1. Introduction

Lazy Audio Book was founded in 2012. It is an audio platform that provides users with a full range of audio books, comedies, storytelling shows, podcasts, and other radio programs [1]. It also has a massive collection of classic and original IP audio books. After many years of development, Lazy Audio Book owns a massive user base and has formed an interactive community with high user activity and participation. As a result, it is one of China's leading audio platforms.

After reaching a strategic cooperation with China Literature Limited for the exploration of the long-form audio field and audio book market in March 2020, Tencent Music Entertainment Group has accelerated the business expansion progress of long-form audio works since then. On January 15, 2021, Tencent Music Entertainment Group reached an agreement with all shareholders of China's audio platform Lazy Audio Book to acquire 100% equity of Lazy Audio Book for 2.7 billion yuan [2]. The transaction is expected to be completed in the first half of 2021, and needs to meet the delivery conditions.

The purpose of this article is to investigate the strategic objectives of Tencent Music Entertainment Group's acquisition and conduct a SWOT analysis of this acquisition.

The significance of this article lies in the fiercely competitive long-form audio market in China and whether Tencent Music Entertainment Group can obtain the key to victory in long-form audio market through its own deployment.

The remaining parts of this paper are organized as follows: Section 2 analyzes strategic objectives and significance of the acquisition; Section 3 analyzes SWOT of the acquisition; Section 4 makes a conclusion.

2. Strategic Objectives and Significance of the Acquisition

2.1. Strategic Objectives

As the leading music enterprise in China and the first music entertainment group to be listed in the United States, Tencent Music Entertainment Group has undergone a development process of legalization and refinement since its listing in 2018. In China, the market competition in the audio book industry is fierce. Acquiring Lazy Audio Book is a key strategy for Tencent Music Entertainment Group to lay out the long-form audio field. Lazy Audio Book's extensive library of audio books will rapidly expand Tencent Music Entertainment Group's long-form audio content pool, and its content production capabilities will promote the production of high-quality audio books for Tencent Music Entertainment Group. Tencent Music Entertainment Group can continue to integrate and expand the supply of long-form audio content and services, and provide users with more high-quality content through diversified content categories and rich product matrix [3]. So, it can fully meet users' listening needs, and ultimately seize the market.

Therefore, the article believes the strategic objective of this acquisition is to form an important complement to Tencent's existing "business ecosystem" and accelerate the capture of the long-form audio market.

2.2. Strategic Significance: Establish Business Ecosystem

Tencent Music Entertainment Group has always hoped to establish its own "business ecosystem" in the audio industry, and since 2020, it has set its sights on the long-form audio field. After entering the long-form audio track, Tencent Music Entertainment Group continued to exert its efforts and supplemented the content of its platforms.

2.2.1. Kugou Changting

Kugou Changting is Tencent Music Entertainment Group's first long-form audio product, which is complete in content, including radio drama, audio book, storytelling, children's songs, and emotional variety shows, among others [4]. As it developed, Kugou Changting collaborated with famous cartoon companies and industry stars and attracted a large number of users.

2.2.2. Kugou Music

Kugou Music focuses on creating high-popularity audio content and has collaborated with China Youth Daily to launch high-quality cultural audio programs such as "Hello! Forbidden City - Hear Your 600 Years". According to data, as of December 2020, the number of Kugou Radio hosts has increased by 12 times year on year [5].

2.2.3. QQ Music

QQ Music is committed to introducing a large number of head audio content and high-quality IP and launching popular audio programs such as the popular young people's show "Talk Show Conference". It has also created new cultural and creative IP audio in cooperation with major museums in China [6].

Clearly, after Tencent Music's layout in the long-form audio industry, it is accelerating collaboration with industry resources to make the market "cake" larger. However, it is not enough to do just these things alone. Tencent Music Entertainment Group believes that it also needs to acquire high-quality companies in the long-form audio field. Through high-quality acquisitions, it can effectively obtain various resources such as content, users, and professional talents and rapidly stimulate the vitality of the entire platform's audio ecology. It can also achieve effective complementarity in content and achieve the goal of entering a new stage of development for the "business ecosystem".

3. Analysis of SWOT

3.1. Advantages of the Acquisition

3.1.1. Huge Potential of the Long-Form Audio Market

First, the development of China's audio book industry has been rapid, with the industry scale continuously expanding and experiencing high-speed growth in recent years. Figure 1 shows the size of China audio book market, and the size of China audio book market has grown by more than 30% for three consecutive years. Second, China has launched relevant actions to combat copyright infringement. For example, from June to October 2020, the National Copyright Administration jointly launched the 16th campaign to combat online infringement and piracy. The purpose of these actions is to create a better reading environment. Third, people are gradually developing a "knowledge payment" habit, with increased reading rates and willingness to pay. According to iiMedia Group data, the number of Chinese knowledge payers increased from 96 million in 2016 to 356 million in 2019 [7]. Fourth, the development of 5G and AI can bring innovation to the audio book industry, broaden listening scenarios and optimize the listening experience. Tencent Music Entertainment Group's acquisition of Lazy Audio Book is undoubtedly the right timing for entry.

|

Figure 1: China audio book market size from 2016 to 2019. |

Data source: iiMedia Group |

Photo credit: Original |

3.1.2. High-Quality Platform

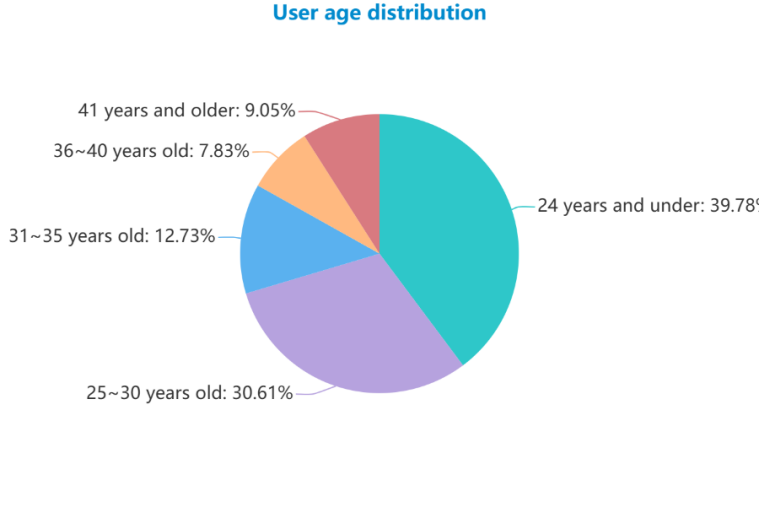

First, Lazy Audio Book is one of China's largest and most popular audio book platforms, with over 2,000 renowned narrators and high-quality content, which is no less impressive compared to Himalaya and Dragonfly FM. Second, as a vertical audio book platform, Lazy Audio Book is a leader in the vertical audio field, with a monthly active user base reaching 8 million at the peak, which is the leading position in this field. Third, the male-to-female user ratio of Lazy Audio Book is nearly 1:1[8], with 54.36% being male and 45.64% being female, which indicates that gender does not limit its development. It is also more popular among young people, indicating great potential. The age distribution can be seen in Figure 2, and users aged 24 and under which is the largest user group account for nearly 40 percent. By acquiring high-quality enterprises, Tencent Music Entertainment Group can better enter the market.

|

Figure 2: This is the user age distribution. |

Data source: iiMedia Group |

Photo credit: Original |

3.1.3. Social Attributes

WeChat and QQ are undoubtedly the most important platforms for people's daily communication. According to Tencent 2022 annual report, the number of WeChat monthly active users is 1.313 billion, and QQ has 0.572 billion monthly active users [9]. So, Tencent has always been focusing on developing social attributes. Therefore, for Lazy Audio Book, Tencent Music Entertainment Group can use its advantages to integrate Lazy Audio Book into its social media platform, providing users with new interactive ways and social functions to attract more users.

3.2. Disadvantages of the Acquisition

3.2.1. Copyright Issues

Copyright remains a potential risk for Tencent Music Entertainment Group. Many of the audio contents on Lazy Audio Book are based on well-known works. It was once sued for not having the copyright to narrate literary works by famous Chinese writers Louis Cha and Echo, which led to significant economic losses. Copyright-related laws in China are not yet perfect, and Lazy Audio Book heavily relies on copyrights, thereby exposing Tencent Music Entertainment Group to potential copyright disputes.

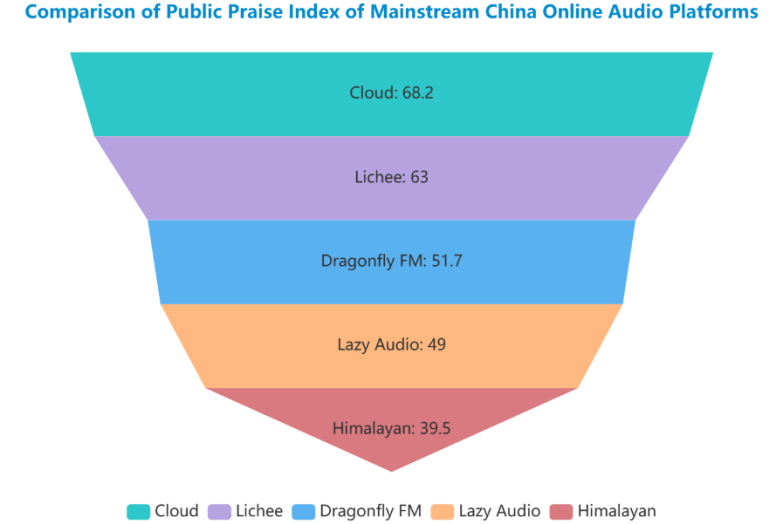

3.2.2. Competitiveness

The competitiveness of Lazy Audio Book in the long-form audio market is not as strong as expected. First, as a vertical audio book product, Lazy Audio Book has a relatively narrow audience and limited product categories, which restricts its future development in other directions. Second, according to data from iiMedia Group, which is a market research firm, the online reputation of Lazy Audio Book is not good, and it has a score lower than 50 out of 100 in terms of online reputation, compared to other leading platforms [10]. The score can be seen on Figure 3, and Lazy Audio received a rating of 49 points, which is the second lowest among the five head audio book platforms. Therefore, Tencent Music Entertainment Group needs to learn from the strengths of Lazy Audio Book while addressing its weaknesses.

|

Figure 3: This is the comparison of score about five leading audio book platforms in China. |

Data source: iiMedia Group |

Photo credit: Original |

3.2.3. Consumer Experience

Lazy Audio Book offers VIP services, and non-VIP users need to watch ads to access the content. However, even after purchasing the VIP membership, some paid audio books still require additional payment, which can affect the user's experience [11]. Therefore,Tencent Music Entertainment Group needs to pay attention to these controversies and avoid losing consumers.

3.3. Opportunities for Acquisition

3.3.1. The Formation of an Ecosystem

With the development of digital media, the prospects of the audio book market are very promising, and many companies in China have successively entered the long audio market, seeing its potential for development. Tencent Music Entertainment Group has always been creating its own "commercial ecosystem" in the audio industry. By acquiring Lazy Audio Book, it can have a foothold in the long audio field and gain more market share. This is an important step for Tencent to complete its own "commercial ecosystem" in the audio industry.

3.3.2. Big Data Push

Tencent Music Entertainment Group has strong technical capabilities, especially in big data technology and algorithms. Taking QQ music as an example, it has a daily recommended songs feature, which recommends suitable songs for users based on their listening preferences and tastes. This feature is loved by most users. Therefore, Tencent Music Entertainment Group can use its accurate big data push ability to add personal recommendation functions to the Lazy Audio Book platform, and satisfy their listening needs according to different users' preferences [12]. This not only improves the user experience of Lazy Audio Book, but also attracts more users.

3.3.3. Exploring Paid Users

Knowledge payment is in its development stage in China, so the proportion of users willing to pay for audio books on long audio platforms is not high. According to data, the proportion of paid users on Lazy Audio Book is only 3%, but still higher than the average level. For Tencent Music Entertainment Group, there are many experiences in exploring paid users. Taking QQ music as an example, many high-quality or famous songs require VIP membership, and there are also digital collection albums that need to be purchased to listen to. This does not contradict the trend of knowledge payment, because high-quality products are worth paying for. Tencent Music Entertainment Group can use its experience to explore more paid users on Lazy Audio Book, and make more users willing to pay for high-quality audio book products.

3.4. Threats to the Acquisition

3.4.1. Competition Pressure

It is not only Tencent Music Entertainment that has turned its attention to the long audio market in China. Companies like ByteDance and Kuaishou have also entered this field. These short video companies often have a large user base and more advantages in launching apps or platforms [13]. Moreover, other platforms that already hold a large share of the market, such as Himalaya, are also continuously strengthening their audio content library and subscription model, which brings greater competition pressure to Tencent Music Entertainment. Competitive landscape of China audio book market can be seen on Table 1, which has a comparison of Himalaya, Dragonfly FM, Lazy Audio in five aspects, and the advantages of lazy listening books are not ideal.

Table 1: The landscape of China audio book market.

Competitive landscape of China audio book market | |||||

Name | Number of monthly active crosses(million) | Permeability (%) | Number of monthly launches (Million times) | Duration of monthly use (Million hours) | Duration of use per person in a single day(minute) |

Himalayan | >100 | >10% | >3000 | >300 | >30 |

Dragonfly FM | >20 | >2% | >1000 | >100 | >30 |

Lazy Audio | >20 | >2% | >700 | >80 | >20 |

Data source: 2021 China Audio Reading Industry Report Photo credit: Original | |||||

3.4.2. Paid Services

Some users may not be willing to pay for the services provided by Lazy Audio Book, which may affect the company's ability to make a profit. According to data, the main source of revenue for Lazy Audio Book is advertising revenue. As a leading audio book platform, advertising revenue should not become the main source of income. Therefore, to obtain more stable revenue, attention should be paid to addressing the issue of paid services while also improving the user experience after payment, making users willing to pay.

3.4.3. Policies and Regulations on Copyright

With the improvement in regulations and policies on copyright issues, Chinese online and physical book authors will pay more attention to the copyright of their works [14]. Before the acquisition, Lazy Audio Book did have related disputes and controversies related to copyright. Therefore, changes in policies and regulations related to copyright may bring unknown risks and challenges to Tencent Music Entertainment, and these risks and challenges are unpredictable.

4. Conclusion

In 2020, Tencent Music Entertainment Group turned its attention to the long-form audio market and began laying out its own long-form audio market. Acquiring a leading audio book platform like Lazy Audio is undoubtedly the key to Tencent's layout in the long-form audio market and an important supplement to its "commercial ecosystem" in the sound industry.

This article, through research on Tencent Music Entertainment Group's strategic goals and significance of the acquisition as well as a SWOT analysis of the acquisition, believes that this acquisition can well achieve Tencent Music Entertainment Group's ultimate goal, and the advantages and opportunities of the acquisition are also very apparent. Undoubtedly, in many ways, this is a successful acquisition.

As for suggestions, I believe that after the completion of the acquisition, Tencent Music Entertainment Group needs to focus on the nature of the platform and try to gradually transform the vertical audio book platform into a comprehensive audio book platform, because vertical audio book platforms have some shortcomings compared to comprehensive ones, and transformation can have greater market potential in the future. Additionally, it should pay attention to copyright issues and related regulations and policies. With China's increasing emphasis on copyright issues, the importance of copyright will become increasingly high for audio book platforms.

References

[1]. M Ren. (2019), Research on content development strategy of lazy audio book platform, new media focus,163-164.

[2]. S Zu. (2021), The long audio market landscape may change, China Business Daily, 1-2.

[3]. Y Ding. (2019), Lazy audio-A practitioner of "Content King",Creative Industry, 73-76.

[4]. S Shao. (2020), Evaluation of music app competitiveness and user stickiness analysis in the era of paid music, Philosophy and Humanities, 1-77.

[5]. P Peng. (2021), Acquired 100% equity of Lazy Listening Books, Tencent Music Entertainment Group builds a "ecosystem" in the sound industry, The paper.

[6]. S Luo. (2021), Research on the pan-entertainment development strategy of Tencent Music Entertainment Group, Philosophy and Humanities, 1-48.

[7]. iiMedia Group. (2022), 2022 China Knowledge Payment Industry Report, iiMedia Future Education Research Center.

[8]. Y Shi, Y Zhang. (2018), Analysis on the current situation and development trend of mobile listening app - Take "lazy audio" as an example, Publication and distribution research, 12-18.

[9]. Tencent (2023), Tencent 2022 Annual Report. https://static.www.tencent.com/uploads/2023/04/06/eac54c79c67d8a501bc4b65ff1718223.pdf

[10]. iiMedia Group, 2018-2019 China audio book market special research report, iiMedia Entertainment Industry Research Center. http://www.iimedia.cn/c400/63471.html

[11]. Ah Li. (2015), Read with your ears,Computer software and applications,60.

[12]. Y Yang. (2021), Analysis of sustainable development strategy of listening to APP-Take the "Lazy Audio" APP as an example, Media Practice, 74-76.

[13]. Q Zhu. (2019), Operational research of audio apps, Information technology, 1-53.

[14]. S Zhang. (2021), The dilemma of the audiobook copyright authorization mechanism and its relief measures, Publication and distribution research, 22-29.

Cite this article

Mei,S. (2023). Can Tencent Music Entertainment Group's Acquisition of Lazy Audio Help It Establishes a Foothold in the Long-form Audio Market. Advances in Economics, Management and Political Sciences,32,123-130.

Data availability

The datasets used and/or analyzed during the current study will be available from the authors upon reasonable request.

Disclaimer/Publisher's Note

The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of EWA Publishing and/or the editor(s). EWA Publishing and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content.

About volume

Volume title: Proceedings of the 7th International Conference on Economic Management and Green Development

© 2024 by the author(s). Licensee EWA Publishing, Oxford, UK. This article is an open access article distributed under the terms and

conditions of the Creative Commons Attribution (CC BY) license. Authors who

publish this series agree to the following terms:

1. Authors retain copyright and grant the series right of first publication with the work simultaneously licensed under a Creative Commons

Attribution License that allows others to share the work with an acknowledgment of the work's authorship and initial publication in this

series.

2. Authors are able to enter into separate, additional contractual arrangements for the non-exclusive distribution of the series's published

version of the work (e.g., post it to an institutional repository or publish it in a book), with an acknowledgment of its initial

publication in this series.

3. Authors are permitted and encouraged to post their work online (e.g., in institutional repositories or on their website) prior to and

during the submission process, as it can lead to productive exchanges, as well as earlier and greater citation of published work (See

Open access policy for details).

References

[1]. M Ren. (2019), Research on content development strategy of lazy audio book platform, new media focus,163-164.

[2]. S Zu. (2021), The long audio market landscape may change, China Business Daily, 1-2.

[3]. Y Ding. (2019), Lazy audio-A practitioner of "Content King",Creative Industry, 73-76.

[4]. S Shao. (2020), Evaluation of music app competitiveness and user stickiness analysis in the era of paid music, Philosophy and Humanities, 1-77.

[5]. P Peng. (2021), Acquired 100% equity of Lazy Listening Books, Tencent Music Entertainment Group builds a "ecosystem" in the sound industry, The paper.

[6]. S Luo. (2021), Research on the pan-entertainment development strategy of Tencent Music Entertainment Group, Philosophy and Humanities, 1-48.

[7]. iiMedia Group. (2022), 2022 China Knowledge Payment Industry Report, iiMedia Future Education Research Center.

[8]. Y Shi, Y Zhang. (2018), Analysis on the current situation and development trend of mobile listening app - Take "lazy audio" as an example, Publication and distribution research, 12-18.

[9]. Tencent (2023), Tencent 2022 Annual Report. https://static.www.tencent.com/uploads/2023/04/06/eac54c79c67d8a501bc4b65ff1718223.pdf

[10]. iiMedia Group, 2018-2019 China audio book market special research report, iiMedia Entertainment Industry Research Center. http://www.iimedia.cn/c400/63471.html

[11]. Ah Li. (2015), Read with your ears,Computer software and applications,60.

[12]. Y Yang. (2021), Analysis of sustainable development strategy of listening to APP-Take the "Lazy Audio" APP as an example, Media Practice, 74-76.

[13]. Q Zhu. (2019), Operational research of audio apps, Information technology, 1-53.

[14]. S Zhang. (2021), The dilemma of the audiobook copyright authorization mechanism and its relief measures, Publication and distribution research, 22-29.