1. Introduction

Tesla and BYD are two of the most recognized brands in the electric vehicle (EV) sector, which has been revolutionized in recent years by the popularity of EV technology [1]. The success of these two companies is a direct result of their use of forward-thinking technology and business strategies that set them apart from their competitors. Both companies aim to lead the transition to sustainable transportation. Despite operating in the same industry, these companies have different corporate strategies that differentiate them in various areas. Previous research on Tesla and BYD has focused on various aspects of their corporate strategies, such as their technological innovations, financial performance, and marketing strategies. For instance, some studies have examined the impact of Tesla’s open-source approach to technology on the electric vehicle market, while others have analyzed BYD’s diversification strategy and its effects on the company’s financial performance [2, 3]. However, relatively little research has been done on a comprehensive comparison of the corporate strategies implemented by the two companies across multiple areas of operations. In contrast, this paper aims to enrich the gaps in this study by providing a detailed comparison of the corporate strategies employed by Tesla and BYD in key business areas. The paper identifies the similarities and differences in their approaches to economic innovation, human resource management, financial resource management, marketing strategy, and the market environment, which have enabled both companies to achieve success in the electric vehicle industry. The research results of this paper are helpful in better understanding the success factors of Tesla and BYD by analyzing their similarities and differences and discovering the unique characteristics of their respective corporate strategies.

2. Economic Innovation

Economic innovation involves several aspects, like developing new products, improving existing products, finding new ways to produce products, and improving production processes. It also involves exploring new markets and business models, as well as adapting to changes in the market and regulatory environment. In the context of the electric vehicle industry, economic innovation is critical for companies to stay competitive and meet the evolving needs of consumers.

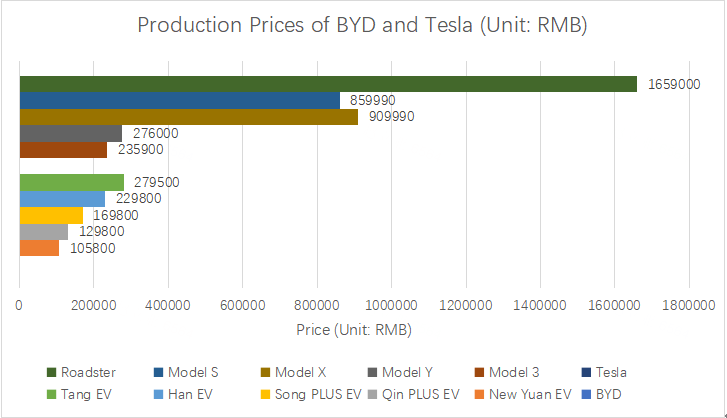

Tesla is a pioneer in the electric vehicle market, focusing on developing innovative technologies to improve the performance and range of electric vehicles. The company’s economic innovation strategy includes significant investment in research and development to bring new products to market quickly [4]. BYD has a broader approach to innovation that focuses on developing sustainable solutions for transportation, energy storage and other industries [5]. The company’s economic innovation strategy includes a focus on research and development as well as the acquisition of intellectual property and technology from other companies. Figure 1 suggests that BYD’s production costs are generally lower than Tesla’s due to its vertical integration of manufacturing processes and use of locally sourced materials. Besides, the main market of BYD is located in China, but Tesla has a more global reach with a significant presence in markets such as the United States, Europe, and China.

Figure 1: Productions prices of BYD and Tesla (Unit: RMB) [2].

Both Tesla and BYD cite economic innovation as a major factor in their respective successes. Technology and research have been leveraged by both companies to achieve their goals of expanding their markets and increasing profits. Tesla has adopted a business strategy of investing heavily in research and development to develop new and groundbreaking products [3]. Because of this, they have been able to develop cutting-edge technologies, such as self-driving cars and battery-powered vehicles, which have played an important role in the company’s success [6]. At the same time, BYD has invested in research and development with the aim of developing novel and cutting-edge products that can both increase productivity and reduce costs. Because of this, the company has been able to consolidate its position as a leader in the electric vehicle and battery storage markets [7].

Both Tesla and BYD have invested in research and development partnerships as part of their efforts to take advantage of the possibilities offered by the technological innovations they develop. To develop cutting-edge technologies, Tesla has formed strategic alliances with other well-known companies such as Panasonic and Daimler [5]. Because of this, the company has been able to quickly broaden the range of products it offers and gain an advantage over its competitors. At the same time, BYD has established partnerships with a number of universities and other research institutions to develop new technologies suitable for inclusion in its products. Because of this, the company has been able to maintain a lead over its competitors and continue to be competitive in the marketplace [8].

In addition to the money invested in research and development, both Tesla and BYD have developed strategies to leverage the technological innovations they have developed. Tesla has made a concerted effort to build a network of collaborators to design and implement its technologies. Because of this, the company has been able to rapidly scale up its production and leverage the full potential of its products [4]. In doing so, BYD has implemented a strategy that involves collaboration and partnerships with suppliers to ensure that its products are of high quality and competitively priced. The company has been able to maintain its competitive position in the market and secure a larger share of the market.

Both Tesla and BYD have invested in research and development partnerships as part of their efforts to take advantage of the possibilities offered by the technological innovations they develop. To develop cutting-edge technologies, Tesla has formed strategic alliances with other well-known companies such as Panasonic and Daimler [5]. Because of this, the company has been able to quickly broaden the range of products it offers and gain an advantage over its competitors. At the same time, BYD has established partnerships with a number of universities and other research institutions to develop new technologies suitable for inclusion in its products. Because of this, the company has been able to maintain a lead over its competitors and continue to be competitive in the marketplace [9].

In addition to the money invested in research and development, both Tesla and BYD have developed strategies to leverage the technological innovations they have developed. Tesla has made a concerted effort to build a network of collaborators to design and implement its technologies. Because of this, the company has been able to rapidly scale up its production and leverage the full potential of its products [4]. In doing so, BYD has implemented a strategy that involves collaboration and partnerships with suppliers to ensure that its products are of high quality and competitively priced. The company has been able to maintain its competitive position in the market and secure a larger share of the market.

3. Human Resources

Simply put, an organization’s human resources are one of the most important factors in determining whether or not it will be successful. This is especially true for Tesla and BYD. Both companies have made great efforts to identify, attract and retain the talent that can guide their respective business efforts [9]. These are just some of the talent acquisition strategies that have been implemented [10]. In addition, both companies offer extensive training and development programs for their employees to ensure that their employees have the skills they need to succeed in business.

Both Tesla and BYD have comprehensive retention strategies in place to keep their employees engaged and motivated. These strategies are based on the aggressive recruitment of top talent. Both Tesla and BYD offer employees opportunities for career advancement, as well as flexible work schedules, competitive wages and benefit packages [11]. Tesla and BYD both provide flexible work schedules and benefit packages, which are highly valued by professionals. For example, Tesla provides health insurance, life insurance, paid parental leave, retirement plans, and wellness programs, while BYD provides a relatively high salary for new graduates in 2022 [9]. They do this to give employees a solid sense of purpose and security in their jobs, which is another aspect of their mission to foster a positive atmosphere in the workplace. In addition, both companies have invested in employee engagement initiatives, such as creating team-based events and recognition programs to ensure their workers feel valued and appreciated [12].

Tesla is known for its demanding workplace, with a stressful work environment that focuses on innovation and efficiency. The company employs a rigorous hiring process to ensure that it hires the best talent in the industry. Tesla also offers stock options and other incentives to motivate and keep its employees engaged. BYD is known for its strong company culture and commitment to employee development [13]. The company invests heavily in training and development programs to ensure that its employees have the necessary skills and knowledge to succeed in their positions. BYD also has a strong focus on work-life balance and has policies in place to support employee health and well-being.

4. Financial Resources

Both Tesla and BYD recognize the importance of having adequate financial resources as a fundamental part of their business strategies. Both companies have made significant investments in their capital allocation strategies to ensure that they have the financial resources they need to pursue their strategic goals. To ensure they have the resources necessary to develop breakthrough electric vehicles and energy storage systems, Tesla has made significant investments in research and development as well as manufacturing and production capabilities [13]. In addition, BYD has taken an aggressive approach to capital allocation, investing in advanced battery and electric vehicle research and development in addition to energy storage systems.

Tesla is known for its financial discipline and focus on controlling costs and generating cash flow. The company has successfully raised capital through public offerings and debt financing, and has a strong balance sheet and large cash reserves. BYD’s business model is more diversified, with operations in energy storage, solar power and electric buses [14]. The company has a strong focus on investing in growth opportunities and has been successful in securing financing through partnerships with major investors.

Both Tesla and BYD have taken a unique approach to managing their respective capital resources. Tesla has taken a long-term view and has directed its investments to ensure the long-term viability of the company. Because of this, they have been able to invest in creating cutting-edge technologies to improve the quality of their products and services. BYD, on the other hand, has taken a short-term focused approach, making investments designed to provide financial returns in the short term [15]. They have been able to quickly capitalize on market opportunities and reap the benefits quickly as a result of this approach. Overall, both companies have implemented effective capital allocation strategies, which have given them the ability to make strategic investments and capitalize on market opportunities.

5. Marketing Strategies

Both Tesla and BYD are driving their respective corporate strategies by leveraging the popularity of their respective brands. To position itself as the dominant player in the electric vehicle market, Tesla has successfully leveraged the brand recognition it has earned. The company has been able to differentiate itself from its competitors due to its forward-thinking design, high-quality products and overall futuristic look [3]. Tesla has been able to promote its corporate strategy of economic innovation, human resource management and financial resource management by leveraging the widespread recognition of its brand.

Tesla is known for its innovative marketing strategy, which relies heavily on word-of-mouth and social media to build its brand. The company has a strong social media presence, and it has a loyal customer base that is passionate about its products. BYD has a more traditional marketing strategy that focuses on building strong relationships with customers and partners [16]. The company has a strong presence in China, where it has built a reputation for reliability and innovation.

In addition, BYD has successfully leveraged the recognition of its brand to promote its corporate strategy. The company has leveraged its brand recognition to emphasize its commitment to environmental sustainability, energy efficiency and low-carbon lifestyles. It has promoted its corporate strategy of economic innovation, human resource management and financial resource management by leveraging the brand recognition it has earned over the years [14].

In terms of marketing strategies, both Tesla and BYD have successfully leveraged their brand awareness to promote their respective corporate strategies. Tesla distinguishes itself from its competitors by emphasizing its forward-thinking design, high-quality products, and overall futuristic appearance. BYD, on the other hand, emphasizes its dedication to environmental sustainability, energy efficiency and low-carbon lifestyles to stand out in the marketplace [11]. By doing so, both companies have been able to attract customers with their cutting-edge products and services and maintain their position as market leaders.

6. Conclusion

A comparison of the corporate strategies employed by Tesla and BYD shows that both companies have implemented a number of cutting-edge strategies to maintain their position as market leaders in the current environment. Both companies have implemented talent recruitment and retention strategies to strengthen their human resources departments and drive economic innovation through the use of technology and research. In addition, both companies have implemented effective capital allocation and strategic marketing strategies to expand their customer base and increase revenues. Both companies have been able to maintain their level of success and continue to outperform their competitors as a direct result. Despite their differences, both companies have been successful in competing in the electric vehicle industry by taking advantage of opportunities in the marketplace and leveraging their respective strengths. While the comparison of corporate strategies between Tesla and BYD is insightful, there are some areas that could be improved or expanded upon. For example, there could be further analysis on the differences in their talent recruitment and retention strategies, and how these strategies have contributed to their success in the electric vehicle industry. Additionally, a deeper examination of their capital allocation and strategic marketing strategies could provide insights into how these companies have been able to expand their customer base and increase revenues. Another area for further research is the comparative analysis of the two companies’ approaches to sustainability and environmental responsibility. Both Tesla and BYD are leaders in the production of electric vehicles, but there may be differences in how they approach sustainable manufacturing, supply chain management, and other environmental initiatives.

Acknowledgement

First of all, I would like to thank the professors and teachers involved in the scientific research project for their help. They have provided me with a lot of thinking directions and suggestions in the field of corporate innovation. I would also like to thank my family for their support in my studies, without their encouragement, I would not be able to accomplish many things.

References

[1]. J.-y. Kwak et al., “TESLA: an extended study of an energy-saving agent that leverages schedule flexibility,” Autonomous agents and multi-agent systems, vol. 28, no. 4, pp. 605-636, 2014, doi: 10.1007/s10458-013-9234-0.

[2]. X. Du and B. Li, “Analysis of Tesla’s Marketing Strategy in China,” in 2021 3rd International Conference on Economic Management and Cultural Industry (ICEMCI 2021), Atlantis Press, pp. 1679-1687. 2021.

[3]. B. Choi, “Technology Development Path of Electric Vehicle (EV) Frontiers: Case Analysis on BYD, Geely & Tesla,” China Studies, vol. 68, pp. 249-282, 2016.

[4]. J.-y. Qian, M.-r. Chen, Z.-x. Gao, and Z.-j. Jin, “Mach number and energy loss analysis inside multi-stage Tesla valves for hydrogen decompression,” Energy, vol. 179, pp. 647-654, 2019, doi: 10.1016/j.energy.2019.05.064.

[5]. J.-h. Liu and Z. Meng, “Innovation model analysis of new energy vehicles: taking Toyota, Tesla and BYD as an example,” Procedia engineering, vol. 174, pp. 965-972, 2017, doi: 10.1016/j.proeng.2017.01.248.

[6]. K. Liu, “Study on Strategic Cost Management of BYD New Energy Vehicles,” Master, Xiangtan University, 2017.

[7]. M. Wei, “An analysis of the strategic cost management of BYD for new energy vehicles,” Times Automotive, no. 10, pp. 72-73, 2021.

[8]. Y. Sheikhnejad, J. Simões, and N. Martins, “Introducing Tesla turbine to enhance energy efficiency of refrigeration cycle,” Energy Reports, vol. 6, pp. 358-363, 2020.

[9]. H. Huang, “Investment Analysis of BYD A New Energy Vehicle Enterprise,” 2022.

[10]. J. Clausen and Y. Olteanu, “New Players in the Automotive Industry: Waymo, Build Your Dreams and Sono Motors,” Tech. Rep, 2021.

[11]. T. An, “The Strategic Group Analysis of BYD New Energy Vehicles From the Perspective of Value Chain,” in 6th Annual International Conference on Social Science and Contemporary Humanity Development (SSCHD 2020), Atlantis Press, pp. 735-740, 2021. doi: 10.2991/assehr.k.210121.146.

[12]. C. Pillot, “The rechargeable battery market and main trends 2014–2025,” in 31st International Battery Seminar & Exhibit, pp. 5-7. 2015.

[13]. J. He, S. Liao, X. Li, and P. Yu, “Research on Marketing Strategy of New energy Vehicles in China,” in 2022 7th International Conference on Social Sciences and Economic Development (ICSSED 2022), Atlantis Press, pp. 853-859. 2022.

[14]. C. Curry, “Lithium-ion battery costs and market,” Bloomberg New Energy Finance, vol. 5, no. 4-6, p. 43, 2017.

[15]. Y. Wang, S. Qin, and C. Zhang, “Tesla’s Supply Chain Vulnerabilities in the Chinese EV Market,” Frontiers, vol. 2, no. 4, 2021.

[16]. Z. Hu and J. Yuan, “China’s NEV market development and its capability of enabling premium NEV: Referencing from the NEV market performance of BMW and Mercedes in China,” Transportation Research Part A: Policy and Practice, vol. 118, pp. 545-555, 2018, doi: 10.1016/j.tra.2018.10.010.

Cite this article

Liu,C. (2023). Comparison of Corporate Strategies Adopted by Tesla and BYD. Advances in Economics, Management and Political Sciences,25,170-175.

Data availability

The datasets used and/or analyzed during the current study will be available from the authors upon reasonable request.

Disclaimer/Publisher's Note

The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of EWA Publishing and/or the editor(s). EWA Publishing and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content.

About volume

Volume title: Proceedings of the 2023 International Conference on Management Research and Economic Development

© 2024 by the author(s). Licensee EWA Publishing, Oxford, UK. This article is an open access article distributed under the terms and

conditions of the Creative Commons Attribution (CC BY) license. Authors who

publish this series agree to the following terms:

1. Authors retain copyright and grant the series right of first publication with the work simultaneously licensed under a Creative Commons

Attribution License that allows others to share the work with an acknowledgment of the work's authorship and initial publication in this

series.

2. Authors are able to enter into separate, additional contractual arrangements for the non-exclusive distribution of the series's published

version of the work (e.g., post it to an institutional repository or publish it in a book), with an acknowledgment of its initial

publication in this series.

3. Authors are permitted and encouraged to post their work online (e.g., in institutional repositories or on their website) prior to and

during the submission process, as it can lead to productive exchanges, as well as earlier and greater citation of published work (See

Open access policy for details).

References

[1]. J.-y. Kwak et al., “TESLA: an extended study of an energy-saving agent that leverages schedule flexibility,” Autonomous agents and multi-agent systems, vol. 28, no. 4, pp. 605-636, 2014, doi: 10.1007/s10458-013-9234-0.

[2]. X. Du and B. Li, “Analysis of Tesla’s Marketing Strategy in China,” in 2021 3rd International Conference on Economic Management and Cultural Industry (ICEMCI 2021), Atlantis Press, pp. 1679-1687. 2021.

[3]. B. Choi, “Technology Development Path of Electric Vehicle (EV) Frontiers: Case Analysis on BYD, Geely & Tesla,” China Studies, vol. 68, pp. 249-282, 2016.

[4]. J.-y. Qian, M.-r. Chen, Z.-x. Gao, and Z.-j. Jin, “Mach number and energy loss analysis inside multi-stage Tesla valves for hydrogen decompression,” Energy, vol. 179, pp. 647-654, 2019, doi: 10.1016/j.energy.2019.05.064.

[5]. J.-h. Liu and Z. Meng, “Innovation model analysis of new energy vehicles: taking Toyota, Tesla and BYD as an example,” Procedia engineering, vol. 174, pp. 965-972, 2017, doi: 10.1016/j.proeng.2017.01.248.

[6]. K. Liu, “Study on Strategic Cost Management of BYD New Energy Vehicles,” Master, Xiangtan University, 2017.

[7]. M. Wei, “An analysis of the strategic cost management of BYD for new energy vehicles,” Times Automotive, no. 10, pp. 72-73, 2021.

[8]. Y. Sheikhnejad, J. Simões, and N. Martins, “Introducing Tesla turbine to enhance energy efficiency of refrigeration cycle,” Energy Reports, vol. 6, pp. 358-363, 2020.

[9]. H. Huang, “Investment Analysis of BYD A New Energy Vehicle Enterprise,” 2022.

[10]. J. Clausen and Y. Olteanu, “New Players in the Automotive Industry: Waymo, Build Your Dreams and Sono Motors,” Tech. Rep, 2021.

[11]. T. An, “The Strategic Group Analysis of BYD New Energy Vehicles From the Perspective of Value Chain,” in 6th Annual International Conference on Social Science and Contemporary Humanity Development (SSCHD 2020), Atlantis Press, pp. 735-740, 2021. doi: 10.2991/assehr.k.210121.146.

[12]. C. Pillot, “The rechargeable battery market and main trends 2014–2025,” in 31st International Battery Seminar & Exhibit, pp. 5-7. 2015.

[13]. J. He, S. Liao, X. Li, and P. Yu, “Research on Marketing Strategy of New energy Vehicles in China,” in 2022 7th International Conference on Social Sciences and Economic Development (ICSSED 2022), Atlantis Press, pp. 853-859. 2022.

[14]. C. Curry, “Lithium-ion battery costs and market,” Bloomberg New Energy Finance, vol. 5, no. 4-6, p. 43, 2017.

[15]. Y. Wang, S. Qin, and C. Zhang, “Tesla’s Supply Chain Vulnerabilities in the Chinese EV Market,” Frontiers, vol. 2, no. 4, 2021.

[16]. Z. Hu and J. Yuan, “China’s NEV market development and its capability of enabling premium NEV: Referencing from the NEV market performance of BMW and Mercedes in China,” Transportation Research Part A: Policy and Practice, vol. 118, pp. 545-555, 2018, doi: 10.1016/j.tra.2018.10.010.