1. Introduction

Multinational enterprises tend to expand continuously as economic globalization develops by leaps and bounds, which triggers increasing difficulty in their financial management. Hence an increasing number of international firms have established FSSC. However, the development of FSSC tends to face many challenges, especially in ensuring the security of financial information, which can be handled through blockchain applications. This thesis takes the Haier group, for instance, analyzing the challenges existing in multinational companies' financial shared service centers and providing suggestions on optimizing the financial sharing service model with blockchain.

Many branches characterize multinational firms and tend to be constantly expanding; thus, they are suitable for establishing FSSC. Both Martin and Li pointed out that the FSSC was established by Ford Motor Enterprise in the early 1980s, which has standardized the accounting business and considerably raised the efficiency of financial management [1, 2]. Gan took the FSSC of a famous multinational firm called China Railway Construction Corporation, for instance, which has reduced the invested cost in financial management, and enhanced capital stock and operation efficiency to a large extent using financial software with domestic databases [3].

Nevertheless, there are still challenges existing in the FSSC of multinational enterprises. On the one hand, Yu took inventory management as an example, namely, the accountant should extract relevant data from the inventory management system first and then submit the information to FSSC for introductory examination post for review manually. The data can be accepted only after the examination is passed. Such a process tends to be prone to causing errors or omissions of data but also results in a heavy workload of financial personnel and inefficient operation of FSSC [4]. Tian, Zhu & Hao mentioned that in the financial sharing service model, the problem of repetitive examination and verification exists between the business and financial sharing sides. Besides, receipts are frequently returned due to failure to pass the examination simultaneously, leading to unnecessary human resource consumption, inefficient financial business processing, and increased investment costs in FSSC [5, 6].

On the other hand, many scholars such as Zhu & Hao, Li, Li & Du put forward that the over-centralization of financial information in FSSC caused by the continuous expansion of multinational companies can give rise to increased risk of data security, including fraud, malicious intrusion and tampering with financial information, which may also cause low operation efficiency of FSSC [6-8]. In addition, Yang pointed out that in the current financial sharing service mode, the identity of the transaction entities tends to be diversified or difficult to identify, which may generate the problem of information asymmetry [9]. Furthermore, according to Tian and Yang, there are still discrepancies in accounting standards and principles among different accounting entities in the present financial sharing service model. This fails enterprises to fully play the scale and synergy effects [5, 9]. Besides, Li put forward that the FSSC in multinational enterprises still needs to have more standardization of the accounting process, which leads to low efficiency of FSSC in processing accounting business [2].

2. Application of Blockchain to FSSC in Multinational Enterprises

Blockchain is a shareable ledger that runs on mandatory and normative code, featuring intelligent contracts, distributed ledger, consensus mechanisms, timestamps, and digital signatures. Applying blockchain to FSSC in multinational enterprises can replace some of the human labor that tends to be relatively inefficient with efficiently running code and tackle potential security problems due to the over-centralization of financial information.

First and foremost, an intelligent contract combined with the consensus algorithm can not only compile the repetitive financial business processing flow into the digital protocol. After the financial personnel of the branches uploads the financial business information, the digital protocol can automatically judge whether it meets the requirements. If the data meets the conditions that trigger the contract, it will further correspond to the accounts and generate vouchers. Otherwise, it will be returned for modification [6]. Furthermore, smart contracts can also set various templates, such as receipt and payment templates, in advance, which can satisfy the personalized and real-time reimbursement requirements from relevant users at any time [9]. By and large, smart contracts can assist the FSSC in realizing financial business transparency and financial processing process automation on the premise of ensuring the authenticity, integrity as well as security of financial information, assisting the financial sharing service center of multinational enterprises in achieving the purpose of raising the efficiency of processing accounting business and reduce the investment cost to a minimum level [8]. Besides, the distributed accounting mode of blockchain enables each node on the chain to possess its ledger, each ledger of a node can update the same transaction information synchronously and in real-time, replacing the original accounting business processing work of the FSSC that requires layers of examination and approval of vouchers with flat processing mode, which can enhance the operation efficiency of FSSC to a large extent without increasing the risk of financial data security [7,10].

In addition, timestamps arrange all blocks that consist of financial data of headquarters and branches in chronological order. If blockchain can be employed in the FSSC of multinational enterprises, the financial information of each block is time-stamped to generate a unique Hash. Hence the difficulty of tampering with financial data will increase with the length of the blockchain. Moreover, timestamps and digital signatures enable the recording of all node data comprehensively throughout the entire accounting process based on the Merkle tree, making financial data immutable and traceable in time and space [9]. Besides, consortium blockchain can be employed in the FSSC of multinational enterprises, which can make financial information symmetrical among all stakeholders [5]. Consortium blockchain has more affordable transaction costs, higher efficiency of financial business processing, and easier consensus to reach than a public blockchain.

To sum up, the application of blockchain to FSSC of multinational enterprises can not only raise its efficiency in processing financial business by utilizing smart contracts, distributed accounting mode as well as the consensus mechanism but also lessen the workload of financial personnel in the center by automatically processing accounting business that is repetitive and basic via application smart contract [7]. Moreover, the information between headquarters and branches can be symmetrical by applying the consortium blockchain [11]. Meanwhile, the integrity and security of financial information can be ensured using blockchain surveillance in the process of financial data transmission and processing. Blockchain helps the FSSC of multinational enterprises reduce invested operation costs to a minimum level and improve its operation efficiency to ensure data security using distributed node consensus algorithm [9].

3. Case Study of Haier Group

3.1. Overview of Haier’s FSSC

Established in the early 1980s in China, Haier is a world-renowned large-scale multinational domestic appliance enterprise, also a pioneer in digital financial management transformation among Chinese firms. Due to its continuous expansion, the number of branches has increased swiftly. The traditional financial management model requires each branch to set up an independent financial department, which leads to cumbersome accounting and statistics processes, high administrative expenses, and unnecessary resource consumption [6]. Accordingly, Haier initiated the construction of the Financial Shared Service Center in 2007.

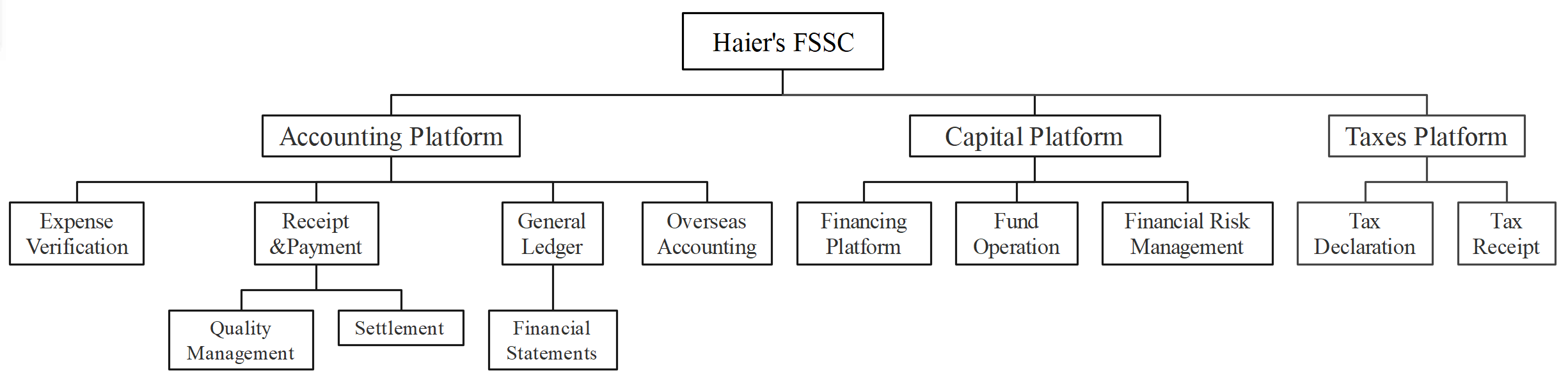

Figure 1: The structure of Haier’s financial shared service center.

Figure 1 demonstrates that Haier’s FSSC has subdivided into 12 business segments under three platforms, among which the accounting platform handles 95% of accounting work.

Figure 2: General mode of operation of Haier’s financial shared service center.

As shown in Fig.2, the operation procedure of Haier’s FSSC can be roughly divided into three steps, and firstly, the internal staff uploads business information through the imaging system. The financial team in FSSC reprocess that information, extracting business, financial, and tax-related information to provide data support for decision-making.

Secondly, financial staff systematically examine external information to ensure authenticity and minimize risk as much as possible. Ultimately, financial statements, performance analysis reports, and profitability analysis reports enable to be generated [12].

By unifying and standardizing the financial management process, Haier's FSSC centralizes the initially dispersed financial work, lessening costs and enhancing operational efficiency via the scale effect [12]. It also efficiently controls the risk of information asymmetry caused by the difficulty of headquarters in acquiring accurate financial information about branches. Nevertheless, it still needs help in terms of the workload of financial personnel as well as the security of financial information [11].

3.2. Optimization of Haier’s FSSC with Blockchain

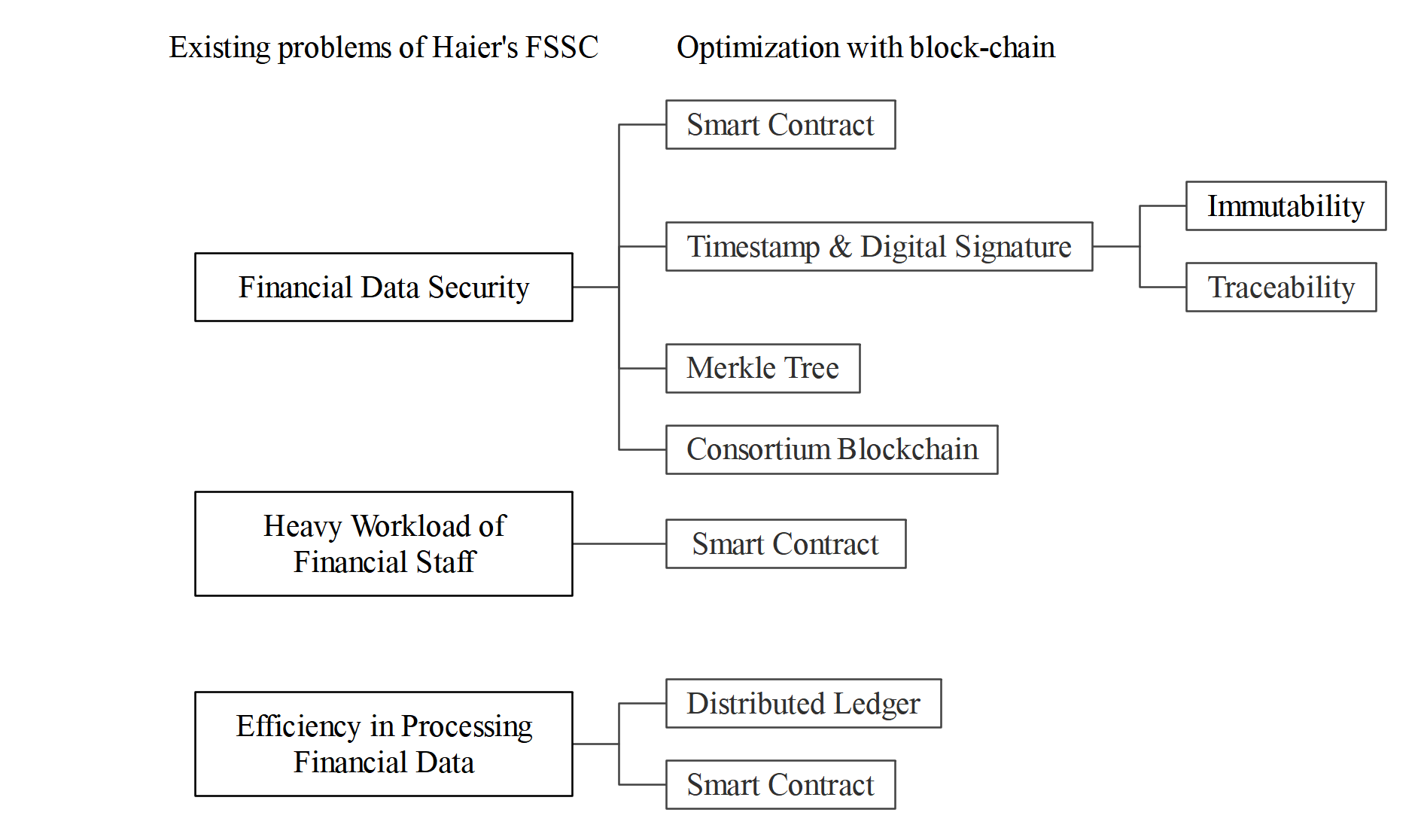

This section will present a case study of Haier's FSSC with blockchain. The Figure 3 shows that the blockchain application to optimize Haier's financial shared service center.

Figure 3: Blockchain application to optimize Haier's financial shared service center.

3.2.1. Enhancing the Security of Financial Information.

The higher degree of centralization of financial information tends to be accompanied by higher risk. For instance, the financial data of branches are all centralized in Haier’s financial shared service center, which may give rise to fraud on account of the expansion of financial personnel’s rights. Furthermore, excessive concentration of economic data is prone to wreaking malicious intrusion.

Therefore, Haier can use a distributed ledger, smart contracts, timestamps, and digital signatures. The distributed ledger is essentially a database that can share information, and each participant possesses its ledger. When a transaction occurs, the transaction information will be synchronously updated in branches and FSSC via ledgers. Hence malicious manipulation of financial data will be detected in time. It can also elevate the integrity of financial information, as the data on each node is backed up. A single node failure will not negatively influence the integrity of financial data, making transaction parties prone to reaching consensus [6]. Distributed ledger tends to be regarded as a more secure decentralization requiring a trust mechanism, compared with complete decentralization, which is more realizable, secure, and efficient [7].

Moreover, Haier can incorporate stakeholders into the blockchain to form a consortium blockchain, enabling stakeholders to use the secret key to enter the corresponding block. Thus, stakeholders can be swiftly shared information swiftly [5]. Consortium blockchain not only takes the place of the conventional manual disclosure of financial information and lessens the workload of relevant financial personnel but also makes the financial business data transparent and reduces the occurrence of fraud.

On the other hand, smart contracts can also be utilized to ensure the security of financial information. Standard conditions that trigger the digital protocol are tailored via code in advance so that once a transaction occurs that meets the criteria, it can be processed automatically without human or other interference [10]. In addition, Haier’s financial shared service center can ensure the traceability and immutability of financial information by using the timestamp and digital signature on the blockchain. Meanwhile, through utilizing Merkle Tree, a fundamental component of blockchain, the financial information can be swiftly located to the specific block to ensure the operation efficiency of FSSC, the traceability, and the security of accounting business information.

Financial data's authenticity, security, and integrity can be ensured through the application blockchain in Haier’s FSSC.

3.2.2. Application Smart Contract to Reduce Workload of Financial Personnel.

As a massive multinational enterprise with 143,300 branches around the world, the financial personnel of Haier’s FSSC tends to be faced with a multitude of fundamental and repetitive work as a result of numerous financial business processing work concentrated in Haier’s FSSC from branches, which may give rise to unfavorable effects on the enthusiasm of financial staff [7].

Accordingly, Haier can use a smart contract, which combines with a consensus algorithm to assign repetitive and essential accounting work such as reimbursement and accounting calculation. The financial staff of branches transmits data to Haier's FSSC through an imaging system. As long as conditions set in advance are met, triggering the digital protocol, the business can automatically correspond to accounting items and complete accounting processing. If the smart contract estimates that the accounting vouchers uploaded do not meet the requirements, the vouchers will be automatically returned for modification [10]. For instance, when the financial business that should be included in the sales expense occurs, the accounting information system finds the keyword by the definition of the sales expense swiftly in the first place. The business can automatically match the sales expense classification items through the intelligent contract and carry out accounting [6].

In general, Haier can take advantage of smart contract in the financial shared service center, which can improve the degree of automatic processing of financial data and reduce the workload of financial personnel by automatically completing repetitive and fundamental accounting work, and alleviate the problem of staff flow.

3.2.3. Raising Efficiency in Processing Financial Information.

Since Haier established the financial shared service center, the efficiency of financial management has been enhanced to a considerable extent. Nevertheless, there are still problems regarding low efficiency due to repetitive examination and verification and lack of timeliness of manual accounting on account of large financial data volume.

Therefore, Haier can attempt to exploit the preponderance of blockchain, such as smart contract and distributed ledgers, to raise the operation efficiency of its FSSC. The smart contract enables to process of accounting business via taking advantage of code designed digital protocol that can be triggered in specific conditions, which can achieve higher operation efficiency of FSSC while ensuring data security by avoiding human interference. In addition, distributed ledger enables each node in the blockchain to have a complete ledger. When a transaction occurs, all the ledger records the same transaction information in real-time and synchronously. Distributed ledger retains each branches a part of the rights concentrated initially in the financial sharing service center, which can simplify the accounting process and improve efficiency while ensuring that the financial information cannot be tampered with [13]. Meanwhile, the consensus algorithm similar to the general meeting of shareholders called DPoS (Delegated Proof of Stake) enables several representative nodes to operate the whole network and verify the transaction information, which shortens the generation time as well as confirmation time of each block, can not only ensures the operation efficiency of FSSC but also reduces the operation cost to a minimum level without increasing the risk of financial information security [6].

By and large, Haier can apply smart contract, distributed accounting models, and DPos consensus algorithms, which are the features of blockchain, to FSSC to raise its operation efficiency to ensure the security of transaction information.

4. Conclusion

There are many problems of the FSSC in multinational enterprises, including information asymmetry existing between the headquarters and branches, potential safety hazard of accounting information, and heavy workload of financial personnel, and there is still room for improvement in operation efficiency, which enable to be handled through the application of blockchain. This paper provides some following feasible suggestions for optimizing the FSSC of multinational enterprises via blockchain application after analyzing the status of Haier’s FSSC. First, distributed ledger, smart contract, consortium blockchain, timestamp, and digital signature can be exploited to ensure the security of financial business information. Secondly, the invested cost and the workload of the financial staff of FSSC can be reduced to a large extent using a smart contract, which can complete fundamental and repetitive work automatically. On the other hand, the smart contract and distributed ledger application enable FSSC to raise the operation efficiency without increasing the data security risk.

Acknowledgement

Author Introduction: Yuehe Tian, female, undergraduate, Shandong Technology and Business University, research interests: blockchain, financial management

Fund Project: This thesis relates to Shandong Provincial Project S202211688031 of 2022 Shandong Province Training Program of Innovation and Entrepreneurship for Undergraduates

References

[1]. Martin, W.: Critical Success Factors of Shared Service Projects-Results of an Empirical Study. Advances in Management 14, 21-26 (2011).

[2]. Li, Y.: Study on Optimization of Financial Sharing Service Center. Modern Economy 7, 1290-1302 (2016).

[3]. Gan, L.: Application of Financial Sharing in Financial Management of Group Enterprises. Finance and Market 3, 140-142 (2020).

[4]. Yu, L., Guo, F.: Research on Cost Management Optimization of Financial Sharing Center Based on RPA. Procedia Computer Science 166, 115–119 (2020).

[5]. Tian, T.: Application of Blockchain to Optimize Financial Sharing Mode. Commercial Accounting 10, 103-105(2020).

[6]. Zhu, J., Hao, Y., Song, B.: Financial Sharing Center Model Based on Blockchain and Benefit Analysis. Economic Issues 10, 113-120 (2019).

[7]. Li, Q.: Consideration About Further Optimization of Financial Sharing Centers from the Perspective of Blockchain. Accounting Learning, 08-09 (2021).

[8]. Li, X., Du, X., Su, S.: Research on the Internal Control Problems Faced by the Financial Sharing Center in the Digital Economy Era1-An example of Financial Sharing Center of H Co.Ltd. Procedia Computer Science 187, 158-163(2021).

[9]. Yang, R.: Application of blockchain in the Domain of Financial Sharing. Finance and Accounting Monthly 9, 35-40 (2020).

[10]. Yao, Y.: Application of Blockchain to Further Optimize Financial Shared Service Center Based on the Integration of Business and Finance. Communication of Finance and Accounting 7, 134-137(2020).

[11]. Liu, C.: Inspiration and Problem Analysis of Haier’s Financial Sharing Service Research. Commercial Modernization 2, (2021).

[12]. Chen, Q.: Study on the Practice of Corporate Finance Sharing Center -Vanke Company as an Example. Frontiers in Economics and Management 8, 93-99 (2021).

[13]. Li, Y., Li, R.: Research on Financial Sharing Innovation Model of Multinational Enterprises in the Background of Digital Economy. Pioneering with Science and Technology 8, 72-75 (2022).

Cite this article

Tian,Y. (2023). Blockchain Application in Financial Shared Service Centers for Multinational Enterprises. Advances in Economics, Management and Political Sciences,31,101-107.

Data availability

The datasets used and/or analyzed during the current study will be available from the authors upon reasonable request.

Disclaimer/Publisher's Note

The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of EWA Publishing and/or the editor(s). EWA Publishing and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content.

About volume

Volume title: Proceedings of the 7th International Conference on Economic Management and Green Development

© 2024 by the author(s). Licensee EWA Publishing, Oxford, UK. This article is an open access article distributed under the terms and

conditions of the Creative Commons Attribution (CC BY) license. Authors who

publish this series agree to the following terms:

1. Authors retain copyright and grant the series right of first publication with the work simultaneously licensed under a Creative Commons

Attribution License that allows others to share the work with an acknowledgment of the work's authorship and initial publication in this

series.

2. Authors are able to enter into separate, additional contractual arrangements for the non-exclusive distribution of the series's published

version of the work (e.g., post it to an institutional repository or publish it in a book), with an acknowledgment of its initial

publication in this series.

3. Authors are permitted and encouraged to post their work online (e.g., in institutional repositories or on their website) prior to and

during the submission process, as it can lead to productive exchanges, as well as earlier and greater citation of published work (See

Open access policy for details).

References

[1]. Martin, W.: Critical Success Factors of Shared Service Projects-Results of an Empirical Study. Advances in Management 14, 21-26 (2011).

[2]. Li, Y.: Study on Optimization of Financial Sharing Service Center. Modern Economy 7, 1290-1302 (2016).

[3]. Gan, L.: Application of Financial Sharing in Financial Management of Group Enterprises. Finance and Market 3, 140-142 (2020).

[4]. Yu, L., Guo, F.: Research on Cost Management Optimization of Financial Sharing Center Based on RPA. Procedia Computer Science 166, 115–119 (2020).

[5]. Tian, T.: Application of Blockchain to Optimize Financial Sharing Mode. Commercial Accounting 10, 103-105(2020).

[6]. Zhu, J., Hao, Y., Song, B.: Financial Sharing Center Model Based on Blockchain and Benefit Analysis. Economic Issues 10, 113-120 (2019).

[7]. Li, Q.: Consideration About Further Optimization of Financial Sharing Centers from the Perspective of Blockchain. Accounting Learning, 08-09 (2021).

[8]. Li, X., Du, X., Su, S.: Research on the Internal Control Problems Faced by the Financial Sharing Center in the Digital Economy Era1-An example of Financial Sharing Center of H Co.Ltd. Procedia Computer Science 187, 158-163(2021).

[9]. Yang, R.: Application of blockchain in the Domain of Financial Sharing. Finance and Accounting Monthly 9, 35-40 (2020).

[10]. Yao, Y.: Application of Blockchain to Further Optimize Financial Shared Service Center Based on the Integration of Business and Finance. Communication of Finance and Accounting 7, 134-137(2020).

[11]. Liu, C.: Inspiration and Problem Analysis of Haier’s Financial Sharing Service Research. Commercial Modernization 2, (2021).

[12]. Chen, Q.: Study on the Practice of Corporate Finance Sharing Center -Vanke Company as an Example. Frontiers in Economics and Management 8, 93-99 (2021).

[13]. Li, Y., Li, R.: Research on Financial Sharing Innovation Model of Multinational Enterprises in the Background of Digital Economy. Pioneering with Science and Technology 8, 72-75 (2022).