1. Introduction

1.1. Research Background

Morgan Stanley was originally the investment arm of JP Morgan Chase. In 1933, as the Glass-Steagall Act prohibited companies from offering both commercial and investment banking services, Morgan Stanley stand-alone as an investment bank in New York on September 16, 1935. In response to the rapid expansion of its securities business, Morgan Stanley became a partner of the New York Stock Exchange in 1943. In 1970s, Morgan Stanley added departments of sales and trading, research, investment management, real estate, and private wealth management. In 1984, Morgan Stanley successfully developed TAPS, the first automated transaction processing system, and established its fixed-income division in 1985. Morgan Stanley's global presence has grown since 1990. In 1997, Morgan Stanley and Dean Witter Discover & Co. merged to become the largest securities firm in the world by far. Philip Purcell, from Dean Witte, has been global CEO of Morgan Stanley since July 2001 and led Morgan Stanley's evolution into the world's leading financial services company, providing a one-stop shop for a broad spectrum of financial services. Morgan Stanley established a strategic partnership with Mitsubishi Japan Financial Group as a bank holding company in 2008. In 2013, Morgan Stanley completed the acquisition of Morgan Stanley Wealth Management Joint Venture, fully controlling one of the world's largest wealth management companies,and futher established investment platform and a sustainable investment institution to promote sustainable development. To date, according to Morgan Stanley’s website, Morgan Stanley has office in 41 countries, 82000 employees and more than 24000 members around the world. The employees of the company are dedicated to serving enterprises, government agencies, institutions, and individual investors everywhere.

Etrade was founded in California in 1982 and re-established in Delaware in July 1996. Etrade has been trading U.S. stocks electronically since its inception, is one of the top online brokerages in the United States, The digital platform provides brokerage-related activities, including merchants, institutional investors, individual investors and equity planning managers. Etrade also maintains a business network of financial advisers and commercial representatives. Etrade went public on the NASDAQ Stock Market on August 15, 1996 under the symbol ETC. Etrade plunged into bankruptcy during the 2008 financial crisis due to its exposure to substandard goods. After hedge fund Citadel invested $1.75 billion in the company in 2007, other side Etrade sold its Canadian operations, the bankruptcy crisis was resolved, but it lost more than 90% of its market value [1]. Emerging from the financial crisis, Etrade now has more than 2.6 million customers worldwide and manages more than $1513.1 billion in assets by 2020 [1], making it one of the leading online securities traders in the United States. However, after the economic crisis, the trade platform lacks reputation and the support of giant investment banks, and it lacks the appeal to customers.in the fierce market competition.

On October 2, 2020, Morgan Stanley released an announcement to complete the acquisition of Etrade in an all-stock transaction valued at approximately $13 billion [2]. E*TRADE Stockholders will receive 1.0432 shares of Morgan Stanley for each share, as measured by the closing price of Morgan Stanley's common shares on February 19, 2020, for a consideration per share of $58.74. Morgan Stanley paid a 30 percent premium to the closing price of e-trade shares on Feb. 19 [3], and the expected cost will cover the three-year balance. In the short term after the deal closes, Morgan Stanley's stock price will have a temporary decline by about 10 percent [4], and the value may be diluted after the end of the acquisition. Whether the price was too high and how well it would be run to cover the cost of the acquisition was initially questioned. Longer term, Jonathan Pruzan, Morgan Stanley's chief financial officer and executive vice president, said that the value of franchises and earnings will increase with the increased organic growth opportunities in subsequent operations [4], the estimates of these potential benefits are not shown in the announcement. After the acquisition, Financial Markets Analyst Michael Wong from Morningstar Research Services said trade by all-share was a right choice, as the cash payment would affect Morgan Stanley's capital ratios [5]. The deal was announced at a time when U.S. stock markets were at record highs, and just weeks after it was announced, the bottom line of the nation's biggest banks faces a big challenge.

1.2. Research Purpose and Significance

Morgan Stanley's acquisition of trade was a high-profile merger and acquisition case in 2020. The acquisition brought considerable new business growth for Morgan Stanley, reflected the general trend of retail brokerage and financial management business in 2020, and played a certain leading role in the change of business ecosystem and competitive landscape. The information of the existing literature in this case is relatively fragmented and lacks systematic sorting. This article analyzes this classic acquisition and provides more comprehensive information for finance lovers and finance learners to understand the merger and acquisition process. Based on the above research purposes and significance, this paper mainly answers the three questions of Morgan Stanley's transformation reasons, merger reasons and merger objectives, sorts out the acquisition methods and processes, and analyzes the operation of Morgan Stanley by focusing on these aspects.

1.3. Structure Arrangement

The following sections of this paper are as organized as follow: Section2 summarize the reasons for Morgan Stanley’s business transformation, the operations, and earnings of Morgan Stanley before the acquisition are analyzed. Section3 introduces the purpose of acquisition from three aspects: deepening financial management business, establishing digital bank, and creating synergy effect. Section4 analyzes the settlement method and process of this merger and acquisition, and shows the specific details of the transaction. Section5 shows the subsequent operation of the merger, to reflect the opportunities and challenges.

2. Reasons for Morgan Stanley’s Business Transformation

2.1. Macroeconomic Pressure

As emerging economies stabilize, the United States as an advanced economy slows; Tighter Labour markets have left core inflation at new-cycle highs in advanced economies and low elsewhere. By mid-2019, Morgan Stanley expects growth to slow sharply as fiscal stimulus fades and financial conditions tighten due to higher interest rates. With real interest rates at "neutral," the Fed expects to raise rates only two times in 2019, possibly pausing in the second half of the year and entering wait-and-see mode.

According to Morgan Stanley's 2019 Global Macro Outlook Report [6], corporate credit and trade frictions pose downside risks to the economy. The report sees risks in 2020 mainly from US corporate credit risks, trade tensions, a strong US dollar and policy uncertainties. Us companies face rising unit Labour costs and real interest rates, while trade tensions affect business confidence and capital spending. Since July 2018 the International Monetary Fund (IMF) has warned that trade tensions pose a threat to future global economic growth. In October, the World Economic Outlook Report [7] revised down global growth for 2018-19 to 3.7 percent, 0.2 percentage points lower than the previous forecast. After October, European and American stock markets and international oil prices began to fall sharply, as market investors are concerned about the outlook for the global economy in 2019. In the US and the eurozone, core inflation is forecast to hit new cycle highs in 2019, reaching 2.3 per cent and 1.9 per cent respectively by the fourth quarter of 2020 [8].

According to Morgan Stanley's Global Macro Outlook 2020 [9], global GDP growth will rebound from 2.9% in the fourth quarter of 2019 to 3.4% in the fourth quarter of 2020, and the global economy will grow by 3.5% by 2021, higher than the estimated estimate of 3% in 2019. Growth will mainly come from emerging markets, and the outlook for Europe will also improve. The U.S. economy continues to remain stable, and the growth rate may slow down. If additional tariffs are implemented, Morgan Stanley believes that global growth may slow down further. In addition, with interest rates already low, global central bank officials will be more limited in responding to global shocks than ever before. Therefore, under economic pressure, Morgan Stanley's strategic positioning is biased towards flexibility and defense. Due to the relaxation of the M&A policy in recent years, mergers and acquisitions in the retail brokerage industry are especially facing more favorable policies under economic pressure. The acquisition of Etrade is a feasible decision that Morgan Stanley has been planning for a long time.

2.2. Competitive Landscape of the Industry Before Acquisition

After the outbreak of the global financial crisis in 2008, the United States enacted the Dodd-Frank Act [10], which imposed stricter rules on banks with assets of more than $50 billion. Regulators prohibited the expansion of banks with compliance problems. In 2019, due to the additive effect of the Federal Reserve's continuous interest rate hike and tax reform, the main operating indicators of the American banking industry have exceeded the best level before the crisis. The United States has gradually relaxed the strict regulation on the financial industry, and the industry integration through mergers and acquisitions has become a trend. The value of U.S. financial-services mergers and acquisitions doubled from $82.3 billion in 2017 to $196.5 billion in 2018, according to Ernst & Young. Morgan Stanley's acquisition of Etrade came after Charles Schwab led the way in cutting online trading commissions for stocks, ETFs, and options to zero, forcing rivals to follow suit [11] Under zero commission, the securities industry in the United States has undergone changes, and merger and integration is an effective way to survive. Schwab acquired TD Ameritrade in a $26 billion, all stock deal [12] and other big banks are embarking on a new round of mergers and acquisitions. Under the trend of merger and acquisition integration and competitive pressure in the industry, Morgan Stanley needs to acquire Etrade to expand its business form and transform the industry in order to seek greater revenue growth and more sustainable development. In this paper, Morgan Stanley's earnings before the acquisition transaction will be analyzed in detail in Section 2.3.

2.3. Morgen Stanley’s Operations and Sources of Income Before Acquisition

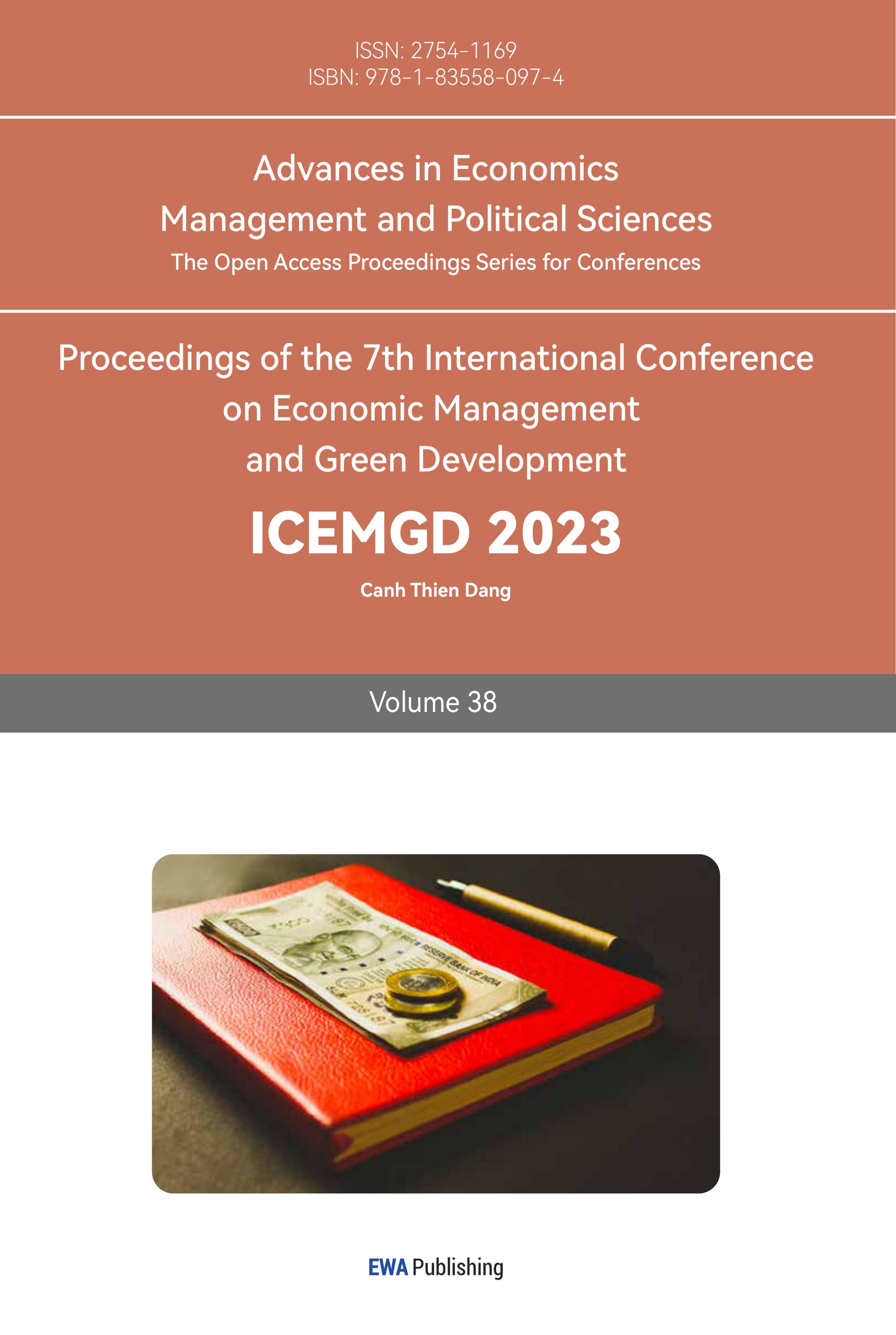

Figure 1 shows the revenue trend of Morgan Stanley from 2015 to 2019. It can be seen that the total revenue of Morgan Stanley in 2019 in the year before its acquisition was 4.138 billion US dollars, a large decline from 0.5019 billion US dollars in 2018, and even lower than 4.364 billion US dollars in 2017, and the total revenue is in the position of historical data. In recent years, the fluctuation of the net profit margin curve has also been relatively flat from the above figure, so it is judged that Morgan Stanley urgently needs new business growth to drive a significant increase in net revenue.

|

Figure 1: Revenue trend from 2015 to 2019. |

Data source: Investing.com |

Photo credit: Original |

The deepening of financial technology, digital transformation and financial management business have been the attempts of Morgan Stanley. After Morgan Stanley acquired Citigroup in 2013, the profit margin of the wealth management business increased from 18.5% to 25.5%. By 2019, the financial management business had grown into the most important. One of the three major businesses. At the same time, the transformation, leadership and integration of financial technology investment and modern information technology have always been the focus of Morgan Stanley's business development. In recent years, according to the company's vision, funds used to construct wealth management platforms represent a large proportion of expenditures. In June 2018, CEO James Gordon said that Morgan Stanley's 2017 budget was $1.3 billion, and the annual investment in technology was about $4 billion, which accounted for about 40% of the budget,10.6% of operating revenue in 2017, and is also a competitor Citi's information technology. About twice the investment. In terms of personnel investment, Morgen Stanley attaches great importance to the personnel input of the wealth management system, and specially sets up Chief Information Officer, Chief Digital Officer, Chief Data and Analysis Officer to manage and check the corresponding financial technology application platforms, and has begun to pay attention to data-driven and digital transformation.

Morgan Stanley has Next Best Action (NBA) as the core platform for wealth management business and investment advisory work. First, the function of the platform is to provide investment advisers or customers with market events and portfolio suggestions or operational warnings through analysis of research reports, customer data and market data, and can think and continuously modify suggestions like investment advisers based on daily new relevant information. On the other hand, the system can find the customer's asset distribution, tax situation and investment preferences in a very short time, build a personalized customer relationship and facilitate efficient communication with customers through electronic channels. The system has the function of issuing different investment advice to thousands of customers at the same time, which significantly improves the efficiency of investment advisory services. The platform also integrates Hassan software, through which customers can realize one information input and can be used many times, simplifying the customer operation process.

Other digital transformations are reflected as follows. Morgan Stanley has been using Hadoop technology to build infrastructure since 2010, which is used to analyze the entire website and database log to find problems. At the same time, it also provides them with scalable, flexible, and powerful solutions to analyze their portfolios to meet their rapidly growing big data needs. In terms of big data application, Morgan Stan is using wire data (a high-value business data source that has been processed) to reorganize the data transmitted in the massive network into structured data in real time to show the status of the entire delivery chain. Help operation and maintenance personnel detect abnormal behaviors, and carry out real-time performance fault location and troubleshooting.

According to the above analysis, the way Morgan Stanley obtains new revenue growth should continue its efforts in the deepening of financial management business and the construction of digital platforms, and look for development opportunities in this direction. The acquisition of Etrade is a good choice to enter the market from the retail brokerage business.

3. Purpose

3.1. Deepen Financial Management Business

Morgan Stanley focused on retail dealers as an opportunity to expand its wealth management footprint. The financial management objectives of the acquisition are to provide comprehensive financial management and considerably increase the degree of the business extension across all channels and wealth management. Through this deal, Morgan Stanley's business will cover all aspects and will be super competitive in financial consulting, workplace, and self-direction. As Morgan Stanley notes in its announcement: The combined wealth management platform will have a combined 8.2 million existing customers, 4.6 million possible additional investors, and customer assets total 3.1 trillion US dollars [13].

3.2. Construction of Digital Bank

The objective is to combine E-trade's direct-to-consumer capabilities and technology with Morgan Stanley's full-service, advisor-driven model to create a digital bank with first- rate products and services that support a full range of wealth management services.

Morgan Stanley has targeted competitive large enterprises and wealthy people since its establishment, E- trade serves younger, moderately affluent people, this group is digital banking services expand. On the other hand, this group of clients will be wealthy enough and financially complex enough in a few decades to become Morgan Stanley's wealth management clients. That will be a sustainable income.

3.3. Synergy

The Financial Times reported that the acquisition would save Morgan Stanley $400 million in operation within three years. In addition, E-trade's $56 billion in low-interest deposits will cut Morgan Stanley's funding costs by $1.50 billion within two years [4]. Morgan can boost its fledgling retail banking business by adding high-yield savings and checking accounts to E*Trade. At the same time, Morgan Stanley merged its $280 billion equity plan with the $300 billion [4] held by the E-trade Equity Edge platform, making it the industry's leading manager of workplace equity plans in the US.

Above all, Morgan Stanley forecasted the combined wealth and investment management business will be expected to contribute 57% of the bank's pre-tax profit, up from 26% in 2016 after the acquisition [4].

4. Prospect

4.1. Integrated Business Chain

The acquisition aims to achieve revenue growth by integrating the business chain and acquiring downstream companies. The acquisition of Etron Wealth Management is an extraordinary opportunity for the growth of the wealth management business and a significant advance in wealth management strategy. Morgan Stanley's financial management business has been through decades of mergers and acquisitions, including its $13.5 billion purchase of SmithBarney in 2009 [14]. Morgan Stanley management decided that simply adding businesses that were already in operation did not require more capital or balance sheet strength, so consolidating the business chain was a good way to go.

Focusing on digital brokerage and banking, Etrade offers a full suite of digital banking services, including direct integration with brokerage accounts, checking and high-yield savings accounts, and is a downstream player in the financial management business. The acquisition brings Etrade's signature a platform for direct communication with customers as a supplement to Morgan Stanley's existing leading consultant-oriented professional ability and greatly accelerated the development of digital banking business.

The consolidation of business chains in the acquisition continues Morgan Stanley's decade-long strategy of overloading its portfolio with light balance sheets by looking to increase the range of services available to a broader client base, rebalancing the firm's business portfolio to emphasize more durable revenue streams. The combined entity will enhance its competitive advantage through advanced technology, innovative products, and financial stability. Online brokerage and digital banking provide comprehensive financial management, giving organizations a comprehensive view of customer assets while enhancing the customer experience, and ensuring that funds remain in the company's ecosystem.

4.2. Transaction Achievement

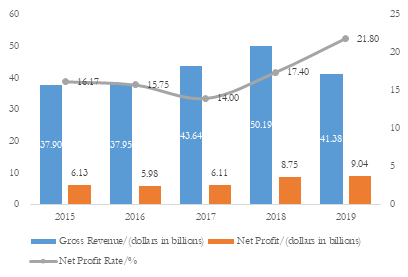

On February 20, 2020, Morgan Stanley announced the acquisition of Etrade. Figure 2 shows the weekly closing price from January to March 2020. The lowest closing price of the month before the acquisition was $52.21, and the highest closing price reached $57.51.

The trend fluctuated steadily around the average stock price of $54.26. After the announcement of the acquisition, the closing price fell to $53.75, or 4.55% on February 20. Since then, the stock price has been on a downward trend. As of March 29, the closing price was 33.86 yuan, and the lowest closing price fell to 29.67 yuan. Because it is a full-stock transaction and Morgan Stanley paid a 30% premium for the price of trade's common stock at the close of trading on February 19. The short decline in Morgan Stanley's stock price was expected. Morgan Stanley’s Chief Financial Officer and Executive Vice President Jonathan Pruzan previously stated that Morgan Stanley will be in the short term after the transaction is completed. The value of Stanley's stock will fall or be diluted by 10%. It is common for the buyer's company to fall in M&A transactions after the announcement of the transaction, so it is not possible to judge whether the acquisition price is too high and whether the transaction is successful by the short-term stock price one month after the transaction. Figure 3 shows the monthly closing price from April 1, 2020 to March 1, 2021.

|

Figure 2: Weekly closing prices, January to March. |

Data source: Investing.com |

Photo credit: Original |

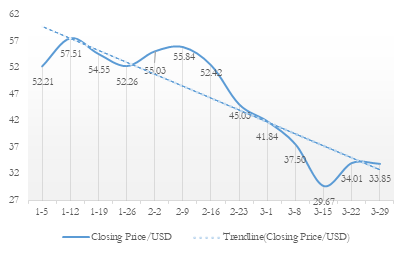

Judging from the trend line, the overall trend is obvious, with the stock price rising from $39.43 to $77.66. It is a qualitative leap compared with the average stock price of $54.26 in the month before the acquisition. One of the important reasons for Morgan Stanley's mergers and acquisitions is the slow growth of earnings, which has been demonstrated in section 2.3 above. In terms of the growth rate of the stock price, the merger and acquisition were successful, resulting in considerable new revenue growth. This growth is also sustainable. During the data collection process of this article in April 2023, the stock price has exceeded $90. This sustainable growth comes from the new considerable revenue generated by the $56 billion of low-cost deposits brought by Etrade as the company's cash flow for investment. It also comes from the cost savings brought by synergies, and the development of the most important financial management business brings significant returns.

|

Figure 3: Closing Price per month from April 2020 to March 2021. |

Data source: Investing.com |

Photo credit: Original |

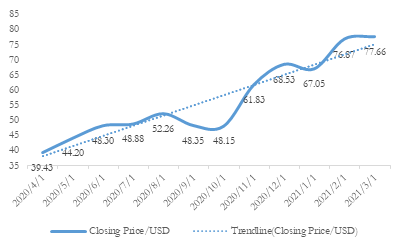

|

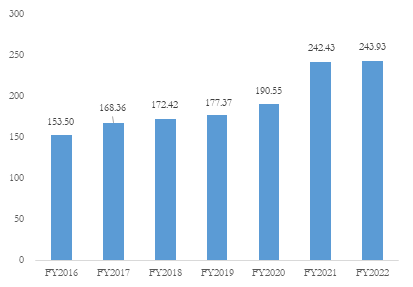

Figure 4: Wealth Management Net Revenues(dollars in billions). |

Data source: Investing.com |

Photo credit: Original |

Figure 4 compares the net income of the wealth management business disclosed in Morgan Stanley's annual report before and after the acquisition. On October 2, 2020, Morgan Stanley announced the closure of the acquisition of Etrade. According to the data, the net income of the wealth management business in 2020 increased by 1.318 billion US dollars. In 2021, with the gradual stabilization of the operation of the digital economy bank created by the merger of Morgan Stanley and Etrade, the wealth management business income can be seen to have covered the cost of the acquisition, net income Yi has created an increase of 5.188 billion US dollars in 2020, exceeding 24 billion US dollars, achieving a qualitative leap. The financial management business, as an important source of revenue for Morgan Stanley since 2013, has been discussed in detail in Chapter 2.3. It can be seen that the acquisition of Etrade is a successful case, which provides new possibilities for the operation mode of wealth management business, expands the customer base, and boosts more sustainable revenue growth and business development, which is in line with the trend of Morgan Stanley's efforts. At the same time, the wealth management business has expanded a new generation of wealthy customers, and these customers have also begun to handle other businesses in Morgan Stanley, driving a significant increase in Morgan Stanley's total revenue.

5. Conclusion

Morgan Stanley was originally the investment department of JPMorgan Chase. It became independent on September 5, 1935 and was established as an investment bank in New York. At present, it has developed into the world's leading financial services company, providing one-stop services for a broad spectrum of financial services. for a broad spectrum of financial services. The business model covers investment banking, securities, asset management, corporate mergers and reorganizations, wealth management business. Founded in California in 1982, Etrade has been trading U.S. stocks electronically since its establishment. It is one of the top online brokerage companies in the United States. It provides traders, investors, stock plan managers and participants through digital platforms and industry-licensed guest service representatives and financial advisor networks. For brokerage and related products and services. Morgan Stanley announced a full-stock acquisition of AOL brokerage company Etrade on February 20, 2020, paying a 30% premium for Morgan Stanley for the deal.

The research content of this article mainly includes: analyzing the reasons for Morgan Stanley's business transformation as a top investment bank by sorting out the annual net income in the first five years of the acquisition, summarizing the acquisition target, and comparing and analyzing the acquisition future of stock prices before and after the acquisition.

The main findings of this article are as follows: Morgan Stanley's acquisition of Etrade continues its efforts to deepen the wealth management business since 2010 and pay attention to building a technology platform to assist the digital transformation of the wealth management business, bringing significant and sustainable growth in the net income of the wealth management business. This acquisition looks at the development opportunity of digital retail brokers and conforms to the trend of industry integration. After the completion of the transaction, the two companies jointly built a digital bank to expand the moderately wealthy group into Morgan Stanley's customer base to achieve personalized service to customers. Through electronic channels, it facilitates customers to handle various services or consult, and significantly improves the efficiency of investment advisory services. The completion of the acquisition has created huge synergies. The most significant is the reduction of operating management costs of $400 million and the reduction of low-cost deposits of 56 billion from Etrade as funds that Morgan Stanley can use for investment, resulting in significant revenue growth. Based on the above conclusions, the merger and acquisition has become a successful case under the correct decision and organic operation afterwards.

The significance of this paper lies in the complete analysis of the beginning and end of the second high-value transaction on Wall Street after the financial crisis from a long-term perspective, providing a reference for financial enthusiasts to understand the case. Through the study of this article, the advice given to investors is that from the perspective of fundamental analysis, Morgan Stanley's profit is growing steadily, and the relevant business needs of investing in its stocks or choosing the investment bank for personal asset management can be considered.

References

[1]. American Hong Kong stock economy AL. (2011). E*Trade-An online brokerage that started out by tranding U.S. stock online. https://m.douban.com/note/189372929/

[2]. Morgan Stanley New York. (2020) Morgan Stanley Closes Acquisition of E*trade. https://www.morganstanley.com/press-releases/morgan-stanley-closes-acquisition-of-e-trade

[3]. Morgan Stanley. (2020). Morgan Stanley is byuying E*TRADE to create a leader in omnichannel wealth management. https://www.morganstanleychina.com/press-releases/200220_press.pdf

[4]. Laura Noonan New York. (2020) Morgan Stanley agrees$13bn deal to buy ETrade. https://www.ft.com/content/600b1100-53df-11ea-8841-482eed0038b1

[5]. M. Jane. (2020). Will Morgan Stanley’s E-trade Move Pay off? The Banker; London,66. https://www.proquest.com/docview/2392198051?parentSessionId=sKxWrg4DI4DCNenYICdXgnbrIGlNRfk0HSWV3wYKyiQ%3D&pq-origsite=primo&accountid=14511

[6]. Morgan Stanley RESEARCH. (2018). 2019 Global Outlook: Turning Point Ahead.https://www.morganstanley.com/ideas/2019-global-macroeconomic-outlook

[7]. IMF. (2019) World Economic Outlook, October 2019 Global Manufacturing Downturn,Rising Trade Barriers. https://www.imf.org/en/Publications/WEO/Issues/2019/10/01/world-economic-outlook-october-2019

[8]. Morgan Stanley New York. (2021) Morgan Stanley announces fourth quarter and full year 2020 results. https://www.morganstanleychina.com/earnings/2020q4-release-zh.pdf

[9]. Morgan Stanley RESEARCH. (2019) 2020 Global Macro Outlook: Calmer Waters Ahead. https://www.morganstanley.com/ideas/global-economic-outlook-2020

[10]. Adam Hayes. (2023) Dodd-Frank Act: What It Does, Major Components,Criticisms. https://www.investopedia.com/terms/d/dodd-frank-financial-regulatory-reform-bill.asp

[11]. Maggie Fitzgerald USA. (2020) Morgan Stanley to buy E-Trade for $13 billion in latest deal for online brokerage industry. https://www.cnbc.com/amp/2020/02/20/morgan-stanley-reportedly-to-buy-e-trade-for-13-billion.html

[12]. Thomas Health, Rachel Siegel. The Washington Post. (2019). Charles Schwab will acquire TD Ameritrade, creating wealth management Goliath with $5 trillion in assets. https://go.gale.com/ps/i.do?id=GALE%7CA606705858&sid=googleScholar&v=2.1&it=r&linkaccess=abs&issn=01908286&p=AONE&sw=w&userGroupName=anon%7E93240256&aty=open+web+entry

[13]. Morgan Stanley. (2020) Morgan Stanley to Acquire E-TRADE, Creating a Leader in all Major Wealth Management Channels. https://www.morganstanley.com/press-releases/morgan-stanley-to-acquire-e-trade

[14]. Morgan Stanley US. (2012) Morgan Stanley Smith Barney is Now Morgan Stanley Wealth Management. https://www.morganstanley.com/press-releases/morgan-stanley-smith-barney-is-now-morgan-stanley-wealth-management_7a78aa1d-036a-4fbf-9df7-1e73387a1c8a

Cite this article

Yang,D. (2023). Morgen Stanley’s Acquisition of Etrade: Reasons, Purposes and Prospect. Advances in Economics, Management and Political Sciences,38,215-224.

Data availability

The datasets used and/or analyzed during the current study will be available from the authors upon reasonable request.

Disclaimer/Publisher's Note

The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of EWA Publishing and/or the editor(s). EWA Publishing and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content.

About volume

Volume title: Proceedings of the 7th International Conference on Economic Management and Green Development

© 2024 by the author(s). Licensee EWA Publishing, Oxford, UK. This article is an open access article distributed under the terms and

conditions of the Creative Commons Attribution (CC BY) license. Authors who

publish this series agree to the following terms:

1. Authors retain copyright and grant the series right of first publication with the work simultaneously licensed under a Creative Commons

Attribution License that allows others to share the work with an acknowledgment of the work's authorship and initial publication in this

series.

2. Authors are able to enter into separate, additional contractual arrangements for the non-exclusive distribution of the series's published

version of the work (e.g., post it to an institutional repository or publish it in a book), with an acknowledgment of its initial

publication in this series.

3. Authors are permitted and encouraged to post their work online (e.g., in institutional repositories or on their website) prior to and

during the submission process, as it can lead to productive exchanges, as well as earlier and greater citation of published work (See

Open access policy for details).

References

[1]. American Hong Kong stock economy AL. (2011). E*Trade-An online brokerage that started out by tranding U.S. stock online. https://m.douban.com/note/189372929/

[2]. Morgan Stanley New York. (2020) Morgan Stanley Closes Acquisition of E*trade. https://www.morganstanley.com/press-releases/morgan-stanley-closes-acquisition-of-e-trade

[3]. Morgan Stanley. (2020). Morgan Stanley is byuying E*TRADE to create a leader in omnichannel wealth management. https://www.morganstanleychina.com/press-releases/200220_press.pdf

[4]. Laura Noonan New York. (2020) Morgan Stanley agrees$13bn deal to buy ETrade. https://www.ft.com/content/600b1100-53df-11ea-8841-482eed0038b1

[5]. M. Jane. (2020). Will Morgan Stanley’s E-trade Move Pay off? The Banker; London,66. https://www.proquest.com/docview/2392198051?parentSessionId=sKxWrg4DI4DCNenYICdXgnbrIGlNRfk0HSWV3wYKyiQ%3D&pq-origsite=primo&accountid=14511

[6]. Morgan Stanley RESEARCH. (2018). 2019 Global Outlook: Turning Point Ahead.https://www.morganstanley.com/ideas/2019-global-macroeconomic-outlook

[7]. IMF. (2019) World Economic Outlook, October 2019 Global Manufacturing Downturn,Rising Trade Barriers. https://www.imf.org/en/Publications/WEO/Issues/2019/10/01/world-economic-outlook-october-2019

[8]. Morgan Stanley New York. (2021) Morgan Stanley announces fourth quarter and full year 2020 results. https://www.morganstanleychina.com/earnings/2020q4-release-zh.pdf

[9]. Morgan Stanley RESEARCH. (2019) 2020 Global Macro Outlook: Calmer Waters Ahead. https://www.morganstanley.com/ideas/global-economic-outlook-2020

[10]. Adam Hayes. (2023) Dodd-Frank Act: What It Does, Major Components,Criticisms. https://www.investopedia.com/terms/d/dodd-frank-financial-regulatory-reform-bill.asp

[11]. Maggie Fitzgerald USA. (2020) Morgan Stanley to buy E-Trade for $13 billion in latest deal for online brokerage industry. https://www.cnbc.com/amp/2020/02/20/morgan-stanley-reportedly-to-buy-e-trade-for-13-billion.html

[12]. Thomas Health, Rachel Siegel. The Washington Post. (2019). Charles Schwab will acquire TD Ameritrade, creating wealth management Goliath with $5 trillion in assets. https://go.gale.com/ps/i.do?id=GALE%7CA606705858&sid=googleScholar&v=2.1&it=r&linkaccess=abs&issn=01908286&p=AONE&sw=w&userGroupName=anon%7E93240256&aty=open+web+entry

[13]. Morgan Stanley. (2020) Morgan Stanley to Acquire E-TRADE, Creating a Leader in all Major Wealth Management Channels. https://www.morganstanley.com/press-releases/morgan-stanley-to-acquire-e-trade

[14]. Morgan Stanley US. (2012) Morgan Stanley Smith Barney is Now Morgan Stanley Wealth Management. https://www.morganstanley.com/press-releases/morgan-stanley-smith-barney-is-now-morgan-stanley-wealth-management_7a78aa1d-036a-4fbf-9df7-1e73387a1c8a