1. Introduction

Mergers and acquisitions, as an important means of enterprise asset restructuring and optimizing resource allocation, play a role in improving enterprise competitiveness, expanding market share, and helping enterprises go public. Since the introduction of market economy through reform and open policy, mergers and acquisitions by Chinese enterprises have not always been smooth. Based on the research of Sun, Hou and Liu, among the 2613 M&A transactions of A-share listed companies in China from 2004 to 2017, the number of failed transactions was higher than the number of successful transactions, accounting for 65% of the total sample [1]. Huang's study indicates that in order to improve the success rate of mergers and acquisitions, Chinese enterprises need to strengthen their main business and generate synergies based on strategic acquisitions that focus on industrial integration and long-term development. Enterprises should avoid financial acquisitions that blindly "diversify" their operations, ignore cultural differences and M&A risks [2].

As a very promising emerging industry, the science and technology innovation board are conducive to promoting the diversified development of China's capital market. However, China's science and technology innovation board started late, and there is still space for improvement in the valuation method of science and technology innovation board enterprises. High R&D funding, high risk and poor stability are all difficulties in evaluating companies on the science and technology innovation board. Yuan shows that the combination of PEG and EVA valuation models is more suitable for enterprises on the science and technology innovation board, and the effective performance of pricing in the science and technology innovation market is enhanced [3]. Based on the research of Hu, Wu, and Huang, it is necessary to combine the growth stage, operation situation, main asset types and special indicators of the enterprise to establish a valuation model suitable for the science and technology innovation board [4].

With the rapid development of China's economy, mergers and acquisitions have gradually become an important measure for enterprises to expand new business directions and obtain new profit points. In 2019, China Securities Regulatory Commission officially issued the Special Provisions on Major Asset Restructuring of Listed Companies in the Science and Technology Innovation Board, which indicated that the reform direction of the Science and Technology Innovation Board gradually expanded from listing to a new field of mergers and acquisitions. Yang pointed out that most of the enterprises in the science and technology innovation board are private enterprises, and private enterprises mainly rely on connotative growth. When connotative growth is difficult to cope with fierce market competition, science and technology enterprises adopt extensional expansion to acquire enterprises to expand new markets and gain new profit growth points [5]. Therefore, it is extremely important to study the M&A motivation of science and technology innovation board enterprises.

This paper takes Huaxing Yuanchuang's acquisition of Olyto, the first acquisition case in the Science and technology innovation board, as an example. Through case analysis and literature review, this paper analyzes the motivation for its acquisition, PEG valuation method and EVA valuation method were used to predict the future development status through the valuation analysis of the enterprise and comprehensively analyzes the success of this acquisition. Finally, based on the analysis results, it puts forward some reference suggestions for the acquisition of science and technology enterprises.

2. Background

Scientific and technological innovation is an important part of promoting economic development, China encourages the development of high-tech innovative enterprises. The reform mechanism and development trend of the capital market are hot topics in China. The Science and Technology Innovation Board was officially launched on June 13, 2019.The science and technology innovation board closely follows China's strategic development and contributes to China's transformation from a "manufacturing power" to a "intelligent manufacturing country".

Huaxing Yuanchuang was established on June 15, 2005 and successfully listed on July 22, 2019. Huaxing Yuanchuang's main business has several major segments: flat panel business, semiconductor business, automotive electronics business, and Huaxing testing and so on. Huaxing Yuanchuang is ahead of other companies in the field of testing and acts as a leader in the science and technology innovation board. On the day after the official launch of the Science and Technology Innovation Board in 2019, Huaxing Yuanchuang successfully registered its IPO on the Science and Technology Innovation Board.Strong innovation and creativity ability enables Huaxing Yuanchuang to reach high-quality cooperative relations with many domestic and foreign enterprises.

Olyto was founded on February 13, 2005. The main business of Olyto includes: intelligent assembly and testing equipment design, production, and sales. Olyto has strong and advanced technology, has great advantages in the field of artificial intelligence and intelligent wear, and has also formed certain technical characteristics. The company has advanced equipment and systems, which have played a significant role in medical, automotive, and new energy.

3. Motivation & Process of M&A

According to the annual report of Huaxing Yuanchuang, in 2019, the operating revenue was 1257.74 million yuan, an increase of about 25% compared to the operating revenue of 1005.08 million yuan in 2018. After deducting non-recurring gains and losses, the net profit attributable to the parent company was 157.049 million yuan, a decrease of about 33% compared to last year's data of 236.8355 million yuan. The main reason for the decline in company performance is the high R&D expenses, which reached 190 million yuan, and the increase in operating costs, which exceeded the increase in operating revenue. Therefore, Huaxing Yuanchuang needs to acquire new intelligent detection technologies through mergers and acquisitions, reduce research and development costs, and expand the company's intelligent equipment product line and new business space. From 2017 to 2019, the operating revenue and net profit of Olyto Company increased year by year, with a net profit of nearly 117 million yuan in 2019, approximately eight times that of 2017. At the same time, the main business scope of Olyto and Huaxing Yuanchuang does not overlap. Mergers and acquisitions can increase the variety of products of Huaxing Yuanchuang, expand the market share of enterprise products, and achieve the needs of property integration and industrial structure adjustment.

Although the net profit of Olyto has grown rapidly, there are still some problems. Its accounts receivable was significantly overdue in 2019, with the overdue portion far exceeding 50% of the total, reaching 139 million yuan. The decline in order volume of Olyto was severe, and the outbreak of the epidemic in 2020 caused a sharp decrease in downstream orders in the panel industry. The net profit in 2020 was only 83.4886 million yuan, a decrease of 28.48% compared to last year. Therefore, Olyto chose to be acquired rather than listed independently, with the aim of reducing the loss of internal competition in the industry and alleviating competitive pressure.

On December 6, 2019, Huaxing Yuanchuang disclosed its restructuring plan for Olyto, which is the first major asset restructuring plan on the Science and Technology Innovation Board. It planed to purchase 100% of its equity through issuing shares and paying cash. The stock issuance price for purchasing assets through mergers and acquisitions is 25.92 yuan per share [6]. On June 18, 2020, Huaxing Yuanchuang completed the transfer procedures of the underlying assets. Since then, Huaxing Yuanchuang has held 100% equity in Olyto. This merger belongs to a horizontal merger with parallel business scope. The final assessed value of Olyto is 1040.70 million yuan, and the consideration is paid in a 7:3 ratio using a combination of equity and cash payment method [7].

Table 1: Huaxing Yuanchuang's expected growth rate.

Data information (unit: RMB 10,000) | Growth rate (before the merger) | Expected growth rate (before the merger) | |||

Year | 2,020 | 2,019 | 2,018 | ||

Net profit | 26,500 | 17,600 | 24,300 | 4% | 16% |

Operating income | 167,700 | 125,800 | 100,500 | 29% | |

Data information (unit: RMB 10,000) | Growth rate (post-merger) | Expected growth rate (post-merger) | |||

Year | 2,021 | 2,020 | 2,019 | ||

Net profit | 31,400 | 26,500 | 17,600 | 34% | 30% |

Operating income | 202,000 | 167,700 | 125,800 | 27% | |

4. Valuation Analysis under the PEG Valuation Method

PEG valuation is upgraded from PE valuation, taking into account both the P/E ratio and the growth of enterprises. Because the price-earnings ratio of the science and technology innovation board is usually higher than that of other sectors [8, 9], the future growth of enterprises is integrated into the valuation of enterprises. The valuation result of this method is more accurate than that of PE, and it can also more effectively express the embedded value of enterprises and the growth of future stocks. In this chapter, the PEG model is used to value the share price of Huaxing Yuanchuang Company in 2020 and 2021, and the reasonable range of shares before and after the M&A is obtained.

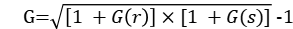

This paper draws lessons from Yuan Zhenchao's calculation of the expected growth rate of enterprises and avoids the uncertainty of a single index to improve the accuracy of research[3]. This paper also uses compound indicators to calculate the expected growth rate. However, after the analysis of calculation results, only when the growth rate of operating income (G (s)) and the growth rate of net profit (G (r)) are both positive, the valuation at this time is meaningful. Table 1 shows the expected growth rate of Huaxing Yuanchuang. The formula for calculating the expected growth rate of enterprises in this paper is as follows:

(1)

(1)

Here, G(s) is growth rate of operating income while G(r) is growth rate of net profit.

The value of the share price per share (P) divided by earnings per share (EPS) is the price-earnings ratio (PE). The price-earnings ratio is based on earnings per share, which reflects the market premium multiple and heat. Share per share generally refers to the current stock price, while earnings per share are generally valued as earnings per share in the previous fiscal year. Table 2 shows the price-earnings ratio of Huaxing Yuanchuang.

Table 2: Huaxing Yuanchuang P/E ratio.

P/E ratio (before the merger) | Capital stock | Total market value (10,000 yuan) |

78.54 | 43,900 | 3,447,906 |

P/E ratio (post-merger) | Capital stock | Total market value (10,000 yuan) |

51.01 | 43,900 | 2,239,339 |

Table 3: Huaxing Yuanchuang benchmark PEG coefficient.

Enterprise name | Price-earnings ratio | Expected growth rate | PEG coefficient (before the merger) |

Huaxing Yuanchuang | 78.54 | 16% | 4.91 |

Price-earnings ratio | Expected growth rate | PEG coefficient (post-merger) | |

51.01 | 30% | 1.70 |

Benchmark PEG coefficient is the core of PEG valuation. According to Peter Lynch's theory, the reasonable ratio of PEG should be 1 if the company price is reasonably priced. When PEG=1, the market value reasonably reflects the intrinsic value of the enterprise's stock price; When PEG > 1, it means that the enterprise value is overvalued; When PEG < 1, it means that the enterprise value is underestimated. The formula for calculating the benchmark PEG coefficient is as follows:

Benchmark PEG coefficient = P/E ratio/(expected growth rate ×100) (2)

It can be seen from Table 3 that the coefficients of Huaxing Yuanchuang PEG before and after M&A are 4.91 and 1.70, respectively, which are greater than 1, indicating that the stock value of Huaxing Yuanchuang is likely to be overvalued by the market or the market thinks that the future performance growth of Huaxing Yuanchuang will be higher than the market expectation. However, investors should be vigilant about this indicator and make rational decisions. Through the above calculation of growth rate (G), earnings per share (EPS) and benchmark PEG coefficient, the valuation formula of value per share is obtained:

P=PEG×EPS×G×100 (3)

To ensure the prudence of valuation, this paper makes a sensitivity analysis on the expected growth rate of 5%, and PEG is adjusted to 3.74 and 7.14 before the merger and 1.46 and 2.04 after the merger. According to the data, the stock price range forecast of Huaxing Yuanchuang is shown in Table 4.

Table 4: Valuation per share of Huaxing Yuanchuang.

Earnings per share (yuan) | Expected growth rate | PEG coefficient (before the merger) | Share price per share (before the merger) | ||||

0.64 | 16% | 3.74 | 4.91 | 7.14 | 38.30 | 50.27 | 73.11 |

Earnings per share (yuan) | Expected growth rate | PEG coefficient (post-merger) | Share price per share (after the merger) | ||||

0.72 | 30% | 1.46 | 1.70 | 2.04 | 31.48 | 36.73 | 44.07 |

5. EVA Valuation

5.1. Value of the Enterprise Before M&A

According to the Wind database, the total value of ordinary shares of Huaxing Yuanchuang as of December 31, 2019 was 17756.28 million yuan, with a total of 401000000 shares. The stock price of Huaxing Yuanchuang in 2019 was 44.28 yuan per share. Enterprise Value is the overall market value of an enterprise. Huaxing Yuanchuang's its estimated enterprise value for 2019 is shown in Table 5.

Table 5: Enterprise value of Huaxing Yuanchuang in 2019 (Unit: million yuan).

Equity value | Total liabilities | Preferred stock value | Non-controlling interests | Cash and cash equivalents | Enterprise value |

17,756.28 | 239.18 | 0 | 0 | 276.51 | 17,718.95 |

5.2. Valuation Method

EVA valuation method, also known as economic value added valuation method, is an absolute valuation method that predicts the future economic value added of a company through the analysis of historical business performance data, and calculates the company's value through discounting and summation. The calculation formula for EVA is:

EVA=NOPAT-TC×WACC (4)

Here, NOPAT represents net operating profit after tax, TC represents total capital, and WACC represents weighted average cost of capital.

Huaxingyuan Creation is a science and technology innovation board enterprise with strong technological innovation capabilities, and has established cooperative relationships with multiple domestic and foreign enterprises. After its acquisition of Olyto, the product range has increased, including smartwatches and wireless headphones, and the market share has expanded. Since the end of the COVID-19 in 2022, the economic situation has recovered steadily, which is conducive to improving the operation of enterprises. It is expected that in the next five years, Huaxingyuan Chuang will first enter a high-speed and stable development state due to mergers and acquisitions to expand production and operation scale, improve business performance, and then slow down and stabilize due to market saturation or technological bottlenecks. Therefore, this article uses the EVA valuation method as a two-stage model to estimate the future stock price of the enterprise.

Table 6: NOPAT of Huaxing Yuanchuang from 2020 to 2021 (Unit: million yuan).

Year | 2021 | 2020 |

Net profit after tax | 313.9717 | 265.1139 |

interest expenses | 5.0740 | 1.4771 |

Increase in deferred tax credit balance | -1.4104 | 28.6653 |

Increase in other reserve balances - provision for asset impairment | 31.8141 | 9.8422 |

Increase in other reserve balances - bad debt reserves | 17.5170 | 14.7927 |

NOPAT | 366.9664 | 319.8912 |

Table 7: TC of Huaxing Yuanchuang from 2020 to 2021 (Unit: million yuan).

year | 2021 | 2020 | |

equity capital | Ordinary equity | 439.3865 | 438.5367 |

Debt capital | Non current loans due within one year | 12.5727 | 0 |

Non current liabilities | 796.8814 | 31.5768 | |

Adding back | Asset impairment provision | 31.8141 | 9.8422 |

R&D expenses | 352.8094 | 252.6523 | |

Non operating expenses after tax | 2.3680 | 2.0556 | |

Deferred Tax Liability | 28.6097 | 30.0201 | |

Subtract | Amortization of R&D expenses | 10.1775 | 10.4909 |

Balance of deferred income tax assets | 24.8261 | 12.2960 | |

Non operating income after tax | 9.8109 | 36.8306 | |

TC | 1,619.6273 | 705.0662 | |

5.3. Historical Indicators

Net operating profit after tax is an indicator that reflects the profitability of a company's assets. It is the after-tax profit obtained by a company's operations without involving capital structure, that is, the after-tax investment income of all capital. Considering the high risk of R&D activities leading to high uncertainty in future economic benefits inflow and the simplicity of accounting treatment, Huaxing Yuanchuang did not capitalize R&D expenses. Therefore, the amortization of capitalized R&D expenses and capitalized R&D expenses in this year is 0. In addition, the corporate income tax rate of Huaxing Yuanchuang in 2020 and 2021 was 15%. After the acquisition of Olyto, the NOPAT calculation for Huaxing Yuanchuang from 2020 to 2021 is shown in Table 6.

Total capital refers to the amount of paid in capital during the operation of a company. The calculation formula is TC=Shareholders' Equity+Liabilities. Shareholders' equity includes all funds and profits invested by the company's shareholders, while liabilities include all debts and outstanding loans of the company. After adjusting some accounting subjects according to China's accounting standards and the characteristics of enterprises on the Science and Technology Innovation Board, the TC of Huaxing Yuanchuang from 2020 to 2021 is given in Table 7. The weighted average cost of capital is a company's cost of capital calculated based on the weighted average of the total sources of capital occupied by various types of capital. The weighted average capital cost of Huaxing Yuanchuang in 2020 and 2021 is shown in Table 8.

Table 8: WACC of Huaxing Yuanchuang from 2020 to 2022.

Year | 2022 | 2021 | 2020 | Average WACC |

WACC | 7.72% | 4.78% | 0.88% | 4.46% |

Table 9: Income statement forecast for 2022-2026(Unit: million yuan).

Year | 2022 | 2023 | 2024 | 2025 | 2026 |

Operating income | 256,368.14 | 317,039.97 | 397,200.17 | 494,414.61 | 617,422.16 |

Operating costs | 113,124.33 | 129,020.24 | 150,501.11 | 173,603.75 | 201,380.09 |

Taxes and surcharges | 1,332.89 | 1,426.27 | 1,532.00 | 1,642.45 | 1,762.53 |

Selling expenses | 23,123.07 | 33,745.99 | 47,725.12 | 68,572.73 | 97,752.92 |

Management fees | 26,217.44 | 34,548.18 | 46,064.12 | 61,059.97 | 81,175.35 |

R&D expenses | 47,730.68 | 65,612.91 | 89,480.37 | 122,516.97 | 167,417.38 |

Asset impairment losses | -7,729.43 | -21,881.92 | -57,555.45 | -157,162.73 | -421,267.30 |

Other benefits | 1,367.60 | 3,609.97 | 8,353.10 | 20,688.66 | 49,556.22 |

Operating profit | 40,873.47 | 51,719.31 | 66,771.16 | 85,346.28 | 109,636.69 |

Non-operating income | 1,343.50 | 1,839.80 | 2,519.42 | 930.67 | 809.13 |

Non-operating expenses | 272.55 | 313.84 | 361.30 | 415.99 | 478.93 |

Total profit | 42,041.30 | 50,804.80 | 64,295.14 | 79,532.52 | 99,516.01 |

Income tax expense | 485.34 | 339.78 | 330.74 | 276.74 | 250.47 |

Net profit | 42,178.51 | 53,306.79 | 69,491.35 | 89,207.77 | 115,405.25 |

5.4. Two-stage Forecasting

The science and technology innovation board has a large space for development and rapid development. Huaxingyuan Creation is the first enterprise to enter the science and technology innovation board. The first stage of enterprise development is the stage of rapid growth,the expected time frame is roughly five years. The data comes from Huaxing Yuanchuang's 2019-2021 financial report, and the average growth rate in 2019-2021 predicts the value of 2022, and so forth. Among them, because the growth rate of non-operating expenses from 2019 to 2020 is too large, the original value is 10076.24%, so the growth rate from 2020 to 2021 is taken as 15%. The increase in non-operating income fluctuated too much in 2020, resulting in large changes in subsequent valuation differences, so without referring to the 2020 data, the average growth rate was 36.94% when calculating the data for 2019 and 2021.From the forecast, the estimated profit for 2022-2026 is obtained, as shown in the Table 9.

Net operating profit after tax and total assets are projected based on average growth rates from 2019 to 2021.Because the gain and loss on fair value changes is 0 yuan in 2020, which will lead to large changes in subsequent valuation differences. So we take the three-year average of 502.98 from 2019 to 2021, with a growth rate of 0%. Huaxing Yuanchuang has exchanged all expenses to R&D, so the capitalized R&D expenses and amortization of NOPAT should be 0 yuan. Because the increase in the deferred tax credit balance fluctuated too much in 2020, and the tax expense could not be predicted, So take the three-year average of 626.19 million yuan, the growth rate is 0%. Because the increase in non-operating income fluctuated too much in 2020, the average growth rate of 2019 and 2021 was calculated directly without referring to the 2020 data, and the data was 36.94%.By forecasting, NOPAT forecasts are shown in Table 10.

Table 10: NOPAT forecast for 2020 to 2021 (Unit: million yuan).

Year | 2022 | 2023 | 2024 | 2025 | 2026 |

Net profit after tax | 42,178.51 | 53,306.79 | 69,491.35 | 19,716.41 | 15,648.29 |

interest expenses | 976.21 | 2,615.77 | 6,020.81 | 8,974.78 | 17,017.81 |

Increase in other reserve balances - provision for asset impairment | 7,729.43 | 21,881.92 | 57,555.45 | 99,607.28 | 217,188.99 |

Increase in other reserve balances - bad debt reserves | 1,847.26 | 2,067.75 | 2,247.56 | 231.85 | 137.97 |

Gain or loss on changes in fair value | 502.98 | 502.98 | 502.98 | 502.98 | 502.98 |

Non-operating income | 1,343.50 | 1,839.80 | 2,519.42 | 930.67 | 809.13 |

Increase in deferred tax assets | 626.19 | 626.19 | 626.19 | 626.19 | 626.19 |

NOPAT | 53,685.07 | 80,825.89 | 136,268.82 | 129,483.99 | 250,946.71 |

Huaxing Yuanchuang only disclosed non-current borrowings due within one year in 2021, so this article uses 2021 data as the forecast value for the next five years, and the growth rate is set at 0%. R&D expense amortization only discloses data for 2020 and 2021, so the growth rate for this two years is used. The growth rate of non-current liabilities and deferred tax liabilities fluctuates too much, so take the three-year average. Non-tax operating expenses after tax differed too much from 2019 to 2020, and the growth from 2020 to 2021 was flat, so the growth rate from 2020 to 2021 was adopted. The after-tax non-operating income in 2020 is too different from the values of other years, so the growth rate of 2019 and 2021 is adopted. Provision for asset impairment rose too much in 2021, so the growth rate from 2019 to 2020 was adopted as the three-year average growth rate. The TC projections are shown in Table 11.

Table 11: TC forecast for 2022-2026 (Unit: million yuan).

Year | 2022 | 2023 | 2024 | 2025 | 2026 | |

equity capital | Ordinary equity | 46,037.72 | 47,131.86 | 48,766.41 | 50,191.53 | 51,795.24 |

Minority shareholders' equity | 113,124.33 | 129,020.24 | 150,501.11 | 173,603.75 | 201,380.09 | |

Debt capital | Short term loans | 1,332.89 | 1,426.27 | 1,532.00 | 1,642.45 | 1,762.53 |

Adding back | Asset impairment provision | 5,175.21 | 7,793.76 | 11,266.82 | 16,627.58 | 24,288.08 |

R&D expenses | 47,730.68 | 63,416.32 | 82,107.04 | 107,698.09 | 140,352.68 | |

Non-operating expenses after tax | 272.79 | 311.52 | 354.18 | 403.58 | 459.35 | |

Deferred Tax Liability | 1,999.49 | 1,999.49 | 1,999.49 | 1,999.49 | 1,999.49 | |

Subtract | Amortization of R&D expenses | 987.32 | 957.36 | 928.08 | 899.80 | 872.33 |

Balance of deferred income tax assets | 3,675.52 | 6,144.73 | 9,205.89 | 14,591.22 | 22,493.56 | |

Non-operating income after tax | 1,343.46 | 1,772.76 | 2,295.08 | 2,999.88 | 3,902.43 | |

TC | 124,215.25 | 140,783.76 | 161,070.56 | 187,435.03 | 220,632.17 | |

Huaxing Yuanchuang was listed in July 2019 and did not disclose the WACC of 2019, and if only the average values for 2020 and 2021 are calculated, the results will be low, which will lead to negative growth in the valuation data of the second phase of EVA.The WACC in the third quarter of 2022 was disclosed, and because the WACC is relatively normalized, the data in the third quarter of 2022 can represent the data of the whole year to a certain extent, so this paper uses the average value of the third quarter of 2020, 2021 and 2022 to calculate the WACC of 4.46%.Based on all the corresponding data, the EVA forecast for the next five years is calculated, and the EVA calculation result is presented in Table 12.

Table 12: EVA calculation for 2022-2026(Unit: million yuan).

Year | 2022 | 2023 | 2024 | 2025 | 2026 |

NOPAT | 53,685.07 | 80,825.89 | 136,268.82 | 129,483.99 | 250,946.71 |

TC | 124,215.25 | 140,783.76 | 161,070.56 | 187,435.03 | 220,632.17 |

WACC | 4.46% | 4.46% | 4.46% | 4.46% | 4.46% |

EVA | 48,145.07 | 74,546.93 | 129,085.07 | 121,124.39 | 241,106.52 |

Discounted to 2022 | 48,145.07 | 71,364.10 | 118,297.61 | 106,262.87 | 202,492.46 |

Total present value | 546,562.11 | ||||

After five years of rapid development, Huaxing Yuanchuang will enter a stage of steady development. China's GDP can well reflect the degree of economic activity,This paper assumes that the growth rate of Huaxing Yuanchuang in the stable development stage is consistent with the growth rate of China's GDP, and China's GDP growth rate in the past three years is 2.94%.Since the growth rate of enterprises and GDP cannot completely coincide, the difference between the two can fluctuate, with a range of about 5%. The predictor formula for EVA in the stable development stage is:

EVA perpetuity=EVA2025/(WACC-g) (5)

The forecast table of EVA in the stable development stage is presented in Table 13.

Table 13: Perpetual EVA calculation in the stable development stage (Unit: million yuan).

Year | EVA 2027 | WACC | g | Perpetual EVA | Perpetual EVA discount |

EVA floats down 5% | 247,833.39 | 4.46% | 2.79% | 14,840,322.57 | 12,463,592.89 |

EVA | 248,204.83 | 4.46% | 2.94% | 16,329,264.92 | 13,714,075.91 |

EVA floats up by 5% | 248,556.71 | 4.46% | 3.09% | 18,142,825.29 | 15,237,188.23 |

5.5. Analysis

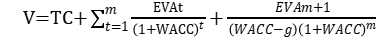

The core principle of the EVA valuation method is to add the total capital at the beginning (TC) to the present value of EVA in future periods. Its specific valuation is as follows. Value of enterprise = total invested capital at the beginning of the period (TC) + discounted value of expected EVA in the future:

(6)

(6)

The valuation of Huaxing Yuanchuang Enterprise is shown in Table 14.

Table 14: Valuation of Huaxing Yuanchuang Enterprise (Unit: RMB 10,000).

2022TC | 2022-2026EVA | Perpetual renewal | Enterprise value |

124,215.25 | 546,562.11 | 12,463,592.89 | 13,134,370.25 |

13,714,075.91 | 13,714,075.91 | ||

15,237,188.23 | 15,907,965.59 |

Using the EVA model, the enterprise value of Huaxing Yuanchuang in 2022 is [131,343,702,500 yuan, 159,079,655,900 yuan], and the total share capital of the enterprise is 440,591,700 shares. Therefore, the stock price range per share is [298.11 yuan, 361.06 yuan]. In December 2022, the average share price of Huaxing Yuanchuang was 28.16 yuan. It can be seen from the stock price that the current market price of Huaxing Yuanchuang is far lower than the valuation data, indicating that it has strong value-added value in the future, and the market is likely to underestimate its value at present.

Huaxing Yuanchuang's overall financial situation is good and its growth rate is relatively stable. Therefore, it also provides the premise of valuation stability for the establishment of the Huaxing Yuanchuang valuation model. However, the valuation results show that the price ranges under PEG and EVA valuation models are quite different, which may be due to the following reasons: First, the difference between relative valuation and absolute valuation methods. Second, the error between the two valuation methods in predicting the future development stage, operating status, asset status and cash flow of the enterprise, due to the shortlisting time of Huaxing Yuanchuang, there are few historical data to refer to, which cannot effectively reflect the data change trend. In the process of forecasting, we have made some adjustments to the indicators that fluctuate greatly in recent years, and these adjusted data may be far from the actual situation in the future. Therefore, the results of the two types of valuation are quite different. Third, science and technology innovation board enterprises, due to their unique growth stage, financial data value-driving factors and many other aspects, are quite different from traditional enterprises [10]. Simply applying the system of enterprise value evaluation methods of other industries may be difficult to reasonably draw the correct conclusion of enterprise valuation.

6. Risk Analysis

A large part of the company's revenue comes from cooperation with Apple, Huaxing Yuanchuang's revenue is directly linked to the sales of Apple products. Olyto has advantages in the field of smart wear, and the intelligent assembly and testing of products is the main scope of Olyto, especially smart watches and wireless headphones.In 2020, Huaxing Yuanchuang acquired Olyto, and the acquisition of Olyto can help Huaxingyuanchuang enter the smart wearable market. With the help of Olyto, Huaxing Yuanchuang can develop business other than smartphone screen detection, and disperse the direct impact of changes in the sales of Apple products on the company's revenue. However, the cooperation between Apple and Huaxing Yuanchuang still accounts for too large a proportion of the overall revenue, and the impact cannot be underestimated.

In order to be able to deliver in time, raw materials and parts for various equipment required will be purchased in advance. If the customer does not confirm the order or cancel the order, these products will become stock. Reserve products also become the company's inventory. Huaxingyuan's financial report data shows that the net inventory book in 2021 is nearly 238 million yuan more than the net inventory book amount in 2020.If there is too much inventory, the risk of inventory falling in price will be higher, and the company's earnings will be adversely affected.

Huaxing Yuanchuang has many foreign transactions, and most of the income is generated from trading with overseas enterprises. In overseas transactions, the currency used for settlement is the US dollar, and the transaction of imported raw materials is settled in Japanese yen, the exchange rate fluctuates too much and will greatly affect the company's earnings.

Nowadays, China vigorously supports the development of scientific and technological innovation enterprises, and has many preferential policies in taxation and other aspects. Huaxing Yuanchuang belongs to the science and technology innovation board and has received many preferential treatments in terms of taxation. However, the future policy provisions are unknown, if the country adjusts the relevant policies in the future, e.g., the tax refund rate is reduced, the amount of tax that the company must bear is huge, and the company's income will be affected to a certain extent.

7. Conclusion

Overall, mergers and acquisitions have not been successful. From the perspective of corporate value, mergers and acquisitions have not played a role in raising stock prices and enhancing corporate value. If Chinese enterprises want to improve the success rate of mergers and acquisitions, they should focus on generating integrated synergies through industrial integration, achieving optimal resource allocation, and thus improving their core competitiveness. From a financial perspective, the valuation results of PEG indicate that the stock value of Huaxing Yuanchuang is likely to be overestimated by the market, while the EVA valuation results indicate that the current enterprise value is likely to be underestimated. Therefore, it is difficult to infer the financial success of its mergers and acquisitions solely from data analysis. Most of Huaxing Yuanchuang's revenue comes from cooperation with overseas enterprises. The risk of exchange rate fluctuations has a significant impact on corporate performance. Therefore, Huaxing Yuanchuang can consider increasing cooperation with local enterprises in the future.

This article evaluates the value of mergers and acquisitions from both relative and absolute perspectives, enhancing the objectivity and effectiveness of valuation data. The listing time of China's Science and Technology Innovation Board is relatively short, and there is currently relatively little literature on merger and acquisition cases and valuation of enterprises on the Science and Technology Innovation Board. Thereby, this article has important implications for mergers and acquisitions of science and technology innovation enterprises. The drawback of this article is that due to the author's lack of involvement in the specific operation of the enterprise, the data used in this article are all public data from financial websites, without considering the impact of deep data within the enterprise on the depth and breadth of research on objective problems. In addition, there are inevitably subjective assumptions in the valuation models of PEG and EVA. Finally, failure to consider the impact of non-financial indicators on corporate valuation in valuation analysis may also result in biased results.

References

[1]. Sun, Y., Hou, L., Liu, J.: Cumulative Experience and M&A Performance: Learning from Success and Failure. Collected Essays on Finance and Economics 8, 69-80 (2021).

[2]. Huang, S., An, L.: Integration after Mergers and Acquisitions: Key Factors for the Success or Failure of Enterprise Mergers and Acquisitions. Business and Management Journal 15, 6-13 (2003).

[3]. Yuan, Z.: Research on the valuation of enterprises on the science and technology innovation board based on PEG method and EVA method. Dongbei University of Finance and Economics (2022).

[4]. Hu, X., Wu, Z., Huang, J.: Research on the selection of enterprise value evaluation method on the science and technology innovation board. China Asset Valuation 11, 4-7+33 (2019)

[5]. Yang, N.: Research on Risk Management and Control of Huaxing Yuanchuang's Acquisition of Olyto from the Perspective of Value Creation. Guizhou University of Finance and Economics (2022).

[6]. Wang, D.: A Case Study of HYC Technology Acquiring Olyto. Hebei University (2021).

[7]. Leng, F.: Case Study on M&A of the STAR Market. Jiangxi University of Finance and Economics (2022).

[8]. Wang, F.: A Brief Analysis of Equity Value Evaluation Methods of New Third Board Enterprises. Hebei Enterprises 3, 32-33 (2015).

[9]. Cheng, X., Fu, H., Zuo, B.: Research on capitalization of R&D expenses of high-tech enterprises. Friends of Accounting 5, 37-43 (2016).

[10]. He, Y.: Application of high-tech enterprise value evaluation based on real options. Chongqing University of Technology (2017).

Cite this article

Cheong,K.;Guo,F.;Lu,J. (2023). Analysis of Huaxing Yuanchuang M&A Based on PEG and EVA Valuation Model. Advances in Economics, Management and Political Sciences,36,53-65.

Data availability

The datasets used and/or analyzed during the current study will be available from the authors upon reasonable request.

Disclaimer/Publisher's Note

The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of EWA Publishing and/or the editor(s). EWA Publishing and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content.

About volume

Volume title: Proceedings of the 7th International Conference on Economic Management and Green Development

© 2024 by the author(s). Licensee EWA Publishing, Oxford, UK. This article is an open access article distributed under the terms and

conditions of the Creative Commons Attribution (CC BY) license. Authors who

publish this series agree to the following terms:

1. Authors retain copyright and grant the series right of first publication with the work simultaneously licensed under a Creative Commons

Attribution License that allows others to share the work with an acknowledgment of the work's authorship and initial publication in this

series.

2. Authors are able to enter into separate, additional contractual arrangements for the non-exclusive distribution of the series's published

version of the work (e.g., post it to an institutional repository or publish it in a book), with an acknowledgment of its initial

publication in this series.

3. Authors are permitted and encouraged to post their work online (e.g., in institutional repositories or on their website) prior to and

during the submission process, as it can lead to productive exchanges, as well as earlier and greater citation of published work (See

Open access policy for details).

References

[1]. Sun, Y., Hou, L., Liu, J.: Cumulative Experience and M&A Performance: Learning from Success and Failure. Collected Essays on Finance and Economics 8, 69-80 (2021).

[2]. Huang, S., An, L.: Integration after Mergers and Acquisitions: Key Factors for the Success or Failure of Enterprise Mergers and Acquisitions. Business and Management Journal 15, 6-13 (2003).

[3]. Yuan, Z.: Research on the valuation of enterprises on the science and technology innovation board based on PEG method and EVA method. Dongbei University of Finance and Economics (2022).

[4]. Hu, X., Wu, Z., Huang, J.: Research on the selection of enterprise value evaluation method on the science and technology innovation board. China Asset Valuation 11, 4-7+33 (2019)

[5]. Yang, N.: Research on Risk Management and Control of Huaxing Yuanchuang's Acquisition of Olyto from the Perspective of Value Creation. Guizhou University of Finance and Economics (2022).

[6]. Wang, D.: A Case Study of HYC Technology Acquiring Olyto. Hebei University (2021).

[7]. Leng, F.: Case Study on M&A of the STAR Market. Jiangxi University of Finance and Economics (2022).

[8]. Wang, F.: A Brief Analysis of Equity Value Evaluation Methods of New Third Board Enterprises. Hebei Enterprises 3, 32-33 (2015).

[9]. Cheng, X., Fu, H., Zuo, B.: Research on capitalization of R&D expenses of high-tech enterprises. Friends of Accounting 5, 37-43 (2016).

[10]. He, Y.: Application of high-tech enterprise value evaluation based on real options. Chongqing University of Technology (2017).