1 Introduction

Financial informatization refers to the process of introducing the information system into financial activities and forming the information industry in a leading position in the development of the financial system so as to promote the coordinated development of the financial system. Since entering the 21st century, globalization and informatization are the two main trends, all and types of work are influenced by this trend like an industrial revolution. In the case of the financial sector, the big wave of informatization brings new technologies which lead to new financial derivative instruments like electronic currency and internet banks. For example, E-Commerce is widely used in modern enterprises. Consumers use that E-Commerce like online shopping which is increasingly popular. These E-Commerce platforms, like Alibaba in China, are complex and information pluralistic. The information comes from every place in the world; and is processed, translated, and published to the public. Thus, the critical part of the mode of operation is based on informatization. On the one hand, those new derivative instruments are stimulating the development of the financial industry. On the other hand, there are also some unstable and unknown factors in the internet environment. The development of new technologies is facing new risks. In the modern world, informatization is still a start-up trend, in the case of the using of new techs and controlling those new financial risks is worth considering and making research. This could bring a positive trend to the financial industry by using informatization. This essay is mainly focused on the positive influence and negative influence, in the end, the Precautionary measures of reducing the risk of financial informatization. This purpose of this research is to provide the public with business knowledge to stimulate them to find new entrepreneurial opportunities.

2.The development of the financial informatization

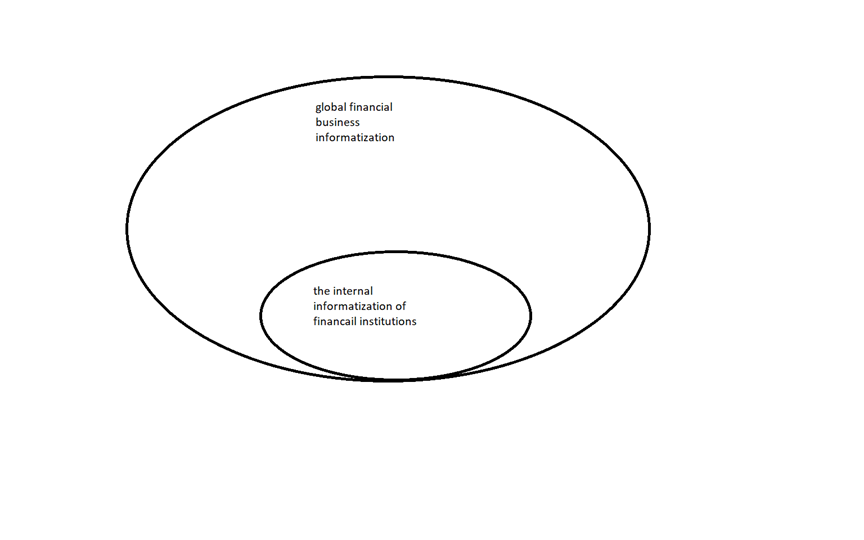

. Firstly, the internal informatization of financial institutions, after the 1950s, the bank industry, the securities industry, and the insurance industry replaced manual work to assist internal business and management by computers which could improve the working efficiency of the financial institutions (Zhang, Y. 2010). Secondly, financial informatization also leads to a link between different financial centres in the world through computers and other communication equipment. For example, in 1982, The Chicago Mercantile Exchange, Chicago Fair Board, and Reuters jointly launched a global electronic trading execution system called GLOBEX. The trading network formed by the system connected at least 129 countries and managed hundreds of world-class securities and tens of thousands of securities of the United States, Europe, and other connected countries. Form a borderless electronic securities market. So, Drucker said: that in today's economic society, the most important thing is our resources are no longer labour, capital or land, but knowledge (Drucker, 2009).

To realize the interconnection of everything, the first thing we need is online (Wang, 2016). Thus ‘Online’ is becoming more and more popular after the 2000s. In 2000, there were 0.23 million people using the internet in China, after 17 years, according to CNNIC (China Internet Network Information Centre), there were 7.53 million people online. There is an increasing number of people using the internet and getting information from it which is the main embodiment of information development.

Fig. 1. information overlay map

3. The influence of financial informatization on financial development

With the rapid development of computers and the internet, financial informatization initiated a revolution in the financial industry, especially the global financial market did show an obvious expression. But the influence of financial informatization on the financial industry is a double-edged sword.

3.1 The positive influence.

The most important business features in the information age include three aspects: social thinking dimension, data-driven and intelligent applications. The business innovation principle has three main trends, namely, online, networked and intelligent (Ming Zeng, 2018).

The financial informatization did provide a scientific decision-making tool. The prediction and decision of financial activity should consider social factors and lots of contact economy in the financial market. The development of informatization has a big influence on financial market decision-making and skills. It has led the financial market’s analysis and management to rely more on computers and other tech tools that are easier to adapt to different financial environments. And with the development of digitized information, the internet has become a tool for organizing information and finding financial resources. AI technology especially computational intelligence technology is becoming the main and most useful tool for making a financial decision.

The positive influences also include the stimulation of new jobs for those unemployed people. It also promotes the new type of financial tools. The development of financial informatization encourages financial institutions to create new financial tools. To some extent, it changes the fixed functions. In the past, only the big financial organization in the financial centre held the information and made an explanation to the public. But after the development of informatization, small companies also could gain the information and make explanations in time. The business innovation path in the information age should pay attention to the online product and core service process, emphasize the online customer data and the use of data analysis to guide decision-making and promote the coordinated development of network information and data sharing among different subjects.

Accelerating the process of globalization. In the process of globalization, informatization is playing an important role. The integration of computers and communication technology leads to a quick informatization world based on numbers and it could cross the countries to transmit information. Under this consideration, the electronic information processing technology could reduce the cost to zero to transform the capital. In a second, billions of dollars flow from one area to another.

Due to financial informatization stimulates the development of information technologies, which shows high demand in the market for those bit organizations and companies like Alibaba, TikTok, Amazon, and YouTube. Information Technology (IT) includes sensor technology, computer technology, intellectual technology, communication technology, and control technology. All of these technologies are developing rapidly with the process of informatization. Information technology is an important part of college financial management because of the realization of college financial information.

3.2 The negative influence

Due to the capital moving faster and more conveniently, the risk of holding the financial products and maintaining the scale of the financial transactions will increase.

Financial informatization applies information technology to the financial institutions to update the business process, like promoting computers. It did improve the working efficiency. But if any step goes wrong in this process, it will cause a much bigger problem than before the informatization. And that if the internal employees get out of line on purpose or illegal operation will leak the core information or fake information or lose information. Therefore, professional criminals could take the advantage of a weak point.

The informatization conflict is one of the shortcomings of financial informatization. Due to the decentralization of decision-making, enterprises are preferring to use the expert system as the main productivity to improve their core competitiveness in the market. Although lots of enterprises start using information systems and manage these systems to work normally, the result is not satisfactory.

At the beginning of the information system, system analysis failure happened all the time. Under this condition, analysis failure caused a conflict between actual demand and forecast demand. This is because the current situation is always changing but the information system will have a message delay. Firstly, the system objective principle is ambiguous or inappropriate. Secondly, the source of information is unreliable and the basic information is unqualified. The information might be from an internal enterprise or external enterprise, which means there is a deviation in information quality.

4. Precautionary measures in the process of informatization

In the age of the information economy financial informatization is the total trend of financial development and it is irreversible. But when informatization brings a huge profit, it also brings some unstable factors. If the risk of financial informatization could not be eliminated. It will be hard to bring more profit and be stable. Therefore, this essay will put forward some measures.

4.1 Improve information security management system

Financial institutions like a bank should develop an internal control system to improve the security management of information. For example, strengthen the management authority of the staff. Strengthen the network system maintenance. Downloading the genuine anti-virus software to check the computer stay away from those network viruses. Those overdue documents or CDs should be destroyed. Those actions against the system should take some measures.

Using the informatization to support the management decisions. Using the information technology to collect the information and process the information by using the data basement and management system to make it useful decision information. Some financial institutions always make a wrong decision by ignoring the important information and the value due to the fake information.

For the information technology problem, the enterprises could update their systems and pay for professionals to maintain system safety and quality. The managers should make a clear, achievable and reliable objective based on business evaluation results. When the enterprise faces intensively competitive market pressure and a changeable market environment, enterprises should consult objectively and consider input costs and the business value of information.

Most early theories of influence of financial informatization were concerned with information technology.

Luftman (2003) defined it and business matching as: adapting it to enterprise strategies, goals and needs in an appropriate and timely manner.

This is supported by Zhang Y (2010) who concluded that the development of IT has experienced the embryonic period of strategic ideas, the impact period of strategic planning, the matching period of strategic objectives, the matching period of strategy and the matching period of Cross organization.

It can be argued that the development of IT industry is the main factors to stimulate the development informatization. IT had been spread to all fields, finance, information analyses and so on.

These strategies, with their focus on informatization demonstrate that IT industry is an essential component of informatization.

5. Methodology

This essay is using qualitative research to find out what people thought about informatization. An interview with banks’ employees who were by appreciating the invitation, in a small room to ask questions like what do you think about informatization? What do you think it can be used for?

It can benefit the bank or not?........

In this research, I was asking the banks’ employees to use different IT system from different age to deal with the financial information on the market, to see the different result of different IT system.

As a result, the IT is updating with the time. Therefore, financial informatization shows a same trend with IT industry and also show a both good and bad influence on financial industry.

The result indicates that financial informatization could help institutions be more efficient and at high risk. In line with the interview, informatization and IT is still processing forward. The data contributes to a clearer understanding of measures of protection. This result is like a warning that when we are looking for information, we also should check the technologies are normal working. Due to the pandemic and the time, the results cannot confirm that financial informatization has both good and bad sides. Because we only have an interview with bank staff, there are some other financial institutions. Thus, further research is needed to expand the scale of people to make big data research.

6. Conclusion

This research aimed to identify the influence of financial informatization on the financial industry. This research also could provide a clear basic theory that IT will be the main productivity and innovation in the financial industries and informatization. Based on the qualitative analysis of some people who work in financial institutions like a bank. It can be concluded that financial informatization is a double-edged sword to the development of finance. Informatization and IT system improves the working efficiency of financial institutions. However, informatization also exacerbates the risk. This essay analyses the influence of financial informatization on the financial industry deeply. In the end, figure out some measures to reduce the risks by looking at the characteristics of informatization.

References

[1]. Zheng, L. I. (2007). On the financial informatization and its influence on financial development. Information Science, 25(11), 1743-1745.

[2]. Yang, Y. (2007). On the enlightenment of the development of international financial informatization to China's financial informatization. China Economic Review (1536-9056), 7(2), 3.

[3]. Li gang. (2006). Research on financial informatization of commercial banks. Tech-nology Entrepreneurship Monthly.

[4]. Zhou, Z. L. (2002). The impact of financial information on finances. Research On Financial and Economic Issues.

[5]. Lin, Z. (2021). Research on Financial Informatization Construction in Colleges and Universities under the Background of "Internet+".

[6]. Yongsheng, X, Fang, Q & Rui, C (2020). Business Innovation in the information age: trends and paths Business age, 000 (003), 114-116

[7]. Ming, Z. (2018). Smart Business [m] CITIC Publishing Group

[8]. Zhang, Y. (2010). A research on informatization conflict in IT and business align-ment. Communication of Finance and Accounting.

[9]. Luftman, J. N. . (2003). Competing in the information age: align in the sand.

Cite this article

Zhao,W. (2023). How does Financial Informatization Influence the Financial Industry?. Advances in Economics, Management and Political Sciences,4,580-584.

Data availability

The datasets used and/or analyzed during the current study will be available from the authors upon reasonable request.

Disclaimer/Publisher's Note

The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of EWA Publishing and/or the editor(s). EWA Publishing and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content.

About volume

Volume title: Proceedings of the 6th International Conference on Economic Management and Green Development (ICEMGD 2022), Part Ⅱ

© 2024 by the author(s). Licensee EWA Publishing, Oxford, UK. This article is an open access article distributed under the terms and

conditions of the Creative Commons Attribution (CC BY) license. Authors who

publish this series agree to the following terms:

1. Authors retain copyright and grant the series right of first publication with the work simultaneously licensed under a Creative Commons

Attribution License that allows others to share the work with an acknowledgment of the work's authorship and initial publication in this

series.

2. Authors are able to enter into separate, additional contractual arrangements for the non-exclusive distribution of the series's published

version of the work (e.g., post it to an institutional repository or publish it in a book), with an acknowledgment of its initial

publication in this series.

3. Authors are permitted and encouraged to post their work online (e.g., in institutional repositories or on their website) prior to and

during the submission process, as it can lead to productive exchanges, as well as earlier and greater citation of published work (See

Open access policy for details).

References

[1]. Zheng, L. I. (2007). On the financial informatization and its influence on financial development. Information Science, 25(11), 1743-1745.

[2]. Yang, Y. (2007). On the enlightenment of the development of international financial informatization to China's financial informatization. China Economic Review (1536-9056), 7(2), 3.

[3]. Li gang. (2006). Research on financial informatization of commercial banks. Tech-nology Entrepreneurship Monthly.

[4]. Zhou, Z. L. (2002). The impact of financial information on finances. Research On Financial and Economic Issues.

[5]. Lin, Z. (2021). Research on Financial Informatization Construction in Colleges and Universities under the Background of "Internet+".

[6]. Yongsheng, X, Fang, Q & Rui, C (2020). Business Innovation in the information age: trends and paths Business age, 000 (003), 114-116

[7]. Ming, Z. (2018). Smart Business [m] CITIC Publishing Group

[8]. Zhang, Y. (2010). A research on informatization conflict in IT and business align-ment. Communication of Finance and Accounting.

[9]. Luftman, J. N. . (2003). Competing in the information age: align in the sand.