1. Introduction

1.1. Chinese Copper Spot Market

1.1.1. Market Features

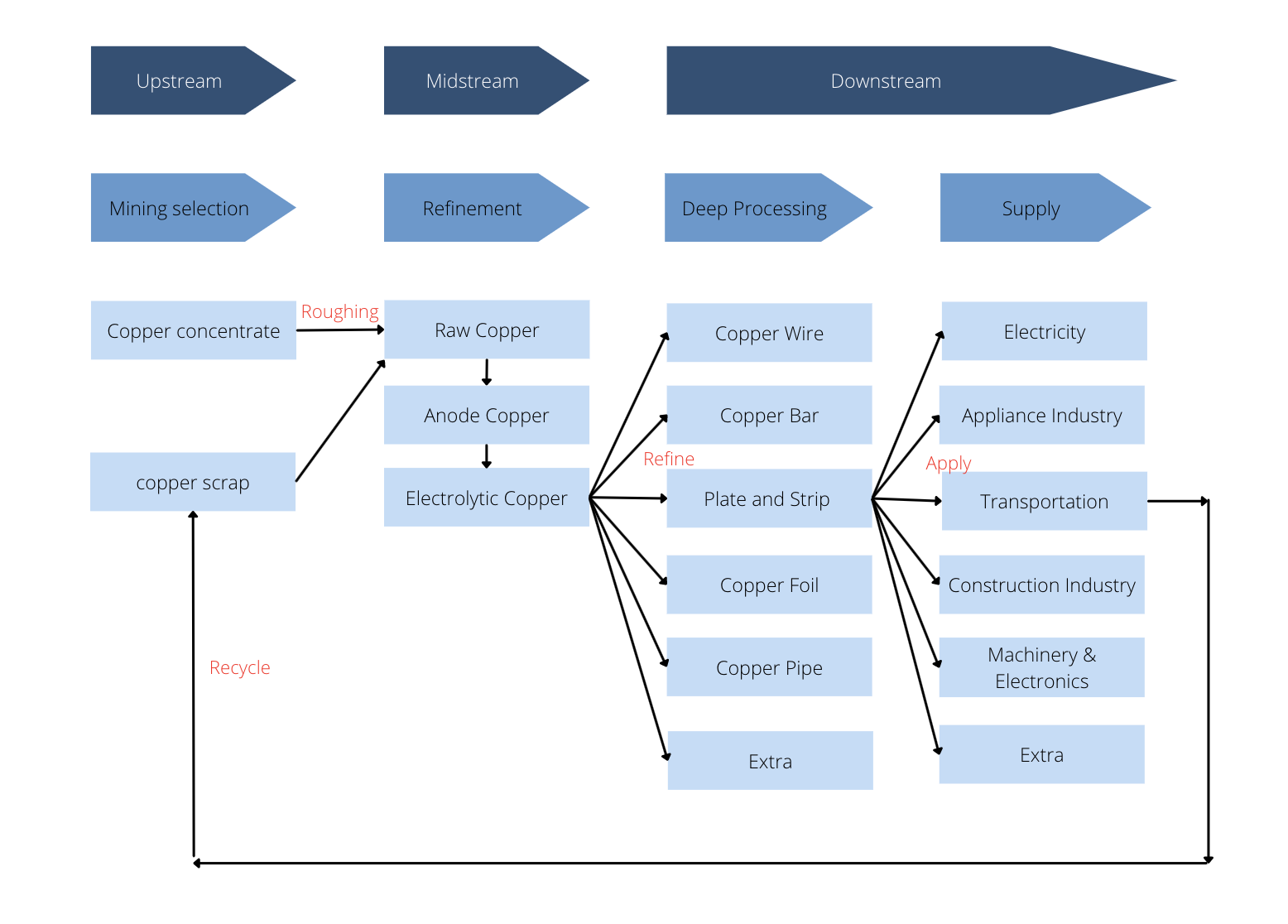

As a non-ferrous metal with a wide range of applications, copper has a high degree of market demand. Both domestic and foreign futures spot markets are relatively developed [1]. The copper industry chain includes the entire process from mining, copper smelting, processing into materials, and final consumption (Figure 1). Copper would be a great representative of China's economic trend since the downstream market is extensive [2].

Figure 1: Copper industry chain structure diagram, source from https://www.tzqc.net/.

China was the second largest producer of refined copper in the world after Chile, based on the data provided by the government of China. In 2021, China had a raw copper production of 21.24 million tons, a refined copper output of 10.49 million tons, a year-on-year increase of 7.4% and an average two-year growth of 3.5%. Copper played an important part of China's economy [3]. In 2021, China had a copper reserve of 26 million metal tons, accounting for 2.95% of global copper reserves [3]. As a major user of copper, China had relatively scarce copper ore and became a major importer of copper. According to Reuters, China's copper consumption accounted for half of the world market. The global copper demand was largely dependent on Chinese demand, which had been the main factor driving copper prices over the past decade. China's copper consumption was mainly distributed in the power cable, real estate, home appliance industries, railways, electronics, engineering and various other fields, of which the power cable industry accounted for more than 40%, followed by the real estate and home appliance industries [4]. Electrolytic copper is the most widely used and the largest in the electrical and electronic industries, accounting for more than half of the total consumption. Used for various cables and wires, windings of motors and transformers, switches and printed circuit boards, etc. There are usually two ways to purchase electrolytic copper, either through import procurement, signing long-term contracts with foreign suppliers such as large traders Glencore, BHP Billiton, etc.; or purchasing spot from the spot market in Shanghai. However, due to the skyrocketing price of raw material electrolytic copper and its transportation, copper prices have continued to rise since April last year, from about 40,000 yuan/ton before the epidemic to over 70,000 yuan/ton [5].

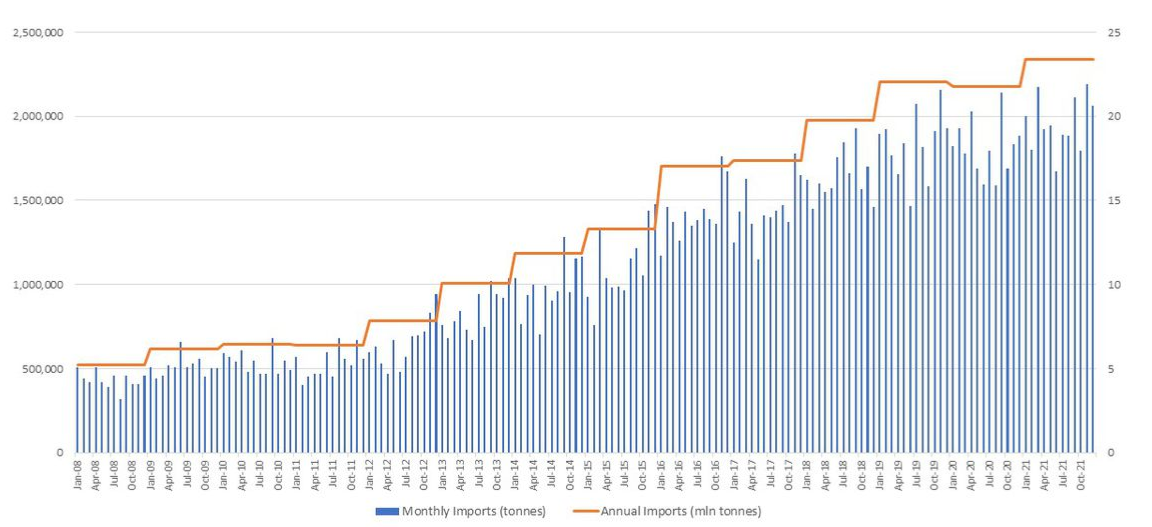

Figure 2: China's Monthly and Annual Copper Concentrate Imports, source from China's General Administration of Customs, taken from https://www.reuters.com/.

As shown in figure 2, China's copper imports presented a continuous upward trend. According to Chinese customs data, China’s 2021 copper concentrate imports reached a record of 23.4 million tonnes, with a +7.6% difference from 21.78 million tonnes imported in 2020. It could be seen that China's copper demand was increasing every year, which undoubtedly further expanded China's copper trade market and increased economic flow at the same time. The import trade with other countries made up for the lack of copper resources in China and plays an irreplaceable role in maintaining the comprehensive and balanced development of the national economy.

1.1.2. Trend Analysis of Spot Prices

This is a graph of the price of copper over the last ten years, from which two of the more pronounced fluctuations in the price of copper can be observed; in 2020 and 2016 respectively [6].

According to the graph shown above, it is easy to judge that the major factor that influences spot coppper prices is countries that are in the developing stages, and the largest demand for copper as a developing country is China. In 2020, the price of copper fell off a cliff, mainly because the epidemic in 2020 was a major blow to the economies of developing countries, and China's GDP growth rate was significantly reduced, while the demand for copper was significantly reduced as well [7]. This led to a precipitous drop in the price of copper. The subsequent increase in China's GDP growth rate was accompanied by a rapid rise in the price of copper, as shown in the graph in mid-2022.

The gradual decline in the price of copper in 2016 was mainly due to the recession caused by the debt crisis in Europe and the United States and Brexit at the time, which led to the beginning of a decline in economic growth in some developing countries and a decrease in demand for copper [6].

Figure 3: The price of copper from https://tradingeconomics.com/commodity/copper.

As Figure 3 shows, the price trend of copper has no obvious cycle. Mainly driving the price trend of copper to a large extent is the economic development rate of those developing countries driving the demand and price of copper.

2. Chinese Copper Futures Market

2.1. Introduction

The copper future started trading on May 1991 on Shanghai Future Exchange (SHFE) [8]. The main exchanges that trade copper futures are London Metal Exchange (LME), The Commodity Exchange Inc. (COMEX), SHFE and Multi Commodity Exchange (MCX). The subject matter of the future is Copper Cathodes that are produced when pure copper separates from unwrought copper in an electrolytic refining process. The Standard is Cu- CATH-2 and the substitute is Cu- CATH-1. Each contract trading is 5 tons. The minimum price fluctuation is 10 yuan per ton. The minimum margin of the main contract is 12%. The limit move is 10% [9].

In 2021, the transaction amount of copper futures on the Shanghai Futures Exchange was 21.97 trillion yuan, an increase of 7.84 trillion yuan compared with the same period in 2020, an increase of 55.46% year-on-year. Copper futures ranked third, accounting for 15.32% of the total commodity futures volume in China. It shows that the copper futures market is highly active [9].

2.2. Trend Analysis of Futures and Spot Prices

Since the beginning of 2020, the COVID-19 epidemic has ravaged the world, market pessimism had been on the rise, and the copper futures price fell to a new low. With the introduction of stimulus bills in various countries, the copper price rose from a new low of 35300 yuan in March 2020 to 78270 yuan in May 2021. From a macro perspective, in order to cope with the risk of economic recession caused by the epidemic, the major central banks represented by the Federal Reserve have launched a new round of interest rate cut and RRR cut. Monetary policies such as "unlimited QE" have made global liquidity extremely abundant. Under the continuous stimulus of global macroeconomic policies, commodities prices had reached a new high in May 2021 [10]. From the beginning of 2022 to the end of April 2022, driven by energy worries and supply shortages caused by the Russian-Ukrainian war, the copper future price steadily fluctuated and went up, and reached the high point of 75000 yuan at the end of April. With the Fed’s rate rises expectations in the United States and the downward adjustment of global economic growth, copper prices have been under pressure since the end of April till now, and future prices more likely to keep going down.

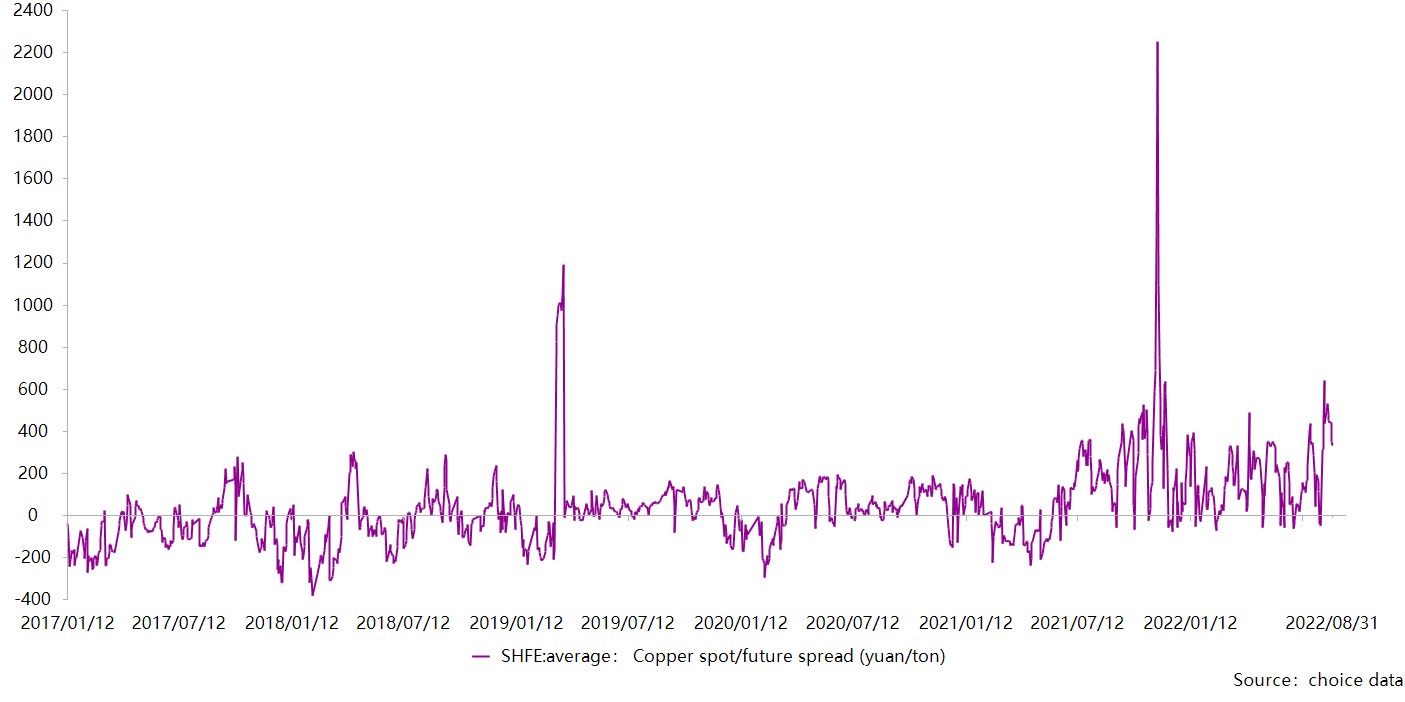

Basis risk is the main risk of futures hedging. It occurs when offsetting investments on copper futures do not experience price changes in entirely opposite directions from the spot price. Basis risk directly affects the effectiveness of hedging. When the basis is strengthening, the difference between the cash price of copper and the futures price of copper becomes more positive and less negative. It is good for short hedges (sell future contracts) and bad for long hedge (buy future conctracts). Figure 4 shows that in 2022 copper is in backwardation (future price is lower than the spot price). A positive basis is beneficial for manufacturers and producers who do short hedges to lock in the copper price.

2.3. The Role of Hedging with Copper Futures in Chinese Copper Industry Chain

Figure 4: 2017-2022 Copper spot/future spread : Source: choice data.

2.3.1. The Basic Practice of Hedging

Futures are commonly used to hedge against risk due to price change, in which in essence, an enterprise who hedges lock in the price of a commodity for sometime in the future. The basic practice of hedging is to sell (or buy) a (or more) futures contract(s) while buying in (or selling out) actual goods in the spot market. For example, if a copper refinery worries about the spot price of copper ores will increase in the future, it can hedge with copper futures by buying copper futures contracts at present, and later on, the company will trade actual copper (buy copper ores) in the spot market while simultaneously sell the copper futures contracts, hence the profit gained from selling the futures contract can offset the loss in the spot market’s transactions. Note that this is a simplified example without considering other aspects, such as the transaction fees, storage fees, etc., that will occur when hedging with futures in real-life situations.

2.3.2. The Chinese Copper Industry Chain

The copper industry chain started with extractions of copper ores. However, as one of the major importers of copper ores and concentrates in the world, China is not a country rich in copper ores [11].

The midstream of the copper industry chain was mainly the process of converting copper ore or scrap copper into electrolytic copper (containing 99.95%~99.99% copper) or refined copper (containing 99%~99.7% copper). This process will take place in refineries where copper ores/concentrates will be smelted and refined. This is because copper ores contain not only copper, but also other elements such as oxygen and sulfur as outcomes of the refinery processes, electrolytic copper and refined copper are produced. Recycled copper is also an important material in the copper industry chain and it mainly uses copper scraps, waste equipment parts and daily necessities as raw materials. By the end of smelting, pure metal will be extracted from the ores and it will be even purer after the refining process. After this, refined copper will then go into the manufacturing procedures and becomes casting products as an outcome, waiting to be distributed into different industries. In detail, refined copper is melted and alloyed, and will be going through either mould casting or semi-continuous/continuous casting, of which, according to a different type of products, including copper stripes, copper sheets, copper tubes, copper wire, etc., different processing methods will be applied. These casting products processed eventually are widely used in traditional fields such as electrical, transportation, electronics, construction and military industry, as well as emerging fields such as wind power infrastructure and new energy electric vehicles. In 2020, copper for electricity accounts for 52% of China's total copper demand. Power engineering construction is the main source of copper consumption in power engineering, and the demand is mainly divided into power transmission and motor manufacturing [11].

2.3.3. Hedging with Copper Futures in the Copper Industry Chain

Assuming there are only four entities in the copper industry chain, copper ore extraction enterprise A, refinery B, copper processing enterprise C and constructions company D. A sells copper ores to B, and they’ve made an agreement that A will deliver 100 tons of copper ores to B three months from now [12]. Since A is the seller, it expects the price of copper will go up after three months so A could increase its revenues. However, in the contrary, B as the buyer is worried about that the price will go up three months later, which it will increase B’s costs. Hence, both of them decided to hedge with copper futures. The spot price of copper is $100/ton and the price of copper futures that will be delivered in three months is $105/ton. A wants to lock in the revenues of $105/ton, so it sells 100 tons of copper futures in the futures market; whilst B wants to lock in the cost of $105/ton so B buys 100 tons of copper futures in the futures market. After three months, the spot price of copper went up by 20%, in which it’s $120/ton now, A bought the futures contract with the price of $120/ton. Therefore, the total revenues that A has made are 105*100+120*100-120*100=$10500, which is the price A has locked into at the beginning. If A didn’t hedge, he would have made a revenue of 120*100=$12000. In terms of B, B sold the futures contract and gain $12000. Simultaneously, B traded copper ores with a cash outflow of $12000. As a result, the total cost of B equals to 12000-12000+105*100=$-10500, which is the cost that B has locked into at the beginning. If B didn’t hedge three months before the actual transaction, the total cost would be 120*100=$12000, which is much higher than the actual cost B had spent.

B now has the copper ores and will go through the smelting and refining processes to sell it to copper processing enterprise C. Assume it will take B one month to refine the copper and sell it to C. Assume the spot price of electrolytic copper is $200/ton. B, who is the seller, now worries that the price will decrease in one month, which will reduce B’s profits, even loss of money if the price drops below $120. From C’s side, C’s hoping for the price to go down, which would lessen the cost for C. Similar to what A has done previously, B also sells copper futures in which the transaction will take place one month later, and the price of copper futures is $250/ton, whereas C buys 100 ton of copper futures for the same maturity. One month later, the price of copper went up by 40%, and the spot price of electrolytic copper is now $280/ton. B delivered the refined (electrolytic) copper to C and at the same time, B bought and C sold the copper futures with the spot price of $280/ton. Eventually, B makes a revenue of 250*100+280*100-280*100=$25000, which is lower than what B would have got without hedging. C costs -250*100-280*100+280*100=$|-25000|, lower than what C will cost originally without hedging. If both B and C didn’t hedge at the beginning, B will make a revenue of 280*100=$28000 and C will cost $28000.

Electrolytic copper is going to be processed by C and becomes tubes to be consumed by D for piping. Suppose it will take two months for C to process the refined copper into copper tubes, hence, C and D made an agreement upon the delivery of 100kg copper tubes. At this stage, C is the seller and D is the buyer, therefore, C would expect the price to go up and D the opposite. In order to circumvent price risk at the greatest extent, both C and D decide to hedge with copper futures. C as the seller in this future transaction with D buys 100kg of copper futures, and D buys 100kg copper futures. Assume the spot price of a copper tube is $30/kg, and the price of a two-month copper future is $260/ton. After two months, the spot price of copper tube increased by 20% to $36/kg, and the spot price of copper increased also by 20% to $312/ton. C delivered 100kg of copper tubes to D with this price, whilst C bought the futures and D sold the futures. Consequently, C gains 0.26*100+36*100-0.312*100=$3594.8, whilst D costs -0.26*100-36*100+0.312*100=$|-3542.8|. Without hedging, C would make a profit of 36*100=$3600 and D would cost $3600, in which decreases in D's profit but also a reduction in C's profit are seen.

This is a simplified demonstration of China's copper industry chain, including price risks that different parties face when trading with other parties, as well as different parties' roles in the futures market, which often switch around in between buyer and seller. In this example, it is also observed that refineries and processing enterprises are two of the riskiest parties in the copper industry chain as they are facing two potential price risks, one from the seller side and one from the buyer side.

2.3.4. Risks in Hedging for Enterprises

Although hedging does help different copper enterprises to circumvent a lot of potential risks, it is not are not a riskless practice [13]. Futures were to hedge the risk of spot goods, but there is a potential possibility that the futures rises more in the same period, and the spot rises less. If the companies were short hedging in the trading market and encountered a unilateral uptrend, then they need to constantly add margin. If the margin is not enough, it will be liquidated by the exchange. In 2021, in the process of rising the price of commodities, some copper processing enterprises shorted copper prices due to uncareful hedging operations, resulting in serious losses [14]. It was unreasonable for enterprises to prepare more inventory, because the price of the material itself was high, and the downstream orders were not so sufficient nowadays, and the enterprise had no great initiative to prepare inventory.

2.4. The Role of Futures for the Spot Market

The futures market in China is built on the foundation of the spot market, and there is an interaction mechanism between the two markets [15]. The spot price surged and dropped dramatically while there was no futures market in place. The futures market was created to modify the spot market. between futures and spots, as well as their reciprocal influence and futures' stabilizing impact on spot.

1. The development of the futures market should be based on the spot market, but once the futures market is formed and developed under the impetus of the spot market, it will react to the spot market and regulate and guide the operation of the spot market through its unique functions. This adjustment and guidance are reflected in the following aspects:

2. By buying the same spot commodity and selling the same amount of futures, making reasonable hedging, the purpose of avoiding the risk of price fluctuations and controlling expected costs can be achieved. To be specific, it means that while buying copper in the spot market, selling the same amount of copper in the futures market, and no matter how the spot supply market price fluctuates, stakeholders can eventually achieve a loss in one market while making a profit in another. It is precisely because the futures market has such an economic function, Therefore, the futures market regulates the spot market is formed

3. Promote the improvement of comprehensive capabilities of non-ferrous metal enterprises. Copper is a widely used industrial raw material; its application status will become more prominent as new energy technology and other fields develop; the price of copper and other non-ferrous metals will have further advantages in the future; and the non-ferrous metal industry as a whole has a bright future. The Figure 5 shows that the main Shanghai copper contract has risen to 70,380 yuan per ton, close to the highest point in the past ten years and has improved in terms of supply and demand , inventory and other factors.

Figure 5: Copper futures prices in Shanghai.

3. Conclusion

In conclusion, copper futures plays an important role in China's financial market, especially in assisting the stable development of the copper industry chain. It is apparent that every party in the industry chain faces different types of risks and hedging works as a useful and practical tool which helps enterprises in the copper industry including refineries, processing enterprises and terminal consumption firms, to offset potential risks specifically caused by price fluctuations in the market. The variety in fields of copper applications along with the developing stages of China, currently indicates the importance of stability in the copper industry. By locking in prices as explained in the paper, enterprises minimize the negative effects of price change and helps enterprises to save their cost of funds.

References

[1]. Li, X. (2020, October 24). China Securities Regulatory Commission Approves International Copper Futures Trading. China Securities Regulatory Commission Approves International Copper Futures Trading_Department Government Affairs_China Government Network. Retrieved September 1, 2022, from http://www.gov.cn/xinwen/2020-10/24/content_5553845.htm

[2]. Raw Materials Industry Division. (2022, January 29). Operation of the copper industry in 2021. Ministry of Industry and Information Technology of the People's Republic of China. Retrieved September 1, 2022, from https://www.miit.gov.cn/gxsj/tjfx/yclgy/ys/art/2022/art_35aac0c0f0c147f49ced8c2b953e52c4.html#:~:text=2021%E5%B9%B4%EF%BC%8C%E6%88%91%E5%9B%BD%E9%93%9C %E8%A1%8C%E4%B8%9A, %E5%90%A8%EF%BC%8C%E5%90%8C%E6%AF%94%E4%B8%8B%E9%99%8D0.9% 25%E3%80%82

[3]. He, H., & Ma, P. (2020, October). Thinking on improving the stability of mining industry chain by metal investment and financing. China Mining Magazine. Retrieved September 2, 2022, from http://www.chinaminingmagazine.com/uploads/pdf/1632481408564.pdf

[4]. Nguyen, M. (2021, October 7). Copper analysts reset outlook on China's dual demand ructions. Reuters. Retrieved September 1, 2022, from https://www.reuters.com/article/copper-outlook-idUSKBN2GX0P9

[5]. Chow, E. (2022, January 14). China 2021 copper imports slip after previous year's record high. Reuters. Retrieved September 1, 2022, from https://www.reuters.com/markets/asia/china-2021-copper-imports-slip-after-previous-years- record-high-2022-01-14/

[6]. OpenMarkets. (2020, September 22). Importance of copper in China's economyOpenMarkets. CME Group. Retrieved September 1, 2022, from https://www.cmegroup.com/cn-s/education/articles-and-reports/the-importance-of-copper-in- chinas-economy.html

[7]. Dong, J. (2020, November 12). The practical significance of imports to the current Chinese economy. China World Trade Organization Research Association. Retrieved September 1, 2022, from http://www.cwto.org.cn/article/m/202011/20201103015151.shtml

[8]. Marian Radetzkl. (n.d.). Rural market imperfections and the role of ... - Wiley Online Library. Long-run Price Prospects for Aluminium and Copper. Retrieved September 2, 2022, from https://onlinelibrary.wiley.com/doi/abs/10.1111/j. 1477-8947.2008.00167.x

[9]. My Color: Copper Market 2020 Review and 2021 Outlook _ My Color. (n.d.). Www.mymetal.net. Retrieved September 2, 2022, from https://www.mymetal.net/20/1231/14/C3C6DA5B405FBA4A.html

[10]. Copper price rises as China's factory activity accelerates. MINING.COM. (2021, December 31). Retrieved September 2, 2022, from https://www.mining.com/copper-price-up-on-robust-china-demand/

[11]. "China Mining" magazine. "China Mining" magazine. (n.d.). Retrieved September 2, 2022, from http://www.chinaminingmagazine.com/

[12]. Copper futures prices in Shanghai rose 6% to the highest point in nearly a decade. NAI 500. (2021, February 22). Retrieved September 2, 2022, from https://nai500.com/blog/2021/02/copper-futures-prices-in-shanghai-rose-6-to-the-highest-point-in-nearly-a-decade/

[13]. Lovell, H., & Journal, T. H. F. (n.d.). Copper spot prices and stock market volatility. The Hedge Fund Journal. Retrieved September 9, 2022, from https://thehedgefundjournal.com/copper-spot-prices-and-stock-market-volatility/

[14]. Stone, H. (2021, February 22). Copper futures prices in Shanghai rose 6% to the highest point in nearly a decade. NAI 500. Retrieved September 9, 2022, from https://nai500.com/blog/2021/02/copper-futures-prices-in-shanghai-rose-6-to-the-highest-point-in-nearly-a-decade/

[15]. The "supply chain" troubles of a copper processing company, the price of raw material electrolytic copper and its transportation has skyrocketed: "I dare not import copper anymore." (2021, December 5). Finance.sina.com.cn. https://finance. sina.com.cn/wm/2021-12-05/doc-ikyakumx2120425.shtml

Cite this article

Xi,W.;Zhang,C. (2023). Research on the Copper Futures Market in China. Advances in Economics, Management and Political Sciences,30,270-278.

Data availability

The datasets used and/or analyzed during the current study will be available from the authors upon reasonable request.

Disclaimer/Publisher's Note

The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of EWA Publishing and/or the editor(s). EWA Publishing and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content.

About volume

Volume title: Proceedings of the 7th International Conference on Economic Management and Green Development

© 2024 by the author(s). Licensee EWA Publishing, Oxford, UK. This article is an open access article distributed under the terms and

conditions of the Creative Commons Attribution (CC BY) license. Authors who

publish this series agree to the following terms:

1. Authors retain copyright and grant the series right of first publication with the work simultaneously licensed under a Creative Commons

Attribution License that allows others to share the work with an acknowledgment of the work's authorship and initial publication in this

series.

2. Authors are able to enter into separate, additional contractual arrangements for the non-exclusive distribution of the series's published

version of the work (e.g., post it to an institutional repository or publish it in a book), with an acknowledgment of its initial

publication in this series.

3. Authors are permitted and encouraged to post their work online (e.g., in institutional repositories or on their website) prior to and

during the submission process, as it can lead to productive exchanges, as well as earlier and greater citation of published work (See

Open access policy for details).

References

[1]. Li, X. (2020, October 24). China Securities Regulatory Commission Approves International Copper Futures Trading. China Securities Regulatory Commission Approves International Copper Futures Trading_Department Government Affairs_China Government Network. Retrieved September 1, 2022, from http://www.gov.cn/xinwen/2020-10/24/content_5553845.htm

[2]. Raw Materials Industry Division. (2022, January 29). Operation of the copper industry in 2021. Ministry of Industry and Information Technology of the People's Republic of China. Retrieved September 1, 2022, from https://www.miit.gov.cn/gxsj/tjfx/yclgy/ys/art/2022/art_35aac0c0f0c147f49ced8c2b953e52c4.html#:~:text=2021%E5%B9%B4%EF%BC%8C%E6%88%91%E5%9B%BD%E9%93%9C %E8%A1%8C%E4%B8%9A, %E5%90%A8%EF%BC%8C%E5%90%8C%E6%AF%94%E4%B8%8B%E9%99%8D0.9% 25%E3%80%82

[3]. He, H., & Ma, P. (2020, October). Thinking on improving the stability of mining industry chain by metal investment and financing. China Mining Magazine. Retrieved September 2, 2022, from http://www.chinaminingmagazine.com/uploads/pdf/1632481408564.pdf

[4]. Nguyen, M. (2021, October 7). Copper analysts reset outlook on China's dual demand ructions. Reuters. Retrieved September 1, 2022, from https://www.reuters.com/article/copper-outlook-idUSKBN2GX0P9

[5]. Chow, E. (2022, January 14). China 2021 copper imports slip after previous year's record high. Reuters. Retrieved September 1, 2022, from https://www.reuters.com/markets/asia/china-2021-copper-imports-slip-after-previous-years- record-high-2022-01-14/

[6]. OpenMarkets. (2020, September 22). Importance of copper in China's economyOpenMarkets. CME Group. Retrieved September 1, 2022, from https://www.cmegroup.com/cn-s/education/articles-and-reports/the-importance-of-copper-in- chinas-economy.html

[7]. Dong, J. (2020, November 12). The practical significance of imports to the current Chinese economy. China World Trade Organization Research Association. Retrieved September 1, 2022, from http://www.cwto.org.cn/article/m/202011/20201103015151.shtml

[8]. Marian Radetzkl. (n.d.). Rural market imperfections and the role of ... - Wiley Online Library. Long-run Price Prospects for Aluminium and Copper. Retrieved September 2, 2022, from https://onlinelibrary.wiley.com/doi/abs/10.1111/j. 1477-8947.2008.00167.x

[9]. My Color: Copper Market 2020 Review and 2021 Outlook _ My Color. (n.d.). Www.mymetal.net. Retrieved September 2, 2022, from https://www.mymetal.net/20/1231/14/C3C6DA5B405FBA4A.html

[10]. Copper price rises as China's factory activity accelerates. MINING.COM. (2021, December 31). Retrieved September 2, 2022, from https://www.mining.com/copper-price-up-on-robust-china-demand/

[11]. "China Mining" magazine. "China Mining" magazine. (n.d.). Retrieved September 2, 2022, from http://www.chinaminingmagazine.com/

[12]. Copper futures prices in Shanghai rose 6% to the highest point in nearly a decade. NAI 500. (2021, February 22). Retrieved September 2, 2022, from https://nai500.com/blog/2021/02/copper-futures-prices-in-shanghai-rose-6-to-the-highest-point-in-nearly-a-decade/

[13]. Lovell, H., & Journal, T. H. F. (n.d.). Copper spot prices and stock market volatility. The Hedge Fund Journal. Retrieved September 9, 2022, from https://thehedgefundjournal.com/copper-spot-prices-and-stock-market-volatility/

[14]. Stone, H. (2021, February 22). Copper futures prices in Shanghai rose 6% to the highest point in nearly a decade. NAI 500. Retrieved September 9, 2022, from https://nai500.com/blog/2021/02/copper-futures-prices-in-shanghai-rose-6-to-the-highest-point-in-nearly-a-decade/

[15]. The "supply chain" troubles of a copper processing company, the price of raw material electrolytic copper and its transportation has skyrocketed: "I dare not import copper anymore." (2021, December 5). Finance.sina.com.cn. https://finance. sina.com.cn/wm/2021-12-05/doc-ikyakumx2120425.shtml