1. Introduction

Through the research of the blind box economy, there are some biases, such as status quo, endowment effect, empowerment effect, anchoring effect, etc. Due to the fact that the anchoring effect can be reflected everywhere in life, anchoring thus seems to be a general phenomenon underlying a wide variety of processing strategies. This article will study it through three aspects: individual, market, and investment. Individual differences in anchoring were investigated by Matthew B et al. Experiments reveal that participants demonstrated clear anchoring effects on our experimental task, however the degree of bias decreased as the card game advanced [1]. These results imply that players may have developed a more accurate understanding of the underlying chances of winning based on the various hands. When genuine values were taken into account, the average partial correlation between participants' estimates and the anchors they had seen decreased from 0.28 in the first quarter of the trials to 0.12 [1]. The purpose of this article is to study the anchoring effect between individuals, markets, and investments based on existing literature and relevant experimental results, as well as the impact of the anchoring effect and which factors may affect it. The research in this article can provide individuals and investors with a better understanding of the relevant knowledge of anchoring effects and correspondingly reduce adverse effects in personal decision-making.

2. Anchoring Effect

The anchoring effect is the phenomenon of “different starting points producing different estimates that lean towards the initial values” [2]. Professor Musweller said that the anchoring effect is the “assimilation of numerical estimates into previously considered standards” so, the anchoring effect is a type of cognitive bias [3]. Why does it matter? Anchoring effects are common in both the individual, market, and investment worlds. People’s initial judgment and decision on something can greatly affect the final outcome. Investors may overlook long-term risk control and asset allocation due to excessive pursuit of short-term investment returns (anchors), which may lead to a decrease in returns. Investors will use the highest price as a reference value, excessively anchoring the highest price, ignoring the true reasons for stock decline, and being unable to identify risks.

3. Anchoring in Individual

Individual differences and susceptibility to the influence of anchoring signals were investigated by Adrian Furnham and colleagues from University College London in London, UK. The 172 undergraduate students found in this study had an average age of 19.6 years. Participants were split into two groups; one group received questions with high anchors, while the other group received questions with low anchors. The following anchor nail criteria were chosen at random for them: "What is the current population of Ukraine?" How many nations are there in Africa today? How far from the sea can you get in England? And how many Americans have permits to keep lions, leopards, and tigers as pets [4].

Table 1: Anchor values used and the correct answer for each anchoring task [4].

Heading level Title (centered) | Anchors used | Correct answer | ||

High | Low | |||

What is the current population of the Ukraine? | 68 million | 22 million | 45.7 million | |

How many countries are there in Africa today? | 77 | 17 | 54 | |

In England, what is the greatest distance you can be from the sea? | 113 miles | 49 miles | 70 miles | |

How many people in America have licenses to keep lions, leopards and tigers as pets? | 187 | 24 | 76 | |

Table 1 shows that anchors have a significant impact on the estimated values of each problem. The estimates given by high anchor respondents are significantly higher than those given by low anchor respondents. The strongest anchor effect (measured in R2) is related to the current number of African countries, with anchors accounting for approximately 40% of the variance. It can be observed that the average estimate caused by a high anchor (77) is very close to the true value (54), but the average estimate caused by a low anchor is about to deviate from the true value. In the second major issue of the impact of re anchoring, anchors account for approximately 20% of the variance.

4. Anchoring in Marketing

Franz-Rudolf Esch, et al. have studied the brand anchoring effect in the market. Propose based on two assumptions: there are two brands forming a co branded brand, one with high visibility and the other with low visibility. A high-profile brand will have a greater impact on people’s influence on this co-branded brand. Two brands with similar brand awareness will also affect co-branded brands.

Study 1: Randomly sample and survey some people for research, giving respondents a questionnaire divided into three parts separated by filling tasks. Divide the respondents into two parts and have them evaluate the co branded brands first, followed by evaluating the two brands separately. Some people evaluate a group consisting of one well-known and one unknown, while others evaluate a group consisting of two individuals with similar popularity.

Aaker’s brand personality scale was used to assess respondents, and distance measures were calculated by contrasting the ratings of hypothetical co-branded brands with those of each brand. It is possible to demonstrate the presence of an anchoring effect when the distance measurement is small, but not otherwise. The sum of the squared differences between the profiles is X. The second measurement, the global distance D, is the square root of the sum of the differences.

To evaluate the correlation, the q-correlation of Hofstätter was also used, and the q-coefficient ranges from 1.00 (maximal similarity) to 1.00 (no similarity) [5].

Table 2: Results of study 1 [6].

Brand Alliance with a High and a Low Awareness Brand (Test of H1) (n=40) | Brand Alliance with a Two Low Awareness Brand (Test of H1) (n=40) | |||

Title (centered) | Comparison of the Profiles of Signal and Colgate/Signal | Comparison of the Profiles of Colgate and Colgate/ Signal | Comparison of the Profiles of Sensodyne and Signal/ Sensodyne | Comparison of the Profiles of Signal and Signal Sensodyne |

Global distance (D) | 1.66a | 0.67b | 0.74 | 0.65 |

Square sum of the differences (X) | 2.74a | 0.45b | 0.55 | 0.43 |

q-correlation | 0.68 | 0.97 | 0.94 | 0.95 |

Note: Within row, following a t-test, means with different superscripts (a,b) differ significantly at p < 0.05. All correlations are significantly different from q = 0. A significance test between correlation does not exist for the measure q.

According to Table 2, it is clear that the sum of squares of the differences between co branded brands and signals is X=2.74. According to the t-test, it is significantly higher than the sum of squares of the differences between co branded brands and Colgate (X=0.45, P<0.05). Moreover, the correlation between co branded brands and Colgate is stronger. This confirms hypothesis 1 that consumers’ impression of co branded brands is more influenced by high visibility brands. In comparing the data of similar products, it can be found that q is almost the same in both cases (q=0.95, q=0.94). It can be confirmed that hypothesis 2 is also valid.

Study 2: It studied the anchoring effect of replicating a new product category with high and low visibility. In addition, it was also studied that when the popularity of both brands is relatively high, the relatively more well-known brands have a more significant anchoring effect. (The two brands studied are Milka and Ritter Sport, the research method is vastly different from the previous experiment)

The difference between co branded brands and Milka’s products is smaller, with co branded brands and Milka having almost the same image, but completely different from the brand Hachez. According to Figure 2, the comparative data shows that brand images with relatively higher visibility are closer to co branded brands, indicating the existence of anchoring effect, confirming hypothesis 1. In contrast, brands belong to relatively high visibility, and there is no difference in the image between co branded brands and the two, confirming hypothesis 2.

5. Anchoring in Investment

Alberto Shigueru Matsumoto et al. have conducted a study on 217 undergraduate business school students from the University of Calia in Brazil. Through their research, it has been found that there is anchoring in investor decision-making [7].

The questionnaire is divided into two parts: Part 1: The questionnaire described an important family background influenced by external economic factors, with the aim of evaluating their behavior during the questioning process. Part 2: The property valuation provided by the real estate agent is 500000 reais, and students are asked to provide a higher or lower valuation.

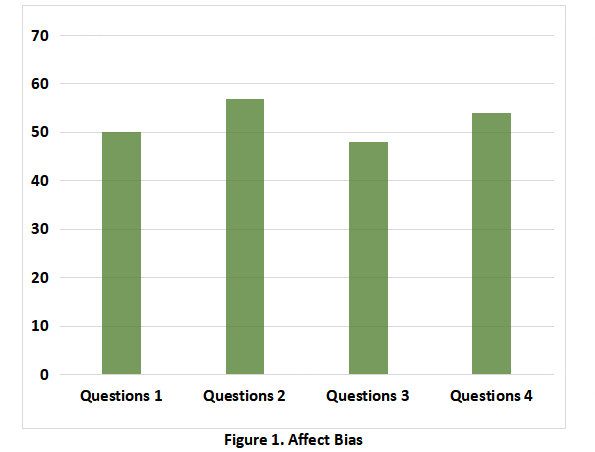

Figure 1: Affect bias.

To evaluate whether investors have participated in their investments, the median real estate value set by investors was determined. According to the data from the wimoveis website, this value is compared to the actual value of the property, which is R $2900000 [8].

According to the data, for the first problem, the starting value is close to 50%, but it remains stable throughout the entire result, indicating that there is a bias. When students were asked whether the property price was higher or lower at 500000 reais, 82.48% of students thought the price was higher (17.52% of students thought it was lower). But when they were asked what the higher price was, the median given was 1.5 million reais (to avoid the impact of extreme values). This result is lower than the 2.9 million reais given on the website.

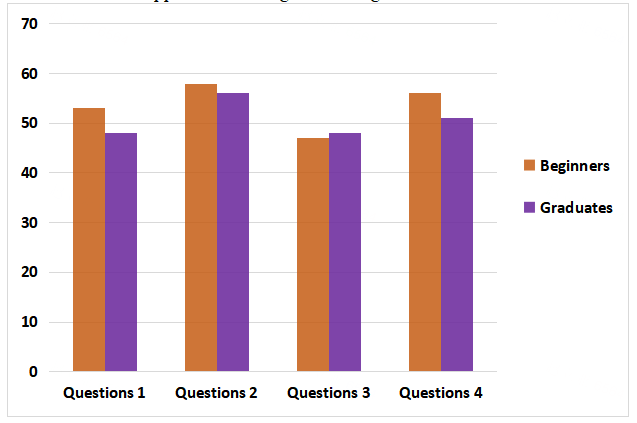

These results indicate that for the given 500000 reais at the beginning, it will affect students’ bias. But even if the property is sold at the student’s price, it will be lower than the market value due to the anchoring effect. This study also investigated whether knowledge factors affect anchoring in investor behavior. To determine this, this research tool is applied to both beginners and graduates.

Figure 2: Affect bias by financial knowledge.

Through the data, it can be found that beginners: 78.7%, graduates: 86.2%. The influence of knowledge factors on the anchoring effect is minimal, and even knowing the financial situation does not weaken this bias. When asked about the value of real estate, both types of students believe that the actual value of real estate is higher. After verification, beginners and graduates have demonstrated anchoring effects in financial decision-making. According to statistics, 1 million reais is the median given by beginners, and 1.5 million reais is the median given by graduates. From this, it can be seen that in both groups of experiments.

6. Conclusion

The research purpose of this article is to demonstrate that anchoring effects occur in individuals, markets, and investments, and to further explore the impact of anchoring effects and some factors that affect anchoring. In terms of individual differences, individuals with high values on the open volume scale are more affected by anchoring effects than those with low values. For brands in the market, the above research provides opinions on important strategic and operational decisions for brand co branding. Choosing brand co branding, whether it is a brand with higher or lower brand awareness than oneself, will have a decisive impact on the brand with higher brand awareness. Therefore, the focus should be on relatively high brand awareness. For brands that are similar to their own, the impact of the two is not significantly different, which provides more flexibility. Mastering this is the core key to brand anchoring.In the impact on personal investment, it can be found through experiments that the anchoring effect exists, and that there are behavioral biases that affect the degree of anchor influence on investors and their final investment decisions. By comparing the data, it can be seen that knowledge and other factors have minimal interference with anchoring effects. So when individual investors value a property, they will be influenced by the property agent’s valuation of the property. In addition, financial knowledge can relatively weaken this impact. The scope of the research in the article is broad and relatively rough, so in the following research, the author will focus on investment research. Study the anchoring effect, anchoring bias, and how to avoid it in investment.

References

[1]. Baddeley, A. D. A 3 min reasoning test based on grammatical transformation. Psychonomic science, 10(10), 341-342. (1968).

[2]. Ariely, D., Loewenstein, G., & Prelec, D. “Coherent arbitrariness”: Stable demand curves without stable preferences. The Quarterly journal of economics, 118(1), 73-106. (2003).

[3]. Furnham, A., Boo, H. C., & McClelland, A. Individual differences and the susceptibility to the influence of anchoring cues. Journal of Individual Differences. (2012).

[4]. Teovanović, P. (2019). Individual differences in anchoring effect: Evidence for the role of insufficient adjustment. Europe's Journal of Psychology, 15(1), 8. (2019).

[5]. Simonson, I., & Drolet, A. Anchoring effects on consumers’ willingness-to-pay and willingness-to-accept. Journal of consumer research, 31(3), 681-690. (2004).

[6]. Esch, F. R., Schmitt, B. H., Redler, J., & Langner, T. The brand anchoring effect: A judgment bias resulting from brand awareness and temporary accessibility. Psychology & Marketing, 26(4), 383-395. (2009).

[7]. Zong, Y., & Guo, X. An experimental study on anchoring effect of consumers’ price judgment based on consumers’ experiencing scenes. Frontiers in Psychology, 13, 794135. (2022).

[8]. Welsh, M. B., Delfabbro, P. H., Burns, N. R., & Begg, S. H. Individual differences in anchoring: Traits and experience. Learning and Individual Differences, 29, 131-140. (2014).

Cite this article

Ye,G. (2023). Anchoring Effect and Its Applications. Advances in Economics, Management and Political Sciences,44,47-51.

Data availability

The datasets used and/or analyzed during the current study will be available from the authors upon reasonable request.

Disclaimer/Publisher's Note

The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of EWA Publishing and/or the editor(s). EWA Publishing and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content.

About volume

Volume title: Proceedings of the 7th International Conference on Economic Management and Green Development

© 2024 by the author(s). Licensee EWA Publishing, Oxford, UK. This article is an open access article distributed under the terms and

conditions of the Creative Commons Attribution (CC BY) license. Authors who

publish this series agree to the following terms:

1. Authors retain copyright and grant the series right of first publication with the work simultaneously licensed under a Creative Commons

Attribution License that allows others to share the work with an acknowledgment of the work's authorship and initial publication in this

series.

2. Authors are able to enter into separate, additional contractual arrangements for the non-exclusive distribution of the series's published

version of the work (e.g., post it to an institutional repository or publish it in a book), with an acknowledgment of its initial

publication in this series.

3. Authors are permitted and encouraged to post their work online (e.g., in institutional repositories or on their website) prior to and

during the submission process, as it can lead to productive exchanges, as well as earlier and greater citation of published work (See

Open access policy for details).

References

[1]. Baddeley, A. D. A 3 min reasoning test based on grammatical transformation. Psychonomic science, 10(10), 341-342. (1968).

[2]. Ariely, D., Loewenstein, G., & Prelec, D. “Coherent arbitrariness”: Stable demand curves without stable preferences. The Quarterly journal of economics, 118(1), 73-106. (2003).

[3]. Furnham, A., Boo, H. C., & McClelland, A. Individual differences and the susceptibility to the influence of anchoring cues. Journal of Individual Differences. (2012).

[4]. Teovanović, P. (2019). Individual differences in anchoring effect: Evidence for the role of insufficient adjustment. Europe's Journal of Psychology, 15(1), 8. (2019).

[5]. Simonson, I., & Drolet, A. Anchoring effects on consumers’ willingness-to-pay and willingness-to-accept. Journal of consumer research, 31(3), 681-690. (2004).

[6]. Esch, F. R., Schmitt, B. H., Redler, J., & Langner, T. The brand anchoring effect: A judgment bias resulting from brand awareness and temporary accessibility. Psychology & Marketing, 26(4), 383-395. (2009).

[7]. Zong, Y., & Guo, X. An experimental study on anchoring effect of consumers’ price judgment based on consumers’ experiencing scenes. Frontiers in Psychology, 13, 794135. (2022).

[8]. Welsh, M. B., Delfabbro, P. H., Burns, N. R., & Begg, S. H. Individual differences in anchoring: Traits and experience. Learning and Individual Differences, 29, 131-140. (2014).