1. Introduction

The crash of China's stock market in 2015 caused many investors to lose a lot of money. Relevant research reports that the "sentiment effect" was one of the main causes of the crash. In the face of the rapidly rising stock market, investor sentiment has become overly optimistic and confident, prompting more investors to join the stock market, and blind follow-up behavior will soon lead to stock prices breaking through the real value. As the market overheated, problems continued to emerge. The stock price began to fall in June 2015 and has experienced several stops since then. Investor sentiment serves as an important market reference indicator. Lee et al. [1] believe that investor sentiment is a judgment generated by investors based on emotions. Therefore, theoretical and practical ramifications of researching investor sentiment and its effects on the equity markets are so significant.

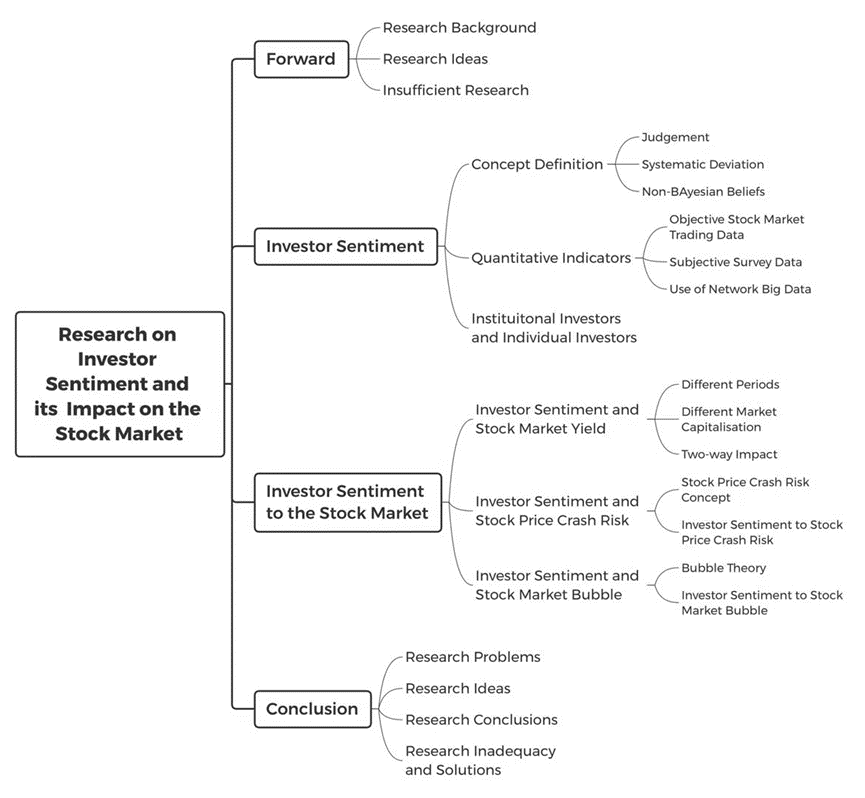

This article focuses on the market for stocks and investor sentiment, and the specific research ideas are shown in Figure 1. Firstly, the concept of investor sentiment is defined and explained, and different definitions are given from different angles. Furthermore, the quantitative methods and indicators of investor sentiment adopted by different scholars are also different, so this article summarizes the measurement methods of investor sentiment. At the same time, since investors' investment behavior is closely related to the equity markets, the precise effects of investor sentiment on stock market, including stock market yield, stock price crash risk, and stock market bubbles, will be examined in this article. According to an empirical study by Zhang and Zeng [2], investor sentiment has an additional apparent short-term influence on stock market profits. Yang and Wang [3] came to the conclusion that small-cap equities are more sensitive to investor sentiment. Shiller et al. [4] found through case studies that stock market crashes have a significant connection to investor sentiment. Li et al. [5] have found empirically that noisy traders with emotions are directly proportional to the components of irrational speculative bubbles.

In addition, this paper points out the shortcomings and problems in the current research field at the end of the article and supplements the research direction and ideas of investor sentiment and the equity markets. The article notes that the existing literature concentrates on how individual investors can be affected investor sentiment, while there is insufficient research on institutional investors. There is less research on the impact of investor sentiment on extreme situations, such as the phenomenon of stock price crashes and the emergence and bursting of bubbles in the stock market, even the two-way influence relationship between investors and investor sentiment needs to be further studied.

Figure 1: Research on investor sentiment and its impact on the stock market.

2. Investor Sentiment

2.1. An Explanation of the Term Investor Sentiment

The traditional "rational man" hypothesis holds that the only goal of rational agents in conducting economic activities is to maximize their own economic interests. Many empirical studies have shown that the large amount of complex information present in the market affects investors' rational judgment, so prices in the capital market can seriously deviate from their fundamental values. The emergence of many stock market anomalies is also the embodiment of emotional and cognitive bias in investor decision-making, that is, "investor sentiment".

So far, the definition of investor sentiment has not been uniform. Some people believe that the process of investors forming investment ideas can be understood as investor sentiment, and there are further arguments in favor of the idea that investor sentiment reflects investors' individual preferences for changes in stock prices. "Investor sentiment" has been characterized by several authors from different points of view. Lee et al. [1] believe that investor sentiment is a judgment that is generated by investors based on emotions and is rooted in a certain bias in investor psychology or cognition. Stein [6] defines investor sentiment in terms of systematic bias in investors' expectations about the future. Baker et al. [7] have pointed out that in most existing definitions, investor sentiment is often considered to be a non-Bayesian belief in returns and risks. At the same time, academics generally agree that the boundaries of investor mood are blurred.

2.2. Quantitative Indicators of Investor Sentiment

Investor sentiment indicates the investment expectations of market participants, and it is of great significance to effectively select quantitative indicators of investor sentiment. A large number of scholars try to carry out the specific quantification of investor sentiment from three aspects: objective stock market transaction data, subjective data investigation, and the use of network big data.

Objective stock market trading data: closed-end fund discount rates, turnover rates, the number of new accounts opened, number of IPOs, income ratios, etc. Through empirical research, a large number of academics have demonstrated the effectiveness of closed-end fund discount rates on the assessment. With a study conducted by Lee et al. [1], it became known that investor sentiment and closed-end fund discount rates were considerably correlated. Studies by scholars such as Long et al. [8], Baker and Wurgler [9] have demonstrated that closed-end fund discounts can represent individual investor sentiment.

When market sentiment is high, individual investors tend to follow the market trend and rush to open an account, so the number of new accounts is also an effective indicator to measure investor sentiment. Such as Lu and Li [10], An and Zhang [11] all choose the number of new account openings to develop investor sentiment indicators and gauge investor sentiment levels.

In addition, using multiple objective indicators at the same time inevitably involves a certain degree of redundancy or variability. Baker and Wurgler [9] pointed out that the analysis of principal components can be used to evaluate investor sentiment by reducing the dimensionality of indicators and detecting common elements. According to Baker's analysis of principal components approach [9], Ma and Sun [12] constructed an index that could better reflect the sentiment of Chinese investors.

Subjective survey data: investor intelligence index, consumer confidence index, friendliness index, long and short index, investor confidence index, etc. Subjective survey data refers to the collection of a large number of investors' ideas about the future economic situation through questionnaire collection or other methods, and finally formed relevant indicators through certain algorithmic transformations. Many scholars, such as Christiansen et al. [13], Lee et al. [14], conducted studies assessing investor sentiment by using the consumer confidence index. Wang et al. [15] analyzed survey data from the Securities Investor Information Index to study how investor sentiment affected the volatility of China's A-share market.

Use network big data: Google index, Baidu index, WeChat index, and other web search indexes, social media news text, etc. With the emergence of a bull or bear market, investors' demand for information about the stock market will also increase, so the number of people searching for keywords related to the stock market on the Internet will also increase, so it is feasible to quantify investor sentiment by searching for indices. Chen et al. [16] selected the Weibo Index and Baidu Index to investigate how investor sentiment affects stock price indicators. Zhou [17] used the Baidu Index to study the cross-market spillover effect of investor sentiment. At the same time, with the help of artificial intelligence or computers, relevant information in social media or websites can be effectively extracted for textual opinion analysis to represent investor sentiment in the existing market. Meng et al. [18] use text mining technology to conduct text analysis and build an investor sentiment index by combining the Baidu index for investor sentiment research.

2.3. Investor Sentiment of Individual Investors and Institutional Investors

There are primarily two kinds of investors in the securities market, institutional investors and individual investors. Most institutional investors are rational or informed traders, while individual investors tend to be noise traders, who are more deeply influenced by investor sentiment. Previous views suggest that investor sentiment creates greater impact on individual investors, who are often irrational and lack effective data analysis representatives, especially in the Chinese capital market. Therefore, the majority of the literature analysis focuses on the perceptions of individual investors.

With the deepening of research, scholars have gradually found that institutional investors can also be affected by investor sentiment and bias, which are used to be believed to affect only individual investors, and sometimes even exacerbate mispricing in the market. Further, the interaction between the emotions of individual investors and institutional investors produces a superposition effect, which will increase the spread and amplification of noise in the market.

Shleifer and Vishny [19] point out that institutional investors are also standard noise traders at some point, and institutional investors can also make various cognitive bias mistakes. Sun and Shi [20] found that "herd behavior" is common in the fund industry, which has a high degree of rationality compared to individual investors and has advantages in information collection, processing, and transmission. Empirical research by Devault et al. [21] shows that investor sentiment affects institutional investors more than individual investors.

3. Investor Sentiment and the Stock Market

There are non-market factors in the securities market that affect asset prices, and changes in investor sentiment will also affect the volatile price changes in the market. There is an important impact on stock market price movements, stock price crash risks, and even the emergence, development, and disappearance of stock market bubbles. For example, investors overreact to both positive and bearish news, and this overreaction exacerbates the volatility of the securities market [22]. In addition, Gregory et al. [23] did research about the correlation between many objective investor sentiment indicators and sentiment measures and discovered that investor emotion and prior market returns have a high degree of correlation.

3.1. Investor Sentiment and Stock Market Yields

Numerous empirical researches have demonstrated that investor sentiment can influence changes in stock market prices, especially changes in stock market returns, but the precise positive or negative effects depend on the characteristics of the stock in question, the specific industry in which the stock is located, and the impact period that was selected.

The Effect of Investor Sentiment on Stock Returns over Period. Most of the articles focus on how investor sentiment affects recent stock market returns or short-term market returns to demonstrate that the equity returns and investor sentiment are strongly associated. As for the connection between long-term stock market earnings and investor sentiment, scholars have mostly concluded that there is a negative correlation or weak correlation. It is widely believed that investor sentiment will create an immediate beneficial influence on stock earnings in near future. However, this effect will gradually diminish in the long run.

According to Baker and Wurgler’s research [24], the effect of investor sentiment on equity price earnings has a lag. Hu et al. [25] found through empirical tests that investor sentiment in China's equity markets can make a significant impact in near future, but the effect will gradually wane over time. Zhang and Zeng [2] have found empirical research that there are short-term speculators in the market, who can capture short-term market trends and make profits. As a result, investor sentiment has a greater short-term influence on equity market earnings than long-term impacts.

Stock Yields of Different Market Capitalizations and the Effect of Investor Sentiment. The analysis discovered that small-cap stock yields are better predicted by investor sentiment. Neal and Wheatley [26] discovered that investor sentiment may forecast size premiums as well as explain the earnings of small-cap stocks. Baker and Wurgler [8] also discovered that the negative association between investor emotion and anticipated returns was more evident for stocks with small-er market capitalizations. Furthermore, Yang and Wang [3] discovered that investor sentiment has more of an effect on small-cap shares than large-cap corporations and that changes in sentiment can be used to forecast the features of small-scale equities such as short-term return inertia and intertemporal income reversal.

The Connection between Stock Yield and Investor Sentiment that Involves the Two-way Influence. Investor sentiment and the equity market affect each other, however, most of the literature already in existence is concerned with researching the one-way implications of investor sentiment on the market. Changes in stock prices will, in turn, further affect investor sentiment. However, at present, there is insufficient attention paid to the research on whether there is a two-way influence relationship between the two. Han [27] believes that investor sentiment is affected by a number of factors, including historical data and national policy. Han [27] concludes that the connection between investor sentiment and the China’s Shanghai Composite Index is not a one-way influence, but a relationship of mutual influence. and investor sentiment was improved by stock market earnings. Increased investor confidence might also increase yields.

3.2. Investor Sentiment and Stock Price Crash Risk

Stock price collapse refers to the phenomenon of a sudden and large decline in the price of a market index or individual stock without any information or warning. Investor sentiment is closely related to stock price crash risk, and investors' sentiment and the state of the stock market directly affect market supply and demand, thereby changing stock prices, and further there is a stock price crash risk. Especially when there is a lot of negative information in society or companies are forced to announce bad news for various reasons, a large amount of pessimism among investors will also promote the emergence of "killing" behavior, further causing the stock price to collapse [28].

Scholars Shiller et al. [4] used the 1987 US stock market crash as a background to find that the stock price crash occurred due to a sudden and sharp change in investor sentiment. Wang and Xu [29] combined stock price crash risk with behavioral financial theory and found that investor sentiment raises the chance of a drop in corporate stock prices. Zhang and Sun [30] conducted empirical research and found that a large number of follow-up reprints of positive news by online media will cause investors to generate excessive optimism, significantly increasing the likelihood of future stock price crashes.

3.3. Investor Sentiment and Stock Market Bubbles

A bubble is an economic phenomenon in which the market prices of financial securities, real estate, etc. rise sharply from their real values due to extremely active speculative trading, resulting in a superficial prosperity. Stock market bubbles are not necessarily caused by investor sentiment, but investor sentiment is a key factor in them, which will promote the emergence and development of bubbles to a certain extent. Under the influence of noise traders, other types of traders, such as rational traders with inside information, can play games and obtain excess profits by using the trading strategies of noise traders, which provides the basis for the emergence of speculative bubbles.

Based on historical facts, the primary cause of the US stock market's high stock price during the "irrational boom" period was due to investors' overall bullish sentiment towards the stock market at that time. Li et al. [5] found empirically that the market's irrational speculative bubble component increases with the amount of chatty, emotional traders present.

Based on this, by grasping the level of investor sentiment, it is helpful to predict the bubble phenomenon in the stock market. Pan’s research [31] shows, when employing the S&P 500 index, investor sentiment has significant consequences on both the likelihood of a bubble in the securities market and the size of the bubble. With the Bi-LSTM model, Yin and Yang [32] discovered that the probability of a stock price bubble's existence and strength increases with investor sentiment. In the age of mobile Internet, investor sentiment from social media can effectively predict stock price bubbles to a certain extent.

4. Conclusion

As behavioral finance continues to advance, the importance of irrational factors of investor sentiment in the financial market is increasing. As a result, this paper first clarifies the definition of the concept of investor sentiment and categorizes its quantitative methods from various perspectives. Learn more concerning the association between investor sentiment and the equity markets, paying particular attention to how it affects stock market yields, stock price crash risk, and stock market bubbles. The definition of investor sentiment is inseparable from the two concepts of "expectation" and "deviation", and investor sentiment can be effectively quantified through objective stock market data, subjective survey data, or data mining using the Internet. More academics are also observing the role investor sentiment plays in the equity markets, and the study indicated that investor sentiment is more predictive for short-term, small-cap stocks. The risk of stock price collapse is strongly associated with investor sentiment and the occurrence of market bubbles, and stock price fluctuations can be effectively controlled by controlling investor sentiment. It is also helpful to control investor sentiment, stock price crash risk or stock market foam in the stock market, and reasonably curb the generation of foam from the source.

The current research focuses more on how investor sentiment affects stock market returns only in one direction, and lacks discussion on whether the two are two-way influences. Whether investor sentiment works with other influencing factors to stock market yields needs to be further refined. At the same time, future research directions should pay more attention to the impact of institutional investors. Experiment could also be made on the application of investor sentiment to financial market forecasting. The theme of this paper, "Investor Sentiment and Stock Market", involves investment, psychology and behavioral finance, which helps to deeply understand market behavior and investor decision-making, and helps guide investors to formulate more scientific and reasonable investment strategies and risk management.

References

[1]. Lee, C., Shleifer, A., Thaler, R.: Investor sentiment and the closed-end fund puzzle. The Journal of Finance 46(1), 75-109(1991).

[2]. Zhang, F., Zeng, Q. D.: Research on the Relationship between Investor Sentiment and Stock Market Income from the Perspective of Margin Trading: An Empirical Test Based on the CSI 300 Index. Price Theory & Practice (6), 123-128(2021).

[3]. Yang, L., Wang, Z.: Review of Investor Sentiment. Financial Theory & Practice (10), 100-104(2016).

[4]. Shiller, R. J., Konya, F., Tsutsui, Y.: Investor Behavior in the October 1987 Stock Market Crash: The Case of Japan. NBER Working Papers, (1988).

[5]. Li, C., Hu, Z. Y., Shi, S. R.: Research on irrational speculative bubble model based on stock market investor sentiment. Finance & Economics Theory & Practice 39(5), 51-57(2018).

[6]. Stein, J. C.: Rational Capital Budgeting in an Irrational World. Scholarly Articles, (1996).

[7]. Baker, M., Wurgler, J., Yu, Y.: Global, local, and contagious investor sentiment - ScienceDirect. Journal of Financial Economics 104(2), 272-287(2012).

[8]. Long, J. D., Shleifer, A., Summers, L. H., et al.: Positive Feedback Investment Strategies and Destabilizing Rational Speculation. Journal of Finance 45(2), 379-0(1990).

[9]. Baker, M., Wurgler, J.: Investor Sentiment and the Cross‐Section of Stock Returns. The Journal of Finance 61(4), (2006)

[10]. Lu, X. F., Li, J. Q.: The correlation between China's stock market index and investor sentiment index. Systems Engineering-Theory & Practice 32(03), 621-629(2012).

[11]. An, J. L., Zhang, L. C.: Investor Sentiment and Stock Returns - A Comparative Study Based on Individual and Institutional Investor Sentiment. Journal of Financial Development Research (8), 19-24(2016).

[12]. Ma, X. K., Sun, J.: Construction of Investor Sentiment Composite Index in China's Stock Market. Journal of Beijing Technology and Business University(Social Science Edition) 27(6), 89-95(2012).

[13]. Christiansen, C., Eriksen, J. N., SV, Møller.: Forecasting US Recessions: The Role of Sentiment. Social Science Electronic Publishing 49(72), 459-468(2014).

[14]. Lee, J., Kim, S., Park, Y. J.: Investor Sentiment and Credit Default Swap Spreads During the Global Financial Crisis. Journal of Futures Markets 37(7), 660-688(2017).

[15]. Wang, D. P., Fan, X. Y., Jia, Y. N., et al.: Investor Sentiment, Overtrading and China's A-share Market Volatility: An Analysis Based on Securities Investor Confidence Index Survey Data. Journal of Management Science25(7), 85-105(2022).

[16]. Chen, Y., Wang, L. X., Zhou, Z. M.: Research on the Impact of Investor Sentiment on Stock Price Index: Using Baidu Index and Weibo Index as Indicators. Price Theory & Practice (9), 56-59(2017).

[17]. Zhou, L.: Cross-market spillover effects of investor sentiment: A study based on online search indices for stock and commodity futures. Financial Theory & Practice (2), 110-118(2023).

[18]. Meng, X. J., Meng, X. L., Hu, Y. Y.: Research on investor sentiment index based on text mining and Baidu index. Macroeconomic Research (1), 144-153(2016).

[19]. Shleifer, A., Vishny, R.: The Limit of Arbitrage. Journal of Finance (52), 35-55(1997).

[20]. Sun, P. Y., Shi, D. H.: Research on herd behavior in Chinese stock market based on CAPM——Discussion with Mr. Song Jun and Mr. Wu Chongfeng. Economic Research Journal (02), 64-70+94(2002).

[21]. Devault, L., Sias, R., Starks, L.: Sentiment Metrics and Investor Demand. Journal of Finance (74), (2019).

[22]. Bondt, W. D., Thaler, R.: Does the Stock Market Overreact?. Journal of Finance 40(3), 793-805(1985).

[23]. Gregory, W., Brown, et al.: Investor sentiment and the near-term stock market. Journal of Empirical Finance, (2004).

[24]. Baker, M., Wurgler, J.: Appearing and disappearing dividends: The link to catering incentives. Journal of Financial Economics 73(2), (2003).

[25]. Hu, Y. T., Wang, L. X., Zhao, Y.: An empirical study on the impact of individual investor sentiment on stock returns——Based on the A-share market. Journal of Panzhihua University 37(06), 64-70(2020).

[26]. Neal, R., Wheatley, S., M.: Do Measures Of Investor Sentiment Predict Returns?. Journal of Financial and Quantitative Analysis 33(04), 523(1998).

[27]. Han, Z. X.: An Empirical Study on Investor Sentiment and China's Securities Market. (2005).

[28]. Shen, B., Chen, X. J.: Equity pledge, investor sentiment and stock price crash risk. Journal of Finance and Economics 430(09), 72-79(2019).

[29]. Wang, D., Xu, F. Q.: M&A goodwill, investor sentiment and corporate stock price crash risk. Friends of Accounting (17), 19-26(2021).

[30]. Zhang, T. J., Sun, Q.: Excessive optimism in online media and the risk of a stock price crash in listed companies. Management Modernization 42(1), 34-39(2022).

[31]. Pan, W. F.: Does investor sentiment drive stock market bubbles? Beware of excessive optimism!. Journal of Behavioral Finance 21(1), 27—41(2020).

[32]. Yin, H. Y., Yang, Q. S.: The influence of stock bar investor sentiment on stock price bubble based on Bi-LSTM model mining. Chinese Journal of Management 19(12), 1874-1885(2022).

Cite this article

Song,Z. (2023). Research on Investor Sentiment and Its Impact on the Market for Stocks. Advances in Economics, Management and Political Sciences,38,121-127.

Data availability

The datasets used and/or analyzed during the current study will be available from the authors upon reasonable request.

Disclaimer/Publisher's Note

The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of EWA Publishing and/or the editor(s). EWA Publishing and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content.

About volume

Volume title: Proceedings of the 7th International Conference on Economic Management and Green Development

© 2024 by the author(s). Licensee EWA Publishing, Oxford, UK. This article is an open access article distributed under the terms and

conditions of the Creative Commons Attribution (CC BY) license. Authors who

publish this series agree to the following terms:

1. Authors retain copyright and grant the series right of first publication with the work simultaneously licensed under a Creative Commons

Attribution License that allows others to share the work with an acknowledgment of the work's authorship and initial publication in this

series.

2. Authors are able to enter into separate, additional contractual arrangements for the non-exclusive distribution of the series's published

version of the work (e.g., post it to an institutional repository or publish it in a book), with an acknowledgment of its initial

publication in this series.

3. Authors are permitted and encouraged to post their work online (e.g., in institutional repositories or on their website) prior to and

during the submission process, as it can lead to productive exchanges, as well as earlier and greater citation of published work (See

Open access policy for details).

References

[1]. Lee, C., Shleifer, A., Thaler, R.: Investor sentiment and the closed-end fund puzzle. The Journal of Finance 46(1), 75-109(1991).

[2]. Zhang, F., Zeng, Q. D.: Research on the Relationship between Investor Sentiment and Stock Market Income from the Perspective of Margin Trading: An Empirical Test Based on the CSI 300 Index. Price Theory & Practice (6), 123-128(2021).

[3]. Yang, L., Wang, Z.: Review of Investor Sentiment. Financial Theory & Practice (10), 100-104(2016).

[4]. Shiller, R. J., Konya, F., Tsutsui, Y.: Investor Behavior in the October 1987 Stock Market Crash: The Case of Japan. NBER Working Papers, (1988).

[5]. Li, C., Hu, Z. Y., Shi, S. R.: Research on irrational speculative bubble model based on stock market investor sentiment. Finance & Economics Theory & Practice 39(5), 51-57(2018).

[6]. Stein, J. C.: Rational Capital Budgeting in an Irrational World. Scholarly Articles, (1996).

[7]. Baker, M., Wurgler, J., Yu, Y.: Global, local, and contagious investor sentiment - ScienceDirect. Journal of Financial Economics 104(2), 272-287(2012).

[8]. Long, J. D., Shleifer, A., Summers, L. H., et al.: Positive Feedback Investment Strategies and Destabilizing Rational Speculation. Journal of Finance 45(2), 379-0(1990).

[9]. Baker, M., Wurgler, J.: Investor Sentiment and the Cross‐Section of Stock Returns. The Journal of Finance 61(4), (2006)

[10]. Lu, X. F., Li, J. Q.: The correlation between China's stock market index and investor sentiment index. Systems Engineering-Theory & Practice 32(03), 621-629(2012).

[11]. An, J. L., Zhang, L. C.: Investor Sentiment and Stock Returns - A Comparative Study Based on Individual and Institutional Investor Sentiment. Journal of Financial Development Research (8), 19-24(2016).

[12]. Ma, X. K., Sun, J.: Construction of Investor Sentiment Composite Index in China's Stock Market. Journal of Beijing Technology and Business University(Social Science Edition) 27(6), 89-95(2012).

[13]. Christiansen, C., Eriksen, J. N., SV, Møller.: Forecasting US Recessions: The Role of Sentiment. Social Science Electronic Publishing 49(72), 459-468(2014).

[14]. Lee, J., Kim, S., Park, Y. J.: Investor Sentiment and Credit Default Swap Spreads During the Global Financial Crisis. Journal of Futures Markets 37(7), 660-688(2017).

[15]. Wang, D. P., Fan, X. Y., Jia, Y. N., et al.: Investor Sentiment, Overtrading and China's A-share Market Volatility: An Analysis Based on Securities Investor Confidence Index Survey Data. Journal of Management Science25(7), 85-105(2022).

[16]. Chen, Y., Wang, L. X., Zhou, Z. M.: Research on the Impact of Investor Sentiment on Stock Price Index: Using Baidu Index and Weibo Index as Indicators. Price Theory & Practice (9), 56-59(2017).

[17]. Zhou, L.: Cross-market spillover effects of investor sentiment: A study based on online search indices for stock and commodity futures. Financial Theory & Practice (2), 110-118(2023).

[18]. Meng, X. J., Meng, X. L., Hu, Y. Y.: Research on investor sentiment index based on text mining and Baidu index. Macroeconomic Research (1), 144-153(2016).

[19]. Shleifer, A., Vishny, R.: The Limit of Arbitrage. Journal of Finance (52), 35-55(1997).

[20]. Sun, P. Y., Shi, D. H.: Research on herd behavior in Chinese stock market based on CAPM——Discussion with Mr. Song Jun and Mr. Wu Chongfeng. Economic Research Journal (02), 64-70+94(2002).

[21]. Devault, L., Sias, R., Starks, L.: Sentiment Metrics and Investor Demand. Journal of Finance (74), (2019).

[22]. Bondt, W. D., Thaler, R.: Does the Stock Market Overreact?. Journal of Finance 40(3), 793-805(1985).

[23]. Gregory, W., Brown, et al.: Investor sentiment and the near-term stock market. Journal of Empirical Finance, (2004).

[24]. Baker, M., Wurgler, J.: Appearing and disappearing dividends: The link to catering incentives. Journal of Financial Economics 73(2), (2003).

[25]. Hu, Y. T., Wang, L. X., Zhao, Y.: An empirical study on the impact of individual investor sentiment on stock returns——Based on the A-share market. Journal of Panzhihua University 37(06), 64-70(2020).

[26]. Neal, R., Wheatley, S., M.: Do Measures Of Investor Sentiment Predict Returns?. Journal of Financial and Quantitative Analysis 33(04), 523(1998).

[27]. Han, Z. X.: An Empirical Study on Investor Sentiment and China's Securities Market. (2005).

[28]. Shen, B., Chen, X. J.: Equity pledge, investor sentiment and stock price crash risk. Journal of Finance and Economics 430(09), 72-79(2019).

[29]. Wang, D., Xu, F. Q.: M&A goodwill, investor sentiment and corporate stock price crash risk. Friends of Accounting (17), 19-26(2021).

[30]. Zhang, T. J., Sun, Q.: Excessive optimism in online media and the risk of a stock price crash in listed companies. Management Modernization 42(1), 34-39(2022).

[31]. Pan, W. F.: Does investor sentiment drive stock market bubbles? Beware of excessive optimism!. Journal of Behavioral Finance 21(1), 27—41(2020).

[32]. Yin, H. Y., Yang, Q. S.: The influence of stock bar investor sentiment on stock price bubble based on Bi-LSTM model mining. Chinese Journal of Management 19(12), 1874-1885(2022).