1. Introduction

Recently, the blockchain gained attention since it has potential value of application. Satoshi Nakamoto [1] first introduced the concept of the “Blockchain”. Blockchain is decentralized ledger used to record transactions and make sure that it’s transparent, secure, and impossible to be changed. Blockchain’s most pervasive application is the cryptocurrencies like Bitcoin, ETH, DOGE and SHIB. However, blockchain has potential on various industries. There are several representative applications of the Blockchain on accounting, auditing, and accountability:

(1) Digital Record Keeping. Blockchain can store and manage the digital records of transactions,

contracts, and invoices, provide secure and unchangeable system of record keeping, increased the accuracy of bookkeeping and decreased the possibility of fraud and error. Not only financial transactions like bitcoin, but also supply chain management, medical records, or legal documents.

(2) Fraud Detection: Blockchain can detect fraud through evaluate whether a transaction met the

rule of blockchain or not. Illegal transaction cannot be recorded into the block. Blockchain can create immutable and transparent records to help fraud detection. Since blockchain record every transaction in real-time, it will increase the efficiency and effectivity of fraud detection. Besides, through analysis of much structural transactional data, machine learning algorithm can identify patterns and anomalies in data that will indicate activities that may have fraud or error.

(3) Financial Auditing: it can provide secure and unchangeable transaction recording and help to

automate the auditing process, with lower cost and increased accuracy. Furthermore, blockchain can enable auditors to have access to financial data from multiple sources in real-time and then improving their ability to monitor financial activities, detect fraud, and improve the quality of audit work and reports.

(4) Public Financial Transactions: create a transparent, secure, and unchangeable system of government financial transaction, provide increased accountability and reducing the risk of fraud.

Another possible application is distribution of public benefits and subsidies. By using blockchain, governments can create a secure and transparent system to distribute fund to target persons. They can reduce fraud and embezzlement and make sure that the fund can be distributed to eligible persons.

(5) Trust, Credibility and Costs of Transactions: Record all transaction and unchangeable, easier to verify whether a transaction have problems or not. An illegal transaction cannot be included into a block.

(6) Supply Chain Auditing: through creating immutable record of transactions within the supply chain, provide accurate trail of different transactions. Help to increase accountability and reduce risks of fraud on the supply chain.

(7) Blockchain-based Digital Identity: create a secure and decentralized digital identity that can be used to verify individuals and organizations involved in transactions, reducing the risk of fraud.

(8) Cross-border Payment: facilitating cross-border payments, reducing the need for intermediaries, and increasing the speed and security (since there are no intermediaries) of these transactions.

This literature review mainly discusses three new potential applications that have extensively studied in the academy of accounting, auditing, and accountability: new methods of record-keeping, tackling fraud and increasing on trust and credibility of the audit process. As a distributed ledger technology, it enables the security and transparence of record-keeping process through cryptographic algorithms and consensus mechanisms. The decentralized nature of blockchain means that users need to report their transaction to every node and the content of blocks is hard to be change, it increased trust and credibility of information recorded.

2. Application and Risk of Blockchain to the Accounting, Auditing and Accountability

This article provides a review of the accounting blockchain literature, with a focus on blockchain’s applications and risks on the field of Accounting, Auditing and Accountability, this review identifies four main areas: (i) new method of record-keeping; (ii) new ways of tackling fraud; (iii) trust and credibility of the audit process; (iv) potential risk of blockchain on accounting on Accounting, Auditing and Accountability, and its potential risks.

2.1. Blockchain’s Inspiration to New Method of Record-keeping

when people have deeper and deeper understand about the blockchain, new method of record-keeping is unavoidable. Schmitz and Leoni [2] propose a research agenda for the influence of blockchain on trust and credibility of the accounting and auditing sector. This literature review provides a series of interesting points: Blockchain can accelerate the automation of the accounting and auditing work, improve the timeliness and accuracy of accounting information, and provide new alternative choices for accounting and auditing systems. However, it has the risk of replacing accountants and auditors’ jobs, besides, the threat to the tradition of accounting and auditing also brings new potential problems. the field of accounting has been tackling this problem from several years, a little bit late.

One paper [3] also mentioned similar viewpoints, but more radical: Blockchain’s influence on accounting and auditing sector is disruptive, these days, most of CFO's exposure to the blockchain mainly in payments and banking sector, tracing blockchain-based cryptocurrencies, for example, Bitcoin and ETH. However, blockchain’s nature is an open, trusted, and easily accessible ledger system, which means it directly speak to the financial reporting community, this increased its effect of disruption.

This article also includes an interview with Jon Raphael. He was the chief audit innovation officer of Deloitte (at the time of this paper finished). Jon mentioned that to some extent, blockchain is similar with the Internet, after it was invented, it initially used inside organizations before its popular among the public. When it reaches scale, it can also have greater impact on the way of transaction recorded, and on value’s transfer and evidence. Besides, Blockchain can record structural data that can be used by AI and Big data. Finally, all information recorded in blocks is open to all participants, it’s a key advantage (this will be mentioned again in part 2.3 and 2.4).

The blockchain will also provide new thinking on triple-entry accounting [4] since it can act as a perfect third party that is transparent and cannot be modified. This will be explained in next part, the new way of tackling fraud, since it relates to fraud tackling more.

2.2. Blockchain Provides New Ways of Tackling Fraud

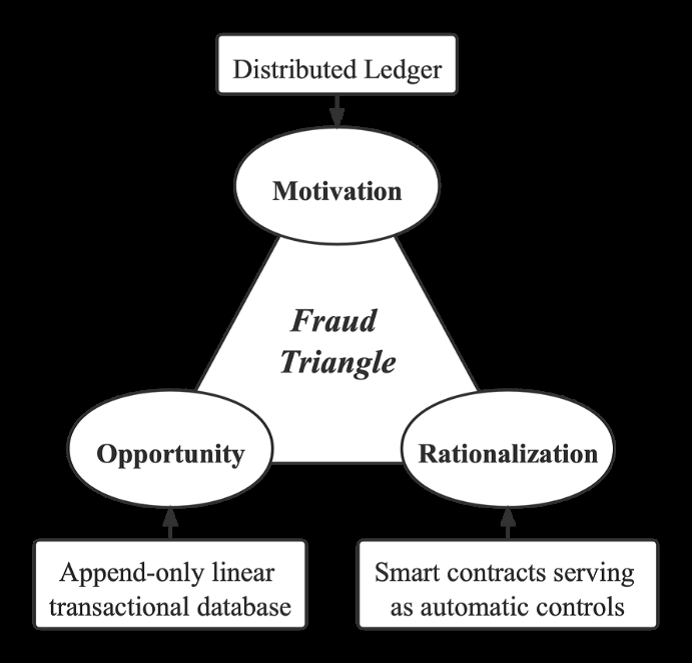

It closely connected to potential improvements of record-keeping system, but I will focus on fraud tackling in this part. Ijiri [4] firstly introduced the theory of triple-entry accounting that can prevent fraud in accounting and auditing process: traditional double-entry bookkeeping can be extended to include a third dimension; he also calls this “momentum accounting." It’s Ian Grigg’s paper [5] that expanded the concept of triple-entry accounting. Chen Tianhao [6] linked this concept with the blockchain since its nature of recording all transactions in blocks that transparent and cannot be changed, blockchain is a perfect third dimension in the triple-entry system that preventing the fraud in accounting.

Chen also analyzed the case of Luckin coffee from the perspective of fraud triangle. Blockchain can break both 3 angle of the fraud triangle: Motivation, Opportunity and Rationalization. First, in this case, the author also compared the difference of typical ERP and the audit base on blockchain. Luckin recorded information of transaction under a traditional ERP system. Since a traditional ERP system is centralized (controlled by top managers), it’s easy for management to change the accounting information, that is fraud. In the contrast, blockchain (and systems that based on it) is decentralized, which means manager should control over 50% of nodes on the blockchain, it very difficult so that one angle of the triangle, the motivation, will be broken. Secondly, since blockchain is linear transaction database, the data can only be upload by appending, while typical ERP is a rational database which provides more direct methods of adding, updating and deleting data. Under blockchain’s linear nature, all invoices inside the firm are consecutively numbered, there are less opportunities of fraud. Finally, combining blockchain with other technologies like AI, big data, etc., build an automated accounting system that rely less on people is possible, under smart contract that based on blockchain and Cryptography, the accounting process rely less on people, the leg “rationalization” of the triangle will also be cut down.

Figure 1: The fraud triangle and how the blockchain can break all its 3 angles [6].

Another paper [7] proposed that under the blockchain the decentralized way of storing data, has potential to replace the typical ERP accounting system since the right to verify transactions, storage data, and organizing will be distributed over every node (every participant or computer in the blockchain system called a “node”) in the blockchain system, which could diminish a single node’s risk of fraud or error. The traditional ERP system usually regarded as a safe system since a modern ERP can prevent attack from outside the organization, but in this case, the fraud problem is from the internal, the managers, traditional ERP cannot control the manager since they have the highest access to the system.

Blockchain is also the perfect tool of forming a platform that firms can share information voluntarily on it. This will decrease the possibilities of error or fraud on accounting information and improve the quality of accounting information, then facilitate the trust and credibility of audit process.

2.3. Blockchain’s Improvement on Trust and Credibility of the Audit Process

Blockchain provide transparent and immutable recording of transactions and contracts.

With the development of Blockchain technology, there are 2 kinds of typical blockchain was developed: permissionless and permissioned blockchain [8]. Different blockchain will have different improvements (and challenges) to auditors [9]. For example, permissionless blockchain will provide following opportunities to auditors: they can audit transaction records on the blockchain; develop new method of audit for items and their transactions on the blockchain; check the consistency between items’ records on the blockchain and its physical existence. Permissioned blockchain will bring such opportunities to auditors: Develop guidelines for blockchain implementation (from the perspective of auditors); Leverage knowledges and experiences on accounting and audit to provide professional advice for improvements of the blockchain consensus protocols; apply their business networks to build a blockchain to meet market demand; participate as a planners and coordinators of potential participants of a permissioned blockchain; use their professional experiences of IT auditing to facilitate the internal control in the blockchain sector, for example, the integrity and security of transaction and item information/data on the blockchain; provide third-party’s independent scoring to different blockchains and serve as administrators of the blockchain. A paper from Deloitte official website [10] also proposed a key improvement that a blockchain will bring to auditors. Blockchain will make it more efficient and less errors. In the past, the collection of data is a key problem for auditors, it cost much time and much error in the collection process. Auditors cannot fully use their accounting and auditing expertise to have control on the bigger picture. With new technologies, this problem can be alleviated. For example, robotic process automation can accelerate and standardize traditional audit process, while artificial intelligence (AI) and analytics help auditors to understand the data population more directly and point out correlations, anomalies, and outliers, thus risk identification and focusing on what is the most important will also be improved.

Then comes to the financial industry, with the increasing application of big data analysis, those new data-driven auditing technologies is popular among firms and governments, and the development of blockchain technology will also greatly influence the auditing industry [11]. A new blockchain structure has been built to decrease the cost of replacing current information system, which will help auditors to get credible digital audit evidence more convenient. Auditors will be able to conduct consecutive audit work for customers without spending large money on the software integration [12].

2.4. Challenges That Faced by the Field of Accounting and Auditing

The interview with Jon Raphael [3] not only mentioned about blockchain’s power of reversing the accounting and auditing industry, but also bring some threat. For example, since data of all transaction are open to all nodes on the blockchain, firms cannot generate benefit from them because everyone know all data.

Different kind of blockchain will not only have different improvement to auditors, but also cause different challenges to them [9]. I have mentioned about this paper.

For example, permissionless blockchain’s challenges to auditors: No reversal of erroneous transactions (though this is low possibility); no authority to verify the items recorded on the blockchain and to report and tackle cyberattacks (though there are methods that make sure the safety of the blockchain); Data leakage because of clients’ loss of private key is also noteworthy.

Challenges from permissioned blockchain: Auditors should have good grasp on various blockchain technologies; it’s difficult to reach a consensus between all users (and the consensus itself will change as time passes), when the auditor is managing the organization through the blockchain; audit transaction linked to a side agreement that is ‘‘off-chain’’; hard to solve the problem that sometimes there is a centralized authority that overrides all other nodes of the blockchain(theoretically, the blockchain is decentralized, but this kind of problem is possible in some situation).

3. Conclusion

This essay has reviewed papers related to three applications of blockchain on accounting, auditing, and accountability. First, for the new record-keeping system, blockchain has disruptive effect on traditional audit work and will reverse the traditional auditing. Second, for the fraud-tackling, blockchain’s refinement to the triple-entry bookkeeping and its nature of decentralization reduced the possibility of fraud, especially management fraud. Third, both permission-less and permissioned blockchain will provide more opportunities for auditors (different form permissionless and permissioned blockchain). Finally, challenges that auditors may face includes: permissionless and permissioned blockchain’s challenge that mentioned, and its thread of data’s opening to the public (this may threat to firms’ decisions).

References

[1]. Nakamoto, S. (2008), “Bitcoin: a peer-to-peer electronic cash system”. Retrieved from www.bitcoin.org.

[2]. Schmitz, J., & Leoni, G. (2019). Accounting and auditing at the time of blockchain technology: A research agenda. Accounting & Auditing, 32(4), 75-86. doi: 10.1111/auar.12286

[3]. Deloitte. (2018) Blockchain for Financial Leaders: Opportunity vs. Reality. Deloitte official website. Retrieved fromhttps://www2.deloitte.com/us/en/pages/audit/articles/blockchain-financial-reporting.html

[4]. Ijiri, Y. (1986). A framework for triple-entry bookkeeping. The Accounting Review, 61(4), 745-759. https://www.jstor.org/stable/247368

[5]. Grigg, I. (2005). Triple entry accounting. Systemics, Inc. Retrieved from http://iang.org/papers/triple_entry.html.

[6]. Chen, T. (2022). Blockchain and accounting fraud prevention: A case study on Luckin Coffee. In Proceedings of the 2022 7th International Conference on Social Sciences and Economic Development (ICSSED 2022) (Vol. 652, pp. 44-50). Atlantis Press International B.V.

[7]. Peters, G., & Panayi, E. (2016). Understanding Modern Banking Ledgers Through Blockchain Technologies: Future of Transaction Processing and Smart Contracts on the Internet of Money. Retrieved from https://arxiv.org/abs/1511.05740.

[8]. Zheng, Z., S. Xie, H. Dai, X. Chen, and H. Wang. 2018. Blockchain challenges and opportunities: A survey. International Journal of Web and Grid Services 14 (4): 352–375. Retrieved from https://doi.org/10.1504/IJWGS.2018.095647.

[9]. Manlu Liu, Kean Wu, Jennifer Jie Xu; How Will Blockchain Technology Impact Auditing and Accounting: Permissionless versus Permissioned Blockchain. Current Issues in Auditing 1 September 2019; 13 (2): A19–A29. https://doi.org/10.2308/ciia-52540

[10]. Raphael, J., Steele, A. (n.d.) Audit transformation and opportunities in cognitive, blockchain, and talent. Retrieved fromhttps://www2.deloitte.com/us/en/pages/audit/articles/impact-of-blockchain-in-accounting.html.

[11]. Gepp, A., Linnenluecke, M. K., O'Neill, T. J., & Smith, T. (2018). Big data techniques in auditing research and practice: current trends and future opportunities. Journal of Accounting Literature, 40, 102-115. https://doi.org/10.1016/j.acclit.2017.05.003

[12]. Vincent, Nishani Edirisinghe & Skjellum, Anthony & Medury, Sai, 2020. "Blockchain architecture: A design that helps CPA firms leverage the technology," International Journal of Accounting Information Systems, Elsevier, vol. 38(C).

Cite this article

Huang,X. (2023). Review on Research of Blockchain's Impact on Bookkeeping, Fraud Detection and Trust of Auditing Process. Advances in Economics, Management and Political Sciences,22,60-65.

Data availability

The datasets used and/or analyzed during the current study will be available from the authors upon reasonable request.

Disclaimer/Publisher's Note

The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of EWA Publishing and/or the editor(s). EWA Publishing and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content.

About volume

Volume title: Proceedings of the 2023 International Conference on Management Research and Economic Development

© 2024 by the author(s). Licensee EWA Publishing, Oxford, UK. This article is an open access article distributed under the terms and

conditions of the Creative Commons Attribution (CC BY) license. Authors who

publish this series agree to the following terms:

1. Authors retain copyright and grant the series right of first publication with the work simultaneously licensed under a Creative Commons

Attribution License that allows others to share the work with an acknowledgment of the work's authorship and initial publication in this

series.

2. Authors are able to enter into separate, additional contractual arrangements for the non-exclusive distribution of the series's published

version of the work (e.g., post it to an institutional repository or publish it in a book), with an acknowledgment of its initial

publication in this series.

3. Authors are permitted and encouraged to post their work online (e.g., in institutional repositories or on their website) prior to and

during the submission process, as it can lead to productive exchanges, as well as earlier and greater citation of published work (See

Open access policy for details).

References

[1]. Nakamoto, S. (2008), “Bitcoin: a peer-to-peer electronic cash system”. Retrieved from www.bitcoin.org.

[2]. Schmitz, J., & Leoni, G. (2019). Accounting and auditing at the time of blockchain technology: A research agenda. Accounting & Auditing, 32(4), 75-86. doi: 10.1111/auar.12286

[3]. Deloitte. (2018) Blockchain for Financial Leaders: Opportunity vs. Reality. Deloitte official website. Retrieved fromhttps://www2.deloitte.com/us/en/pages/audit/articles/blockchain-financial-reporting.html

[4]. Ijiri, Y. (1986). A framework for triple-entry bookkeeping. The Accounting Review, 61(4), 745-759. https://www.jstor.org/stable/247368

[5]. Grigg, I. (2005). Triple entry accounting. Systemics, Inc. Retrieved from http://iang.org/papers/triple_entry.html.

[6]. Chen, T. (2022). Blockchain and accounting fraud prevention: A case study on Luckin Coffee. In Proceedings of the 2022 7th International Conference on Social Sciences and Economic Development (ICSSED 2022) (Vol. 652, pp. 44-50). Atlantis Press International B.V.

[7]. Peters, G., & Panayi, E. (2016). Understanding Modern Banking Ledgers Through Blockchain Technologies: Future of Transaction Processing and Smart Contracts on the Internet of Money. Retrieved from https://arxiv.org/abs/1511.05740.

[8]. Zheng, Z., S. Xie, H. Dai, X. Chen, and H. Wang. 2018. Blockchain challenges and opportunities: A survey. International Journal of Web and Grid Services 14 (4): 352–375. Retrieved from https://doi.org/10.1504/IJWGS.2018.095647.

[9]. Manlu Liu, Kean Wu, Jennifer Jie Xu; How Will Blockchain Technology Impact Auditing and Accounting: Permissionless versus Permissioned Blockchain. Current Issues in Auditing 1 September 2019; 13 (2): A19–A29. https://doi.org/10.2308/ciia-52540

[10]. Raphael, J., Steele, A. (n.d.) Audit transformation and opportunities in cognitive, blockchain, and talent. Retrieved fromhttps://www2.deloitte.com/us/en/pages/audit/articles/impact-of-blockchain-in-accounting.html.

[11]. Gepp, A., Linnenluecke, M. K., O'Neill, T. J., & Smith, T. (2018). Big data techniques in auditing research and practice: current trends and future opportunities. Journal of Accounting Literature, 40, 102-115. https://doi.org/10.1016/j.acclit.2017.05.003

[12]. Vincent, Nishani Edirisinghe & Skjellum, Anthony & Medury, Sai, 2020. "Blockchain architecture: A design that helps CPA firms leverage the technology," International Journal of Accounting Information Systems, Elsevier, vol. 38(C).