1. Introduction

With the rapid development of China's economy, small and medium-sized enterprises occupy an indispensable position in China's economy because they account for over 50% of GDP and provide 79.4% percent of employment, which shows how important SMEs are to the Chinese economy. Thus, in China's economic development, small and medium-sized enterprises are the backbone of the economy. Their existence is essential. However, the overall development of Chinese SMEs has been bumpy and full of problems, such as non-standard management, unclear business model, resource supply cannot keep up, and complex financing. Among them, financing is the most critical issue.

SMEs, different from large enterprises, lack good channels to raise funds and are not qualified for bank loans. Limited financing limits SMEs' development and accelerates many SMEs' disappearance. The average life of Chinese SMEs is only four years, while the average life of American SMEs is about seven years [1].

When exploring financing channels, we find that shadow banking provides SMEs financing. As the name implies, shadow banking is a financial intermediary outside traditional commercial banks, which needs more supervision by the government. However, in analyzing how shadow banking acts as an intermediary, it expands the financing channels and scale of SMEs; also positively impacts large enterprises and individuals, and accelerates the flow of money.

We also focus on the interest rates of shadow banks. The interest rate of shadow banking is more market-oriented. It is determined by supply and demand and influenced by individual qualifications and the type of loan. However, since most companies that borrow from shadow banks are small companies with poor credit qualifications, they cannot borrow from traditional commercial banks but turn to shadow banks. Hence, the interest rate of loans from shadow banks is generally higher. But because shadow banks tend to operate outside the regulatory system, risks are often exposed.

2. Small-and-Medium Enterprises and Their Status in China

2.1. Definition of Small-and-Medium Enterprises

Small-and-medium enterprises (sometimes called small-and-medium-sized enterprises), or SMEs, are businesses whose number of workers, operational revenue, or net asset value are small compared to leading corporations in the economy or industry. The standards of SMEs are defined by respective governments considering the industry's degree of development and scale of capital. In this paper, we will follow the classification standards set by China in 2011, shown in the table below. SMEs can be divided into medium-, small- and micro-enterprises.

Table 1: SME classification standards put forward by the Chinese government [2].

Industry | SME Classification Standard |

Farming/Husbandry | Operation Revenue < ¥200MM |

Industrial production | Employees < 1000 or Operation Revenue < ¥400MM |

Construction | Operation Revenue < ¥800MM or Net Asset <¥800MM |

Wholesale | Employees < 200 or Operation Revenue < ¥400MM |

Retailing | Employees < 300 or Operation Revenue < ¥200MM |

Transportation | Employees < 1000 or Operation Revenue < ¥300MM |

Warehousing | Employees < 200 or Operation Revenue < ¥300MM |

Post Services | Employees < 1000 or Operation Revenue < ¥300MM |

Hotels | Employees < 300 or Operation Revenue < ¥100MM |

Catering | Employees < 300 or Operation Revenue < ¥100MM |

Information Transfer | Employees < 2000 or Operation Revenue < ¥1000MM |

InfoTech and Software | Employees < 300 or Operation Revenue < ¥100MM |

Estate Development | Operation Revenue < ¥2000MM or Net Asset <¥100MM |

Property Management | Employees < 1000 or Operation Revenue < ¥50MM |

Leasing/Business Services | Employees < 300 or Net Asset < ¥1200MM |

Others | Employees < 300 |

2.2. Roles of SMEs in China's Economy

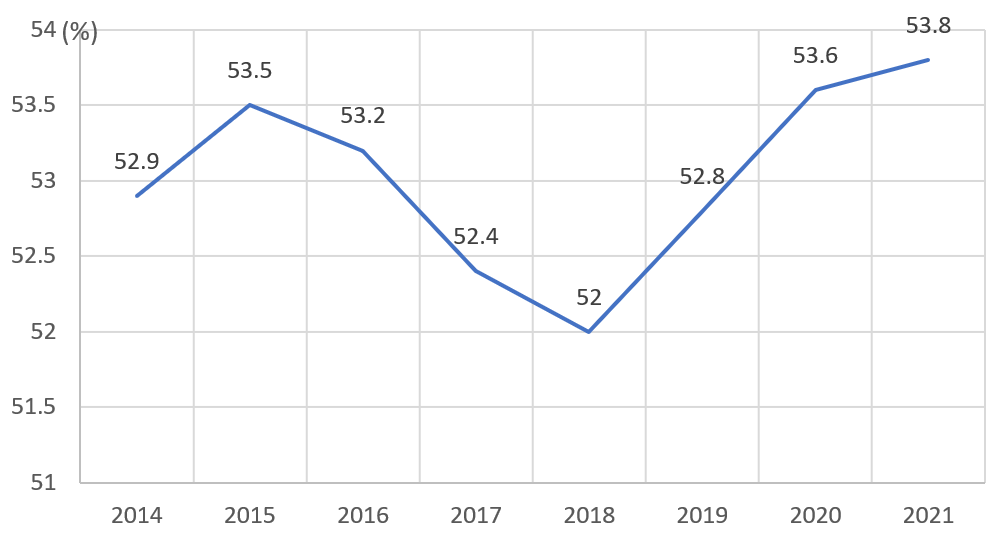

Over the last decade, SMEs have played a crucial role in China's economy. The following graph, which takes on different years on its x-axis and the proportion of SMEs' GDP in China's total GDP, shows that SMEs' contribution to China's real GDP has been slightly above 50% since 2014 (data before 2014 was unpublished) [3]. Though the proportion fluctuates quite insignificantly, it does seem to change in unison with China's economic cycle: proportions were high in economic spurring in 2015 and 2021 and low in 2018 due to policies and initial shocks of the China-US trade war. The correlation between macro surges and SMEs' well-being will be discussed in 1.3.

Figure 1: SME's contribution to China's GDP.

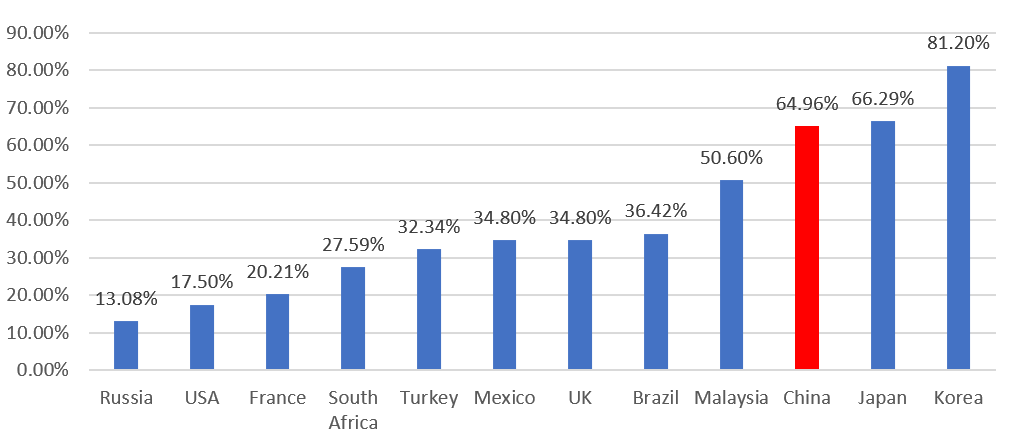

SMEs’ importance to the Chinese economy is also evident in its scale of debt: the proportion of SME debt to debt owed by all enterprises is 64.96%, far higher than the world median of 40.41%.

Figure 2: Proportion of SME debt to total enterprise debt [4].

SMEs also provided job opportunities for 233 million workers, constituting 79.4% of all enterprise-employed personnel [5]. The total asset and annual operation proceeds comprised 77.1% and 68.2% of all enterprises, respectively [6]. The high contribution of SMEs to China's economy makes their well-being essential to China's economic prosperity. This trend is likely to continue, as the number of micro-enterprises (the smallest sub-category of SMEs in terms of size) rose by 151.1% from 2013 to 2018, indicating rapid entry of new SMEs into the market.

2.3. SMEs’ Financing Means and Development

Due to their limited sizes, most SMEs require significant funding from various sources. In 2020, a total of ¥43.2 Trillion flowed into SME financing. Despite the considerable budget, the loan satisfaction rate (amount of loans received/amount of desired loan) among all SMEs is only 48.5%, leaving over ¥50 Trillion in loan demand yet to be satisfied by the end of 2021. In addition, for micro-enterprises, the loan satisfaction rate is only 31.7%.

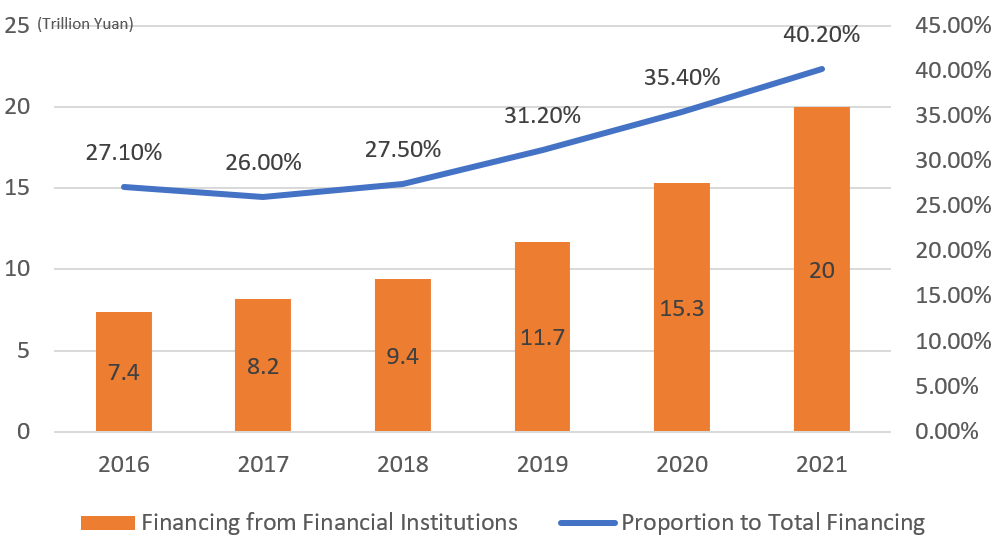

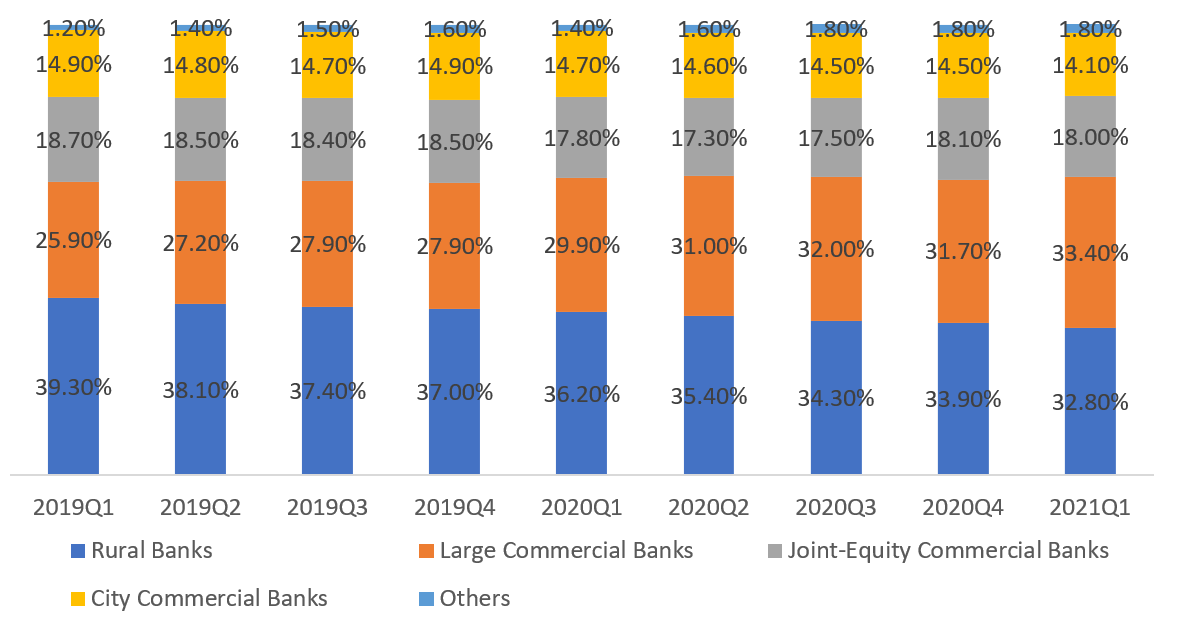

As with large enterprises, SME financing sources can be roughly divided into four categories: bank credit loans, non-standard assets (Non-standard assets include trust loans, entrusted loans, letters of credits, acceptance bills, receivables, equity financing with repurchase clauses, etc.), bond financing and equity financing. The primary source of SME financing is bank loans granted by rural banks, large-scale commercial banks, joint-equity commercial banks, municipal commercial banks, and other institutions. All financing institutions combined make up 40% of SME financing, and this ratio is expected to rise to 55% by 2025.

Figure 3: Financial institutions’ contribution to SME financing [5].

As shown in the graph above, rural and large commercial banks within these institutions contributed roughly 65%-70% of all SME funding. The contribution of rural banks has decreased recently, and that of large commercial banks increased. This can be attributed to large banks' lower interest rate: the average interest rate of five central commercial banks (Five major banks refer to the five largest state-owned banks, including Industrial and Commercial Bank of China, China Construction Bank, Bank of Communication, Agricultural Bank of China and the Bank of China) to SMEs is 4.7%, which is 0.54% lower than the average loan rate to SMEs. Thanks to their widespread nature and focus on local SMEs, rural banks remain a high contributor to SMEs.

Figure 4: Composition of SME financing by respective financial institutions.

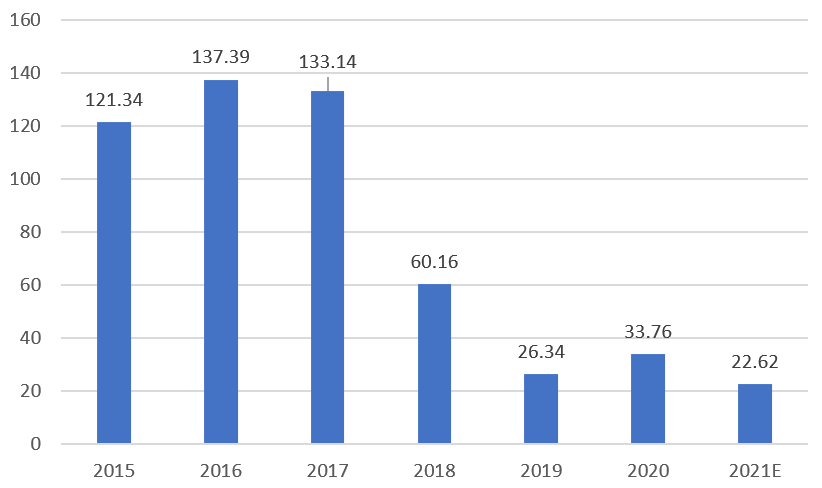

Besides thrift institutions, bond, and equity financing is crucial for medium-sized enterprises. However, both methods appear to have decreasing contribution to SMEs. In 2021, enterprises included on NEEQ (NEEQ (National Equities Exchange and Quotations) is a platform for the trading of stocks of unlisted enterprises, which primarily consists of SMEs.) financed ¥28.1 Billion through equity [9], a 17.11% year-on-year decrease [10]. The number of bonds issued by NEEQ enterprises also remained low since 2018 compared to 2015 standards—the reduced proportion of bond and equity financing results in decreased liquidity of SME assets.

Figure 5: Bond financing received by NEEQ enterprises (unit: billion yuan).

2.4. Predicaments of SMEs

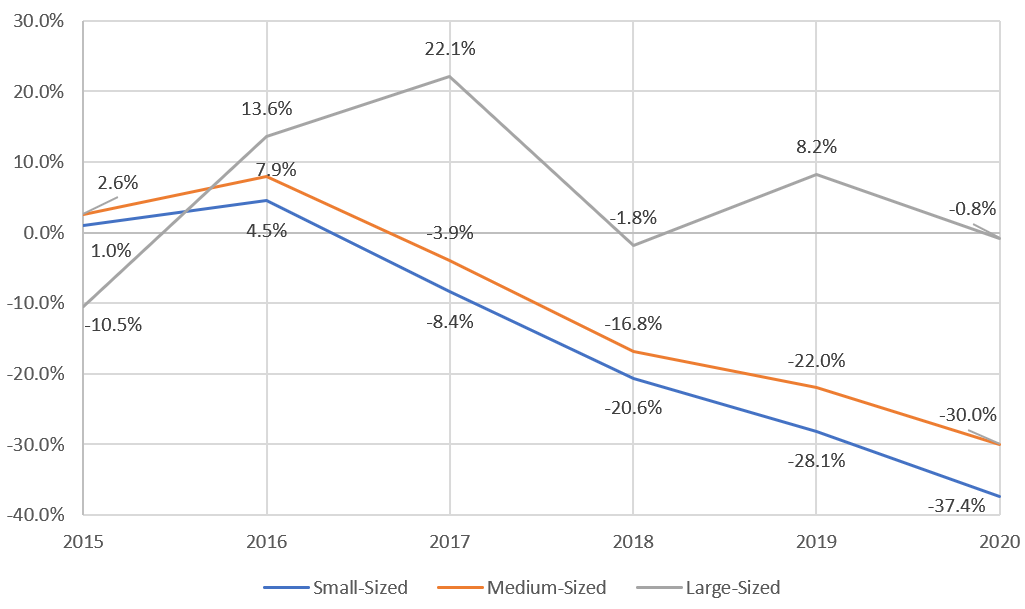

Despite their continuous growth, SMEs' growth has been heavily limited by macroeconomic shocks such as COVID-19 in recent years. The CAPM beta of SMEs is 0.927 (CAPM, or capital asset pricing model, which is a model that attempts to estimate the market equilibrium price of a capital asset. The CAPM beta coefficient measures the responsiveness of the capital asset's worth to the market's fluctuations. In this essay, the collective price of SMEs is indicated by SME 300 Index (399008. SH). The macro market is represented by China Securities Index 1000, and the risk-free rate of return is measured by money market funds ETF (511620. SH).), which is higher than that of consumption (0.667), catering (0.663), and most industries considered to be highly affected by the business cycle. Continuous COVID-19 policies and shocks since 2020 and the Russia-Ukraine war have worsened SMEs' operation status over the past few years.

Figure 6: Year-on-year profit increase for enterprises of different sizes.

More importantly, SMEs lack economies of scale and bargaining power with upstream and downstream corporations [11]. The small sizes of SMEs make them disadvantageous in negotiating deals. As large corporations pay SMEs primarily through acceptance bills with terms ranging from 3 months to 1 year, SMEs often need more time to collect their earnings for reinvestment. Moreover, their debt-to-asset ratios are typically significantly higher than more giant corporations (44.3% of small- and micro-enterprises have debt-to-asset ratios over 40%, while that for medium- and large enterprises is 32.9%) [12], banks have low incentives to lend to SMEs due to risk control, limiting the financing means of SMEs. When they face the payments of fixed costs or raw material purchases, the difference in their assets' and liabilities' duration exerts financial pressure on the business.

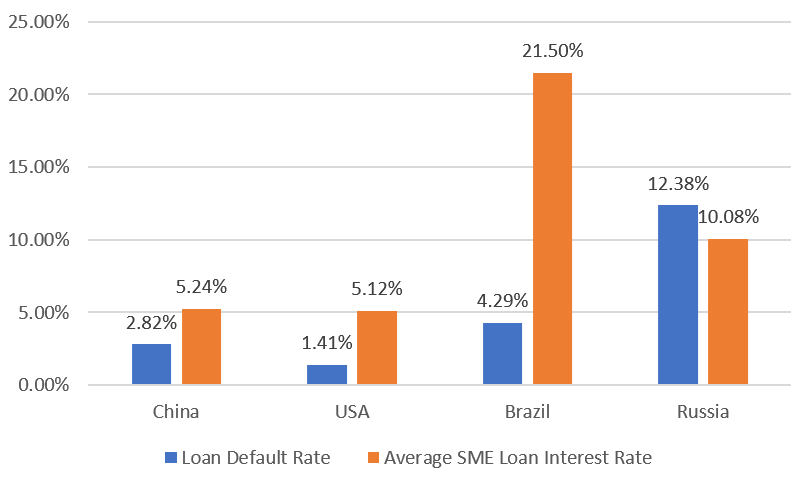

Moreover, their debt-to-asset ratios are typically significantly higher than more giant corporations (44.3% of small- and micro-enterprises have debt-to-asset ratios over 40%, while that of medium- and large-enterprises is 32.9%), banks have low incentives to lend to SMEs due to risk control, limiting the financing means of SMEs. The lack of public information about SMEs' financial situation also increases banks' costs to measure their risk, further lowering banks' willingness to lend to SMEs. Furthermore, Chinese banks' average returns on SME loans are far lower than other nations. The average interest rate of SME loans in China is roughly equal to that of the USA, but the default rate in China is twice that in the USA. Other developing countries have higher default rates but significantly higher returns, as shown in the following graph. The gap in returns also demotivates banks to lend to SMEs.

Figure 7: Loan default rate and interest rate in different countries [13].

Lack of government support and various legislation of related sectors have also added pressure to SMEs' survivorship. Government SME aid in different provinces appeared to be positively correlated with their local development -- prosperous coastal areas like Shandong, Zhejiang, and Jiangsu legislated most SME-related policies. In contrast, poorer sections in Northwestern China received almost none. This regional discrepancy significantly suppressed the development potential and competitiveness of SMEs located in poorer provinces. In addition, the central government's abrupt environmental protection schemes and requirements significantly raised production costs, and many SMEs could not combat the decreasing profit. Deleveraging policies (Deleveraging policies in China started in 2018 to lower firms' financial leverage, that is, the ratio of a firm's debts to its assets. Related policies, combined with investors' fear of the US-China trade war, resulted in a 25%-35% decline in all major Chinese stock indexes in 2018) since 2018 has created massive financing and expansion difficulties for SMEs. Lastly, shadow banks, SMEs' primary source of external funding, received more legislation attention and were increasingly tightly regulated, thus limiting SMEs' ability to acquire new loans. The symbiosis between SMEs and shadow banks will be discussed in detail in the subsequent sections of this paper.

Lastly, SMEs' small market value limits their ability to invest in research projects, their primary advantage over large corporations. While SMEs filed 2.3 million patents in 2020, constituting 68.4% of all new patents that year, their research devotion (capital devoted to research/total revenue) is still less than 7%, significantly less than the 15% benchmark of large enterprises. The inability to contribute much income to development makes SMEs less competitive than blue-chip corporations, thus facing more survivorship pressure.

2.5. Survivorship and Bankruptcy Rate of SMEs

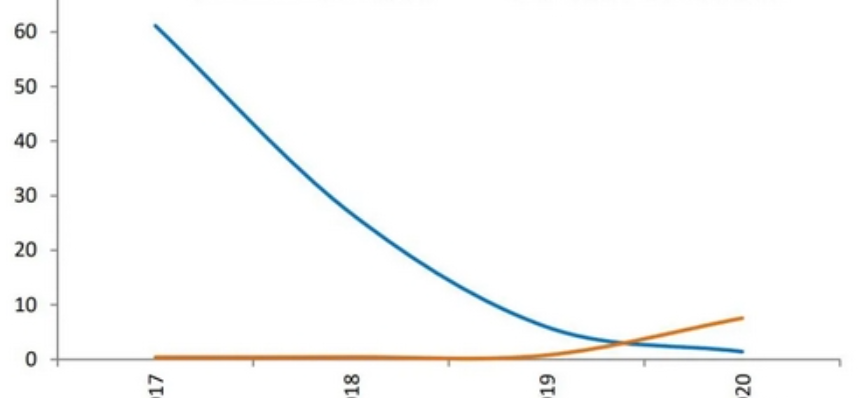

A key statistic to measure the well-being of SMEs is the registration-dissolve ratio, calculated by dividing the number of newly registered SMEs by the number of SMEs written off. As indicated by the following graph, during the prosperous 2017, the registration-dissolve ratio was as high as 60. The ratio quickly fell 2018 due to deleveraging and the China-US trade war. By 2020, as COVID-19 exposed SMEs' inability to bear significant risk, the percentage had dropped to 1.41. It is below 1 for SMEs operating in the tertiary industry (the Chinese government classified businesses into three sectors: the primary sector referring to agricultural and natural resource-related industries, the secondary sector including industrial production, and the tertiary sector containing services and high-tech businesses). On the other hand, this ratio increased in 2020 for non-SMEs (shown in the orange line) to 7.56 as the stability of larger firms gathered more financing.

Figure 8: The registration-dissolve ratio of SMEs, 2017-2020.

The average lifespan of SMEs is only four years, which is 2.5 years shorter than that of large businesses. Moreover, roughly half of all SMEs cannot survive over three years, indicating the extremely high risks of investing in SMEs and why their registration-dissolve ratio has fallen significantly. Such high risks of bankruptcy made SMEs less appealing to elite workers, causing the employee turnover rate among SMEs to be roughly 28%, much higher than the 10-15% average turnover rate.

3. SMEs Financing and Shadow Banking

3.1. Shadow Banking

3.1.1. Definition

According to Paull McCulley, executive director of Pacific Investment Management Co., shadow banking is defined as

1. a bank-like credit intermediary, investment vehicle, or institution

2. that is outside the financial regulatory system and

3. attracts short-term funds.

In the recent ten years, with the development of the Chinese economy and in-depth study of shadow banking, the definition of shadow banking is gradually perfected, but somewhat different from that of foreign countries because of the difference in start time and development. By comparing previous studies, shadow banking can be roughly defined as an institution that has the function of expanding social financing channels (for borrowers) and social fund investment channels(for investors) but is subject to less supervision (compared with banks and other institutions).

3.1.2. Features and Trends

Shadow banking rarely discloses information publicly. Meanwhile, its liability mode is asset securitization rather than a deposit, which increases the expansion of financial uncertainty and leads to regulatory arbitrage (Institutions reduce regulatory capital requirements through financial transactions without reducing the size and overall risk of their business, provided that they don’t violate regulations). This issue will be discussed in detail in the following framework. Secondly, the high leverage ratio of shadow banking also undoubtedly increases its risk. But shadow banking is an essential part of China's economic system. An international rating agency shows that in the first half of 2021, broad shadow banking assets, which include bank financial products, small loan companies, private lending, financial leasing, etc., are about 57.8 trillion yuan, accounting for 52.9% of nominal GDP. However, this figure is reduced compared with previous years, and this proportion is a constant concern of regulators to mitigate the risks of shadow banking [14].

In addition, according to the bank-enterprise scale matching theory (The financing of small banks and small and medium-sized enterprises is better matched, while the funding of large banks and large enterprises is better compared), the financing demand of SMEs matches the financing supply of small and medium financial institutions, and small and medium shadow banking has advantages such as simple procedures, various types of business and easy loan conditions, which can provide SMEs with matching funds. However, small and medium-sized shadow institutions are also faced with financing difficulties. So, although it can play a positive role in financing small and medium-sized enterprises, the part is limited.

3.2. Structure (Lender-Borrower-Investor)

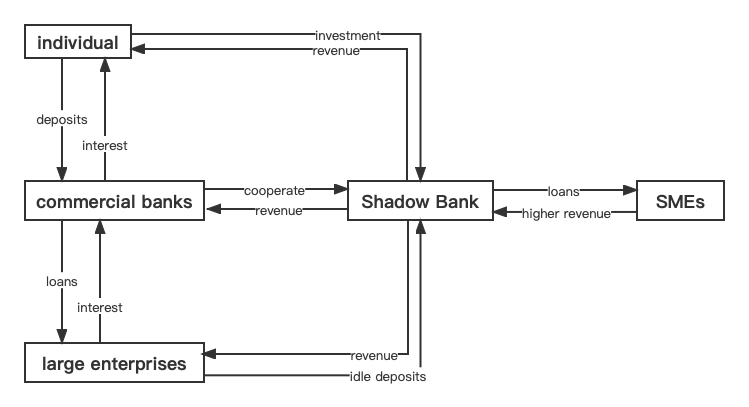

Based on the above analysis of the definition of shadow banking, it is easy to conclude that China's shadow banking is a financial intermediary, a credit intermediary between commercial banks, enterprises, and individuals.

There are three main ways for shadow banks to obtain funds and provide them to SMEs.

1. Commercial banks cooperate with shadow banks and always own them, such as launching off-balance sheet wealth management products (Yields are relatively high. Most of them won't be reported on the balance sheet) (effects of bank-trust cooperation). At the same time, it invests the absorbed funds in trust companies, which obtain funds through some projects and lend to small and medium-sized enterprises [15].

2. Shadow banking can obtain funds through large enterprises. But The law forbids businesses from lending to each other, while entrusted loans made by banks as intermediaries are not restricted by law. Large enterprises will invest part of their idle deposits in some trust projects or projects with the nature of shadow banking, such as small loan companies, to meet their own business needs. They can make considerable profits in the short term and then get loans from shadow banks.

3. funds can also be obtained from individual residents in the above two essential ways. With the continuous improvement of the financial structure and the progress of individual residents' financial awareness, people turn to convenient and flexible private lending for investment to obtain higher investment returns when traditional savings deposits even fail to beat inflation. The money from the private lending system flows into the shadow banking system and is finally lent to SMEs.

The above three forms of shadow banking play the role of credit intermediary. The following figure 5 also describes the capital flow between them in detail. It facilitates the flow of money and increases the efficiency and scale of social financing.

Figure 9: Structure.

3.3. The Interest Rate Offered by Shadow Banking (Borrowing Cost)

The interest rate shadow banks provide to borrowers can be divided into two levels. On the one hand, the interest rate is determined by the supply and demand relationship between market currency and the country's monetary policy. On the other hand, the interest rate is also determined by the borrower's qualifications and the loan type.

From the macroscopic aspects, when the country adopts a tight monetary policy, the funds of commercial banks are insufficient to meet the capital demand of enterprises, the money supply in the market is less than the demand, and the interest rate will rise. On the contrary, when the country adopts an expansionary monetary policy, the bank has sufficient funds, and the money supply in the market is greater than the demand, the interest rate will fall. For shadow banking with a high degree of interest rate liberalization, shadow banking is hardly subject to the supervision of monetary authorities, and both parties usually decide its interest rate. It has certain freedom of interest rate, but its interest rate will also follow the above conclusion. In other words, the interest rate of shadow banking is determined by the national monetary policy.

From the microscopic aspects, The first is personal qualification; different companies apply for the same kind of loan, the loan interest rate will be different, and the bank will determine the interest rate according to the borrower's credit and repayment ability. In short, more qualified users will get lower interest rates. The qualification of small and medium-sized enterprises is poor, leading to small and medium-sized enterprises borrowing from commercial banks, and the interest rate is higher than that of some large enterprises. In addition, the timing and size of the loan also affect the interest rate.

3.4. Banks SME Financing

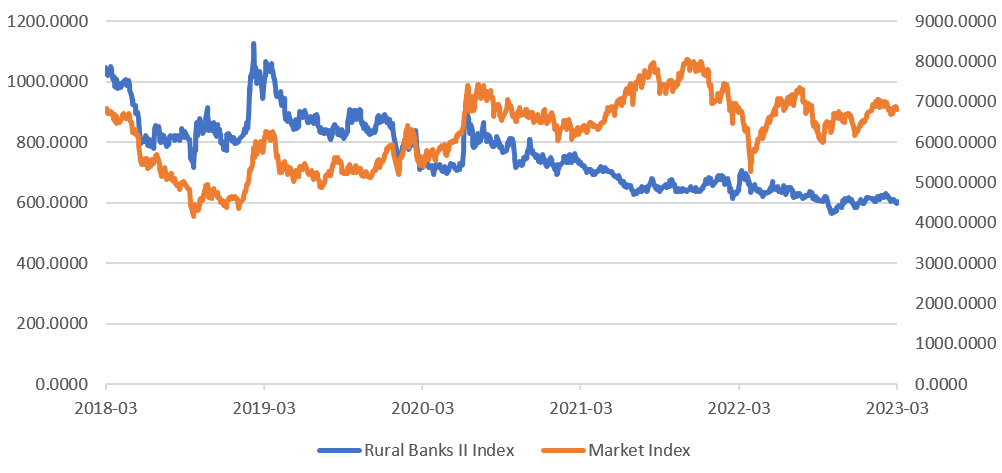

As mentioned in 2.3, large commercial and rural banks comprise 70% of SME financing. While large banks contribute higher proportions, SME financing is only a minor business segment of such banks. On the other hand, rural banks devote a large section of their businesses to SME financing, primarily supporting their nascent local enterprises. Thus, the well-being of rural banks provides a general picture of the condition of SMEs. According to SWHY Securities' Firm Classification, ten rural central banks are listed on China's stock market. Their performances are collectively measured by the "Rural Bank II Index" (Rural Banks II Index (801785.SI) includes all ten banks in the "Rural Banks II" sub-category under the "Banks" primary category. The index is free-floating-value-weighted. Other renowned securities (ChangJiang Securities and CITICS) have also constructed similar rural bank indices, including the same 10 banks using different weighting methods). The performance of the index over the past five years is shown below.

Figure 10: The trend of rural banks index and market index.

Rural banks’ performance and the market index moved in unison before 2020. However, starting in March 2021, the two trends deviated, and the rural bank's index fell by roughly 18% since then. The beta of rural banks fell from 1.06 in pre-2021 to 0.56 in 2021. This deviation matches the disparity between M2 and GDP in recent years, indicating a presumable switch of SMEs’ main financing channel. Moreover, the vast difference between the market's rise (+20.52%) and the rural bank index's decline (-15.41%) in 2021 showed a pessimistic need for SMEs' financing banks.

One of the three largest rural banks, ChangShu Bank, has the following balance sheet in 2022:

Table 2: Balance sheet of ChangShu Bank (601128.SH), data collected from wind.

Assets | Liabilities | ||

Cash and Central Bank Deposit | 16,954,085 | Financial Institution Loans | 890,016 |

Financial Institution Deposit | 2,570,832 | Central Bank Loans | 7,546,431 |

Interbank Lending Funds | 3,640,092 | Interbank Loans | 6,659,739 |

Financial Investment | 72,492,197 | Tradable Financial Liabilities | 1,725,741 |

In Which: Tradable Financial Assets | 12,130,960 | Derivative Liabilities | 218,256 |

In Which: Bond Investments | 42,175,213 | Financial Assets Sold for Repurchase | 9,251,207 |

In Which: Other Debt Investments | 17,425,680 | Deposit Taking | 219,182,495 |

In Which: Other Equity Investments | 760.344 | Payable Payroll | 464.441 |

Derivatives | 188,562 | Payable Tax | 464,243 |

Redemptory Monetary Capital | 100,007 | Lease Obligations | 291,869 |

Loans Offered | 185,626,290 | Payable Bonds | 14,766,793 |

Long-term Equity Investment | 1.508.161 | Estimated Liabilities | 100,531 |

Fixed Assets | 1,252.895 | Other Liabilities | 2,203,946 |

Construction in Process | 350,830 | All Liabilities | 263,765,708 |

Use Right Assets | 319,933 | Equities | |

Intangible Assets | 293,152 | Share Capital | 2,740,856 |

Business Reputation | 9,440 | Other Equities | 719,697 |

Deferred Tax Assets | 1,936,878 | Capital Reserve | 3,249,584 |

Other Assets | 638.020 | Other Comprehensive Equities | 443,168 |

Surplus Capital Reserve | 4,619,273 | ||

Undistributed Profit | 6,663,718 | ||

General Risk Reserve | 4.141,277 | ||

Equities Ascribed to Parent Company | 22,577,573 | ||

Minority Equity | 1,538,093 | ||

All Equities | 24,115,666 | ||

Total Assets | 287,881,374 | All Liabilities and Equities | 287,881,374 |

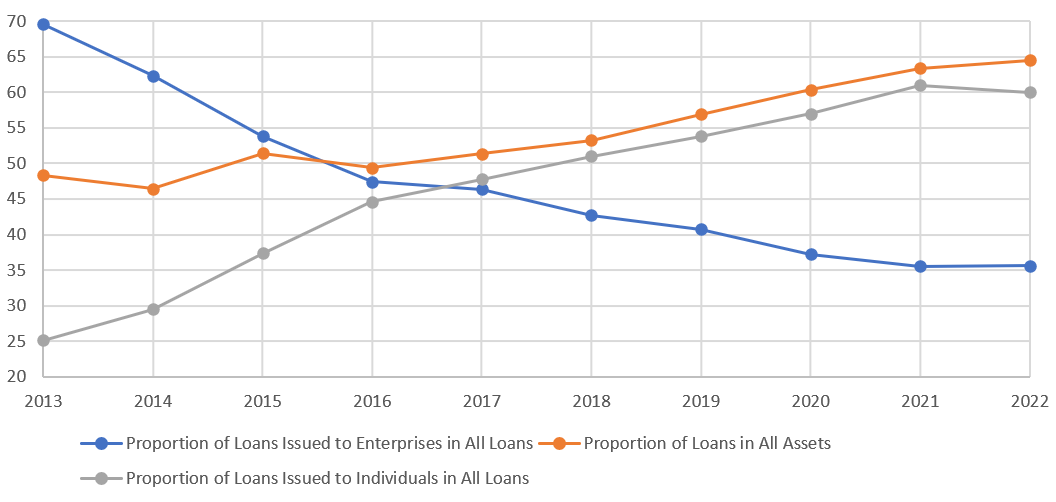

This balance sheet is very typical for banks: roughly 65% of all assets are loans to enterprises or individuals. More specifically, enterprises take up 36% of all loans, individuals take 60%, and the rest is attributed to bill discounts. Despite the increase in loans issued by this bank, the amount of business loans has decreased significantly over the past years, which shows the lenders' lack of confidence or interest in investing in SMEs.

Figure 11: Proportion of ChangShu Bank’s loans and the loans’ composition.

4. The Upturn of the Environment of SMEs Financing

4.1. Development of the Credit Investigation Industry

According to SMEs, financing is the most important reason due to information asymmetry, so it is difficult to obtain bank loans [16]. There are many SMEs, and it is difficult for financial institutions to give an objective evaluation of each SME through the existing data. SMEs have few credit loans, and the scale and frequency of loans to financial institutions are relatively small, so financial institutions cannot judge the risk of lending to the enterprise. Therefore, banks usually refuse to lend to SMEs. Even if they agree, they will sharply raise the interest rate to compensate for the loan risk. This leads to adverse selection. Small and medium-sized enterprises with significant risks and high profits can easily access loans. At the same time, companies are making up for the high-interest rates by investing in high-risk, high-yield projects. The credit investigation industry also emerged [17].

However, with the development of China's credit investigation industry, information is gradually becoming transparent. China's credit investigation system started late compared with Western countries. In March 2006, the People's Bank of China Credit Reference Center (PBOCCRC) was established.

In September 2021, the much-concerned Measures for the Management of Credit Investigation Business were issued, which proposed that the credit investigation industry collect, provide services for financial activities, and identify and judge the credit status of enterprises and individuals by the law. This means the credit investigation function services are included in the management scope. Some behaviors in the market that wander around the edge of the law will also be more effectively regulated.

By the end of 2020, the system had access to nearly 4,000 financial institutions, including 1.1 billion natural persons and 60.923 million enterprises and other organizations. In 2020, the average daily inquiry for personal credit investigation was 8.66 million times, and that for enterprise credit investigation was 190,000 times .

The development of the credit investigation industry not only optimizes the financing environment of SMEs but also standardizes the business reports of SMEs. At the same time, personal and enterprise assets are strictly separated and, through the third-party credit investigation service agencies, fundamentally solved the problem of information asymmetry between small and medium-sized enterprises and financial institutions.

4.2. Other External Irresistible Factors

Besides, some financing environment is also affected by external factors, especially global disasters.

Small and medium-sized enterprises generally have poor risk resistance and weak capital reserve ability. During the three years of COVID-19, they were hit in many ways. But now that the epidemic is over. Although the environment is still grim, it is at least improving.

5. Conclusion

This paper aims to conclude the positive influence of small and medium-sized enterprises' development and shadow banking on them through data analysis and framework research. The conclusion is as follows:

1. Small and medium-sized enterprises are essential in China, although they still have many problems.

2. Banks are pessimistic about SMEs, while the government is taking some measures to change the financing environment for SMEs

3. Shadow banking has indeed played a positive role in SME financing. It is believed that through some measures to standardize the shadow banking and credit investigation industry, it will be more conducive to the development of small and medium-sized enterprises.

Only through the guidance and support of the government, the perfect service of financial institutions, and the self-strengthening management of small and medium-sized enterprises to keep up with the pace of The Times can help small and medium-sized enterprises to overcome the most concise problems in the development process.

References

[1]. [1]Zhou Baohai "Three Enlightenments from the Development of Henkel to the Sustainable Development of Small and Medium-sized Enterprises in China". Journal of Jiaozuo University,34.2(2020):78-80.

[2]. [2]National Bureau of Statistics. China Statistical Yearbook 2004 [J]. China Statistical Publishing House, 2004

[3]. [3]National Bureau of Statistics of the China. 2012 Statistical Bulletin of National Economic and Social Development of the China: Chinese English Comparison [M]. China Statistics Press, 2013

[4]. [4]International Comparison and Chinese Experience in Financing of Small and Micro Enterprises. 2020. Research Group of the Research Bureau of the People's Bank of China.https://www.financialnews.com.cn/ll/xs/202005/t20200527_191893.html

[5]. [5]Over the past 10 years, the growth rate has been 2.7 times, and the quality and efficiency have continuously improved - the number of small and medium-sized enterprises in China has reached 48 million.https://www.gov.cn/xinwen/2022-09/02/content_5707953.htm?eqid =aaa31c7a0018891200000006645f9ca6

[6]. Ren Zeping: Research on the Current Situation of Small and Medium-sized Enterprises in China in 2021 (2021). Ren Zeping http://finance.sina.com.cn/zl/china/2021-12-20/zl-ikyamrmz0029687.shtml

[7]. research Consulting Group, (2021) China's SME Financing Development Report.https://www.iresearch.com.cn/Detail/report?id=3877&isfree=0

[8]. Research research Consulting Group, (2023) Research report on the development and prospect of small and micro-financing in 2022.https://www.iresearch.com.cn/Detail/report?id=4139&isfree=0

[9]. The New Third Board Market of the Beijing Stock Exchange will raise 28.1 billion yuan in 2021 to serve the high-quality development of small and medium-sized enterprises and the real economy.http://www.wabei.cn

[10]. Analysis of the Current Situation of China's Small and Medium-sized Enterprise Financing Market in 2021: More Sustainable Financing Support for Small and Medium-sized Banks_ Industry research report https://baijiahao.baidu.com/s?id=1708324118024823681&wfr=spider&for=pc.

[11]. The report on financing small and micro enterprises after the epidemic shows that the asset-liability ratio of 44.3% of small and micro enterprises exceeds 40% - news - Shanghai Securities Journal (2022). China Securities Network. Chen Fang.https://news.cnstock.com/news,bwkx-202012-4635201.htm

[12]. Xue Xiaoming, and Wang Yuxue Analysis of Talent Loss and Countermeasures in Small and Medium-sized Enterprises. Hebei Enterprises,11(2021):144-146.

[13]. Scoreboard A O .Financing SMEs and Entrepreneurs 2012[J].[2023-06-28]..

[14]. Cross-Sector – China: China Shadow Banking Monitor, Moody’s,2022-9-28,15

[15]. Shao Jiahui. Research on the Impact of Shadow banking system on SME Financing.2019. Xi'an University of Science and Technology,MA thesis.

[16]. Daniel Badulescu. SMEs financing: the extent of need and the responses of different credit structures[J]. Theoretical and Applied Economics, 2010, Vol.07(548):25-36

[17]. Li Jun. Empirical Study on Factors Influencing SME Financing. 2017. Kunming University of Science and Technology,MA thesis.

Cite this article

Feng,Y.;Guan,X. (2023). China's SME Financing and Shadow Banking’s Positive Impact on it. Advances in Economics, Management and Political Sciences,39,47-59.

Data availability

The datasets used and/or analyzed during the current study will be available from the authors upon reasonable request.

Disclaimer/Publisher's Note

The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of EWA Publishing and/or the editor(s). EWA Publishing and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content.

About volume

Volume title: Proceedings of the 7th International Conference on Economic Management and Green Development

© 2024 by the author(s). Licensee EWA Publishing, Oxford, UK. This article is an open access article distributed under the terms and

conditions of the Creative Commons Attribution (CC BY) license. Authors who

publish this series agree to the following terms:

1. Authors retain copyright and grant the series right of first publication with the work simultaneously licensed under a Creative Commons

Attribution License that allows others to share the work with an acknowledgment of the work's authorship and initial publication in this

series.

2. Authors are able to enter into separate, additional contractual arrangements for the non-exclusive distribution of the series's published

version of the work (e.g., post it to an institutional repository or publish it in a book), with an acknowledgment of its initial

publication in this series.

3. Authors are permitted and encouraged to post their work online (e.g., in institutional repositories or on their website) prior to and

during the submission process, as it can lead to productive exchanges, as well as earlier and greater citation of published work (See

Open access policy for details).

References

[1]. [1]Zhou Baohai "Three Enlightenments from the Development of Henkel to the Sustainable Development of Small and Medium-sized Enterprises in China". Journal of Jiaozuo University,34.2(2020):78-80.

[2]. [2]National Bureau of Statistics. China Statistical Yearbook 2004 [J]. China Statistical Publishing House, 2004

[3]. [3]National Bureau of Statistics of the China. 2012 Statistical Bulletin of National Economic and Social Development of the China: Chinese English Comparison [M]. China Statistics Press, 2013

[4]. [4]International Comparison and Chinese Experience in Financing of Small and Micro Enterprises. 2020. Research Group of the Research Bureau of the People's Bank of China.https://www.financialnews.com.cn/ll/xs/202005/t20200527_191893.html

[5]. [5]Over the past 10 years, the growth rate has been 2.7 times, and the quality and efficiency have continuously improved - the number of small and medium-sized enterprises in China has reached 48 million.https://www.gov.cn/xinwen/2022-09/02/content_5707953.htm?eqid =aaa31c7a0018891200000006645f9ca6

[6]. Ren Zeping: Research on the Current Situation of Small and Medium-sized Enterprises in China in 2021 (2021). Ren Zeping http://finance.sina.com.cn/zl/china/2021-12-20/zl-ikyamrmz0029687.shtml

[7]. research Consulting Group, (2021) China's SME Financing Development Report.https://www.iresearch.com.cn/Detail/report?id=3877&isfree=0

[8]. Research research Consulting Group, (2023) Research report on the development and prospect of small and micro-financing in 2022.https://www.iresearch.com.cn/Detail/report?id=4139&isfree=0

[9]. The New Third Board Market of the Beijing Stock Exchange will raise 28.1 billion yuan in 2021 to serve the high-quality development of small and medium-sized enterprises and the real economy.http://www.wabei.cn

[10]. Analysis of the Current Situation of China's Small and Medium-sized Enterprise Financing Market in 2021: More Sustainable Financing Support for Small and Medium-sized Banks_ Industry research report https://baijiahao.baidu.com/s?id=1708324118024823681&wfr=spider&for=pc.

[11]. The report on financing small and micro enterprises after the epidemic shows that the asset-liability ratio of 44.3% of small and micro enterprises exceeds 40% - news - Shanghai Securities Journal (2022). China Securities Network. Chen Fang.https://news.cnstock.com/news,bwkx-202012-4635201.htm

[12]. Xue Xiaoming, and Wang Yuxue Analysis of Talent Loss and Countermeasures in Small and Medium-sized Enterprises. Hebei Enterprises,11(2021):144-146.

[13]. Scoreboard A O .Financing SMEs and Entrepreneurs 2012[J].[2023-06-28]..

[14]. Cross-Sector – China: China Shadow Banking Monitor, Moody’s,2022-9-28,15

[15]. Shao Jiahui. Research on the Impact of Shadow banking system on SME Financing.2019. Xi'an University of Science and Technology,MA thesis.

[16]. Daniel Badulescu. SMEs financing: the extent of need and the responses of different credit structures[J]. Theoretical and Applied Economics, 2010, Vol.07(548):25-36

[17]. Li Jun. Empirical Study on Factors Influencing SME Financing. 2017. Kunming University of Science and Technology,MA thesis.