1. Introduction

Beginning in 2020, when COVID-19 broke out, the Chinese government imposed tough rules to restrict the movement of people in order to prevent and manage the epidemic. This resulted in a steep fall in the number of travellers, which inflicted a severe blow to the civil aviation transport industry. China has relaxed its limitations on the mobility of people, but the threat of COVID-19 persists and the possibility of COVID-19 mutation outbreaks has not been eliminated. Hence, it is advantageous for civil aviation firms to limit risks, prevent losses, and reduce losses in the future operation process by summarising the operational techniques of prior airlines during the pandemic and learning from their experiences and lessons. There are currently limited studies by domestic experts on the influence of the epidemic on the debt risk of civil aviation firms using financial indicators.

This paper employs the empirical analysis method, selects three large state-owned civil aviation enterprises in China (China Southern Airlines, Air China, and China Eastern Airlines) to analyse the impact of the epidemic impact on the debt risk of civil aviation enterprises, and offers corresponding recommendations for the management of airline debt risk.

Using the financial accounts of three airlines listed on China's A-share market, this research empirically evaluates the effect of the epidemic on the debt risk of the aviation industry. It serves as a point of reference for similar public systematic practise in future civil aviation operations. This paper's research also acts as a resource for other traditional capital-intensive sectors with comparable characteristics.

2. The COVID-19 Epidemic and the Civil Aviation Transportation Industry

2.1. The Impact of COVID-19 on the Civil Aviation Transport Industry

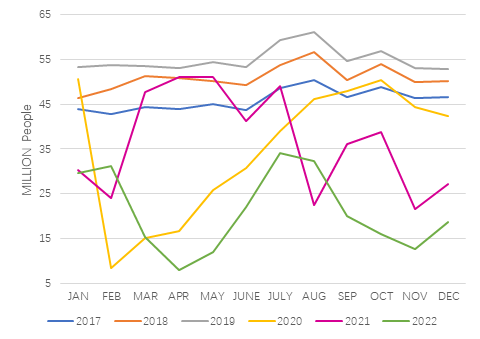

During the years 2020 to 2022, when the Chinese government implemented the lockdown policy for the COVID-19 pandemic, local governments frequently restricted the mobility of people to prevent the spread of the disease. Despite the fact that the path of transmission of the new coronavirus has been effectively prevented, it has had a significant impact on transportation and other businesses. The implementation of quarantine measures such as production suspension, work stoppage, school suspension, flight cancellation, road blocking, and even "lockdown" has severely impacted the transportation industry and passenger traffic volume during each quarter when the epidemic prevention situation is severe. After the epidemic has been effectively contained, the government's control over the transportation industry remains relatively tight, the passenger transport volume of civil aviation is unstable, and the production and operation of the civil aviation transport industry are hampered by an unfavorable environment. From January 2017 to December 2019, Figure 1 depicts the monthly passenger volume statistics for civil aviation.

Figure 1: Monthly statistical data of total civil aviation passenger traffic from January 2017 to December 2019 [1].

After a steady climb from 2017 to 2019, the overall passenger transport volume of China's civil aviation plummeted in February 2020 due to the impact of the pandemic and other causes, as shown in figure 1. In the two years that followed, the passenger volume of civil aviation was consistently lower than the pre-epidemic level and fluctuated with the domestic epidemic situation. This was the result of tight epidemic prevention regulations. It may be extrapolated that during this period, as a result of the drop in passenger traffic, civil aviation businesses' operating revenue decreased dramatically, their cash flow reduced, and their debt risk grew.

2.2. The Air Transport Enterprise Debt Risk Analysis

Debt finance is not only one of the most important funding strategies for modern businesses, but also the most common. Debt management provides several benefits, such as tax savings and operating leverage, but it is also a high-risk business activity if the enterprise is utilized improperly, which can bring about significant hazards. Due to the peculiarities of airlines' high debt levels in their capital structure, the identification and management of debt risk are particularly crucial. The following is a list of frequent debt management risks.

First, risk capital structure with an unbalanced capital structure, or the ratio of a company's liabilities to its shareholders' equity. Modest debt is helpful to firms lowering their cost of capital, providing an interest tax shield, and gaining leverage. However, if excessive debt, an imbalanced capital structure, and fixed interest payments are a substantial burden on the organization, interest not only erodes profits but can also lead to corporate losses [2].

Second, the adverse effect of "financial leverage effect" on the return on equity capital. The magnitude of a company's financial risk is mostly determined by its financial leverage coefficient. The larger the financial leverage coefficient, the stronger the elasticity between the rate of return on equity capital and the rate of profit before interest and taxes. If the rate of profit before interest and taxes declines, the rate of profit drop on equity capital would accelerate, hence increasing the risk. In contrast, the financial risk will diminish. The essence of the presence of financial risk is the transfer of debt's operating risk to equity capital. Due to the fixed amount of interest burden, as the enterprise capital returns decline, the return on equity capital declines at a quicker pace when the enterprise is confronted with the low tide of economic development or other operating challenges brought about by other causes [3].

Third, for debt financing, the business is legally obligated to pay interest and refund the amount upon maturity. If the enterprise debt investment project cannot achieve the anticipated rate of return, or if the enterprise's overall production and operation and financial situation deteriorates, or if the enterprise short-term fund action is improper, these factors will not only cause the above equity capital income benefit to decline significantly, but they will also increase the enterprise's risk of insolvency. The result will not only place a burden on the enterprise's finances, but it will also have a negative impact on the enterprise's credibility, and in extreme cases may even lead to the enterprise's collapse.

3. Profiles of Three Sample Companies

China Southern Airlines, Air China, and China Eastern Airlines are chosen as sample companies for analysis in this research. The relevant quarterly statements from 2017 to 2022 are picked to assess their debt risk.

China Southern Airlines Co., Ltd. is a subsidiary of China Southern Air Holding Company Ltd., a company that specializes in air transportation services. China Southern's headquarters are in Guangzhou. China Southern Airlines is the largest airline in the People's Republic of China [4] in terms of fleet size, route network development, and passenger capacity.

Air China is responsible for providing China's leaders with special flying services when they go abroad. Air China is also responsible for chartering special flights within China for a large number of foreign heads of state and government, emphasizing its exclusive status as the national flag carrier. Air China has other branch offices in other regions [5]. Its headquarters are in Beijing.

China Eastern Airlines Co., Ltd., with its headquarters in Shanghai, is one of the three largest airlines in China. Its origins can be traced back to January 1957, when the first squadron was established in Shanghai, and it was the first Chinese airline to be listed on the New York, Hong Kong, and Shanghai stock exchanges [6].

4. Selection and Analyzation of Debt Risk Assessment Indicators

4.1. Selection of Debt Indicators

Initially, there is the total debt of each company. The greater the total amount of debt and the size of the obligation that must be repaid, the bigger the danger associated with the debt. The second component is the interest guarantee multiple. The interest coverage multiple represents the relationship between EBIT and interest expense. Not only may the interest coverage multiple show the magnitude of profitability, but it can also reflect the degree of profit protection against maturing debt. Third is the ratio of total assets to total liabilities. This indicator is the ratio of liabilities to total assets, which reflects the total liability risk and long-term solvency of the organization. Fourth is the quick ratio, which indicates the company's short-term solvency. Fifth, it is the ratio of the company's current liabilities to its overall liabilities, which might provide some insight into the company's debt structure and debt maturity structure [7].

4.2. Total Liability Analysis

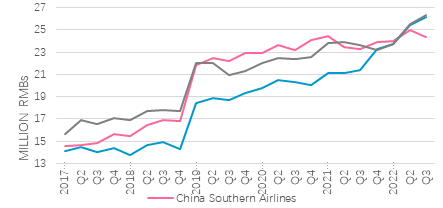

Figure 2: Line chart of quarterly statistical data of the three companies’ debt scale from the first quarter of 2017 to the third quarter of 2022 [8].

Since the first quarter of 2018, the debt levels of the three airlines have climbed quarter by quarter, as seen in figure 2. This suggests that the debt repayment pressure and debt risk of the three airlines are increasing. China Southern Airlines has the most manageable debt level among the three businesses. From the fourth quarter of 2019, China Southern Airlines has maintained the lowest quarterly debt size fluctuation among the three corporations. China Southern Airlines has the lowest debt of the three companies during the third quarter of 2022. In contrast, Air China's debt increased from the lowest among the three firms in the fourth quarter of 2019 to nearly the highest in the third quarter of 2022. This suggests that the company's debt financing rose quicker during the epidemic period, hence increasing the debt risk [9].

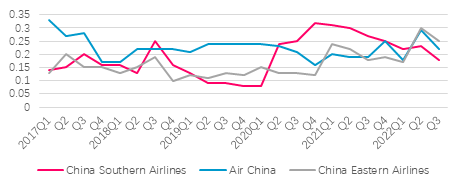

4.3. Times Interest Earned Ratio Analysis

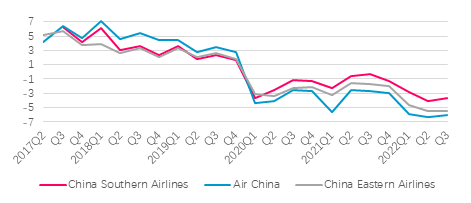

Figure 3: Line chart of quarterly statistical data of the three companies’ interest guarantee multiple from the first quarter of 2017 to the third quarter of 2022 [10].

As depicted in Figure 3, the COVID-19 epidemic has had a relatively evident effect on the revenue of businesses. Prior to the epidemic, the interest cover multiples of the three corporations were all at high levels; nevertheless, they all fell to negative levels in the first quarter following the pandemic and did not recover until the third quarter of 2022. This implies that numerous factors, such as the epidemic-caused dramatic fall in passenger traffic, have a substantial impact on the company's income and solvency. During this period, the greater the company's debt ratio, the greater the chance of debt default and bankruptcy.

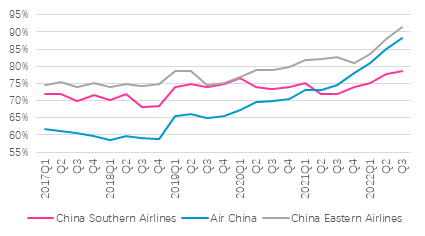

4.4. Total Debt Ratio Analysis

Figure 4: Line chart of quarterly statistical data of the three companies’ total debt ratio from the first quarter of 2017 to the third quarter of 2022 [10].

As seen from the figure 4, the asset-liability ratio assesses the ratio of total liabilities to total assets and is a significant predictor of a company's debt risk and long-term solvency. Throughout this time, the debt-to-asset ratios of all three corporations have increased, and their financial leverage ratios in the third quarter of 2022 are at their greatest levels in the previous six years. During the period of the epidemic, all businesses turned to borrowing to deal with the cash flow crisis. China Southern Airlines has the best asset-liability ratio of the three corporations, which has stayed around 75% since the outbreak. China Eastern Airlines had a debt-to-asset ratio of 91% at the conclusion of the five-year period, whereas Air China's debt-to-asset ratio increased by 22% during the pandemic, greatly increasing its debt risk. Relative to the relatively constant ratio prior to the pandemic, the company's asset-liability ratio increased more rapidly during the pandemic.

4.5. Quick Ratio Analysis

Figure 5: Line chart of quarterly statistical data of the three companies’ quick ratio from the first quarter of 2017 to the third quarter of 2022[11].

As depicted in Figure 5, the quick ratios of the three enterprises fluctuated within a reasonable range during the outbreak, demonstrating that their short-term solvency was effectively managed. Before the outbreak, Air China's quick ratio was greater than those of the other two corporations. After the outbreak, China Southern Airlines and China Eastern Airlines increased their fast ratios in order to prevent risks, suggesting that the companies had taken appropriate measures to deal with the disease's effects and enlarged their current assets to reduce the danger of debt default.

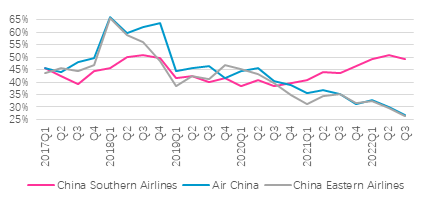

4.6. Current Debt Ratio Analysis

Figure 6: Line chart of quarterly statistical data of the three companies’ current debt ratio from the first quarter of 2017 to the third quarter of 2022 [11].

Figure 6 demonstrates that China Eastern Airlines and Air China's current debt ratio decreased significantly compared to the three years preceding the epidemic, indicating that, under the influence of the epidemic, these two airlines tend to reduce the size of their short-term liabilities and increase the size of their long-term liabilities. This reduces the pressure on businesses to repay their debts in the short term but raises the debt burden and debt cost in the long run. China Southern Airlines' current debt ratio maintained a reasonably constant upward trajectory during the epidemic, showing that the company's debt policy was distinct from those of the other two corporations. The corporation tended to employ short-term debt to alleviate cash flow issues, which raised the company's need to repay short-term debt.

5. Suggestions for Airlines

The following are some of the author's recommendations for handling the risks associated with airline liabilities.

The first step is to make some sensible modifications to the development strategy, business plan, and production and business plan, for example, the introduction of aircraft. Make a scientific prediction of the epidemic's development trend, revise the budget data in accordance with the principle of living within means, give priority to ensuring the production of benefits in the current period, screen out projects that are not urgent, slow down the progress of investment of some assets, and reduce the pressure on operations.

Second, many airlines have a predetermined number of grounded planes due to the national aircraft introduction target strategy. Hence, it's important to fine-tune the strategy, understand the cadence and volume of aircraft introduction, and keep the operating risks and capital risks associated with parking and mothballing well under control.

Third, it is important to refine load management, which must be tightened; air routes must be optimised; precise oil plans must be made; the current window of opportunity presented by the international oil price should be completely exploited, and crude oil hedging must be carried out correctly. Aviation fuel prices will continue to drop.

The fourth strategy is to actively communicate and negotiate with suppliers in order to: obtain discounts; extend settlement time; reasonably arrange aircraft maintenance; extend or optimise planned maintenance; strictly control the quantity of high-priced turnover parts; reactivate idle aviation materials; reduce maintenance costs; delay the introduction of personnel; conduct internal recruitment; reactivate stock personnel; and speed up the localization of personnel stationed abroad. Besides, it is necessary to encourage pinpoint advertising, fortify agency channel management, and cut down on sales costs [12].

6. Conclusion

This paper uses financial index analysis to examine the debt risk of three domestic airlines before and after the epidemic, based on financial statement analysis, debt risk theories, and domestic airline development. These are perspectives and conclusions.

The pandemic has hurt domestic airlines' revenues, debt, and safety. China Eastern Airlines has the largest debt and the worst debt risk, while China Southern Airlines has the most stable debt amount and asset-liability ratio. Air China and China Eastern Airlines' rapid ratios were constant before and after the pandemic, whereas China Southern Airlines soared afterward. It shows that the company changed its debt policy and created a capital reserve to manage liquidity risk. Air China and China Eastern Airlines reduce their current liabilities to reduce short-term debt repayment pressure after the pandemic, but China Southern Airlines' current debt ratio rises considerably.

This study fails to theoretically address debt risk and examine each enterprise's debt risk factors due to insufficient academic abilities. The universality of the research samples selected for this paper must be improved, the representativeness of the three selected firms to the entire industry must be discussed, and the selection of financial indicators is limited to debt risk measurement without considering the indirect impact of other financial factors on debt risk.

References

[1]. Official website of Ministry of Transport of the People's Republic of China, 2020. https://www.mot.gov.cn/tongjishuju/minhang/index_2.html

[2]. Franco Modigliani, Merton H. Miller The Cost of Capital, Corporation Finance and the Theory of Investment The American Economic Review [J] Vol. 48, No. 3 (Jun., 1958), pp. 261-297 (37 pages)

[3]. Jiao Ying. Strategies to deal with financial crisis in highly leveraged enterprises [J]. International Business Finance and Accounting,2009, No.251(11):32-33.

[4]. Official website of China Southern Airlines, 2021. https://www.csair.com/cn/about/gongsijianjie/

[5]. Official website of Air China, 2021. http://www.airchina.com.cn/cn/about_us/company.shtml

[6]. Official website of China Eastern Airlines, 2021. https://www.ceair.com/global/static/AboutChinaEasternAirlines/intoEasternAirlines/chinaeasternInto/index.html

[7]. Stephen A. Ross, Randolph W Westerfield, Jeffrey F. Jaffe, Bradford D. Jordan Corporate Finance, 11th Edition [M]. China Machine Press. 2018: 45-48.

[8]. Official website of China Southern Airlines, 2022. https://www.csair.com/en/about/investor/yejibaogao/2022/

[9]. Gu Yun. Research on Corporate Debt Risk and Control [J]. Tax Payment, 2019, 20.

[10]. Official website of Air China, 2022. http://www.airchina.com.cn/en/investor_relations/financial_info_and_roadshow.shtml

[11]. Official website of China Eastern Airlines, 2022. https://www.ceair.com/global/static/AboutChinaEasternAirlines/intoEasternAirlines/InvestorRelations/periodicReports/

[12]. PENG Q. Analysis of operation management and control of civil aviation enterprises under the impact of epidemic [J]. China Aviation Weekly,2020, No.1398(51):64-65.

Cite this article

Liang,C. (2023). A Comparative Study on Debt Risks of Chinese Civil Aviation Companies Under the Covid-19 Epidemic. Advances in Economics, Management and Political Sciences,23,12-19.

Data availability

The datasets used and/or analyzed during the current study will be available from the authors upon reasonable request.

Disclaimer/Publisher's Note

The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of EWA Publishing and/or the editor(s). EWA Publishing and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content.

About volume

Volume title: Proceedings of the 2023 International Conference on Management Research and Economic Development

© 2024 by the author(s). Licensee EWA Publishing, Oxford, UK. This article is an open access article distributed under the terms and

conditions of the Creative Commons Attribution (CC BY) license. Authors who

publish this series agree to the following terms:

1. Authors retain copyright and grant the series right of first publication with the work simultaneously licensed under a Creative Commons

Attribution License that allows others to share the work with an acknowledgment of the work's authorship and initial publication in this

series.

2. Authors are able to enter into separate, additional contractual arrangements for the non-exclusive distribution of the series's published

version of the work (e.g., post it to an institutional repository or publish it in a book), with an acknowledgment of its initial

publication in this series.

3. Authors are permitted and encouraged to post their work online (e.g., in institutional repositories or on their website) prior to and

during the submission process, as it can lead to productive exchanges, as well as earlier and greater citation of published work (See

Open access policy for details).

References

[1]. Official website of Ministry of Transport of the People's Republic of China, 2020. https://www.mot.gov.cn/tongjishuju/minhang/index_2.html

[2]. Franco Modigliani, Merton H. Miller The Cost of Capital, Corporation Finance and the Theory of Investment The American Economic Review [J] Vol. 48, No. 3 (Jun., 1958), pp. 261-297 (37 pages)

[3]. Jiao Ying. Strategies to deal with financial crisis in highly leveraged enterprises [J]. International Business Finance and Accounting,2009, No.251(11):32-33.

[4]. Official website of China Southern Airlines, 2021. https://www.csair.com/cn/about/gongsijianjie/

[5]. Official website of Air China, 2021. http://www.airchina.com.cn/cn/about_us/company.shtml

[6]. Official website of China Eastern Airlines, 2021. https://www.ceair.com/global/static/AboutChinaEasternAirlines/intoEasternAirlines/chinaeasternInto/index.html

[7]. Stephen A. Ross, Randolph W Westerfield, Jeffrey F. Jaffe, Bradford D. Jordan Corporate Finance, 11th Edition [M]. China Machine Press. 2018: 45-48.

[8]. Official website of China Southern Airlines, 2022. https://www.csair.com/en/about/investor/yejibaogao/2022/

[9]. Gu Yun. Research on Corporate Debt Risk and Control [J]. Tax Payment, 2019, 20.

[10]. Official website of Air China, 2022. http://www.airchina.com.cn/en/investor_relations/financial_info_and_roadshow.shtml

[11]. Official website of China Eastern Airlines, 2022. https://www.ceair.com/global/static/AboutChinaEasternAirlines/intoEasternAirlines/InvestorRelations/periodicReports/

[12]. PENG Q. Analysis of operation management and control of civil aviation enterprises under the impact of epidemic [J]. China Aviation Weekly,2020, No.1398(51):64-65.