1. Introduction

1.1. Research Background

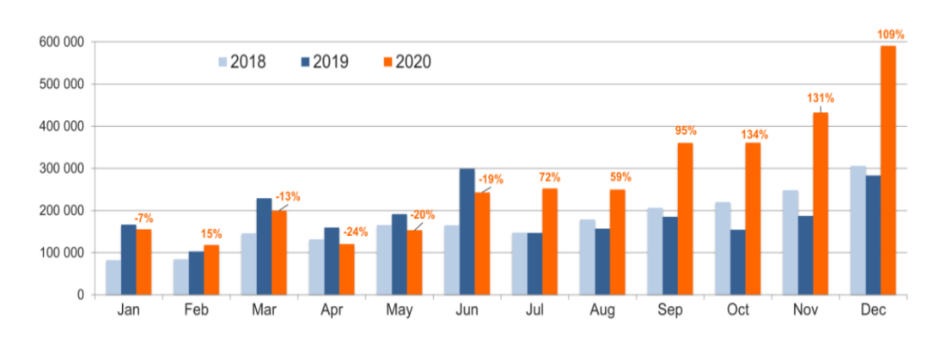

The domestic electric vehicle (EV) market in China is the world’s largest and has seen significant growth in recent years. The Chinese government has been promoting EV adoption by implementing various policies—for example, consumer subsidies. As a result, EV sales have surged, with China accounting for around 50% of global EV sales in 2020 [1]. As shown in Figure 1

Figure 1: the table of the sale volume of EVs in Europe [1].

(Source: EV volumes.com https://www.ev-volumes.com/country/china/ last accessed 2021)

BYD Auto Co., Ltd. (BYD), a leading Chinese automaker specializing in EV production, is a notable example of a company China’s consumption subsidy policy has significantly influenced. With the government’s support, BYD has become one of the top EV manufacturers in China and a major player in the global EV market [2]. As shown in Table 1.

Table 1: The output and sales volume of BYD in 2022.

Output | Sales volume | |||||||||

Project Categories: | This month | Same period last year | Current year’s accumulation | Last year’s accumulation | Cumulative year-on-year | This month | Same period last year | Current year’s accumulation | Last year’s accumulation | Cumulative year-on-year |

New Energy Vehicles | 235,215 | 92,030 | 1,877,034 | 607,119 | 209.17% | 235,197 | 93,945 | 1,863,494 | 603,783 | 208.64% |

-Passenger Cars | 234,616 | 90,908 | 1,870,919 | 597,081 | 213.34% | 234,598 | 92,823 | 1,857,379 | 593,745 | 212,82% |

-Pure Electric | 109,577 | 46,588 | 917,118 | 322,983 | 183.95% | 111,939 | 48,317 | 911,140 | 320,810 | 184.01% |

-Plug-in Hybrid | 125,039 | 44,320 | 953,801 | 274,098 | 247.98% | 122,659 | 44,506 | 946,239 | 272,935 | 246.69% |

-Commercial Vehicles, | 599 | 1,122 | 6,115 | 10,038 | -39.08% | 599 | 1,122 | 6,115 | 10,038 | -39.08% |

-Passenger Buses | 335 | 783 | 4,870 | 5,772 | -15.63% | 335 | 783 | 4,870 | 5,772 | -15.63% |

-Other | 264 | 339 | 1,245 | 4,226 | -70.82% | 264 | 339 | 1,245 | 4,226 | -70.82% |

Fuel Vehicles | 0 | 5,244 | 4,635 | 140,421 | -96.70% | 0 | 5,167 | 5,049 | 136,348 | -96.30% |

-sedan | 0 | 1,915 | 1,458 | 35,302 | -95.87% | 0 | 1,771 | 1,544 | 33,401 | -95.38% |

-SUV | 0 | 3,147 | 3,177 | 93,728 | -96.61% | 0 | 3,214 | 3,505 | 93,012 | -96.23% |

-MPV | 0 | 182 | 0 | 11,391 | -100.00% | 0 | 182 | 0 | 9,935 | -100.00% |

In total | 235,215 | 97,274 | 1,881,669 | 747,540 | 151.71% | 235,197 | 99,112 | 1,868,543 | 740,131 | 152.46% |

(Source: Shenzhen stock exchange, http://www.szse.cn/disclosure/listed/bulletinDetail/index.html?d5ca1309-9220-41ee-861a-fc49dbdfb174 last accessed 2023/01/03)

1.2. Literature Review

This policy has significantly boosted the sales of BYD’s NEVs, contributing to the company’s rapid growth and expansion. As a result, BYD has increased its market share and competed with leading automakers in China’s EV market, such as Tesla, NIO, and Xiao Peng. However, the effectiveness and sustainability of consumption subsidies as a policy tool remain controversial, as some argue that such policies may distort market competition and create inefficiencies. Nonetheless, the influence of consumption subsidies on BYD and other Chinese EV manufacturers cannot be denied. These policies was important to drive the growth and advancement of China’s NEV industry. Some relevant articles also describe this issue. For instance: Masiero et al. analyzed that government support in the form of subsidies combined with effective strategies for BYD contributed a lot to the successful expansion of China’s electronic vehicle industry. And China’s heavy investment in electric vehicle development reduced the opportunity cost of certain companies and helped helps them become the largest car producer and a strong investor in EV manufacturing [3]. Also, Sun Zhang and Su proposed the different influences that Various types of government subsidies can impact the market differently. The findings point out that by putting in every units of investment in research, development, and publicity which falls below 0.574 in region X, consumption-side subsidies prove more effective in enhancing R&D and advertising investments, increasing revenue, and promoting public welfare compared to production-side subsidies. However, when the investment was less than 1.414 in Y region. It is the production-side subsidy that more likely come with a superior performance [4]. Also, Jin has proposed the old and new criteria of government relevant subsidy policies for the new energy automotive industry in China, along with the accounting approaches for government subsidies and financial discounts under updated standards, are being examined. The paper proposed the necessity to improve and reform the domestic accounting system to cover international standards and develop a sustainable subsidy policy, making enterprises independent instead of relying on government subsidies excessively to remain competitive in the global market [5].

Most of the papers focused on BYD and governmental subsidies and discussed the importance of government support in the success of the company and the new energy automobile industry in China. These papers analyze the effect of government subsidies in accelerating the industry’s growth, as well as the impact of changes in subsidy policies on companies like BYD. Many of the papers focus on the accounting methods for government subsidies and financial discounts and the impact of these factors on BYD’s financial performance. Additionally, some of the papers examine the role of government subsidies in supporting BYD’s research and development efforts and its expansion into other new energy sectors. Most of these papers focused on the importance of government subsidies, their impact on BYD’s financial performance, and the changes in government policies related to subsidies. Only a few of the papers focused on other aspects of BYD’s business, such as its strategies for market competition or its expansion into other new energy sectors. Overall, the papers provide a detailed analysis of BYD’s reliance on government subsidies and the impact of these subsidies on the company’s success.

1.3. Research Framework

First, the paper will provide an overview of China’s inland electric vehicle market and how important government policies are to the market, particularly consumption subsidies, in promoting the industry’s growth.

Second, the paper will analyze the impact of the consumption subsidy policy on BYD, one of China’s largest electric vehicle manufacturers. This analysis will examine BYD’s sales performance, financial performance, and market share before and after the implementation of the consumption subsidy policy.

Thirdly, this paper will address the possible challenges and constraints of the consumption subsidy policy in fostering long-term expansion and stability within the domestic electric vehicle market. The analysis will encompass topics like the policy's effectiveness in lowering emissions and encouraging innovation, as well as the likelihood of the policy causing market imbalances and reliance on government assistance.

Fourth, the paper will conclude by summarizing the key findings of the research and offer some recommendations for policymakers, businesses, and other stakeholders in China’s domestic electric vehicle market. These recommendations would include suggestions for changes to government policies related to consumption subsidies and strategies that companies like BYD can use to ensure their long-term success in the rapidly evolving electric vehicle market.

2. Methods: Case Study

Case study is a research approach employed to thoroughly examine a phenomenon or a topic of interest. It involves examining a particular case or situation to gather and analyze data, conclude, and make recommendations. The first step is defining the research question, or problem the case study will address. The research question should be clear, specific, and relevant to the field. And then select the case that will be studied. The case can be found in an individual, a group, an organization, a community, or a specific event. The third stage is to collect the data by gathering information about the case through various methods such as interviews, observations, surveys, and document analysis. The data collected should then be analyzed to identify their patterns, themes, and relationships among them. These procedures help us to understand the case and develop insights. Fifthly, based on the analysis, conclusions can be drawn that help us to answer the research question. The conclusions should also be based on collected evidence and supported by logical reasoning. This paper will first focus on the current situation of China’s EV market by analyzing the data searched on the internet. And then, it focused on the consumption subsidy policy on the domestic electric vehicle market, using BYD as a case study. The paper will then discuss the potential problems with the policy, unequal distribution of subsidies, and inadequate support for long-term industry development. The paper concludes by suggesting that the government should address the problems with the subsidy policy while continuing to support the advancement of the electric vehicle industry through furthered alternative methods, including enhancing charging infrastructure and fostering research and development.

3. Results

3.1. Analysis of the Current Situation of China’s EV Market

China’s electric vehicle (EV) market had experienced significant growth in last few years. In accordance with a report from the International Energy Agency (IEA), China’s EV market became one of the biggest in the world in 2020, accounting for more than 40% of global sales. The report also notes that China aims to have 50% of new car sales electric by 2035, which is predicted to drive further rise in the electric vehicle market [6]. However, the Chinese EV market has also faced some challenges. One issue is the decrease in government subsidies for EVs, which has led to a decline in sales. According to the China National information center, EV sales in China fell by 63.8% in 2017, the first decline in over a decade, largely attributed to decreased subsidies [6]. Despite these challenges, the Chinese EV market is expected to grow in the coming years, driven by government policies promoting EV adoption and investment in charging infrastructure. A report by McKinsey & Company predicts that China will account for around 60% of global EV sales by 2030. In summary, the Chinese EV market has experienced significant growth in recent years but faces challenges such as decreased government subsidies and a lack of charging infrastructure. However, the market is expected to grow in the coming years.

3.2. The Influence of Consumer Subsidy Policy on the Market—Take BYD as Example

The consumer subsidy policy, including companies like BYD, has significantly impacted the Chinese electric vehicle market. According to a report by the China Association of Automobile Manufacturers, the subsidy policy has helped promote the adoption of electric vehicles in China, leading to significant growth in the market and boosting the success of companies like BYD. For example, BYD saw a significant increase in sales of its electric vehicles following the introduction of the subsidy policy. In 2020 BYD’s sales of electric vehicles in China increased by over 200% compared to the previous year [7]. As shown in Table 2 and Table 3

Table 2: Consolidated Statement of Profit or Loss of BYD in 2019.

Notes | 2019 RMB’000 | 2018 RMB’000 | |

Revenue | 5 | 121,778,117 | 121,790,925 |

Cost of sales | (103,702,124) | (103,724,161) | |

Gross profit | 18,075,124 | 18,066,764 | |

Other incomes and gains | 5 | 1,974,993 | 2,138,163 |

Government grants and subsidies | 7 | 1,707,657 | 2,332,863 |

Selling distribution expenses | (4,345,897) | (4,729,481) | |

Research and development costs | (5,629,327) | (4,989,360) | |

Administrative expenses | (4,232,316) | (3,826,379) | |

Impairment losses on financial and contract assets | (477,031) | (332,080) | |

Loss on disposal of financial assets measured at amortized cost | (519,134) | (361,765) | |

Other expenses | (213,536) | (568,610) | |

Financial costs | 8 | (3,487,407) | (3,118,751) |

Share if profits and losses of: | |||

Joint ventures | (435,311) | (277,602) | |

Associations | 12,535 | 52,878 | |

Profit before tax | 6 | 2,431,131 | 4,385,640 |

Income tax expense | 11 | (312,274) | (829,447) |

Profit for the year | 2,118,857 | (3,556,193) | |

Attributable to: | |||

Owners of parent | 13 | 1,614,450 | 2,780,194 |

Non-controlling interests | 504,407 | 775,999 | |

2,118,857 | 3,556,193 | ||

Earning per share attributable to ordinary equity holders of the parent Basic and diluted. -For profit for the year | 13 | RMB 0.50 | RMB 0.93 |

(Source: BYD, Investor relations periodic reports)

Table 3: Consolidated Statement of Profit or Loss of BYD in 2020.

Notes | 2020 RMB’000 | 2019 RMB’000 | |

Revenue | 5 | 153,469,184 | 121,778,117 |

Cost of sales | (126,225,593) | (103,702,124) | |

Gross profit | 27,243,591 | 18,075,124 | |

Other incomes and gains | 5 | 1,700,078 | 1,974,993 |

Government grants and subsidies | 7 | 1,688,142 | 1,707,657 |

Selling a distribution expenses | (5,055,613) | (4,345,897) | |

Research and development costs | (7,464,861) | (5,629,327) | |

Administrative expenses | (4,395,630) | (4,232,316) | |

Impairment losses on financial and contract assets | (1,166,268) | (477,031) | |

Loss on disposal of financial assets measured at amortized cost | (299,523) | (519,134) | |

Other expenses | (2,056,691) | (213,536) | |

Financial costs | (3,123,801) | (3,487,407) | |

Share if profits and losses of: | 8 | ||

Joint ventures | (198,955) | (435,311) | |

Associations | 12,118 | 12,535 | |

Profit before tax | 6 | 6,882,587 | 2,431,131 |

Income tax expense | 11 | (868,624) | (312,774) |

Profit for the year | 6,013,963 | 2,118,857 | |

Attributable to: | |||

Owners of parent | 13 | 4,234,267 | 1,614,450 |

Non-controlling interests | 1,779,696 | 504,407 | |

6,013,963 | 2,118,857 | ||

Earing per share attributable to ordinary equity holders of the parent Basic and diluted. -For profit for the year | 13 | RMB 1.47 | RMB 0.50 |

(Source: Investor relations periodic reports)

With many of these sales being in the small and medium-sized passenger vehicle segment, the company has also invested heavily in research and development of electric vehicle technology and has been recognized as a Chinese electric vehicle market leader. However, there have also been problems with the consumer subsidy policy, including fraud and unequal distribution of subsidies. A report by the people’s Daily indicated that some companies were cheating the subsidy system by misrepresenting their vehicles’ performance, which has reduced the number of subsidies available [8]. Additionally, some analysts have criticized the policy for focusing too much on short-term sales growth and not enough on supporting long-term industry development. Overall, the consumer subsidy policy has significantly impacted the Chinese electric vehicle market, including companies like BYD. While there have been some problems with the policy, it has helped promote the adoption of electric vehicles and boost the success of companies like BYD [9].

3.3. Imperfect Aspect of Consumer Subsidy Policy and Existing Problems

The consumer subsidy policy for electric vehicles (EVs) in China has faced criticism due to its imperfect aspects and existing problems, which have affected the sale volume of EVs, including those produced by BYD.

One of the issues with the subsidy policy is the unequal distribution of subsidies, which has led to the concentration of sales in small and medium-sized passenger vehicles. As a result, larger EVs have struggled to gain market share, even if they offer better performance or are more affordable than subsidized models. This has impacted BYD, whose sales of larger electric vehicles have been lower than expected due to the subsidy policy’s focus on smaller vehicles

Furthermore, the subsidy policy has also been criticized for promoting short-term sales growth rather than supporting long-term industry development. This has led to concerns about the sustainability of the EV market in China. A report by the China association of automobile Manufacturers notes that the subsidy-dependent market created by the policy is vulnerable to government policy fluctuations, which can negatively affect EV sales [10].

In summary, the consumer subsidy policy for EVs in China has faced criticism due to its imperfect aspects and existing problems, including unequal distribution of subsidies, lack of long-term planning, and fraud. These issues have impacted the sale volume of EVs, including those produced by BYD.

4. Discussion

To improve China’s electric vehicle (EV) consumer subsidy policy and promote the development of the EV industry, several measures could be considered. The government could adjust the subsidy structure to promote the development of larger and higher-performance EVs, which have struggled to gain market share due to the current subsidy policy’s focus on small and medium-sized passenger vehicles. This could include offering higher subsidies for larger EVs and adjusting the criteria for subsidy eligibility to reflect performance and affordability better. Also, the government could introduce long-term planning and policy stability to support the sustainable growth of the EV industry. This could include setting clear targets and policies for developing EVs and related infrastructure and establishing stable subsidy policies that promote industry growth while avoiding dependency on government support. Thirdly, the government could consider offering subsidies for EV charging infrastructure development, which could help to address one of the major barriers to EV adoption in China. This could include subsidies for the installation of public charging stations or the development of EV battery-swapping networks. Lastly, the government could work to address fraud-related issues and the unequal distribution of subsidies, which have undermined the effectiveness of the subsidy policy. This could include increasing the transparency and accountability of the subsidy system, as well as cracking down on fraudulent behavior by EV manufacturers and dealers. Overall, by implementing measures such as adjusting the subsidy structure, introducing long-term planning and policy stability, offering subsidies for charging infrastructure development, and addressing issues related to fraud and unequal distribution of subsidies. China has the potential to enhance its electric vehicle consumer subsidy policy, thereby fostering the sustainable growth of the EV sector.

One important consideration in improving China’s EV consumer subsidy policy is balancing the goals of improving the EV industry with ensuring the subsidy program’s sustainability. While subsidies can be effective in encouraging EV adoption, However, such measures can be expensive for the government and may not be viable over an extended period. Therefore, it’s important to balance promoting the EV industry and ensuring the stability and sustainability of the subsidy program.

It is also essential to take the influence of the subsidy policy on the environment into consideration. While EVs are generally considered more environmentally friendly than traditional gasoline-powered vehicles, producing EV batteries and the electricity used to charge them can still have significant environmental impacts. Therefore, the government should consider incorporating environmental goals into the subsidy policy, for instance, encouraging the use of renewable energy sources to power EVs and promoting the recycling and responsible disposal of EV batteries.

Considering the significance of innovation and competition is also crucial in promoting the development of the EV industry. While subsidies can encourage the adoption of existing EV models, they may not be as effective in promoting innovation and competition in the industry. Therefore, the government could consider other policy tools, such as research and development funding, tax incentives, or regulatory reforms, to promote innovation and competition in the EV industry. The official should also be prepared to Slowly reduce subsidies, such as those for electric cars, which incentivizes firms to develop technology steadily on their own .

Overall, improving China’s EV consumer subsidy policy will require a comprehensive approach that balances promoting the EV industry with ensuring the subsidy program’s sustainability, considers the industry’s environmental impacts, promotes innovation and competition, and addresses broader societal impacts.

5. Conclusion

China's consumption subsidy policy was a pivotal character in the growth of the domestic electric vehicle (EV) market, with companies such as BYD reaping the benefits. The subsidies have effectively reduced the cost of EVs, stimulated consumer demand, and fostered the development of the industry. As a prominent EV manufacturer in China, partly fueled by government incentives, BYD has seen considerable expansion in both its EV sales and market share.

Nevertheless, the EV subsidy policy encounters several challenges, including instances of fraud, unequal distribution of subsidies, and concerns regarding the program's long-term sustainability. To tackle these issues, the government could contemplate altering the subsidy structure to better encourage the development of larger, high-performance EVs. Furthermore, introducing long-term planning and policy stability, allocating subsidies for charging infrastructure development, and fostering innovation and competition within the EV industry can help overcome these obstacles.

In conclusion, while the EV subsidy policy has been instrumental in promoting the expansion of China's domestic electric vehicle market, there is still room for improvement to ensure the policy's sustainability and effectiveness in the long run. By addressing these challenges and seizing opportunities, China's EV industry can continue to flourish and contribute to the nation's economic and environmental objectives. This can be achieved by continually refining and optimizing the subsidy policy, investing in infrastructure, and encouraging innovation to maintain a thriving, competitive market.

References

[1]. EV volumes.com, China NEV Sales for 2019 Q3, October, (2021), 2023/3/14 https://www.ev-volumes.com/country/china/.

[2]. Shenzhen stock exchange, BYD Monthly Production and Sales Report for December 2022, (2023/1/03), 2023/3/14 http://www.szse.cn/disclosure/listed/bulletinDetail/index.html?d5ca1309-9220-41ee-861a-fc49dbdfb174 .

[3]. Masiero, G., Ogasavara, M., Jussani, A., Risso, M.: Electric vehicles in China: BYD strategies and government subsidies. RAI Revista de Administração e Inovação (2016).

[4]. Sun, Y., Yue, J., Su. B.: Impact of government subsidy on the optimal R&D and advertising investment in the cooperative supply chain of new energy vehicles. Energy policy, (2022).

[5]. Jin, S.: An Analysis of the Influence of New Guidelines for Government Subsidies on China’s New Energy Automobile Industry--A Case Study of BYD. IOP Conference Series: Earth and Environmental Science (2019).

[6]. State information center, Where will China’s new energy vehicles go as subsidies decline?, (2018/3/28), 2023/3/14, http://www.sic.gov.cn/News/457/8915.htm .

[7]. BYD, BYD Co., Ltd. 2020 and 2019 Annual Report (Printed Version), (2021/3/29), 2023/3/14, https://www.bydglobal.com/sitesresources/common/tools/generic/web/viewer.html?file=%2Fsites%2FSatellite%2FBYD%20PDF%20Viewer%3Fblobcol%3Durldata%26blobheader%3Dapplication%252Fpdf%26blobkey%3Did%26blobtable%3DMungoBlobs%26blobwhere%3D1600575181734%26ssbinary%3Dtrue.

[8]. People.cn, 2023/3/14, What does a non-complete list of new energy vehicle subsidy cheating mean?, http://auto.people.com.cn/n1/2016/0911/c1005-28706880.html last accessed 2016/9/11

[9]. Sun, X.: The impact of government subsidies on innovation and performance of new energy vehicle industry (2021)

[10]. China association of automobile industry, 2023/3/14, Several car companies are suspected of cheating on new energy subsidies and investigation results will be announced, http://www.caam.org.cn/chn/9/cate_107/con_5191185.html.

Cite this article

Fu,Y. (2023). The Influence of Consumption Subsidy Policy on China’s Domestic Electric Vehicle Market -- Take BYD as Example. Advances in Economics, Management and Political Sciences,23,178-186.

Data availability

The datasets used and/or analyzed during the current study will be available from the authors upon reasonable request.

Disclaimer/Publisher's Note

The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of EWA Publishing and/or the editor(s). EWA Publishing and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content.

About volume

Volume title: Proceedings of the 2023 International Conference on Management Research and Economic Development

© 2024 by the author(s). Licensee EWA Publishing, Oxford, UK. This article is an open access article distributed under the terms and

conditions of the Creative Commons Attribution (CC BY) license. Authors who

publish this series agree to the following terms:

1. Authors retain copyright and grant the series right of first publication with the work simultaneously licensed under a Creative Commons

Attribution License that allows others to share the work with an acknowledgment of the work's authorship and initial publication in this

series.

2. Authors are able to enter into separate, additional contractual arrangements for the non-exclusive distribution of the series's published

version of the work (e.g., post it to an institutional repository or publish it in a book), with an acknowledgment of its initial

publication in this series.

3. Authors are permitted and encouraged to post their work online (e.g., in institutional repositories or on their website) prior to and

during the submission process, as it can lead to productive exchanges, as well as earlier and greater citation of published work (See

Open access policy for details).

References

[1]. EV volumes.com, China NEV Sales for 2019 Q3, October, (2021), 2023/3/14 https://www.ev-volumes.com/country/china/.

[2]. Shenzhen stock exchange, BYD Monthly Production and Sales Report for December 2022, (2023/1/03), 2023/3/14 http://www.szse.cn/disclosure/listed/bulletinDetail/index.html?d5ca1309-9220-41ee-861a-fc49dbdfb174 .

[3]. Masiero, G., Ogasavara, M., Jussani, A., Risso, M.: Electric vehicles in China: BYD strategies and government subsidies. RAI Revista de Administração e Inovação (2016).

[4]. Sun, Y., Yue, J., Su. B.: Impact of government subsidy on the optimal R&D and advertising investment in the cooperative supply chain of new energy vehicles. Energy policy, (2022).

[5]. Jin, S.: An Analysis of the Influence of New Guidelines for Government Subsidies on China’s New Energy Automobile Industry--A Case Study of BYD. IOP Conference Series: Earth and Environmental Science (2019).

[6]. State information center, Where will China’s new energy vehicles go as subsidies decline?, (2018/3/28), 2023/3/14, http://www.sic.gov.cn/News/457/8915.htm .

[7]. BYD, BYD Co., Ltd. 2020 and 2019 Annual Report (Printed Version), (2021/3/29), 2023/3/14, https://www.bydglobal.com/sitesresources/common/tools/generic/web/viewer.html?file=%2Fsites%2FSatellite%2FBYD%20PDF%20Viewer%3Fblobcol%3Durldata%26blobheader%3Dapplication%252Fpdf%26blobkey%3Did%26blobtable%3DMungoBlobs%26blobwhere%3D1600575181734%26ssbinary%3Dtrue.

[8]. People.cn, 2023/3/14, What does a non-complete list of new energy vehicle subsidy cheating mean?, http://auto.people.com.cn/n1/2016/0911/c1005-28706880.html last accessed 2016/9/11

[9]. Sun, X.: The impact of government subsidies on innovation and performance of new energy vehicle industry (2021)

[10]. China association of automobile industry, 2023/3/14, Several car companies are suspected of cheating on new energy subsidies and investigation results will be announced, http://www.caam.org.cn/chn/9/cate_107/con_5191185.html.