1. Introduction

Nike started out as a small workshop in 1964. Since there were two European footwear giants, Adidas and Puma, controlling the sports brand market at that time, Nike was always in a difficult situation. However, as Nike continued to improve and progress, the market demand for Nike products continued to grow. Thanks to its focus on innovation and marketing activities, the company has grown strongly in recent decades, and its company culture and philosophy resonate with consumers around the world, with Nike having the largest market share of all sports brand. Nike has experienced several ups and downs in its nearly 60-year history, facing different struggles while creating different legends. Nike's 2020 annual earnings report looks less than optimistic, and it is worth exploring what can be done to turn Nike's turnover around again in response to this dilemma [1,2].

Nike's annual revenue over 5 years is shown in Table 1. The table shows that starting off strong, Nike's revenue continued to grow from 2016 to 2019, decreasing but decreased significantly in 2020 [3]. Nike offers products at a variety of price points to meet the needs of different consumers. Its pricing strategy is based on providing all customers with quality products at competitive prices. The main purpose of this paper is to conduct a theoretical study on the negotiation based on interests and positions in the global marketing strategy of Nike footwear products. It also distinguishes how Nike should negotiate with agents or customers when trading and positioning different products through product classification.

Table 1: Nike 5-year annual revenue [4].

Year | Annual Revenue (In billions of USD) | Growth(%) |

2016 | $32.4 | 5.7 |

2017 | $34.4 | 5.8 |

2018 | $36.4 | - |

2019 | $39.1 | - |

2020 | $37.4 | - |

Nike's annual revenue over 5 years is shown in Table1. The table shows that Nike's revenue continues to grow from 2016 to 2020, starting off strong and decreasing significantly in annual revenue by 2020. Nike offers products at a variety of price points to meet the needs of different consumers. Its pricing strategy is based on providing all customers with quality products at competitive prices. The main purpose of this paper is to conduct a theoretical study on the negotiation based on interests and positions in the global marketing strategy of Nike footwear products. It also distinguishes how Nike should negotiate with agents or customers when trading and positioning different products through product classification.

2. Analysis of Nike's Current Negotiation Status

Currently, Nike products are still widely popular, particularly among younger consumers. However, Nike is facing increased competition from upstart brands and veteran sports brands like Lulu-lemon, Under Armour and Adidas, which have been eating into Nike's market share in key demographics. Additionally, geopolitical tensions have put pressure on Nike's supply chain and manufacturing operations, leading to higher costs and potentially lower margins. Besides that, Nike has faced significant issues in recent years in its negotiations with its agencies over pricing. The company has long relied on a network of third-party manufacturers to produce its products, and these manufacturers have been pushing for higher prices in recent years due to rising costs and increasing demand for their services.

While Nike has been able to negotiate some lower prices with its agencies in certain regions, the company has also faced push-back from some of its key partners. This has led to tension between Nike and its agencies, with some calling for more transparency and fairness in the pricing negotiations process. Overall, the current state of Nike products is still strong, but the company is facing challenges on several fronts. With increased competition and pressures on its supply chain, Nike needs to continue to innovate and come up with a more scientific pricing in order to stay ahead in the competitive world of sports apparel. As it negotiates with its agencies on pricing, the company will need to balance its desire for profitability with the needs of its manufacturing partners and its own commitment to fair labor practices.

3. Analysis of Nike's Negotiation Objectives and Strategies

Using the Boston Matrix, Nike can assess its product portfolio and make strategic decisions regarding investments, divestment, and resource allocation. This allows Nike to focus its efforts on products that have the potential for high growth and profitability, while also managing products that have reached its maturity or declining phase in the product life-cycle. When representing Nike in interest-based bargaining and position-based bargaining, one should first identify the advantages and disadvantages of different products. Nike may consider the potential concerns and needs of its customers when pricing.

Interest-based negotiation should develop and regulate negotiation regulations based on the strengths of the product. For example, Nike may conduct market research to understand the demand for each product and set prices accordingly to maximize revenue without losing customers. Only terms that focus on the needs and interests of both negotiating parties can lead to a win-win situation for both parties. Rather than arguing on the basis of a particular position, it is better to reach cooperation.

On the contrary, position-based negotiations tend to be a more traditional bargaining approach, considering only their own needs and requirements. It is obvious that Nike needs to make a profit and keep the agency and customers as profitable as they can afford. That is, they may set a fixed price for each product based only on their own needs and goals. This would likely be based on factors such as production costs, profit margins and brand positioning.

3.1. Nike Star Products

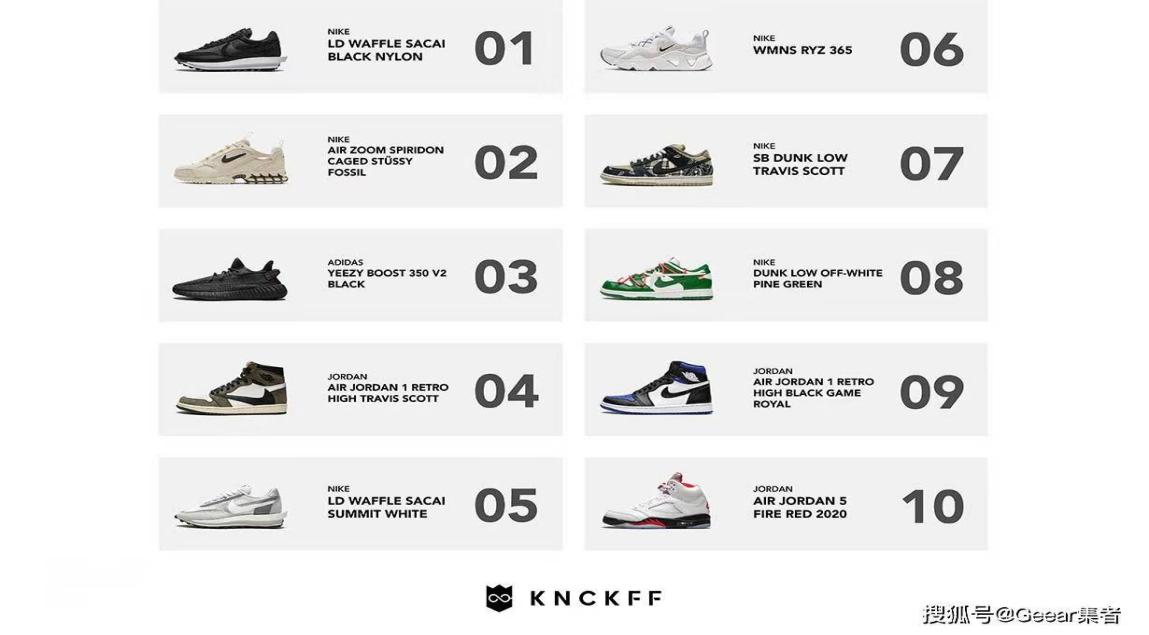

Stars are products with high market share and high growth potential. For Nike, products such as the Air Jordan line, Nike Air Max line, and Vapor-fly running shoes can be classified as Stars. These products have a loyal customer base and are constantly updated with new technology and designs to maintain their popularity (see Fig. 1.).

Figure 1: Top selling sneakers in the first half of 2020 [5].

Both practically and theoretically Air Jordan Sneaker has been a successful negotiation case for Nike. With Interest-Based negotiations. Nike can focus on its revenue and celebrity endorsement effects. Flying Jordan is one of Nike's most profitable brands, generating billions of dollars in sales each year for Nike. The sneaker appeals to a wide range of consumers and is expensive, making it a highly profitable product. Michael Jordan himself, has played an important role in promoting the brand. This celebrity endorsement further elevated the brand and helped raise its profile [6]. This is because its higher visibility and price alone represent the Air Jordan Sneaker's solid position with Nike.

With Position-Based negotiations, Nike company focuses on its innovation and brand equity, and air Jordan sneakers have been at the forefront of innovation in the sneaker industry. They were the first brand to introduce an air-cushioned sole and since then the brand has continued to push the boundaries of technology and design. This has helped Nike stay at the forefront of the industry. For the Air Jordan Sneaker's brand equity, Jordan the Fly has become an icon in the sneaker world and has played a major role in building Nike's brand equity. The sneaker has a loyal following of basketball fans, fashion lovers, and collectors.

The successful negotiation of Air Jordan sneakers has helped the company establish itself as a leader in the athletic shoe industry and has contributed significantly to its profits. For the star product, the company invested a lot of resources in it every year and the company have an absolute advantage in the negotiation. Therefore, the best option for price negotiations with customers and distributors is Nike's pricing itself. That is, present Nike's position at the beginning of the negotiation and stick to it all the way through. And only giving the customer and the distributor a short period of time to consider it in order to make a decision in Nike's favor.

3.2. Nike Cash Cow Products

In the case of Nike, the classic Converse All-Star sneaker, the Nike Air Force Series sneaker and the Nike Cortez sneaker can all be categorized as cash cows.

In terms of interest-based negotiations, the Nike Air Force remains a popular product, but their growth potential is limited due to their longevity and wide availability. The Air Force sneaker is designed for athletes and wearers who prefer versatile shoes. The Nike Air Force is positioned as an all-time classic with an evolving design and changing style. Nike plans to continue to innovate with the Air Force1 by introducing new designs and collaborating with global artists and designers, which demonstrates the goal of sustainability of the Air Force line's interests. This strategy will help keep the sneaker fresh and relevant, while also attracting new customers to the brand.

From position-based negotiation standpoint, Nike Air Force to a certain extent meets the needs of customers, and greatly promotes the development of Nike products. The main needs of customers for Air Force sneakers are comfort, durability and fashion. Nike air force is more of a trend-setting factor for consumers. The sneaker reportedly brings in more than $1 billion in revenue for the company each year. This figure represents more than 2% of Nike's total revenue, making it one of the most important products in the company's portfolio [7]. So, the price factor will not be a stumbling block for Nike. Since the production area based on this series of Air Force sneakers is mainly represented by East and South Asia with high-profit margins, this Cash Cow product from Nike represents the possibility of profitability.

3.3. Nike Dog Products

For Nike lean dog products may include products that have been discontinued or have failed to catch on, such as the Nike Lunar Eclipse+ running shoe or the Nike Air Trainer 1.0 sneaker.

When negotiating based on the interest it should be clear that the main needs of customers for the Air Trainer line of sneakers are comfort, versatility and performance. The Air Trainer is designed for athletes who prefer cross-training shoes for a variety of sports. The product was designed and developed carefully in order to capture the maximum number of customers. The brand is positioned to represent Nike's dedication to athletic training and the concept of "fitness-based"[8]. Pricing should be set reasonably on the basis of design and technology, without excessive consideration of price when quoting in negotiations. Because the more dedicated fitness groups are mostly casual about price, customers are concerned about function and comfort.

Negotiations based on positioning should first make it clear that Air Trainer, as the company's question mark product, has high growth and low share. Although the product is more focused on fitness, Nike representatives can also give customers and dealers more concessions during the negotiation process compared to the first two products. This can balance the star products and cash cow products to a certain extent and let the money be used on the edge. Through such positioning, it can also be seen that the negotiation process can be different according to the market positioning of the product, thus sacrificing some benefits and achieving a win-win situation.

3.4. Nike Question Mark Products

In Nike's Question Mark products case, this may include emerging products or technologies that have yet to gain widespread adoption, such as Nike Fly Ease shoes or Nike Joyride running shoes.

Interest-Based negotiation is to maximize revenue without losing customers. Only by capturing customers' preferences can Nike better capture the market, and only by capturing a larger market first can Nike Inc not be crowded out by other brands. Therefore, the two factors that need to be considered in interest-based negotiation are competition from other brands and changes in fashion trends. While Nike was one of the first major sports brands to introduce adaptive designs (such as Fly Ease), other companies are now entering the market, including Reebok and Puma. Nike's Fly Ease proved to be perceived as lagging behind in terms of innovation, so it was difficult to maintain a dominant position in the sportswear market [9]. But like all fashion brands, Nike's success depends to some extent on anticipating and keeping up with changing fashion trends. The Fly Ease running shoe has gradually been perceived as less fashionable than other Nike products, and it has become less popular, thus hurting Fly Ease Nike's sales and customer base. So, the author believes that during the negotiation process of pricing customers need to be shown the value of Fly Ease running shoes as well as the not-so-substantial cost.

Combined with its production costs and brand positioning, it was easier to analyze the Position-Based negotiation [10]. The product is positioned as an innovative product. This means that these are considered such as high production costs and limited appeal. Negotiating and measuring from a business perspective, where the ultimate goal is to make a better profit, the high cost of the Fly Ease running shoes has rightly become a Question Mark product for Nike. the Fly Ease running shoes require special engineering and design to make them easier to put on and take off. This could mean that Fly Ease shoes cost more to produce than other Nike shoes, which could erode the company's profits. At the same time, Nike need to be careful: While Fly Ease shoes have a more approachable design, they may not appeal to everyone. Some people may prefer the traditional laces or may not need the extra support and assistive features that Fly Ease offers. This may limit the market for this Nike product. Not only did Nike Inc need to show that its expectations of the Interest were lower when negotiating but also needed to set a worst alternative to a negotiated agreement (WATNA) to protect Nike Inc costs from being affected [11].

4. Conclusion

Business negotiations play a vital role in today's business world. Regardless of the size and industry sector, every business needs to come up with appropriate negotiation strategies to maximize its benefits. This paper examines negotiation techniques by categorizing a range of Nike products to discuss how Nike should base its negotiation strategies on benefits and positions and how the growth-share matrix can be applied in today's competitive sales arena. For the Star product, Cash Cow product, Pet product, Question Mark product classification and related strategic negotiation model formed after Nike's footwear products are categorized according to BCG. It is further discussed how Nike's negotiation strategies, i.e., interest-based and position-based negotiation approaches can help gain more competitive advantage. The results of this study demonstrate the importance of interest-based and position-based negotiation strategies and call for a flexible mindset in the face of uncertainty in the business negotiation process. The results of this study are expected to provide insights into Nike's future growth strategies and theoretical development and practice of business negotiation.

References

[1]. Cullinan G., Le Roux JM., Weddigen RM.: When to walk away from a deal. Harvard Business Review 82(4), 96-104, 141 (2004).

[2]. Denny, I.: The sneaker–marketplace icon. Consumption Markets & Culture, 24(5), 456-467 (2021).

[3]. Nike Issues Fiscal 2020 Third Quarter Results. Manufacturing Close - Up. (2020).

[4]. Almani, M., Nobanee, H.: Financial Statement Analysis of NIKE. (2020).

[5]. Taiwan third party trading platform. KNCKFF, a third-party sneaker trading platform in Taiwan, announced its sales report for the third quarter of 2020. October 19, 2020, https://www.bouncin.net/p/news/hot-topics/1585/knckff-2020-q3-sneakers, last accessed 2023/3/27.

[6]. Choi, JW., Kim, M.: (2014, January). Do the Sneakerheads Just Want to Be Like Mike? In International Textile and Apparel Association Annual Conference Proceedings 71(1),Iowa State University Digital Press.

[7]. Tirpak, JA.: The Air Force Today and Tomorrow. Air Force Magazine 79, 20-27 (1996).

[8]. Nike Lab Free Trainer 1.0, https://www.sneakerfiles.com/nikelab-free-trainer-1-0/, last accessed 2023/3/31.

[9]. Grimmer, L., Mortimer, G., Pallant, J., Pallant, J.: What is adaptive clothing and how can it make life easier for people with a disability? Journal of the Home Economics Institute of Australia, 27(1), 48-49 (2022).

[10]. Ashcroft, S.: "Commercial negotiation skills", Industrial and Commercial Training 36(6), pp. 229-233 (2004)

[11]. Cullinan G., Le Roux JM,, Weddigen RM.: When to walk away from a deal. Harvard Business Review 82(4), 96-104, 141 (2004).

Cite this article

Sun,Q. (2023). Analysis of Business Negotiation Strategy Application -Taking Nike as an Example. Advances in Economics, Management and Political Sciences,31,234-239.

Data availability

The datasets used and/or analyzed during the current study will be available from the authors upon reasonable request.

Disclaimer/Publisher's Note

The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of EWA Publishing and/or the editor(s). EWA Publishing and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content.

About volume

Volume title: Proceedings of the 7th International Conference on Economic Management and Green Development

© 2024 by the author(s). Licensee EWA Publishing, Oxford, UK. This article is an open access article distributed under the terms and

conditions of the Creative Commons Attribution (CC BY) license. Authors who

publish this series agree to the following terms:

1. Authors retain copyright and grant the series right of first publication with the work simultaneously licensed under a Creative Commons

Attribution License that allows others to share the work with an acknowledgment of the work's authorship and initial publication in this

series.

2. Authors are able to enter into separate, additional contractual arrangements for the non-exclusive distribution of the series's published

version of the work (e.g., post it to an institutional repository or publish it in a book), with an acknowledgment of its initial

publication in this series.

3. Authors are permitted and encouraged to post their work online (e.g., in institutional repositories or on their website) prior to and

during the submission process, as it can lead to productive exchanges, as well as earlier and greater citation of published work (See

Open access policy for details).

References

[1]. Cullinan G., Le Roux JM., Weddigen RM.: When to walk away from a deal. Harvard Business Review 82(4), 96-104, 141 (2004).

[2]. Denny, I.: The sneaker–marketplace icon. Consumption Markets & Culture, 24(5), 456-467 (2021).

[3]. Nike Issues Fiscal 2020 Third Quarter Results. Manufacturing Close - Up. (2020).

[4]. Almani, M., Nobanee, H.: Financial Statement Analysis of NIKE. (2020).

[5]. Taiwan third party trading platform. KNCKFF, a third-party sneaker trading platform in Taiwan, announced its sales report for the third quarter of 2020. October 19, 2020, https://www.bouncin.net/p/news/hot-topics/1585/knckff-2020-q3-sneakers, last accessed 2023/3/27.

[6]. Choi, JW., Kim, M.: (2014, January). Do the Sneakerheads Just Want to Be Like Mike? In International Textile and Apparel Association Annual Conference Proceedings 71(1),Iowa State University Digital Press.

[7]. Tirpak, JA.: The Air Force Today and Tomorrow. Air Force Magazine 79, 20-27 (1996).

[8]. Nike Lab Free Trainer 1.0, https://www.sneakerfiles.com/nikelab-free-trainer-1-0/, last accessed 2023/3/31.

[9]. Grimmer, L., Mortimer, G., Pallant, J., Pallant, J.: What is adaptive clothing and how can it make life easier for people with a disability? Journal of the Home Economics Institute of Australia, 27(1), 48-49 (2022).

[10]. Ashcroft, S.: "Commercial negotiation skills", Industrial and Commercial Training 36(6), pp. 229-233 (2004)

[11]. Cullinan G., Le Roux JM,, Weddigen RM.: When to walk away from a deal. Harvard Business Review 82(4), 96-104, 141 (2004).