1. Introduction

1.1. Game Industry

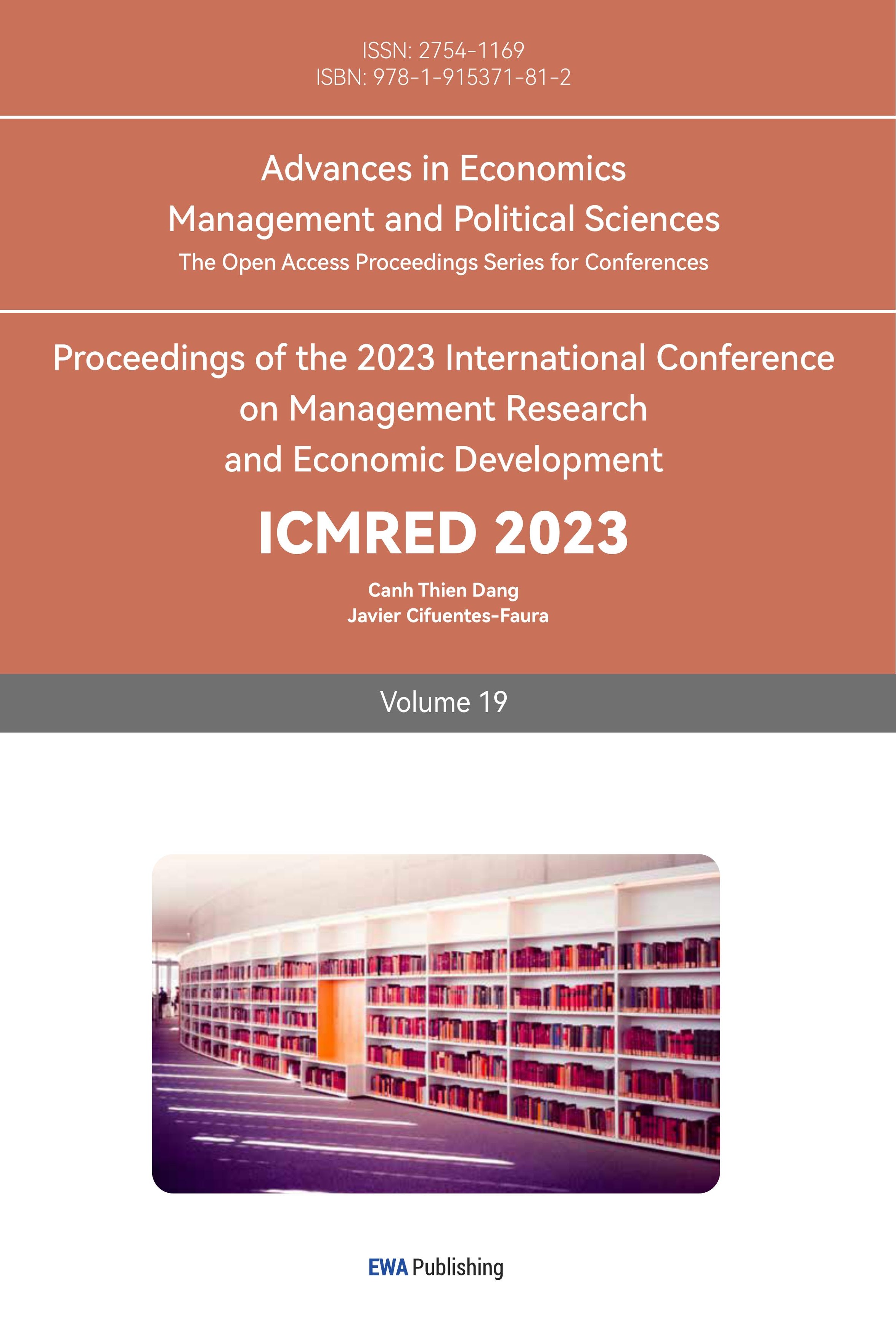

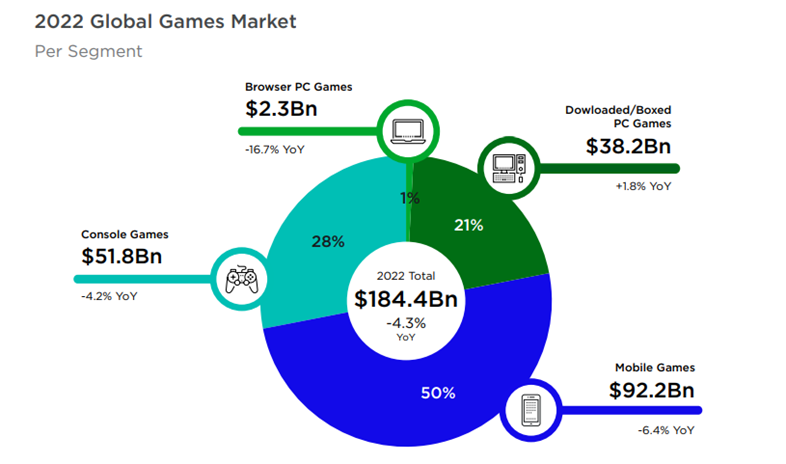

With the fast development of the online industry and the influence of Covid-19, the game industry has a significant growth from 2019 to 2021. According to the Newzoo, the players will reach 3534 million in 2024, increased 5.6% compared with 2015. Its market scale has increased 26% in these years and up to 184.4 billion in the end of 2022 [1].

Figure 1: Global player forecast (Resource: Newzoo, free global market report).

Another important trend is blurring the boundaries of different platforms, many games can play in both PC platform and console game platform, even can connect with the mobile platform. According to the report of Newzoo, half players focus on the platform, the other half in the PC and console platform. But PC is the only platform has an increase in 2022.

Figure 2: 2022 Global game market (Source: Newzoo, free global game market report).

Although experienced fast development before, especially from 2019-2021. In 2022 the global game market has a decrease of 4.3% and a slower increase in players. It’s the first decrease after the fast development and the market environment and fierce competition require the company need to re-evaluate their business strategy.

1.2. Game Publication

New game, sequel, history edition and DLC New game is a completely new IP in the game market, and it usually the first version and beginning of the whole series.

Sequel game is the game that have previous game. In the name dimension, the sequel game often has the same name as previous game to show that it is a continuation of the previous game and part of the series, usually its name will add a number like NBA2K20, NBA2K21, sometimes it also adds a name that represent the game plot. In the contain dimension, it is usually a follow-up to the plot of the previous game. The primary target audience is the players of the first game, and the reviews of the first game's players are an important measure of the success of the sequel [2].

History edition is the remake or integration of former games in one series, the company usually through improving the user experience of previous games such as picture quality and story integration to make the history edition. Sometimes the market will give a high evaluation to this edition because some games have a higher reputation before and companies took advantage of the opportunity to release higher-quality versions to achieve the sales promotion [3].

DLC is the content updates and extensions of the story in standard edition, some popular games release a lot of DLC, and it is also an important source of sustained profits after game launch. In general, the amount of DLC is directly proportional to the popularity and life cycle of the game.

2. Data and Method

2.1. Data

Our data only focus on the game developer not game distributors and platforms, and if there is a large game company (Such as: Sony group), its game developed by its subsidiary and the subsidiary is listed, we only collect the data of the subsidiary responsible for game development.

Our data focus on the main eight game developer, such as EA, KONAMI, Capcom and other. We collected their game release record from 2018 to 2022 and the stock price that related the game release event. For the game release event, it includes the new game publication, sequel release and history edition publication, expect the DLC release, because DLC is only the extended content for one game, not the change for whole game publication. Besides, the game we collected must have the PC platform, if its only for mobile or console we exclude it.

We gather game record from official website for each company and the main game platform around the world (Such as: Steam), the data of stock price and other financial data all from Yahoo finance.

In general, we gathered 146 event cases for eight company: Electronic Arts, Take-Two Interactive, Activision Blizzard, Capcom, KONAMI, SEGA, Square ENIX and Ubisoft. The data included 17 records of history edition, 129 records of new game and sequel. In five years, EA has the most event cases up to 37 records and Activision Blizzard has the lowest number of data only 8 in five years.

Table 1: The number of events.

game developer | number of cases | percentage |

EA | 37 | 25.34% |

2K | 21 | 14.38% |

ATVI | 8 | 5.48% |

Capcom | 12 | 8.22% |

KONAMI | 10 | 6.85% |

SEGA | 14 | 9.59% |

Square ENIX | 25 | 17.12% |

Ubisoft | 19 | 13.01% |

total | 146 | 100.00% |

2.2. Method

At first, we need to make a hypothesis, many people and institutions think the official released and every beta test will bring the improvement of company value and reflects on its stock price, so we make the null hypothesis:[4]

H0: The game is officially released has an impact on stock price.

In this study, we adopted the traditional event study based on market model. We set event day as t = 0 which as the day that game developer releases the game [5]. The days before official days are minus number like t=-1 and after it are positive number like t=1. We set the window size as 11 days from -5 to +5. We use the relatively small window size because the we only research the impact of one game release, we don’t focus on its follow-up updates like DLC.

\( {R_{it}}={α_{i}}+{β_{i}}{R_{m,t}}+{ε_{i,t}} \) (1)

We use Regression (1) to calculate the coefficient of market based on the daily market change. And we use regression (2) to calculate the stock return, \( {R_{it}} \) represents the return on day t of company \( i \) , and \( {R_{m}} \) , \( t \) is the market return on day t calculated by (3). Because the common stock return, \( {R_{it}} \) and the market return, \( {R_{m}} \) , \( t \) , are evaluated as the difference of each price respectively. And in the regression (1) the \( {β_{i}} \) measures the systemic risk of stocks, the relationship to the market yield. And the \( {ε_{i}} \) , \( t \) measures the non-systemic risk of stocks and is used to study the impact of specific corporate events on stock prices [6].

\( {R_{it}}={price_{i,t}}-{price_{i,t-1}}/{price_{i,t-1}} \) (2)

\( {R_{mt}}={price_{m,t}}-{price_{m,t-1}}/{price_{m,t-1}} \) (3)

In this study, we use regression (4) to estimate the abnormal return which represents the difference the expected return and the actual return of company \( i \) in the event window size. We also used the cumulative abnormal return (CAR) values to calculate the total abnormal return that the events we study occurs in the window size. We used (5) to calculate the cumulative abnormal return (CAR) for various window sizes [7, 8].

\( {AR_{i,t}}={R_{i,t}}-({α_{i}}+{β_{i}}{R_{m,t}}) \) (4)

\( {CAR_{i,t}}=\sum _{-t}^{t}{AR_{i,t}} \) (5)

When we select day of window size, if the stock does not open on the release date, we choose t=0 as the first trading day after the release date. Finally, we use the t-test as the significance test for CAR, we use it average and variance in the test [9].

\( \bar{CAR}=\frac{1}{N}\sum _{I=1}^{N}{CAR_{i, π}} \) (6)

\( var(\bar{CAR})=\frac{1}{{N^{2}}}\sum _{i}^{N}var({CAR_{i,π}}) \) (7)

\( t=\frac{CAR}{\sqrt[]{var(CAR)}} \) (8)

3. Result

The table shows the general description and result of t-test of CAR. All the event of game official released has CAR of mean 7.0281% and Std. Deviation of 15.62263%.

Table 2: General description and t-test result.

One-Sample Test | ||||||

df | Sig. (2-tailed) | N | Mean | Std. Deviation | Std. Error Mean | |

CAR | 145 | <.01 | 146 | 7.0281% | 15.61163% | 1.29203% |

The p-value of t-test <0.01, so we need to reject the H0, the event of official game release doesn’t have the impact on stock price. And we conclude the two main reasons as follow:

(1) Before the game official release, new game need public test to solve the problem and do the promotion. Public test needs a certain number of players support, the public beta period and the early publicity will lead to the leakage of game information, so that the market enters the reaction cycle in advance it means before the official release the market has already gotten the message and changed, so there will not be obvious CAR on the official launch day. In the official release day, capital is more likely to wait for user evaluation to decide where to invest. It is a very common phenomenon in the stock market [10].

(2) The relationship between actual reviews and market expectations: If the market does not have high expectations for the game, or the actual reviews of the game do not exceed market expectations, especially if the market has reacted before the official launch, the event of official event can’t bring special CAR [11].

4. Conclusion and Outlook

Games has become an important industry and main type of leisure; the game industry also has become an important source of profits for Internet companies. So, the relevant personnel of all industries, especially the financial market participants in the case of enterprise listing, hope to find the game with the highest potential return. Meanwhile, the capital flow also affects the enterprise's financing scale, and its subsequent game development and update funds

By analyzing the data of main companies around the world in five years, we analyze the relationship between the official release event and stock price, although we reject the null hypothesis because of the t-test, there are still some helps for company.

Because the characteristic of stock market, if the company want to get high CAR, the company need to Focus more on early publicity and the user experience of the game itself. At the same time, the size and content of the new game information flaw should be strictly selected, it refers to the public test period price, public test number, channel selection and many other aspects [12].

Besides there are some outlooks for this research: First, our research only focusses on the event of official release, there are many aspects can classify the game, such as the number of subsequent updates like DLC, the target customer group and others. We can use a variety of criteria to categorize games and the impact of different categories on security values to better provide targeted advice to companies [13].

Second, for some games, the market and user reviews are relatively delayed, and a longer window can be used to analyze the topic.

References

[1]. Newzoo. https://newzoo.com/cn/trend-reports/newzoo-global-games-market-report-2022-free-version-cn

[2]. T. Abramova, “Stock Price Reactions on M&A, Dividends and Game Releases. Evidence from Gaming Industry.,” lutpub.lut.fi, 2013.

[3]. C. Elverdam and E. Aarseth, “Game Classification and Game Design,” Games and Culture, vol. 2, no. 1, pp. 3–22, Jan. 2007, doi: 10.1177/1555412006286892.

[4]. A. McWilliams and D. Siegel, “Event Studies In Management Research: Theoretical And Empirical Issues,” Academy of Management Journal, vol. 40, no. 3, pp. 626–657, Jun. 1997, doi: 10.5465/257056.

[5]. P. He, Y. Sun, Y. Zhang, and T. Li, “COVID–19’s Impact on Stock Prices Across Different Sectors—An Event Study Based on the Chinese Stock Market,” Emerging Markets Finance and Trade, vol. 56, no. 10, pp. 2198–2212, Jul. 2020, doi: 10.1080/1540496x.2020.1785865.

[6]. C. Suh and B. Lee, “An Analysis of Events in Online Game Industry and Stock Price Reactions,” PACIS 2011 Proceedings, vol. 185, Jul. 2011, [Online]. Available: https://aisel.aisnet.org/pacis2011/185/

[7]. J. Koh and N. Venkatraman, “Joint Venture Formations and Stock Market Reactions: An Assessment in the Information Technology Sector,” Academy of Management Journal, vol. 34, no. 4, pp. 869–892, Dec. 1991, doi: 10.5465/256393.

[8]. J. W. Kolari and S. Pynnönen, “Event Study Testing with Cross-sectional Correlation of Abnormal Returns,” Review of Financial Studies, vol. 23, no. 11, pp. 3996–4025, Sep. 2010, doi: 10.1093/rfs/hhq072.

[9]. M.-H. Chen, S. (Shawn) Jang, and W. G. Kim, “The impact of the SARS outbreak on Taiwanese hotel stock performance: An event-study approach,” International Journal of Hospitality Management, vol.26, no.1, pp.200–212, Mar. 2007, doi: 10.1016/j.ijhm.2005.11.004.

[10]. D. A. Reinstein and C. M. Snyder, “THE INFLUENCE OF EXPERT REVIEWS ON CONSUMER DEMAND FOR EXPERIENCE GOODS: A CASE STUDY OF MOVIE CRITICS*,” Journal of Industrial Economics, vol. 53, no. 1, pp. 27–51, Mar. 2005, doi: 10.1111/j.0022-1821.2005.00244.x.

[11]. M. T. CLEMENTS and H. OHASHI, “INDIRECT NETWORK EFFECTS AND THE PRODUCT CYCLE: VIDEO GAMES IN THE U.S., 1994-2002*,” Journal of Industrial Economics, vol. 53, no. 4, pp. 515–542, Dec. 2005, doi: 10.1111/j.1467-6451.2005.00268.x.

[12]. R. Sharma, “Stock Price Behaviour around Dividend Announcements: An Event Study Methodology,” Vilakshan: The XIMB Journal of Management, vol. 8, no. 2, pp. 23–32, Sep. 2011.

[13]. S.-K. Lo, C.-C. Wang, and W. Fang, “Physical Interpersonal Relationships and Social Anxiety among Online Game Players,” CyberPsychology & Behavior, vol. 8, no. 1, pp. 15–20, Feb. 2005, doi: 10.1089/cpb.2005.8.15.

Cite this article

Zhang,Z. (2023). Game Publication and Influence on Stock Price. Advances in Economics, Management and Political Sciences,19,14-18.

Data availability

The datasets used and/or analyzed during the current study will be available from the authors upon reasonable request.

Disclaimer/Publisher's Note

The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of EWA Publishing and/or the editor(s). EWA Publishing and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content.

About volume

Volume title: Proceedings of the 2023 International Conference on Management Research and Economic Development

© 2024 by the author(s). Licensee EWA Publishing, Oxford, UK. This article is an open access article distributed under the terms and

conditions of the Creative Commons Attribution (CC BY) license. Authors who

publish this series agree to the following terms:

1. Authors retain copyright and grant the series right of first publication with the work simultaneously licensed under a Creative Commons

Attribution License that allows others to share the work with an acknowledgment of the work's authorship and initial publication in this

series.

2. Authors are able to enter into separate, additional contractual arrangements for the non-exclusive distribution of the series's published

version of the work (e.g., post it to an institutional repository or publish it in a book), with an acknowledgment of its initial

publication in this series.

3. Authors are permitted and encouraged to post their work online (e.g., in institutional repositories or on their website) prior to and

during the submission process, as it can lead to productive exchanges, as well as earlier and greater citation of published work (See

Open access policy for details).

References

[1]. Newzoo. https://newzoo.com/cn/trend-reports/newzoo-global-games-market-report-2022-free-version-cn

[2]. T. Abramova, “Stock Price Reactions on M&A, Dividends and Game Releases. Evidence from Gaming Industry.,” lutpub.lut.fi, 2013.

[3]. C. Elverdam and E. Aarseth, “Game Classification and Game Design,” Games and Culture, vol. 2, no. 1, pp. 3–22, Jan. 2007, doi: 10.1177/1555412006286892.

[4]. A. McWilliams and D. Siegel, “Event Studies In Management Research: Theoretical And Empirical Issues,” Academy of Management Journal, vol. 40, no. 3, pp. 626–657, Jun. 1997, doi: 10.5465/257056.

[5]. P. He, Y. Sun, Y. Zhang, and T. Li, “COVID–19’s Impact on Stock Prices Across Different Sectors—An Event Study Based on the Chinese Stock Market,” Emerging Markets Finance and Trade, vol. 56, no. 10, pp. 2198–2212, Jul. 2020, doi: 10.1080/1540496x.2020.1785865.

[6]. C. Suh and B. Lee, “An Analysis of Events in Online Game Industry and Stock Price Reactions,” PACIS 2011 Proceedings, vol. 185, Jul. 2011, [Online]. Available: https://aisel.aisnet.org/pacis2011/185/

[7]. J. Koh and N. Venkatraman, “Joint Venture Formations and Stock Market Reactions: An Assessment in the Information Technology Sector,” Academy of Management Journal, vol. 34, no. 4, pp. 869–892, Dec. 1991, doi: 10.5465/256393.

[8]. J. W. Kolari and S. Pynnönen, “Event Study Testing with Cross-sectional Correlation of Abnormal Returns,” Review of Financial Studies, vol. 23, no. 11, pp. 3996–4025, Sep. 2010, doi: 10.1093/rfs/hhq072.

[9]. M.-H. Chen, S. (Shawn) Jang, and W. G. Kim, “The impact of the SARS outbreak on Taiwanese hotel stock performance: An event-study approach,” International Journal of Hospitality Management, vol.26, no.1, pp.200–212, Mar. 2007, doi: 10.1016/j.ijhm.2005.11.004.

[10]. D. A. Reinstein and C. M. Snyder, “THE INFLUENCE OF EXPERT REVIEWS ON CONSUMER DEMAND FOR EXPERIENCE GOODS: A CASE STUDY OF MOVIE CRITICS*,” Journal of Industrial Economics, vol. 53, no. 1, pp. 27–51, Mar. 2005, doi: 10.1111/j.0022-1821.2005.00244.x.

[11]. M. T. CLEMENTS and H. OHASHI, “INDIRECT NETWORK EFFECTS AND THE PRODUCT CYCLE: VIDEO GAMES IN THE U.S., 1994-2002*,” Journal of Industrial Economics, vol. 53, no. 4, pp. 515–542, Dec. 2005, doi: 10.1111/j.1467-6451.2005.00268.x.

[12]. R. Sharma, “Stock Price Behaviour around Dividend Announcements: An Event Study Methodology,” Vilakshan: The XIMB Journal of Management, vol. 8, no. 2, pp. 23–32, Sep. 2011.

[13]. S.-K. Lo, C.-C. Wang, and W. Fang, “Physical Interpersonal Relationships and Social Anxiety among Online Game Players,” CyberPsychology & Behavior, vol. 8, no. 1, pp. 15–20, Feb. 2005, doi: 10.1089/cpb.2005.8.15.