1. Introduction

In today’s era, where the video games industry is blossoming, most people are exposed to video games. The configuration of smartphones and communication facilities have led to the growth of demand in the Mobile game market, which is more popular than computer games because of its more convenient and accessible features.

In 2011, three graduate students (Cai Haoyu, Liu Wei, and Luo Yuhao) from Shanghai Jiaotong University formed a team and created the first game, "Fly me 2 the moon", the founder Cai Haoyu said that Two-dimensional users were the initial target group of miHoYo, and hoped to create a game genre of miHoYo’s style.

In 2012, miHoYo was officially registered and established, and then released the first game of miHoYo’s self-built IP "Honkai’’. 2014 online "Houkai Gakuen 2" was a success in terms of data, which not only exploded the game field of domestic anime but also helped miHoYo’s earnings grow significantly. This also provides a strong guarantee for the miHoYo next game development. In 2016 the Honkai series extended to the emergence of "Honkai Impact 3", which established the status of miHoYo in the Two-dimensional game. Honkai Impact 3 is also the perfect result of miHoYo’s accumulation and exploration.

The success of miHoYo is inseparable from its original Two-dimensional IP. More and more game companies are developing games and deeper creations of anime and novels based on it, which also brings fierce competition in the market. Based on the above background, this paper will discuss the market competition of handheld game operations and analyze the differentiation strategy of miHoYo. Firstly, this study will review the strategy analysis of miHoYo and discuss the potential strategy of miHoYo to achieve “overtaking” in the market operation afterward. Part 4 will analyze the differentiation strategy of miHoYo, the current market context and industry background, and the strategies of rivals, than analyze the company’s strategy compared to miHoYo’s, pointing out its current situation, development trend, and future opportunities and threats it faces.

2. Literature Review

Academics have mainly studied miHoYo in the form of case studies, mainly focusing on marketing strategy analysis. Guo applied SWOT analysis to study in detail the strategy of miHoYo’s development in various aspects. But in Guo’s study, although the advantages of miHoYo are given, it does not highlight the differentiation strategy of miHoYo [1]. Zhang et al. introduced some game characteristics sublimation about the Genshin Impact on going abroad, but their study was not linked to the economic system [2]. Wang studied the value co-creation in the virtual brand community of games, obtained the characteristics of miHoYo’s game community HoYoLAB, and revealed the brand value of this community [3]. Han analyzed the historical process of miHoYo’s operation in the case study of miHoYo’s operation and should have discussed more of the present-day company’s strategy [4]. Li studied the advantages of entry of representative Chinese Internet companies. However, Li examines the advantages of representative Chinese Internet companies but still needs a strategic analysis of the major game production [5]. Li analyzed the detail of Mihoyo’s strengths and weaknesses, but improvement methods still needed to be proposed to address these weaknesses [6].

The current situation of Two-dimensional culture has also been covered in the academe. Liu and Zhu introduced the development history of Two-dimensional culture, and the consumption characteristics of Two-dimensional fans are presented. However, it needs a more specific comparison and analysis of Two-dimensional products [7]. Zhu introduced two-dimensional culture’s development, evolution, construction, and dissemination. Development, evolution, construction, dissemination, and trend. However, it did not analyze the game company [8]. Jin introduced the whole Two-dimensional communication and future trends. Still, it should have mentioned something about the effectiveness of the game industry in producing IP and its attraction to consumers [9].

3. Industry Background and Its Competition Strategy

When people’s requirements for the game industry increase nowadays, the game research and development threshold also increases. The increase of this threshold has caused a kind of Matthew effect that the stronger, the stronger, and the weaker. The game users gather the head products, making the industry barriers in the game industry more obvious and causing the situation that a few new games can be a big fire [10]. miHoYo has entered the list of head competitions in the field of hand games through the great success of the Genshin Impact production. If analyze miHoYo’s competitors from the enterprise perspective, they are Tencent and NetEase, respectively.

Tencent and NetEase have been leading the market in handheld games. They have a large share of revenue in the Internet field, and these are the two most representative rivals of miHoYo. Tencent’s "Honor Of Kings" and "Peace Elite" and NetEase’s "Fantasy Westward Journey" and "Onmyoji" are the games that are currently the biggest hits and have most of the users in the game market. Tencent’s "boutique industry chain strategy" focuses on its core products, engaging professional technical talent and targeting consumer demand. Tencent has also used multi-party partnerships to lower its consumption threshold, such as partnering with telecom operators to stimulate consumer spending. Tencent has the advantage of its social platform to provide good game marketing and promotion. Compared with Tencent, NetEase’s advantage comes from its independent research and development and its excellent innovation ability. NetEase pays much attention to after-sales service, which helps in improving user stickiness. Tencent and NetEase will also use their usual trick of acquiring some newcomers, which will not only solidify their current market position but also curb their worries in time.

4. miHoYo’s Differentiation Strategy

Compared with NetEase and Tencent, miHoYo has a small number of users and solid financial support. However, miHoYo’s right approach and unique differentiation strategy make it break out of the grassroots of the handheld game industry.

4.1. Brand Differentiation (Producing Original IP)

An industry-leading business model with multiple product lines centered around well-known Ips. miHoYo is one of the few companies in China with original Two-dimensional IPs and has independently created a number of famous Two-dimensional IPs, such as "Honkai" and "Genshin Impact". The company’s products cover various genres, including mobile games, comics, anime, light novels, anime peripherals, etc. Each product type’s characters, the main storyline, and worldview system are presented around the original game IP. The products promote each other, gradually forming a delicate IP product ecosystem.

4.1.1. Original IP can gather a large user base and many core fans.

The audience-gathering effect of successful IP can provide a user base for new products, for example, the company launched the mobile game "Honkai Impact 3" in September 2016, and the number of new accounts exceeded 5 million in the first month of the product’s public test, and the game flow exceeded 100 million yuan, which shows that the vast user base and a large number of core fans under the "Honkai" IP have become a strong guarantee for the success of the company’s other products in the future.

4.1.2. A corporate culture conducive to IP establishment.

The core corporate culture of miHoYo is Two-dimensional culture. Most of the company’s employees, from the grassroots to the senior management team, are creators and consumers of Two-dimensional culture. This is conducive to establishing a Two-dimensional IP that miHoYo wants to create. Employees can better produce new ideas for the company based on their love of this culture.

4.2. Revenue Differentiation (In-game Purchase Mechanism Strategy)

miHoYo’s games use IAP (In-app Purchase) for in-app billing. Except for the first game, "Fly Me 2 The Moon," made by the miHoYo team, which is a paid download game, all the games released by miHoYo after that use the strategy of free download + IAP, that is, it doesn’t cost money to play the game, but you need to spend money to buy the items in the game. This operation strategy is theoretically more profitable compared to some paid APPs.

miHoYo’s revenue differentiation can also be felt in the players’ game experience. For example, for two well-known game IPs, "Genshin Impact’’ and "Honkai Impact 3", gamers with zero recharge can spend more time on the game and thus accumulate game currency that they can only get by recharging to use to get their favorite game characters.

4.3. Internationalization Strategy

In terms of performance trends and the competitive landscape in the market, large manufacturers seek stability and tend to act within their strategy to ensure certainty. Coupled with the market’s inherent perception of product categories, they tend to avoid taking risks to try some uncommon areas. miHoYo avoided the track of giant companies stronger than him, and the track he chose to major in differs from those companies. At this point, miHoYo decided to think outside inherent thinking and was preparing for the sea early on.

In September 2016, the launch of the 3D action hand game "Honkai Impact 3" opened the door for miHoYo to go to sea. During this period, miHoYo products were continuously sold to South Korea and Southeast Asia. According to the report of Korean data company IGA works, "Honkai Impact 3" became the highest revenue domestic hand game in South Korea. Honkai Impact 3 has successfully survived the crisis and become one of the top 10 Chinese games of 2018 and the top 10 most popular overseas games of the year. According to incomplete statistics, “Honkai Impact 3” was second only to “Onmyoji’” in the water flow among domestic Two-dimensional hand games that year. But the fame and fortune of miHoYo are facing a more complex game market.

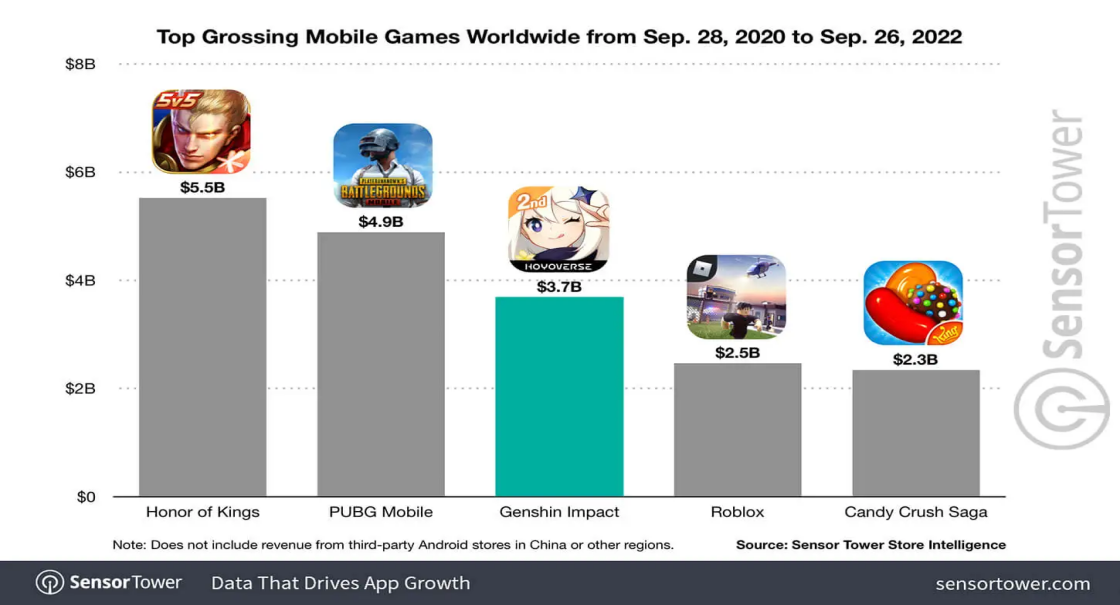

In the recent release of miHoYo launched, the Genshin Impacts were also able to notice this. Because the Two-dimensional in Japan has always been in the mainstream market, the target group audience is wide, so miHoYo, in the creation of the Genshin Impact of, this type of Two-dimensional theme game, intentionally tends to the Japanese market, Genshin Impact, there is a city called Inazuma, which was created according to Japanese architectural style. This also played a significant role in miHoYo going abroad and solidifying the time difference overseas. This map shows the turnover accumulated by "Genshin Impact ’’ in two years from 2020 to 2022. The Genshin Impact reached third place in the Top International Mobile Games chart after only two years of launch. These figures prove the success of miHoYo’s internationalization strategy. The Fig.1 shows the growth ranking of the Genshin Impacts in the global handicap from September 28, 2020, to September 26, 2022.

Figure 1: This picture shows Genshin Impact's global mobile game revenue ranking from September 28, 2020 to September 26, 2022 (Image from SensorTower).

4.4. Technology Differentiation (R&D Integration Strategy)

4.4.1. At the level of product operation, miHoYo adopts the game management strategy of integrating R&D and operation.

The integration of R&D and operation is the game product management strategy that the company has been insisting on, and this strategy has the following advantages.

Compared with game developers who are not engaged in the operation, the company can grasp the demand trend of game players for the first time and develop game products that adapt to market changes; compared with operators who are not engaged in game development, the company holds the copyright of online games and does not have the risk of losing the agency right.

The integrated R&D and operation business model can reduce the communication cost and the risk of coordination failure between development and operation in the continuous operation of online games and effectively solve the contradiction of profit distribution between game developers and game operators.

In terms of profitability, miHoYo usually has a higher net profit margin and stronger profitability than game operators who mainly distribute products; the company’s products gather a core fan base and form word-of-mouth communication. At the beginning of the new product launch, the company mainly conducts small-scale promotion on platforms or communities with a high concentration of core Two-dimensional users to attract Two-dimensional core users to experience the company’s games. The Two-dimensional core users have distinctive characteristics and are willing to communicate with friends with similar interests. When they approve of the company’s products, they strongly recommend them to their friends, forming effective word-of-mouth communication.

4.4.2. Another point of technological differentiation is the launch of the cloud version of "Genshin Impact" by miHoYo.

"Cloud Genshin Impacts" takes up about 100mb of cell phone storage space, nearly 150 times smaller than the 15GB storage space of "Genshin Impacts". Not only does it help free up storage space on your phone, and it makes it possible for less-equipped devices to experience games with higher image quality and frame rates. Because cloud-based games such as "Cloud Genshin Impacts" run on a computer elsewhere, cell phones that download cloud-based games only need sufficient network speed to play high-quality games. However, cloud games are generally charged, and the official price of "Cloud Genshin Impacts", for example, is ¥2 an hour or ¥60 a month.

5. Suggestions

The current competitive strategy of miHoYo company still has many advantages compared to the rest of the game companies. This is also an important reason why miHoYo has been able to go step by step until now. MiHoYo’s internal purchase mechanism and original Two-dimensional IP attract players and secure a large group of players by focusing on the quality of the game, making the players very sticky. For the company’s operation, miHoYo plans ahead to go to sea, as well as for the sea to make some for the game content enrichment, making miHoYo can successfully occupy the overseas market essential factors. At the same time, miHoYo’s R&D integration strategy can keep the company’s internal core firmly in its own hands and increase its revenue.

5.1. Improving the Operability of Mobile Games

Take miHoYo’s current hottest game, "Genshin Impact," for example, miHoYo’s "Genshin Impact" was released last year on mobile, PC, and console cross-platform, its operation mode in PC and console are relatively mature, although there are flaws to improve, no harm.

However, some things could be improved with the mobile phone operation, which is also the main improvement goal of miHoYo needs. In TapTap, Apple store, including some Internet platforms, many players feedback that "Genshin Impact" is the first open-world 3D action mobile game, using cell phones to operate will quickly produce the phenomenon of mids-touch (such as the forward button is easy to mids-touch the big move and bow and arrow character is not easy to aim, etc.).

Since miHoYo’s primary market is still on a mobile game, I think miHoYo’s R&D department can still improve the game based on this feedback.

5.2. Develop New IPs, Increase the Variety of Games, and Broaden the Market

miHoYo accumulated a lot of popularity and praise due to the success of the Honkai series. Still, at that time miHoYo only had one main IP, the Honkai series, in existence. With the growth of the operation time, the flow of the "Honkai" series is not as good as before.

At present, miHoYo has launched the Genshin Impact and set up a more diverse IP. But the miHoYo company still needs to pay attention to the IP single problem. Suppose the Genshin Impact product’s reputation declines or other issues, then miHoYo’s revenue can not be guaranteed. So miHoYo can develop IP to broaden the market and better development.

5.3. Increase Brand Awareness

Although miHoYo has accumulated a particular reputation in the field of Two-dimensional animation, its user base is not many due to the minority culture of Two-dimensional culture. However, the gap between the brand influence and other large game companies still has huge differences, especially in the domestic game market under the monopoly market formed by Tencent and NetEase. They cannot compete with them. The most important is to have a certain number of users, and Tencent and NetEase, which occupy the most, have their platforms and traffic channels. MiHoYo’s current strategy is to slowly transform the Two-dimensional market into a huge market, so it can be more oriented to the public to do promotion.

6. Conclusion

In today’s competitive opening of all kinds of mobile games, miHoYo has come one step forward with its excellent differentiation strategy and high standard for game design. miHoYo has become an emerging company that has survived enormous challenges. This study mainly reflects the differentiation strategy in four areas: brand, revenue, international strategy, and technology. At the same time, this study believe that miHoYo should improve mobile game operability, develop new IPs, increase game variety, broaden the market, and enhance brand awareness through various ways in the next operation.

This article still focuses on miHoYo’s characteristic differentiation strategy and also analyzes the strategies of both Tencent and NetEase to highlight the differences in miHoYo’s strategies. This article is an analysis of miHoYo and a reference for the game industry to find the right way to create their own companies. This article can also help people who want to learn more about this knowledge.

Given the academic pressure and limited academic level, it is crucial to provide a thorough and detailed analysis of miHoYo’s differentiation strategies. As a recent start-up, miHoYo’s differentiation strategies may not have been extensively documented in the literature, making it challenging to obtain complete and reliable data. However, this limitation presents an opportunity for further exploration and research to uncover any new strategies that may have been implemented by miHoYo. Future studies will aim to provide a more comprehensive and up-to-date understanding of miHoYo’s differentiation strategies and will help to improve the current knowledge base on this topic.

References

[1]. Guo, H.: Research on the development strategy of miHoYo Company. Huazhong University of Science and Technology, (2021).

[2]. Zhang, Y., Li, J., Zhao, Y.: Model exploration of innovation and promotion of domestic games in the context of cultural tourism integration: a case study based on The Original God. Library Intelligence Knowledge 38(5), 107-118(2021).

[3]. Wang, M.: Value co-creation in virtual brand communities of games: the case of HoYoLAB. National circu-lation economy 16, 139-141(2021).

[4]. Han, L.: miHoYo makes big money. 21st Century Business Review 07,54-56(2022).

[5]. Li, Z.: Competing for cloud games: Tencent, miHoYo and other big players have entered the game. China Business News, (2022).

[6]. Li, G.: Business Analysis of miHoYo and Its Honkai Series. University of Sussex, (2022).

[7]. Liang, S., Zhu, X.: On the conceptual change of secondary culture and its cultural consumption character-istics. Modern Communication (Journal of Communication University of China) 42(08), 22-26(2022).

[8]. Zhu, Y.: Research on Two-dimensional culture style of online games. Henan University, (2022).

[9]. Jin, X.: Research on the flow of Two-dimensional culture communication in China (1993-2017). Southwest University, (2018).

[10]. Macey, J., Tyrväinen, V., Pirkkalainen, H., Hamari, J.:Does esports spectating influence game consump-tion? Behaviour & Information Technology 41(1), 181-197(2022).

Cite this article

Chao,Y.;Gao,X.;Ma,M.;Zhao,Y. (2023). Research on the Differentiation Strategy of miHoYo Company. Advances in Economics, Management and Political Sciences,20,388-394.

Data availability

The datasets used and/or analyzed during the current study will be available from the authors upon reasonable request.

Disclaimer/Publisher's Note

The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of EWA Publishing and/or the editor(s). EWA Publishing and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content.

About volume

Volume title: Proceedings of the 2023 International Conference on Management Research and Economic Development

© 2024 by the author(s). Licensee EWA Publishing, Oxford, UK. This article is an open access article distributed under the terms and

conditions of the Creative Commons Attribution (CC BY) license. Authors who

publish this series agree to the following terms:

1. Authors retain copyright and grant the series right of first publication with the work simultaneously licensed under a Creative Commons

Attribution License that allows others to share the work with an acknowledgment of the work's authorship and initial publication in this

series.

2. Authors are able to enter into separate, additional contractual arrangements for the non-exclusive distribution of the series's published

version of the work (e.g., post it to an institutional repository or publish it in a book), with an acknowledgment of its initial

publication in this series.

3. Authors are permitted and encouraged to post their work online (e.g., in institutional repositories or on their website) prior to and

during the submission process, as it can lead to productive exchanges, as well as earlier and greater citation of published work (See

Open access policy for details).

References

[1]. Guo, H.: Research on the development strategy of miHoYo Company. Huazhong University of Science and Technology, (2021).

[2]. Zhang, Y., Li, J., Zhao, Y.: Model exploration of innovation and promotion of domestic games in the context of cultural tourism integration: a case study based on The Original God. Library Intelligence Knowledge 38(5), 107-118(2021).

[3]. Wang, M.: Value co-creation in virtual brand communities of games: the case of HoYoLAB. National circu-lation economy 16, 139-141(2021).

[4]. Han, L.: miHoYo makes big money. 21st Century Business Review 07,54-56(2022).

[5]. Li, Z.: Competing for cloud games: Tencent, miHoYo and other big players have entered the game. China Business News, (2022).

[6]. Li, G.: Business Analysis of miHoYo and Its Honkai Series. University of Sussex, (2022).

[7]. Liang, S., Zhu, X.: On the conceptual change of secondary culture and its cultural consumption character-istics. Modern Communication (Journal of Communication University of China) 42(08), 22-26(2022).

[8]. Zhu, Y.: Research on Two-dimensional culture style of online games. Henan University, (2022).

[9]. Jin, X.: Research on the flow of Two-dimensional culture communication in China (1993-2017). Southwest University, (2018).

[10]. Macey, J., Tyrväinen, V., Pirkkalainen, H., Hamari, J.:Does esports spectating influence game consump-tion? Behaviour & Information Technology 41(1), 181-197(2022).