1. Introduction

Silicon Valley Bank, which has assets of over $209 billion and deposits of $175.4 billion, is one of the largest banks in Silicon Valley and also an important bank in the high-tech industry. On March 10th, 2023, the sudden bankruptcy of Silicon Valley Bank caused great panic in the United States and even the whole world. People worry that the financial crisis will reoccur. The bankruptcy is a result of the “COVID-19” crisis. During the period of COVID-19, the United States issued too much currency so various macro risks gathered in the economy. Now, in the post-epidemic era, the economy is experiencing a K-shaped recovery, which means some industries will recover at a rapid speed while bubble in other industries may burst, so the government should carefully supervise the economy, publish practical policy and provide timely aid to prevent a serious financial crisis. In this case, researches on the financial crisis are necessary.

The 2008 financial crisis is the biggest financial crisis after the globalization of the economy, so researches on this financial crisis are of the greatest importance and can give people practical advice. The crisis started in the financial market of the United States, and quickly impacted the global financial market. Stock markets have plummeted worldwide, unemployment has surged, and many companies have closed down. To save the economy from a financial crisis of such epic proportions, the government of the United States has spent over $3 trillion in bailout money so far, including the well-publicized $700 billion approved by Congress, the $1.3 trillion in investments in various risky assets and $900 billion given to large corporations, but the effect is not significant [1]. So reducing the damage of a financial crisis effectively calls for strict supervision and useful policy before the financial crisis, not after the crisis has occurred. Relative research has found many possible factors of the 2008 financial crisis, and given many theoretical suggestions on how to prevent or release the financial crisis. But during the post-epidemic era, there is still inadequate research about how to deal with real problems that have arisen now. Thus, researches on how to deal with specific problems is meaningful.

The main factors causing the 2008 financial crisis include the loose monetary policy, subprime mortgages, credit default swaps, and systemic risk. Loose monetary policy, which means low-interest rates and encouraging excessive consumption, caused the housing bubble and created the foundation for the financial crisis. Subprime mortgages, which means banks loan to people without the ability to pay off, added to default risk on a large scale. Credit default swaps have high leverage and high risk so they should be supervised strictly, but rating agencies failed to do their duty and the CDS market became a place for speculation. This was attributed greatly to such a serious financial crisis. A main systemic risk is “too big to fail”, which describes a business or business sector so ingrained in a financial system or economy that its failure would be disastrous [2].

This paper first focuses on using both data and theory to show how those three factors listed above actually worked in the 2008 financial crisis and the crucial role government must play in controlling these factors. Then this paper concludes the consequence of the crisis. Finally, based on the factors found, this paper compares the 2008 financial crisis and the COVID-19 crisis and aims at giving some suggestions on real problems raised during the COVID-19 crisis.

2. Causes

Research has found plenty of factors jointly leading to the 2008 financial crisis. This paper concentrates on several most important factors: loose monetary policy, subprime mortgage speculation with CDS, and so-called “too big to fail”. The aim is to find how they actually worked in the 2008 financial crisis and what people, financial institutions and the government can do in preventing the crisis based on these factors.

2.1. Loose Monetary Policy

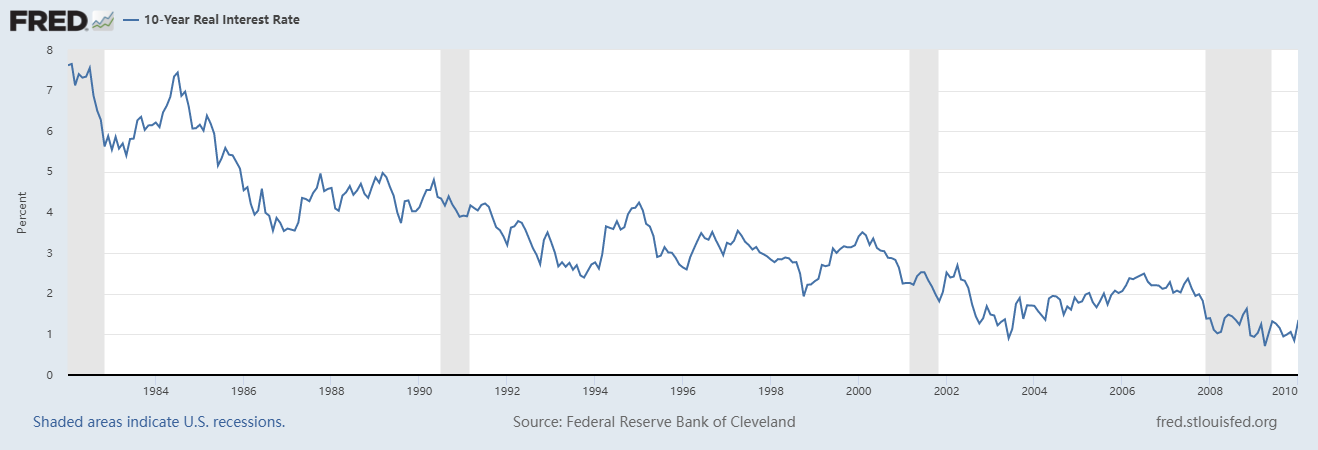

As shown in Figure 1, Federal Reserve's monetary policy was loose before the 2008 financial crisis in order to save the economy of the United States from the recession caused by the burst of the technology bubble in 2000 [3]. This policy created an atmosphere in which people tended to take excessive risks and increase their leverage, leading to excess liquidity and a bubble in real estate. This bubble gave people the wrong belief that they are much richer than before. Thus, US households chose to over-consume without considering whether they were able to consume at such a level sustainably.

Figure 1: 10-Year real interest rate from 1984 to 2010 [4].

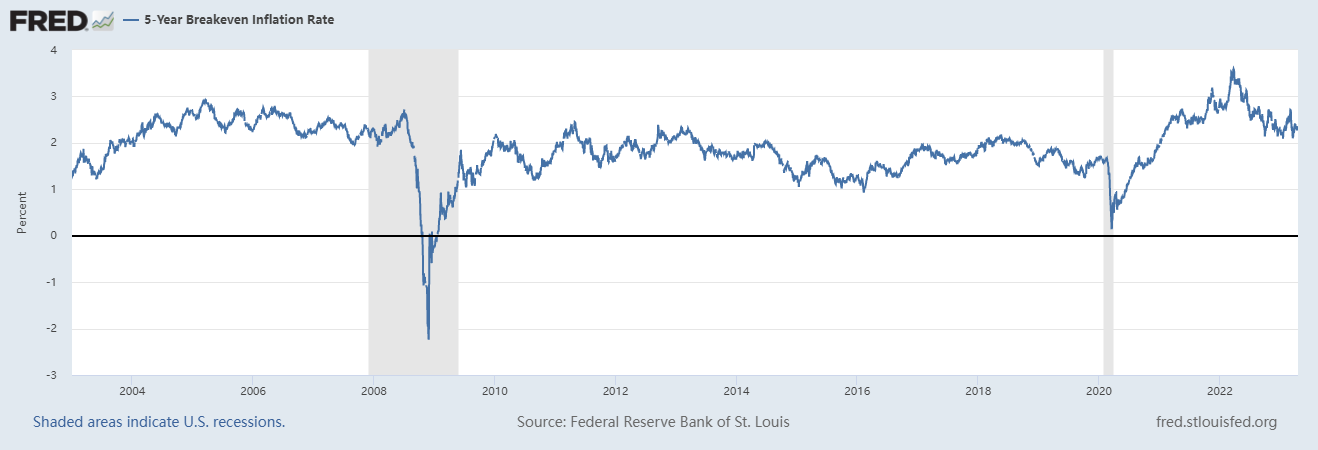

Figure 2: 10-Year real breakeven inflation rate from 2003 to 2010 [4].

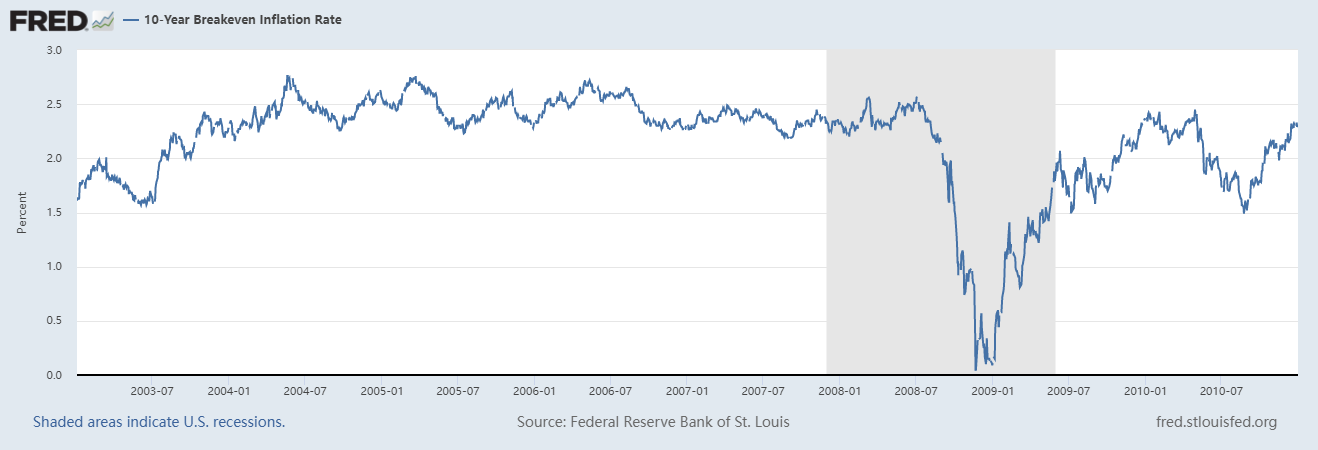

The situation was closely related to Fed’s monetary policy. As shown in Figure 2, the 10-year breakeven inflation rate during 2004-2007 is around 2.5%, which is higher than that before 2004 and after 2010, which is around 1.5%. Although the Fed promised to keep a loose monetary policy, it couldn’t bear the rapid inflation because inflation may increase shoe leather costs, menu costs, tax distortions, uncertainty, and turbulence [5]. Finally, the Fed published a tight monetary policy, which resulted in adjustments in housing prices and defaults on subprime mortgages. Bubbles in real estate and financial market burst. Banks and financial institutions experienced massive losses, and the financial system was at the edge of collapse. People became much more risk-averse than before. They lose confidence in investing and consuming, which finally leads to a serious recession in the economy.

2.2. Subprime Mortgage

Before the 2008 financial crisis, the subprime mortgage was popular in the United States. Many banks loaned to people whose ability to pay off debts was uncertain, which laid the basis for high default risk and bankruptcy of banks. Considering the rapidly rising house prices during that period, people are also motivated to borrow money from banks because they think investing in real estate can enable them to pay off their debt and even earn money. The real estate bubble became more and more serious and finally burst. Since real estate depreciated seriously, people lost the ability to pay off and banks face high subprime delinquency rates. Anthony Sanders’ research found a close relationship between the housing price declines and the rising subprime delinquency rate in the 2005-2008 period [6]. This shows that the burst of the real estate bubble leads to the collapse of subprime mortgages.

An interesting finding is that once the subprime mortgage lacks supervision, even if people know about the real estate bubble and the risk of investing borrowed money in real estate, they will probably still do so if they are rational. Considering a game theory model as below. People are first divided into different groups, Group (1.2.3…n,n+1). The ordinal of groups (i =1,2,...,n) describes the sequence of people borrowing money from banks and investing in real estate. Group n+1 is those who choose not to borrow after observing the behavior of group n. In this case, group n is the group that can’t pay off the debt because of the burst of bubbles. Suppose People of each group are rational and there is perfect recall. People in group i≤n, have the belief that P(i=n) < (the possibility of being group n is less than ). For people in group i=n+1, there is a turning point that makes people believe that they will lose a lot if they borrow (the turning point may be the Fed’s tightening of monetary policy, which will result in decreases in housing prices and increases in risk aversion), so they’ll always choose N [3]. This paper considers what group i≤n do.

In this Dynamic game, consider the extensive form. Each group moves by sequence after observing the behavior of previous groups. For group n, there exist 2n-1 nodes. Since subgames from these nodes are the same for group n and group n+1, this paper only shows one of those subgames. In this subgame, group n doesn’t know whether group n+1 will choose B or N, but their belief is that P(group n+1 choose n) = . So group n can maximize their expectation utility (un). Suppose u(B,B) = (10,10), u(B,N) = (-100,0), u(N,B) = (-10,10), u(N,N) = (0,0). This means u (choice of group n, choice of group n+1) = (un, un+1).

\( E({u_{n}}|group n choose B) = \frac{n-1}{n} * 10 + \frac{1}{n} * (-100) = \frac{10n-110}{n} \) (1)

\( E({u_{n}}|group n choose B) = \frac{n-1}{n} * 10 + \frac{1}{n} * (-100) = \frac{10n-110}{n} \) (2)

Because of people’s wishful thinking, n in their belief is large enough so that E(un|group n choose B) > E(un|group n choose N). As a result, group n will choose B. This game has finite(n) stages so this paper uses backward induction. For all subgames, the analysis between group n and n+1 is also applied because they have the same belief, so all group i (i =1,2,...,n) will all choose B. Subgame perfect Nash equilibrium is (B;B for all nodes of group 2;...;B for all nodes of group n) and the outcome is (B;B;...B).

In fact, the shift of people’s beliefs may be a process instead of an overnight thing, but the long period during which people always choose to borrow from banks still exists. During this period, the real estate bubble increases and becomes almost impossible to deal with. At the same time, there also exists a long period during which people are able to pay off debts because of the increase of the housing bubble. As a result, banks always neglect the risk and tend to loan to make money so that when group n cannot pay off, they are faced with massive losses. Chances are that many banks have to declare bankruptcy. An increasingly serious problem with subprime mortgages and the housing bubble is the result of people's and banks’ rationality and cannot be solved by themselves, so government must play a role in enhancing banking credit risk management.

2.3. Speculation with Credit Default Swaps

A credit default swap (CDS) is a contract in which the buyer pays the seller fees to prevent credit default risk during a certain period. If credit default occurs, the buyer of the default swap will have the right to deliver the bond to the seller of the default swap at face value, thereby effectively avoiding credit risk. Although CDS is a kind of financial derivative, it is similar to gambling about whether a default will occur or not. Thus, the main features of CDS are high leverage and high risk, because CDS lacks a basis of actual properties. Before the 2008 financial crisis emerged, the CDS market had experienced explosive growth from $6.3 trillion in 2004 to $58.2 trillion in 2007 [7].

In this period, CDS trading was not only a means of risk management but also a tool for many institutions and individuals to carry out arbitrage and speculation because of CDS’s high leverage and lack of supervision. Rating agencies failed to fulfill their duty because they evaluated credit mainly based on mathematical models. Those models could reflect credit to some extent but always neglect some important factors. Thus, the rating given by these agencies tended to underestimate the risk of bonds, stocks, and financial derivatives. Some rating agencies even collaborated with people who speculate with CDS to gain profit. This stimulates the CDS market to surge beyond supervision. Similar to the game theory model established in 2.2, the everlasting explosion of the CDS market is also a result of people’s rationality and their belief that they will not be the ones who should pay for all the loss. So control over the CDS market should also mainly rely on the government.

“Too big to fail” describes a business or business sector so ingrained in a financial system or economy that its failure would be disastrous [2]. Because of the big scale and high influence of the company, once the company faces some difficulties, huge turmoil would arise in the market. In addition, the government should spend a lot to prevent the company from failing, otherwise, widespread panic would lead to even greater losses. In this way, companies with a large scale should take low risks. This is impossible without the help of the government because large companies still need to keep competitive by taking some risks. To achieve this goal, the government can publish related policies to make large companies take low risks and pay for their losses.

3. Consequence

The 2008 financial crisis had great negative effects on people’s living quality, widened the gap between people, damaged the financial system, and even struck the global financial market. People’s living quality was worse than before. In 2012, the St. Louis Federal Reserve Bank estimated that the net assets of American households decreased by 26% after the financial crisis [8]. In a research carried out in 2018, the Federal Reserve Bank of San Francisco found that the GDP of the United States was around 7% lower than it would be without the 2008 financial crisis, which means that every American suffers a loss of $70000 on average [8]. From 2007 to 2009, approximately 7.5 million jobs were lost, which made the unemployment rate double. Although during the recovery of the economy, the unemployment rate decreased to 3.9%, most of those new jobs had low salaries and safety. The gap between rich and poor was widened. For most common people, the rate they recover from the financial crisis is low. Millions of households lost their houses, savings, and jobs. Even after several years, they still suffered from poor living quality. Meanwhile, most of those bankers who had partly created the crisis had made up for their loss before 2010. This added to the disparity in society, which caused turmoil such as the Occupy Wall Street movement in 2011.

The financial system had also suffered a severe strike. Before the financial crisis, many derivatives based on the subprime mortgage had been developed and many companies had been established based on those derivatives and the subprime mortgage itself. They account for a large part of the financial market. But in April 2007, New Century Financial Corp, one of the largest subprime mortgage lenders asked for bankruptcy, and then most subprime lenders stopped operation. Many conventional investment banks, such as the 168-year-old Lehman Brothers, also filed for bankruptcy. The Fed had paid tens of billion to save the financial system and the market but this seemed to be inefficient. These all reflect to what extent the financial system was damaged.

The financial crisis even struck the global financial market because many Americans invested in foreign properties and many foreign investments were also in the American financial market. Many countries experienced a recession in the economy, increase in the unemployment rate, and bubbles in real estate because of the financial crisis. Stock markets fall 42% in the United States and, on a dollar-adjusted basis, 46% in the United Kingdom, 49% in Europe, 35% in Japan, and approximately 50% in the larger Latin American countries [9]. Likewise, global GDP fell by 0.8% (the first contraction in decades), with the decline in advanced economies a sharp 3.2%. Furthermore, international trade fell a massive 12% [9].

4. Responses

Based on 2.2 and 2.3, it is human’s nature to pursue profit that contributes to much potential risk in the financial market. Also, according to 2.4, there exist some systemic risk like “too big to fail”, which means when a large financial company faces some difficulties, the government have no choice but to spend a lot saving it because the financial market cannot suffer the consequence of its failure. Since both can’t be dealt with through people or financial companies themselves, the policy of the government is of great importance.

4.1. The Dodd-Frank Act

A main policy published after the 2008 financial crisis is the Dodd-Frank Wall Street Reform and Consumer Protection Act. First, the Consumer Financial Protection Bureau (CFPB), founded by Dodd-Frank, is responsible for preventing subprime mortgage lending and helping people to understand the terms of a mortgage. This is the consequence of the consensus that the subprime mortgage is a key factor in the 2008 financial crisis. Second, the Volcker Rule in the Dodd-Frank Act limits banks from speculation and regulates financial companies’ use of derivatives. In addition, Dodd-Frank established the Securities and Exchange Commission (SEC) Office of Credit Ratings to ensure agencies provide reliable credit ratings. Third, according to the Dodd-Frank Act, the Financial Stability Oversight Council and the Orderly Liquidation Authority monitor the financial stability of major financial firms. The council can not only break up banks that are so large as to pose a systemic risk but also force banks to increase their reserve requirements [10]. This aims at releasing systemic risk.

These three aspects of the Dodd-Frank Act individually focus on 2.2 and 2.3 which shows that people are trying to reduce the seriousness of potential financial crisis through policy based on the experience of the 2008 financial crisis. What is omitted is the response to 2.1, the monetary policy of the Fed. Constantly aggressive monetary policy can help the economy recover from recession, but may also lead to rapid inflation and massive bubbles in markets. It may also create an atmosphere where people invest radically, which adds to the risk of the financial market. How to choose the monetary policy is then a tradeoff, but the constantly aggressive monetary policy may be the background of a financial crisis in the future. However, some economists, politicians, and enterprisers think implementing the Dodd-Frank Act could harm the competitiveness of U.S. firms relative to their foreign counterparts [10].

4.2. Basel III

Another main policy published after the 2008 financial crisis is Basel III. It requires banks to keep certain leverage ratios and capital adequacy ratio, maintain certain levels of reserved capital on hand [11]. It aims at balancing the useful effects of liquidity transformation and its potential risk. However, some economists criticize that the liquidity coverage ratio's highly disparate treatment of retail and wholesale funding may instead undermine financial stability by increasing the competition for the types of funding treated preferably under the rule [12]. Although strictly implementing these policies may do some harm to current interests, they can be neglected compared with the huge losses caused by a serious financial crisis.

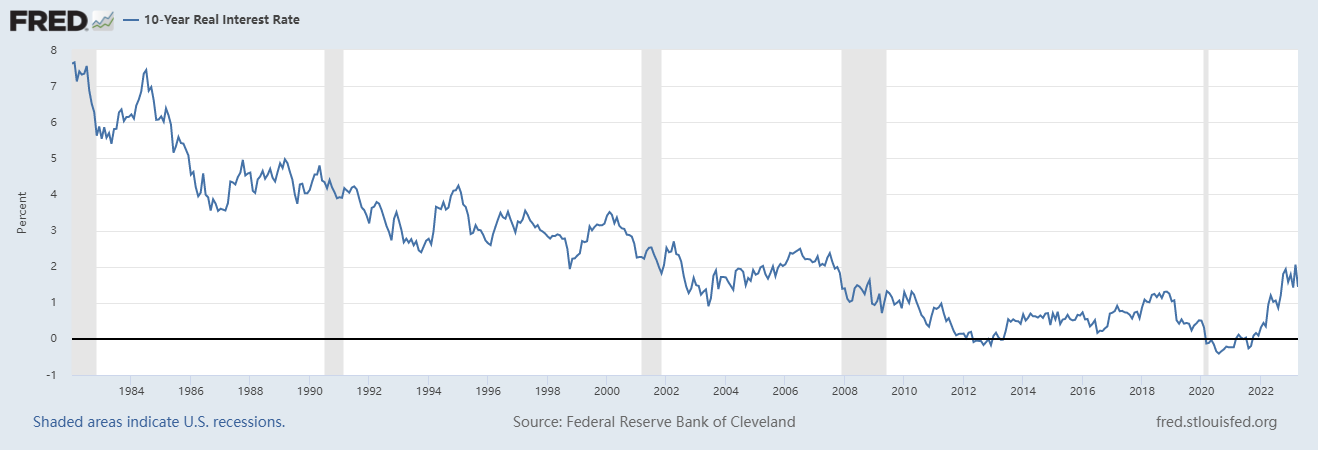

Nowadays, another recession caused by Covid-19 has appeared. Like what Fed do before the 2008 financial crisis, Fed has also taken aggressive monetary policy to help the economy recover and this has caused high inflation just as in 2004-2007. As shown in Figure 3, the 10-year real interest rate is around 0% during 2020-2022, which is even much lower than that during 2004-2007, which may cause bubbles in the market and other potential risks. Also, As shown in Figure 4, the 5-year breakeven inflation rate during 2020-2022 is around 2.5%, which is almost the same as that during 2004-2007. This shows that Fed is unable to keep the interest rate at such a degree for a long time just as in 2008. The Fed should be aware of the potential risks of aggressive monetary policy and adjust it timely to prevent bubbles from accelerating.

Figure 3: 10-Year real interest rate from 1984 to 2022 [4].

Figure 4: 5-Year real breakeven inflation rate from 2003 to 2010 [4].

Optimistically, a difference is that people are more aware of risks and relative regulations are better now than in 2008. The Dodd-Frank Act, the Basel III, and other policies all contribute to releasing the risk of a financial crisis. But when Donald Trump was elected president in 2016, he pledged to repeal Dodd-Frank. Siding with critics, the U.S. Congress passed the Economic Growth, Regulatory Relief, and Consumer Protection Act, which rolled back significant portions of the Dodd-Frank Act. This reflects that people’s awareness of risks is being gradually weakened by their pursuit of profit. However, people should still insist on the Dodd-Frank Act because nobody wants to experience a serious financial crisis once more. This is especially crucial in the recovery from the Covid-19 recession now. Even the world tides over the Covid-19 crisis, a serious financial crisis may reoccur if people’s awareness of risks and regulations continues to be weakened.

5. Conclusion

The background of the 2008 financial crisis was the constantly aggressive monetary policy that initially aimed at speeding up the recovery from a recession caused by the burst of the technology bubble in 2000. This caused people to be too optimistic about the economy and too radical in investment. Then, without awareness of risks and proper regulation, the bubbles in the market accelerated because of subprime mortgages, banks’ speculation with credit default swaps, and systemic risks. Finally, the bubbles burst and the world suffered from a serious financial crisis. Since that time, people have been more aware of potential financial risks and raised policies, such as the Dodd-Frank Act and the Basel iii, to deal with factors attributing to the crisis. The Dodd-Frank Act focuses on preventing subprime mortgage lending, limiting financial companies from speculation, and releasing systemic risk. The Basel III focuses on keeping the bank system stable. This paper shows the importance of these policies by considering what individuals will do in markets through game theory models. Although criticized, these policies are so crucial that they should be implemented strictly.

During the post-pandemic era, the world has an urgent need for the recovery of the economy. The Fed has taken aggressive monetary policy to help the economy recover and this has caused high inflation, which is just like what happened before the 2008 financial crisis. The Fed should be careful about applying constantly aggressive monetary policy. Also, many people’s will to prevent the risks of a financial crisis is weakened by the pursuit of more profit. The government should insist on policies gained from the 2008 financial crisis because a financial crisis will bring much more serious costs to the world than the maintenance of several policies. This paper first analyzes several main causes of the 2008 financial crisis and explains why the financial market needs constant proper regulation, then summarizes the consequences of the crisis and responses to those causes, and finally compares the 2008 financial crisis to the Covid-19 crisis in order to give some suggestions for now and the future. What can be done in the future is to evaluate how efficient those policies are through econometrics.

References

[1]. Murphy, A. An Analysis of the Financial Crisis of 2008: Causes and Solutions. Social Science Research Network (2008).

[2]. Young, J.: Too Big to Fail: Definition, History, and Reforms. Investopedia. https://www.investopedia.com/terms/t/too-big-to-fail.asp, last accessed 2023/4/15.

[3]. Lin, J., & Treichel, V. The Unexpected Global Financial Crisis: Researching Its Root Cause. In The World Bank eBooks (2012).

[4]. Federal Reserve Economic Data. FRED. https://fred.stlouisfed.org/, last accessed 2023/4/15.

[5]. Mankiw, N. G.: Principles of Economics. Cengage Learning (2016).

[6]. Sanders, A. B.: The subprime crisis and its role in the financial crisis. Journal of Housing Economics 17(4), 254–261 (2008).

[7]. Deng, B., & Zhang, D.: Study on Moral Hazard of Credit Default Swap under Financial Crisis. Economic Review (01), 5-14+22 (2011).

[8]. Financial crisis of 2007–08: Definition, Causes, Effects, & Facts. Encyclopedia Britannica. https://www.britannica.com/event/financial-crisis-of-2007-2008/Key-events-of-the-crisis, last accessed 2023/4/15.

[9]. Acharya, V. V., & Richardson, M.: Implications of the Dodd-Frank Act. Annual Review of Financial Economics 4(1), 1–38 (2012).

[10]. Hayes, A. Dodd-Frank Act: What It Does, Major Components, Criticisms. Investopedia. https://www.investopedia.com/terms/d/dodd-frank-financial-regulatory-reform-bill.asp, last accessed 2023/4/15.

[11]. Bloomenthal, A. Basel III: What It Is, Capital Requirements, and Implementation. Investopedia. https://www.investopedia.com/terms/b/basell-iii.asp, last accessed 2023/4/15.

[12]. Hartlage, A. W.: The Basel III Liquidity Coverage Ratio and Financial Stability. Michigan Law Review 111(3), 453–483 (2012).

Cite this article

Chen,H. (2023). 2008 Financial Crisis and Systemic Risk Regulation. Advances in Economics, Management and Political Sciences,34,19-26.

Data availability

The datasets used and/or analyzed during the current study will be available from the authors upon reasonable request.

Disclaimer/Publisher's Note

The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of EWA Publishing and/or the editor(s). EWA Publishing and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content.

About volume

Volume title: Proceedings of the 7th International Conference on Economic Management and Green Development

© 2024 by the author(s). Licensee EWA Publishing, Oxford, UK. This article is an open access article distributed under the terms and

conditions of the Creative Commons Attribution (CC BY) license. Authors who

publish this series agree to the following terms:

1. Authors retain copyright and grant the series right of first publication with the work simultaneously licensed under a Creative Commons

Attribution License that allows others to share the work with an acknowledgment of the work's authorship and initial publication in this

series.

2. Authors are able to enter into separate, additional contractual arrangements for the non-exclusive distribution of the series's published

version of the work (e.g., post it to an institutional repository or publish it in a book), with an acknowledgment of its initial

publication in this series.

3. Authors are permitted and encouraged to post their work online (e.g., in institutional repositories or on their website) prior to and

during the submission process, as it can lead to productive exchanges, as well as earlier and greater citation of published work (See

Open access policy for details).

References

[1]. Murphy, A. An Analysis of the Financial Crisis of 2008: Causes and Solutions. Social Science Research Network (2008).

[2]. Young, J.: Too Big to Fail: Definition, History, and Reforms. Investopedia. https://www.investopedia.com/terms/t/too-big-to-fail.asp, last accessed 2023/4/15.

[3]. Lin, J., & Treichel, V. The Unexpected Global Financial Crisis: Researching Its Root Cause. In The World Bank eBooks (2012).

[4]. Federal Reserve Economic Data. FRED. https://fred.stlouisfed.org/, last accessed 2023/4/15.

[5]. Mankiw, N. G.: Principles of Economics. Cengage Learning (2016).

[6]. Sanders, A. B.: The subprime crisis and its role in the financial crisis. Journal of Housing Economics 17(4), 254–261 (2008).

[7]. Deng, B., & Zhang, D.: Study on Moral Hazard of Credit Default Swap under Financial Crisis. Economic Review (01), 5-14+22 (2011).

[8]. Financial crisis of 2007–08: Definition, Causes, Effects, & Facts. Encyclopedia Britannica. https://www.britannica.com/event/financial-crisis-of-2007-2008/Key-events-of-the-crisis, last accessed 2023/4/15.

[9]. Acharya, V. V., & Richardson, M.: Implications of the Dodd-Frank Act. Annual Review of Financial Economics 4(1), 1–38 (2012).

[10]. Hayes, A. Dodd-Frank Act: What It Does, Major Components, Criticisms. Investopedia. https://www.investopedia.com/terms/d/dodd-frank-financial-regulatory-reform-bill.asp, last accessed 2023/4/15.

[11]. Bloomenthal, A. Basel III: What It Is, Capital Requirements, and Implementation. Investopedia. https://www.investopedia.com/terms/b/basell-iii.asp, last accessed 2023/4/15.

[12]. Hartlage, A. W.: The Basel III Liquidity Coverage Ratio and Financial Stability. Michigan Law Review 111(3), 453–483 (2012).