1. Introduction

In the aftermath of Covid-19 in 2020, economies across the world have been hit hard. The impact has caused the pause button to be pressed in all sectors of the world, and most real businesses have suffered a tragic loss. In response to Covid-19 and to stimulate the economy, monetary and fiscal policies were highly similar across countries. By lowering interest rates to 0% and publicly buying government bonds from some financial institutions, among other things, several instruments were used to inject liquidity into the market while stimulating the recovery of individual companies. However, in March 2022, the Federal Reserve opened a round of interest rate hikes, the tenth to date, and interest rates have gone as high as 5.25% [1], which has also had a direct impact on the yields of US Treasuries. Some Federal Reserve officials are very unattracted by this series of increases and believe that this move could cause the newly recovering US economy to hit rock bottom again.

This report will target the U.S. equity market as a sample, focusing on the impact of the frenzied rise in U.S. interest rates on the U.S. economy as well as the linkage between U.S. interest rates and U.S. treasury bonds.

2. Impact on the U.S. Economy

2.1. Impact on the Lives of People in the US

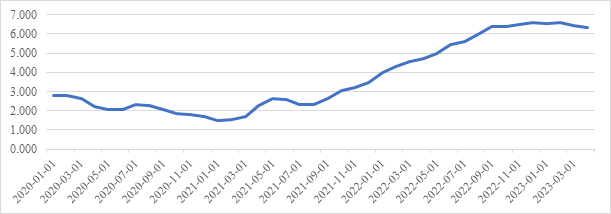

High-interest rates have a significant impact on the lives of people in the US, as high-interest rates are accompanied by a high Consumer Price Index (CPI) for Food and Energy [2], which reduces the purchasing power of people's wages, especially for those on low and fixed incomes. High-interest rates symbolise an increase in the cost of living for families. According to Figure 1, when the CPI index increases, wages spent on food and other necessities gradually increase, which puts considerable strain on people's lives and further triggers social volatility. Moreover, demand for and spending on goods other than necessities are also falling in tandem, which will further lead to a drop in GDP. The demand for higher wages in response to this situation increases the cost of business, a phenomenon also known as the wage-price spiral. Spiraling wage prices also create further inflation, a vicious circle that has a nasty effect on the economy. Fama states that interest rates are the best predictor of inflation [3]. The best-known example of this is the 1970s and 1980s in the United States, where interest rates were at one point over 20% and inflation was over 13%, which led to the subsequent economic depression.

Figure 1: CPI index from 1 January 2020 to 24 May 2023 [1].

2.2. Impact on Businesses

When businesses were faced with rising costs, they had to resort to borrowing, one of the most common forms of business financing. However, with high-interest rates, companies need to spend more on financing to make money. So companies under more pressure from high-interest rates tend to perform poorly, which also directly affects the share price of the company and its role in society. For companies, high-interest rates mean that companies have to pay more capital to borrow in order to carry out their business activities. The most significant impact is on the company's employees. When the company cannot afford its costs, layoffs may be a good solution for the company's management team. But this solution also affects the stability of the company, and has severe repercussions on a social level.

2.3. Impact on the Financial Market

At the financial market level, high-interest rates can create more volatility in the stock, bond and derivatives markets, resulting in a more unstable financial market. González-Aguado and Suarez add that high-interest rates also increase the risk of default, with people fearing that corporate bonds will default [4]. Hence, the price of callable bonds increases in the presence of high-interest rates. Jordan & Kuipers and Kim & Stock again demonstrate the differential impact of interest rates on redeemable and non-redeemable bonds [5-6].

2.4. Impact on Other Countries

High-interest rates in the US reduced national demand for European goods and services, which had a direct impact on European export economies. More importantly, high-interest rates give the US dollar more purchasing power internationally, which means the euro will depreciate. Some European companies that rely on foreign investment and raw materials and must settle in US dollars will have to spend more on imports, which will have a negative impact on the economies of European countries. Therefore, a series of interest rate hikes by the Federal Reserve has also forced the European Central Bank to follow suit, which has also inhibited economic recovery and growth in Europe.

Some Fed officials are not optimistic about the Fed’s series of interest rate hikes. Doubts about further rate hikes emerged at the third FOMC meeting of 2023 on May 2, suggesting a contentious debate over whether further rate hikes or tighter monetary policy would be beneficial. Figure 1 shows that the CPI index has risen in tandem with a string of interest rate hikes issued by the Fed but appears to have plateaued in 2023. The appearance of such smoothness seems to suggest that the current contractionary monetary policy has had the desired effect, while some Fed officials believe that a continuation of strong contractionary monetary policy may not lead to good results.

2.5. Positive Influence

However, high-interest rates do not necessarily mean only negative effects. First, the risk appetite of individual, institutional investors, and companies will change. Investors will be more inclined to invest in lower-risk financial instruments due to the high inflation associated with high-interest rates. Second, when inflation rises, companies or individuals need to borrow may face higher interest rates However, those borrowers with fixed repayment rates benefit from repaying these loans in an inflated currency, which lowers the debt servicing costs after adjusting for inflation. In addition to this, through the experimental results of Stock & Watson and Fuhrer, it can be seen that inflation and unemployment are negatively correlated, especially in the short run, as higher inflation raises the demand for labour [7-8]. Although in the long run, the cost of persistently high inflation tends to be a painful depressed economies. Nevertheless, in terms of the energy, real estate and value equity markets, high inflation rates can make them to perform due to the broader US equity market. But it may be that this phenomenon occurs as a result of high inflation leading to a weakening of the broader stock market.

3. US Treasuries

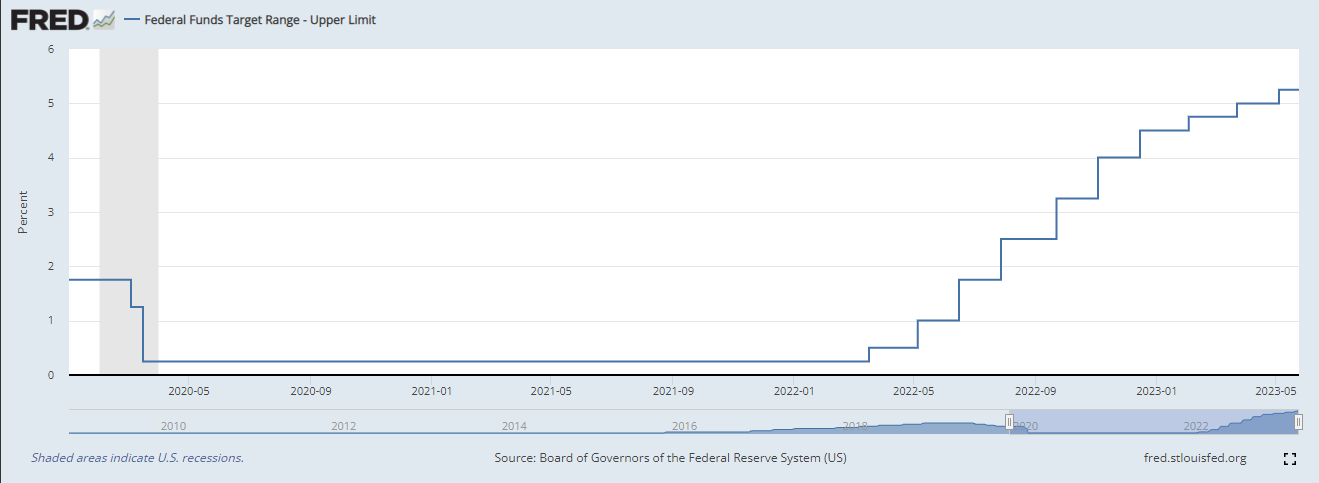

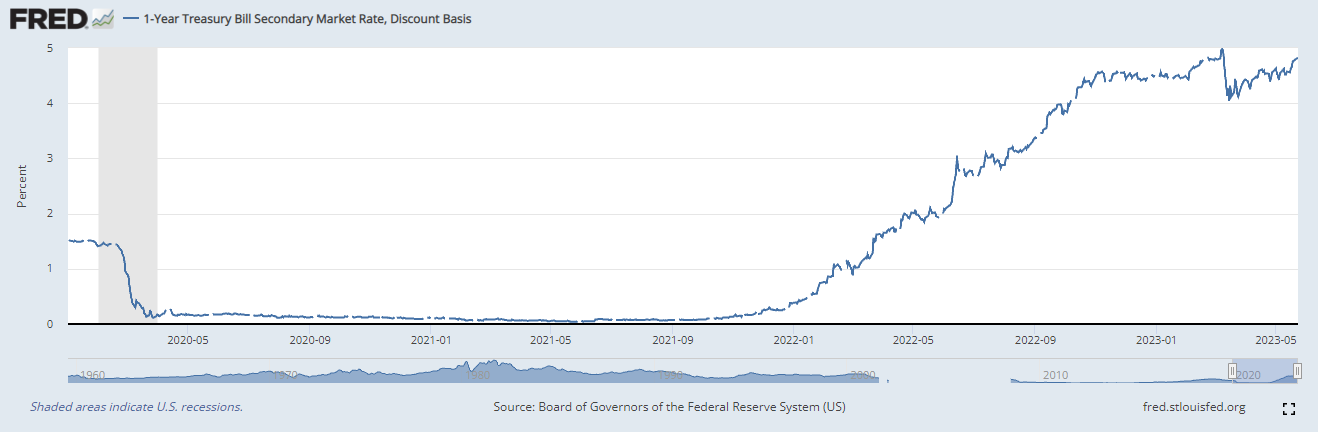

The yield on US Treasuries is an essential signal, as it is not only valued as a risk-free rate as a discount factor but also represents the cost of repaying a fixed-rate mortgage [9]. As can be seen in Figures 2 and 3, the trends in interest rates and Treasury yields are highly overlapping, and an increase in interest rates will also lead to an increase in Treasury yields, which will encourage people to save more than they spend. This is good for some investors, who can buy risk-free bonds with high-interest rates and earn high returns. The portfolio, therefore, earns more than it would if interest rates remained unchanged. However, it also represents a rise in the cost of issuing and servicing debt borne by the government as a bond issuer. According to the empirical results of Ejsing et al. and Von Hagen et al., when Treasury yields remain high, governments are at risk of default because they can hardly afford the high cost of debt [10-11]. In the event of payment deferment and defaults, this could lead to the withdrawal of international capital, leading to a worse outcome, a regional or global financial crisis, such as the historical European debt crisis triggered by the default of Greek debt.

Figure 2: US federal funds target rate from 1 January 2020 to 24 May 2023, [1].

Figure 3: US one-year treasury yields from 1 January 2020 to 24 May 2023, [1].

However, high-interest rates can be costly to investors who hold bonds previously offered for sale. High US interest rates and high yields on Treasuries caused the recent collapse of the three largest banks. During the 2019-2021 Covid-19 epidemic, Silicon Valley Bank invested billions in long-term US government bonds. At the time, market interest rates were near zero, and even though long-term US government bonds paid only a few percentage points of interest, they were still profitable. However, the US Federal Reserve has been aggressive in raising interest rates to keep inflation down, with interest rates rising to 5.25% over the past year. The interest rate hike has caused heavy losses to Silicon Valley banks, which held large amounts of long-term US debt,, directly resulting in its bankruptcies and failures, and had a devastating effect on the banking sector and related industries [12]. In addition, Kyriazis noteed that the outbreak of the Russian-Ukrainian military conflict on February 24 had a considerable impact on the global financial markets. This event led to a rise in risk aversion in the financial markets, which resulted in a gradual rise in the price of US bonds [13].

4. Discussion

The economic situation in the US is currently under high-pressure, with high-interest rates putting people and companies under pressure at various levels. However, in the short term, the contractionary monetary policy has been effective and has managed to contain the rise in inflation, but the long-term outcome is not yet known. Investors' uncertainty about the future will also brought more volatility to financial markets.

To counter the adverse effects mentioned above, the Fed should slow down its contractionary monetary policy and pursue some modestly expansionary fiscal policy in tandem with the government's pursuit of balance. At the same time, high-interest rates also increase the risk of default. Regulators should tighten their control over the market, as the collapse of the three major banks mentioned above has had a devastating impact on the sector due to globalisation and the close interconnectedness of international banks. In addition, the rise in the prices of some low-risk financial instruments can also suggest investors' expectations for the future.

5. Conclusion

In conclusion, the rise in US interest rates has indeed increased the cost of living for households, borrowing costs for businesses, instability in financial markets and dampened the economic recovery in the Eurozone. However, it has also reduced the cost of repaying loans for individuals and businesses, boosted employment, and stimulated some business growth in the country. On the other hand, the yield on US Treasuries is directly influenced by changes in interest rates and is an indicator of risk-free investment returns for investors. Nevertheless, this would be devastating for investors who already own low-yielding Treasuries. The risk of default and volatility that high-interest rates bring to financial markets has sent investors' risk aversion soaring, which has meant a spike in the price of US Treasuries and some investment-grade bonds. This study pays less attention to the long-term effects of high-interest rates in the US currently and the more international implications that need to be examined, such as what impact high-interest rates will have on some emerging markets. Future research should compare the short- and long-term outcomes of high-interest rates, as well as judge the effectiveness and practicality of the series of rate hikes already announced by the Federal Reserve and the continued contractionary monetary policy going forward.

References

[1]. Federal Funds Target Range - Upper Limit. (2023, May 29). https://fred.stlouisfed.org/series/DFEDTARU

[2]. Sticky Price Consumer Price Index less Food and Energy. (2023, May 10). https://fred.stlouisfed.org/series/CORESTICKM159SFRBATL

[3]. Fama, E. F. (1977). Interest rates and inflation: the message in the entrails. The American Economic Review, 67(3), 487-496.

[4]. González‐Aguado, C., & Suarez, J. (2015). Interest rates and credit risk. Journal of Money, Credit and Banking, 47(2-3), 445-480.

[5]. Jordan, B. D., & Kuipers, D. R. (1997). Negative option values are possible: The impact of Treasury bond futures on the cash US Treasury market. Journal of Financial Economics, 46(1), 67-102.

[6]. Kim, D. H., & Stock, D. (2014). The effect of interest rate volatility and equity volatility on corporate bond yield spreads: A comparison of noncallables and callables. Journal of Corporate Finance, 26, 20-35.

[7]. Stock, J. H., & Watson, M. W. (2008). Phillips curve inflation forecasts.

[8]. Fuhrer, J. C. (1995). The Phillips curve is alive and well. New England Economic Review, 41-57.

[9]. Von Hagen, J., Schuknecht, L., & Wolswijk, G. (2011). Government bond risk premiums in the EU revisited: The impact of the financial crisis. European Journal of Political Economy, 27(1), 36-43.

[10]. Edelberg, W. (2006). Risk-based pricing of interest rates for consumer loans. Journal of monetary Economics, 53(8), 2283-2298.

[11]. Ejsing, J., Grothe, M., & Grothe, O. (2012). Liquidity and credit risk premia in government bond yields.

[12]. Vo, L. V., & Le, H. T. (2023). From Hero to Zero-The Case of Silicon Valley Bank. Available at SSRN 4394553.

[13]. Kyriazis, N. A. (2022). Optimal Portfolios of National Currencies, Commodities and Fuel, Agricultural Commodities and Cryptocurrencies during the Russian-Ukrainian Conflict. International Journal of Financial Studies, 10(3), 75.

Cite this article

Sun,M. (2023). Research on the Impact of U.S. Interest Rate Soaring. Advances in Economics, Management and Political Sciences,40,9-13.

Data availability

The datasets used and/or analyzed during the current study will be available from the authors upon reasonable request.

Disclaimer/Publisher's Note

The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of EWA Publishing and/or the editor(s). EWA Publishing and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content.

About volume

Volume title: Proceedings of the 7th International Conference on Economic Management and Green Development

© 2024 by the author(s). Licensee EWA Publishing, Oxford, UK. This article is an open access article distributed under the terms and

conditions of the Creative Commons Attribution (CC BY) license. Authors who

publish this series agree to the following terms:

1. Authors retain copyright and grant the series right of first publication with the work simultaneously licensed under a Creative Commons

Attribution License that allows others to share the work with an acknowledgment of the work's authorship and initial publication in this

series.

2. Authors are able to enter into separate, additional contractual arrangements for the non-exclusive distribution of the series's published

version of the work (e.g., post it to an institutional repository or publish it in a book), with an acknowledgment of its initial

publication in this series.

3. Authors are permitted and encouraged to post their work online (e.g., in institutional repositories or on their website) prior to and

during the submission process, as it can lead to productive exchanges, as well as earlier and greater citation of published work (See

Open access policy for details).

References

[1]. Federal Funds Target Range - Upper Limit. (2023, May 29). https://fred.stlouisfed.org/series/DFEDTARU

[2]. Sticky Price Consumer Price Index less Food and Energy. (2023, May 10). https://fred.stlouisfed.org/series/CORESTICKM159SFRBATL

[3]. Fama, E. F. (1977). Interest rates and inflation: the message in the entrails. The American Economic Review, 67(3), 487-496.

[4]. González‐Aguado, C., & Suarez, J. (2015). Interest rates and credit risk. Journal of Money, Credit and Banking, 47(2-3), 445-480.

[5]. Jordan, B. D., & Kuipers, D. R. (1997). Negative option values are possible: The impact of Treasury bond futures on the cash US Treasury market. Journal of Financial Economics, 46(1), 67-102.

[6]. Kim, D. H., & Stock, D. (2014). The effect of interest rate volatility and equity volatility on corporate bond yield spreads: A comparison of noncallables and callables. Journal of Corporate Finance, 26, 20-35.

[7]. Stock, J. H., & Watson, M. W. (2008). Phillips curve inflation forecasts.

[8]. Fuhrer, J. C. (1995). The Phillips curve is alive and well. New England Economic Review, 41-57.

[9]. Von Hagen, J., Schuknecht, L., & Wolswijk, G. (2011). Government bond risk premiums in the EU revisited: The impact of the financial crisis. European Journal of Political Economy, 27(1), 36-43.

[10]. Edelberg, W. (2006). Risk-based pricing of interest rates for consumer loans. Journal of monetary Economics, 53(8), 2283-2298.

[11]. Ejsing, J., Grothe, M., & Grothe, O. (2012). Liquidity and credit risk premia in government bond yields.

[12]. Vo, L. V., & Le, H. T. (2023). From Hero to Zero-The Case of Silicon Valley Bank. Available at SSRN 4394553.

[13]. Kyriazis, N. A. (2022). Optimal Portfolios of National Currencies, Commodities and Fuel, Agricultural Commodities and Cryptocurrencies during the Russian-Ukrainian Conflict. International Journal of Financial Studies, 10(3), 75.