1. Introduction

The tide of the era of financial and tax intelligence has come. With the continuous progress of science and technology, enterprises' financial and tax business processing has gradually shifted to digitalization and informatization. People's requirements for the completion standards and quality of financial and tax work are constantly improving. Enterprises' financial and tax workflow is large, and a lot of manpower is needed to complete various tasks. A variety of financial data makes the error rate and efficiency of manual processing high, and the efficiency of enterprises can not be improved. The intelligent transformation of financial and tax is imminent. Driven by the trend of the times, robotic process automation technology came into being. Because of its high efficiency, stability and accuracy, more enterprises use RPA technology [1]. The application of RPA technology in the field of finance and taxation will create value for enterprises at a deeper level. In finance and tax, there is a certain gap in the research on the specific application of RPA technology in enterprises. This paper takes Sinochem International corporation. as the object of analysis to explore the application effect of RPA technology in enterprise finance and tax. It is found that after Sinochem International applied Price water house Coopers RPA and Deloitte RPA, it has shown significant benefits in the four fiscal and tax business processes and three tax declaration stages.

2. Current Situation of RPA Technology

2.1. Brief Introduction of RPA Technology

The full name of RPA is robot process automation. Because RPA is good at automating some workflows with high repeatability, it is also called a digital labor force [2].

The word RPA appeared in 2000. With the gradual maturity of AI technology and the gradual landing of AI, RPA is also developing and improving. RPA technology has been successfully applied in accounting, finance, e-commerce, logistics, and other fields requiring process automation [3]. Among them, RPA is widely used in finance and taxation. The principle of RPA technology is to input the workflow with the high frequency of manual operation and low-added value into the computer as a program and further automate the process through robots. RPA technology replaces part of the actual labor force with a virtual one. Human value can be better applied to creative work. While improving efficiency, it also reduces costs and creates greater benefits. The productivity of enterprises has been effectively increased [4]. At the same time, RPA has also helped the digital upgrading of enterprises.

2.2. Current Situation Analysis

RPA technology started early abroad, and many well-known institutions including AIG and Allstate introduced RPA technology early. Although RPA technology started late in China, its expansion speed increases with each passing day. With the arrival of the wave of digital intelligence, the application prospect of RPA is promising. The shortage of labor force caused by the aging phenomenon makes the labor cost rise, and the effect of adopting the "crowd tactics" is increasingly weak. At the same time, the increase in per capita workload also increases the error rate. The improvement of intelligent technology, the practical application of RPA technology, and the emergence of the "RPA+AI" innovative model have become the breakthrough to solve this phenomenon.

Nowadays, China is grasping the pace of digital transformation. As a service software tool that can save manpower, RPA technology is being used by more and more enterprises as an effective way to reduce costs and increase efficiency. The application scenario of RPA technology is also expanding. The application growth rate of RPA technology continues to maintain in the financial field. RPA technology has become the entry point of enterprise financial digital transformation [5].

3. Application of RPA Technology in the Field of Finance and Taxation

3.1. Application Mode

3.1.1. Intelligent Invoice Processing Process

An Invoice is an important original voucher for recording the daily business activities of an enterprise. Invoices exist in all financial processes. Financial personnel needs to verify, enter and manage invoices manually. A large amount of data is very complex and time-consuming to process. The combination of RPA technology and OCR, NLP and other technologies can realize automatic invoice processing [6]. The great convenience brought by the progress of science and technology is well reflected in RPA technology. For example, when collecting and processing the original data of invoices, the financial staff often can only process them one by one. RPA can scan and collect invoices with the help of OCR and NLP technology, automatically check the enterprises' transaction records and invoices, and achieve centralized classification processing and data entry.

3.1.2. Intelligent Tax Declaration Process

In enterprises, tax personnel must manually declare tax on the corresponding tax platform. Especially in some enterprises with a large number of taxpayers, the workload of tax personnel is even greater. In the tax declaration process, such as tax declaration, report preparation and other low complexity and high repeatability of the fixed process, the emergence of RPA technology has promoted the transformation of tax work. RPA can automatically log into the tax platform for tax declaration and payment. In the reporting process, RPA can also use robots to verify tax data and automatically generate reports automatically.

3.2. Application Effect

3.2.1. Invoice Processing RPA

In invoice processing, based on RPA technology, and with the help of OCR and NLP technology, the accuracy of invoice verification, collection, classification and processing has been greatly improved compared with manual operations, even up to 100%. A series of automated operations carried out by RPA in invoice processing have doubled the accounting efficiency of financial personnel. Enterprises can reduce the number of personnel in corresponding positions, and the deployment of financial personnel is more flexible. It reduces the waste of human resources in enterprises.

3.2.2. Tax Declaration RPA

In the automated application of RPA technology in the tax declaration process, human beings only need to ensure the accuracy of the overall process structure of RPA. Some cumbersome and repetitive work processes can be completed by RPA, reducing the workload of tax staff and the risk of error caused by manual operation [7]. When tax personnel make entries, prepare and tax returns for financial data, in the face of fixed and repetitive processes, labor efficiency is often low. Applying RPA has helped improve efficiency and saved a lot of manpower.

4. Application Analysis of RPA Technology of Sinochem International Finance and Taxation Intelligence

4.1. Technology Helps Sinochem International Finance and Taxation Intelligence

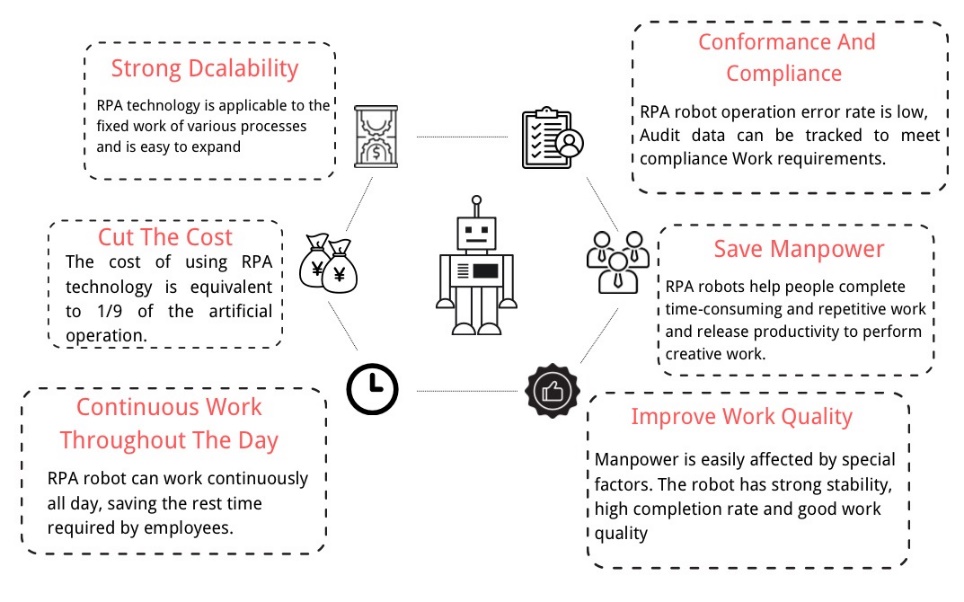

4.1.1. Application analysis of Price Water House Coopers RPA

2017 is the time when RPA technology is emerging in the application of finance and tax intelligence, Sinochem International joined hands with Price water house Coopers RPA to help the intelligent transformation of fiscal and tax processes and became the first central enterprise to introduce RPA technology. Both parties actively carried out various preparations for the RPA operation. With joint efforts, the RPA technology was officially put into operation in August 2017. The following four finance and tax business processes of Sinochem International were significantly improved in the completion quality. As shown in figure 1.

Figure 1: Application advantages of Price water house Coopers RPA in Sinochem International.

(https://cj.sina.com.cn/article/detail/2475967382/351937?autocallup=no&isfromsina=yes)

Bank Reconciliation. In the bank reconciliation process, Price water house Coopers RPA can automatically reconcile accounts of multiple banks and synchronously print the generated reconciliation table. Compared with manual operation, RPA robot is not easily affected by special factors, and their work quality is more stable. In the long run, the maintenance cost of RPA robots is often lower than the wage cost of employees [8], and the cost of using RPA technology can be reduced to one-ninth of that of manual operation.

Reminder of Payment at the end of the Month. At the end of the month, Price water house Coopers RPA can automatically record various bank loan transactions and send transaction payment confirmation instructions to the staff via email. The staff only needs to verify further the recording results of the RPA robot, saving energy and improving the quality of work.

Reminder of the Difference between Purchase and Sales. In the process of confirming the difference between purchase and sales, Price water house Coopers RPA can automatically generate tables based on the data of ticketing, SAP, and other systems and various relevant documents and regularly send reminders to the staff to ensure the normal and efficient completion of this transaction.

Value-added Tax Inspection. In the process of VAT verification, Price water house Coopers RPA first uploaded the VAT invoices to be verified to the verification platform of the State Administration of Taxation, checked the authenticity of invoices with the help of the platform, and automatically recorded the verification results and fed them back to the staff, effectively improving the operational efficiency of the transaction.

Before Sinochem International introduced RPA technology, it needed to spend a lot of manpower to process various financial and tax transactions manually. It was inefficient, and the quality of work could not be guaranteed. With the advent of the era of intelligence, Sinochem International has applied Price water house Coopers RPA to realize 24-hour continuous automatic processing and management of various transactions of finance and taxation. Financial and tax personnel can be separated from various complicated and inefficient work to better focus on highly creative work [9], which greatly contributes to the intelligent reform of enterprises' financial and tax.

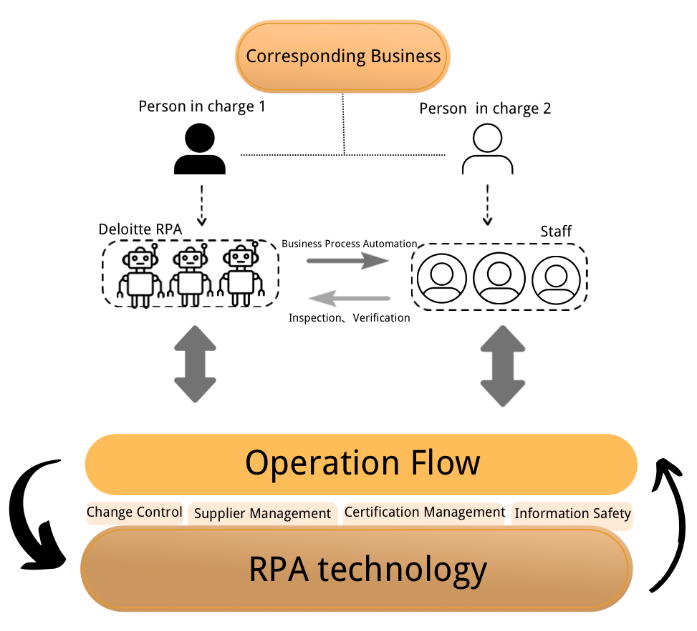

4.1.2. Application Analysis of Deloitte RPA

Many enterprises use Deloitte's financial intelligent robot to assist in financial work because of its strong stability and high quality. As a central enterprise at the forefront of fiscal and tax intelligence and using Price water house Coopers RPA robots, Sinochem International introduced Deloitte RPA to assist tax work and realized process automation in the following three tax stages. As shown in figure 2.

Figure 2: Application mode of Deloitte RPA in Sinochem International.

(https://www2.deloitte.com/cn/zh/pages/tax/articles/deloitte-robot-in-int-tax.html)

Before Tax Declaration. The staff can specify a time to allow Deloitte RPA to complete the query of multiple companies and multiple accounts in the SAP system and then further independently complete the data retrieval in the SAP system, export the data into a file, and provide feedback on the work results to the staff in the form of an email. This series of intelligent operations makes the cumbersome tax declaration preparation work fast and easy.

At the time of the Tax Declaration. According to the instructions, Deloitte RPA can automatically download the tax draft on time and complete the filling and reporting of five major taxes, including turnover and income taxes. It can also automatically complete the filling of the financial statements in the third phase of the Golden Tax and feedback the filling results to the tax personnel, improving the tax execution efficiency.

After Tax Declaration. Deloitte RPA can collect and sort out various financial data of enterprises, archive and share data on a monthly basis in the tax data system built in advance, and provide powerful help for enterprises to conduct tax data analysis, tax risk avoidance and corporate financial decision-making in the future.

At present, under the continuous transformation and optimization of Sinochem International, Deloitte RPA has developed into the second financial robot. Deloitte RPA will help Sinochem International to achieve a simultaneous cross-system platform, company theme, and provincial region. At the same time, it collects three major procedures: the complicated work process, the automatic operation process, and the tax declaration resources. The workflow, fiscal and tax information and data resources can be automated, electronic, and platform-based. The above intelligent operation undoubtedly brings a breakthrough to Sinochem's international tax declaration work.

4.2. Summary of Application Effect of RPA Technology

Sinochem International's application of Price water house Coopers RPA and Deloitte RPA in the field of finance and tax has successfully automated the four finance and tax business processes, namely bank reconciliation, month-end payment reminder, input and output difference reminder, and value-added tax inspection. This application replaces time-consuming and inefficient manual operations, reduces a lot of repetitive work and easing the work pressure of finance and tax personnel. In addition, it releases creative talents to focus on the tasks that need innovation, achieve the effect of reducing costs and increasing efficiency, and also improve the overall service quality of the enterprise.

5. Problems in Application and Optimization Countermeasures

5.1. Existing Problems

5.1.1. RPA Needs Regular Maintenance and Improvement

RPA technology, as an execution program, can simulate human operation to complete various financial and tax businesses with high repeatability and regularity, which also makes RPA technology have high requirements for the deployed system environment. Once the system has errors or needs to be updated, RPA technology also needs to be optimized synchronously. That is, RPA technology needs to be maintained and improved regularly, which also tests developers' ability; only then can RPA meet the characteristics of corporate finance and tax business and ensure the stability of business completion.

5.1.2. Risks in the Use of RPA Technology

RPA relies on input procedures to complete various tasks, which is less flexible than manual work. Suppose there is a problem with the implementation procedures or fiscal and tax data. RPA will not be able to correct or even conduct wrong processing, which will reduce the accuracy of the work results, release the wrong decision information to managers, and increase the risk of corporate fiscal and tax work.

5.1.3. The Application Scope of RPA Technology is Limited

RPA technology is based on a fixed program to run, so it only applies to some work with fixed steps and low complexity [10], for some business processes requiring manual intervention, high complexity and flexibility, RPA technology cannot help.

5.2. Optimization Countermeasures

5.2.1. Strengthen the Management and Monitoring of RPA Technology

Configure exclusive identification information for robots and employees respectively to distinguish the identities of robots and human beings, and strictly register the identification information of operators during work so as to quickly find the operating objects and improve the speed of solving problems in case of work problems. When RPA is running, matching special staff to monitor its working status in real-time is necessary. In case of any abnormality, first, find the reason and then implement countermeasures.

5.2.2. Establish a complete RPA Service Team

This paper needs to build a strong and specialized RPA team. Some team members are responsible for optimizing RPA technology and improving the ability of RPA to process data; Some people are responsible for matching the RPA technology with the current situation and objectives of corporate finance and tax development. Hence, RPA can better serve the enterprise. Some people are responsible for splitting the complex fiscal and tax processes, improving the processing accuracy of RPA technology [11], and better-helping people improve their work efficiency.

6. Conclusion

Through an in-depth analysis of Sinochem International's application methods of Price water house Coopers RPA and Deloitte RPA, it summarizes its application results and finally puts forward problems and optimization strategies. It will serve as a reference for the further development of RPA technology in finance and taxation and also help enterprises realize the intelligent transformation of finance and taxation.

References

[1]. Chen, S. RPA technology: the way of Sinochem International Financial Sharing Center transformation. Financial Management Research,2020(10):53-57.

[2]. Yuan, Q., Li, Y. F. Research on the application of RPA financial robot in financial sharing service center. Modern Business Trade Industry.2023(01):141-143.

[3]. Wang, X. C., Sheng, J. Application of financial intelligence based on RPA technology. Accounting And Finance,2022(2): 67-72. DOI:10.3969/j.issn.1674-3059.2022.02.012.

[4]. Xiao, X. Application of RPA technology in intelligent finance. Industrial Innovation Research.2022(22):91-93.

[5]. He, Q. F., Guo, R. Research on Enterprise Intelligent Finance Construction under the Background of RPA.Economist.2021(11):97-98.

[6]. Shangguan, L. B., Liu, Y. Y. Research on the application of financial robot process automation under the background of intelligent finance. Vitality.2022(10):106-108.

[7]. Wang, H. Y. Research on the application of RPA robot process automation technology in enterprises. Modern manufacturing technology and equipmen.2023(01):205-208.

[8]. Cui, T. T. Research on the Application of RPA Technology in the Digital Transformation of Enterprise Finance.Economist.2023(01):74-75+77.

[9]. Yang, C. H. Research on the application of RPA robot in financial field. China's Management Informatization.2023(01):57-60.

[10]. You, D. Y., Hu, C. C. Research and application of digital employees based on AI+RPA in the financial field of tobacco commercial enterprises. Accounting Study.2022(34):16-18.

[11]. Ji, Z. H., Shen, J. L., Wu, X. H. Research on the Application of RPA in the Digital Transformation of Enterprise Finance. Financial Management Research.2022(10):73-78.

Cite this article

Chen,Y. (2023). The Application Analysis of Enterprise Finance and Tax Intelligence Based on RPA Technology --Taking Sinochem International as an Example. Advances in Economics, Management and Political Sciences,28,164-170.

Data availability

The datasets used and/or analyzed during the current study will be available from the authors upon reasonable request.

Disclaimer/Publisher's Note

The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of EWA Publishing and/or the editor(s). EWA Publishing and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content.

About volume

Volume title: Proceedings of the 7th International Conference on Economic Management and Green Development

© 2024 by the author(s). Licensee EWA Publishing, Oxford, UK. This article is an open access article distributed under the terms and

conditions of the Creative Commons Attribution (CC BY) license. Authors who

publish this series agree to the following terms:

1. Authors retain copyright and grant the series right of first publication with the work simultaneously licensed under a Creative Commons

Attribution License that allows others to share the work with an acknowledgment of the work's authorship and initial publication in this

series.

2. Authors are able to enter into separate, additional contractual arrangements for the non-exclusive distribution of the series's published

version of the work (e.g., post it to an institutional repository or publish it in a book), with an acknowledgment of its initial

publication in this series.

3. Authors are permitted and encouraged to post their work online (e.g., in institutional repositories or on their website) prior to and

during the submission process, as it can lead to productive exchanges, as well as earlier and greater citation of published work (See

Open access policy for details).

References

[1]. Chen, S. RPA technology: the way of Sinochem International Financial Sharing Center transformation. Financial Management Research,2020(10):53-57.

[2]. Yuan, Q., Li, Y. F. Research on the application of RPA financial robot in financial sharing service center. Modern Business Trade Industry.2023(01):141-143.

[3]. Wang, X. C., Sheng, J. Application of financial intelligence based on RPA technology. Accounting And Finance,2022(2): 67-72. DOI:10.3969/j.issn.1674-3059.2022.02.012.

[4]. Xiao, X. Application of RPA technology in intelligent finance. Industrial Innovation Research.2022(22):91-93.

[5]. He, Q. F., Guo, R. Research on Enterprise Intelligent Finance Construction under the Background of RPA.Economist.2021(11):97-98.

[6]. Shangguan, L. B., Liu, Y. Y. Research on the application of financial robot process automation under the background of intelligent finance. Vitality.2022(10):106-108.

[7]. Wang, H. Y. Research on the application of RPA robot process automation technology in enterprises. Modern manufacturing technology and equipmen.2023(01):205-208.

[8]. Cui, T. T. Research on the Application of RPA Technology in the Digital Transformation of Enterprise Finance.Economist.2023(01):74-75+77.

[9]. Yang, C. H. Research on the application of RPA robot in financial field. China's Management Informatization.2023(01):57-60.

[10]. You, D. Y., Hu, C. C. Research and application of digital employees based on AI+RPA in the financial field of tobacco commercial enterprises. Accounting Study.2022(34):16-18.

[11]. Ji, Z. H., Shen, J. L., Wu, X. H. Research on the Application of RPA in the Digital Transformation of Enterprise Finance. Financial Management Research.2022(10):73-78.