1. Introduction

On February 24, 2022, a military conflict officially broke out between Russia and Ukraine. This military conflict has a large number of impacts all over the world. It is known that Russia is a huge oil and energy sources exporting country. And after the Russia-Ukraine military conflict, many countries see Russia as an aggressor and have imposed sanctions on Russia in different areas, including oil and other energy sources. Traditional energy sources have received a shock, new energy industry has a good opportunity for development. The industry of vehicles using new energy was in an unstable state since it is a relatively immature industry. The new energy vehicle industry on the international market has been severely impacted by the current Russia-Ukraine war. The future of the industry of vehicles using new energy is shrouded in uncertainty. This paper investigates how the military conflict impacts the new energy vehicle industry.

On one side, Russia has a close connection with global new energy vehicle market. One of the main producers of lithium is Russia, a major supplier of lithium, and a major market for battery cars. Kolpakov and Yakovlev believe that with the efforts of dealers and service centers, through domestic EV producers and localized foreign EV producers, within the next four to five years, Russia will rank among the top 20 global EV markets [1]. It is well knowledge that lithium plays a significant role in batteries for electric automobiles. If Russian supply is cut due to sanctions from various countries, it could lead to a severe global shortage in the lithium area. This would cause higher prices for new energy vehicles [1]. The military conflict also had other negative impacts on the industry of new energy vehicles. First of all, sanctions from various countries cause international companies can’t develop business in Russia, and companies in Russia can’t have business with other countries’ companies, millions of people who work in the new energy industry have been displayed. The second place, goods, and materials around the market can’t be transported between Russia and other countries. Last but not least, the war is costly for the people and government and would lead the Russian government to reduce new energy resources [2]. From this perspective, the military conflict between Russia and Ukraine seems to have a negative effect on the new energy vehicle industry.

However, from the side of traditional energy, the military conflict between Russia and Ukraine seems to have a positive effect on the new energy vehicle industry. Conventional energy here means the oil used to fuel cars. With more than 7.4 million barrels of oil exported daily in 2020, Russia will be the fourth-largest oil exporter in the world and the third-largest crude oil producer in the world, according to scientific studies [3]. Most countries see this military conflict as the unjustified invasion from Russia and the unauthorized annexation of the Ukrainian regions of Donetsk, Luhansk, Zaporizhzhia, and Kherson [4]. Additionally, comprehensive sanctions have been placed on Russia, including visa requirements, economic sanctions, and targeted restrictive measures (individual sanctions) [4], and oil from Russia suffered a lot of restrictions. On June 20, 2022, the council of EU adopted the sanctions’ sixth package, one of which included restricting the import of crude oil and processed petroleum products from Russia [5]. On December 3, 2022, the EU decided to cap the price of oil produced in Russia or exported to Russia at $60 per barrel, has been implemented on December 5, 2022 [5]. These would significantly reduce Russia's income from energy sources. In March 2022, the US banned all crude oil imported from Russia. In addition, the United Kingdom, Canada, and Australia also took action on banning oil and refined petroleum products produced or imported from Russia [6]. Such sanctions would lead to a world energy shortage, creating a huge supply conflict that would drive up the price of oil. Oil consumption in 2022 will be 550 kbd lower than in 2019, and demand in 2022 could take a 1.2 million barrel hit [7]. Meanwhile, if Russian oil production continues to be disrupted, Brent oil prices could reach $185 a barrel, which could lead to a 3 million barrel drop in global oil demand [7]. Oil prices will immediately increase the cost of operating fuel-powered vehicles, and demand for new energy vehicles, which are fuel-powered vehicles' replacements, will rise as a result.

The second factor would have a more significant impact. This is because Russia's influence on the production and supply of oil is far greater than that of lithium batteries. Russia is a top five global supplier and producer of oil, shipping large amounts of oil to China and Europe in particular. But Russia's lithium battery production and supply can only be among the top 20 or 25 in the world [1]. Furthermore, the mainstream energy source nowadays is still petrol. The market share of petrol fuel vehicles in 2022 Q2 is 38.5%, and the market share of battery electric fuel vehicles in 2022 Q2 is 9.9% [8]. As a result, the new energy vehicle industry will be more significantly impacted by the increase in oil prices.

The new energy vehicle sector's index change would be used in this paper, to determine the effect of the Russia-Ukraine war on the new energy vehicle industry. And based on the results, provide some reference advice for the government and investors.

This paper's sections are divided up as follows: Part 2 is the part of research design, which introduces data source, Augmented Dickey-Fuller test, and ARIMA model specification; Part 3 is empirical result and analysis, which introduces selection of order, testing, forecasting and analysis; Part 4 is discussion; Part 5 is the conclusion part.

2. Research Design

2.1. Data Source

There are a lot of indexes about new energy vehicles, and among those indexes, New Energy Vehicle Sector Index (910031. EI) from Eastmoney Securities is selected. This index is selected from all A-shares in Shanghai, Shenzhen, and Beijing stock markets, and the corresponding listed securities are used as the index sample to reflect the overall performance of the industry. So this index is representative. The New Energy Vehicle Sector Index for each month from the end of December 2014 to the end of January 2022 from the Choice financial terminal is collected. February 2022 is the beginning of the Russia-Ukraine conflict. Therefore, when the counterfactual model is built, there shouldn't have data after January 2022. Thus, the close price from this time period can be used to build the model to get the 10-month forecast fitted value of the sector index assuming there is no Russia-Ukraine conflict. The New Energy Vehicle Sector Index for each month from the end of February 2022 to the end of November 2022 from the Choice financial terminal is collected. Then the actual value with the fitted value should be compared to see the impact of the Russia-Ukraine conflict on new energy vehicle industry.

2.2. Augmented Dickey-Fuller (ADF) Unit Root Test

Before processing the data, the time series should be checked whether it is stationary. According to ADF test, the p-value in Table 1 for index and return are all almost equal to zero, which is considered statistically significant. Because of these tests, it is shown there is enough evidence to reject that the variable has a unit root, and the data used to build the model is feasible and stationery.

Table 1: ADF test.

Variables | t-statistic | p-value |

Raw | ||

Index | -5.698 | 0.0000*** |

Difference | ||

Return | -4.370 | 0.0024 |

2.3. ARIMA Model

ARIMA model predicts future value from historical data. Typically, it is written as ARIMA (p, d, q), where q stands for the moving-average model’s order, differencing’s degree is represented by d, and the autoregressive model’s order is represented by p. [9]. The moving average's order (q) and the regression's order (p) are computed in the first step using the ACF (autocorrelation function) and PACF (partial autocorrelation function) [9]. Then, the differencing’s order (d) is determined by the trend of the time series of New Energy Vehicle Sector Index.

Autoregressive (AR): a regression model with lags for the value of y, where \( ε \) is white noise at time t, p is the number of delays for the observations in the model, and c is a constant [9].

\( {\hat{y}_{t}} = c + {ϕ_{1}}{y_{t-1}} + \) \( {ϕ_{2}}{y_{t-2}} +...+ {ϕ_{p}}{y_{t-p}} + {ε_{t}} \) (1)

Integrated (I): taking the differencing d times to make the time series stationary [9].

\( y_{t}^{ \prime } = {(1-B)^{d}}{y_{t}} s.t. B{y_{t}} = {y_{t-1}} \) (2)

Moving Average (MA): A regression-like model is utilized by a moving average model of historical forecasting blunders, with \( ε= \) white noise at time t, and c is a constant [9].

\( {\hat{y}_{t}} = c + {θ_{1}}{ε_{t-1}} + \) \( {θ_{2}}{ε_{t-2}} +...+ {θ_{q}}{ε_{t-q}} \) (3)

3. Empirical Results and Analysis

3.1. Selection of Order

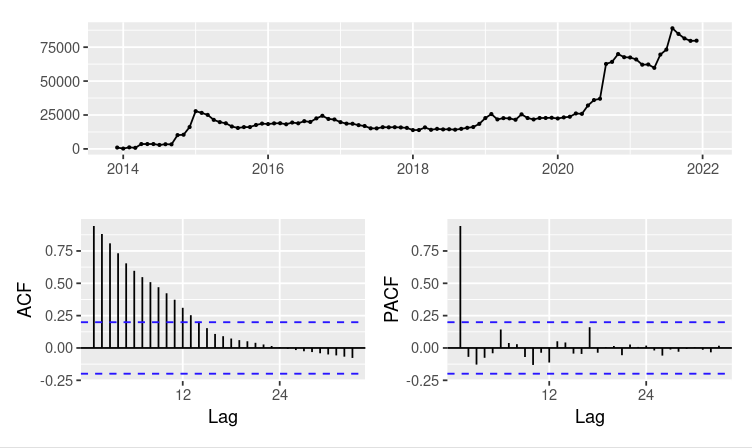

The autocorrelation function and partial autocorrelation function before differencing are represented in Figure 1 as ACF and PACF, respectively. It is shown that there are way less than 95% spikes within the bound, which demonstrate this time series is not white noise. Based on the Unit Root Test for Augmented Dickey-Fuller (ADF), after 1 differencing, the time series is stationary. Thus, the order of differencing is 1 (d = 1).

|

Figure 1: Time series plot before differencing. (Photo credit: Original)

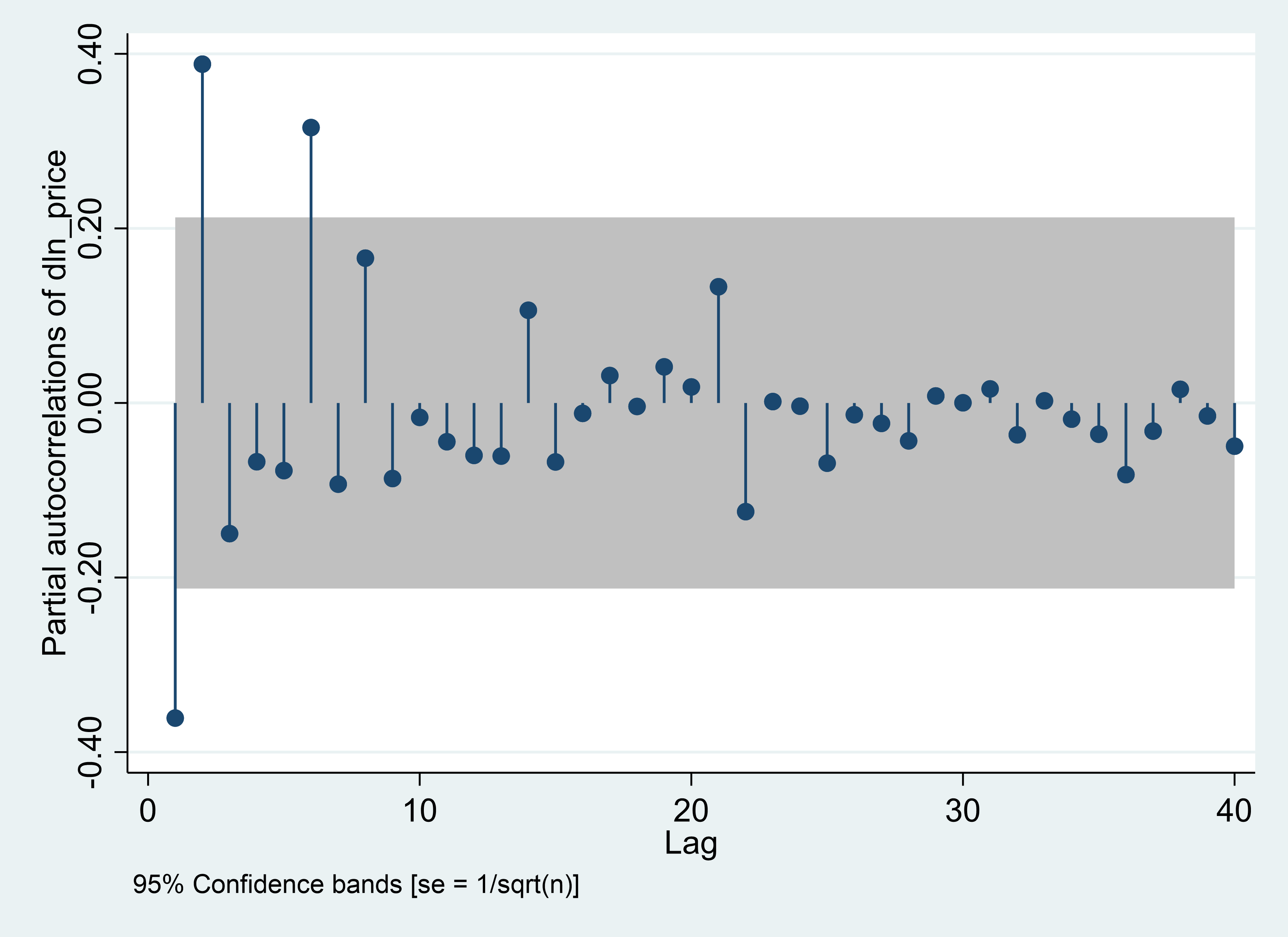

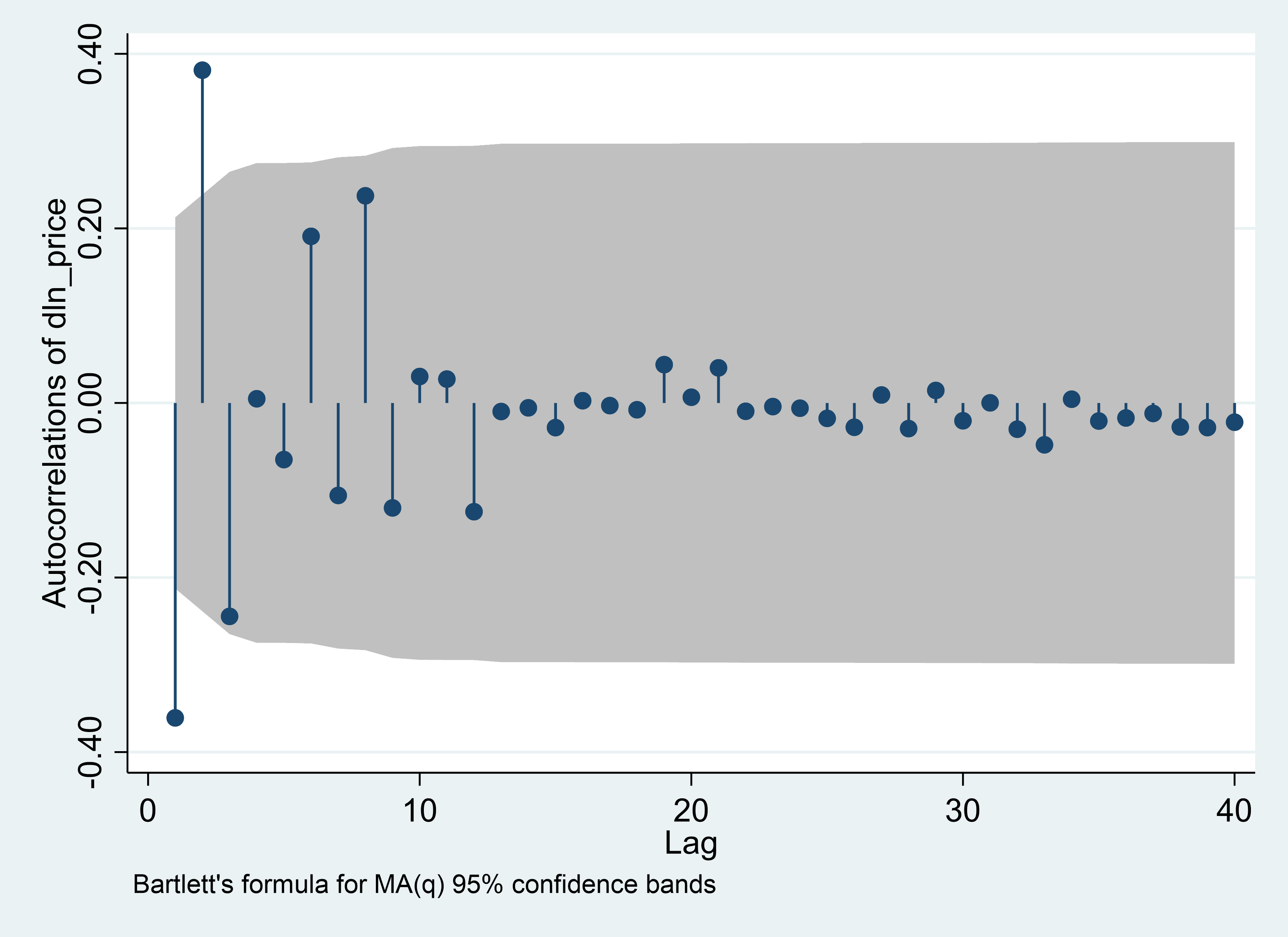

According to PACF and ACF in Figure 2, eyeballing is a good method to determine the order of regression and moving average. PACF is shown a distinct difference after the first and the second spikes. Thus MA(1, 2) is obtained. And ACF is shown distinct differences after the first, the second, and the seventh spikes. Thus, AR (1, 2, 7) is obtained. Now all orders are determined, it is time to proceed to the next step.

PACF | ACF |

|

|

Figure 2: PACF and ACF. (Photo credit: Original)

3.2. Testing, Forecasting, and Analysis

Based on the residual test in Table 2, the model’s residual series is white noise.

Table 2: Residual test.

Portmanteau (Q) statistic | Prob > chi2 |

14.7887 | 0.1400 |

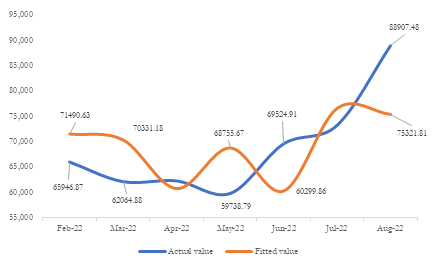

According to Figure 3, in the first half of the forecast time period, the fitted value is higher than the actual value for most of the time. This points out the New Energy Vehicle Sector Index would be higher if there is no military conflict between Russia and Ukraine between February and May. The reason for this is that this military conflict causes shipping cost raising. As previously mentioned, petroleum is the fuel with the highest market share, and Russia is one of the most important petroleum-producing and exporting countries. However, the sanction from other countries to Russia raise the price of petroleum in global market, which leads to higher marine bunker prices, and then all maritime transport sectors’ shipping costs [10]. Therefore, the New Energy Vehicle Sector Index would be higher if there is no military conflict between Russia and Ukraine. In the last half of the forecast time period, the actual value is increasing sharply and surpasses the fitted value. This shows that the New Energy Vehicle Sector Index is becoming higher due to the Russia-Ukraine conflict after May. Electricity is one of the main alternatives to petroleum, wind power, solar energy, and nuclear power are all popular sources of electricity [11]. Therefore, electricity is gradually replacing petroleum, and the Russia-Ukraine conflict speed up this process. All in all, in short term, the cost effect dominates, and in long term, the substitution effect dominates.

|

Figure 3: Actual and fitted value. (Photo credit: Original)

4. Discussion

This paper use ARIMA model to investigate the impact of the Russia-Ukraine conflict on new energy vehicle industry. The New Energy Vehicle Sector Index from A share in Chinese stock market is used to represent the new energy vehicle industry. This paper combines the effect of the Russia-Ukraine war on oil prices, the impact on lithium batteries, and the sanctions received by Russia, and examines the impact of these events combined on new energy vehicles. This is what makes this paper different. The global energy crisis, the rising price of oil, and the increasing cost of using fuel cars. And as new power vehicles are excellent alternatives, the government should put more resources and attention into the new energy vehicle industry. For the Chinese government, this could be done through direct investment or incentives to install public charging posts, reduce taxes on new energy vehicle companies, deploy charging facilities, and encourage the development of sustainable and green batteries [12]. At the same time, the Chinese government should adhere to the "dual carbon" policy. Investors, can choose some stocks of new energy vehicles in their portfolio.

5. Conclusion

The Russia-Ukraine conflict occurred on February 24, 2022, and the new energy vehicle business is significantly impacted by this incident. There are two potential factors, one is that Russia itself is an exporter and producer of lithium batteries and one of the world's major new energy markets, such a military conflict would have an effect on the market for new energy automobiles. The second factor is that Russia is one of the world's most significant oil power, but with the sanctions imposed by various countries, Russian oil received bans and restrictions, which led to a rise in global oil prices. New energy vehicles, which are alternatives to fuel vehicles, are bound to be affected. In this paper, ARIMA model is used to build a counterfactual framework to determine the effect between Russia and Ukraine on the market for new energy automobiles. The data source is the New Energy Vehicle Sector Index from Eastmoney Securities. ADF test is utilized to check whether the time series is stationary, and ADF and PADF are utilized to determine the order. The result shows that, in short term, the cost effect dominates, the shipping cost increases due to the increasing price of petroleum, and the new energy vehicle industry is relatively depressed. In long term, the substitution effect dominates, the increasing usage cost of fuel vehicles causes the demand for the substitute, new energy vehicles, to increase, and the new energy vehicle industry became more elevated.

References

[1]. Semikashev, V.V., Kolpakov, A.Y., Yakovlev, A.A. et al, (2022) Development of the Electric Vehicles Market in Russia as a Necessary Condition for Benefiting from the Global Trend towards Transport Electrification. Stud. Russ. Econ. Dev., 33: 274–281

[2]. Sangita Shetty. (2022) Opinion: Impact Of The Russia-Ukraine War On The Global EV Industry. https://emobilityplus.com/2022/05/27/opinion-impact-of-the-russia-ukraine-war-on-the-global-ev-industry/.

[3]. Statista Research Department. (2022) Russian oil industry - statistics & facts. https://www.statista.com/topics/5399/russian-oil-industry/#dossierKeyfigures.

[4]. Council of the European Union. (2022) EU sanctions against Russia explained. https://www.consilium.europa.eu/en/policies/sanctions/restrictive-measures-against-russia-over-ukraine/sanctions-against-russia-explained/#sanctions.

[5]. Council of the European Union. (2022) Timeline - EU restrictive measures against Russia over Ukraine. https://www.consilium.europa.eu/en/policies/sanctions/restrictive-measures-against-russia-over-ukraine/history-restrictive-measures-against-russia-over-ukraine/.

[6]. Tatiana Mitrova. (2022) Understanding the Impact of Sanctions on the Russian Oil and Gas Sector with Limited Data. https://www.energypolicy.columbia.edu/research/qa/qa-understanding-impact-sanctions-russian-oil-and-gas-sector-limited-data.

[7]. J.P. Morgan. (2022) What’s Next For Oil And Gas Prices As Sanctions On Russia Intensify. https://www.jpmorgan.com/insights/research/oil-gas-energy-prices.

[8]. ACEA. (2022) Fuel types of new cars: battery electric 9.9%, hybrid 22.6% and petrol 38.5% market share in Q2 2022. https://www.acea.auto/fuel-pc/fuel-types-of-new-cars-battery-electric-9-9-hybrid-22-6-and-petrol-38-5-market-share-in-q2-2022/.

[9]. Neha Bora. (2021) Understanding ARIMA Models for Machine Learning. https://www.capitalone.com/tech/machine-learning/understanding-arima-models/.

[10]. UNCTAD. (2022) War in Ukraine raises global shipping costs, stifles trade. https://unctad.org/news/war-ukraine-raises-global-shipping-costs-stifles-trade

[11]. Sean Ross. (2022) What Are the Main Substitutes for Oil and Gas Energy?. https://www.investopedia.com/ask/answers/060415/what-are-main-substitutes-oil-and-gas-energy.asp

[12]. IEA. (2021) Policies to promote electric vehicle deployment. https://www.iea.org/reports/global-ev-outlook-2021/policies-to-promote-electric-vehicle-deployment.

Cite this article

Xia,H. (2023). New Energy Vehicles under the Volatility of International Energy Prices: Evidence from Regional Conflict. Advances in Economics, Management and Political Sciences,19,1-7.

Data availability

The datasets used and/or analyzed during the current study will be available from the authors upon reasonable request.

Disclaimer/Publisher's Note

The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of EWA Publishing and/or the editor(s). EWA Publishing and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content.

About volume

Volume title: Proceedings of the 2023 International Conference on Management Research and Economic Development

© 2024 by the author(s). Licensee EWA Publishing, Oxford, UK. This article is an open access article distributed under the terms and

conditions of the Creative Commons Attribution (CC BY) license. Authors who

publish this series agree to the following terms:

1. Authors retain copyright and grant the series right of first publication with the work simultaneously licensed under a Creative Commons

Attribution License that allows others to share the work with an acknowledgment of the work's authorship and initial publication in this

series.

2. Authors are able to enter into separate, additional contractual arrangements for the non-exclusive distribution of the series's published

version of the work (e.g., post it to an institutional repository or publish it in a book), with an acknowledgment of its initial

publication in this series.

3. Authors are permitted and encouraged to post their work online (e.g., in institutional repositories or on their website) prior to and

during the submission process, as it can lead to productive exchanges, as well as earlier and greater citation of published work (See

Open access policy for details).

References

[1]. Semikashev, V.V., Kolpakov, A.Y., Yakovlev, A.A. et al, (2022) Development of the Electric Vehicles Market in Russia as a Necessary Condition for Benefiting from the Global Trend towards Transport Electrification. Stud. Russ. Econ. Dev., 33: 274–281

[2]. Sangita Shetty. (2022) Opinion: Impact Of The Russia-Ukraine War On The Global EV Industry. https://emobilityplus.com/2022/05/27/opinion-impact-of-the-russia-ukraine-war-on-the-global-ev-industry/.

[3]. Statista Research Department. (2022) Russian oil industry - statistics & facts. https://www.statista.com/topics/5399/russian-oil-industry/#dossierKeyfigures.

[4]. Council of the European Union. (2022) EU sanctions against Russia explained. https://www.consilium.europa.eu/en/policies/sanctions/restrictive-measures-against-russia-over-ukraine/sanctions-against-russia-explained/#sanctions.

[5]. Council of the European Union. (2022) Timeline - EU restrictive measures against Russia over Ukraine. https://www.consilium.europa.eu/en/policies/sanctions/restrictive-measures-against-russia-over-ukraine/history-restrictive-measures-against-russia-over-ukraine/.

[6]. Tatiana Mitrova. (2022) Understanding the Impact of Sanctions on the Russian Oil and Gas Sector with Limited Data. https://www.energypolicy.columbia.edu/research/qa/qa-understanding-impact-sanctions-russian-oil-and-gas-sector-limited-data.

[7]. J.P. Morgan. (2022) What’s Next For Oil And Gas Prices As Sanctions On Russia Intensify. https://www.jpmorgan.com/insights/research/oil-gas-energy-prices.

[8]. ACEA. (2022) Fuel types of new cars: battery electric 9.9%, hybrid 22.6% and petrol 38.5% market share in Q2 2022. https://www.acea.auto/fuel-pc/fuel-types-of-new-cars-battery-electric-9-9-hybrid-22-6-and-petrol-38-5-market-share-in-q2-2022/.

[9]. Neha Bora. (2021) Understanding ARIMA Models for Machine Learning. https://www.capitalone.com/tech/machine-learning/understanding-arima-models/.

[10]. UNCTAD. (2022) War in Ukraine raises global shipping costs, stifles trade. https://unctad.org/news/war-ukraine-raises-global-shipping-costs-stifles-trade

[11]. Sean Ross. (2022) What Are the Main Substitutes for Oil and Gas Energy?. https://www.investopedia.com/ask/answers/060415/what-are-main-substitutes-oil-and-gas-energy.asp

[12]. IEA. (2021) Policies to promote electric vehicle deployment. https://www.iea.org/reports/global-ev-outlook-2021/policies-to-promote-electric-vehicle-deployment.