1. Introduction

Yankershop Food Co., Ltd is a Leisure snack production and sales company in China. The company has been established since August 2005. Yankershop's products mainly include deep-sea snacks (fish intestines, Crab products), spicy snacks (Leisure soy products, leisure meat, and fish products), casual baked snacks (bread, cake), potato chips, dried fruits and Konjac products [1].

In recent years, the Chinese leisure snack industry presents the characteristics of large scale and multiple categories. By retail sales, the Chinese casual food market size of the product industry is 825.1 billion yuan in 2021, with an average annual compound growth rate of 6.1% from 2016 to 2021 [2]. The types of casual food are very affluent too including candy, chocolate, nuts, chips, bread, cake, biscuits, sausage, seafood, and lots of other types. That means it's difficult for one company to operate all categories of leisure food at the same time. Over ten brands of leisure food are competing in this industry [3]. Otherwise, copying leisure food is not quite difficult. Various companies would make similar products with similar flavors. So, companies in the leisure food industry have to compete in other ways. Firstly, food safety is the highest priority for customers. Companies with stable food quality are more favored by consumers. Any negative news would greatly damage the company's reputation. Secondly, price factor impact customers' choices especially when products are familiar. Last but not least, distribution channels are important too, which is the main choice for increasing brand competition [4].

Yankershop is one of the biggest companies in the leisure food industry and has some unique advantages. Yankershop has whole supply chains and stick to independent production, which ensures its products are cheaper and have higher quantities at the same time. Supply chains and independent manufacturing may lead to more income [5]. Independent production always has a side effect. The independent production mode requires a large amount of investment in the early construction of factories and production lines, the capacity construction period is longer, and the category switching is not as flexible as the commissioned processing mode. In the past ten years of development, Yankershop has continued to gain experience to minimize the adverse effects caused by independent production. At the same time, it brings the company advantages in terms of cost and product quality. The epidemic in China has had a brief but severe impact on small and medium-sized enterprises, the price of leisure food ingredients went higher and higher [6]. Stores and supermarkets which used to be the main way to sell leisure food broken down. Yankershop tried to develop baked food products and get wider distributions this year, which helped the company perform better than others. Yankershop's original sales model was mainly direct sales of supermarkets. But in recent years, due to the epidemic, the company has re-expanded its sales channels and developed distributors on a large scale. At the same time, Yankershop began to establish e-commerce platforms, selling products while greatly increasing their popularity.

The company implements the production mode of "production by sales". The next year's sales plan is formulated according to the sales situation of the previous year, combined with production capacity and market demand. Determine the annual total production according to the sales plan and break down the total production plan for every workshop to make a monthly production plan. Every month, through market sales and customer feedback, the company counts the next month's product demand and dynamically adjusts the monthly production plan. Through the introduction and continuous innovation of modern food production technology, Yankershop has developed a small-category leisure food production process that adapts to modern and large-scale production and realized the transformation of small-category leisure food from traditional handmade to modern industrial production. Diversified products are the key for snack food companies to get the advantage [7].Yankershop has established an “experimental factory” to improve the traditional formula of many products, design and transform the food production line, and promote the modernization and automation of production, which greatly improve the production efficiency, product quality, and food safety of small categories of leisure foods. In the meantime, the "experimental factory” has developed over ten new products a year. According to the performance report released by the board of directors of Yankershop in FY2022, Yankershop's research expenses increased significantly in FY2022 [8].

2. Accounting Analysis

Because Yankershop usually releases Preliminary Results at the end of March, the accounting policies are analyzed based on the Annual Report 2021, adjusting with any changes of accounting policies in the 2022 Preliminary Results. Revenue recognition and fix assets required management to exercise a higher degree of judgments or significant estimates. Therefore, Yankershop identified them as critical accounting policies in the 2021 Annual Report.

2.1. Revenue Recognition

Yankershop's way of recognizing revenue is straightforward. Because Yankershop's sales channels are mainly supermarket sales, dealer sales, and e-commerce sales. Yankershop's revenue recognition is recognized by the counterparty after the receipt of goods or after the settlement of statements. Chacha Food, also with independent production, has essentially the same revenue recognition as Yankershop. In contrast, companies, that main business model is franchised stores, such as Bestore and LYFEN have group buying business, raw material sales business, rental income, etc., which means a complex revenue recognition. Companies such as Three Squirrels whose main business is online business will automatically recognize revenue four days after delivering goods. Compared to Three Squirrels, Yankershop's revenue recognition method is less risky, less likely to incur unexpected losses, and less to be accrued in advance.

2.2. Fixed Assets

Due to its independent manufacturing, Yankershop's fixed assets are relatively large in the leisure snack industry. Yankershop's fixed assets are mainly snack food processing workshops and equipment. In 2021, the fixed assets were mainly new production workshops, ancillary facilities and equipment, and display tools. The total carrying value of fixed assets at the end of the period was 100,968.06 million yuan, accounting for 48.50% of the total assets in the consolidated financial statements at the end of the period. Therefore, Yankershop's depreciation of fixed assets is very noteworthy. The depreciation method for Yankershop fixed assets is the same as that of other companies in the industry, the straight-line method. However, Yankershop's annual depreciation rate is different from other companies, and the annual depreciation rate of other companies is a fixed rate, while Yankershop's annual depreciation rate is a range.

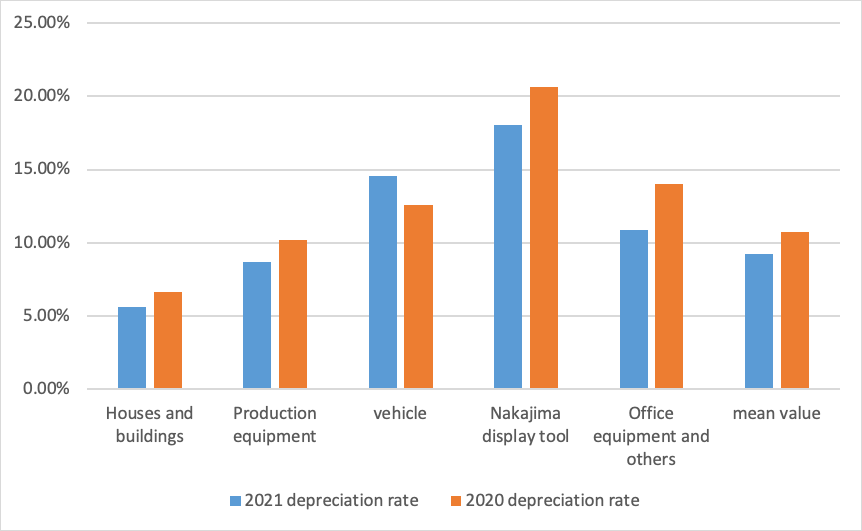

Taking 2020 and 2021 as an example, as shown in Figure 1, Yankershop's depreciation rate fluctuates more realistically every year. In 2021, the Depreciation comparison of Houses and buildings, Production equipment, Nakajima display tool, and Office equipment is lower than in 2020. The depreciation comparison of Vehicles in 2021 is higher. The variable depreciation rate allows Yankershop to adjust its depreciation rate according to the market trend and internal conditions, which increases its flexibility. In this way, Yankershop makes the book value of its fixed assets closer to its true value. However, it also leads to uncertainty about its depreciation and impairment, which makes it more difficult to calculate the company's costs every year.

Figure 1: Comparison of Yankershop’s depreciation expenses in 2020 and 2021.

2.3. Intangibles

Yankershop's intangible assets, including land use rights, software, and trademarks, are initially measured at cost. Among them, the amortization period for land use rights is 40 to 50 years, the amortization period for software is five years, and the amortization period for trademarks is 10 years. In addition, expenditures during the development phase of Yankershop's internal R&D projects can be converted into intangible assets when certain conditions are met. This includes the possibility of proving that the technology can actually be sold, or has the ability to use it internally, etc.

3. Performance Evaluation

In recent years, Yankershop was affected by the epidemic situation in China, and its performance was greatly affected. This article analyzes and explains the financial performance of Yankershop through related information.

3.1. Liquidity

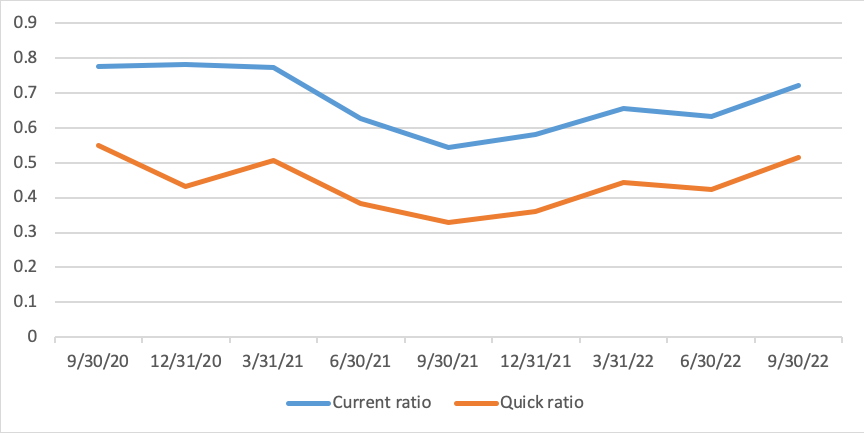

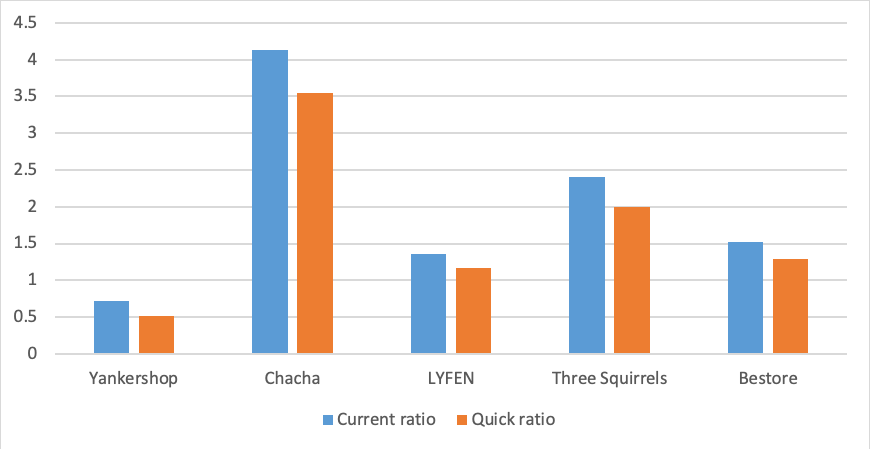

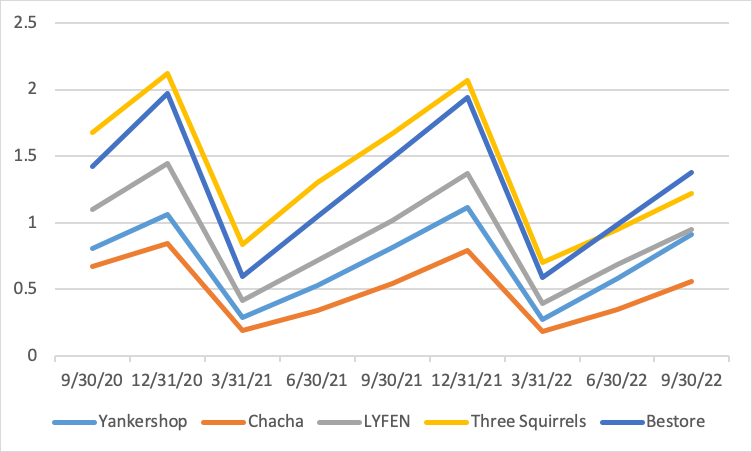

This section will measure Yankershop's financial liquidity by using the current ratio and quick ratio. Figure 2 shows that Yankershop's current ratio and quick ratio are generally stable, but there was a decline in 2021Q2. A report from TF Securities shows that Yankershop's channel laying and new product promotion expenses are heavily invested, and the company's quantitative distribution channel expenses are concentrated in the second quarter, which causes liquidity decline [9]. After Yankershop overcome that period, its current ratio and quick ratio went back to the usual level gradually. But a current ratio and a quick ratio well below 1 do not mean a good level of liquidity for an average company. Figure 3 compares the financial data of Yankershop and other companies in the leisure food industry for the third quarter of FY 2022.

Figure 2: Yankershop’s short-term finance risk from FY 2020Q3 to FY 2022Q3.

Figure 3: Liquidity ratios of Yankershop and its competitors.

The main reason for the poor liquidity of Yankershop is that Yankershop is an independent production and builds factories by itself. Its fixed assets account for a large proportion. In addition, Yankershop is in a stage of rapid development, and its high debt supports Yankershop's continuous development of new products, construction of production lines, and rapid expansion of consumption channels. But every coin has two sides, low liquidity leads to a high risk of cash flow breakage. The risk management of Yankershop should be highly regarded.

3.2. Costs

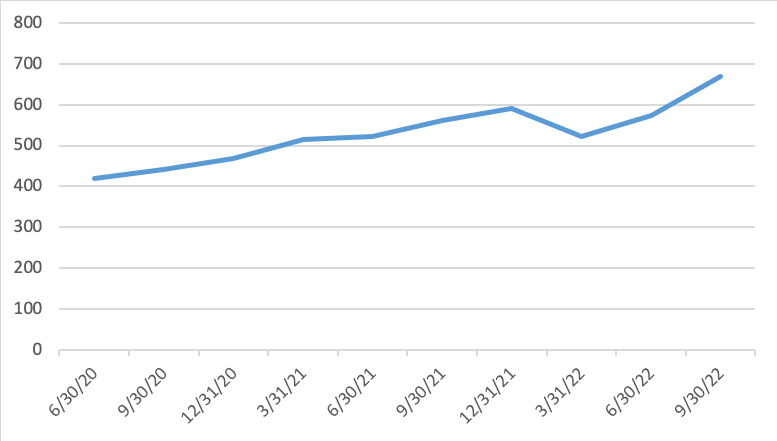

Yankershop implements the production mode of "production by sales", so its cost is maintained at a certain level. As Figure 4 shown, the cost of Yankershop has steadily increased from FY2020Q2 with the expansion of production scale and the increase of sales channels. In FY2022Q1, the cost showed a decrease due to the easing of raw material costs [10]. Since then, as the epidemic in China eased, Yankershop has reformed its sales methods, increased sales volume, and cost has steadily increased with sales volume [11]. Sales channel reform is an important part of Yankershop's corporate strategy in the past two years, and Figure 4 shows the cost of sales from FY2020Q2 to FY2022Q3.

Figure 4: Seasonal total cost of Yankershop (in million).

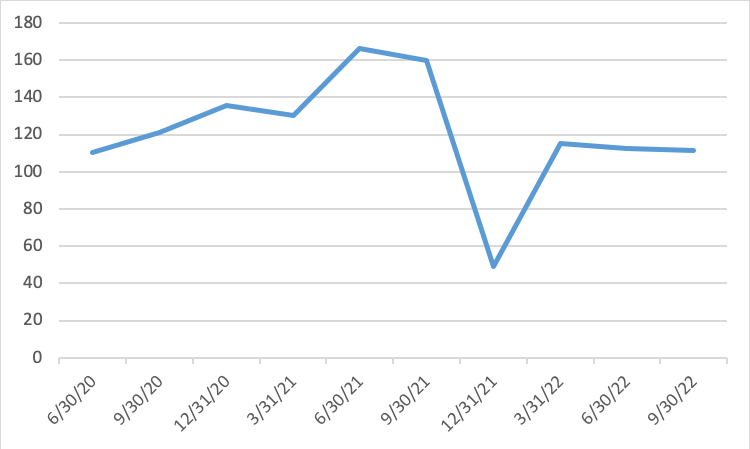

Starting from FY2021Q2, Yankershop has had a sudden increase in sales fees (see Figure 5). This is FY2021 Yankershop began to lay out the sales channel reform, from the direct sales of supermarkets as the main sales model to expand dealer sales, while opening the online sales model. In FY2022, Yankershop has basically completed the rollout of sales channels, and sales expenses have generally decreased a bit. It is foreseeable that Yankershop's sales expenses will remain stable in the future, and the advantages of sales reform will slowly show up in the coming period. For the snack food industry, developing new products can lead to excess profits and better goodwill.

Figure 5: Seasonal sale cost of Yankershop (in million).

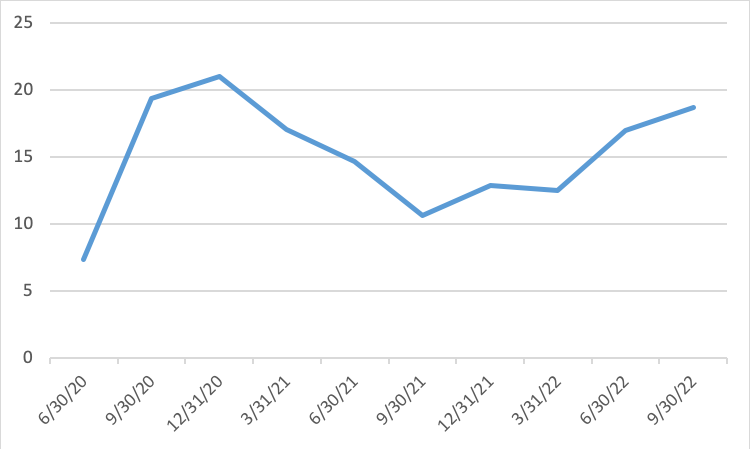

As Figure 6 shown, Yankershop's R&D investment was relatively low in FY2021, but it increased R&D expenditure again in FY2022. In 2022, Yankershop's R&D expenses increased to over 74 million (approximately 55 million in 2021). The Board listed it in its performance report as one of the main factors contributing to the increase in revenue in 2022.

Figure 6: Seasonal R&D expenses of Yankershop (in million).

3.3. Leverage

From Table 1, Yankershop's leverage remains at a relatively high ratio. That means high business risk and rapid development. Yankershop continued to increase its liabilities from FY2020Q3 to FY2021Q2, the value of liabilities remained stable and equity maintained growth. As a result, Yankershop's gearing ratio is characterized by rising first and then slowly decreasing.

Table 1: Seasonal debt ratios of Yankershop.

Date | 2020 | 2021 | 2022 | ||||||

9/30 | 12/31 | 3/31 | 6/30 | 9/30 | 12/31 | 3/31 | 6/30 | 9/30 | |

Asset-liability ratio | 49.24 | 57.19 | 58.84 | 62.35 | 58.52 | 57.66 | 55.52 | 54.41 | 52.5 |

3.4. Profitability

From Table 2, the profitability of Yankershop is highly relative to the epidemic situation in China. In FY2022Q1 and FY2021Q2, ROTA is quite low because of covid-19 and some relative policies. At the same time, Yankershop suffers from rising prices of raw materials too.

Table 2: Seasonal profitability ratios of Yankershop.

Date | 2020 | 2021 | 2022 | ||||||

9/30 | 12/31 | 3/31 | 6/30 | 9/30 | 12/31 | 3/31 | 6/30 | 9/30 | |

ROE(%) | 22.3 | 27.59 | 9.73 | 5.98 | 9.66 | 18.14 | 6.75 | 13.86 | 22.81 |

ROTA(%) | 10.68 | 13.15 | 4.08 | 2.6 | 4.06 | 7.52 | 2.89 | 6.19 | 10.15 |

Gross profit rate(%) | 42.48 | 43.83 | 44.02 | 40.51 | 39.8 | 35.71 | 38.59 | 37.5 | 36.35 |

New profit rate(%) | 13.17 | 12.36 | 14.17 | 4.92 | 4.97 | 6.77 | 10.67 | 10.64 | 11.09 |

In addition, although Yankershop's gross margin has declined, ROTA has continued to rise. This is due to Yankershop's expansion of sales channels, including the development of distributors and e-commerce sales, which significantly increased sales. In 2022, with the gradual liberalization of epidemic control in China, Yankershop turned its sales channel advantages into profitability. At the same time, Yankershop resisted its own market positioning by producing high-quality, cost-effective products. In 2022, the product positioning and sales strategy were optimized, so the ROTA performance in the second half of 2022 was very good.

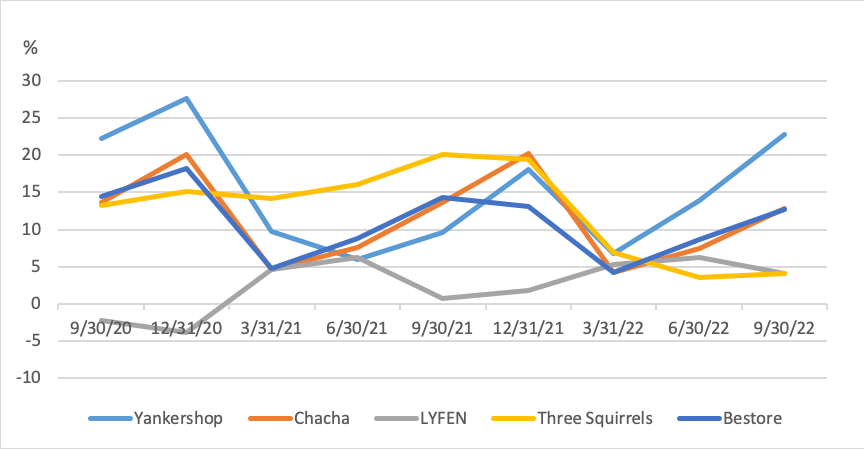

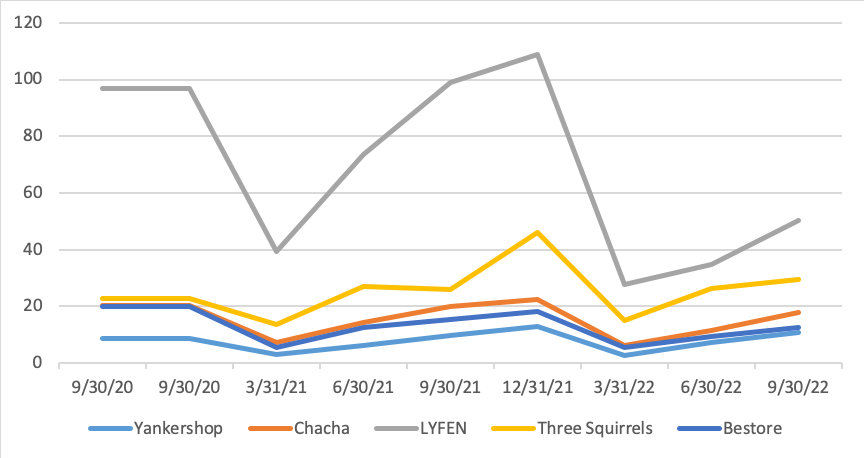

Figure 7: Seasonal ROE of Yankershop and its competitors.

Most companies in the leisure food industry have similar ROE trends, as Figure 7 shown. Yankershop maintains an advantageous ROE in the market between FY2020Q3 and FY2021Q due to the low cost of independent manufacturing. In FY2022Q1, China's epidemic measures are very strict, people in many areas cannot consume normally in certain periods. And the transportation industry has also been affected by policies, transportation capacity has declined, and transportation prices have risen. Yankershop shows greater volatility under the impact of rising raw material prices, rising transportation prices, and the intensification of the epidemic situation in China. After the market recovered, Yankershop showed its advantages in manufacturing and sales and dominated the industry.

3.5. Efficiency

As Figure 8 shown, Yankershop presents a lower total turnover ratio because companies that independent manufacturing needs to invest more capital into fixed assets. But at the same time, independent manufacturing has also helped Yankershop improve its supply chain, reduce costs and improve product margins.

Figure 8: Total turnover ratio of Yankershop and its competitors.

As Figure 9 shown, Yankershop's receivables turnover ratio performed very poorly, indicating that Yankershop took a long time to deliver orders. This is not conducive to the company's liquidity and development.

Figure 9: Seasonal receivables turnover ratio of Yankershop and its competitors.

From January 1, 2022, to the disclosure date of this announcement, the Company and its subsidiaries have received a total of 34 earnings-related and 1 asset-related government grant, totaling RMB43,167,906.09 (unaudited), accounting for 28.64% of the Company's audited net profit attributable to the owners of the parent company in 2021 [12]. In 2022, China provided subsidies to varying degrees for the real industry. The grant could help Yankershop accelerate its growth.

4. Forecasting

Yankershop has achieved good results in the reform of the sales channel. It is foreseeable that Yankershop will continue to expand dealer sales channels. At the same time, live streaming or promotion to develop online purchasing habits, so as to develop online stores. Yankershop hopes to create an omnichannel sales model, but the sales channel is still in the development stage. Yankershop lacks sales channels such as offline chain stores and local life service platforms. Because some newly established channels require promotion, it is hard to provide consumers with an indiscriminate purchasing experience in all channels. R&D is very important for the development of the leisure snack industry. Yankershop has significantly increased its R&D investment in 2022, while the products launched have also achieved good results. This is well reflected in the increase in intangible assets. Yankershop will likely continue to invest in research and development and build new “experiential factories.”

In 2022, Yankershop's share price has rapid rise, the company is also developing rapidly, and Yankershop may launch a new equity incentive plan in the future. In the second half of 2022, Yankershop focused on core category products. Production costs were reduced by cutting some product lines. At the same time, improving the quality and sale cost of core category products to increase its core competitiveness in the market. The strategy has yielded good market feedback. In the future, Yankershop will focus on making the core category a high-quality, cost-effective, healthy product. Yankershop hired a new VP from Weilong [13]. This is a leader with rich experience in snack retail and experience in omnichannel sales.

The epidemic has indeed had a great impact on China's economy, with significant negative impacts on GDP, social welfare, household income, and consumer expenditure [14]. But with the full lifting of China's epidemic control measures, China's economy has begun to recover. As a company in the retail sector, Yankshop's performance is highly correlated with the economic situation. This means that Yankershop's sales volume will increase in 2023, and with the liberalization of epidemic policies, transportation expenses will also be reduced, and costs can be controlled. Yankershop also has certain risks in the future. Firstly, raw material costs may rise. While Yankershop manages some of its risk through financial instruments, its revenue will also take a hit if raw material prices rise sharply. Secondly, Yankershop is a food company, and food safety issues are very important. Although Yankershop is independent manufacturing. Relatively speaking, product quality control is better than others. But when food safety issues arise, the shock to a food company is devastating. Finally, there are many companies in the leisure snack industry, and the competition in various categories is fierce. If other brands reach a monopoly position, it will be a shock to Yankershop.

5. Conclusion

Yankershop has performed well over the past year, with shares up 28% and total operating income up 28.6%. Today, China's leisure snack industry is highly competitive. Sales channels, visibility, and supply chain integrity have become new competitive points in China's leisure snack industry. Yankershop seized the opportunity of China's epidemic period to improve its competitiveness. The reform of internal sales channels and the strategy of focusing on core products has been a great success. In the market, China's economic recovery is obvious, and Yankershop will benefit from the high enthusiasm of the market. In the long run, Yankershop, as an independent production company, has a lower probability of food safety incidents. A complete supply chain will reduce Yankershop's costs and make more profits. These advantages of Yankershop are unique in the Chinese market. In Yankershop's strategic plan, it is mentioned that they will make their products global, which shows that Yankershop still has huge room for development in the future. But what still needs to be paid attention to is Yankershop's poor solvency, market risk, and reputation risk. There're too many fixed assets in Yankershop, an accidental fire or earthquake may cause losses. Based on the above, despite some risks, I still think Yankershop will perform well in the future. Yankershop's continuous improvement in supply chain and sales channels will help him stay ahead in the snack industry.

References

[1]. Yankershop 2022 Financial Results, http://static.cninfo.com.cn/finalpage/2023-01-19/1215648760, last accessed 2023/03/01.

[2]. Yankershop Securities Research Report 2022, Huaan Securities (2022).

[3]. Bestore Co. Securities Research Report 2020, Kaiyuan Securities (2020).

[4]. Yan, X.: Ice and Fire Dualism in Snack Food Industry: Channel Transformation behind the Performance Forecast of Laiyifen and Other Three Companies. China Food Industry, 3, 9-11 (2023).

[5]. Yankershop 2021 Annual Report, http://static.cninfo.com.cn/finalpage/2022-03-31/1212750970, last accessed 2023/03/01.

[6]. Wu, L., & Liu, Y.: The impact of structural shocks on the Chinese economy: On the economic impact of the COVID-19 pandemic. Contemporary Finance & Economics, 11, 3-15 (2021).

[7]. Li, X.: Significant performance differentiation in the snack food industry: category and channel diversification remain the key to success. China Food Industry, 3, 6-8 (2023).

[8]. Yankershop 2022 Financial Statements, http://static.cninfo.com.cn/finalpage/2023-02-28/1215987186, last accessed 2023/03/01.

[9]. Yankershop Securities Research Report 2021H1, TF Securities (2021).

[10]. Yankershop Securities Research Report 2022Q1, Topsperity Securities (2022).

[11]. Yankershop Securities Research Report 2022Q3, Minsheng Securities (2022).

[12]. Yankershop Announcement on the Company's Acquisition of Government Grant, http://static.cninfo.com.cn/finalpage/2023-01-06/1215532071, last accessed 2023/03/01.

[13]. Yankershop Announcement on Appointment of Deputy General Manager, http://static.cninfo.com.cn/finalpage/2022-10-26/1214903150, last accessed 2023/03/01.

[14]. Zhu, Q. R., Sun, M. S., & Yang, W. D. Evaluation of the impact of COVID-19 on China's economy: An empirical study based on the GTAP model. Statistics and Decision, 36(21), 91-96 (2020).

Cite this article

Chen,J. (2023). Financial Analysis on Yankershop Food Co., Ltd. Advances in Economics, Management and Political Sciences,22,378-387.

Data availability

The datasets used and/or analyzed during the current study will be available from the authors upon reasonable request.

Disclaimer/Publisher's Note

The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of EWA Publishing and/or the editor(s). EWA Publishing and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content.

About volume

Volume title: Proceedings of the 2023 International Conference on Management Research and Economic Development

© 2024 by the author(s). Licensee EWA Publishing, Oxford, UK. This article is an open access article distributed under the terms and

conditions of the Creative Commons Attribution (CC BY) license. Authors who

publish this series agree to the following terms:

1. Authors retain copyright and grant the series right of first publication with the work simultaneously licensed under a Creative Commons

Attribution License that allows others to share the work with an acknowledgment of the work's authorship and initial publication in this

series.

2. Authors are able to enter into separate, additional contractual arrangements for the non-exclusive distribution of the series's published

version of the work (e.g., post it to an institutional repository or publish it in a book), with an acknowledgment of its initial

publication in this series.

3. Authors are permitted and encouraged to post their work online (e.g., in institutional repositories or on their website) prior to and

during the submission process, as it can lead to productive exchanges, as well as earlier and greater citation of published work (See

Open access policy for details).

References

[1]. Yankershop 2022 Financial Results, http://static.cninfo.com.cn/finalpage/2023-01-19/1215648760, last accessed 2023/03/01.

[2]. Yankershop Securities Research Report 2022, Huaan Securities (2022).

[3]. Bestore Co. Securities Research Report 2020, Kaiyuan Securities (2020).

[4]. Yan, X.: Ice and Fire Dualism in Snack Food Industry: Channel Transformation behind the Performance Forecast of Laiyifen and Other Three Companies. China Food Industry, 3, 9-11 (2023).

[5]. Yankershop 2021 Annual Report, http://static.cninfo.com.cn/finalpage/2022-03-31/1212750970, last accessed 2023/03/01.

[6]. Wu, L., & Liu, Y.: The impact of structural shocks on the Chinese economy: On the economic impact of the COVID-19 pandemic. Contemporary Finance & Economics, 11, 3-15 (2021).

[7]. Li, X.: Significant performance differentiation in the snack food industry: category and channel diversification remain the key to success. China Food Industry, 3, 6-8 (2023).

[8]. Yankershop 2022 Financial Statements, http://static.cninfo.com.cn/finalpage/2023-02-28/1215987186, last accessed 2023/03/01.

[9]. Yankershop Securities Research Report 2021H1, TF Securities (2021).

[10]. Yankershop Securities Research Report 2022Q1, Topsperity Securities (2022).

[11]. Yankershop Securities Research Report 2022Q3, Minsheng Securities (2022).

[12]. Yankershop Announcement on the Company's Acquisition of Government Grant, http://static.cninfo.com.cn/finalpage/2023-01-06/1215532071, last accessed 2023/03/01.

[13]. Yankershop Announcement on Appointment of Deputy General Manager, http://static.cninfo.com.cn/finalpage/2022-10-26/1214903150, last accessed 2023/03/01.

[14]. Zhu, Q. R., Sun, M. S., & Yang, W. D. Evaluation of the impact of COVID-19 on China's economy: An empirical study based on the GTAP model. Statistics and Decision, 36(21), 91-96 (2020).