1. Introduction

Against the backdrop of expectations of continued unilateral appreciation, a large amount of foreign hot money wanted to be converted into RMB to enjoy the exchange gains from the unilateral appreciation of RMB, i.e., foreign exchange hedging [1].

The danger of foreign exchange hedging to the market is still grave. On the one hand, large-scale fraudulent trade can bias export trade statistics and interfere with the macroeconomic judgment of governments at all levels and individual enterprises [2]; on the other hand, enterprises involved in fraudulent trade usually engage in tax fraud and loan fraud, which can lead to a reduction in the efficiency of resource allocation in the Chinese economy [3]. In order to avoid the occurrence of illegal arbitrage, China's Regulations of the People's Republic of China on Foreign Exchange Management mentions that if any institution or individual violates the foreign exchange management regulations to carry out illegal arbitrage or illegal settlement of foreign exchange, the State Administration of Foreign Exchange (SAFE) and its branches (hereinafter referred to as the Bureau of Foreign Exchange) will make administrative punishment decisions according to the provisions of Articles 40 and 41(2) of the Regulations, and order the illegal arbitrage funds or illegal settlement of foreign exchange to If the institution or individual is ordered to "repatriate" the illegally arbitrated or settled foreign exchange funds, the institution or individual shall [4], within 15 days from the date of receipt of the administrative penalty decision, repatriate the funds already purchased in foreign exchange to RMB or repatriate the RMB funds already settled in foreign exchange to foreign exchange in accordance with the RMB exchange rate on the date of repatriation [5]. For the institution or individual who gains from the exchange rate difference between the RMB exchange rate on the date of the repatriation and the exchange rate on the date of the illegal arbitrage or illegal settlement of foreign exchange, the Bureau of Foreign Exchange shall, when imposing the administrative penalty of a fine, include the amount of such gain in the amount of the illegal arbitrage or illegal settlement of foreign exchange for punishment [6].

The experimental study in this thesis is based on 30 countries (including 14 developed, eight developing, and eight lagging countries). It aims to show whether profits can be generated in this form by starting with the RMB and going through two to three countries' exchange rates. A two-country exchange, also known as a triangular hedge, is also known as an indirect hedge or multilateral hedge, which is the arbitrage of three or more currencies in three or more foreign exchange markets at the same time, using the difference in exchange rates between the three or more currencies.

2. Related Works

In the article " A study of two- and three-place hedging - a calculation method based on hedging routes and profit space", the researchers have explained the principles of arbitrage and some very skilful arithmetic, which the author has read to refine the author arithmetic process further [2].

In the article " Expected exchange rate changes of RMB and false trade - an analysis based on the perspective of hedging " [3], it is seen that arbitrage is illegal, to the extent that the author needs to consider some measures to stop it from happening.

"Analysis of Arbitrage Behavior in Current RMB Cross-Border Settlement" [4], based on defining arbitrage in cross-border settlement of RMB, analyses the possible arbitrage in cross-border settlement of RMB and puts forward corresponding policy recommendations.

The article " Reflections on the teaching of triangular arbitrage "[5] mentions the methodology of arithmetic triangular arbitrage.

Analysis of Arbitrage in RMB Cross-border Settlement: Conditions, Methods and Impacts analyses the market conditions, primary modalities of operation, and economic impact caused by RMB cross-border settlement arbitrage and puts relevant policy recommendations in a targeted manner [6].

However, the author found that no one seems to have explored the comparison between triangular arbitrage and quadrangular arbitrage, so this paper is based on the different lengths of arbitrage paths.

Triangular arbitrage is a form of 'indirect arbitrage.' It is an act of arbitrage using the exchange rate differential between three different currencies in different markets. This arbitrage activity can lock in profits when the cross rate of two currencies, calculated through the exchange rate with a third country's currency, differs from the exchange rate quoted between the two currencies in the market.

Hence, there are two elements to achieving a triangular arbitrage. First, it must choose three currencies and arrange them to determine which one yields the highest benefit. The second element is to see at what point in time the triangular arbitrage will be most profitable.

From the research data, the author knows that on 07 October 2022, if using 1,000 RMB to carry out a triangular arbitrage, then it can get a spread of between 10 RMB and minus 5 RMB. Hence, it must have much money flowing into the market to profit significantly. However, triangular hedging can also be particularly volatile, as the foreign exchange market is highly volatile and uncontrollable.

Through the research, the author wondered whether there would be a more significant profit margin in a quadrangular arbitrage than in a triangular arbitrage. So, the author carried out a survey, and according to the graphs and the findings, on average, there is a more significant profit margin in quadrangular hedging than in triangular hedging. However, this experiment's small amount of data may have caused measurement bias and error.

3. Arbitrage Analysis

A total of 30 countries were selected for the hedging analysis, including 14 developed countries (UK, USA, Canada, Japan, Singapore, Korea, Australia, France, Israel, New Zealand, Switzerland, Denmark, Norway, and Iceland), eight developing countries (China, Russia, Brazil, India, South Africa, Malaysia, Republic of the Philippines and Thailand) and eight backward countries (Democratic Republic of Congo, Myanmar, Cambodia, Laos, Afghanistan, Madagascar, Gambia, and Uganda). Depending on the data of these 30 countries, different permutations are created for hedging. In more detail, this means that starting with 1000 RMB and go through two or three countries' currencies to exchange, it will be able to see whether it have made, or lost money compared to 1000 RMB.

3.1. Triangular Sets and How They Are Calculated

For this paper, we will only consider the intermediate form, meaning that we assume that there are no transaction costs associated with two-location hedging.

For example, the currency code of country 1 is A, and the currency code of country 2 is B.

The hedge is profitable if three is more significant than 1,000 RMB. If the amount 3 is more tremendous than 1000RMB, the arbitrage is profitable; if the amount 3 is less than 1000RMB, the arbitrage is a loss.

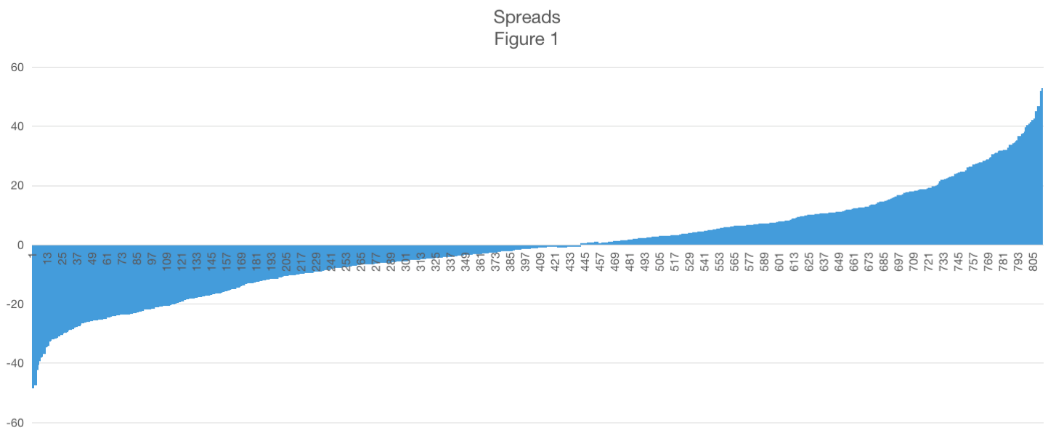

In this manner mentioned above, the remaining 29 countries, other than China, are brought into the role of countries one and two without duplication, resulting in 812 different permutations. The spread distribution for the different permutations is shown in Figure 1, with the overall spread distribution ranging from 60RMB to minus 50RMB.

Figure 1: Spreads among triangular arbitrages.

A table has been compiled to give a clearer picture (Table 1). Of the 812 different permutations, 371 yielded favorable spreads, i.e., profits, but 441 yielded negative spreads, i.e., losses. The average profit for these portfolios was 13.251RMB, of which the most significant profit was 52.964RMB, obtained from RMB to Cambodian riel to Russian ruble to RMB. The minor profit of 0.129RMB was from RMB to DKK to CHF to RMB. Of those portfolios that received a loss, the average loss was 12.511RMB, of which the most significant loss was 48.415RMB, obtained from RMB to EUR to Ugandan shilling to RMB. The minor loss is 0.0049 RMB, obtained from RMB to Indian Rupee to Israeli NIS to RMB.

Table 1: Particular data in the experiment of triangular arbitrage.

Total number of Triangular Arbitrage | Total Average | |||

812 | -0.740432096 | |||

Positive Spreads: | ||||

Total number | Average | Maximum | Minimum | |

371 | 13.25146153 | 52.964 | 0.129 | |

Negative Spreads: | ||||

Total number | Average | Maximum | Minimum | |

441 | -12.51139023 | -0.0049 | -48.41524 | |

Based on the above experiment, it can be concluded that the likelihood of generating a loss through a two-location exchange is somewhat higher than the likelihood of generating a profit.

3.2. Quadrangular Sets and How They Are Calculated

In this paper, as with the triangular hedging mentioned above, we only consider the form of intermediate prices, i.e., we assume that there are no transaction costs associated with hedging between the two locations.

For example, the currency code of country 1 is A, the currency code of country 2 is B, and the currency code of country 3 is C.

Using RMB 1,000 as the principal, the exchange rate of RMB to A on 7 October 2022 will be used to convert to country 1, forming amount 1; similarly, the exchange rate of A to B on 7 October 2022 will be used to convert to country 2, forming amount 2; next, the exchange rate of B to C on 7 October 2022 will be used to convert to country 3, forming amount 3; finally, the exchange rate of B to C on 7 October 2022 will be used to convert to country 3, forming amount 3; finally, the exchange rate of A to B on 7 October 2022 will be used to convert to country 2, forming amount 2. If the amount of 4 is more significant than 1000RMB, then the arbitrage is profitable; if the amount of 4 is less than 1000RMB, the arbitrage results in a loss.

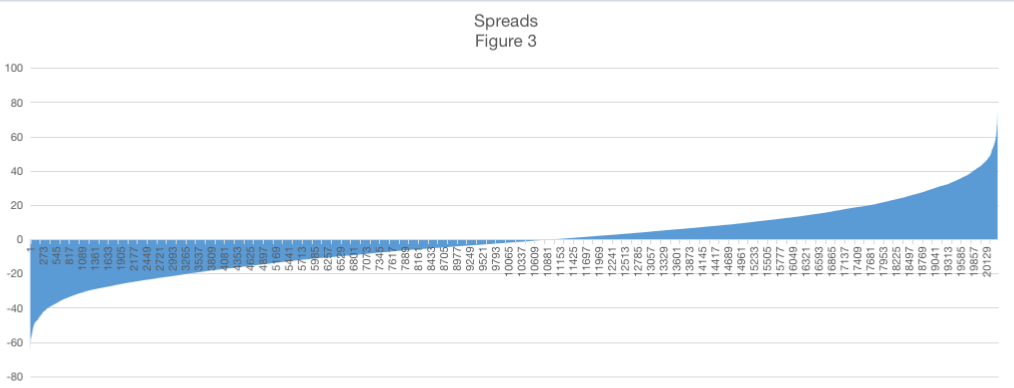

In this manner mentioned above, the remaining 29 countries, other than China, are brought into Country 1, country two, and Country three without duplication, resulting in 20,361 different permutations. The spread distribution resulting from the different permutations is shown in Figure 3, with the overall spread distribution ranging from 80RMB to minus 70RMB.

Figure 2: Spreads among quadrangular arbitrage.

To give a clearer picture, a table has been compiled in Table 2 in which it can be seen that of the 20,361 different combinations, 9,333 yielded favorable spreads, i.e., profits. In contrast, 11,028 yielded negative spreads, i.e., losses. Of these portfolios that made a profit, the average profit was 15.125 RMB, of which the most significant profit was 76.660 RMB, obtained from RMB to GBP to KHR to RUB to RMB. A minor profit of 0.00430RMB was obtained from RMB to NOK to EUR to THB to RMB. The average loss for these combinations where a loss was obtained was 15.116RMB, of which the largest was 65.518RMB, obtained from RMB to Gambian Dalasi to South African Rand to Ugandan Shilling to RMB. A minor loss of 0.00074RMB was obtained from RMB to BRL to CHF to DKK to RMB.

Table 2: Particular data in the experiment of quadrangular arbitrage.

Total number of Triangular Arbitrage | Total Average | |||

20361 | -1.254455666 | |||

Positive Spreads: | ||||

Total number | Average | Maximum | Minimum | |

9333 | 15.12476444 | 76.65974 | 0.004295 | |

Negative Spreads: | ||||

Total number | Average | Maximum | Minimum | |

11028 | -15.11619499 | -0.00074 | -65.5183486 | |

3.3. Triangular Versus Auadrangular Hedging

The four charts above show that the spreads obtained on quadrilateral hedging are more significant than on triangular hedging in terms of profit and loss. In other words, in this database, the figures for quadrilateral hedging are more skewed towards 50% good spreads and 50% negative spreads.

However, in addition to this, there are several scenarios where profits can be made through triangular hedging. For example, if country 2 buys the undervalued currency A of the country 1 in the FX market and sells the overvalued currency A in the country 1 FX market, a profit will be made. Alternatively, profits can be made by buying the undervalued Currency A in Country 1's FX market and selling the overvalued Currency A in Country 2's FX market.

So, those willing to take risks may prefer to hedge quarters or even quarters or hexes, which may lead to higher gains and more significant losses. Those who want to play it safe may prefer a triangular hedge, where they profit less but face less risk.

4. Conclusion and Suggestion

This paper presents an experimental study based on 30 countries (14 developed, eight developing, and eight lagging countries) that starts with the RMB and goes through two or three countries to show whether it is possible to generate profits through this form of exchange. In the end, it is found that four-cornered hedging usually results in higher spreads or more losses than triangular hedging.

In the case of China, for example, arbitrage is explicitly forbidden, so the regulator should make more efforts and increase supervision to prevent unscrupulous elements from taking advantage of it.

References

[1]. Zhang, B. (2010) RMB appreciation expectations, short-term capital flows, and their impact, International Finance, 4:55-60

[2]. Wu, S., Ye, L. (2016) A study of two- and three-place hedging - a calculation method based on hedging routes and profit space', Time Finance, 7:282-284

[3]. Lu, B., Wang, YQ., Hong, SJ. (2020) Expected exchange rate changes of RMB and false trade - an analysis based on the perspective of hedging, Financial Studies, 1:9-27

[4]. Xu, SQ., Wang, DX. (2012) Analysis of Arbitrage Behavior in Current RMB Cross-Border Settlement, Financial Practice, 1:69-71

[5]. Ma, N. (2011) Reflections on the teaching of triangular arbitrage, China Foreign Investment, 243:52-53

[6]. Leng, J. (2013) Analysis of Arbitrage in RMB Cross-border Settlement: Conditions, Methods and Impacts, Business Times, 33: 71-73

Cite this article

Lyu,W. (2023). The Arbitrage Outcome in the Triangular and Quadrangular Arbitrage Paths. Advances in Economics, Management and Political Sciences,19,34-39.

Data availability

The datasets used and/or analyzed during the current study will be available from the authors upon reasonable request.

Disclaimer/Publisher's Note

The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of EWA Publishing and/or the editor(s). EWA Publishing and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content.

About volume

Volume title: Proceedings of the 2023 International Conference on Management Research and Economic Development

© 2024 by the author(s). Licensee EWA Publishing, Oxford, UK. This article is an open access article distributed under the terms and

conditions of the Creative Commons Attribution (CC BY) license. Authors who

publish this series agree to the following terms:

1. Authors retain copyright and grant the series right of first publication with the work simultaneously licensed under a Creative Commons

Attribution License that allows others to share the work with an acknowledgment of the work's authorship and initial publication in this

series.

2. Authors are able to enter into separate, additional contractual arrangements for the non-exclusive distribution of the series's published

version of the work (e.g., post it to an institutional repository or publish it in a book), with an acknowledgment of its initial

publication in this series.

3. Authors are permitted and encouraged to post their work online (e.g., in institutional repositories or on their website) prior to and

during the submission process, as it can lead to productive exchanges, as well as earlier and greater citation of published work (See

Open access policy for details).

References

[1]. Zhang, B. (2010) RMB appreciation expectations, short-term capital flows, and their impact, International Finance, 4:55-60

[2]. Wu, S., Ye, L. (2016) A study of two- and three-place hedging - a calculation method based on hedging routes and profit space', Time Finance, 7:282-284

[3]. Lu, B., Wang, YQ., Hong, SJ. (2020) Expected exchange rate changes of RMB and false trade - an analysis based on the perspective of hedging, Financial Studies, 1:9-27

[4]. Xu, SQ., Wang, DX. (2012) Analysis of Arbitrage Behavior in Current RMB Cross-Border Settlement, Financial Practice, 1:69-71

[5]. Ma, N. (2011) Reflections on the teaching of triangular arbitrage, China Foreign Investment, 243:52-53

[6]. Leng, J. (2013) Analysis of Arbitrage in RMB Cross-border Settlement: Conditions, Methods and Impacts, Business Times, 33: 71-73