to manage the region's public finances. The company's creditworthiness, as well as the belief and attitude of investment companies in the company's long-term future development, will also be shaken by the default of the bonds, lowering or eliminating the company's investment options. For instance, Shanghai Chaori Solar's failure to complete payments of 89 million yuan ($14.5 million) in the beginning of 2014 led to China experiencing its first corporate default in nearly 20 years [12]. It had additional significance because it was the nation's first-ever onshore bond default. This has led to worries about other Chinese businesses and a certain level of fear in the country's fixed income market. The paper can offer some solutions to the interest rate risk based on the instances above.

Leveraged strategies, which require investors to hold longer-duration bonds and hedge them with a very short-duration bond fund [13]. Replacing shorter-term bonds issued by the same company or government with cheaper, longer-duration bonds to earn excess returns before the premium disappears. Bond premiums fall rapidly two years before their maturity because bonds can only be paid at face value, while longer-term bonds have higher time value due to their long duration [14].

Strengthen the regulation of government. In order to prevent the impact of interest rate risks brought about by the unpredictable economic crisis, government departments can strengthen supervision and monitor the relevant liquidity data in real time. When abnormal situations occur, they can be fed back to relevant companies in a timely manner, so as to avoid risks to the greatest extent.

6. Conclusion

This paper analyzes whether the bond market can provide risk-averse information for the overall economic situation. The main research conclusions are: firstly, the interest rate of long-term bonds and short-term bonds in the same period will affect the future economic trend; secondly, The bond market can provide risk-averse information about the overall state of the economy.

This article’s implication is not only to enable investors to observe market trends through the interest rates of bonds of different maturities, and to make choices for their next investment decisions, but also to enhance the functionality of the financial market and strengthen the connection with the economic market. Meanwhile, this paper still points out that the market can use the leverage strategy and the strategy of strengthen the regulation of government to resolve the risk of interest rate.

References

[1]. Gilmore, C. G., Lucey, B. M., & Boscia, M. W. Movements in government bond markets: A minimum spanning tree analysis.

[2]. Chy, M., & Kyung, H. The effect of bond market on bank loan contracting.

[3]. Shigemi, Y., Kato, S., Soejima, Y., & Shimizu, T. Market Participants' Behavior and Pricing Mechanisms.

[4]. Yao, D., Sun, R., & Gao, Q. The network structure in the Chinese bond market.

[5]. Liu, F., Kong, D., Xiao, Z., Zhang, X., Zhou, A., & Qi, J. Effect of economic on the bond market under the im-pact of COVID-19.

[6]. Kadıoğlu, E., & Frömmel, M. Manipulation in the bond market and the role of investment funds: Evidence from an emerging market.

[7]. Wahidin, D., Akimov, A., & Roca, E. The impact of bond market development on economic growth.

[8]. Abuelfadl, M., & Yamani, E. Currency news and international bond markets. The North American Journal of Economics and Finance.

[9]. Pagnottoni, P., Spelta, A., Pecora, N., Flori, A., & Pammolli, F. Financial earthquakes: SARS-CoV-2 news shock the bond markets.

[10]. Tran, N., & Uzmanoglu, C. COVID-19, lockdowns, and the municipal bond market. Journal of Banking & Finance.

[11]. Bond market’s connection with the financial market. https://www.ft.com/content/2ea215eb-c359-4a72-830a-1ecdd575b969.

[12]. John D. Burger, Francis E. Warnock, and Veronica Cacdac Warnock. Bond market development in develop-ing Asia, ADB Economics Working Paper Series, no. 448, August 2015. https://www.adb.org/sites/default/files/publication/173190/ewp-448.pdf.

[13]. Indeed Editorial Team, What Is an Organizational Strategy and Why Does My Business Need One? June 23, 2021. https://www.indeed.com/career-advice/career-development/organizational-strate-gy#:~:text=An%20organizational%20strategy%20is%20a,goals%20and%20develop%20strategic%20plans.

[14]. Nick Lioudis, The Inverse Relationship Between Interest Rates and Bond Prices, May 16, 2022.https://www.investopedia.com/ask/answers/why-interest-rates-have-inverse-relationship-bond-prices/.

Cite this article

Li,Z. (2023). Research on the Interest Rate Risk Strategy of Bond Market. Advances in Economics, Management and Political Sciences,16,65-70.

Data availability

The datasets used and/or analyzed during the current study will be available from the authors upon reasonable request.

Disclaimer/Publisher's Note

The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of EWA Publishing and/or the editor(s). EWA Publishing and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content.

About volume

Volume title: Proceedings of the 2nd International Conference on Business and Policy Studies

© 2024 by the author(s). Licensee EWA Publishing, Oxford, UK. This article is an open access article distributed under the terms and

conditions of the Creative Commons Attribution (CC BY) license. Authors who

publish this series agree to the following terms:

1. Authors retain copyright and grant the series right of first publication with the work simultaneously licensed under a Creative Commons

Attribution License that allows others to share the work with an acknowledgment of the work's authorship and initial publication in this

series.

2. Authors are able to enter into separate, additional contractual arrangements for the non-exclusive distribution of the series's published

version of the work (e.g., post it to an institutional repository or publish it in a book), with an acknowledgment of its initial

publication in this series.

3. Authors are permitted and encouraged to post their work online (e.g., in institutional repositories or on their website) prior to and

during the submission process, as it can lead to productive exchanges, as well as earlier and greater citation of published work (See

Open access policy for details).

References

[1]. Gilmore, C. G., Lucey, B. M., & Boscia, M. W. Movements in government bond markets: A minimum spanning tree analysis.

[2]. Chy, M., & Kyung, H. The effect of bond market on bank loan contracting.

[3]. Shigemi, Y., Kato, S., Soejima, Y., & Shimizu, T. Market Participants' Behavior and Pricing Mechanisms.

[4]. Yao, D., Sun, R., & Gao, Q. The network structure in the Chinese bond market.

[5]. Liu, F., Kong, D., Xiao, Z., Zhang, X., Zhou, A., & Qi, J. Effect of economic on the bond market under the im-pact of COVID-19.

[6]. Kadıoğlu, E., & Frömmel, M. Manipulation in the bond market and the role of investment funds: Evidence from an emerging market.

[7]. Wahidin, D., Akimov, A., & Roca, E. The impact of bond market development on economic growth.

[8]. Abuelfadl, M., & Yamani, E. Currency news and international bond markets. The North American Journal of Economics and Finance.

[9]. Pagnottoni, P., Spelta, A., Pecora, N., Flori, A., & Pammolli, F. Financial earthquakes: SARS-CoV-2 news shock the bond markets.

[10]. Tran, N., & Uzmanoglu, C. COVID-19, lockdowns, and the municipal bond market. Journal of Banking & Finance.

[11]. Bond market’s connection with the financial market. https://www.ft.com/content/2ea215eb-c359-4a72-830a-1ecdd575b969.

[12]. John D. Burger, Francis E. Warnock, and Veronica Cacdac Warnock. Bond market development in develop-ing Asia, ADB Economics Working Paper Series, no. 448, August 2015. https://www.adb.org/sites/default/files/publication/173190/ewp-448.pdf.

[13]. Indeed Editorial Team, What Is an Organizational Strategy and Why Does My Business Need One? June 23, 2021. https://www.indeed.com/career-advice/career-development/organizational-strate-gy#:~:text=An%20organizational%20strategy%20is%20a,goals%20and%20develop%20strategic%20plans.

[14]. Nick Lioudis, The Inverse Relationship Between Interest Rates and Bond Prices, May 16, 2022.https://www.investopedia.com/ask/answers/why-interest-rates-have-inverse-relationship-bond-prices/.