1. Introduction

1.1. Research Background

Didi Dache and Kuaidi Dache were launched in Beijing and Hangzhou in September and August 2012, respectively. Before the strategic merger, the two had fierce competition in various aspects. Didi has received a total of 4 rounds of financing with a total amount of more than 800 million yuan [1], and quickly obtained a financing of 700 million US dollars. In 2014, in the subsidy competition between the two sides in the "payment + red envelope war", Didi's subsidy scale exceeded 1.4 billion, which was nearly 1 billion. The two companies used excess funds to subsidize customers and seized the market by burning money. During the subsidy peak period, Didi Taxi’s daily subsidies and operating costs reached 10 million to 20 million, and it once lost money. The president of Didi said that the project was launched on January 21, 2015, codenamed "Valentine's Day Project"[2]. On February 14, 2015, the two companies announced a strategic merger. The merger was planned to be completed on the 22nd in the form of a joint-stock partnership. No cash transaction was involved, and the two companies did not disclose the shares of both parties. The merger of the two companies is a good start for both parties [3].

1.2. Research Purpose and Research Significance

In the Internet era, the online car-hailing industry has developed rapidly, but there are still many problems. The purpose of this paper is to analyze Didi's motivation for acquiring Kuaidi, the market competition pattern before and after the acquisition, the evolution and supervision of industry norms, and clarify the competitive advantages and development prospects of the ride-hailing industry. The contribution of this paper is to help investors understand the capital operation mode of M&A and restructuring, and adapt to the increasing demand for expansionary development through M&A and restructuring in various fields [4]. Help consumers identify vehicle information, driver information, driving routes, and price information, ensure passenger safety, and improve passenger experience. Help regulators facilitate compliance review, actively respond to the requirements and suggestions of regulatory authorities, and improve the level of industry standardization.

The following sections of this paper are organized as follows: Section 2 analyze reasons for and implications of adopting M&A strategy; Section 3 introduces Competitive landscape and prospects in the same industry.

2. Reasons for and Implications of M&A

2.1. Capital Level

Capital promotes mergers and acquisitions. The largest shareholders behind Didi Dache and Kuaidi are Tencent and Alibaba, respectively. Big data is an inevitable product of the development of the Internet to a certain extent, and Didi and Kuaidi have built a bridge of communication between passengers and taxi drivers with the help of Internet technology, avoiding imbalance of market resources and solving the problem of asymmetric messages. They hope to invest in the transportation sector to expand and promote mobile payments to compete for more big data resources. The two investors have similar market shares and similar product lines. In 2014, the two companies played fiercely in the "payment + red envelope war", and the scale of money burned in the subsidy war exceeded the expectations and acceptance of investors, resulting in an imbalance in the financial structure, and the market was opened by this abnormal business behavior [5].

|

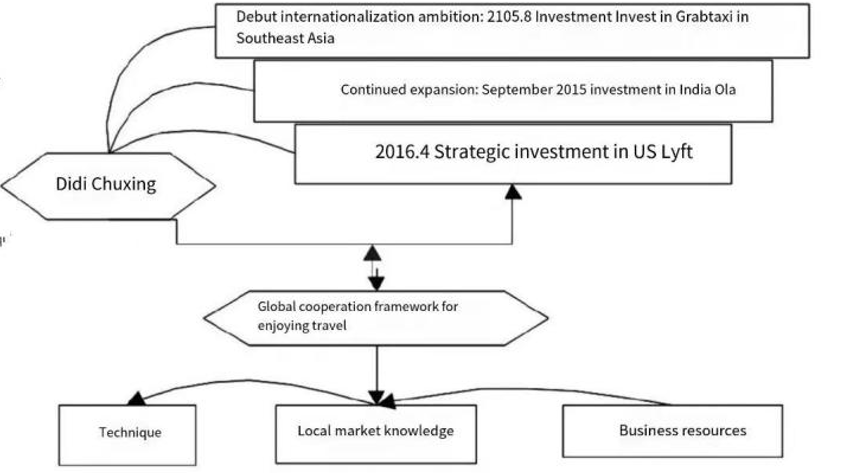

Figure 1: Didi Chuxing global investment. |

Photo credit: ZHENG Yujiao. (2016). Didi Kuaidi's strategic M&A case study. Western Leather (24), 74-7 [6] |

After the merger and acquisition, according to Figure 1, Didi Chuxing relied on multiple investors to make overseas strategic investments, enhance the company's brand and market value, shape the international operation brand image, and reserve strategic talents. In addition, the financing synergy is obvious. In August 2015, Didi Chuxing invested in Grabtaxi in Southeast Asia, showing its international ambitions; in 2019, it continued to expand and invested in Ola in India; in April 2016, it made a strategic investment in Lyft in the United States and formed a strategic alliance, establish a global cooperation framework for shared travel and enhance technical exchanges between countries. The creation of a global cooperation framework for shared mobility is conducive to the exchange of local business knowledge between countries and the rational use of business resources. This framework is still flourishing.

2.2. The Impact of Adopting a Strategic Merger

Business development drives M&A. The two major investors, DDT and Fast Travel, have similar market shares, similar product lines, and similar quality of products and services offered. The incremental returns to scale and diminishing marginal effects brought about by M&A improve efficiency and can be used to provide higher quality goods and services and improve user experience with the same investment of time and cost. The increase in efficiency per unit of time brings about an increase in the total value of goods or services, which in turn can be applied to the product or service, resulting in a decrease in the cost per unit and thus a reduction in the price per unit, and can expand the population. base of the product or service, avoiding greater time costs and opportunity costs and reducing marketing costs. It highlights the economic benefits and enhances the monopoly position in the market. In addition, the merger of two major companies, DDT and Fast Travel, can reduce the loss of funds like the subsidy war, thus expanding the business areas and enhancing the degree of specialization, which allows DDT to develop horizontally and vertically, establish a profit model framework, and further enhance the competitiveness of the company.

3. Competitive Landscape and Prospects in the Same Industry

3.1. Competitive Landscape of Online Ride-hailing Market

According to the 49th "Statistical Report on the Development Status of China's Internet" published by China Internet Network Information Center (CNNIC), the scale of China's online taxi users showed an overall trend of growth from 2017 to 2021, and the scale of online taxi users in 2021 was 453 million, up 24.11% from the previous year, accounting for 43.9% of the overall usage rate of Internet users; by June 2022 The scale of China's online taxi users reached 405 million people, accounting for 38.5% of the overall usage rate of Internet users, and the registration of China's online taxi-related enterprises in 2017-2019 continued to increase, with nearly 2,500 online taxi-related enterprises registered in 2019[7].

|

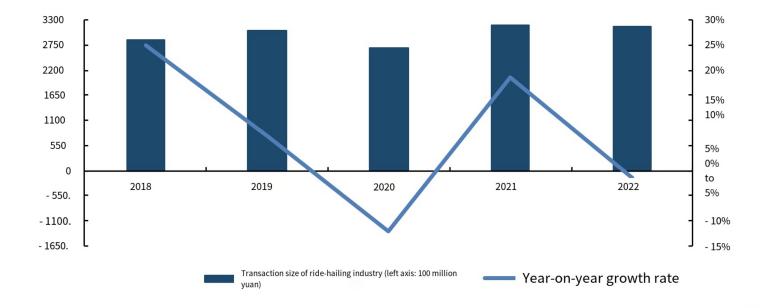

Figure 2: Transaction scale and year-on-year growth rate of online car-hailing industry. |

Photo credit: NetEconomics, China National Finance & Securities Research Institute [8] |

The originator of online car hailing, Easy Car Travel, was the first to propose the "special car" service, which was established in Beijing in May 2010, which has promoted the gradual rise of China's online car hailing industry [9]. Bitcar uses the Internet and location services, and uses information technology to effectively schedule and regulate vehicles on mobile terminals, which improves the resource utilization rate of the traditional car rental industry. The customer base focused on by Yitochu is high-end business people, and the slogan is "1-hour booking response, on-time billing, high-end models, professional services”. Without a car and a driver, users can respond within 1 hour of placing an order, providing real professional services, which is a typical asset-light operation model. Afterwards, Shenzhou Zhuanche and Shouqi car-hailing captured the high-end business market, and Didi Dachekuai’s car-hailing war did not make Bitche travel profitable [10].

Figure 2 describes transaction and scale and year-on-year growth rate of online car-hailing industry. Figure 2 shows that in the past five years, the scale of online ride-hailing in 2021 was the largest, with nearly 320 billion yuan; In 2019 and 2022, the scale of online ride-hailing will be large, fluctuating around 300-320 billion yuan, and the scale of online ride-hailing in 2018 and 2020 will be small, 280 billion yuan per month. From 2018 to 2020, the year-on-year transaction scale of the ride-hailing industry declined, from 25% to -13%, and from 2020 to 2021, the year-on-year growth rate of the e-hailing industry increased to 20%, and in 2022 it fell to -3%.

Uber officially entered China in 2014, its goal proposition is "Uber for Everything", committed to bringing more portable experience to consumers. Uber is involved in a wide range of fields, in addition to providing basic mobility services, but also involves a lot of life business. Examples include Uber Eats (food delivery business), Uber Ubermovers (moving business), Uber-Rush (timely delivery service), etc[11]. In addition, Uber has a wider user segment, first of all, Uber provides a type of service that suits its own characteristics for each different user. From Uber Taxi to Uber SUV, a wide range of service segments can better respond to user needs. Second, Uber offers different mobility services for users of different ages. For example, Uber's main customers in the early days were office workers, and later gradually developed Uber for children and Uber for the elderly. Finally, Uber can use the advantages of price and experience to gradually transfer high-end travel services to mainstream users, for example, users can use Uber for a series of personalized services such as creative services and aircraft services.

Didi Chuxing was founded in Beijing in June 2012. Since its inception, it has developed and expanded at an astonishing speed. Compared with the traditional cruising car model, first of all, Didi Chuxing can use the Internet and positioning to connect taxis and passengers, which improves resource utilization. Secondly, Didi Chuxing has different models to choose from according to the income of different users. Finally, Didi Chuxing has a credit evaluation after use, which shortens the distance between taxis and passengers [12]. The timely feedback from passengers not only protects the rights and interests of individuals, but also provides direction for the improvement of Didi Chuxing, improves the average quality and matching efficiency of the platform, and promotes the sustainable development of the platform.

3.2. Changes in the Market Share Trend of Online Car-Hailing

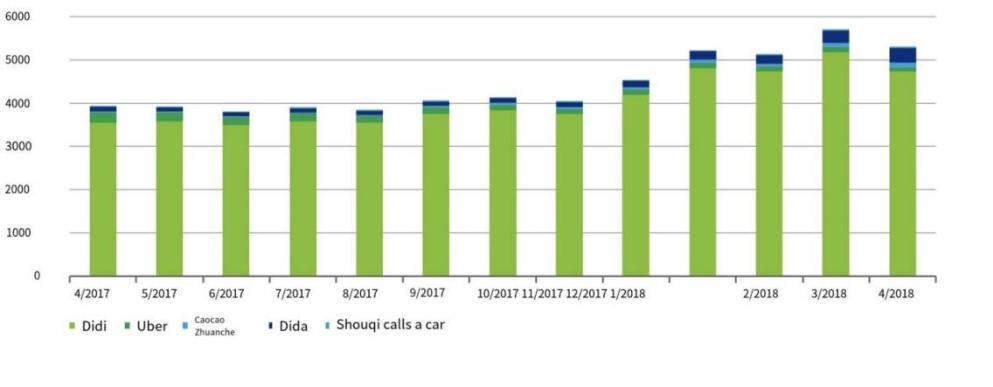

With the rapid development of China's ride-hailing market, the number of China's ride-hailing companies is large, the industry concentration is high, leading companies occupy most of the market share, China's ride-hailing market has almost entered the monopoly market, as shown in Figure3, from 2017 to 2018, Didi Chuxing occupies most of the market share, Uber, Cao Cao car, Dida, Shouqi ride-hailing occupies a smaller share. According to public data, in December 2022, in the urban car industry (excluding aggregation platforms), the penetration rate of Didi Chuxing's active number reached 19.27%, Dida Chuxing 8.75%, Huaxiaozhu taxi 2.89%, T3 Chuxing 1.92%, Cao Cao Chuxing 1.08%, and the penetration rate of active people on other platforms was less than 1%.This competitive landscape shows that there is still a big gap between other ride-hailing platforms and Didi Dache, reflecting passengers' recognition of Didi Dache platform and once again affirming Didi Dache's leading position. However, due to social demand and the in-depth development of Internet technology, the competition in the ride-hailing industry is fierce, and Didi Dache must expand its business scope, enhance its professionalism, and wonder if it does not improve its competitiveness, otherwise, Didi's leading position will be threatened.

|

Figure 3: Monthly active users of major online car-hailing apps on the Android side. |

Photo credit: Trust data [13] |

3.3. Market Competitive Prospects After Merger

3.3.1. Advantages of the Merger

With the development of the Internet industry, people's recognition of online car-hailing is gradually increasing, and the market prospect of online car-hailing is bright. Didi Dache and Kuaidi Dache joined forces to achieve a win-win situation. The two companies, one in the south and the other in the north, were listed in Beijing and Hangzhou respectively. The merger of Didi Dache and Kuaidi Dache has occupied a huge share of the taxi software market. The core businesses of Didi and Kuaidi are highly related and similar. First of all, the merger of the two companies can effectively disperse the risk of enterprise competition, save transaction costs, help integrate resources, improve resource utilization, and more effectively develop the market. Secondly, the merger of the two companies is conducive to accumulating funds, grabbing market share, accelerating the process of listing in the later stage, reducing the pressure on listing, and shortening the time to market. Finally, the cooperation between the two companies can avoid strategic mistakes and avoid operational risks.

3.3.2. The Industry is Gradually Standardized, and the Industry has Great Potential

Over the years, the state and relevant departments have clarified their responsibilities, exerted their own subjective initiative, and continuously introduced new policies to regulate and supervise the ride-hailing industry [14]. In February 2022, eight departments jointly issued the Notice on Strengthening the Joint Supervision of the Whole Chain of the Online Taxi Booking Car Industry, improving the pre-event and in-process supervision of online ride-hailing and detailing the supervision process [15]. According to the information provided by China's online ride-hailing regulatory information exchange platform, as of February 2022, the compliance rate of online ride-hailing orders in 12 central cities across the country exceeded 80%, which is a great improvement compared with the past. Improving the compliance rate of ride-hailing is conducive to avoiding operational risks and increasing confidence in continuously increasing investment.

4. Conclusion

With the acceleration of the integration of the Internet industry and traditional industries, the merger of Didi Dache and Kuaidi Dache follows the historical trend. Although for now, Didi Dache and Kuaidi Dache occupy most of the market share, the competition continues and stagnates. If you don't advance, you may be surpassed. The purpose of this article is to analyze Didi’s motivation for acquiring Kuaidi, the market competition pattern before and after the merger, the evolution of industry norms and supervision, and to clarify the competitive advantages and development prospects of the online car-hailing industry. Didi Dache and Kuaidi Dache should also find a more effective profit model to further expand the market and improve resource utilization. In addition, Didi Dache and Kuaidi Dache still have a lot to improve. First of all, strengthen market supervision and improve the laws and regulations of government supervision. The introduction of the "Interim Measures" has made up for the vacancy of online car-hailing haircuts to a certain extent, but there are also imperfections. Secondly, increase the screening of Didi taxis and Kuaidi taxis, conduct strict interviews and written tests on drivers, improve the overall quality of drivers, arrange training on time, improve their service level and service awareness, and form a unique service style. , Finally, formulate an open and transparent mechanism to refine the passenger ride process, determine the vehicle driver, price information, ride time, and driving route before getting on the bus, and give timely feedback and feedback on the driver's service and ride experience after getting off the bus. evaluation, fully protect the rights and interests of consumers, and promote the sustainable development of the online car-hailing market.

References

[1]. ZHENG Yujiao. (2016). Didi Kuaidi's strategic M&A case study. Western Leather (24), 74-7

[2]. Yang Yang (2015). Liu Qing explained the merger negotiation process of Didi and Kuaidi in detail http://www.eeo.com.cn/2015/0214/272595.shtml

[3]. Liu Zhaojun. (2016). Analysis of the merger strategy of Didi Dache and Kuaida. Modern Business(11),125-126.

[4]. Qi Beibei, Wang Hongchang, Qin Huan, Wu Shanshan, Cong Yujia & Yuan Bingbing. (2017). Development Trend of Internet Industry: A Case Study of M&A of Taxi Software Companies. Transportation Enterprise Management (02),33-36

[5]. Yang Fengshan. Research on market structure and government regulation of ride-hailing industry[D]. Guangdong University of Finance and Economics,2018

[6]. Wang Zhiyuan. (2018).Case Study of Didi M&A Kuai (Master's Thesis, Harbin Institute of Technology)

[7]. ZHENG Yujiao. (2016). Didi Kuaidi's strategic M&A case study. Western Leather (24)

[8]. Wise Research (2023) Netmobile Industry Development Trend - China Netmobile Market Status, Forecast 2023 https://www.fxbaogao.com/view?id=3637156&query=%7B%22keywords%22%3A%22 ride-hailing %22%7D&index=0&pid=NetEconomics, China National Finance & Securities Research Institute

[9]. LI Qing. (2011). Easy-to-use car network: online car rental platform. Internet World (06), 60.

[10]. LI Xiaojin. (2018). Research on financial risk management of corporate mergers and acquisitions (Master's thesis, Tianjin University of Finance and Economics).

[11]. Mei Yan & Wang Siyang. (2023). Comparative Analysis of Uber and Didi Chuxing Business Models: From the Perspective of Sharing Economy. Journal of Hangzhou Dianzi University (Social Science Edition) (02),9-16.

[12]. Liu Yuhao. (2019). Research on the local advantages of O2O platform enterprises in China (Master's thesis, Zhejiang University).

[13]. Trust data https://www.fxbaogao.com/dt?keywords=Online car market activity&order=2

[14]. TANG Pei. (2017). On the development prospects of the ride-hailing industry. Smart City (01), 34-35.

[15]. Wang Chao, Si Xianjun & Ge Aike. (2022). New Direction of Financial Leasing Industry in the Era of Sharing Economy: A Case Study of E-hailing Industry. Financial Management Research (11), 40-46.

Cite this article

Li,J. (2023). Competitive Market and Prospect of Online Car-hailing: Taking the Merger of Didi and Kuaidi as an Example. Advances in Economics, Management and Political Sciences,37,140-145.

Data availability

The datasets used and/or analyzed during the current study will be available from the authors upon reasonable request.

Disclaimer/Publisher's Note

The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of EWA Publishing and/or the editor(s). EWA Publishing and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content.

About volume

Volume title: Proceedings of the 7th International Conference on Economic Management and Green Development

© 2024 by the author(s). Licensee EWA Publishing, Oxford, UK. This article is an open access article distributed under the terms and

conditions of the Creative Commons Attribution (CC BY) license. Authors who

publish this series agree to the following terms:

1. Authors retain copyright and grant the series right of first publication with the work simultaneously licensed under a Creative Commons

Attribution License that allows others to share the work with an acknowledgment of the work's authorship and initial publication in this

series.

2. Authors are able to enter into separate, additional contractual arrangements for the non-exclusive distribution of the series's published

version of the work (e.g., post it to an institutional repository or publish it in a book), with an acknowledgment of its initial

publication in this series.

3. Authors are permitted and encouraged to post their work online (e.g., in institutional repositories or on their website) prior to and

during the submission process, as it can lead to productive exchanges, as well as earlier and greater citation of published work (See

Open access policy for details).

References

[1]. ZHENG Yujiao. (2016). Didi Kuaidi's strategic M&A case study. Western Leather (24), 74-7

[2]. Yang Yang (2015). Liu Qing explained the merger negotiation process of Didi and Kuaidi in detail http://www.eeo.com.cn/2015/0214/272595.shtml

[3]. Liu Zhaojun. (2016). Analysis of the merger strategy of Didi Dache and Kuaida. Modern Business(11),125-126.

[4]. Qi Beibei, Wang Hongchang, Qin Huan, Wu Shanshan, Cong Yujia & Yuan Bingbing. (2017). Development Trend of Internet Industry: A Case Study of M&A of Taxi Software Companies. Transportation Enterprise Management (02),33-36

[5]. Yang Fengshan. Research on market structure and government regulation of ride-hailing industry[D]. Guangdong University of Finance and Economics,2018

[6]. Wang Zhiyuan. (2018).Case Study of Didi M&A Kuai (Master's Thesis, Harbin Institute of Technology)

[7]. ZHENG Yujiao. (2016). Didi Kuaidi's strategic M&A case study. Western Leather (24)

[8]. Wise Research (2023) Netmobile Industry Development Trend - China Netmobile Market Status, Forecast 2023 https://www.fxbaogao.com/view?id=3637156&query=%7B%22keywords%22%3A%22 ride-hailing %22%7D&index=0&pid=NetEconomics, China National Finance & Securities Research Institute

[9]. LI Qing. (2011). Easy-to-use car network: online car rental platform. Internet World (06), 60.

[10]. LI Xiaojin. (2018). Research on financial risk management of corporate mergers and acquisitions (Master's thesis, Tianjin University of Finance and Economics).

[11]. Mei Yan & Wang Siyang. (2023). Comparative Analysis of Uber and Didi Chuxing Business Models: From the Perspective of Sharing Economy. Journal of Hangzhou Dianzi University (Social Science Edition) (02),9-16.

[12]. Liu Yuhao. (2019). Research on the local advantages of O2O platform enterprises in China (Master's thesis, Zhejiang University).

[13]. Trust data https://www.fxbaogao.com/dt?keywords=Online car market activity&order=2

[14]. TANG Pei. (2017). On the development prospects of the ride-hailing industry. Smart City (01), 34-35.

[15]. Wang Chao, Si Xianjun & Ge Aike. (2022). New Direction of Financial Leasing Industry in the Era of Sharing Economy: A Case Study of E-hailing Industry. Financial Management Research (11), 40-46.