1. Introduction

Starbucks is a well-known coffee shop that opened in 1971, and it opened many global chain stores worldwide. The first coffee shop was built along the cobblestone streets of Seattle's historic Pike Place Market (Our Company 1) [1]. Starbucks initially offered fresh-roasted coffee beans, tea, and spices (Our Company 1) [1] and made various innovations in their coffee products. The store was first founded by Jerry Baldwin, Gordon Bowker, and Zev Siegl. Nowadays, Starbucks has over 30,000 stores in 80 countries, most of which are located in the United States domestically.

Alfred Peet greatly inspired the idea of the operation style of Starbucks. Alfred Peet was a Dutch immigrant who built up his brand of coffee and gained a significant population in California last century. He mentored Starbucks' founders and used a manually roasted system [2] to manufacture coffee products. He produced a unique flavor of coffee beverages that others cannot imitate with high-qualified beans. He raised awareness of how coffee can help people support their life, especially during World War 2, and increased customers' expectations for great coffee beverages [2]. Peet's business value and mode attract the founders of Starbucks, and Peet also pays more close attention to continuous product innovation, such as the deep-roasted flavor of the coffee. Gradually, Alfred Peet became the initial supplier of Starbucks coffee beans, and Starbucks' founders mimicked his business operational system in purchasing roasting techniques [3] from third parties to have experimented with Starbucks' alternative flavors brand. Eventually, Starbucks became a successful leader in the coffee market.

Moreover, Starbucks built a new evolution to strengthen its position globally in the coffee beverage market. Starbucks opened different styled experience stores [4] to maintain sustainable consumer relationships and improve customer experience. Starbucks has excellent organizational plans for product innovation. However, it needs consistent improvement in its targeted segmentation to adapt to the local market more efficiently to gain loyal customers. Flexible business operation styles are also essential when adapting to different new environments.

Starbucks gained a great understanding of customer demands by concentrating on targeted customers to make the remarkable transformation of operating offline retail stores during the business system transformation. Taking the university as an example, putting Starbucks trucks in college is an efficient method of catching the public eye and attracting a new classification of customers. Under this business scenario, the targeted customers are students, while the market segmentation is the university. With the rapid development of technology, online shopping has become a standard shopping mode for the young generations. Since beverages occupy most coffee shops' ready-to-eat products for customers, online shopping may significantly challenge the coffee business.

In contrast, Starbucks did not consider the online shopping mode as a barrier to its business success; it uses the online world as a powerful transaction from the previous business operational mode. Starbucks pushes customers to get more interest and get involved in the experience store to gain more customer engagement since consumers trust the brand through the excellent reputation that Starbucks has gained over decades. Furthermore, mobile orders represent 6% of Starbucks' orders with great pay experience in newly released functionality with personalized offers [5]. The net earnings of Starbucks in 2017 were raised by approximately 2.2% from the previous fiscal year's data, which was $2,817.7 million, $1.90 per share in common stock [6].

2. The Pain Point of Starbucks Before 2008

Starbucks is the biggest coffee company in the world right now; however, before 2008, Starbucks was facing a variety of supply chain challenges. Between 2007 and 2008, Starbucks' logistic system cost increased from 750 million dollars to more than 825 million dollars, But the sales dropped 10 percent compared to last year's same period [7]. The reason is that very few of the store deliveries arrived on time, and more than half of the deliveries were late. Therefore, Starbucks had to depend on more than 65% outsourcing, and all of these expenses cost Starbucks logistics, contract manufacturing, and transportation [7].

3. The Transformation of Starbucks Supply Chain in 2008

Due to the situation in 2008, Starbucks had to begin a significant transformation to improve the situation. Starbucks has identified three primary goals: restructuring its supply chain organization to decrease the expenses associated with delivering to shop floors, enhancing execution, and establishing the groundwork for upcoming supply chain capabilities. [7]. Firstly, they simplified their supply chain structure to four different functions: planning, sourcing, making, and delivering. These four parts make Starbucks manage its supply chains more flexibly and efficiently, eliminating tedious steps to control internal costs and consumption. Each job could fall into one category. After that, Starbucks built a "should cost" model. Starbucks used that model to help them negotiate a better price with their supplier. Most importantly, they regionalized their coffee production and established local processing plants to produce in the areas where the product is sold.

Following its transformation, Starbucks had a total of five coffee roasting plants that were owned by the company, as well as twenty-four co-manufacturers and one tea processing plant. Additionally, in terms of distribution, Starbucks established nine regional distribution centers, forty-eight central distribution centers, and more than five "green coffee" warehouses [7]. These changes allowed Starbucks to afford the shipping problems associated with the massive expansion of its stores and put it back on the map as the world's largest coffee company.

4. The Social Responsibility of Starbucks

Starbucks utilizes its own set of standards, the C.A.F.E. practice, to select its suppliers. This practice involves a comprehensive checklist encompassing people, Planet, and Products [8]. The first area, People, focuses on the well-being of farm workers. Starbucks reviews factors such as wages, benefits, and access to healthcare to ensure that they comply with national laws and international conventions. Under the Planet category, Starbucks prioritizes soil and forest conservation, water usage and protection, and wildlife conservation. Lastly, the Product section emphasizes coffee quality and the economics of coffee production to ensure farmers receive fair compensation for their work [8].

Not only is their coffee's quality essential, but Starbucks also sees transparency of their supply chain and transparency of treating farmers equally as one of their criteria. Starbucks built more than ten farmer support centers and trained over two hundred thousand farmers, providing free access to education and resources through its farmer support centers. Moreover, Starbucks has invested more than $150 million in that project.

5. Starbucks’ Key Financial Ratio Analysis

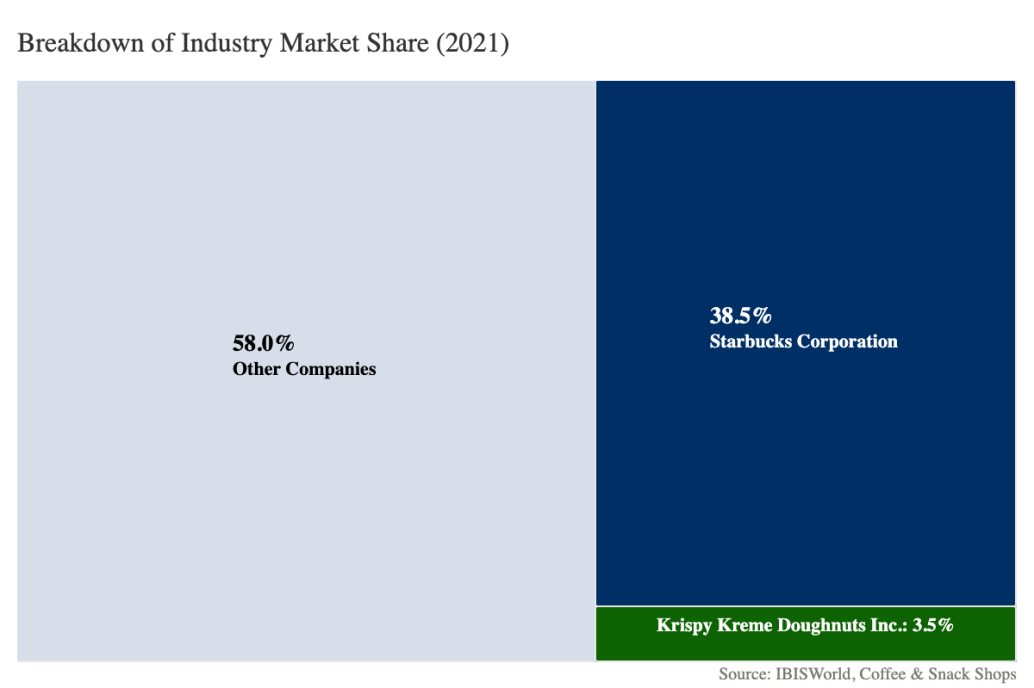

5.1. Market Share

The market share held by various companies in Starbucks' primary industry, Coffee and Snack Shops, is broken down in Chart 1, which can be found below (Le)[9]. We can see that Starbucks holds a market share of 38.5%, which indicates that it is the industry leader in this particular market. Starbucks' brand loyalty, distribution coverage, promotional spending, and profit are all well demonstrated to control the whole market. Market share distribution is one of the primary indicators of this dominance.

Figure 1: Market share of Starbucks.

5.2. Return on Assets (ROA)

Figure 2 contains Starbucks' ROA for the recent five fiscal years (Stock Analysis on Net) [10]. Starbucks' ROA deteriorated from 2019 to 2020 but improved from 2020 to 2021, not reaching the 2019 level. A declining ROA suggests that the company may have overinvested in assets that have failed to create revenue growth, indicating that the company may be in jeopardy. In this case, the main factor driving the ROA decrease is Starbucks's investment in its assets, which almost doubled its total assets from 2017 to 2021. Also, Covid may be another factor that brought down Starbucks' ROA, which will be mentioned in the article's next section. Starbucks' ROA is exceeded by a large margin compared to other industries, again illustrating that Starbucks is a market leader.

Table 1: Return on Assets (ROA).

Starbucks Corp. | Oct 3, 2021 | Sep 27, 2020 | Sep 29, 2019 | Sep 30, 2019 | Oct 1, 2017 |

Return on Assets (ROA) | |||||

Selected Financial Data (US$ in thousands) |

|

|

|

|

|

Net earnings attributable to Starbucks | 4,199,300 | 928,300 | 3,599,200 | 4,518,300 | 2,884,700 |

Total Assets | 31,392,600 | 29,374,500 | 19,219,600 | 24,156,400 | 14,365,600 |

Profitability Ratio | |||||

ROA | 13.38% | 3.16% | 18.73% | 18.70% | 20.08% |

Benchmarks | |||||

ROA, Industry | |||||

Consumer Discretionary | 7.25% | 3.65% | 5.19% | 6.01% | 4.17% |

ROA, Industry | |||||

Coffee & Snack Shops | 4.90% | 4.90% | 5.30% | 7.90% |

5.3. Inventory Turnover

The number of times an organization sells or "turns" the average inventory in its warehouses is one factor that calculates the company's inventory turnover rate. Figure 3 shows the Inventory Turnover for Starbucks for the last five fiscal years (Stock Analysis on Net) [10]. In 2019 and 2020, Starbucks' inventory turnover ratio got worse, but in the years 2020 and 2021, it got better and even surpassed the level it had reached in 2019. A growing ratio indicates that the product that Starbucks provides is in high demand and is swiftly removed from the shelves due to this demand. This results in reduced costs associated with inventory management, which increases the company's overall profitability. After the COVID-19 epidemic, Starbucks' inventory turnover has returned to normal. Over the previous five fiscal years, Starbucks has maintained a healthy-looking inventory turnover rate. Starbucks has a relatively more significant inventory turnover than the industry benchmark for both industries. This indicates that Starbucks achieves a delicate balance between maintaining an adequate inventory stock and minimizing the times it must place new orders.

Table 2: Inventory turnover.

Starbucks Corp. | Oct 3, 2021 | Sep 27, 2020 | Sep 29, 2019 | Sep 30, 2019 | Oct 1, 2017 |

Inventory Turnover | |||||

Selected Financial Data (US$ in thousands) |

|

|

|

|

|

Cost of Revenue | 20,669,600 | 18,458,900 | 19,020,500 | 17,367,700 | 15,531,500 |

Inventories | 1,603,900 | 1,551,400 | 1,529,400 | 1,400,500 | 1,364,000 |

Short-term Activity Ratio |

|

|

|

|

|

Inventory Turnover | 12.89 | 11.90 | 12.44 | 12.40 | 11.39 |

Benchmarks | |||||

Inventory Turnover, Industry |

|

|

|

|

|

Consumer Services | 16.56 | 17.39 | 19.78 | 19.31 | 20.14 |

Inventory Turnover, Industry | |||||

Consumer Discretionary | 6.87 | 7.22 | 7.37 | 7.65 | 7.30 |

Inventory Turnover, Industry | |||||

Coffee & Snack Shops | 26.4 | 13.1 | 10.9 | 26.4 |

5.4. Average Inventory Period

An essential indicator of a company's effectiveness in converting inventory into sales is the average inventory period that the company maintains. The number of days that a company spends on average before selling all of its existing inventory can be calculated with the assistance of a metric known as the average inventory period. In other words, the average inventory period refers to when an item is placed on the shelf and when a customer purchases it. Figure 4 shows Starbucks' average inventory period for the last five fiscal years (Stock Analysis on Net)[10]. The average inventory period at Starbucks declined from 2019 to 2020, but then it improved, and by 2021 it had surpassed the level it had reached in 2019. The fact that Starbucks' average Inventory Period is significantly lower than the industry norm suggests that Starbucks' Management performed a fantastic job of minimizing transporting and storage costs and identifying goods that move quickly to maximize profitability.

Table 3: Average inventory period.

Starbucks Corp. | Oct 3, 2021 | Sep 27, 2020 | Sep 29, 2019 | Sep 30, 2019 | Oct 1, 2017 |

Average Inventory Period | |||||

Selected Financial Data (US$ in thousands) |

|

|

|

|

|

Inventory Turnover | 12.89 | 11.90 | 12.44 | 12.40 | 11.39 |

Short-term Activity Ratio (no. days) |

|

|

|

|

|

Average inventory processing period | 28 | 31 | 29 | 29 | 32 |

Benchmarks (no. days) | |||||

Average inventory processing period | |||||

Consumer Discretionary | 53 | 51 | 50 | 48 | 50 |

5.5. Future Trend on Starbucks

The company's entire financial picture is very much by its position in the industry, which lends credence to the successful implementation of the supply chain strategy that was devised by Starbucks management. It is remarkable how rapidly it demonstrated its capabilities again following the breakout of Covid-19. As an investor, your only concern should be whether or not it can maintain its position as the market leader and how much advancement it will be able to accomplish in the future fiscal years.

5.6. Covid-19 Impact on Supply Chain

Effect on the market.

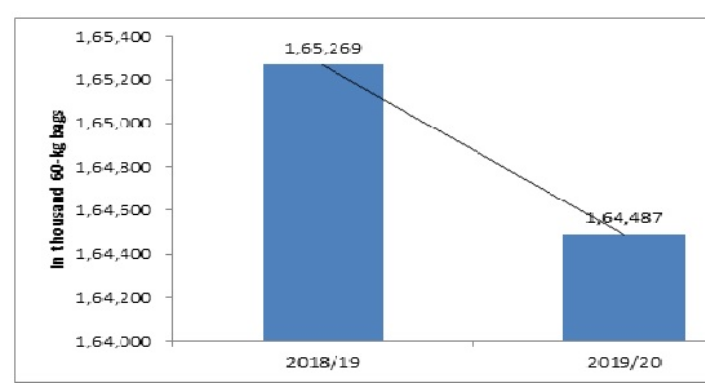

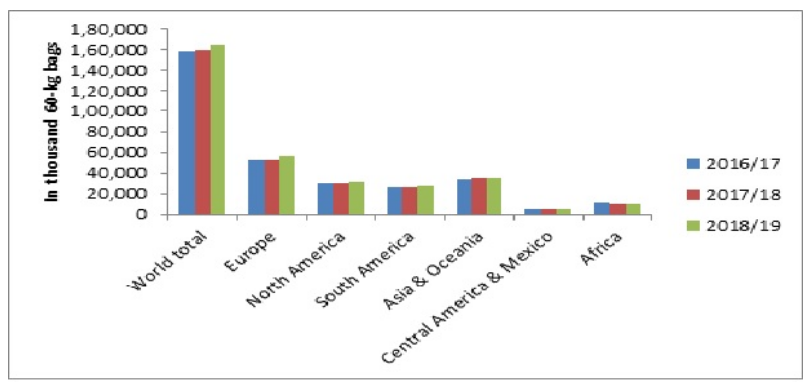

Before the COVID-19 pandemic, the world's coffee sales were increasing yearly. For instance, Figure 3 shows that in America, around 66 billion cups of coffee per year are consumed by consumers (COVID-19 impact on Coffee in Food and Beverage Industry)[11]. It was not until 2020 that the COVID-19 outbreak hit the coffee market, causing the demand for coffee to fall off a cliff, as shown in Figure 2, and the figure compared the world's coffee consumption before and after the COVID-19 pandemic.

Figure 2: Comparison between two years in world coffee consumption (in thousands of 60-kg bags) Source: COVID-19 impact on Coffee in the Food and Beverage Industry.

Figure 3: Coffee consumption (2016-2019).( Source: COVID-19 impact on Coffee in Food and Beverage Industry.)

Expected Impact on Supply Chain.

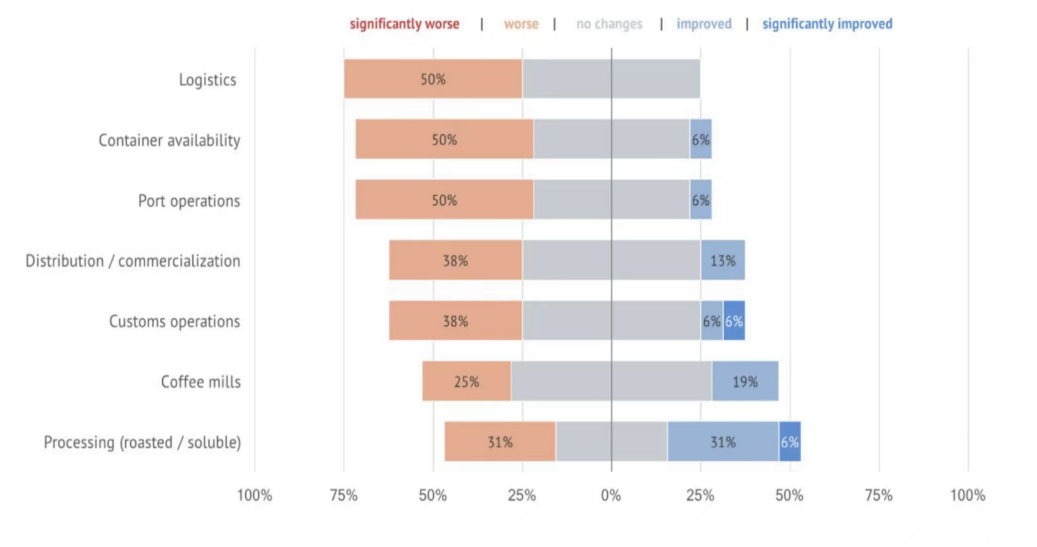

Coffee supply chain operations have been affected worldwide. Disruption to the intralogistics network and export infrastructure due to reduced container volumes, resulting in shipment delays and increased transaction costs, as shown in Figure 4. (COFFEE SECTOR ON THE GLOBAL IMPACT OF COVID-19) [12].

Figure 4: What is the expected impact of covid-19 on downstream coffee value chain operations in your country in the next six months? (Source: COFFEE SECTOR ON THE GLOBAL IMPACT OF COVID-19).

5.7. Impact on the Coffee Sector

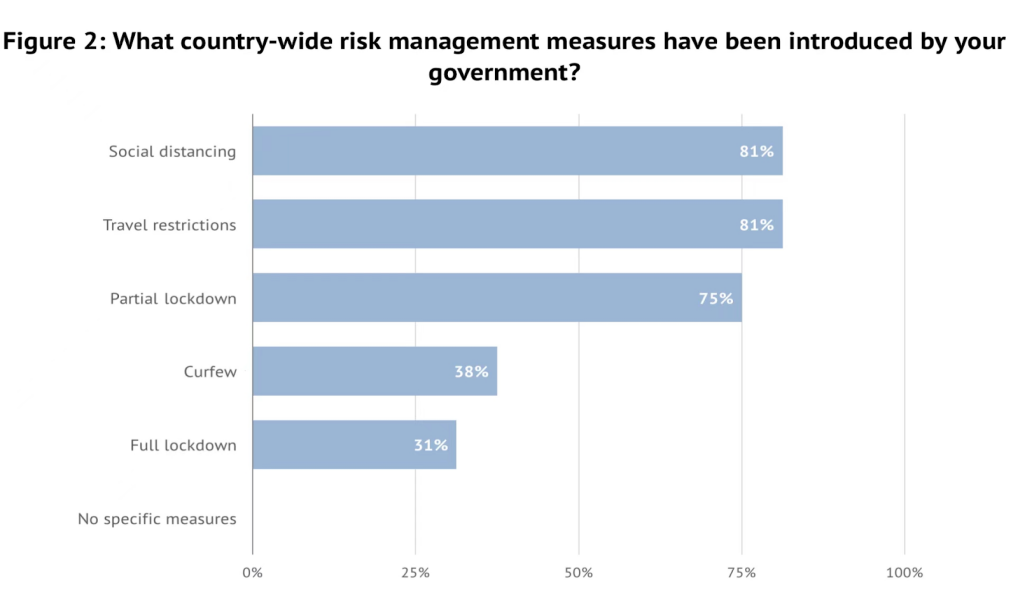

The countries take measures introduced in Figure 5 in Figure 6. Those countries represent 85% of the world's coffee production ("COFFEE SECTOR ON THE GLOBAL IMPACT OF COVID-19”) [12].

These measures significantly influence both the countries' economies and the coffee sector. Firstly, the COVID-19 pandemic has directly impacted the total number of people available to work, as worker mobility has been affected by social distancing measures, lockdowns, and travel restrictions. Secondly, one of the measures introduced by the government - social distancing, has increased the cost of production while causing a substantial reduction in employment and income. Consumption levels across the country have fallen as customers spend less as their incomes drop. Exports suffered due to temporary disruptions in global trade and lower demand.

Figure 5: What have country-wide risk management measures been introduced by your government? (Source: COFFEE SECTOR ON THE GLOBAL IMPACT OF COVID-19)

Figure 6: Participating countries.(Source: COFFEE SECTOR ON THE GLOBAL IMPACT OF COVID-19.)

Impacts on Starbucks.

Starbucks faced a sticky situation as those key ingredients, like peach and guava juice, were short in supply.

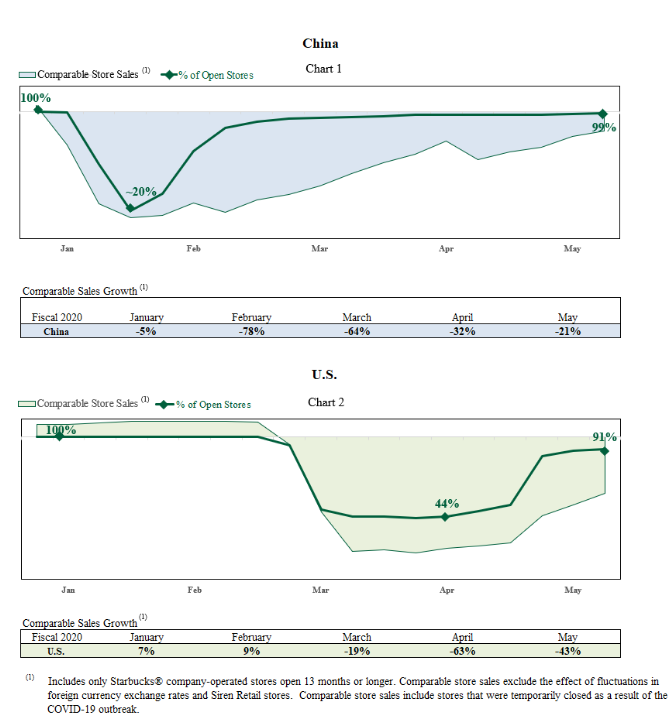

Many stores in the U.S. were closed temporarily. Starbucks faced a sticky situation as those key ingredients, like peach and guava juice, were short in supply. While lack of iced and cold-brew coffee breakfast food, and cups, lids, and straws ("Starbucks, Flush With Customers, Is Running Low on Ingredients")[13]. Customers lost the desire to go to Starbucks to buy a drink because, without ingredients, they often could not buy what they wanted. These factors lead to a decline in sales at Starbucks, as shown in Figure 7.

Figure 7. Includes only Starbucks company-operated stores open 13 months or longer. Comparable store sales exclude the effect of fluctuations in the foreign currency exchange rate and Siren Retail stores. Comparable store sales include temporarily closed stores due to the COVID-19 outbreak. Source: https://www.sec.gov/Archives/edgar/data/829224/000082922420000057/sbux-06102020ex991.htm.

Starbucks takes the initiative.

In 2020, Starbucks temporarily changed to a "to go" model in the U.S. and Canadian stores, as well as moved to primarily drive-thru and pickup in the U.S. (Timeline: Starbucks COVID-19 Milestones) [14]. People in a hurry can place their orders in the Starbucks app beforehand, so they do not have to wait for a while when they arrive at the store. Starbucks selected several stores with high volumes for renovation and added a separate counter to facilitate customers and delivery couriers to get orders.

6. Conclusion

In conclusion, we found the reasons and results of Starbucks' supply chain transformation, comparing social responsibilities between Starbucks and Dunkin. Although Starbucks still spent millions of dollars on its supply chain, they are more efficient in deliveries due to this transformation. At the same time, they can now expand their stores internationally. Moreover, they still insist on their social responsibilities, which also affects their supply chain. Those are why Starbucks could be the biggest coffee company in the world. Also, we got Starbucks' financial information from their financial ratio in recent years.

Moreover, we explained the adverse effects of Covid-19 on the Starbucks supply chain and Starbucks' positive solutions. Overall, Starbucks is an ethical and truthful company. They could provide quality products to us and protect our environment as well. We believe that more and more investors and consumers will keep their trust in this company.

Acknowledgment

Mingquan Zhuang and Longbin Chen contributed equally to this work and should be considered co-first authors. Xia Li should be considered as second author.

References

[1]. “About Us: Starbucks Coffee Company.” About Us: Starbucks Coffee Company, https://www.starbucks.com/about-us/.

[2]. Adam Shrum “A Look inside Starbucks' Coffee Supply Chain.” Dynamic Inventory, 10 July 2018, https://www.dynamicinventory.net/starbucks-supply-chain-management/.

[3]. “Starbucks.” Encyclopædia Britannica, Encyclopædia Britannica, Inc., https://www.britannica.com/topic/Starbucks.

[4]. “Starbucks Rethinks the Brick-and-Mortar Store.” Retail TouchPoints, 18 Dec. 2019, https://www.retailtouchpoints.com/blog/starbucks-rethinks-the-brick-and-mortar-store.

[5]. Gelski, Jeff. “A Survival Plan for Bricks-and-Mortar Starbucks.” Food Business News RSS, Food Business News, 15 Nov. 2016, https://www.foodbusinessnews.net/articles/7156-a-survival-plan-for-bricks-and-mortar-starbucks

[6]. “Starbucks Reports Record Q4 and Record FY16 Results.” Starbucks Corporation - Starbucks Reports Record Q4 and Record FY16 Results, https://investor.starbucks.com/press-releases/financial-releases/press-release-details/2016/Starbucks-Reports-Record-Q4-and-Record-FY16-Results/default.aspx.

[7]. Cooke, James A. “From Bean to Cup: How Starbucks Transformed Its Supply Chain.” CSCMPs Supply Chain Quarterly RSS, CSCMP's Supply Chain Quarterly, 4 May 2020, https://www.supplychainquarterly.com/articles/438-from-bean-to-cup-how-starbucks-transformed-its-supply-chain.

[8]. Ranchman, Bonnie. “Sustainability Is at the Heart of Starbucks Coffee Sourcing.” Starbucks Stories, https://stories.starbucks.com/stories/2017/sustainability-is-at-the-heart-of-starbucks-coffee-sourcing/.

[9]. Le, Thai. “US INDUSTRY (NAICS) REPORT 72221B / ACCOMMODATION AND FOOD SERVICES: Coffee & Snack Shops in the US.” IBIS World, IBIS World, August 2022, https://my.ibisworld.com/us/en/industry/72221b/about.

[10]. Stock Analysis on Net. “Starbucks Corp. (NASDAQ:SBUX).” Stock Analysis on Net, 2022, https://www.stock-analysis-on.net/NASDAQ/Company/Starbucks-Corp.

[11]. DATA BRIDGE MARKET RESEARCH. (2020) COVID-19 impact on Coffee in Food and Beverage Industry. https://www.databridgemarketresearch.com/covid-19-resources/covid-19-impact-on-coffee-in-food-and-beverage-industry.

[12]. https://www.sec.gov/Archives/edgar/data/829224/000082922420000057/sbux-06102020ex991.htm.

[13]. The New York Times (2021) Starbucks, Flush With Customers, Is Running Low on Ingredients. https://www.nytimes.com/2021/06/10/business/starbucks-shortages.html.

[14]. STARBUCKS STORIES & NEWS. (2022) Timeline:Starbucks COVID-19 Milestones. https://stories.starbucks.com/press/2022/timeline-starbucks-covid-19-milestones/.

Cite this article

Zhuang,M.;Chen,L.;Li,X. (2023). Starbucks Supply Chain Analysis. Advances in Economics, Management and Political Sciences,18,183-192.

Data availability

The datasets used and/or analyzed during the current study will be available from the authors upon reasonable request.

Disclaimer/Publisher's Note

The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of EWA Publishing and/or the editor(s). EWA Publishing and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content.

About volume

Volume title: Proceedings of the 2023 International Conference on Management Research and Economic Development

© 2024 by the author(s). Licensee EWA Publishing, Oxford, UK. This article is an open access article distributed under the terms and

conditions of the Creative Commons Attribution (CC BY) license. Authors who

publish this series agree to the following terms:

1. Authors retain copyright and grant the series right of first publication with the work simultaneously licensed under a Creative Commons

Attribution License that allows others to share the work with an acknowledgment of the work's authorship and initial publication in this

series.

2. Authors are able to enter into separate, additional contractual arrangements for the non-exclusive distribution of the series's published

version of the work (e.g., post it to an institutional repository or publish it in a book), with an acknowledgment of its initial

publication in this series.

3. Authors are permitted and encouraged to post their work online (e.g., in institutional repositories or on their website) prior to and

during the submission process, as it can lead to productive exchanges, as well as earlier and greater citation of published work (See

Open access policy for details).

References

[1]. “About Us: Starbucks Coffee Company.” About Us: Starbucks Coffee Company, https://www.starbucks.com/about-us/.

[2]. Adam Shrum “A Look inside Starbucks' Coffee Supply Chain.” Dynamic Inventory, 10 July 2018, https://www.dynamicinventory.net/starbucks-supply-chain-management/.

[3]. “Starbucks.” Encyclopædia Britannica, Encyclopædia Britannica, Inc., https://www.britannica.com/topic/Starbucks.

[4]. “Starbucks Rethinks the Brick-and-Mortar Store.” Retail TouchPoints, 18 Dec. 2019, https://www.retailtouchpoints.com/blog/starbucks-rethinks-the-brick-and-mortar-store.

[5]. Gelski, Jeff. “A Survival Plan for Bricks-and-Mortar Starbucks.” Food Business News RSS, Food Business News, 15 Nov. 2016, https://www.foodbusinessnews.net/articles/7156-a-survival-plan-for-bricks-and-mortar-starbucks

[6]. “Starbucks Reports Record Q4 and Record FY16 Results.” Starbucks Corporation - Starbucks Reports Record Q4 and Record FY16 Results, https://investor.starbucks.com/press-releases/financial-releases/press-release-details/2016/Starbucks-Reports-Record-Q4-and-Record-FY16-Results/default.aspx.

[7]. Cooke, James A. “From Bean to Cup: How Starbucks Transformed Its Supply Chain.” CSCMPs Supply Chain Quarterly RSS, CSCMP's Supply Chain Quarterly, 4 May 2020, https://www.supplychainquarterly.com/articles/438-from-bean-to-cup-how-starbucks-transformed-its-supply-chain.

[8]. Ranchman, Bonnie. “Sustainability Is at the Heart of Starbucks Coffee Sourcing.” Starbucks Stories, https://stories.starbucks.com/stories/2017/sustainability-is-at-the-heart-of-starbucks-coffee-sourcing/.

[9]. Le, Thai. “US INDUSTRY (NAICS) REPORT 72221B / ACCOMMODATION AND FOOD SERVICES: Coffee & Snack Shops in the US.” IBIS World, IBIS World, August 2022, https://my.ibisworld.com/us/en/industry/72221b/about.

[10]. Stock Analysis on Net. “Starbucks Corp. (NASDAQ:SBUX).” Stock Analysis on Net, 2022, https://www.stock-analysis-on.net/NASDAQ/Company/Starbucks-Corp.

[11]. DATA BRIDGE MARKET RESEARCH. (2020) COVID-19 impact on Coffee in Food and Beverage Industry. https://www.databridgemarketresearch.com/covid-19-resources/covid-19-impact-on-coffee-in-food-and-beverage-industry.

[12]. https://www.sec.gov/Archives/edgar/data/829224/000082922420000057/sbux-06102020ex991.htm.

[13]. The New York Times (2021) Starbucks, Flush With Customers, Is Running Low on Ingredients. https://www.nytimes.com/2021/06/10/business/starbucks-shortages.html.

[14]. STARBUCKS STORIES & NEWS. (2022) Timeline:Starbucks COVID-19 Milestones. https://stories.starbucks.com/press/2022/timeline-starbucks-covid-19-milestones/.