1. Introduction

Late in 2019, the COVID-19 broke out and spread quickly over the world. The virus is transmitted mainly by droplet, aerosol, and also depends on contact transmission. It is characterized by high infectivity, large population size, and low relative lethality. As a respiratory infectious disease which is extremely harmful to the human body, the COVID-19 has greatly threatened the both physiological and psychological health of people around the world. At the same time, the direct impact of the pandemic such as trade closure and global supply chain disruption also brought a huge and serious blow to the economy from both supply and demand sides together, such as economic slowdown, trade and investment, commodities, and logistics, which seriously threatened the short-term and long-term global economic growth prospects [1]. With the huge negative impact brought by the COVID-19, stocks in most industry sectors of China's A-shares have fallen significantly. But in contrast, stocks in the pharmaceutical industry have trended significantly higher [2]. With a strong organizational and mobilization system, an efficient central government, and a high level of public policy support [3]. The Chinese government has adhered to the "zero" target since the outbreak of COVID-19 and has continued to adopt mandatory control policies such as controlling population movement, lockdowning cities and borders which are of great efficiency to containing the spread of the pandemic [4], in a responsible manner for people's lives and health. However, though the normal life of the people was maintained, during the process of containment and control, many industries were forced to shut down their production while simultaneously the national economy was severely affected. For reasons of livelihood and economic development, and because the virulence of the strain had been significantly reduced in two years. According to the "Notice on Further Optimizing and Implementing the Prevention and Control Measures of the COVID-19" issued by the Comprehensive Group of the Joint Prevention and Control Mechanism of the State Council, China decided in December 2022 to liberalize the outbreak and encourage industries to resume production in order to restore social operations to normal [5].

The stock market is said to as the "barometer" of the national economy since it is a robust and effective market that accurately reflects all available information. The abrupt COVID-19 outbreak in 2020 severely damaged China's A-share market. While many stocks plummeting, the pharmaceutical sector surged surprisely [6]. The pharmaceutical industry is closely tied to the COVID-19 outbreak. As the pandemic continues, the demand for therapeutic and preventive drugs, hospitals' demand for stockpiled drugs, instruments and consumables have jointly affected the business of listed companies in the pharmaceutical industry. In this context, it is of great value to explore the impact on the pharmaceutical industry by analyzing the return on the industry's securities. So far, domestic, and foreign scholars have conduced a large number of empirical studies regarding COVID-19 and the pharmaceutical industry stock index.

In analyzing the broad effects of COVID-19 on different sectors of the economy and the stock market, Wang Qi, Wang Zhongli et al. discovered that the daily rise in newly confirmed cases causes the stock market to decrease on the same day.[7]. And the decline accelerates as the severity of the outbreak increases [7]. For the reason behind, they attribute the stock price decline partly to investors' sentiment fluctuations [7]; Zhang Zhiping, Zhu Siying et al. argue that the short-term effects of COVID-19 on the capital market are significant and there is a strong industry heterogeneity effect [8]. The stronger shock effect in industries was more affected by the pandemic, while investors' sentiment is an important factor in the short-term shock to the capital market during the pandemic [8]; Xu Hong, Pu Hongxia et al. contend that the COVID-19 had a major detrimental influence on the stock market with a W-shaped trend, and the main board market was greatest impacted. [9]. Nevertheless, even though the pandemic had a detrimental impact on most industries, the impact on the pharmaceuticals is positive [9]. Meanwhile, the shocks brought by COVID-19 were argued to be short-term[9]. This paper has also mentioned that investor sentiment and stock prices have similar shock directions and trends [9]. In his study, Liu Hao showed that the occurrence of the COVID-19 brought unanticipated excess returns to listed companies in the pharmaceutical industry and their investors which has did have a positive impact on listed companies in the Chinese pharmaceutical industry [10]. But the impetus happened only around the event date, which is difficult to sustain for long [10]; Duan Yuyuan's research shows that the COVID-19 has enhanced investors' expectations of the pharmaceutical industry [11]. Therefore, the pharmaceutical industry received a significant and positive impact from the pandemic, but it did not last long [11]; Zhang Kaihuang, Qian Qinglan et al. compared different market capitalization enterprises and draw the conclusion that small and medium-sized market capitalization subjects were more inclined to be affected than large-capitalization and subjected to more severely impact [12]. Comparing to other manufacturing industries, the pharmaceutical industry showed stronger resilience while it has also suffered from different degrees of impact [12].

Foreign studies pay more attention on the industry as a whole. Abiad A, Arao R M, Dagli S studied and found that the COVID-19 had an impact on business activities in terms of investment, consumption, tourism, driving various sectors to be influenced [13]; Barshikar R meticulously analyzed the impact within the pharmaceutical industry, concluding that the COVID-19 had a comparatively small influence on large Indian firms and multinational corporations [14]; Mittal S, Sharma D's study shows that the most affected sectors in the COVID-19 outbreak are real estate, banks, financial institutions and metals, while health care and pharmaceutical stocks are trending higher turning out to be the beneficiaries of this outbreak [15]; Sun Y, Wu M, Zeng X’s study demonstrated that the COVID-19 had a major impact on the pharmaceutical sector's stock market and linked the pandemic's significantly wider effects to investor sentiment [16]. Jena P K, Mishra P K. compared the period of economic embargo and openness, it was concluded that both pharmaceutical industries achieved positive returns [17]. Almurisi S H et al. focused their attention on the plight of pharmaceutical companies in developing countries in the face of the pandemic, arguing that it is imperative to ensure an adequate supply of therapeutic drugs [18].

From the above research results, it can be seen that the existing papers basically adopt the method of empirical analysis, focusing on the impact of the outbreak on various industries. Most of the research’s entry points are both macro and micro. But at present, there are few papers focusing on the pharmaceutical industry, and few studies comparing before and after the Deregulation. Therefore, this paper will take the Deregulation as the time cut-off point, study the Pharmaceutical and Biological Full Benefit data to construct a time series model, and compare the prediction with the actual value. Exploring the impact of the re-opining on China's pharmaceutical industry, and provide investors and decision-makers provide certain information and advice.

The rest of this paper is organized as follows: Section 2 research design; Section 3 empirical results and analysis; Section 4 discussion; Section 5 conclusion.

2. Research Design

The paper adopts the time series approach to analyze and forecast pharmaceutical and biological full benefit closing price prices, which is modeled using an ARIMA autoregressive moving model. Since the secondary moments of the series are required to be smooth when forecasting data using ARIMA model, while in the study of stock prices, it is usually considered that the stock price model obeys Brownian motion which secondary moments are unstable and cannot meet the smoothness requirement. Therefore, this study applied a logarithmic transformation into the closing price of SSE medicine and does a difference operation to obtain a logarithmic return series, in order to transform the data into a stable series. Then in the final presentation of the forecast result, the logarithmic return series is computed to obtain the forecast of the full return closing price of pharmaceuticals and biology.

First, the logarithm of all closing price data is taken to obtain the log closing price data. Then, the closest time point to the release of the pandemic control, December 2, 2022, is noted as T0. So that the data is divided into two parts called before and after. The ARIMA model is used to predict the logarithmic closing price data before T0, and the predicted value is recorded as the theoretical value of the logarithmic closing price in the case of the COVID-19 prevention and control is not be liberalized. The return fluctuation experienced by the Chinese pharmaceutical business following the Deregulation is defined as the difference between the theoretical value and the actual value after T0. The impact of the Deregulation of the COVID-19 on the Chinese pharmaceutical business is investigated using the absolute value of the difference and the trend of the difference.

2.1. Data Sources

The COVID-19 outbreak began in December 2019. Facing with the rapid outbreak of COVID-19, China government adopted the lockdown policy from the beginning until December 7, 2022, when the country finally re-opened. At this point, residents are free to travel and business activities can resume as normal according to the published rules. Because of the long duration of the COVID-19, the thesis selected weekly data of Pharmaceutical and Biological Full Benefit closing price from July 2, 2021 to February 17, 2023 for the research. Totally 83 sets of data, collected from the CHOICE financial terminal.

The weekly closing price data for Pharmaceutical and Biological Full Benefit are shown in Figure 1. As can be seen from the line graph, the Pharmaceutical and Biological Full Benefit closing prices fluctuate during the study period, with fluctuations going lower before the T0 moment. It can be seen that as the duration of the pandemic grew, the stock prices of pharmaceutical industry’s stock prices went down. However, a clear upward trend existed one week after the Deregulation of the COVID-19, which continues for almost a month before declining again. To sum up with, there exists a slight increase, but the change was not significant relative to the overall picture.

Figure 1: Pharmaceutical and Biological Full Benefit.

Data source: Eastmoney

Photo credit: Original

2.2. Augmented Dickey-Fuller Test

The ARIMA model assumes the time series data are stationary, i.e., Their statistical characteristics are independent of time. In this thesis, the Augmented Dickey-Fuller Test is used to test for smoothness. The series is viewed as a non-stationary time series if the null hypothesis equals the existence of a unit root. From the results of the ADF test in Table 1, it can be seen that the logarithmic closing price series has the p-value of 0.6186, which accepts the original hypothesis and refused the stability of the series. Therefore, the logarithmic series is differenced to produce a logarithmic return series with a p-value of 0.0000 in order to achieve a smooth series, rejecting the original hypothesis. The ADF-test result of the differenced series shows there is no unit root which means the logarithmic return series is considered smooth.

Table 1: ADF test.

Variables | t-statistic | p-value |

Price | -1.983 | 0.6108 |

Yield | -7.497 | 0.0000*** |

2.3. ARIMA Model

As a well-known and classic time series forecasting model proposed by Box and Jenkins in the 1970s. The fundamental principle of the ARIMA model is to treat the data sequence created over time by the prediction object as a random sequence. A certain data model can roughly approximate this sequence based on the time series' autocorrelation analysis. The construction looks like this.

\( w={∅_{1}}{w_{t-1}}+{∅_{2}}{w_{t-2}}+…+{∅_{p}}{w_{t-p}}+δ+{u_{1}}+{θ_{1}}{u_{t-1}}+{θ_{2}}{u_{t-2}}…+{θ_{p}}{u_{t-p}} \) (1)

p is the autoregressive term, q is the moving average term, d is the number of differences made when the time series is transformed to smooth.

3. Empirical Results and Analysis

3.1. Order of ARIMA Model

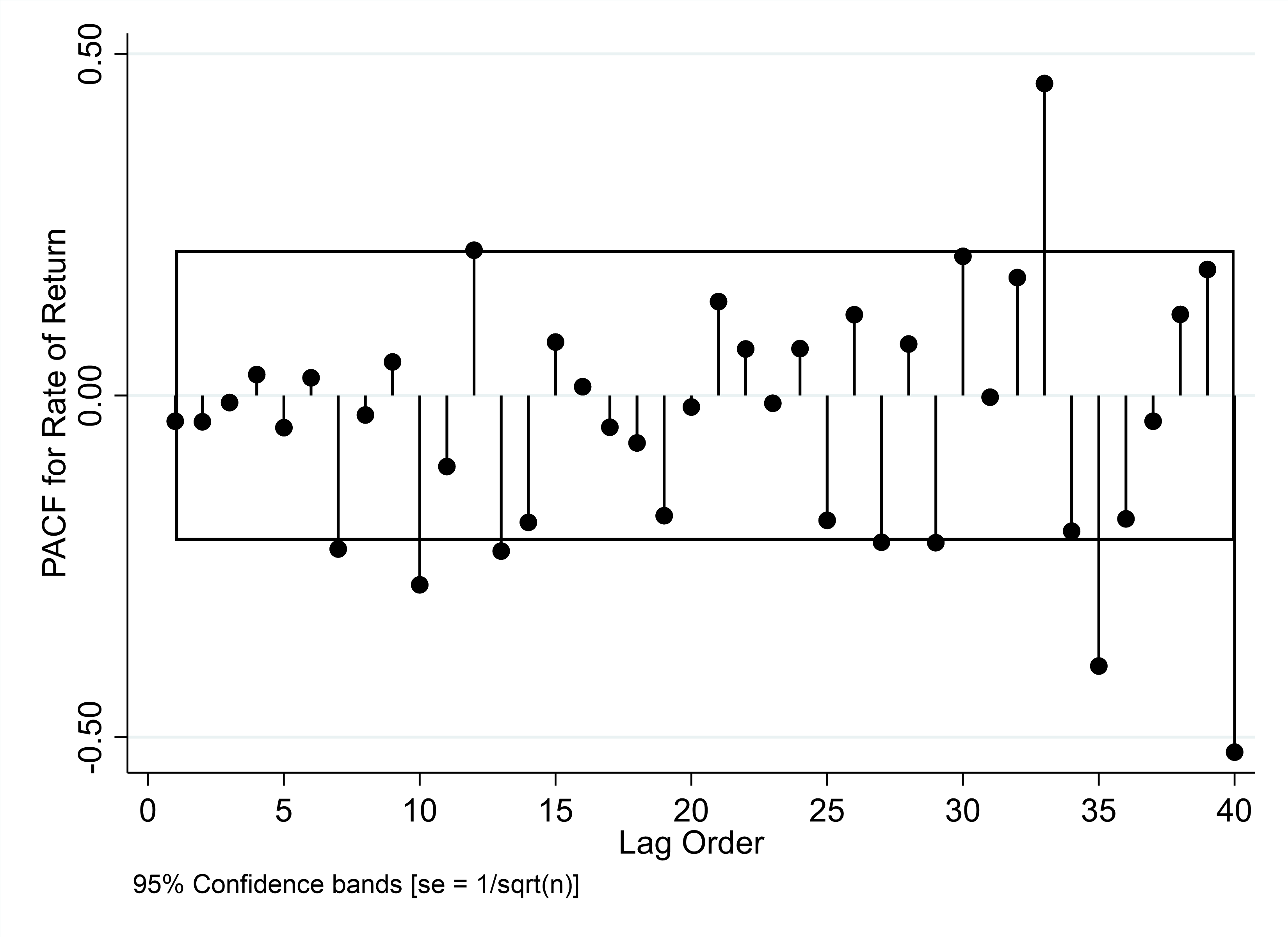

The order of the ARIMA model can be observed through ACF and PACF images, and the judgement criteria are shown in the Table 2.

Table 2: ARIMA ordering standard.

ACF | PACF | order |

trailing | q order truncation | AR (p) |

q order truncation | trailing | MA (q) |

trailing | trailing | ARMA (p, q) |

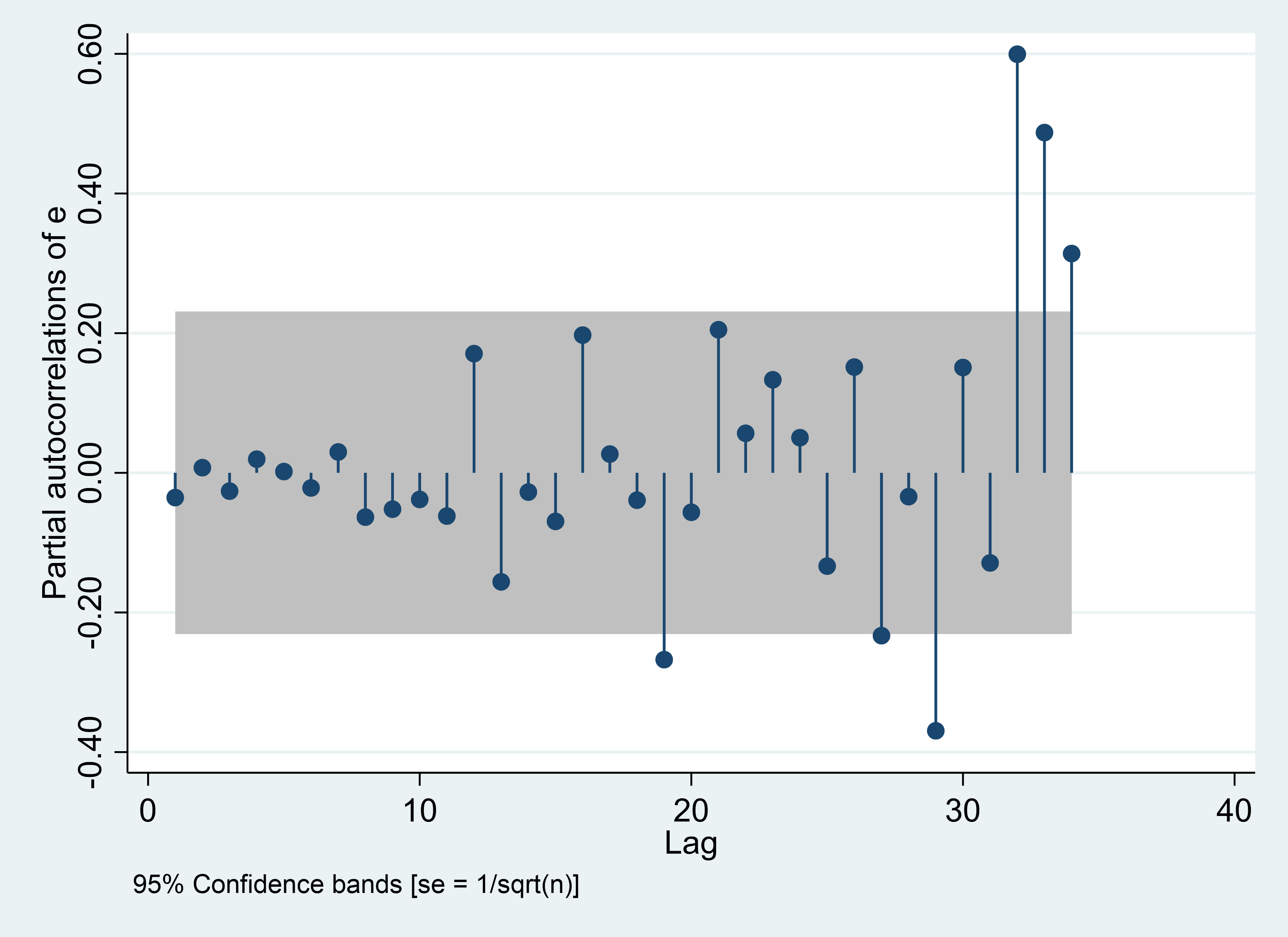

From the Figure 2, the PACF plot shows that the X-axis value corresponding to the points exceeding the critical value in the short term is 10, so the preliminary judgment of the order of the AR model is 10. The ACF plot did not observe any obvious truncation confirmed the series is not suitable for the MA model. So that the initial determination of the model order is AR (10,1,0). Since the AIC and BIC information criteria of the great likelihood fixed-order method could help to judge the best-fit model, after multiple comparisons of the size of the information criteria of the ARIMA model with different coefficients, the ARIMA (10,1,0) was finally concluded to be the best-fitting model.

PACF | ACF |

|

|

Figure 2: PACF and ACF (photo credit: original). | |

3.2. Estimation Results

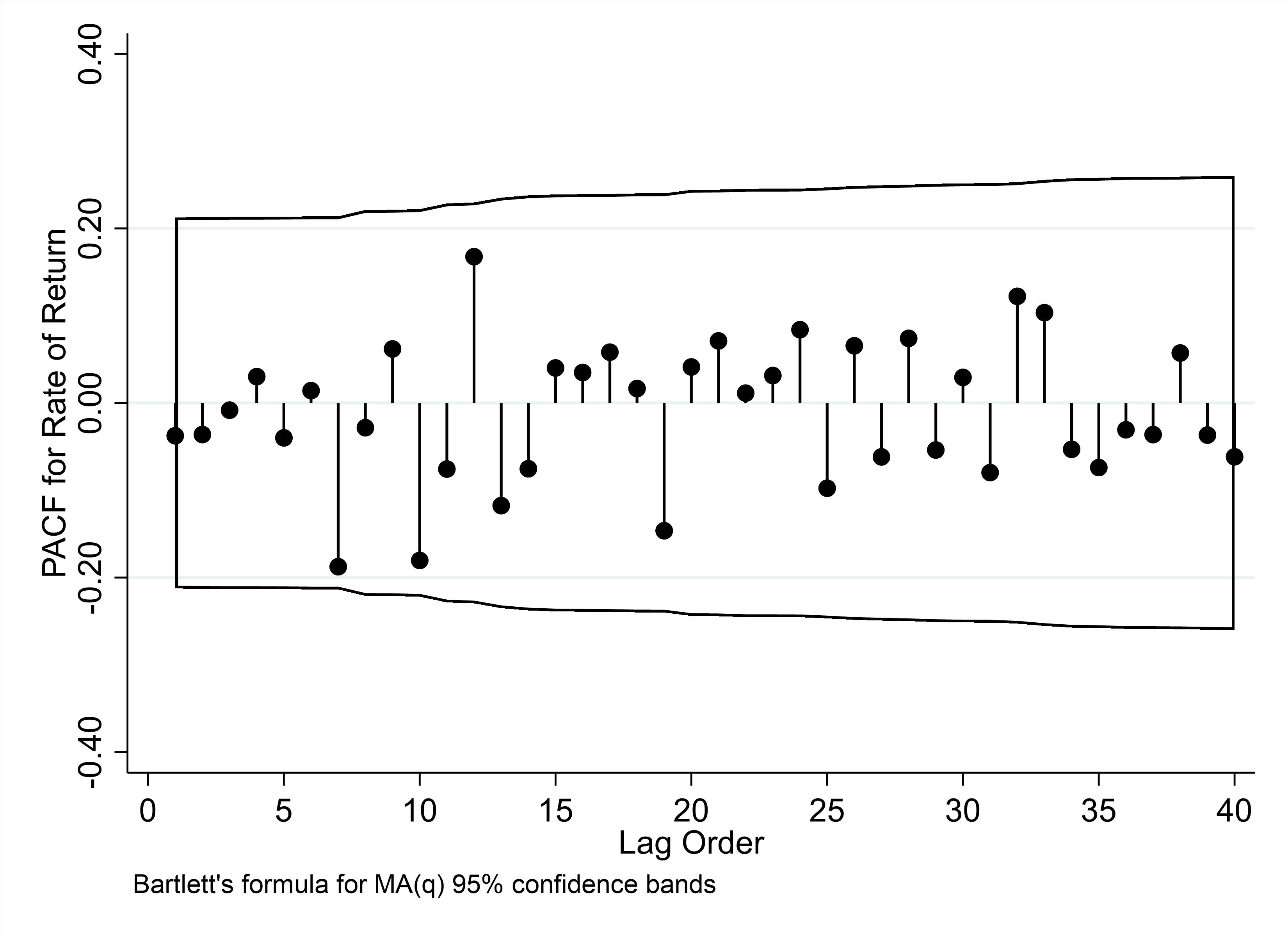

The fitting result of the ARIMA model are shown in the Table 3. The ACF and PACF plots of the residual terms in Figure 3 show that the short-term 95% confidence interval for the autocorrelation function and partial autocorrelation function is met.

|

|

Figure 3: PACF and ACF of residual (photo credit: original). | |

What’s more, the residual test findings revealed a p-value of 0.9877, which is significantly higher than 0.05. The original hypothesis is accepted that the residual series has pure randomness which is defined as white noise series. The results confirms that the model has sufficiently extracted the information in the time series and fits well.

Table 3: Residual test.

Portmanteau test for white noise | |

Portmanteau (Q) statistic | 22.6481 |

Prob > chi2(40) | 0.9877 |

3.3. Prediction and Analysis

The prediction results obtained by the model are shown in the following table. The ARIMA (10,1,0) model was used to dynamically predict the Pharmaceutical and Biological Full Benefit after the Deregulation, 10 weeks of data was fitted. The results were obtained as shown in the table above. The difference in Pharmaceutical and Biological Full Benefit brought about by the Deregulation of COVID-19 is presumed to be the cause of the discrepancy between the prediction and the actual figure. Through this data, the impact which the share price of pharmaceutical industry has suffered could be embodied. Positive difference represents positive impact, negative difference represents negative impact. From the forecast results, it was demonstrated that the variance between the predicted and observed data is primarily negative. The line chart also supports the views that Deregulation will bring a positive impact on the pharmaceutical industry.

Table 4: Actual and fitted value.

Actual value | Fitted value | Difference | |

2022-09-23 | 10443.8 | 11064.46 | |

2022-09-30 | 11022.6 | 10362.601 | |

2022-10-14 | 11885.4 | 11304.633 | |

2022-10-21 | 12017.5 | 11815.501 | |

2022-10-28 | 11640.7 | 11891.985 | |

2022-11-04 | 12362.3 | 11620.76 | |

2022-11-11 | 12080.8 | 12428.096 | |

2022-11-18 | 12730.9 | 12174.13 | |

2022-11-25 | 12076.3 | 12423.534 | |

2022-12-02 | 12207.5 | 11904.24 | |

2022-12-09 | 12261.1 | 12214.446 | 46.654 |

2022-12-16 | 12221.7 | 12317 | -95.3 |

2022-12-23 | 11744.9 | 11683.757 | 61.143 |

2022-12-30 | 12041.7 | 11737.031 | 304.669 |

2023-01-06 | 12359.9 | 11955.964 | 403.936 |

2023-01-13 | 12776.3 | 12264.512 | 511.788 |

2023-01-20 | 13179.5 | 12777.878 | 401.622 |

2023-02-03 | 12895.7 | 12858.653 | 37.047 |

2023-02-10 | 12797 | 12905.564 | -108.564 |

2023-02-17 | 12627.1 | 12790.264 | -163.164 |

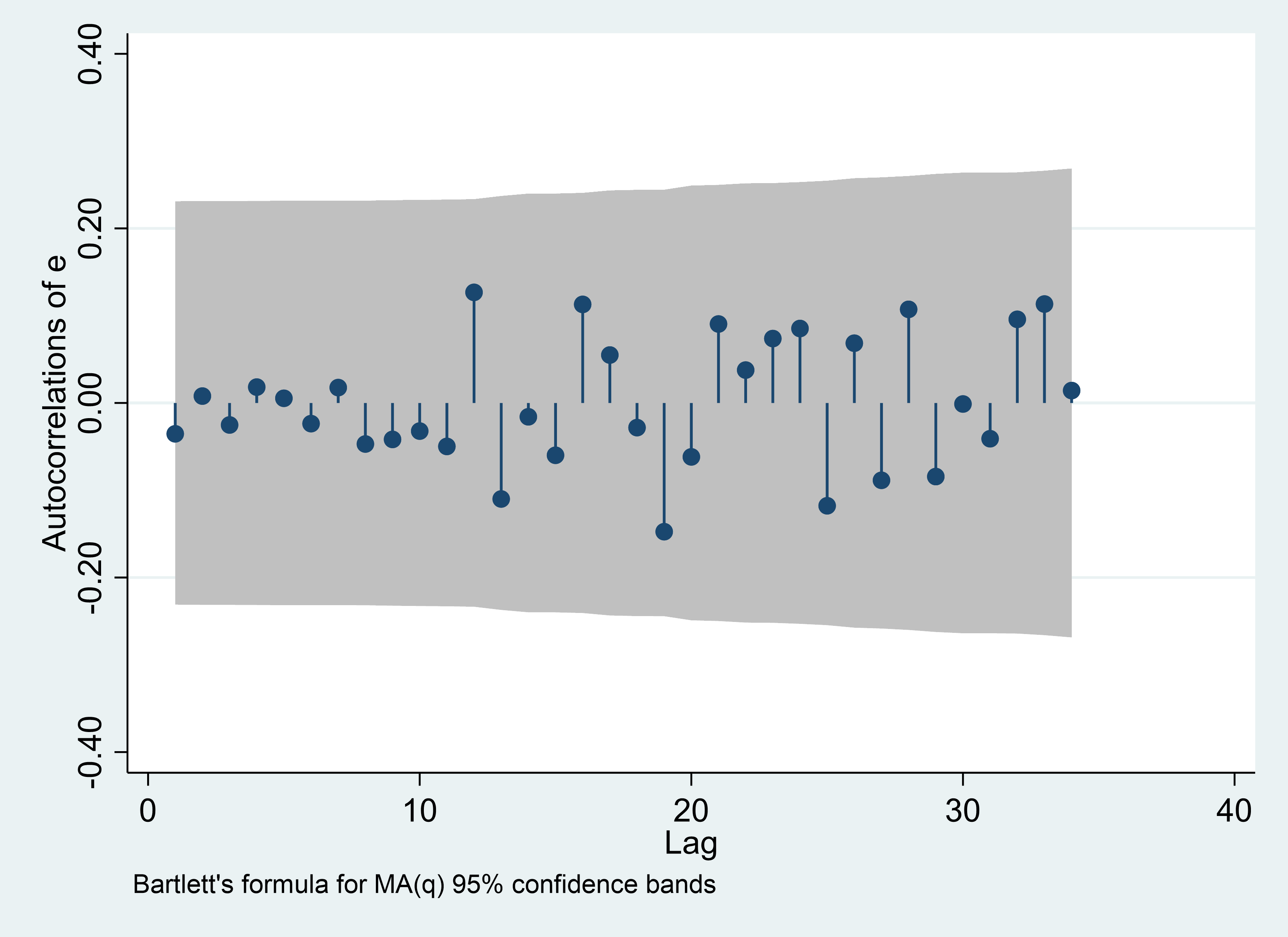

The images of the actual and predicted values are shown in Figure 4:

Figure 4: Actual and fitted value (photo credit: original). |

From the Table 4 and Figure 4, it can be seen that the closing price’s difference between prediction and actual value for the next 10 weeks is highly volatile. Generally speaking, it could be divided into three stages. The difference between the first three weeks and the last three weeks is small, while the difference between the 4-7 weeks is all positive and relatively large. From the perspective of absolute difference, the average absolute difference of the first three weeks is 67.7 yuan, the middle four weeks is 405.5 yuan, and the last three weeks is 102.9 yuan. From the perspective of relative difference, the average relative difference in the first three weeks is 0.56%, 3.22% in the middle four weeks, and 0.81% in the last three weeks. It can be inferred that Deregulation at this stage brought a very strong positive impetus on the pharmaceutical industry. Generally speaking, within ten weeks after the Deregulation, the difference between the actual value and what was predicted is not particularly wide. Combining the current situation of the industry and the analysis of historical influencing factors, it can be concluded that since the outbreak of the COVID-19, the pharmaceutical industry has continued to be positively affected by the pandemic, which is also evidenced by the continuous rise in stock prices in other pharmaceutical industries. Although the rate of increase in each period is different, the closing price of the Pharmaceutical and Biological Full Benefit also continues to rise, and a relatively high level has been reached. Therefore, the increase brought by the Deregulation is relatively insignificant under the large base.

The lower gap in the first three weeks can be explained by the information spreading’s lag and the characteristics of the demand for medical products. Although the Deregulation policy was announced on December 7, 2022, due to different regional policies and actual conditions, the actual Deregulation was not completed until the end of December across the country. Moreover, the demand for pharmaceutical products is mostly inelastic, so that the fluctuations of it are more manifested in the form of delayed consumption. Therefore, the impact of Deregulation on the medical index has a certain lag. Starting from January, all localities have gradually completed the Deregulation. In the short term, due to the fear and concern about the COVID-19 and the increase in the number of confirmed patients, the public's demand for medical drugs, disinfection and protective products has sharply increased. Facing the short-term outbreak of demand, the production capacity of the medical industry is able to be released quickly. And the stock price of pharmaceutical industry could be lifted driven by the demand. Then the decline in the growth rate in the next three weeks could be attributed to the recovery of people who affected the COVID-19 for the first time and the medicines and protective products required by individuals and families have already been purchased in the previous month. In that case the decline in demand has played a significant role in leading a flattening of the increase in the stock price of the pharmaceutical industry.

From a long-term perspective, due to the normalization of the COVID-19 after the Deregulation, its impact on the pharmaceutical industry will continue to weaken. Regression to normalized levels will be attained soon as the gap between the predicted value and the actual number is continuously shrinking.

In order to exclude market trends, the closing price of SSEC on December 9, 2022 and February 17, 2023 is used for calculation. That works out to an overall market gain of 0.53%. The average increase in the closing price of the Pharmaceutical and Biological Full Benefit during this period was 1.13%. After making a difference, it is concluded that the total income of biopharmaceuticals rose by 0.6% after excluding the market effect, which is not a very large range. A possible explanation for this is that investor sentiment influences their behavior. The Deregulation has brought a certain degree of panic, which has exacerbated investors' fear and anxiety. As a result, the stock price has not yet changed in the fundamentals. The stock price has adjusted downward due to fluctuations in investor sentiment and conservative risk appetite [7].

4. Discussion

The influence of the COVID-19 on numerous industries at the macroeconomic level serves as the main analysis object for the papers that have already been published. The research directions cover the size of the impact, industry differences, and behind-the-scenes reasons. The majority of the articles demonstrate that a variety of industries have been severely and negatively impacted by the COVID-19 outbreak. Because of its particularity, the pharmaceutical industry is directly impacted by the pandemic at the level of supply and demand [6]. In that case great number of papers hold the positive attitude towards the impact of the COVID-19 on the pharmaceutical industry. Regarding the duration of the impact, the available literature generally starts with investor sentiment, claiming that the COVID-19's effects on the capital market are short-term in nature, gradually would return to normal with the progressing of pandemic. The entry point of this paper is whether the Deregulation has an impact on the pharmaceutical industry. The results show that the impact of Deregulation and the outbreak of the pandemic on the pharmaceutical industry have the characteristic of positive and short-term, with the existence of lag.

However, the impact of the Deregulation was not as great as the COVID-19 outbreak while it is only be shown as a small-scale fluctuation. From this paper, the effect brought by the Deregulation could be described as positive, short-term and lagging, which is coincided with the existing papers analyzing the impact of the COVID-19 on the pharmaceutical industry. From the closing price fluctuation line chart of the Pharmaceutical and Biological Full Benefit, it can be seen that the closing price first dropped slightly with the outbreak of the COVID-19 as the node, and then rose sharply. After maintaining a high level for a certain period, it began to fluctuate and decline in August 2021. This is consistent with the views of Wu Zhaobo and Guo Huiwen's paper. They believe that in the post-pandemic era, the rate of return and volatility of the medical industry will change more sharply comparing with experiencing the outbreak. There will be a certain decline, but the overall situation is relatively rising [19]. The high level of underlying stock price makes the stock price increase brought about by the Deregulation relatively insignificant. At the same time, the pandemic has lasted for nearly three years. During this process, although China has always adhered to strict control policies, it is constantly adjusting and adapting to national conditions. The COVID-19's effect on the Chinese market is progressively waning. Therefore, by the time of Deregulation, the stock market situation in the pharmaceutical industry has basically returned to normal. And unlike the sudden outbreak of the pandemic, the adjustment of China's supporting policies accompanied the lifting of control, giving the pharmaceutical market enough time to adjust.

From the research results, it can be seen that the dividends brought by the COVID-19 to the pharmaceutical industry are gradually running out. Independent research improvements of high-tech instruments and the upgrading and transformation of medical equipment enterprises require more focus. Meanwhile, improve the research and development capabilities of biomedicine, make full use of technologies. For example, developing big data, bioinformatics, and artificial intelligence are all of great importance to occupy the development highland of biomedicine as soon as possible. For China, they should fully utilize the benefits of China's independent medicine, actively cooperate with foreign companies, and explore overseas markets [20].

At the government policy level, the state should cooperate with the improvement and upgrading of the pharmaceutical industry. After the Deregulation, the shortage of medicines and protective equipment exposed the shortcomings of China's medical industry chain and supply side. From this, it can be concluded that it is essential to intensify the reform of the medical security system and promote a more mature and perfect medical security system to effectively deal with such problems. Bolster the pharmaceutical industry's capacity for supply and uphold its long-term, steady growth.

As far as investors are concerned, major emergencies such as the COVID-19 will often have an adverse effect on investor sentiment and lead to turmoil and decline in the stock market. But subsequent stock price fluctuations may be diametrically opposed to expectations. Therefore, investors should maintain a more stable and positive wait-and-see attitude towards the pharmaceutical industry in order to maximize benefits.

5. Conclusion

In the context of the outbreak of the COVID-19, assuming that China still in the condition of lockdowning, the possible value of the closing price data of the Pharmaceutical and Biological Full Benefit in the short term is predicted through the ARIMA model. By comparing the predicted value to the actual value, the effect of the reopening on the pharmaceutical business is examined. The results show that the Deregulation has had a positive and short-term impact on the pharmaceutical industry, with a certain lag period, and the impact is not very large. In terms of positive, short-term, and hysteresis aspects, this discovery is consistent with how the current COVID-19 outbreak has affected the pharmaceutical industry. Demonstrating the usefulness of the ARIMA model for short-term stock price forecasts in the pharmaceutical sector. And based on the conclusions, it can provide certain theoretical support and action guidance for the pharmaceutical industry, government, and investors. However, the COVID-19 has a long duration and policy changes during the period have a greater impact on the pharmaceutical industry. It is difficult to measure the specific impact of the Deregulation on the pharmaceutical industry. Therefore, more detailed variable considerations are needed in stock price forecasting to obtain more accurate forecasting results and impact analysis.

References

[1]. Jamir, I. (2020). Forecasting potential impact of COVID-19 outbreak on India's GDP using ARIMA model. SSRN.

[2]. M Ren Min, C Wang & H Yan. (2022). The impact of the new crown pneumonia pandemic on the stock price of my country's pharmaceutical industry——An empirical analysis based on the ARIMA model. Northern Economics and Trade (02), 93-96.

[3]. J Yao & L Zhang. (2022). Research on China's New Crown Pandemic Prevention and Control Policy——Based on the Perspective of National Governance Modernization. Humanities Magazine (03), 33-42.

[4]. L Liu. (2022). Research on the Impact of the New Crown Pandemic on the Stock Return Rate of my country's Pharmaceutical Industry (Master's Thesis, Qufu Normal University). https://kns.cnki.net/KCMS/detail/detail.aspx?dbname =CMFD202301&filename=1022032496.nh

[5]. Comprehensive Group of Joint Defense and Control Mechanism of the State Council. (2022). Notice on Further Optimizing and Implementing the Prevention and Control Measures of the COVID-19. https://www.gov.cn/xinwen/2022-12/07/content_5730443.htm

[6]. X Yang. (2022). Research on the Impact of Major Pandemic Events on Stock Price Fluctuations of Listed Biopharmaceutical Companies (Master's Thesis, Zhejiang University). https://kns.cnki.net/KCMS/detail/detail.aspx?dbname= CMFD202301&filename=1022507958.nh

[7]. Wang Qing, Wang Zhongli, Li Shixue & Xue Fuzhong. (2020). The short-term impact of the "new crown pneumonia" pandemic on China's stock market price fluctuations. Economic and Management Review (06), 16-27.

[8]. Z Zhang, S Zhu & F Lu. (2020). Research on the Impact Effect of the New Crown Pandemic on the Capital Market. Friends of Accounting (18), 131-137.

[9]. H Xu & H Pu. (2021). The Impact of the New Crown Pandemic on China's Stock Market——A Study Based on Event Research Method. Financial Forum (07), 70-80.

[10]. H Liu. (2022). The impact of the new crown pandemic on the stock prices of listed companies in China's pharmaceutical industry and the measurement of factors (Master's thesis, Dongbei University of Finance and Economics). https://kns.cnki.net/KCMS/detail/detail .aspx?dbname=CMFD202301&filename=1022067884.nh

[11]. Y Duan. (2020). The Impact of the New Crown Pneumonia Pandemic on my country's Stock Market——Based on the Empirical Analysis of the Pharmaceutical Industry. China Business Theory (18), 28-30.

[12]. K Zhang & Q Qian. (2020). Impact of the New Crown Pandemic on China's Economy and Policy Discussion—Evidence from Listed Companies. Tropical Geography (03), 396-407.

[13]. Abiad, A., Arao, R. M., & Dagli, S. (2020). The economic impact of the COVID-19 outbreak on developing Asia.

[14]. Barshikar, R. (2020). Covid 19–Impact and new normal for pharmaceutical industry (Part–I). Journal of Generic Medicines, 16(3), 112-119.

[15]. Mittal, S., & Sharma, D. (2021). The impact of COVID-19 on stock returns of the Indian healthcare and pharmaceutical sector. Australasian Accounting, Business and Finance Journal, 15(1), 5-21.

[16]. Sun, Y., Wu, M., Zeng, X., & Peng, Z. (2021). The impact of COVID-19 on the Chinese stock market: Sentimental or substantial? Finance Research Letters, 38, 101838.

[17]. Jena, P. K., & Mishra, P. K. (2022). Lockdown vs. Opening-Up of the Economy During the COVID-19 Pandemic and the Indian Stock Market. Asian Economics Letters, 3(Early View).

[18]. Almurisi, S. H., Al Khalidi, D., AL-Japairai, K. A., Mahmood, S., Chilakamarry, C. R., Kadiyala, C. B. N., & Mohananaidu, K. (2020). Impact of COVID 19 pandemic crisis on the health system and pharmaceutical industry. Letters in Applied NanoBioScience, 10(2), 2298-2308.

[19]. Z Wu & H Guo. (2023). An Empirical Analysis of the Development Opportunities of the Pharmaceutical Industry under the Post-pandemic Background. Cooperative Economy and Technology (11), 30-33.

[20]. F Yuan, P Yuan & Y Zheng. (2022). Research on the development opportunities of the biomedical industry under the new crown pandemic. Global Science and Technology Economic Outlook (11), 28-33.

Cite this article

Chen,Y. (2023). The Impact of the Deregulation of Covid-19 on the Pharmaceutical Industry. Advances in Economics, Management and Political Sciences,45,263-273.

Data availability

The datasets used and/or analyzed during the current study will be available from the authors upon reasonable request.

Disclaimer/Publisher's Note

The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of EWA Publishing and/or the editor(s). EWA Publishing and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content.

About volume

Volume title: Proceedings of the 2nd International Conference on Financial Technology and Business Analysis

© 2024 by the author(s). Licensee EWA Publishing, Oxford, UK. This article is an open access article distributed under the terms and

conditions of the Creative Commons Attribution (CC BY) license. Authors who

publish this series agree to the following terms:

1. Authors retain copyright and grant the series right of first publication with the work simultaneously licensed under a Creative Commons

Attribution License that allows others to share the work with an acknowledgment of the work's authorship and initial publication in this

series.

2. Authors are able to enter into separate, additional contractual arrangements for the non-exclusive distribution of the series's published

version of the work (e.g., post it to an institutional repository or publish it in a book), with an acknowledgment of its initial

publication in this series.

3. Authors are permitted and encouraged to post their work online (e.g., in institutional repositories or on their website) prior to and

during the submission process, as it can lead to productive exchanges, as well as earlier and greater citation of published work (See

Open access policy for details).

References

[1]. Jamir, I. (2020). Forecasting potential impact of COVID-19 outbreak on India's GDP using ARIMA model. SSRN.

[2]. M Ren Min, C Wang & H Yan. (2022). The impact of the new crown pneumonia pandemic on the stock price of my country's pharmaceutical industry——An empirical analysis based on the ARIMA model. Northern Economics and Trade (02), 93-96.

[3]. J Yao & L Zhang. (2022). Research on China's New Crown Pandemic Prevention and Control Policy——Based on the Perspective of National Governance Modernization. Humanities Magazine (03), 33-42.

[4]. L Liu. (2022). Research on the Impact of the New Crown Pandemic on the Stock Return Rate of my country's Pharmaceutical Industry (Master's Thesis, Qufu Normal University). https://kns.cnki.net/KCMS/detail/detail.aspx?dbname =CMFD202301&filename=1022032496.nh

[5]. Comprehensive Group of Joint Defense and Control Mechanism of the State Council. (2022). Notice on Further Optimizing and Implementing the Prevention and Control Measures of the COVID-19. https://www.gov.cn/xinwen/2022-12/07/content_5730443.htm

[6]. X Yang. (2022). Research on the Impact of Major Pandemic Events on Stock Price Fluctuations of Listed Biopharmaceutical Companies (Master's Thesis, Zhejiang University). https://kns.cnki.net/KCMS/detail/detail.aspx?dbname= CMFD202301&filename=1022507958.nh

[7]. Wang Qing, Wang Zhongli, Li Shixue & Xue Fuzhong. (2020). The short-term impact of the "new crown pneumonia" pandemic on China's stock market price fluctuations. Economic and Management Review (06), 16-27.

[8]. Z Zhang, S Zhu & F Lu. (2020). Research on the Impact Effect of the New Crown Pandemic on the Capital Market. Friends of Accounting (18), 131-137.

[9]. H Xu & H Pu. (2021). The Impact of the New Crown Pandemic on China's Stock Market——A Study Based on Event Research Method. Financial Forum (07), 70-80.

[10]. H Liu. (2022). The impact of the new crown pandemic on the stock prices of listed companies in China's pharmaceutical industry and the measurement of factors (Master's thesis, Dongbei University of Finance and Economics). https://kns.cnki.net/KCMS/detail/detail .aspx?dbname=CMFD202301&filename=1022067884.nh

[11]. Y Duan. (2020). The Impact of the New Crown Pneumonia Pandemic on my country's Stock Market——Based on the Empirical Analysis of the Pharmaceutical Industry. China Business Theory (18), 28-30.

[12]. K Zhang & Q Qian. (2020). Impact of the New Crown Pandemic on China's Economy and Policy Discussion—Evidence from Listed Companies. Tropical Geography (03), 396-407.

[13]. Abiad, A., Arao, R. M., & Dagli, S. (2020). The economic impact of the COVID-19 outbreak on developing Asia.

[14]. Barshikar, R. (2020). Covid 19–Impact and new normal for pharmaceutical industry (Part–I). Journal of Generic Medicines, 16(3), 112-119.

[15]. Mittal, S., & Sharma, D. (2021). The impact of COVID-19 on stock returns of the Indian healthcare and pharmaceutical sector. Australasian Accounting, Business and Finance Journal, 15(1), 5-21.

[16]. Sun, Y., Wu, M., Zeng, X., & Peng, Z. (2021). The impact of COVID-19 on the Chinese stock market: Sentimental or substantial? Finance Research Letters, 38, 101838.

[17]. Jena, P. K., & Mishra, P. K. (2022). Lockdown vs. Opening-Up of the Economy During the COVID-19 Pandemic and the Indian Stock Market. Asian Economics Letters, 3(Early View).

[18]. Almurisi, S. H., Al Khalidi, D., AL-Japairai, K. A., Mahmood, S., Chilakamarry, C. R., Kadiyala, C. B. N., & Mohananaidu, K. (2020). Impact of COVID 19 pandemic crisis on the health system and pharmaceutical industry. Letters in Applied NanoBioScience, 10(2), 2298-2308.

[19]. Z Wu & H Guo. (2023). An Empirical Analysis of the Development Opportunities of the Pharmaceutical Industry under the Post-pandemic Background. Cooperative Economy and Technology (11), 30-33.

[20]. F Yuan, P Yuan & Y Zheng. (2022). Research on the development opportunities of the biomedical industry under the new crown pandemic. Global Science and Technology Economic Outlook (11), 28-33.