1. Introduction

The rapid development of the Internet is changing the competitive pattern of the traditional financial market from many aspects and angles. And major e-commerce platforms have become necessary providers of financial services in the Internet era. In recent years, with the improvement of social and economic levels, various consumptive needs of consumers can no longer be satisfied by traditional consumption methods. So, the number of consumptions through the Internet is increasing yearly among all consumption types. In this background, major e-commerce platforms and most Internet companies have started credit businesses. This credit business can combine traditional credit lending services with the convenience of Internet finance. It launches a variety of online credit lending products with a large number, convenience, and speed. And fill the gap of the small loan market not covered by traditional credit lending products. This has impacted transforming the consumer financial services system, arousing public concern and bringing new challenges to financial regulation. However, as an emerging financial service, the impact of online credit lending on consumers' overspending decisions could be more precise and needs further research and exploration.

Therefore, this study will explore and analyze the example of micro and small online credit services which provided by Internet businesses to individuals. Firstly, this study summarizes the literature in this area. Secondly, this study will investigate the extent of overspending among the general public and conduct a regression analysis. We will use data analysis software through a matrix scale to find the relationship between each indicator and the willingness to overspend and finally draw relevant conclusions. The findings of this study will provide practical information for financial institutions, government agencies and consumers. And this will help better understand the impact of online credit lending on consumer behavior. In this way, it will benefit governments to develop more scientific and economic policies and consumers to establish more scientific consumption habits.

2. Literature Review

Various scholars have made several qualitative studies on online credit and overspending, raised relevant issues, and used several interdisciplinary research methods to analyze the current situation. This study will provide an overview of the relevant literature.

2.1. Overview of Research on Overspending

For the issue of overconsumption, many scholars have conducted research on the current overconsumption problem among college students. Liu Zile et al. believes that platform competition, the influence of the family consumption concept, and personal control problems lead to the problems of poor purposefulness and susceptibility to consumption inducement of college students' overconsumption [1]. In addition, Li Weixin and Li Dongni et al. explored the significant influencing factors for college students to overspend [2]. Yuan Weiqiang and Yu Tao also concluded that there is an irrational problem of overspending by college students. They are not only induced by the consumer market but also influenced by external factors such as family [3]. This has the same conclusion as the two studies mentioned earlier. And it shows visible commonalities in the problem of overconsumption among college students.

In addition to the research on college students' overspending behavior, some scholars have also studied the influence of psychological accounts on overspending. Zhang Junyi explored the current status of research on psychological accounts and overspending and proposed future perspectives for scholars of overspending research [4]. More in-depth than that, Liu Jiaxi used an empirical model to analyze the irreplaceable psychological budget that significantly promotes the rational overspending model [5].

2.2. Overview of Internet Credit Research

Some scholars have summarized the characteristics of Internet credit products through their research and experience with online credit on the Internet. They found the pernicious features such as solid homogeneity and compulsive propaganda. Generally, college students with less family wealth and higher risk appetite are likelier to use Internet credit [6]-[8]. This tends to make college students more likely to fall into the vicious cycle of borrowing money-spending money-repaying money-borrowing money again. Therefore, online credit products are very harmful to college students.

Online credit is also equally risky for lending platforms. The general risks include lousy debt risk, overdue risk, security risk, and payment risk. Therefore, the platform needs to strengthen the qualification review of customers. They should lend more to users with high credit ratings and those under 20 and over 55. Occupational, educational, and income factors are all significantly associated with users' willingness to use online credit. These measures can help platforms speed up approvals and eliminate customers at risk of default [8]-[10].

2.3. Overview of Research Combining Online Credit Lending and Overspending Decisions

According to Liu Jinzhi and Wen Xiao, in the context of the popularity of the Internet, online credit lending products have emerged and have quickly become an essential part of Internet finance [11]. Many college students have favored consumer credit products because of their convenience and on-demand borrowing advantages. More and more college students are overspending through these consumer credit products [11].

Based on this, Chen Lina found that there is a problem of excessive borrowing in the current consumption of college students. This lead to the increasing alienation of college students' consumption [12]. She found that "lack of consumer education among college students," "deteriorating consumer environment among college students," and "insufficient development of college students themselves" are the factors [12].

Unlike Chen Lina, Yue Shangren and Hong You studied the psychological factors that motivate Chinese college students to overspend through credit products. They found the main psychological factors leading to the use of such credit products. The factors were underestimating the objective financial risks of overspending and overestimating others' evaluation of their consumption behavior [13].

In addition, Sun Zhaoming and Li Xinyang studied the relationship between college students' overspending and Internet consumer credit behavior. They argued that the Internet Society had redefined college students' consumption channels. And Internet consumer credit tools have met the market demand and supported the demand for overspending [14].

On the other hand, Zhang Chi and Wang Mancang found that credit constraints significantly inhibited residents' consumption levels. In contrast, with the rapid development of digital finance, residents' credit constraints were alleviated, thus indirectly promoting increased residents' consumption [15].

2.4. Literature Summary and Analysis

By summarizing and organizing the studies related to online credit and overspending, it can be seen that overspending by college students has become extremely common in recent years. In contrast, some college students have started to take online credit. And psychological accounts can influence overspending by the general population. Currently, these studies are adequate, but the concept of the online credit model and the overspending decision needs to be clearly defined. This results in few studies on the influence of the online credit model on the overspending decision.

This study considers the online credit model as the counterpart to the traditional lending model, in which credit is taken out through the Internet. The overspending decision is the decision of the public to decide whether to overspend and the amount of overspending. The public will collect and organize information on various loan consumption modes. Then they will make a judgment on their own risk tolerance and consumption level. This study will explore the factors influencing the online credit loan model on the public's overspending decision.

3. Research Design

3.1. Data Sources

To investigate the influence of online credit models on public excessive consumption, a survey questionnaire was utilized to collect pertinent data. The questionnaire employed a Likert scale to gauge the extent of excessive consumption, ranging from extremely unsatisfied to extremely satisfied. It primarily solicited feedback from the public regarding the excessive consumption level under the influence of credit line, repayment period, loan interest rates, loan eligibility, and loan convenience. A total of 207 questionnaires were distributed and subsequently collected, with 207 valid samples acquired after evaluating their effectiveness.

3.2. Main Variables

The online credit loan model, which versus the traditional loan model, serves as the independent variable in this study. Specifically, the effects of online credit on excessive consumption are evaluated based on five dimensions, namely, repayment period, credit line, loan interest rate, loan eligibility, and loan convenience.

The dependent variable in this study is the public's decision to engage in excessive consumption. This decision is determined by the public's assessment of various loan models, their risk tolerance, and their desired consumption level. Ultimately, this leads to a decision on whether to engage in excessive consumption and to what extent.

Furthermore, the study includes several control variables, including gender, age, occupation, location, monthly income, and monthly expenditure. These variables are considered in order to minimize the potential influence of extraneous factors and to help ensure that any observed effects are solely attributable to the independent variable.

3.3. Research Methods

3.3.1. Reliability Analysis

To evaluate the validity of hypothesis testing and goodness of fit, a reliability test was performed on the questionnaire design in this study. Specifically, Cronbach's alpha was employed to assess the consistency of the 5 independent variables and 1 dependent variable across a total of 6 dimensions in each questionnaire item. This process was undertaken to ensure the accuracy and reliability of the questionnaire design.

3.3.2. Validity Analysis

Validity testing is primarily employed to evaluate the soundness of the questionnaire's structure. This study performed KMO and Bartlett's tests on the final questionnaire after modifying the questions. The aim of these tests was to assess the appropriateness of the questionnaire's design and to ensure that the data collected were suitable for subsequent analysis.

3.3.3. Multiple Linear Regression

In this study, a multiple linear regression analysis was employed to model the relationship between the dependent variable, “The degree of excessive consumption (Y)”, and five independent variables, namely, “The degree of influence of credit line on excessive consumption (X1)”, “The degree of influence of repayment period on excessive consumption (X2)”, “The degree of influence of loan interest rate on excessive consumption (X3)”, “The degree of influence of loan eligibility on excessive consumption (X4)” and “The degree of influence of loan convenience on excessive consumption (X5)”. This approach was used to assess the impact of each independent variable on the dependent variable, with the aim of gaining a deeper understanding of the factors that influence excessive consumption behaviors.

3.3.4. Regression Diagnostics

After conducting multiple linear regression modeling, this study will examine four fundamental assumptions of linear regression: normality, independence, linearity, and equal variance. The aim of this analysis is to evaluate the extent to which these assumptions hold true for the collected data, thereby ensuring the validity and reliability of the regression results.

3.3.5. Research Tools

The data analysis and testing in this study will be performed using both SPSS and R STUDIO.

3.4. Research Hypothesis

Drawing on the literature review presented in Section 2.4, this study puts forth the following two hypotheses:

Hypothesis 1: A correlation exists between the online credit loan model and the public's decision to engage in excessive consumption.

Hypothesis 2: There is a positive correlation between the online credit loan model and the public's decision to engage in excessive consumption. Specifically, the hypothesis proposes that as credit line increases, repayment periods lengthen, loan interest rates decrease, loan eligibility becomes more accessible, and loan convenience improves, the public's readiness to pursue excessive consumption will increase correspondingly.

4. Data Analysis and Verification

4.1. Sample Description

The basic information of the samples are as follows Table 1:

Table 1: Sample basic information.

Variable | Index | Sample Size | Proportion | |||

Gender | Male | 105 | 50.72% | |||

Female | 102 | 49.28% | ||||

Age | 18~25 | 6 | 2.90% | |||

26~35 | 71 | 34.30% | ||||

36~45 | 52 | 25.12% | ||||

46~55 | 61 | 29.47% | ||||

56 above | 17 | 8.21% | ||||

District | First-tier City | 16 | 7.73% | |||

Second-tier City | 22 | 10.63% | ||||

Third-tier City | 70 | 33.82% | ||||

Other | 99 | 47.83% | ||||

Monthly Income (RMB) | 2000 below | 8 | 3.86% | |||

2001~4000 | 11 | 5.31% | ||||

Table 1: (continued). | ||||||

4001~6000 | 97 | 46.86% | ||||

6001~8000 | 55 | 26.57% | ||||

8001~10000 | 22 | 10.63% | ||||

10001 above | 10 | 4.83% | ||||

No income | 4 | 1.93% | ||||

Monthly Expenditure (RMB) | 2000 below | 18 | 8.70% | |||

2001~4000 | 63 | 30.43% | ||||

4001~6000 | 73 | 35.27% | ||||

6001~8000 | 38 | 18.36% | ||||

8001~10000 | 13 | 6.28% | ||||

10001 above | 2 | 0.97% | ||||

4.2. Reliability Analysis

Cronbach's alpha was employed in this step to assess the consistency of the 5 independent variables and 1 dependent variable across a total of 6 dimensions in each questionnaire item. Reliability analysis results are as follows:

Table 2: Reliability statistics.

Dimensions | Standardized Cronbach's alpha | Number of questions after adjusted |

The degree of excessive consumption | 0.959 | 10 |

The degree of influence of credit line on excessive consumption | 0.951 | 9 |

The degree of influence of repayment period on excessive consumption | 0.955 | 9 |

The degree of influence of loan interest rate on excessive consumption | 0.948 | 8 |

The degree of influence of loan eligibility on excessive consumption | 0.947 | 7 |

The degree of influence of loan convenience on excessive consumption | 0.944 | 8 |

As presented in Table 2 Reliability Statistics, the Standardized Cronbach's alpha values for all six dimensions of the questionnaire exceed 0.9, implying a high level of internal consistency and reliability.

4.3. Validity Analysis

After Reliability analysis, this study performed KMO and Bartlett's tests on the final questionnaire after modifying the questions. Validity analysis results are as follows:

Table 3: KMO and Bartlett's test.

Kaiser-Meyer-Olkin Measure of Sampling Adequacy | 0.987 | |

Bartlett's test of Sphericity | Approx. Chi-Square | 12074.878 |

df | 1275 | |

Sig. | 0.000 | |

Table 3 KMO and Bartlett's test results reveal that the Kaiser-Meyer-Olkin measure of sampling adequacy for the questionnaire is 0.987, which exceeds the recommended threshold of 0.9, indicating high suitability for factor analysis. Additionally, the Bartlett's test of sphericity has a significance level of 0.000, which is lower than the typical alpha level of 0.05, signifying that the correlations between the questionnaire items are sufficiently large to support factor analysis. These outcomes suggest that after necessary adjustments to the questionnaire items, the questionnaire demonstrates good structural validity.

4.4. Model Development and Regression Analysis

Placing all data into the model, a multiple linear regression analysis was conducted, and the regression results are as follows:

Table 4: Linear regression.

Estimate | Std Error | t | P | |

Intercept | 0.054 | 0.059 | 0.919 | 0.359 |

The degree of influence of credit line on excessive consumption (X1) | 0.201 | 0.064 | 3.117 | 0.002 |

The degree of influence of repayment period on excessive consumption (X2) | 0.232 | 0.063 | 3.671 | <0.001 |

The degree of influence of loan interest rate on excessive consumption (X3) | 0.308 | 0.061 | 5.037 | <0.001 |

The degree of influence of loan eligibility on excessive consumption (X4) | 0.168 | 0.061 | 2.767 | 0.006 |

The degree of influence of loan convenience on excessive consumption (X5) | 0.089 | 0.061 | 1.442 | 0.151 |

Based on the linear regression in Table 4, it is evident that the independent variables X1 and X3 have a highly significant impact on the dependent variable Y (P<0.001). Furthermore, the independent variables X1 and X4 also have a significant impact on the dependent variable Y (P<0.01). However, the regression results indicate that the significance level of the independent variable X5 is 0.151, which is greater than 0.05. Therefore, this variable does not have a statistically significant impact on the dependent variable Y and should be removed.

The regression results after removing the impact of "The degree of influence of loan convenience on excessive consumption (X5)" are as follows:

Table 5: Second Linear regression.

Estimate | Std Error | t | P | |||

Intercept | 0.060 | 0.059 | 1.007 | 0.315 | ||

The degree of influence of credit line on excessive consumption (X1) | 0.223 | 0.063 | 3.563 | <0.001 | ||

The degree of influence of repayment period on excessive consumption (X2) | 0.257 | 0.061 | 4.216 | <0.001 | ||

The degree of influence of loan interest rate on excessive consumption (X3) | 0.327 | 0.060 | 5.480 | <0.001 | ||

The degree of influence of loan eligibility on excessive consumption (X4) | 0.187 | 0.059 | 3.146 | 0.002 | ||

After conducting a second linear regression analysis on the data from Table 5, we arrived at the final predictive equation:

Y = 0.223X1+0.257X2+0.327X3+0.187X4+0.060 (1)

The variance in the degree of overspending (Y) is explained up to 95% by these four variables, all of which are significant (P<0.05). Specifically, the impact of loan amount, repayment period, and loan interest rate on overspending are highly significant (P<0.001), with each variable increasing overspending by an average of 0.223, 0.257, and 0.327, respectively, per unit increase. The intercept term is 0.060, indicating that when all other independent variables are equal to zero and no other factors influence it, the degree of overspending (Y) is 0.060.

4.5. Regression Diagnosis

4.5.1. Normality Test

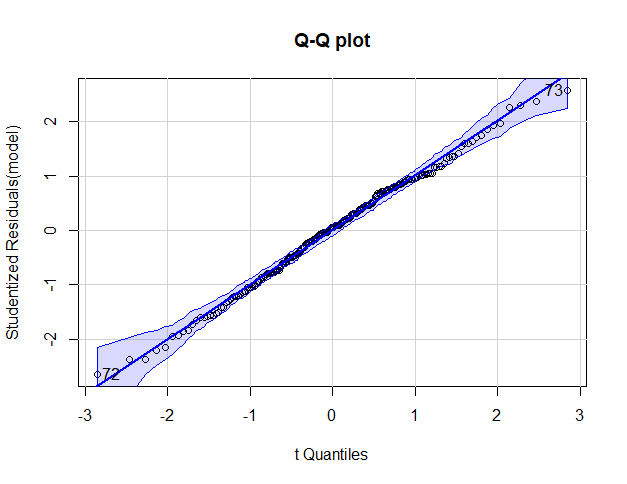

This study conducted a normality test on the residuals of the regression model using a QQ plot, and the results are shown in the following figure:

Figure 1: Q-Q plot (Photo credit: Original). |

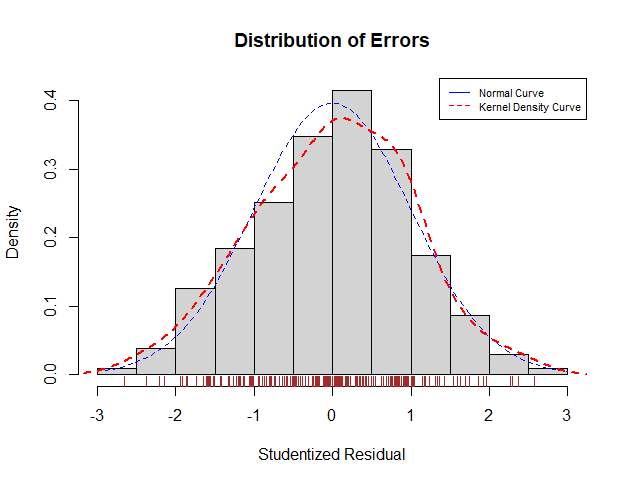

Figure 2: Column density plot(Photo credit: Original). |

Based on the Q-Q plot in Fig. 1, it can be observed that almost all points fall on the y=x line, indicating that the residuals of the model are normally distributed. To further verify the normality assumption, we will plot a density graph:

From the histogram chart in Fig. 2, it can be observed that the residuals of the model closely resemble a normal distribution. This indicates that our model satisfies the assumption of normality.

4.5.2. Independence Assumption

For the independence test of errors, this study utilized the 'Durbin-Watson function' from the R car package to conduct the test, and the results are presented below:

Table 6: Durbin-Watson testing

Autocorrelation | D-W Statistic | P |

-0.064 | 2.128 | 0.39 |

The null hypothesis of the Durbin-Watson test is that errors are independent. According to Table 6, the Durbin-Watson test shows a non-significant P-value (P > 0.1), indicating that there is no autocorrelation among errors and that they are independent of each other.

4.5.3. Linear Hypothesis Testing

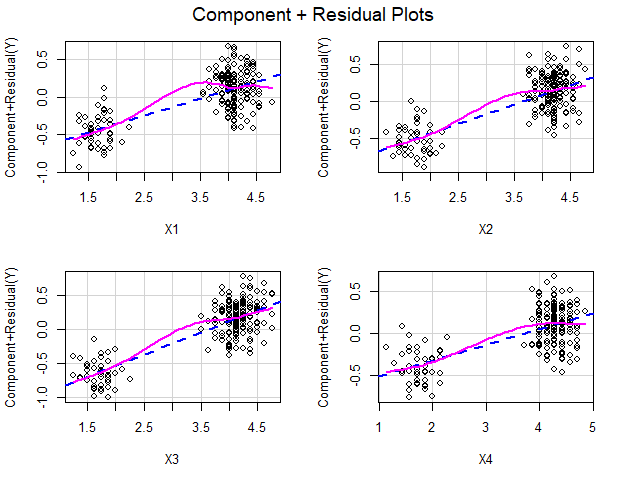

This study utilized component residual plots to examine the linearity between the dependent variable and the independent variable, using the ‘crPlots' function from the car package. The results are presented below:

Figure 3: Component residual plots (Photo credit: Original).

From the residual plot in Fig. 3, it can be observed that these independent variables largely conform to the linear assumption, indicating that the linear model is appropriate for the dataset.

4.5.4. Homoskedasticity Test

Homoscedasticity is a statistical test used to check whether the variances are equal for different values of the dependent variable. In this study, the ‘ncvTest' function from the ‘car' package was chosen to test for homoscedasticity. The ‘ncvTest' function produces a score test, with the null hypothesis being that the error variance is constant, and the alternative hypothesis being that the error variance changes with the level of fitted values. The test results are presented below:

Table 7: Non-constant error variance fractional test.

Chisquare | Df | P |

0.871 | 1 | 0.351 |

According to the non-constant error variance test in Table 7, the p-value for the homoscedasticity test is 0.351, which is greater than 0.1. This suggests that the model complies with the homoscedasticity assumption.

4.6. Summary

The final model of this study includes four independent variables - " The degree of influence of credit line on excessive consumption", " The degree of influence of repayment period on excessive consumption", " The degree of influence of loan interest rate on excessive consumption" and " The degree of influence of loan eligibility on excessive consumption" - which can effectively predict the dependent variable " The degree of excessive consumption" The model achieves an explanatory power of 95.17% in terms of variance, and does not violate the four linear assumptions specified in Section 3.2. All four independent variables in the model are significant, and their regression coefficients are positive, indicating that all four independent variables have a positive impact on the degree of overspending.

Therefore, it can be concluded that both hypothesis one and hypothesis two are valid, that is, there is a positive correlation between online credit models and mass forward consumption decisions. Additionally, the higher the loan amount, the longer the repayment period, the lower the loan interest rate, and the easier the loan eligibility, the greater the public's willingness to engage in forward consumption. The convenience of obtaining a loan does not have a statistically significant impact on the level of forward consumption.

5. Conclusion

Currently, there is a wealth of research on overspending and credit consumption, but there is little research on the impact of online credit models on overspending decisions. Therefore, this study focuses on the public and uses quantitative research methods to explore the influence of online credit models on the overspending decisions of the general public. Among the five independent variables involved in this study, four have a significant impact on the dependent variable. This study establishes a model that can predict whether users of online credit companies tend to overspend and to what extent, thereby improving the success rate of online lending businesses. This model can help online credit companies save time and resources, avoid harassing users who are unlikely to overspend, and better serve customers with overspending needs. This approach can not only improve platform performance and profits but also reduce the negative effects of harassing users. Based on these findings, the results of this study will help government agencies formulate more scientific economic policies to promote the healthy development of financial markets. Additionally, this study will also help consumers establish more scientific spending habits to avoid falling into the trap of high-interest loans. However, there are limitations to this study, such as the use of only a linear regression model, which is relatively ordinary and singular. Future research could consider using more advanced machine learning models to improve the model's performance.

References

[1]. Liu Zile, Liu Dongyu, Liu Yao, Xia Yuting & Xia Yujia.(2019). The characteristics and causes of college students' excessive consumption behavior in Wuhan. Journal of Entrepreneurship in Science & Technology (04),33-38.

[2]. Li Weixin, Li Dongni, & Yao Lu.(2022). Research on the status quo and influencing factors of college students' excessive consumption. Statistics and Application, 11, 809.

[3]. Yuan Weiqiang & Yu Tao.(2012). Research on the status quo and countermeasure of excessive consumption of contemporary college students. The world of mass literature (09),289-290.

[4]. Zhang Junyi.(2020). Research review on mental accounts and excessive consumption. Economic Research Guide (12),48-50.

[5]. Liu Jiaxi.(2021). The mechanism of psychological account on rational excessive consumption pattern from the perspective of consumer socialization. Journal of Commercial Economics (23),54-57.

[6]. Tang Kenan & He Tianyang.(2022). The harm, formation logic and countermeasure of the chaos of Internet credit. Economic Research Guide (21),102-104.

[7]. Zheng Hanyu, Huang Xiaoya & Chen Yu.(2022). The Impact of Internet Credit on College Students' Consumption——Analysis from the Two Perspectives of Liquidity Constraint and Risk Preference. China Journal of Commerce (14),59-62. doi:10.19699/j.cnki.issn2096-0298.2022.14.059.

[8]. Liu Wenqian.(2021). Research on the Influencing Factors of Internet Financial credit products -- Take Ant Check Later As an example. https://kns.cnki.net/KCMS/detail/detail.aspx?dbname=CMFD202102&filename=1021065561.nh

[9]. Wu Yuping & Yuan Limei.(2021). Systematic Research on User Behavior Analysis of Internet Credit Platform. Computer Programming Skills & Maintenance (10),54-56. doi:10.16184/j.cnki.comprg.2021.10.021.

[10]. Chen Shunquan, Xiao Yu & Zhang Yuhong.(2019). Risk control of online lending and borrowing business. Co-Operative Economy & Science (23),50-51. doi:10.13665/j.cnki.hzjjykj.2019.23.020.

[11]. Liu Jinzhi & Xiao Wen.(2022). Research on the influence of Internet consumer credit on college students' excessive consumption behavior -- Based on the questionnaire data analysis of four colleges in H City. Legality Vision (31),14-17.

[12]. Chen Lina.(2021). Study on the Dissimilation of College Students' Consumption Concept——Taking Campus Loan as an Example.https://kns.cnki.net/KCMS/detail/detail.aspx?dbname=CMFD202202&filename=1021839616.nh

[13]. Yue Shangren & Hong You.(2020). Research on college students' excessive consumption psychology using Credit products -- taking Hangzhou Normal University as an example. Marketing Circles (08),94-96.

[14]. Sun Zhaoming & Li Xinyang.(2022). Consumer socialization, excessive consumption and online credit consumption behavior of college students. Mathematics in Practice and Theory (12),15-29.

[15]. Zhang Chi, Wang Mancang & Li Cuini.(2022). Credit Constraint, Digital Finance and Resident Consumption. Journal of Statistics and Information (12),55-65.

Cite this article

Chen,Y.;Fan,H.;Huang,Y. (2023). The Impact of Online Credit Lending Model on the Public's Overspending Decision. Advances in Economics, Management and Political Sciences,24,60-70.

Data availability

The datasets used and/or analyzed during the current study will be available from the authors upon reasonable request.

Disclaimer/Publisher's Note

The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of EWA Publishing and/or the editor(s). EWA Publishing and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content.

About volume

Volume title: Proceedings of the 2023 International Conference on Management Research and Economic Development

© 2024 by the author(s). Licensee EWA Publishing, Oxford, UK. This article is an open access article distributed under the terms and

conditions of the Creative Commons Attribution (CC BY) license. Authors who

publish this series agree to the following terms:

1. Authors retain copyright and grant the series right of first publication with the work simultaneously licensed under a Creative Commons

Attribution License that allows others to share the work with an acknowledgment of the work's authorship and initial publication in this

series.

2. Authors are able to enter into separate, additional contractual arrangements for the non-exclusive distribution of the series's published

version of the work (e.g., post it to an institutional repository or publish it in a book), with an acknowledgment of its initial

publication in this series.

3. Authors are permitted and encouraged to post their work online (e.g., in institutional repositories or on their website) prior to and

during the submission process, as it can lead to productive exchanges, as well as earlier and greater citation of published work (See

Open access policy for details).

References

[1]. Liu Zile, Liu Dongyu, Liu Yao, Xia Yuting & Xia Yujia.(2019). The characteristics and causes of college students' excessive consumption behavior in Wuhan. Journal of Entrepreneurship in Science & Technology (04),33-38.

[2]. Li Weixin, Li Dongni, & Yao Lu.(2022). Research on the status quo and influencing factors of college students' excessive consumption. Statistics and Application, 11, 809.

[3]. Yuan Weiqiang & Yu Tao.(2012). Research on the status quo and countermeasure of excessive consumption of contemporary college students. The world of mass literature (09),289-290.

[4]. Zhang Junyi.(2020). Research review on mental accounts and excessive consumption. Economic Research Guide (12),48-50.

[5]. Liu Jiaxi.(2021). The mechanism of psychological account on rational excessive consumption pattern from the perspective of consumer socialization. Journal of Commercial Economics (23),54-57.

[6]. Tang Kenan & He Tianyang.(2022). The harm, formation logic and countermeasure of the chaos of Internet credit. Economic Research Guide (21),102-104.

[7]. Zheng Hanyu, Huang Xiaoya & Chen Yu.(2022). The Impact of Internet Credit on College Students' Consumption——Analysis from the Two Perspectives of Liquidity Constraint and Risk Preference. China Journal of Commerce (14),59-62. doi:10.19699/j.cnki.issn2096-0298.2022.14.059.

[8]. Liu Wenqian.(2021). Research on the Influencing Factors of Internet Financial credit products -- Take Ant Check Later As an example. https://kns.cnki.net/KCMS/detail/detail.aspx?dbname=CMFD202102&filename=1021065561.nh

[9]. Wu Yuping & Yuan Limei.(2021). Systematic Research on User Behavior Analysis of Internet Credit Platform. Computer Programming Skills & Maintenance (10),54-56. doi:10.16184/j.cnki.comprg.2021.10.021.

[10]. Chen Shunquan, Xiao Yu & Zhang Yuhong.(2019). Risk control of online lending and borrowing business. Co-Operative Economy & Science (23),50-51. doi:10.13665/j.cnki.hzjjykj.2019.23.020.

[11]. Liu Jinzhi & Xiao Wen.(2022). Research on the influence of Internet consumer credit on college students' excessive consumption behavior -- Based on the questionnaire data analysis of four colleges in H City. Legality Vision (31),14-17.

[12]. Chen Lina.(2021). Study on the Dissimilation of College Students' Consumption Concept——Taking Campus Loan as an Example.https://kns.cnki.net/KCMS/detail/detail.aspx?dbname=CMFD202202&filename=1021839616.nh

[13]. Yue Shangren & Hong You.(2020). Research on college students' excessive consumption psychology using Credit products -- taking Hangzhou Normal University as an example. Marketing Circles (08),94-96.

[14]. Sun Zhaoming & Li Xinyang.(2022). Consumer socialization, excessive consumption and online credit consumption behavior of college students. Mathematics in Practice and Theory (12),15-29.

[15]. Zhang Chi, Wang Mancang & Li Cuini.(2022). Credit Constraint, Digital Finance and Resident Consumption. Journal of Statistics and Information (12),55-65.