1. Introduction

The film and television entertainment industry are a typical international industry [1], with the number of companies, products and service scope covering the global market. Therefore, financial risks such as exchange rate fluctuations and inflation are significant challenges for the film and television entertainment industry.

First of all, the film and television entertainment industry usually adopt diversified business models and revenue sources. Higher interest rates will affect multinationals differently. For multinationals that adopt a borrowing model and borrow from the United States, an increase in the rate of interest increases the financial cost of payments. On the other hand, for firms that earn revenue in foreign markets, an increase in interest rates leads to a decrease in their earnings because these firms do not include the impact of the dollar appreciation in their revenue conversion. Thus, affecting the profitability of enterprises.

Second, exchange rate risk has become more important for multinationals that trade with the United States. For example, if firms purchase raw materials and equipment in the United States, or export their products to the United States, exchange rate fluctuations will directly affect their costs and benefits [2].

In short, the impact of the Federal Reserve's interest rate hike on the film and television entertainment industry is a multifaceted problem. It not only affects corporate profitability, but may also have a significant impact on future markets and business models. The film and television entertainment industry must adapt and adjust to this change [3].

As one of the most famous film and television entertainment companies in the world, Disney's business covers the global market. In recent years, the Federal Reserve has repeatedly raised interest rates, which has had an impact on global markets and also posed certain challenges for Disney. Therefore, studying the impact of the Federal Reserve's interest rate hike on Disney Company is of great practical significance for deeply understanding the exchange rate risk of the film and television entertainment market, improving the economic adaptability, improving the corporate governance structure and expanding overseas business.

Exchange rate changes are one of the important factors affecting international trade and investment. The research and analysis of Duan and Gu showed that the factors affecting exchange rate changes included macroeconomic factors [4, 5], policy factors, market factors and so on [6]. For a long time, the Federal Reserve is one of the important decision-making bodies in the global financial market, and the fine tuning and change of its monetary policy will have an impact on the global economy and financial market. The research of Juergen Donges showed that the stable economic development of the United States and the interest rate hike of the Federal Reserve will promote the global market, but it will also bring challenges to some enterprises [7]. Disney is one of the most famous film and television entertainment companies in the world, and its stock price is one of the most closely watched targets in the market. Jensen and Perez showed that the performance of Disney Company was good, and there was a correlation between the rise and fall trend of its stock price and financial data. Disney has been expanding its presence in overseas markets. The study by Osili and Wang showed that Disney adopted different market entry modes in its internationalization strategy, and achieved good results in new market development and overseas business expansion [8].

At present, there are some gaps in the research on the impact of the Fed's rate hike on Disney. First, after the Federal Reserve rate hike, the exchange rate of the US dollar changes and forecasts. Secondly, at the micro level, it is also necessary to deeply explore the changes of Disney's stock price in international and overseas markets.

2. Research Design

2.1. Augmented Dickey–Fuller (ADF) Unit Root Test

This study collected daily Disney closing price data and USD index from June 2021 to April 2023 from the Wind financial terminal. To elaborate, first take the log of the raw data on Disney's closing stock price, the data is transformed by the formula ln(1+x), continuing the analysis in the logarithmic price, and then differencing the logarithmic price to get logarithmic yield, the same goes for the USD index, and Table 1 shows ADF test results.

Table 1: ADF test.

Variables | t-statistic | p-value |

Price | ||

Disney | -2.243 | 0.4657 |

USD index | -0.886 | 0.9576 |

Yield | ||

Disney | -14.988 | 0.0000*** |

USD index | -17.126 | 0.0000*** |

2.2. Model

The use of VAR models can be traced back to the study of linear stochastic difference equations [9] and the study of autoregressive properties of Tinbergen models [10], leading to the famous contribution of Sim in the application of VAR models [11,12]. While AR models can only study univariate time series, VAR models can be used to capture the relationship between multiple variables and build multivariate time series while avoiding the challenge of building models based on rigorous economic theory [13].

\( {x_{t,1}}={α_{1}}+{∅_{11}}{x_{t-1,1}}+…+{∅_{1p}}{x_{t-p,1}}+{β_{11}}{x_{t-1,2}}+…+{β_{1p}}{x_{t-p,2}}+{e_{1t}} \) | (1) |

\( {x_{t,2}}={α_{2}}+{∅_{21}}{x_{t-1,1}}+…+{∅_{2p}}{x_{t-p,1}}+{β_{21}}{x_{t-1,2}}+…+{β_{2p}}{x_{t-p,2}}+{e_{2t}} \) | (2) |

\( [\begin{matrix}{x_{t,1}} \\ {x_{t,2}} \\ \end{matrix}]=[\begin{matrix}{α_{1}} \\ {α_{2}} \\ \end{matrix}]+[\begin{matrix}{∅_{11}}⋯{ ∅_{1p}} \\ {∅_{21}}⋯{ ∅_{2p}} \\ \end{matrix}][\begin{matrix}{x_{t-1,1}} \\ ⋮ \\ {x_{t-p,1}} \\ \end{matrix}]+[\begin{matrix}{β_{11}}⋯{ β_{1p}} \\ {β_{21}}⋯{ β_{2p}} \\ \end{matrix}][\begin{matrix}{x_{t-1,2}} \\ ⋮ \\ {x_{t-p,2}} \\ \end{matrix}]+[\begin{matrix}{e_{1t}} \\ {e_{2t}} \\ \end{matrix}] \) | (3) |

The equation (1), (2) above are for Disney stock return and USD index, and equation (3) is in matrix form.

The ARMA-GARCH model can evaluate both the yield and volatility of the Disney stock. This model is broken down into two sections in this paper: ARMA and GARCH.

The formula about the ARMA model is illustrated in equation (4). The AR(p) is represented by the component \( {∅_{0}}+Σ_{ⅈ=1}^{p}{∅_{i}}{y_{t-i}} \) , and \( {α_{i}}-Σ_{ⅈ=1}^{q}{∅_{i}}{α_{t-i}} \) is MA(q). AR(p) forecasts future value using past Disney stock returns from June 2021 to April 2023, while MA(q) using an error term to predict.

\( {y_{t}}={∅_{0}}+Σ_{ⅈ=1}^{p}{∅_{i}}{y_{t-i}}+{α_{i}}-Σ_{ⅈ=1}^{q}{∅_{i}}{α_{t-i}} \) | (4) |

The GARCH model is based on the ARCH model, with both modeling volatility as a variance [14]. In this study, the GARCH (1,1) model was utilized, where the first number indicates the autoregressive lag and the second number denotes the moving average lag. The GARCH (1,1) model was selected due to its advantages over the ARCH(p) model, including requiring fewer parameters, being suitable for modeling many time series [15], only needing one lag for analysis, and effectively identifying volatility clustering in the data [16]. Therefore, the GARCH (1,1) model was chosen for this study.

\( σ_{t}^{2}={α_{0,1}}+{α_{1}}ε_{t-1}^{2}+{β_{t}}{x_{t}}+{γ_{1}}σ_{t-1}^{2} \) | (5) |

3. Empirical Results and Analysis

Table 2 reveals that lags 0, 6, and 10 all have that sign. Lag 0 is not meaningful and the model cannot be estimated, A comparison of LR differences is necessary to determine the optimal lag order. Lag 10 has the biggest LR value and the smallest p value.

Table 2: VAR model identification.

Lag | LL | LR | df | p | FPE | AIC | HQIC |

0 | 2975.36 | 1.0e-08 | -12.7339* | -12.72* | |||

6 | 2992.61 | 15.688 | 4 | 0.003 | 1.0e-08 | -12.705 | -12.61 |

10 | 3014.39 | 27.392* | 4 | 0.000*** | 1.0e-08 | -12.7297 | -12.5 |

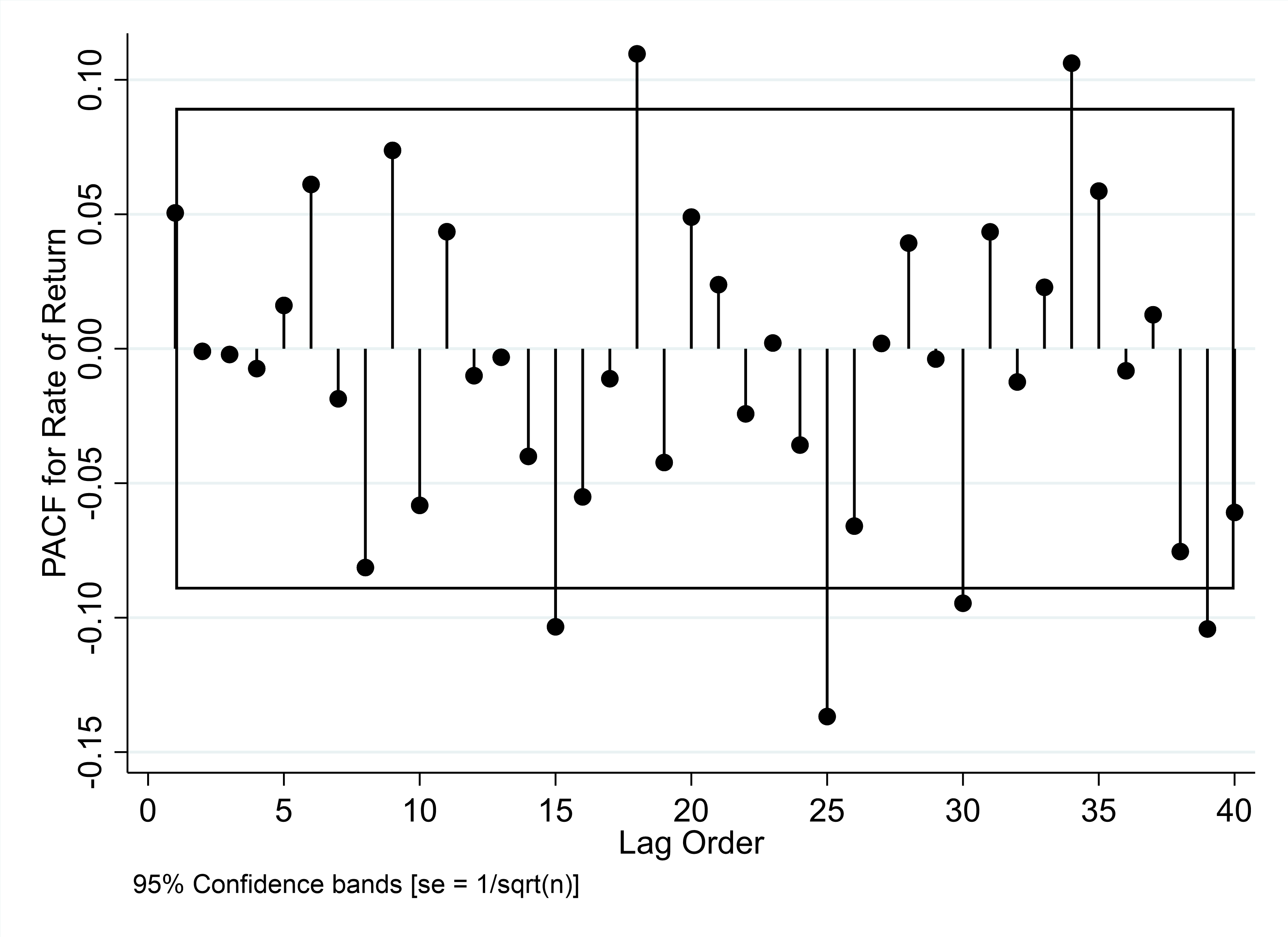

Every root is clearly in the circle in Figure 1, implying that there is no need to recalculate the lag order and bivariate VAR (10) is stable.

Figure 1: Unit root test (Photo credit: Original).

From the perspective of theoretical analysis, it is certain that the Fed's interest rate hike will lead to an increase in the demand for international liquidity and dollars in the international financial market, and further lead to an increase in the exchange rate [17]. But there are several possible economic outcomes for Disney from a higher exchange rate or a higher USD index:

First of all, this paper assumes that the price of enterprises' products is rigid in the short term, that is, it is difficult to adjust. As a large multinational corporation operating worldwide, Disney's main revenues and financial reports are all calculated in USD index [18]. A rise in the USD index means lower earnings abroad, and in that sense, a Fed rate hike could be negative for Disney. On the other hand, if the international financial market holds more dollars, this part of funds may flow into the stock market or bond market, increasing the demand for stocks and leading to the rise of stock prices [19]. In addition, higher interest rates must mean a cooling of the economy, and this monetary policy must encourage saving while discouraging consumption.

Based on the above analysis, it is impossible to determine which effect of foreign currency depreciation, capital flow or consumption inhibition has a greater impact on Disney's return rate, so further empirical test is needed.

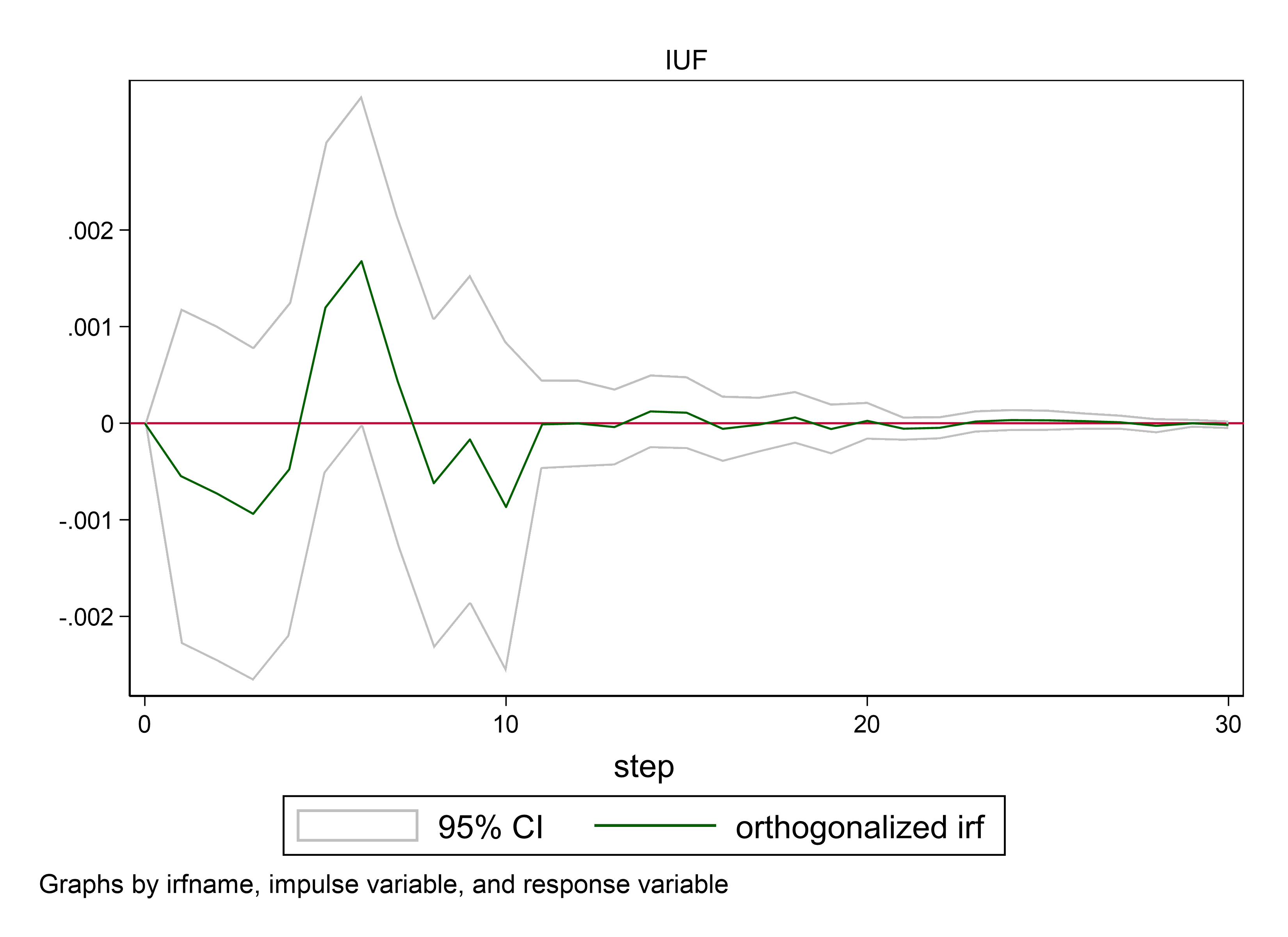

Figure 2: Impulse response (Photo credit: Original).

Based on the estimation results of the Impulse Response of the model, when the logarithmic return rate increases by one unit in period t=0, the maximum positive effect of the return rate of Disney stock is about 0.15%, which appears in period t=6. The largest negative effect occurs in period t=3, at about 0.1%, but t=8,9 and 10 both exhibit continuous negative effects. Figure 2 shows that the positive and negative effects basically cancel out. This is because the response of Disney to a one-unit increase in the USD index usually has a decay process, with the pulse gradually weakening over time and eventually disappearing.

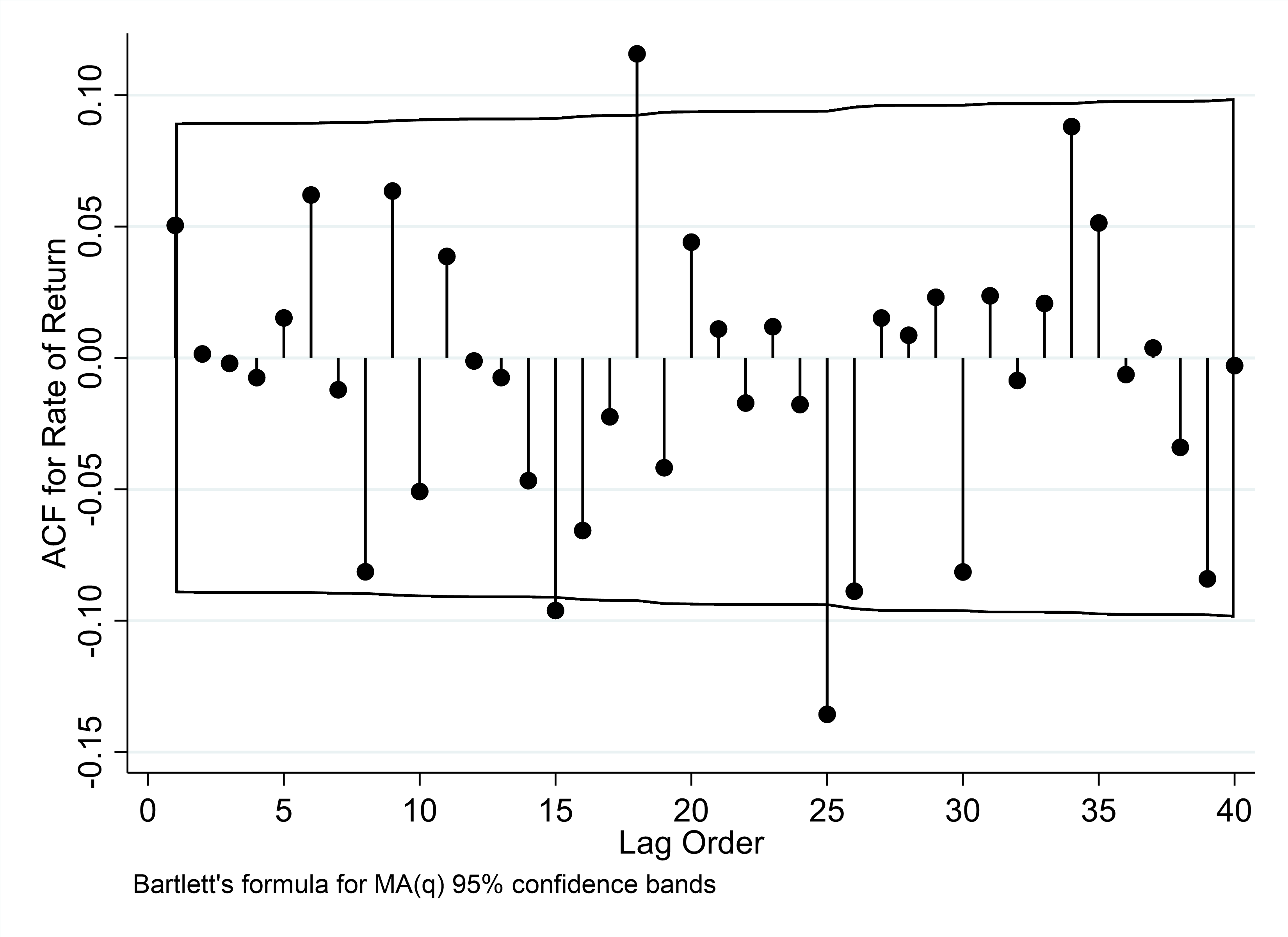

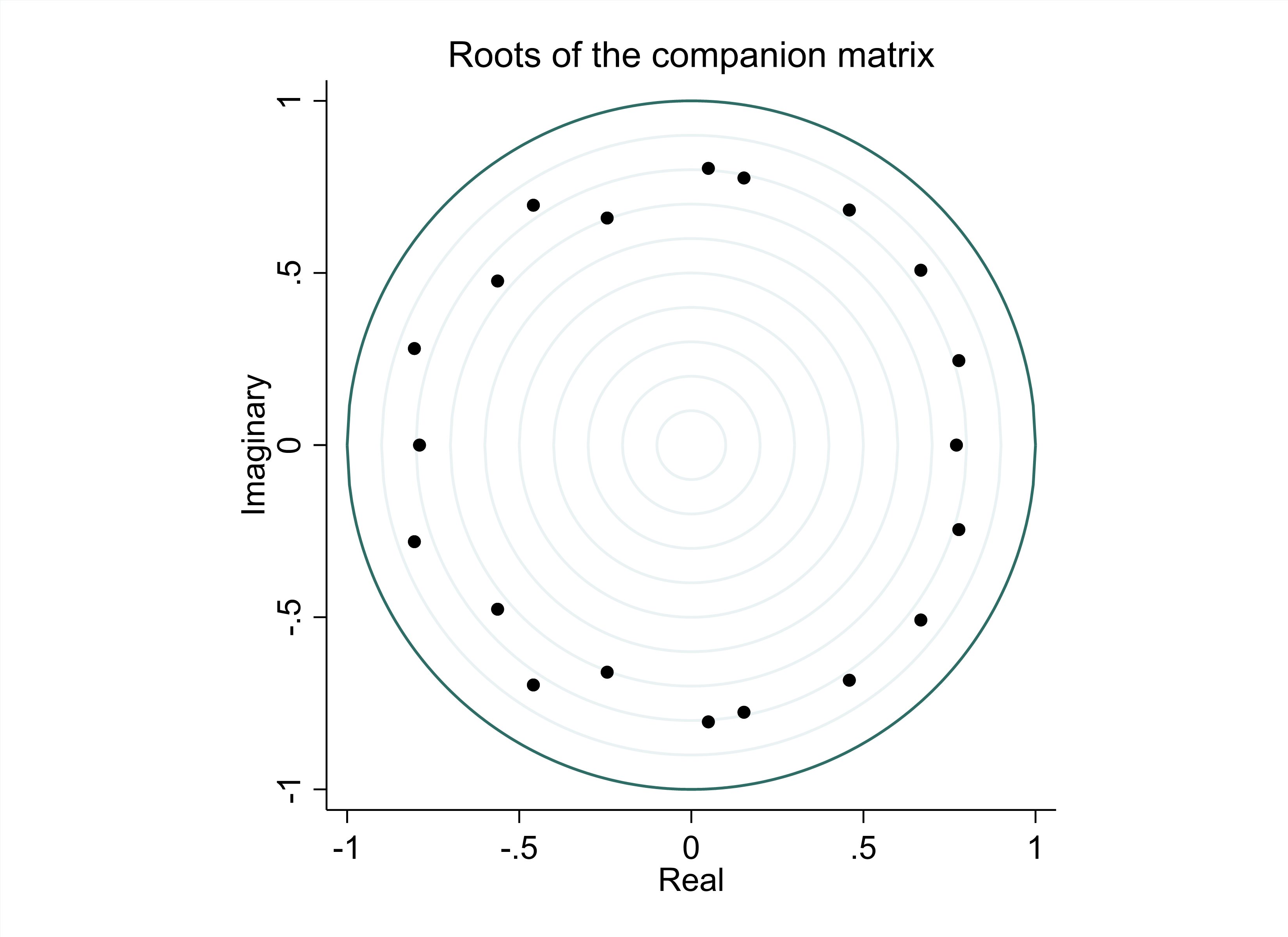

The orders for AR(p) and MA(q) can be obtained through evaluation of the PACF and ACF of the logarithmic stock return. In Figure 3, the PACF and ACF plots both exhibit a value of 2 beyond the critical values. This suggests that the orders for both AR(p) and MA(q) are 15. Hence, this study utilized the value of 15 for both orders in subsequent analyses, based on the findings from the PACF and ACF plots.

PACF | ACF |

|

|

Figure 3: PACF and ACF (Photo credit: Original). | |

After the autocorrelation of Disney stock return is controlled by the mean equation, the GARCH terms of the variance equations in (1) to (3) are all significant at the level of 1%, indicating that Disney stock return has statistically significant heteroscedasticity (please see Table 3).

From the estimation results of the exogenous variables, the coefficient of the USD index in the model in (1) is significantly negative, but after t=−1 and t=−2 are added, it can be clearly seen that the positive effect exceeds the negative effect. Accordingly, this paper argues that although the Federal Reserve's interest rate hike did not lead to major changes in Disney stock returns, it increased the volatility of returns.

Table 3: ARMA-GARCHX estimation results.

(1) | (2) | (3) | ||||

Coefficient | p>|Z| | Coefficient | p>|Z| | Coefficient | p>|Z| | |

USD, L0 | -105.8154 | 0.000 | -116.6667 | 0.000 | 37.89049 | 0.401 |

USD, L1 | 36.89967 | 0.190 | 199.7943 | 0.000 | ||

USD, L2 | -124.5205 | 0.002 | ||||

ARCH | 0.0510 | 0.158 | 0.0405 | 0.230 | -0.0020 | 0.824 |

GARCH | 0.6580 | 0.000 | 0.6701 | 0.000 | 0.9481 | 0.000 |

4. Conclusion

The objective of this paper is to study the relation between USD index hiking and entertainment industry in terms of usage, stock return, and stock volatility, especially in American film company Disney. VAR and ARMA-GARCH models are introduced for this purpose, with the VAR model exploring impulse response and the ARMA-GARCH model assessing stock returns and conditional variances. The study leads to a conclusion after conducting empirical investigation.

Finally, this article demonstrates that although the Fed's interest rate hike did not lead to a large change in the return of Disney stock, it increased the volatility of the return. Overall, the Fed needs to make trade-offs as it considers raising interest rates, but it should not come at the expense of the market's growth. The Federal Reserve needs to make a comprehensive assessment of the economic situation and take appropriate monetary policy measures to promote economic development and stabilize the market.

For investors, it is possible to diversify their portfolio. Investors can diversify across industries, markets and asset classes, reducing the risk posed by a single stock and sector. the impact of the Federal Reserve's interest rate hike on the market may bring short-term volatility risk, but for long-term investors, a stable portfolio can control the risk and achieve long-term investment goals. Therefore, in view of market risks, investors should patiently wait for the market to return to the reasonable value, and do a good job in asset allocation and risk control according to their own risk preferences.

References

[1]. Henry S. (2018). https://deadline.com/2018/06/federal-reserve-rate-hike-impact-film-industry-1202412385/

[2]. Zhong Jia, Zhang Qiaoshan, Ding Xiaoqin (2018) The Impact of Interest Rate Increases on Exchange Rate Risk of Multinational Corporations. International Business Education, 33(41):61-68.

[3]. PwC (2018) Cross-border Mergers and Acquisitions in the Film and Entertainment Industry: Challenges and Opportunities. PwC China Cross-border M&A Report.

[4]. Duanmu Zhiping (2018) The Impact of Exchange Rate Risk on Corporate Financial Decision-making and Risk-avoidance Strategies. Foreign Theoretical Dynamics, 03:72-74.

[5]. Gu Sufeng (2018) The Impact of Exchange Rate Variations on Multinational Corporations. Business Research, 06:73-74.

[6]. Juergen Donges (2017) The Impact of US Federal Reserve Interest Rate Increases on Global Markets. Economic Management, 15:213-217.

[7]. Jensen and Perez (2017) Financial Analysis of the Film and Entertainment Industry. Financial Management, 05:127-129.

[8]. Osili and Wang (2017) Study on Corporate Internationalization Strategy and Capital Structure. Accounting and Financial Management, 09:53-56.

[9]. Mann H B, Wald A. On the statistical treatment of linear stochastic difference equations. Econometrica, Journal of the Econometric Society, 1943: 173-220.

[10]. Orcutt G H, Irwin J O. A study of the autoregressive nature of the time series used for Tinbergen's model of the economic system of the United States, 1919-1932. Journal of the Royal Statistical Society. Series B (Methodological), 1948, 10(1): 1-53.

[11]. Sims C A. The role of approximate prior restrictions in distributed lag estimation. Journal of the American Statistical Association, 1972, 67(337): 169-175.

[12]. Sims, C. A. Macroeconomics and Reality. Econometrica, 1980, 48(1), 1.

[13]. Freeman J R, Williams J T, Lin T. Vector autoregression and the study of politics. American Journal of Political Science, 1989: 842-877.

[14]. Engle R. GARCH 101: The use of ARCH/GARCH models in applied econometrics. Journal of economic perspectives, 2001, 15(4): 157-168.

[15]. Hill R C, Griffiths W E, Lim G C. Principles of econometrics. John Wiley & Sons, 2018.

[16]. Ghani I M M, Rahim H A. Modeling and forecasting of volatility using arma-garch: Case study on malaysia natural rubber prices. IOP Conference Series: Materials Science and Engineering. IOP Publishing, 2019, 548(1): 012023

[17]. Cheung, Yin-Wong, and Menzie David Chinn. "Determining long-run equilibrium exchange rates: Historical overview and current methods." Handbook of exchange rates (2012): 3-51.

[18]. Guillén, Mauro F. "International capital flows and economic growth: The Latin American experience." The Journal of Development Studies 34, no. 5 (1998): 119-148.

[19]. Eichengreen, Barry. Exorbitant privilege: The rise and fall of the dollar and the future of the international monetary system. Oxford University Press, 2011.

Cite this article

Lu,K. (2023). The Impact of Federal Reserve Interest Rate Hike on the Entertainment Industry: An Empirical Evidence. Advances in Economics, Management and Political Sciences,45,79-85.

Data availability

The datasets used and/or analyzed during the current study will be available from the authors upon reasonable request.

Disclaimer/Publisher's Note

The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of EWA Publishing and/or the editor(s). EWA Publishing and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content.

About volume

Volume title: Proceedings of the 2nd International Conference on Financial Technology and Business Analysis

© 2024 by the author(s). Licensee EWA Publishing, Oxford, UK. This article is an open access article distributed under the terms and

conditions of the Creative Commons Attribution (CC BY) license. Authors who

publish this series agree to the following terms:

1. Authors retain copyright and grant the series right of first publication with the work simultaneously licensed under a Creative Commons

Attribution License that allows others to share the work with an acknowledgment of the work's authorship and initial publication in this

series.

2. Authors are able to enter into separate, additional contractual arrangements for the non-exclusive distribution of the series's published

version of the work (e.g., post it to an institutional repository or publish it in a book), with an acknowledgment of its initial

publication in this series.

3. Authors are permitted and encouraged to post their work online (e.g., in institutional repositories or on their website) prior to and

during the submission process, as it can lead to productive exchanges, as well as earlier and greater citation of published work (See

Open access policy for details).

References

[1]. Henry S. (2018). https://deadline.com/2018/06/federal-reserve-rate-hike-impact-film-industry-1202412385/

[2]. Zhong Jia, Zhang Qiaoshan, Ding Xiaoqin (2018) The Impact of Interest Rate Increases on Exchange Rate Risk of Multinational Corporations. International Business Education, 33(41):61-68.

[3]. PwC (2018) Cross-border Mergers and Acquisitions in the Film and Entertainment Industry: Challenges and Opportunities. PwC China Cross-border M&A Report.

[4]. Duanmu Zhiping (2018) The Impact of Exchange Rate Risk on Corporate Financial Decision-making and Risk-avoidance Strategies. Foreign Theoretical Dynamics, 03:72-74.

[5]. Gu Sufeng (2018) The Impact of Exchange Rate Variations on Multinational Corporations. Business Research, 06:73-74.

[6]. Juergen Donges (2017) The Impact of US Federal Reserve Interest Rate Increases on Global Markets. Economic Management, 15:213-217.

[7]. Jensen and Perez (2017) Financial Analysis of the Film and Entertainment Industry. Financial Management, 05:127-129.

[8]. Osili and Wang (2017) Study on Corporate Internationalization Strategy and Capital Structure. Accounting and Financial Management, 09:53-56.

[9]. Mann H B, Wald A. On the statistical treatment of linear stochastic difference equations. Econometrica, Journal of the Econometric Society, 1943: 173-220.

[10]. Orcutt G H, Irwin J O. A study of the autoregressive nature of the time series used for Tinbergen's model of the economic system of the United States, 1919-1932. Journal of the Royal Statistical Society. Series B (Methodological), 1948, 10(1): 1-53.

[11]. Sims C A. The role of approximate prior restrictions in distributed lag estimation. Journal of the American Statistical Association, 1972, 67(337): 169-175.

[12]. Sims, C. A. Macroeconomics and Reality. Econometrica, 1980, 48(1), 1.

[13]. Freeman J R, Williams J T, Lin T. Vector autoregression and the study of politics. American Journal of Political Science, 1989: 842-877.

[14]. Engle R. GARCH 101: The use of ARCH/GARCH models in applied econometrics. Journal of economic perspectives, 2001, 15(4): 157-168.

[15]. Hill R C, Griffiths W E, Lim G C. Principles of econometrics. John Wiley & Sons, 2018.

[16]. Ghani I M M, Rahim H A. Modeling and forecasting of volatility using arma-garch: Case study on malaysia natural rubber prices. IOP Conference Series: Materials Science and Engineering. IOP Publishing, 2019, 548(1): 012023

[17]. Cheung, Yin-Wong, and Menzie David Chinn. "Determining long-run equilibrium exchange rates: Historical overview and current methods." Handbook of exchange rates (2012): 3-51.

[18]. Guillén, Mauro F. "International capital flows and economic growth: The Latin American experience." The Journal of Development Studies 34, no. 5 (1998): 119-148.

[19]. Eichengreen, Barry. Exorbitant privilege: The rise and fall of the dollar and the future of the international monetary system. Oxford University Press, 2011.