1 Introduction

With the gradual development of the country, the quality of resident’s life continues to improve, and medical means are increasingly advanced. However, at the same time, the problem of the aging population in China is becoming increasingly serious. In this context, a special kind of risk was born in society - longevity risk. A significant feature of longevity risk is that it is inversely correlated with the degree of social development which means the higher the degree of social development, the more significant problems of longevity risk will be. Nowadays, China has achieved the goal of Comprehensively building a well-off society, longevity risk will be a serious challenge for us as we prepare to build a modern powerful socialist country.

In the past decade or so, scholars have written a large number of studies on longevity risk, but many of these studies tend to focus on the longevity risk in the annuity insurance field, and there are few studies on longevity risk borne by individuals and governments. In China, the traditional way of supporting the aged makes households bear most of the cost of providing for the aged, which means that longevity risk will bring great financial pressure on families. In addition, the social pension funds managed by the government are also struggling to make ends meet because of longevity risks.

Hence, longevity risk is linked to many social problems. In order to deepen the social understanding of the impact of different subjects on longevity risk and related management methods. Based on existing research literature, this paper integrates different subjects into a unified analytical framework for comprehensive consideration. Deepening the understanding of longevity risk is conducive to preventing other kinds of risks caused by it and has benefits of improving the security of household financial and social pension funds, and also can improve the operating efficiency of enterprises.

2 Literature Review

Richard gave a comprehensive definition of longevity risk: the risk of wealth shortage caused by the fact that the actual life of people in the future is higher than the expected life expectancy. MacMinn and Brockett further divided longevity risk into individual and aggregate levels [1].

In order to quantify longevity risk, Lee and Carter jointly proposed the Lee-Carter model which could be used to predict mortality in different age ranges [2]. They discarded a large number of subjective factors, such as medical development level and environment, in the modeling process. Hence, compared with other random mortality models, the Lee-Carter model has a better predictive effect. In addition, the model only needs to establish a one-dimensional time series model for time factors, which greatly reduces the calculation of prediction. Lee-Carter model provides an effective mathematical tool for the academic community and related industries to measure and quantify longevity risk. Patricia Berry et al. took the population data of Australia as a sample and used three models including the ‘Lee-Carter’ to fit its population data [3]. And the limitations of different models in practical application are analyzed.

Lin and Cox created longevity swaps with trigger mechanisms by adjusting the cash flow of longevity bonds [4]. A securitization model of longevity risk based on an annuity is proposed. Provides insurance and financial companies with innovative derivative instruments to manage longevity risk. Chinese scholars Zhao and Wang proposed three ways to measure longevity risk for the operation of annuity products of insurance companies: stochastic simulation method, standard formula method and pressure trend method [5]. Among them, the stochastic simulation method based on Value at Risk and Conditional Tail Expectation has been widely used in domestic empirical studies in relevant fields.

Pang discussed in her article that the extension of actual life expectancy may lead to insufficient early savings and thus affect the quality of life in later years [6]. Yang provided reliable theoretical guidance on how to optimize asset allocation for families coping with longevity risk and discuss those life insurance company how to innovate their products in the same scenario through empirical research [7].

To sum up, foreign studies on longevity risk cover the definition of this risk, key indicator (mortality) prediction model and related industry risk management strategies, as well as the creation of financial derivatives that can be used to hedge this kind of risk, with a relatively complete system. The research on longevity risk started late in China, but there are still a lot of accomplishments in longevity risk measurement of annuity insurance products and corporate risk governance.

Most of these research focus on the financial market and financial enterprises. By contrast, there has been little analysis of the impact of longevity risks on individuals and governments which also needs to be taken seriously.

In the existing analysis, we could find some deficiencies. Pang only discussed the possible negative impact of exceeding the actual life expectancy on individuals but ignored the possible positive effect on personal development based on such expectations [6]. In addition, as the provider of social basic endowment insurance, it is also of great practical significance for the Chinese government to pay attention to the impact of longevity risk and the governance plan. What’s more, longevity risk can be transmitted among the three subjects, and the study of the interaction between the three subjects is conducive to analyzing their risk dispersion path.

Therefore, this paper will comprehensively consider the impact of longevity risk on different subjects, and comment on its related management methods. It is hoped that the academic community will pay more attention to different subjects in the context of longevity risk, and at the same time arouse scholars' interest in constructing a more comprehensive and holistic perspective to analyze the longevity risk problems faced by China, so as to construct effective solutions for the system as a whole in the future.

3 Methodology

This paper mainly adopts qualitative analysis and a small amount of quantitative analysis to study the impact of longevity risk on different subjects and management methods.

3.1 Theory Analyze

With the help of SSRN, CNKI and other academic journal databases, this paper took longevity risk as the theme, studying some relevant literature. By analyzing existing theories, this paper summarizes the consensus of the academics on longevity risk and clarifies its definition. Then, from the perspective of different subjects, this paper further sorted out the relevant literature. The purpose of it is to clarify the different scenarios of longevity risk, the positive and negative impacts on different subjects and the management methods, as well as the models for measuring longevity risk and its applicable conditions. At the same time, this paper also summarized the current research progress and shortcomings in this field.

3.2 Data Selection and Analysis

This paper illustrates the aging problem of Chinese society through three indexes: average life expectancy, the proportion of the elderly population in the total population and the dependency ratio of the elderly population. These data are all from the annual macro data released by the Official Bureau of Statistics of China, with strong time series characteristics and reliability. In order to analyze the trend of these data changes and make them more visual, this paper plots these data into linear graphs by year.

The Chinese Household Finance Survey (SHFS)provided by the Southwestern University of Finance and Economics is the main data source for this paper to analyze the financial market participation rate of households. This database provides the economic situation of a total of 34,643 families in different regions of China. In this paper, the households holding risky assets are assigned a value of 1, and the households not holding risky assets are assigned a value of 0, and the sample mean is solved by SPSS.

3.3 Theoretical Model Analysis

Based on the life cycle hypothesis and the life cycle consumption model, this paper analyzes the path of how longevity risk affects the total utility of households from the perspective of mathematics. And based on Merton's consumption-investment optimization model and the extended consumption decision model, this paper also illustrates the mechanism of how holding risky assets can affect household consumption decisions.

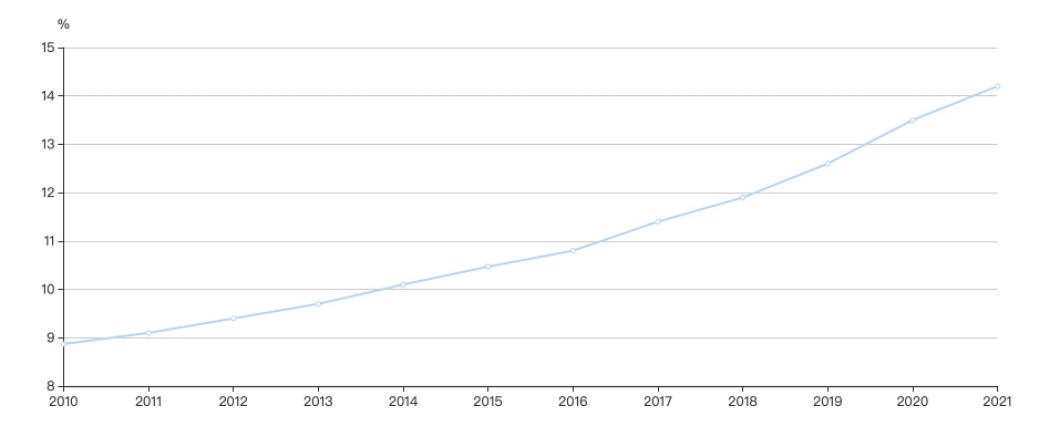

4 The Current Situation of Chinese Aging Population

The aging trend in Chinese society is one of the important reasons for the occurrence of longevity risk. According to the seventh population census conducted in 2020, there are 264.02 million people over 60 years old in China, accounting for 18.7% of the total population (190.64 million people over 65 years old, accounting for 13.5% of the total population). And the Figure (1) below illustrates that an upward trend in the percentage of Chinese population aged over 65 can be seen from 2010 to 2021. It is clear from the chart that Chinese society is now facing an aging degree and has far exceeded the United Nations criteria for the aging society.

Fig. 1. The proportion of China's population aged over 65. (From: CEInet Statistics Database)

As the level of social development continues to rise, China's higher aging trend is becoming increasingly obvious. The average annual growth rate of the elderly population over 80 years old is about 4.7%, and it is expected to reach 43.44 million in 2030.

In addition, It is clear from the table (1) that the average life expectancy of the Chinese population has also shown an obvious growth trend, rising from 67.8 years in 1981 to 76.7 years in 2017.

Table 1 average life expectancy of china from1981to2015

Year | Average life expectancy |

1981 | 67.77 |

1990 | 68.55 |

1996 | 70.80 |

2000 | 71.40 |

2005 | 72.95 |

2010 | 74.83 |

2015 | 76.34 |

Horizontal comparison of other countries in the world shows that between 1981 and 2015, the average life expectancy of developed countries such as the US, the UK and Japan increased by 6.3 years respectively, while the average life expectancy of Chinese residents increased by 8.6 years during the same period. It shows that the average life expectancy in China increases significantly in a short period of time. As an important risk factor, life expectancy with frequent changes in the short term will bring more uncertainty to the financial market, especially the insurance market, and increase pressure on the stability of cash flow.

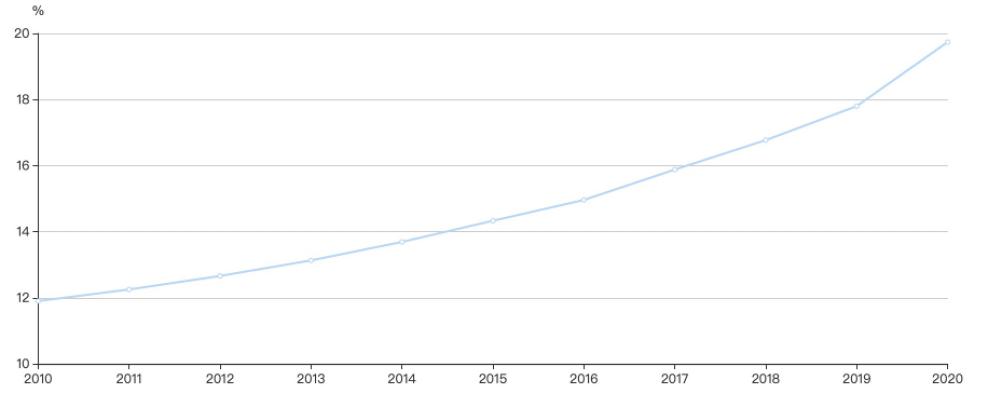

The increasing dependency ratio of the elderly is another important cause of longevity risk. And Figure (3) shows the trend of the dependency ratio of the elderly in China since 2010.

Fig. 2. Dependency ratio of China's elderly population. (From: CEInet Statistics Database)

We can clearly see that the dependency ratio of the elderly population continues to rise year by year. In addition, China's aging population is projected to grow at 3.2 percent, about five times the rate of the overall population, according to the United Nations. Therefore, the proportion of the elderly population in China will increase significantly in the future, while the birth rate will decrease significantly. Therefore, the dependency ratio of the elderly population will rise further in the future, and the problems caused by the increasing dependency ratio burden will reduce the average welfare level of the social endowment and increase the burden on each unit of a family.

5 Analysis of the Impact of Longevity Risk on Different Subjects

5.1 The Impact on Individuals (Families)

American economists Modigliani and Brumberg were the first scholars to study the life cycle hypothesis [8]. They defined the total utility of an individual (family) in the life cycle as a function of consumption in different periods and the final assets that can be used to bequeath, as follow:

U=U(ct,ct+1,···,cL,L+1) (1)

Where, t is the factor measuring time, ct represents the consumption of the individual at the t stage, α is the wealth accumulation level of the individual, and L is the total life span of the individual. In Modigliani and Brumberg's theory, L is defined as the sum of working years (N) and retirement years (M), which are as follows:

L=N+M (2)

To further clarify the relationship between life-consumption-income, Modigliani and Brumberg also present an expression for individual consumption decisions in their literature:

\( C=\frac{N×y}{L}\ \ \ (3) \)

throughing these models, we can find that: when given by the working periods, individuals' decisions about consumption are only related to wage income and life span. At the same time, the expression reflects those individuals will distribute the income during their working lives equally over their lifetime, based on life expectancy. Hence the extension of life (parameter L increases) will let individuals make decisions about reducing their consumption in each stage, which means that the average living standard of individuals (families) in the life cycle will be reduced, and the total utility of individuals in the life span will also be reduced.

To sum up, based on the life cycle hypothesis, we can see that the negative impact of longevity risk on individuals (families) is mainly reflected in the reduction of consumption (living standard) caused by the increase in longevity. When residents live longer than expected, early savings for retirement may fall short. When the labor force retires, its source of income is generally reduced, its income is also generally lower, and it is often difficult to cope with the financial gap caused by insufficient savings, which affects the quality of life in later years. Especially when the residents are not conscious to choose or do not have the conditions to participate in annuity plans such as enterprise annuity and commercial insurance, it is almost necessary for the residents or their families to fully bear the longevity risk.

On the other hand, Longevity expectations also have a positive effect on personal development. Individuals are likely to receive more investment in human capital in social life when life expectancy is generally expected to increase. Human capital investment is typically affected by time cost, so in the context of a general increase in life expectancy, the extension of life cycle will reshape the choice and preference of human capital investment. Scholars Liu and Huang discussed the long-term economic impact of the declining mortality rate through an iterative generation model and believed that the increase in paternity life expectancy would have a direct impact on the human capital investment of offspring and found through empirical research that the net effect of such an impact was positive [9]. It is therefore prudent to conclude that when an individual is in early childhood and school age, his/her parents will invest more in his/her education based on the expectation that he/she will live longer.

5.2 The Impact on Enterprises and the Insurance Industry

Under the background of increasing life expectancy and the aging population, enterprises and insurance companies need to pay pensions or coupons will increase, and their obligations will be extended, which brings about an increase in operating costs year by year.

For general enterprises, if they do not choose a proper way to manage longevity risk at the beginning of the period, and do not retain enough capital to deal with tail risk. The uncertainty brought by the actual life may lead to an increase in cash flow pressure when the enterprise pays the unexpected pension, which may result in liquidity risk. And in a serious scenario, it may hinder the operation of the enterprise and have a negative impact on its credibility of the enterprise.

For the insurance companies, the impact of longevity risk is more complicated due to its operating characteristics. Those companies will use the Mortality table published by the China Banking and Insurance Regulatory Commission (CBRC) as the basis for the pricing of relevant annuity products. However, the mortality rate data on this form is not updated frequently, and insurance companies use it as a basis for premiums, which may lead to a lag in actuarial results. When the premium collection is not at parity with the actual payment in the future, the risk exposure will increase. At the same time, the insurance industry has to bear the aggregated longevity risk, which, as a systemic risk, makes the insurance company unable to achieve the purpose of risk diversification by expanding the insured population. In addition, the adverse selection problem of endowment insurance means that insurance companies have already taken high risks at the beginning of the period. It will easy to result in widespread losses in the later period and may affect the overall development of the industry.

5.3 The Impact on the Government

The government's exposure to longevity risk is mainly affected by basic pension plans. The basic endowment insurance is a compulsory pension security system set up by the government. The pension fund adopts the financial mode of a partial accumulation system and takes into account both short-term horizontal balance and long-term vertical balance. Social pension funds use the management mode of "unified accounting", which is managed by the government and provides pensions to participants according to certain standards. When the actual mortality rate falls, the proportion of people insured by basic pension insurance will increase year by year, and the fund account may be unable to meet its expenses. At this point, the pressure on the government to pay rises.

6 Longevity Risk Management

6.1 Individuals and Households Dealing with Longevity Risk

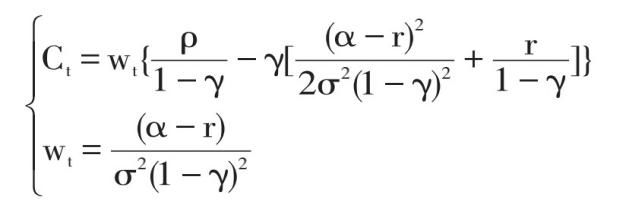

Merton constructed a decision model for portfolio optimization within the life cycle under the condition of time continuity based on the repetitive dynamic method, aiming to explore how to maximize the utility of individual (family) pension assets [10]. In his paper, he gives an analytical formula for the optimal allocation of consumption and investment:

(4)

(4)

Where, w represents the wealth accumulation level of an individual (family) and is a measure of risk.

Through this analytical formula, we can see that Merton takes risk assets into account in the asset allocation of individuals (families). Through participation in the financial market, effective allocation of risk assets has a positive effect on improving the level of wealth accumulation, and can enable households to expand consumption, thus improving the quality of life.

However, according to data from CHFS in 2019, in a sample of 34,643 households from all Chinese provinces. In this paper, the households with risky assets are assigned a value of 1, and the households without risky assets are assigned a value of 0. Next, using the statistical analysis software-SPSS to calculate the mean of this sample, and found that the sample, financial market participation rate of household (FMA) is less than 20%. Which results are showed in table (2) :

Table 2. Descriptive Statistics

N | Minimum | Maximum | Mean | Std.Deviation | |

FMA | 34643 | .00 | 1.00 | 0.1707 | .37629 |

Valid N (listwise) | 34643 | ||||

Influenced by traditional culture, Chinese households are generally averse to risks. Housing and savings account for a high proportion of the composition of family or individual assets. While related financial assets such as stocks, funds and insurance account for a low proportion. The Chinese family also has a low awareness of longevity risk. Thus, they seldom adjust financial management strategies for longevity risk.

A lower participation rate in the capital market may lead to a greater impact on the value of family assets caused by time changes, which may lead to the loss of family welfare. Therefore, further diversification of asset allocation by Chinese residents can be one of the effective ways to deal with longevity risk. Diversifying a family's asset allocation, such as buying an annuity from an insurance company, can largely pass on longevity risk.

In addition, participating in the capital market religiously can also achieve the expansion of income channels, while maintaining the value of assets. To further illustrate that increasing risky asset allocation can be an effective means for households to manage longevity risk, this paper extends Modigliani and Brumberg's equation of consumption decision:

\( C=\frac{(N-t)y+\frac{{(1+{r_{σ}})^{n}}ty}{{(1+{r_{f}})^{n}}}}{L} \) (5)

In this equation, \( ty \) represents the income which households allocate to the risky assets. And \( {r_{σ}} \) is the return at risk, while \( {r_{f}} \) represents the risk-free interest rate. There always have \( {r_{σ}} \gt {r_{f}} \) .

By analyzing the equation, we can find that \( \frac{{(1+{r_{σ}})^{n}}}{{(1+{r_{f}})^{n}}} \) will always larger than 1. Consequently, we can draw a conclusion that \( (N-t)y+\frac{{(1+{r_{σ}})^{n}}ty}{{(1+{r_{f}})^{n}}} \) will always more than Ny. It means that households can accumulate more wealth through participating financial markets with constant wages and years of work, and possibly maintain the same or even higher level of consumption in the expectation of longevity.

6.2 The Management of Longevity Risk of Companies

Quantification of Mortality.Since longevity risk is the result of a larger-than-expected decline in mortality, companies that want to manage longevity risk effectively need to be able to accurately quantify future mortality. The classical Lee-Carter model is the most widely used model at present, and a large number of studies have proved that it does have an accurate prediction ability. Ronald Lee and Lawrence Carter (1992) excluded social factors, economic factors and other factors that were difficult to quantify in the modeling process, and only included time and age factors. Therefore, the Lee-Carter model has the advantages of a simple calculation process and accurate fitting results. The expression of mortality logarithm is as follows:

\( ln{{m_{xt}}={c_{x}}+{β_{x}}{k_{t}}+{ε_{xt}}}\ \ \ (6) \)

Where, x represents age, t represents year, mxt represents population mortality rate, cx represents an average mortality rate of age x, βx represents the sensitivity of different ages to changes in mortality rate, and kt represents changes in mortality rate over time. And εxt, is the random perturbed variable whose distribution obeys the standard normal distribution.

By using the model, companies can use historical data fitting to obtain parameters Cx and β X, and further solve the predicted value of parameter Kt by assuming that Cx and β X will not change in the future. Based on the predicted Kt values, the industry can compile relevant empirical life tables to provide a basis for pricing annuity products and managing longevity risk.

However, the classic Lee-Carter model usually requires regression of 20-30 years of historical mortality data to obtain more accurate results. Due to the lack of relevant historical data reserves in China, direct use of the model may cause errors in the prediction results. In order to solve the problem caused by data, many Chinese scholars have improved the model. For example, Han and Wang improved the Lee-Carter model by using a double random process to overcome the problem of an insufficient historical sample size of mortality in China [11]. Li and Liu respectively used singular value decomposition (SVD), least square method (OLS), weighted least square method (WLS) and maximum likelihood method (MLE) to estimate the parameters of The Lee-Carter model, and found that weighted least square method had better fitting effect and prediction effect for Chinese data [12].

The exploration of mortality prediction by domestic scholars has formed a large number of empirical studies based on China's population mortality data, and tested the mortality prediction model and longevity risk calculation index proposed by foreign scholars, providing many critical empirical tools for the analysis and measurement of longevity risk.

Product Innovation and Longevity Risk Securitization.China's aging social structure has been the general trend, in this context, the demand for life insurance will continue to rise. At the same time, aging will bring more disability, dementia and other elderly groups to support the problem. These increasingly complex problems will put forward more complex requirements for the service of the insurance industry, forming a new demand. Nowadays, the life insurance in China's insurance market is single, which will lead to a high degree of risk concentration. Therefore, the insurance industry should actively speed up the innovation of life insurance products to meet the personalized and differentiated needs of different groups. Through product innovation, different groups can be divided effectively, the number of risks of a single product can be reduced, and the risks can be dispersed by diversifying products.

On the other hand, although longevity risk, as a systemic risk, cannot be distributed among insured people, insurance companies can translate such risks into the capital market. Through securitization, insurance companies can effectively transfer longevity risk to other investors in the capital market. This approach to managing longevity risk through securitization has been successfully practiced in many countries. In 2004, the European Investment Bank and BNP Paribas issued EIB/BNP longevity bonds. The LLMA was established in London in February 2010 to provide consistent standards, methodologies and benchmarks for the liquidity trading market in longevity securities. In November 2013, Deutsche Bank introduced longevity experience options (LEO), which allow longevity risk to be transferred between pension funds, insurance companies and investors and reduce risk management costs.

However, due to the imperfect development of China's capital market, there is a lack of issuers and investors of longevity securities, which makes the process of longevity risk securitization develop slowly in China. In addition, the longevity risk securitized derivatives themselves have three problems: lack of liquidity, low transparency and imperfect rating mechanism. Therefore, China needs to gradually overcome the relevant problems and provide a better trading environment for the circulation of longevity securities in the secondary market. Securitization will be an important and effective channel to mitigate the impact of longevity risk on the insurance industry in the future.

6.3 The Chinese Government's Response to Longevity Risk

As a macro regulator, the state should pay attention to the adaptation of system adjustment and objective reality, so as to make the superstructure fit the development of the economic foundation. According to relevant empirical analysis[] and combined with the retirement experience of developed countries, appropriately extending the retirement age can be regarded as a way to deal with longevity risk. Raising the retirement age, if health conditions permit, will slow the growth of the corporate retirement population, thus can ease the rising cost of pensions for companies and the state. In managing pension funds, China can learn from the standards of some developed countries, where the minimum contribution period for a full pension is 41 years in France, 35 years in the UK and 45 years in Germany. It is obvious that in many countries with high social welfare, the standard of payment fixed number of years for receiving a pension is far higher than the current standard of our country. According to the level of economic development in different regions, increasing the minimum number of years for fund contribution and expanding the income of the endowment insurance fund can accumulate more sufficient capital for payment.

Most importantly, China should actively improve and develop its capital market. As an effective place to disperse risks, the capital market not only enables residents to effectively transfer the financial pressure brought by longevity risk, but also helps insurance companies to hedge risks and operate smoothly. The government actively guides the construction of the domestic financial market, so that the participation of families in the financial market and the securitization of longevity risk not only become an important way to manage longevity risk, but also become an important source to improve the efficiency of financial resource allocation and promote the benign and healthy development of the national economy and financial market, thus achieving a win-win result.

Finally, as a regulatory department, CBRC should actively adjust and update the life table to minimize the model risk caused by the lag of data in the table.

7 Conclusion

This paper demonstrates the objectivity of the occurrence of longevity risk in China through population data and analyzes the impact of longevity risk on different subjects. At the personal level, this paper, based on the life cycle theory and through model analysis, explains from a mathematical perspective that the general increase in people's life expectancy will cause the decline of the average consumption level of individuals (families) and have a negative impact on the total utility of individuals (families). In addition, when actual life expectancy exceeds expectations, it can also lead to poor quality of life in later years due to insufficient savings. But on the other hand, rising life expectancy also gives individuals the opportunity to reap more investment in human capital. For general enterprises and the insurance industry, longevity risk will bring about a general increase in operating costs. For the insurance industry, it will increase the difficulty of risk management and expand its risk exposure. For the country, longevity risk increases the expenditure pressure on social basic endowment insurance funds.

When analyzing the countermeasures, this paper finds through data survey that Chinese households have a low participation rate in the financial market and weak awareness of risk asset allocation and risk management. This leaves households with no effective hedge against longevity risk. According to Merton's consumption-investment decision model, this paper points out that increasing the allocation of risk assets can effectively expand the source of income and improve the consumption level of individuals (families). Therefore, Chinese families should make more active use of the financial market to trade risk assets, so as to transfer or mitigate the financial pressure caused by longevity risk. The insurance industry should accelerate the innovation progress of securitized products and actively promote the process of longevity risk securitization in China. For ordinary companies, it is necessary to actively improve the level of financial risk management and effectively use the capital market to disperse operational risks. As a macro regulator, the government should improve the relevant legal system and gradually adjust the retirement age based on the expectation of longevity. And optimize the management of pension funds to achieve a stable income and expenditure. At the same time, the government should actively guide and encourage the development of the domestic capital market.

Finally, as an important state department, THE CBRC should also update and adjust the life table in a timely manner and try to avoid errors and losses in actuarial work in relevant industries.

References

[1]. MacMinn, R., Brockett, P., & Blake, D. (2006). Longevity risk and capital markets. The Journal of Risk and Insurance, 73(4), 551-557.

[2]. Lee, R. D., & Carter, L. R. (1992). Modeling and forecasting US mortality. Journal of the American statistical association, 87(419), 659-671.

[3]. Berry, P., Tsui, L., & Jones, G. (2010, September). Our new “old” problem–pricing longevity risk in Australia. In 6th International Longevity Risk and Capital Markets Solutions Conference, Sydney (pp. 9-10).

[4]. Lin, Y., & Cox, S. H. (2005). Securitization of mortality risks in life annuities. Journal of risk and Insurance, 72(2), 227-252.

[5]. Zhao Ming& Wang Xiaojun. (2015). Measurement of Longevity Risk in insurance company. Statistical study, (12), 76-83.

[6]. Pang Xuesong. A Study on The Longevity Risk in Aging [D]. GuangXi University ,2017.

[7]. Yang Qianqian. (2019).Longevity Risk、Subjective Life Expectancy and Household Portfolio Choice (Doctoral Dissertation, Zhejiang University) From: https://kns.cnki.net/KCMS/detail/detail.aspx?dbname=CDFDLAST2020&filename=1019114852.nh

[8]. Modigliani, F., & Brumberg, R. (1954). Utility analysis and the consumption function: An interpretation of cross-section data. Franco Modigliani, 1(1), 388-436.

[9]. Liu Yongping & Huang Lizhen.(2009). The impact of family child mortality risk on economic growth. Journal of Fuzhou University (Philosophy and Social Sciences) (05),17-23+112.

[10]. Merton, R. C. (1969). Lifetime portfolio selection under uncertainty: The continuous-time case. The review of Economics and Statistics, 247-257.

[11]. Han Meng & Wang Xiaojun.(2010). Application and improvement of Lee-Carter model in urban population mortality prediction in China. Insurance research (10),3-9. doi:10.13497/j.cnki.is.2010.10.001.

[12]. Li Zhisheng, & Liu Hengjia. (2010). Estimation and Application of the Lee-Carter Mortality model: An analysis based on Chinese population data. Chinese Population Science, (3), 46-56.

[13]. Huang Shuyan.(2021). Research on the basic pension Gap of urban Enterprise workers in Yunnan Province (Master's Thesis, Yunnan University of Finance and Economics).https://kns.cnki.net/KCMS/detail/detail.aspx?dbname=CMFD202102&filename=1021614889.nh

Cite this article

Wen,Y. (2023). A Discussion on the Impact and Management of Longevity Risk on Households, Enterprises and Governments in the Context of Aging in China. Advances in Economics, Management and Political Sciences,3,439-449.

Data availability

The datasets used and/or analyzed during the current study will be available from the authors upon reasonable request.

Disclaimer/Publisher's Note

The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of EWA Publishing and/or the editor(s). EWA Publishing and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content.

About volume

Volume title: Proceedings of the 6th International Conference on Economic Management and Green Development (ICEMGD 2022), Part Ⅰ

© 2024 by the author(s). Licensee EWA Publishing, Oxford, UK. This article is an open access article distributed under the terms and

conditions of the Creative Commons Attribution (CC BY) license. Authors who

publish this series agree to the following terms:

1. Authors retain copyright and grant the series right of first publication with the work simultaneously licensed under a Creative Commons

Attribution License that allows others to share the work with an acknowledgment of the work's authorship and initial publication in this

series.

2. Authors are able to enter into separate, additional contractual arrangements for the non-exclusive distribution of the series's published

version of the work (e.g., post it to an institutional repository or publish it in a book), with an acknowledgment of its initial

publication in this series.

3. Authors are permitted and encouraged to post their work online (e.g., in institutional repositories or on their website) prior to and

during the submission process, as it can lead to productive exchanges, as well as earlier and greater citation of published work (See

Open access policy for details).

References

[1]. MacMinn, R., Brockett, P., & Blake, D. (2006). Longevity risk and capital markets. The Journal of Risk and Insurance, 73(4), 551-557.

[2]. Lee, R. D., & Carter, L. R. (1992). Modeling and forecasting US mortality. Journal of the American statistical association, 87(419), 659-671.

[3]. Berry, P., Tsui, L., & Jones, G. (2010, September). Our new “old” problem–pricing longevity risk in Australia. In 6th International Longevity Risk and Capital Markets Solutions Conference, Sydney (pp. 9-10).

[4]. Lin, Y., & Cox, S. H. (2005). Securitization of mortality risks in life annuities. Journal of risk and Insurance, 72(2), 227-252.

[5]. Zhao Ming& Wang Xiaojun. (2015). Measurement of Longevity Risk in insurance company. Statistical study, (12), 76-83.

[6]. Pang Xuesong. A Study on The Longevity Risk in Aging [D]. GuangXi University ,2017.

[7]. Yang Qianqian. (2019).Longevity Risk、Subjective Life Expectancy and Household Portfolio Choice (Doctoral Dissertation, Zhejiang University) From: https://kns.cnki.net/KCMS/detail/detail.aspx?dbname=CDFDLAST2020&filename=1019114852.nh

[8]. Modigliani, F., & Brumberg, R. (1954). Utility analysis and the consumption function: An interpretation of cross-section data. Franco Modigliani, 1(1), 388-436.

[9]. Liu Yongping & Huang Lizhen.(2009). The impact of family child mortality risk on economic growth. Journal of Fuzhou University (Philosophy and Social Sciences) (05),17-23+112.

[10]. Merton, R. C. (1969). Lifetime portfolio selection under uncertainty: The continuous-time case. The review of Economics and Statistics, 247-257.

[11]. Han Meng & Wang Xiaojun.(2010). Application and improvement of Lee-Carter model in urban population mortality prediction in China. Insurance research (10),3-9. doi:10.13497/j.cnki.is.2010.10.001.

[12]. Li Zhisheng, & Liu Hengjia. (2010). Estimation and Application of the Lee-Carter Mortality model: An analysis based on Chinese population data. Chinese Population Science, (3), 46-56.

[13]. Huang Shuyan.(2021). Research on the basic pension Gap of urban Enterprise workers in Yunnan Province (Master's Thesis, Yunnan University of Finance and Economics).https://kns.cnki.net/KCMS/detail/detail.aspx?dbname=CMFD202102&filename=1021614889.nh