1. INTRODUCTION

1.1 Purpose of Research

The research on how search cost primarily affects price dispersion has evolved ceaselessly over the last six decades. In 1961, the notion that search cost causes price dispersion was proposed by Stigler [1]. Around 20 years later in the 1980s, economists started to realize that asymmetric information is mainly responsible for high search costs. As research in asymmetric information developed, economists then began to specialize in a new branch, customer heterogeneity. Papers published mostly in the 2000s suggested the partial dependency of customer heterogeneity on asymmetric information, as well as proposed new factors to explain the observed price dispersion in the market. And until recent times, another affiliated branch, consumer confusion, was mentioned by several economists.

By collecting abundant information from relevant papers, analyzing, and refining the currently available academic insights, we aim to trace the advancement in those economic papers critically, point out an integrated conceptual framework of this topic, spotlight research gaps along with unicity of arguments, and finally propose the future directions. We hope this paper can provide a reference for subsequent Economic studies and promote academic development.

1.2 Structure

This paper consists of three sections, the introduction, literature review, and the conclusion. The factor proposed in the research question, search cost, will be discussed shortly in the introduction section as the fundament of this study.

Our literature review mainly focuses on three specific branches within search cost, which are asymmetric information, customer heterogeneity and consumer confusion. Within each branch, integrating pieces of literature with similar experiment results and arguments facilitates the explanation of their indirect contributions to the existence of price dispersion by directly affecting the level of search cost, followed by limitations of each statement as well. To reach the purpose of our research, suggestions of ideas for further study of each topic are provided at the end of each branch.

The conclusion of this paper not only summarises the causal relationship between search cost and price dispersion but also identifies the unicity of this research question, that perhaps search cost is not the primary cause of price dispersion observed in markets. This evaluation is completed through the acknowledgement of supply-side factors, such as seller heterogeneity.

1.3 The Effect of Search Cost

As mentioned previously, Stigler proposed the causality between search cost and price dispersion as early as 1961. Stigler’s theoretical explanation that buyers will become reluctant to obtain sufficient information once their cost of searching for such information is excessive severely contradicts the previously well-established law of one price, hence the existence of price dispersion.

This belief is later highlighted by a comparison between atomistic models and a duopoly [2]. The findings that search will only be induced in a duopoly when firms lower prices with more firms entering the market suggest the perceived price elasticity with duopoly is greater than that with the atomistic competition. This is because as the number of firms in a duopoly market increases, the cost of acknowledging a lower-price store also increases. Hence, the amount of search induced decreases, and the level of price dispersion rises accordingly. While this phenomenon is not observed in atomistic models, it can be concluded that Stiglitz’s finding proves that in reality, there is a positive relationship between search cost and price dispersion, as perfect competition does not practically occur.

Mathematical models built later justify the causal effect search cost has on price dispersion further [3]. The finding of this model has taken customers’ compromises into account and illustrated that consumers are more likely to compromise concerning their ideal products, specifically in electronic markets. Therefore, while consumers become less demanding due to unwillingness to bear high search costs, the competition level in the market is reduced. Price dispersion thus exists, as profit-driven firms now are incentivised to push up their prices.

2. LITERATURE REVIEW

2.1 Asymmetric Information

2.1.1 The Effect of Asymmetric Information

Asymmetric information is thought to be the most influential branch within the factor of search cost, as ultimately search cost is chiefly affected by the amount of information customers obtain. Therefore, the existence of asymmetric information enables the prevalence of price dispersion by initiating contrasting degrees of search cost.

This notion is evidenced in three papers, which all suggest that customers can be divided into informed and uninformed ones [4][5][6]. With the informed customers acknowledging what the lowest price stores are, there is a motivation for other firms to deviate for a higher price to exploit the uninformed shoppers, who will face a much higher search cost when comparing prices. Price dispersion hence inevitably occurs and will be maintained due to higher-price stores always absorbing enough uninformed customers who are unwilling to bear high search costs. With asymmetric information, the market equilibrium results in price dispersion where a fraction of the stores sells at the competitive price and the rest sell at a higher price.

Stahl’s analysis focusing on uniting both Bertrand and Diamond’s arguments reinforced the approach above [7][8][9]. The positive relationship between the quantity of information customers hold and their search cost is indicated by Stahl’s observation that the Nash equilibrium (NE) moves continuously and monotonically from the Bertrand results (where the unique NE is Walrasian price) to the Diamond results (where the unique NE is the monopoly price) when the proportion of customers with zero-search costs decreases from 1 to 0. Accordingly, asymmetric information contributes to the presence of price dispersion indirectly.

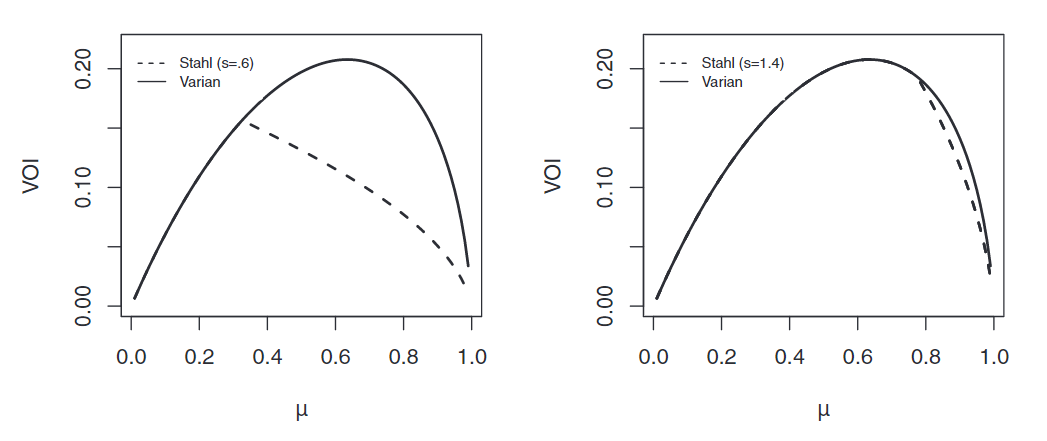

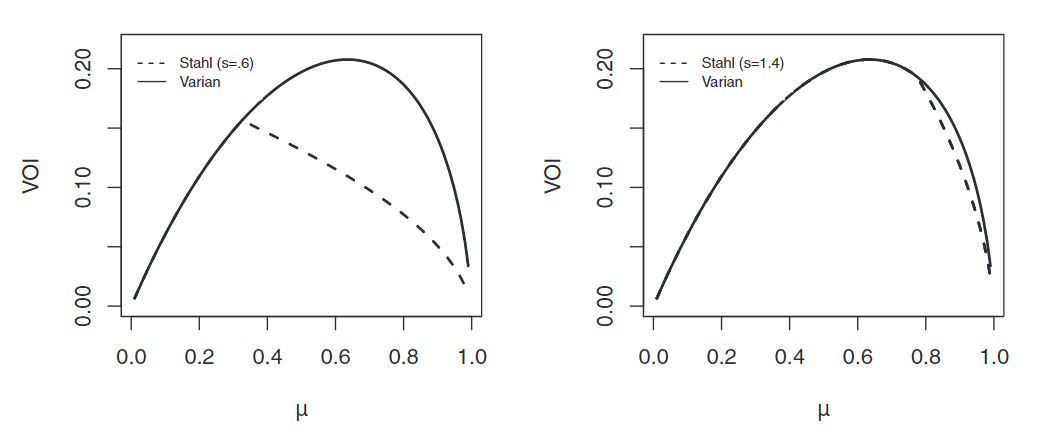

As research in this area develops, two groups of economists respectively further strengthened the mentioned argument. Firstly, Salop and Stiglitz’s model’s accuracy is buttressed by a case put forward by Balis and Perloff [10]. Assuming most customers wanting to buy a camera on the Internet have little information on where their most desired product will be, Balis and Jeffrey found that it usually takes more than three pages to finally reach the ideal camera and that the prices on later pages are lower, too. This discovery consequently confirms that uninformed customers will face a much higher search cost and are most likely to land on higher-price stores after quitting their searching, enabling price dispersion to persist. Furthermore, the strong statistical evidence found by a case study on the retail gasoline market in Austria also advanced the negative relationship between consumer information and price dispersion, as shown by the inverse-U-shaped figures below [11]. The authors combined Varian and Stahl’s models in one picture, where the solid lines indicate the relationship between μ (which refers to informed consumers) and VOI (which is the value of information, hence the measure of price dispersion) suggested by Varian’s model, and the dashed lines represent the relationship induced by Stahl’s model. As the graphs show, the two models coincide at a low enough μ when s is smaller in the left panel, and only differ when VOI peaks. Therefore, the conception that asymmetric information causes price dispersion is further emphasised.

Fig. 1 Combination of Stahl and Varian’s Models: The Relationship Between Information and Price Dispersion

Overall, works of literature starting from the 1970s to nowadays all demonstrate the causal effect asymmetric information has on price dispersion by encouraging different levels of search cost for customers. Lowest-price stores are winners, as not only they are automatically consumed by informed customers, but also attract some uninformed consumers by chance.

2.1.2 Limitation

However, this argument can be refuted by an example provided by Brynjolfsson and Michael, who pointed out that Amazon has the largest proportion of sales in online book sales, but is far from the leader in having lower prices [12]. This finding leads to questions on the complete dominance of asymmetric information has over affecting price dispersion, which will be discussed in later sections.

2.1.3 Further Development

As this paper aims to deliver suggestions for developing a deeper understanding of the role of asymmetric information in affecting search cost and hence price dispersion, more factors are to be considered, such as the prominence of firms in a search platform suggested by Wilson [13]. The acquisition of a prominent position by a firm through advertising ultimately enables more customers to gain information about the said firm, consequently attracting more consumers and therefore higher profits even at an extremely small cost of further search. For this reason, the most relevant firms may be willing to pay the most for such prominent positions such that their products can be matched to customers most quickly and easily, resulting in a higher consumer surplus and efficiency due to fierce competition over these positions on price comparison sites. In this case, price dispersion is deemed to decrease to an extent. However, in other cases where search engines decide to reduce the precision of search results in order to earn more profits through the use of cost-per-click payments, firms have a smaller incentive to pay for prominent positions, and the price competition level decreases significantly, leading to a higher equilibrium price and hence larger price dispersion.

The factor, asymmetric information itself, needs closer inspections, too. Determining which type of asymmetric information is the most common in causing price dispersion is crucial to further research in this area. For instance, a cheaper information source such as online videos or blogging would be ideal in solving adverse selection, as it ultimately reduces the role of insider information by preventing people in power from withholding essential information from the customers. On the other hand, if it turns out to be a moral hazard problem, some policies should be imposed in order to restrain firms from enabling customers to pay high prices for highly risky actions.

We also acknowledge that most measures of asymmetric information are mere proxies, hence generally difficult to determine the exact degree of asymmetric information. However, it is plausible to learn where the level of asymmetry of information lies on the spectrum. The bid-ask spread should be noted, as the bid-ask spread essentially reflects the difference between the maximum willingness of a customer and the lowest price for a seller to accept. Taken data from S&P 500 stocks, the average bid-ask spread is around 13%-18%, suggesting the possibility of an asymmetric information problem once the bid-ask spread is over approximately 20%. The wider the bid-ask spread, the higher the degree of asymmetric information.

2.2 Customer Heterogeneity

2.2.1 The Effect of Customer Heterogeneity

In 1961, Stigler discovered an inverse relationship between the level of frequency of purchase and the level of price dispersion. Another factor of customer heterogeneity which is the nonzero price elasticity of customers’ demand curves was demonstrated by Reinganum [14]. Following the assumption that all buyers are homogeneous and that they each follow a sequential search strategy, a common reservation price Pr and common demand curves for all goods will be shared. However, the assumption of the inelastic demand curve (e<-1) will be considered inappropriate, given the marginalist demand theory. In addition, other substitution and income effects will interplay, resulting in varied demand. Thus, as customers’ demand for homogeneous products has been proved different, firms can exploit customers who are more price inelastic than others by charging them a higher price, hence the occurrence of price dispersion. Later, Stigler’s belief was further supported by Nelson, Cohen, and Rasmussen who mentioned several factors within customer heterogeneity that affect price dispersion, which are the frequency of purchase, customers awareness, and the options customers have [15]. These three factors all have an inverse relationship with price dispersion. For example, if customers search less frequently, they will gain less information about the product and the level of price dispersion will increase. Later in 2010, Dubois and Helena found out that the prices paid by customers will increase with the increasing opportunity cost of time, indicating that search cost is an important component of customer behavior [16]. They also discovered that the opportunity cost of time on prices paid is different among different people by demonstrating heterogeneities of people, including ages, class, number of children, level of education, and household size. In addition, customers who are time-constrained will search less intensively and end up paying higher prices for identical products than others. In 2015, an empirical study of the positive relationship between conspicuous consumption and price tolerance was conducted by Wang using 287 samples of fast fashion apparel products, which indicates that conspicuous consumption is also a factor of a higher price [17].

To sum up, four main types of customer heterogeneity can result in price dispersion: frequency of purchase, PED of customers, the different opportunity costs of time for different customers, and conspicuous consumption. Meanwhile, firms will exploit customers with a more inelastic PED by setting a higher price. In addition, different opportunity costs of time which is the search cost for different customers will lead to price dispersion, and customers with a higher opportunity cost of time will end up paying higher prices.

2.2.2 Limitation

Yet limitations still existed. A case in point is that, previously researched aspects of customer heterogeneity may not be well-comprehensive while other diverse types of customer heterogeneity are left undiscussed. For example, different geographic locations could be taken into account.

2.2.3 Further Development

For further development, given the existed heterogeneity of customers, proceeding with the research on how customer heterogeneity affects the price dispersion could be crucial for scholars who are interested in this topic, thus, leading to more factors of customer heterogeneity being considered and explored. Further research is needed to analyze whether customers’ sensitivity to price can lead to higher price dispersion. For instance, we assume that electronic payment causes customers’ insensitivity to price. As a result, they may be more irrational while shopping, since the feeling of spending money is less obvious than paying cash, leading to higher price dispersion. In addition, price dispersion may appear due to the varied geographical locations of customers. For instance, customers who live downtown may receive higher quotations of organic vegetables than people living in rural areas due to the lack of space in cities to grow crops, firms will include transport costs on their quotations, and this will lead to higher prices paid by the city dwellers.

2.3 Consumer Confusion

2.3.1 The Effect of Consumer Confusion

As early as 1987, the phenomenon that it is possible for individuals to remain customers at a store for a long period after purchasing was noticed by Stigiliz, which was also agreed upon by Ronayne and Taylor [18]. He explained that since the PED of customers is inelastic, even if sellers set a higher price, customer retention is easy as customers are somehow tricked into thinking the seller whom they’re most familiar with is the best option. Yet at that time, the research system of consumer confusion had not been formed.

Then in 2009, imperfect consumer decisions were well documented by Carlin, which was a foundation of consumer confusion and many scholars began to focus on the relationship between consumer confusion and price dispersion since then [19]. As for the main question, how consumers are confused, different scholars gave different interpretations. Based on Carlin’s view, Chioveanu and Zhou mentioned that retailers change the way prices are presented which they called price framing, frequently [20]. So, consumers may be confused by prices at different frames or two prices in the same but incomprehensible frame. Thus, consumers can be divided into four types: fully aware ones, consumers confused by different price frames, consumers confused by frame complications, and fully bewildered ones. As a result, for some consumers, the search cost of price is so high that they will fail to identify the best available deal in the market, leading to price dispersion.

Table 1 Effect of Price Framing on Consumers

Frame Complexity | |||

Frame Differentiation | Awareness | Confusion | |

Awareness | Fully aware | Confused by a complex frame | |

Confusion | Confused by different frames | Fully confused | |

Then the following year, this question was continually focused on by Gu and Wenzel [21]. They promoted Consumer Confusion Theory by developing a theoretical model of strategic obfuscation. And they found that the more prominent firms are, the higher prices will be set due to their larger power to confuse consumers. There are other explanations for how consumers are confused. According to Hirshleifer and Welch, consumers cannot remember their past decisions [22]. A similar idea is shared by Kutlu as he believes that consumers cannot remember the exact price but only remember whether the price is below or above their valuation of goods [23].

As for how price dispersion can be induced, Ronayne and Taylor used two regimes to elucidate further, which is an innovation. In the first regime, the competitive channel attracts the most sensitive consumers by asking for a low fee, resulting in the lowest price in the market. Meantime, sellers attract their captive consumers at high prices through direct channels. In the other regime, sellers undercut the fee and compete for price-sensitive consumers in their direct prices so that the situation is reversed. Either way, price dispersion will inevitably occur, as consumers are confused about which platform would be the best.

Concisely, according to different scholars, there are many factors from various aspects which lead to consumer confusion, including different price framings, the prominence of firms, consumer loyalty, memory, and so on, thus increasing search costs. And how price dispersion is increased then is also expatiated.

2.3.2 Limitation

However, there are also some limitations that remain to be elucidated. In recent years, as the Internet has become the main channel for acquiring price information, consumer confusion has become an important phenomenon. Despite recent progress, as a relatively new branch, scholars have not paid enough attention to how consumer confusion affects price dispersion. So, research on this issue is very limited, and many factors are not taken into account. Furthermore, although current papers have focused on several sources of consumer confusion, there is a lack of a unified scale to measure consumer confusion.

2.3.3 Further Development

For one thing, more factors can be taken into account, as for consumer confusion. It is worthwhile to focus on whether the amount of information that customers have access to affects consumers’ decisions, thus influencing price dispersion, as we believe that if there is a lack of information, consumers will be confused about which product to buy, and if there is information overload of a product, it is difficult for customers to evaluate whether purchasing the product is a good deal or not. We can also focus on whether choice overload can increase price dispersion. A typical example is that some supermarkets display more than 1,000 different kinds of wine, leaving confused consumers with a difficult selecting decision, which may cause irrational consumption, leading to higher price dispersion. Meanwhile, different store environments, the time of shopping, the number of people shopping together, and so on can also be taken into account. For another thing, scholars need to clarify the dimensions of consumer confusion further and develop corresponding measurement scales so that it will be helpful to combine different papers and compare which explanation of consumer confusion is more important while affecting price dispersion.

3. CONCLUSION

While traditionally industrial economics focused more on supply-side than demand-side issues in understanding the market, our paper aims to concentrate on the demand-side factors to deliver an analysis of the way search cost acts as a dominant force in generating price dispersion, as well as provide ideas for further study in this critical area. Based on our findings, there is a positive relationship between search cost and price dispersion, due to exploitation of customers who have imperfect information, customer heterogeneity, and consumer obfuscation.

Whist a considerable body of research has been carried out on supply-side explanations for price dispersion like search cost, much less is known about what affects price dispersion from the supply-side aspect, for instance, seller heterogeneity. Brynjolfsson and Michael proposed that the trust consumers have for the various Internet retailers and the associated value of branding can account for dispersion in Internet prices. But how to explain the phenomenon that it will only cost 1.78 dollar to buy a tall latte of Starbuck in Turkey while in Singapore, it will cost 4.5 dollar? In 2007, product and store dimensions were focused on by Berardi, Sevestre, and Thébault since they accounted for a significant proportion of the observed price dispersion, which can explain the price difference of Starbuck in different regions [24]. In addition, an empirical study of Clemons, Hann and Hitt [25] collected a total of 7512 tickets sample for their investigation and suggested the existence of price dispersion with service differentiation and strategies by firms. However, since it is a relatively new area, this problem has received scant attention and is poorly understood. As a result, more profound studies on what increases price dispersion should be established to fill the gap.

References

[1]. Stigler, G. J. (1961). The economics of information. Journal of political economy, 69: 213-225.

[2]. Stiglitz, J. E. (1987). Competition and the number of firms in a market: Are duopolies more competitive than atomistic markets?. Journal of political Economy, 95: 1041-1061.

[3]. Bakos, J. Y. (1997). Reducing buyer search costs: Implications for electronic marketplaces. Management science, 43: 1676-1692.

[4]. Salop, S., Stiglitz, J. (1977). Bargains and ripoffs: A model of monopolistically competitive price dispersion. The Review of Economic Studies, 44: 493-510.

[5]. Salop, S. C. (1979). Monopolistic competition with outside goods. The Bell Journal of Economics, 141-156.

[6]. Varian, H. R. (1980). A model of sales. The American economic review, 70: 651-659.

[7]. Stahl, D. O. (1989). Oligopolistic pricing with sequential consumer search. The American Economic Review, 700-712.

[8]. Bertrand, J. (1883). Théorie mathématique de la richesse sociale. Journal des savants, 67: 499-508.

[9]. Diamond, P. A. (1971). A model of price adjustment. Journal of economic theory, 3: 156-168.

[10]. Baylis, K., Perloff, J. M. (2002). Price dispersion on the Internet: Good firms and bad firms. Review of industrial Organization, 21: 305-324.

[11]. Pennerstorfer, D., Schmidt‐Dengler, P., Schutz, N., Weiss, C., & Yontcheva, B. (2020). Information and price dispersion: Theory and evidence. International Economic Review, 61: 871-899.

[12]. Brynjolfsson, E., Smith, M. D. (2000). Frictionless commerce? A comparison of Internet and conventional retailers. Management science, 46: 563-585.

[13]. Wilson, C. M. (2011). Advertising, search and intermediaries on the Internet: Introduction. The Economic Journal, 121: F291-F296.

[14]. Reinganum, J. F. (1979). A simple model of equilibrium price dispersion. Journal of Political Economy, 87: 851-858.

[15]. Nelson, R. A., Cohen, R., Rasmussen, F. R. (2007). An analysis of pricing strategy and price dispersion on the internet. Eastern Economic Journal, 33: 95-110.

[16]. Dubois, P., Perrone, H. (2010). Price dispersion and search costs: the roles of imperfect information and product differentiation. Unpublished manuscript.

[17]. Wang, Q (2015). Influence Factors of Consumer Price Tolerance in Fast Fashion Industry. Journal of Textile Research, 26: 153-160.

[18]. Ronayne, D., Taylor, G. (2020). Competing sales channels.

[19]. Carlin, B. I. (2009). Strategic price complexity in retail financial markets. Journal of financial Economics, 91: 278-287.

[20]. Chioveanu, I., Zhou, J. (2013). Price competition with consumer confusion. Management Science, 59: 2450-2469.

Cite this article

Han,Y.;Wu,J.;Chen,Y. (2023). Analysis on the Dominance of Search Cost in Affecting Price Dispersion. Advances in Economics, Management and Political Sciences,3,663-670.

Data availability

The datasets used and/or analyzed during the current study will be available from the authors upon reasonable request.

Disclaimer/Publisher's Note

The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of EWA Publishing and/or the editor(s). EWA Publishing and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content.

About volume

Volume title: Proceedings of the 6th International Conference on Economic Management and Green Development (ICEMGD 2022), Part Ⅰ

© 2024 by the author(s). Licensee EWA Publishing, Oxford, UK. This article is an open access article distributed under the terms and

conditions of the Creative Commons Attribution (CC BY) license. Authors who

publish this series agree to the following terms:

1. Authors retain copyright and grant the series right of first publication with the work simultaneously licensed under a Creative Commons

Attribution License that allows others to share the work with an acknowledgment of the work's authorship and initial publication in this

series.

2. Authors are able to enter into separate, additional contractual arrangements for the non-exclusive distribution of the series's published

version of the work (e.g., post it to an institutional repository or publish it in a book), with an acknowledgment of its initial

publication in this series.

3. Authors are permitted and encouraged to post their work online (e.g., in institutional repositories or on their website) prior to and

during the submission process, as it can lead to productive exchanges, as well as earlier and greater citation of published work (See

Open access policy for details).

References

[1]. Stigler, G. J. (1961). The economics of information. Journal of political economy, 69: 213-225.

[2]. Stiglitz, J. E. (1987). Competition and the number of firms in a market: Are duopolies more competitive than atomistic markets?. Journal of political Economy, 95: 1041-1061.

[3]. Bakos, J. Y. (1997). Reducing buyer search costs: Implications for electronic marketplaces. Management science, 43: 1676-1692.

[4]. Salop, S., Stiglitz, J. (1977). Bargains and ripoffs: A model of monopolistically competitive price dispersion. The Review of Economic Studies, 44: 493-510.

[5]. Salop, S. C. (1979). Monopolistic competition with outside goods. The Bell Journal of Economics, 141-156.

[6]. Varian, H. R. (1980). A model of sales. The American economic review, 70: 651-659.

[7]. Stahl, D. O. (1989). Oligopolistic pricing with sequential consumer search. The American Economic Review, 700-712.

[8]. Bertrand, J. (1883). Théorie mathématique de la richesse sociale. Journal des savants, 67: 499-508.

[9]. Diamond, P. A. (1971). A model of price adjustment. Journal of economic theory, 3: 156-168.

[10]. Baylis, K., Perloff, J. M. (2002). Price dispersion on the Internet: Good firms and bad firms. Review of industrial Organization, 21: 305-324.

[11]. Pennerstorfer, D., Schmidt‐Dengler, P., Schutz, N., Weiss, C., & Yontcheva, B. (2020). Information and price dispersion: Theory and evidence. International Economic Review, 61: 871-899.

[12]. Brynjolfsson, E., Smith, M. D. (2000). Frictionless commerce? A comparison of Internet and conventional retailers. Management science, 46: 563-585.

[13]. Wilson, C. M. (2011). Advertising, search and intermediaries on the Internet: Introduction. The Economic Journal, 121: F291-F296.

[14]. Reinganum, J. F. (1979). A simple model of equilibrium price dispersion. Journal of Political Economy, 87: 851-858.

[15]. Nelson, R. A., Cohen, R., Rasmussen, F. R. (2007). An analysis of pricing strategy and price dispersion on the internet. Eastern Economic Journal, 33: 95-110.

[16]. Dubois, P., Perrone, H. (2010). Price dispersion and search costs: the roles of imperfect information and product differentiation. Unpublished manuscript.

[17]. Wang, Q (2015). Influence Factors of Consumer Price Tolerance in Fast Fashion Industry. Journal of Textile Research, 26: 153-160.

[18]. Ronayne, D., Taylor, G. (2020). Competing sales channels.

[19]. Carlin, B. I. (2009). Strategic price complexity in retail financial markets. Journal of financial Economics, 91: 278-287.

[20]. Chioveanu, I., Zhou, J. (2013). Price competition with consumer confusion. Management Science, 59: 2450-2469.