1. Introduction

Known for its innovation, customer centrality, and quality products, Apple has been consistently setting new benchmarks in the industry since its inception in 1976. However, beyond the aesthetics and functionalities of its groundbreaking products, understanding the operational and financial mechanics that underpin Apple's success is key to gaining a comprehensive perspective of its corporate strategy and market position. The purpose of dissecting Apple's financial operations is to provide a rigorous assessment of the company's operational health and financial stability, as well as its key financial statements (cash flow statement, balance sheet, and income statement). The assessment aims to illuminate the financial strategies that contribute to Apple's industry-leadership and how its implementation will navigate market dynamics through 2022.

At the same time, using financial data as a lens can also provide valuable information and insight about Apple's operations. Study Apple's corporate management strategy as one of the world's most valuable companies, and the factors that underpin its success in 2022. Through these analyses, related industries can better identify opportunities for innovation and predict market changes in respond to changing customer needs. Moreover, product development strategy can be adjusted to cope with continuously evolving technology and market requirements.

2. Definition

2.1. Financial Statements

Financial statements are vital tools that provide detailed quantitative information about a company's performance, financial health, and cash flow [1]. These documents offer a comprehensive picture of a company's operations, facilitating informed decision-making for stakeholders such as investors, creditors, management, and regulatory agencies [2]. They play a significant role in fostering transparency, ensuring accountability, and providing a basis for strategic planning and forecasting [3].

2.2. Cash Flow

A cash flow statement is a financial statement that provides valuable information about a company's cash inflows and outflows during a specific period. It summarizes a company's operating, investing, and financing activities, providing insights into how businesses generate and use cash. The cash flow statement tracks cash inflows and outflows in three main areas within a company: operating activities, investing activities, and financing activities [2]. Operating activities deal with the cash flows from a company's core business, investing activities reflect cash used or provided by investing in assets and securities, and financing activities show how a company raises funds through the capital markets and repays them to investors [4].

2.3. Income Statement

The Income Statement, also known as the Profit and Loss Statement, outlines a company's revenues, costs, and expenses over a particular period [1]. It begins with sales and ends with net income, showing the company's earnings performance [4]. The income statement is critical for assessing a company's profitability, operational efficiency, and performance trends [3].

2.4. Balance Sheet

The balance sheet consists of three main parts: assets, liabilities, and shareholders' equity. Assets are resources owned by corporate that have future economic value. Liabilities are financial obligations or debts that company owes to external parties. Shareholders' equity, also known as net assets, is the remaining equity after deducting liabilities from corporate assets. Balance sheets are critical to analyzing a firm's liquidity and capital structure [5].

3. Apple's Cash Flow Statement

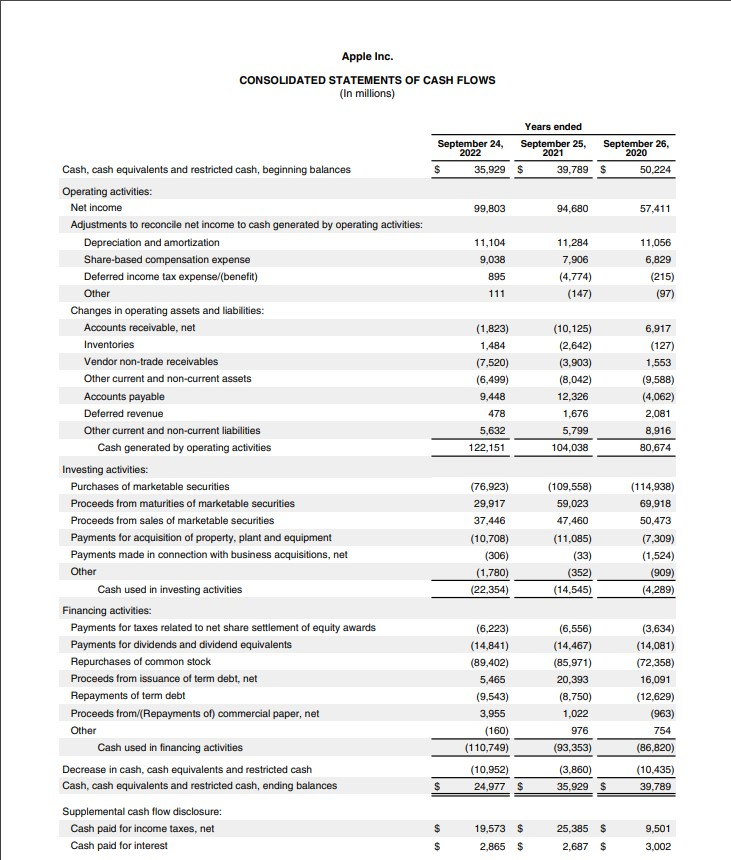

Apple's cash flow statement can be broken down into three core sections: operating cash flow, investing cash flow, and financing cash flow. Investing cash flow reflects cash used to invest in a company's long-term future, such as capital expenditures or securities investments. It can be a key indicator of future growth strategies and business expansion plans. Financing cash flow shows cash transactions between Apple and its investors and creditors, including dividend payments, stock repurchases, or debt repayments.

3.1. Apple's Operating Cash Flow

Operating cash flow illustrates the cash generated by Apple's core business operations, giving insight into the company's ability to generate enough cash to maintain and grow its operations. Figure 1 shows Apple's operating cash flow from 80,674 Million Dollar in 2020 to 104,038million Dollars from 2021, and then 122,151million Dollar in 2022 [6]. From this data, operating cash flow rose from 2020 to 2021. 28%, rose 17%from 2021 to 2022. Apple's operating cash flow is positive from 2020 to 2022, which is reached by the driver of several key factors, including high profitability, effective communication with consumers, service business, and customer loyalty.

Figure 1: Apple's operating cash flow [6].

A positive increase in operating cash flow indicates that Apple's core business operations are generating more and more cash. This is a good sign, as it indicates that Apple's primary activity is profitable and that it is able to fund the company's ongoing operations, service its current liabilities, and pay a dividend.

3.1.1. High Profitability

Compared with other companies such as Huawei and Samsung, Apple has relatively high profit margins, and has been able to maintain a high profit margin. As of March 31, 2023, Apple’s net profit The rate is 24.49%. In contrast, Huawei's net profit margin is only 2.3%, and Samsung's net profit margin is only 2.2%, which are far smaller than Apple's [7].

3.1.2. Effective Communication with Consumer

The employees of Apple's offline sales stores are a very effective communication technology. They approach clients with a personal, warm welcome and politely ask about their needs. Customers are most satisfied with Apple products at 92%, compared to 91% for Samsung and 85% for Google [8]. One of the reasons is effective communication technology. At the same time increase sales and generate revenue by attracting and retaining customers. And improved communication with consumers can enhance invoice processing, billing accuracy and timely payment collection [9].

3.1.3. Service Business

The growing service business. Because service income is also a part of operating cash flow, the growth of Apple's service income reflects the growth of operating cash flow from the side. Since the 20th century, Apple has been committed to developing its service business, including the revenue of App Store, Apple Music, Apple Care and other Services. The business department has a positive contribution to cash flow. Apple's service attitude has been at a high level [10].

3.1.4. Customer Loyalty

Apple has a highly loyal customer base, and the ecosystem of Apple devices encourages repeat purchases and upgrades, especially their phones, where Apple releases a new phone every year, so their customers always get a phone that makes them happy. Customer loyalty and repeat purchases can contribute to positive cash flow for a company. Because customers make repeat purchases of Apple's phones, it often leads to a steady stream of revenue. Higher revenue means more cash flowing into the company [8].

3.2. Investment Cash Flow

The investment cash flow in the company's cash flow statement mainly reflects the company's investment in long-term assets such as real estate, plant and equipment, and also includes investment or disposal of subsidiaries or other businesses. Positive cash flow from investing indicates that the company is selling more assets than it is buying, while a negative cash flow from investing generally indicates that the company is investing more in future growth by acquiring more assets.

Apple's investment cash flow rose from $4,289 million in 2020 to $22,354 million in 2022, with an important factor in reduding purchases of securities (Figure 2). In response to the impact of COVID-19 on Apple, Apple has reduced the purchase of securities, and the purchase amount has dropped from $114,938 million in 2020 to $76,923 million. The reduction in the purchase of securities has led to an increase in investment cash flow.

Figure 2: Apple's investment cash flow [6].

3.3. Financing Cash Flow

Apple's 2020-2022 financing cash flow trend is positive, indicating that the company issues debt or equity, reduces dividend payments, or buys back stock. Apple has repurchased a lot of stock in both 2022 and 2021. In 2021, Apple announced that it would increase its current share repurchase program authorization from $225 billion to $315 billion and increase its quarterly dividend from $0.205 to $0.22 per share. May 2021. In 2021, the company repurchased $85.5 billion in common stock and paid $14.5 billion in dividends and dividend equivalents [11]. A reduction in a company's dividend or share repurchases could result in increased financing cash flow.

Positive growth in financing cash flow suggests that Apple may invest in debt or equity. The offering raises more money, or reduces cash outflows such as dividends or debt repayments. This can provide additional capital to fuel the company's growth and investment plans.

4. Apple’s Balance sheet

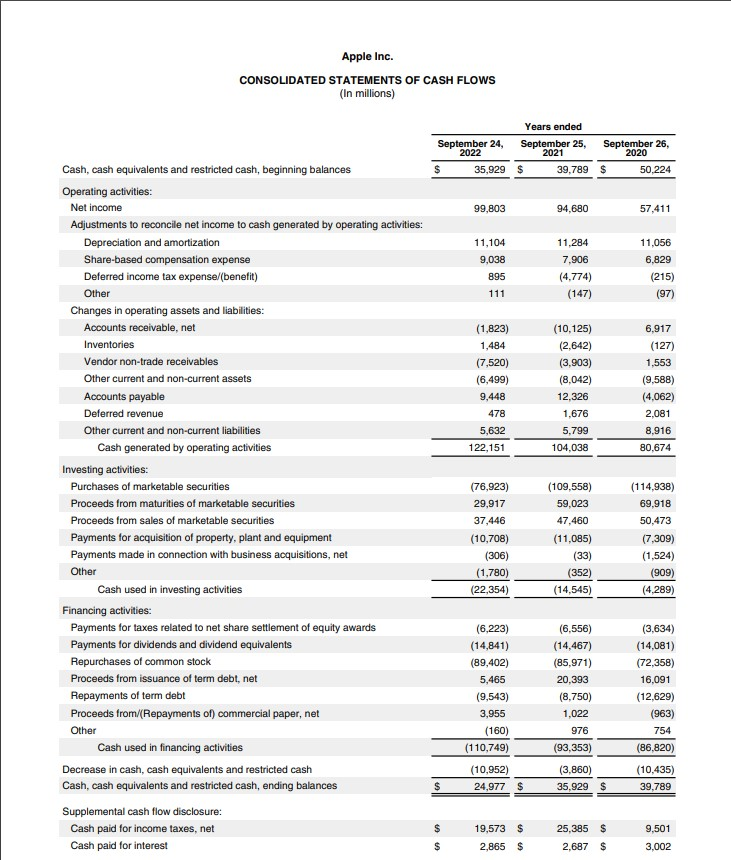

4.1. Asset

Apple's current and non-current assets from 2022 to 2021 have not undergone major changes. Figure 3 shows that current assets range from 134,836 million to 135,405 million, while non-current assets range from 351,002 million to 352,775 million. These data prove that the company's business operations are stable.

Figure 3: Consolidated balance sheet [6].

4.2. Liability

From 2022 to 2021, Apple's current liabilities and total liabilities increase. This is mainly due to Apple increasing financing to fund its operations or long-term investment strategy. For example, the company rented more equipment, and the cost of the lease increased from $14.6 billion dollars to $15.3 billion [6]. In April 2022, Apple announced that it will increase the budget to develop mobile phones from $315 billion to $405 billion [6]. While increased debt means higher financial risk, it does not always carry negative connotations. The impact of increased debt also depends on how Apple's assets and equity have changed over the same period.

4.3. Equity

Apple's retained earnings decreased from 2021 to 2022, and the value of common stock increased. This is because Apple announced that it will increase its quarterly dividend from $0.22 to $0.23 per share in 2022, and during 2022, Apple repurchased $902 billion in common stock and paid $14.8 billion in dividends and dividend equivalents [6]. Companies already pay dividends to shareholders, and while dividends are usually paid out of retained earnings, large dividends can reduce that account [6]. There is no major change in assets, but the increase in liabilities and the decrease in retained earnings are mainly due to Apple’s strategic investment. It has developed its products, such as iPhone 14 series, Air Pods Pro series, and Apple Watch Series 8 [6].

5. Income statement

An income statement provides an overview of a company's revenues, costs, and expenses for a specific period. It mainly consists of revenue, cost, fee, tax and net profit.

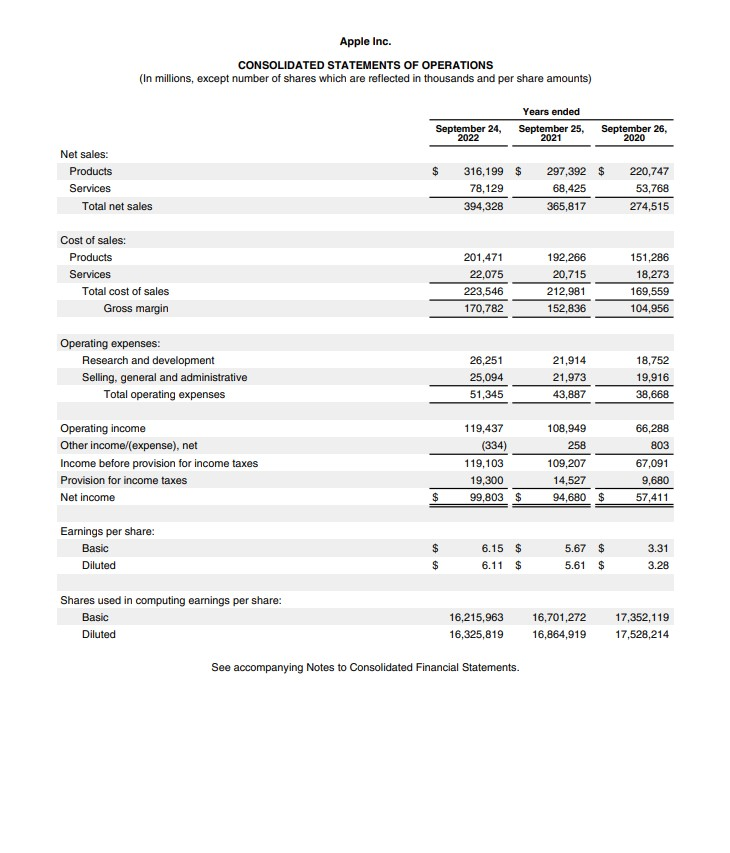

5.1. Revenue

Apple's revenue has been growing from 2021 to 2022. Through comparison, it is found that the growth rate from 2020 to 2021 is 33%, and the growth rate from 2021 to 2022 is 7% (Figure 4). Although the growth rate is declining, it still maintain a continuous growth trend. Apple's main source of income is still mobile phones. Affected by Covid-19 in 2020, the company's revenue is not high. However, after the Covid-19 epidemic stabilizes in 2021, the company's income suddenly increase due to retaliatory consumption. And this is thanks to successful product launches, an expanding customer base, and strong brand loyalty. Revenue growth also reflects Apple's ability to generate sales and meet customer demand.

Figure 4: Consolidated statement of operations [6].

5.2. Cost and Expense

As Apple's revenue grows, it increases input costs, and so does its cost of sales. Apple's costs and expenses have been growing from 2021 to 2022. Cost has increased from the $152,836 million to $170,782 million, and expenditures have increased from $43,887 million to $51,345 million. This is mainly because the cost of sales (COGS), operating expenses, and research and development (R&D) costs have been increasing. Apple's research and development of Apple mobile phones has not stopped, which has also led to high research and development costs for Apple. However, based on the ability to sell new products, heavy investments in innovation should create the higher revenues in the future. In addition, in the face of fierce competition in the market, the company also needs to continuously expand into new markets and increase the promotion of new products. As a result, higher marketing and sales costs are also incurred. Furthermore, the increase in taxes due to Apple's timely commitment and fulfillment of its social responsibilities is also the reason for the increase in Apple's revenue.

6. Conclusion

This article comprehensive analyses Apple's cash flow statement, balance sheet, and income statement to comprehensive understand Apple's financial status and operating performance. Apple has been growing healthily, making up for losses during the Covid-19 pandemic. And Apple's operations have been strong and are constantly refining its financial strategy. The company's financial performance and cash management strategy have been very effective, as evidenced by increased revenue, effective cost management, and expanded asset base. While Apple must continue to manage potential risks and challenges, the overall analysis indicates that it has a sound and effective operational and financial strategy. In addition, stakeholders should continue to monitor Apple's financial statements and key performance indicators to assess the company's continued financial health and operational success.

References

[1]. Epstein, Barry J. and Ralph Naher. Wiley GAAP: Interpretation and Application of Generally Accepted Accounting Principles. Wiley Press, 2011.

[2]. Warren, Carl S., and James M. Reeve. financial accounting. Southwest Cengage Learning, 2012.

[3]. Albrecht, W. Steve, and Earl K. Stice. Accounting: Concepts and Applications. Southwest Cengage Learning, 2011.

[4]. Wahlen, James M., Stephen P. Baginski, and Mark Bradshaw. Financial reporting, financial statement analysis and valuation. Southwest Cengage Learning, 2011. "cash flow statement."Apple Inc. "Form 10-K."2022, https://s2.q4cdn.com/470004039/files/doc_financials/2022/q4/_10-K-2022-(As-Filed).pdf.

[5]. Brealey, Richard A., Stewart C. Myers, and Franklin Allen. Principles of corporate finance. McGraw-Hill/Owen, 2011.

[6]. Apple Inc. "Form 10-K." United States Securities and Exchange Commission, 2022, https://s2.q4cdn.com/470004039/files/doc_financials/2022/q4/_10-K-2022-(As-Filed).pdf.

[7]. "Apple's Profit Margins 20011-2023 | AAPL." Macro Trends. 2021, https://www.macrotrends.net/stocks/charts/AAPL/apple/profit-margins.

[8]. "Brand Loyalty for Apple iPhone in the US 2021-2022." Statistician. 2022, https://www.statista.com/chart/27694/satisfaction-and-brand-loyalty-among-us-smartphone-users/.

[9]. "How the Apple Store Creates an Irresistible Customer Experience" Forbes. 2015, https://www.forbes.com/sites/carminegallo/2015/04/10/how-the-apple-store-creates-irresistible-customer-experiences/?sh=3b053cac17a8.

[10]. "Apple Services Revenue 20013-2023 | Statista." Statistician. 2021, https://www.statista.com/statistics/250918/apples-revenue-from-itunes-software-and-services/

[11]. Apple Inc. "Form 10-K." United States Securities and Exchange Commission, 2021, https://s2.q4cdn.com/470004039/files/doc_financials/2021/q4/_10-K-2021-(As-Filed).pdf.

Cite this article

Chen,K. (2023). Analysis of Apple’s Financial Statements. Advances in Economics, Management and Political Sciences,43,225-231.

Data availability

The datasets used and/or analyzed during the current study will be available from the authors upon reasonable request.

Disclaimer/Publisher's Note

The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of EWA Publishing and/or the editor(s). EWA Publishing and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content.

About volume

Volume title: Proceedings of the 7th International Conference on Economic Management and Green Development

© 2024 by the author(s). Licensee EWA Publishing, Oxford, UK. This article is an open access article distributed under the terms and

conditions of the Creative Commons Attribution (CC BY) license. Authors who

publish this series agree to the following terms:

1. Authors retain copyright and grant the series right of first publication with the work simultaneously licensed under a Creative Commons

Attribution License that allows others to share the work with an acknowledgment of the work's authorship and initial publication in this

series.

2. Authors are able to enter into separate, additional contractual arrangements for the non-exclusive distribution of the series's published

version of the work (e.g., post it to an institutional repository or publish it in a book), with an acknowledgment of its initial

publication in this series.

3. Authors are permitted and encouraged to post their work online (e.g., in institutional repositories or on their website) prior to and

during the submission process, as it can lead to productive exchanges, as well as earlier and greater citation of published work (See

Open access policy for details).

References

[1]. Epstein, Barry J. and Ralph Naher. Wiley GAAP: Interpretation and Application of Generally Accepted Accounting Principles. Wiley Press, 2011.

[2]. Warren, Carl S., and James M. Reeve. financial accounting. Southwest Cengage Learning, 2012.

[3]. Albrecht, W. Steve, and Earl K. Stice. Accounting: Concepts and Applications. Southwest Cengage Learning, 2011.

[4]. Wahlen, James M., Stephen P. Baginski, and Mark Bradshaw. Financial reporting, financial statement analysis and valuation. Southwest Cengage Learning, 2011. "cash flow statement."Apple Inc. "Form 10-K."2022, https://s2.q4cdn.com/470004039/files/doc_financials/2022/q4/_10-K-2022-(As-Filed).pdf.

[5]. Brealey, Richard A., Stewart C. Myers, and Franklin Allen. Principles of corporate finance. McGraw-Hill/Owen, 2011.

[6]. Apple Inc. "Form 10-K." United States Securities and Exchange Commission, 2022, https://s2.q4cdn.com/470004039/files/doc_financials/2022/q4/_10-K-2022-(As-Filed).pdf.

[7]. "Apple's Profit Margins 20011-2023 | AAPL." Macro Trends. 2021, https://www.macrotrends.net/stocks/charts/AAPL/apple/profit-margins.

[8]. "Brand Loyalty for Apple iPhone in the US 2021-2022." Statistician. 2022, https://www.statista.com/chart/27694/satisfaction-and-brand-loyalty-among-us-smartphone-users/.

[9]. "How the Apple Store Creates an Irresistible Customer Experience" Forbes. 2015, https://www.forbes.com/sites/carminegallo/2015/04/10/how-the-apple-store-creates-irresistible-customer-experiences/?sh=3b053cac17a8.

[10]. "Apple Services Revenue 20013-2023 | Statista." Statistician. 2021, https://www.statista.com/statistics/250918/apples-revenue-from-itunes-software-and-services/

[11]. Apple Inc. "Form 10-K." United States Securities and Exchange Commission, 2021, https://s2.q4cdn.com/470004039/files/doc_financials/2021/q4/_10-K-2021-(As-Filed).pdf.