1. Introduction

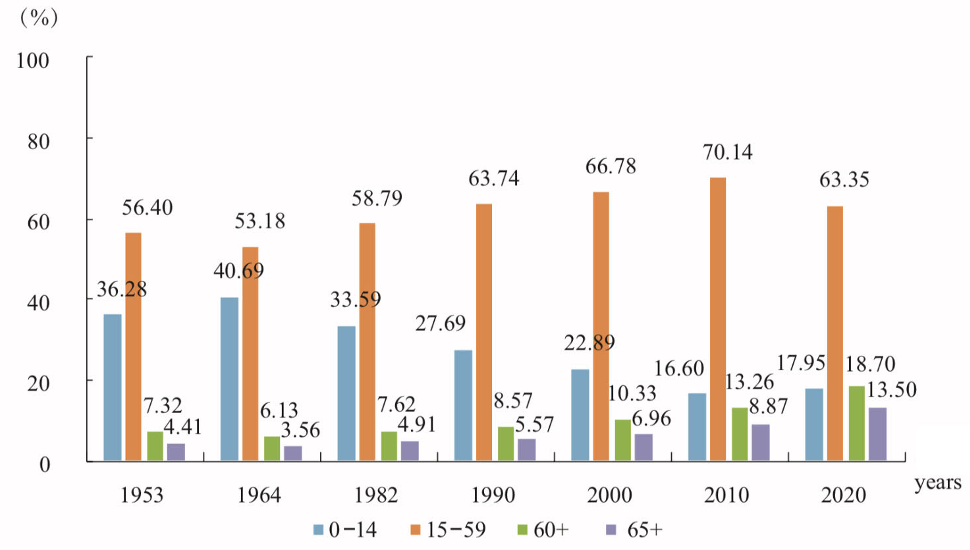

China is currently moving swiftly closer to reaching middle age. The proportion of the population in China who are 60 or older will reach 18.70% in 2020, up 5.44% from 2010, and the proportion who are 65 or older will reach 13.50%, up 4.63% from 2010, further accelerating the ageing of the population. The total fertility rate for women of childbearing age in China will be 1.3 in 2020, which is lower than the average fertility rate corresponding to the current level of GDP per capita. At the same time, fertility intentions have also decreased, aggravating the dynamics of population aging.

China's aging population has three main characteristics: First, it has a huge base of elderly people. The size of its aging population already accounts for a quarter of the world's total population in the same age group. Second, the aging of its population is accelerating. A comparison with the world's top ten economies shows that while China is not yet very old, it is expected to age much faster than other countries in the coming decades. Third, there is a phenomenon of 'aging before wealth' between China's wealth and its aging. Due to its late start in economic development, China is already facing a number of problems caused by its aging population, such as insufficient labor supply, declining labor productivity, increasing social security burden, changing consumption structure, and weakening investment demand, compared with other middle-income countries.

As the population ages, factors such as a declining working-age population and rising pension expenditure will have far-reaching macroeconomic implications for China. As a result, a thorough examination of how China's ageing population affects the country's macroeconomy can offer theoretical direction and useful examples for the government as it develops policy measures to address population aging's challenges. This will support long-term social stability and economic growth, and it also has significant academic value.

Research on this topic has previously been done by a number of academics in China. In accordance with Zhong's paper, China has begun to age due to rising per capita life expectancy and the long-term implementation of China's early family planning policy. As a result, there will likely be a decline in economic dynamism, low investment demand, a double deficit in the balance of payments, and simultaneous contractions of supply and demand. It does not foster the growth of an inventive environment or long-term economic progress [1]. Li & Zhang concluded that an aging population will reduce investment and national savings rates, and increase fiscal and deflationary pressures, but will also bring new development opportunities in artificial intelligence, pension finance, and financial markets [2]. Wu similarly argues that an aging population will inhibit China's economic growth and lead to a recession by affecting factors such as inflation, employment, and the balance of payments [3].

This study examines the effects of population ageing on China's labour market, investment demand, balance of payments, and fiscal pressure by integrating the research findings of numerous scholars, choosing pertinent data from previous population census results made public by the National Bureau of Statistics of China, and applying the theories of the Solow model and the Cobb-Douglas production function.

2. Aging Population Leads to Shrinking Size of Labor Market

2.1. Supply of Labor

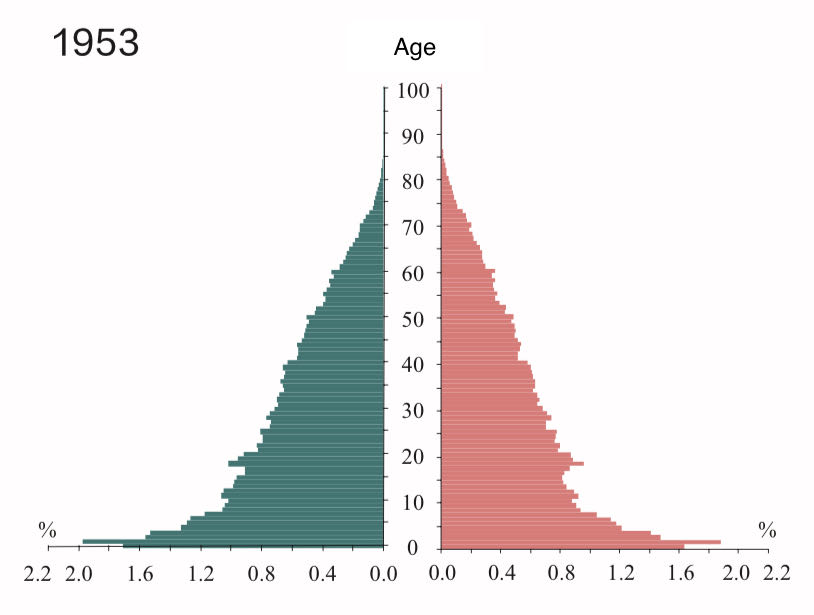

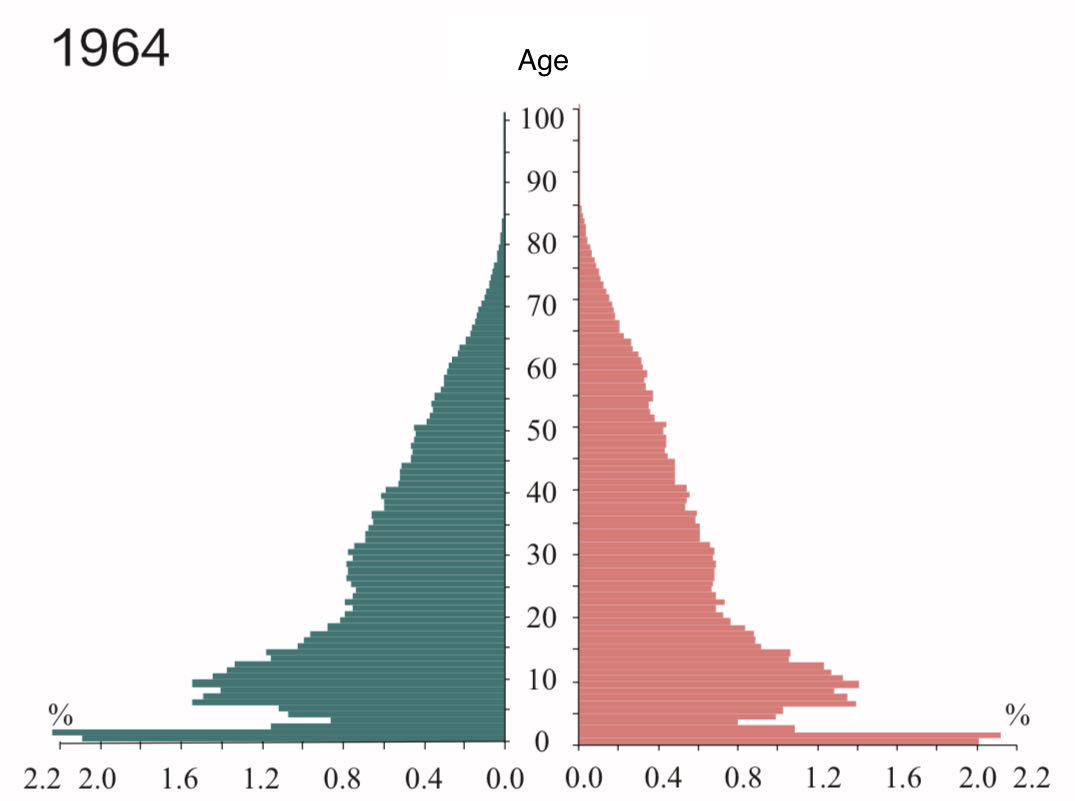

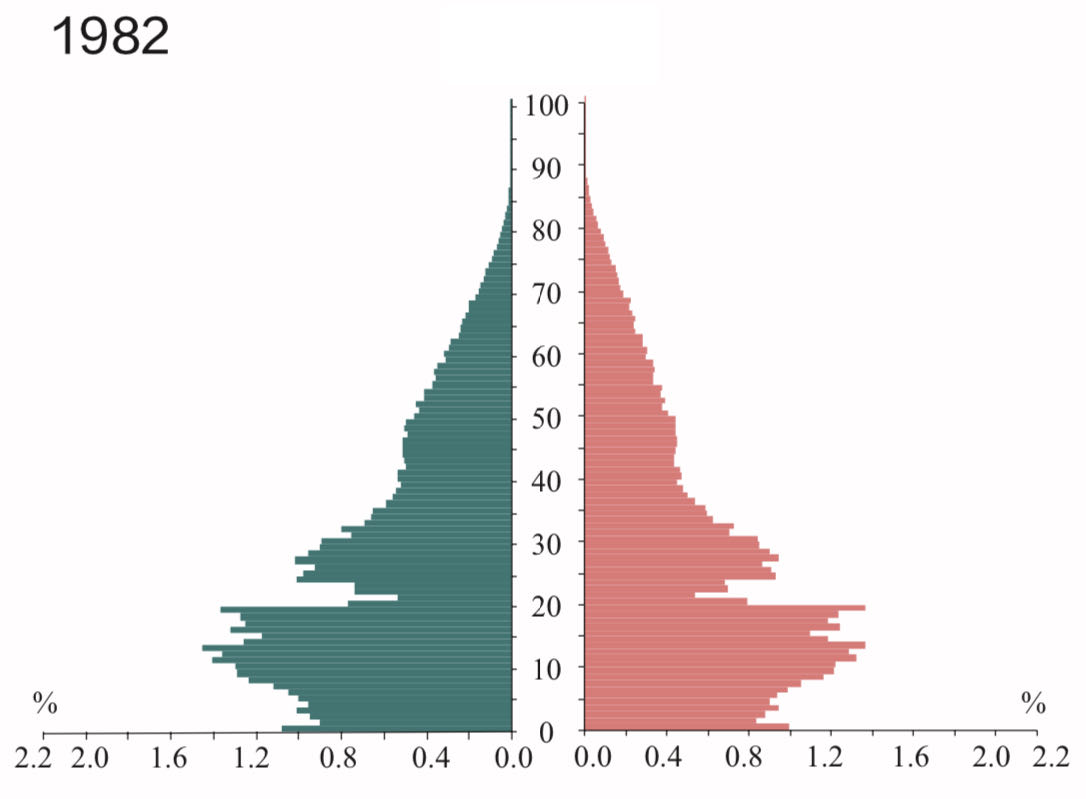

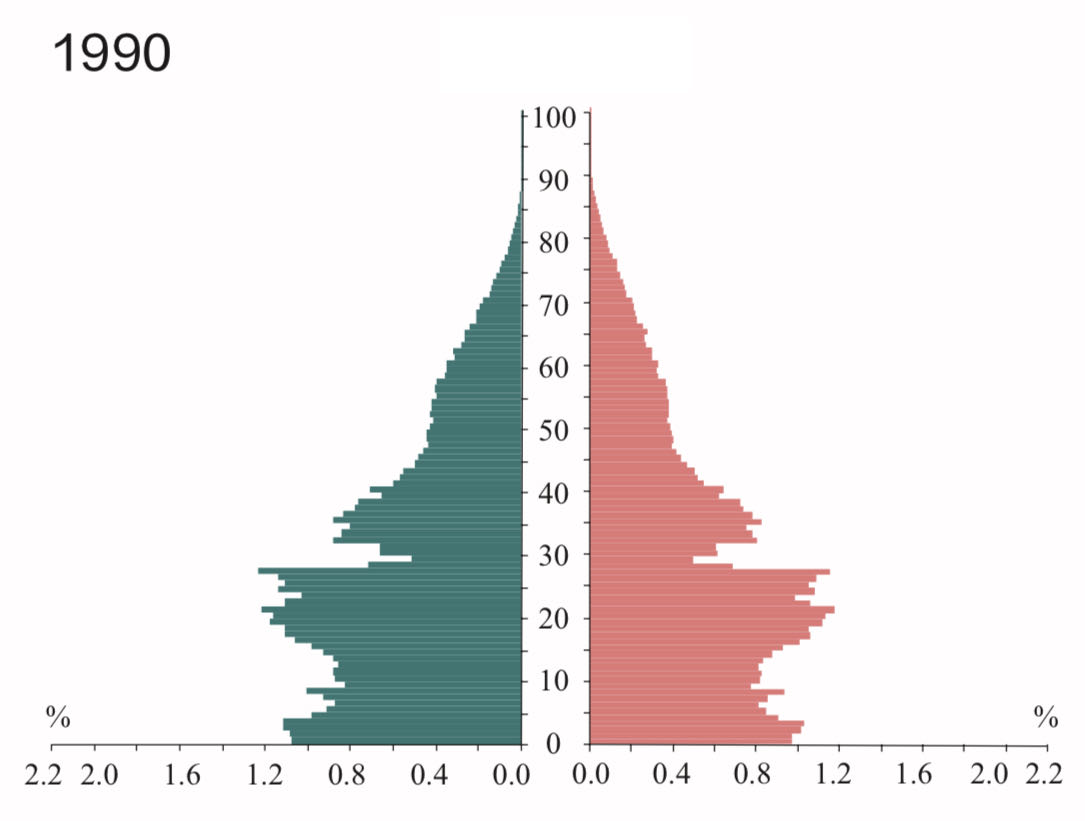

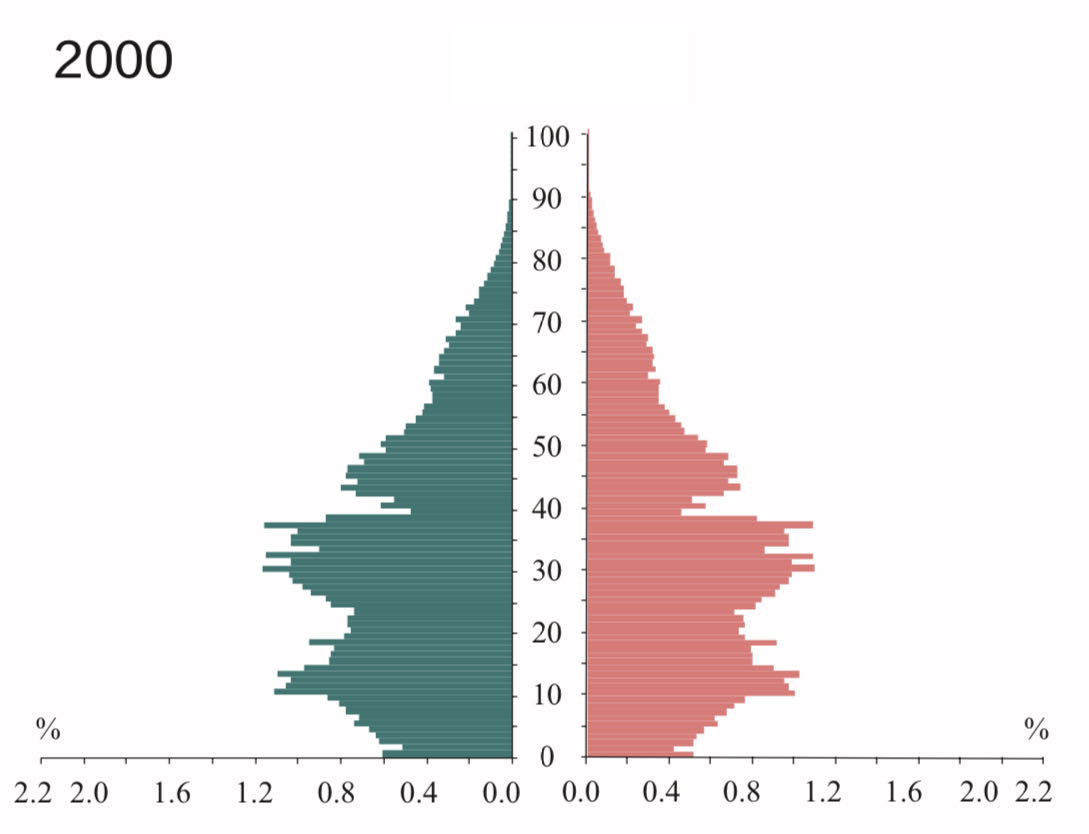

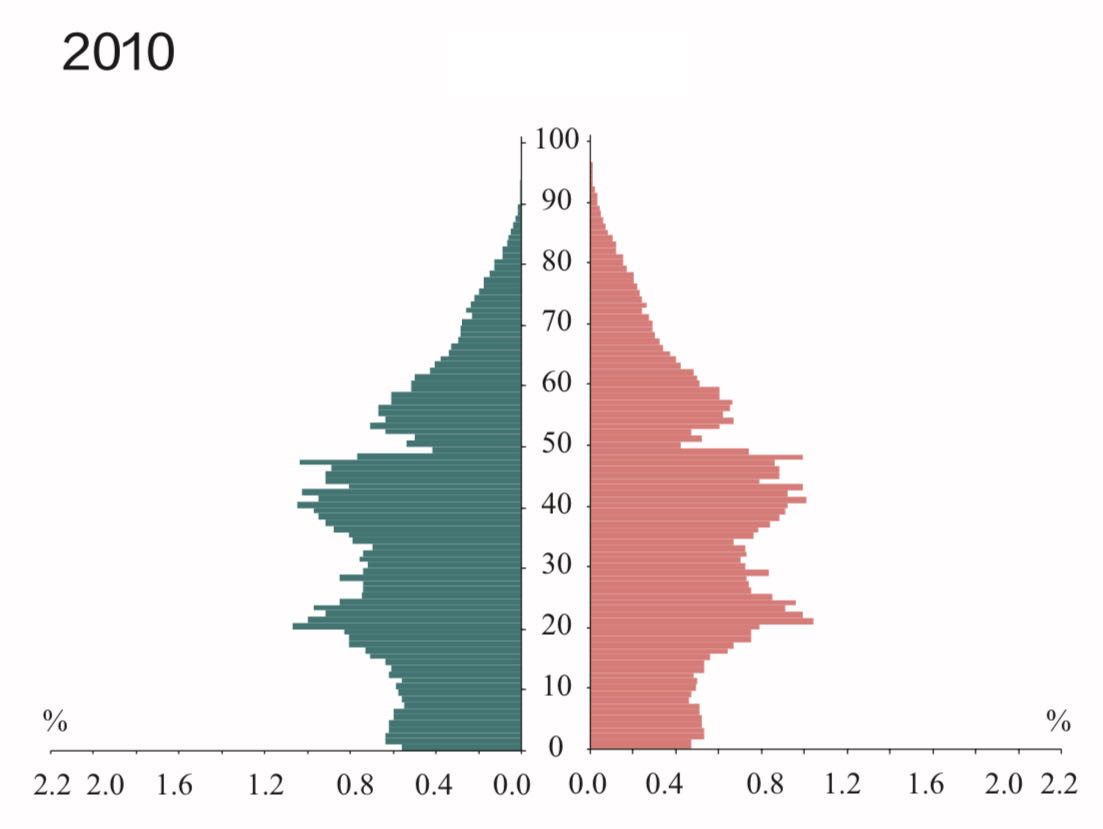

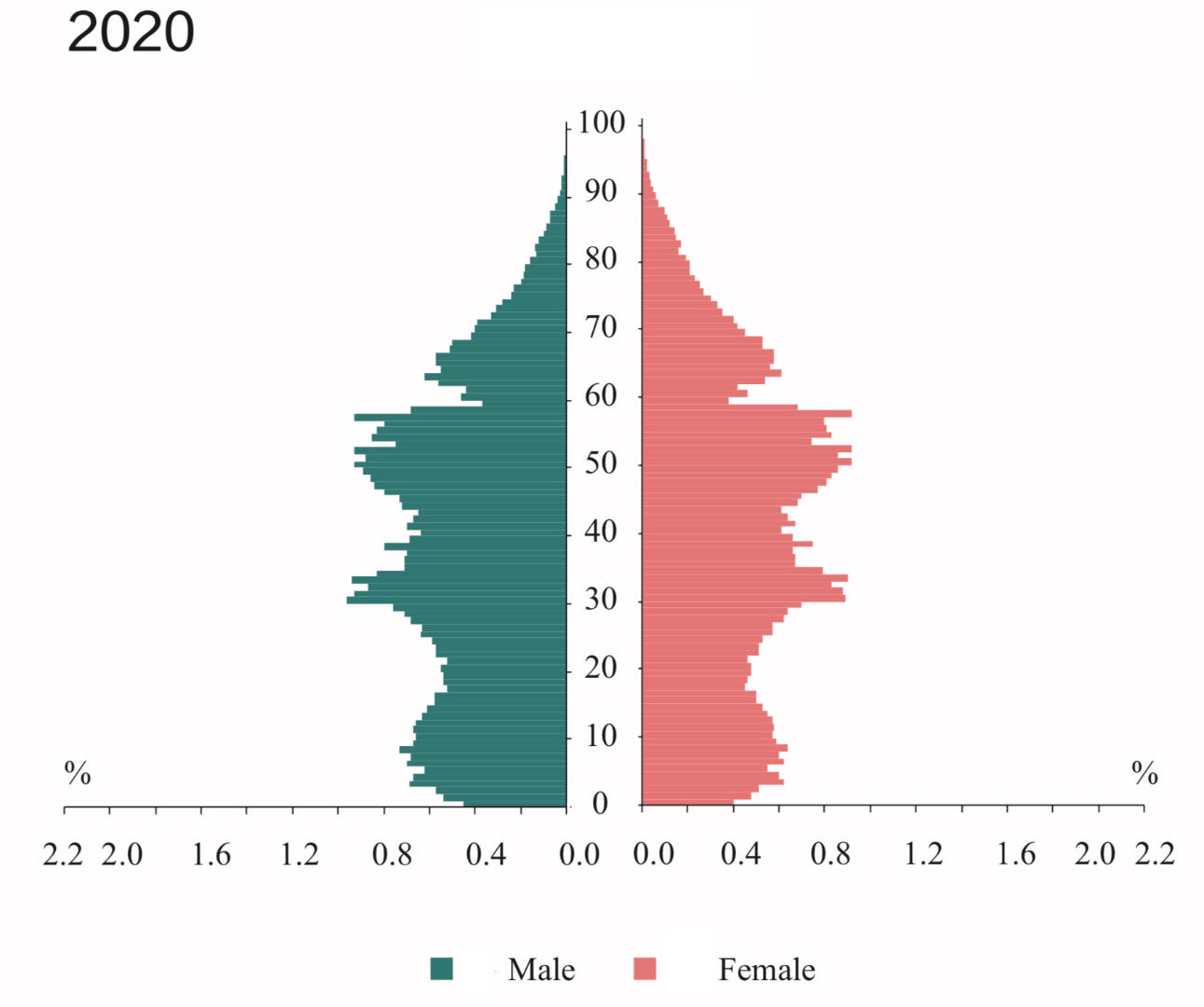

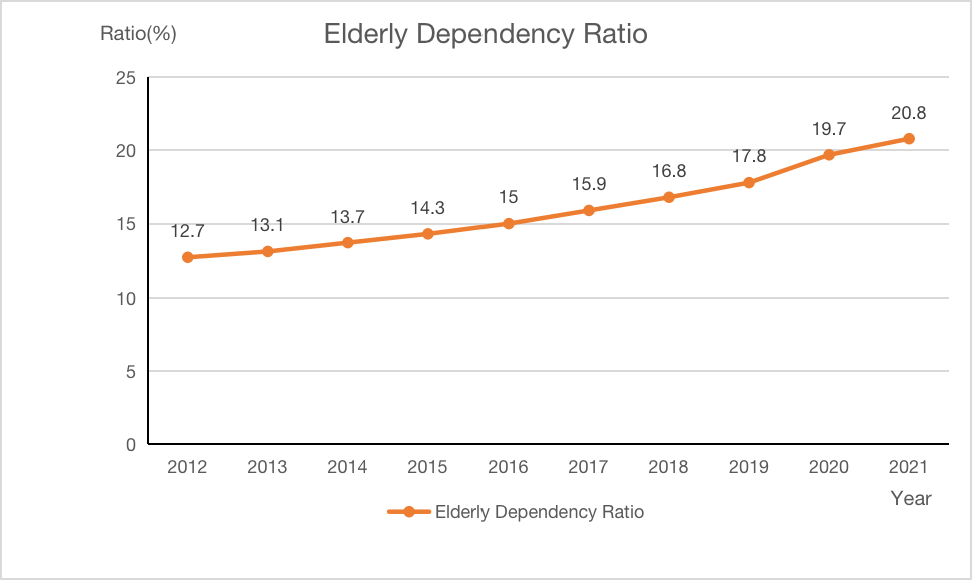

Population aging affects the effective supply of labor in two ways. First, the number of people in the labor force decreases as a result of aging. As shown in Figure 1, between 2010 and 2020, the proportion of China's working-age population will fall sharply, from 70.14% to 63.35%, while the proportion of the elderly population, especially those aged 65 and above, will rise by 4.63%. As shown in Figure 2, the age structure of China's population also shows a gradual aging trend. The labor supply is relatively declining. As China's total population will experience negative growth for the first time in 2023, the actual labor supply capacity is already gradually weakening. Second, aging will lead to a lower labor force participation rate. This is mainly because the burden of old age on China's working population will continue to rise. As shown in Figure 3, the dependency ratio of China's elderly population aged 65 and above will continue to rise from 2012 to 2021, reaching 20.8% in 2021, an increase of 1.1% from 2020. In May 2021, the China Association of the Aging released the Report on the Status and Development of Care Services for the Elderly with Cognitive Disorders, which predicts that China's elderly dependency ratio will exceed 50% by 2035, meaning that one elderly person will be needed for every two young people. The continued rise in the elderly dependency ratio means that young adults will increasingly bear the burden of old age. And as the population ages, the health of the older population will inevitably continue to decline. These two factors will directly reduce the participation of young people in the labor market and thus reduce the effective labor supply.

Figure 1: Age composition of China's population by census (data source: NBS).

|

|

(a) | (b) |

|

|

(c) | (d) |

|

|

(e) | (f) |

| |

(g) | |

Figure 2: China's population pyramid by census (data source: NBS).

Figure 3: National dependency ratio of older people aged 65+, 2012-2021.

Data source: NBS

An aging population will also have a negative impact on the efficiency of labor production. A study by Zhang on migrant workers in Dongguan City found that the productivity of workers in labor-intensive industries declined rapidly with age after the age of 35 [4]. Most companies in China are still labor-intensive. According to Lehman's research, there is an inverted U-shaped relationship between individual age and labor productivity, but the location of the peak appears slightly different in different industries. In fields such as artistic creation and purely physical theoretical research, labor productivity tends to peak around the age of 30 and then decline rapidly. In contrast, in fields such as medical research and historical research, labor productivity is expected to peak around the age of 40-50, followed by a slow decline [5]. In addition, older workers face the problems of gradually declining physical functions, an aging knowledge base, and inefficient use of information, as well as reduced organizational and innovative skills, and are unable to adapt quickly to the changes needed to modernize the industrial structure [6]. Therefore, labor productivity growth will be adversely affected by an increase in the share of middle-aged and older workers.

2.2. Human Capital

The impact of an aging population on China's human capital is twofold. On the one hand, an aging population will inhibit investment in educational human capital and be detrimental to the accumulation of educational human capital. According to the human capital theory proposed by Schulz and Becker, the key to improving human capital is to raise the level of education and invest more in basic education. From the perspective of individual households, an aging population leads to a relative reduction in the share of the working population, which in turn reduces household income. Under the combined pressure of rising healthcare costs and the need for precautionary savings, households tend to cut back on current investment and consumption expenditure and directly reduce their investment in the education of their offspring. From the perspective of society as a whole, the rising proportion of the elderly population will force social resources to be directed more toward meeting the needs of the elderly, such as old-age security and medical services. China's social security and healthcare systems are still in the early stages of development and the level of investment is insufficient. To cope with aging, the government will inevitably increase spending on healthcare and pensions, crowding out investment in education. At the same time, the reduced labor supply brought about by an aging population may lead to slower economic growth and shrinking fiscal revenues. With limited fiscal resources, the Chinese government will face greater challenges in meeting its investment needs in education, including infrastructure development, teacher training, and salary security. In addition, an aging population may also lead to restructuring and transformation of the education system. As the older population increases, education systems will need to focus more on areas such as adult education and vocational training to meet the learning needs of the older workforce. This may lead to changes in traditional patterns of investment in human capital for education, which may affect investment in human capital for other age groups.

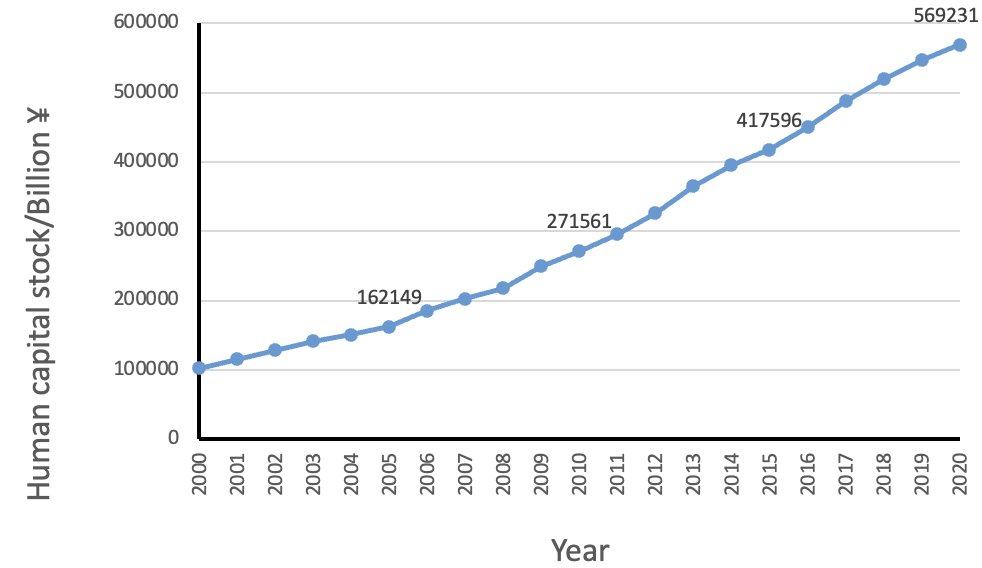

On the other hand, an aging population will increase investment in healthy human capital. By constructing a structural equation model, Su found that population aging promotes healthy human capital, which has a positive driving effect on economic growth [7]. In other words, as government spending is skewed towards social security and services for the elderly, increased investment in healthy human capital will contribute to the accumulation of healthy human capital in society. Thus, population aging will lead to a decrease in educational human capital and an increase in healthy human capital, with the overall effect on China's human capital depending on the relative size of these two effects. Figure 4 shows that China's human capital stock has been on an upward trend since it entered an aging society in 2000, probably mainly due to the significant increase in its own labor force per capita and the increase in the total labor force. However, the Chinese government still needs to be aware of the medium- to long-term impact of aging on its human capital stock and take timely policy measures to promote sustainable economic growth.

Figure 4: Total real human capital in China, 2000-2020.

Data source: China human capital report 2022

3. Aging Population Curbs Investment Demand

An aging population will have a negative impact on investment demand in China. From the perspective of the demand side of investment, when investment is generated, it is used in two main ways, partly for capital deepening, i.e. increasing the stock of capital per capita, and partly for capital broadening, i.e. providing average capital for the new population. As the aging process deepens and the number of new entrants to the labor force declines, the need for capital deepening declines, and so does China's domestic investment demand. From the point of view of the rate of return to capital, the declining number of workers as a result of the aging trend means that labor becomes more expensive and the business sector can increase the amount of capital used in production in order to improve the capital-labor ratio and thus increase productivity. However, due to the effect of diminishing marginal returns, the rate of return to capital falls and is not conducive to attracting more investment into the sector.

While reducing the total amount of social investment, an aging population will also affect the direction of investment in physical capital. The increase in the elderly population requires society to provide more health care, which also crowds out some productive investments to a certain extent. Thus, population aging has a greater negative impact on total investment, especially on investment that has a greater pull on total output. In terms of the investment preferences of the older population, older age groups tend to be more focused on capital preservation and stable returns than other age groups, preferring a more conservative approach to investing and showing greater concern and avoidance of risk. Risk aversion is expected to increase in the market as the aging population deepens, and this will be a major challenge for high-risk, high-return emerging markets. Thus, an aging population is also likely to hamper investment and growth in the emerging industries sector.

4. Aging Population Leads to Balance of Payments Deficit

In terms of the current account, aging will lead to a deterioration in the current account. On the one hand, according to the life-cycle hypothesis and the permanent income hypothesis, an aging population tends to reduce the savings rate of the population, increase the overall level of consumption, and residents may be more inclined to buy goods and services from other countries, leading to an increase in import demand. On the other hand, with an aging population, a reduction in the supply of labor will raise the wage level of society as a whole and increase the labor cost of production for firms. In order to maintain a certain level of profit, companies will have to raise the price of their products, which in turn will weaken the competitiveness of China's exports, leading to a decline in exports. The increase in imports and decrease in exports will cause China to run a current account deficit.

In terms of international capital flows, aging will increase the pressure for capital outflows. As discussed above, an aging population will lead to lower domestic investment demand and a lower return on capital. In this case, in order to increase the rate of return on capital, capital will tend to flow more to countries or regions where investment demand is strong and the rate of return on capital is higher, i.e. countries or regions where the ageing of the population is slower or not occurring at all. In addition, older people have a lower propensity to borrow and consume than younger people and are more likely to rely on self-financing to meet their consumption and investment needs, which would be detrimental to the inflow of funds from other accounts such as credit [8]. A relative decline in the working-age population will also have a dampening effect on FDI inflows by affecting the savings rate and the rate of return on capital [9].

5. Aging Population Adds to China's Financial Pressure

5.1. Financial Expenditure

The aging population will lead to a year-on-year increase in pension expenditure, putting enormous pressure on China's treasury. With a large base of China's aging population, social and economic development, and advances in medical technology extending the average life expectancy of the aging population, pension expenditure is also tending to increase year on year. According to data from the National Bureau of Statistics, in 2020, China's basic pension insurance fund for urban workers will see a sharp decline in income to only RMB 4,437.57 billion, while expenditures will increase rather than decrease to RMB 513.14 billion. This will result in a shortfall of RMB 692.5 billion in the pension fund, with the accumulated balance of the pension insurance showing negative growth for the first time. Some projections show that by 2050, China's pension expenditure will account for 14% of GDP and the accumulated balance of pension insurance will be -16.73 trillion yuan. To promote the financial sustainability of pensions in the context of an aging population, China has started to implement a policy of delayed retirement in certain regions. However, Guo's research suggests that while delaying the retirement age can to some extent alleviate the pressure on pension finance deficits caused by structural imbalances in the working population, there are many other factors that affect the financial sustainability of basic pensions, and a thorough solution to the pension finance problems caused by an aging population will require a synergistic approach by the government [10].

An aging population will also increase the Chinese government's spending on health services. Older people have higher healthcare and long-term care needs. And the growing burden of old age in China makes the need for services for the elderly even more pressing for the country's aging population. On the one hand, China's elderly dependency ratio is set to rise rapidly. According to the UN's World Population Prospects 2022, China's old-age dependency ratio will rise from 28.92 in 2022 to 78.02 in 2050, meaning that by 2050, 10 working-age people will have to support nearly 8 elderly people, and the burden of old-age care will continue to grow [11]. On the other hand, under the influence of the early family planning policy, the number of elderly parents with only one child is still increasing rapidly, and the trend of elderly families becoming empty nesters, living alone, smaller, and with fewer children is intensifying. The number of empty nesters and old persons living alone in China will reach 118 million by 2020, according to the findings of the Fourth Sample Survey on the Living Conditions of the old in Urban and Rural China. In China, there would be 79 million senior adults without children and roughly 100 million elderly persons who are disabled or semi-impaired by the year 2050. As the population ages, the need for elderly care services in China will become even more urgent. Moreover, the health status of China's elderly is not optimistic. By 2018, the proportion of elderly people in China suffering from more than one chronic disease will be as high as 75%, with more than 180 million elderly people suffering from chronic diseases, and the demand for medical and healthcare services in society is gradually increasing. However, China's healthcare system is not yet developed and mature, and the scale of investment is relatively small. As the aging process gradually deepens, the Chinese government will inevitably expand the coverage of medical insurance and increase support in terms of investment in medical resources, medical subsidies, and the construction of public medical facilities to meet the demand for medical security services for the elderly population.

An aging population will also increase government spending on social welfare. In addition to spending on pensions and healthcare, the Chinese government will also need to increase its spending on social welfare for the elderly population, such as home care, pensions for the elderly, and education for the elderly. The development and improvement of these welfare programs will also put some pressure on the treasury. At the same time, with an aging population, there may be more groups of elderly people in society who have financial difficulties and are unable to provide for themselves, requiring social assistance and various welfare programs to ensure basic livelihoods, which will also increase social welfare spending by the treasury.

5.2. Financial Revenue

The aging population will reduce China's personal and corporate income tax revenues. As the population ages, the number of people of working age will decrease, leading to a reduction in total social income from wages, resulting in a shrinking source of personal income tax. The rise in labor prices caused by the relative reduction in the supply of labor has increased production costs for companies, dampening their profit growth and leading to a reduction in corporate income tax revenues. At the same time, rising costs and falling output will also make it difficult for some firms to survive and they will withdraw from the market, resulting in fewer targets for corporation tax.

An aging population will also reduce social consumption expenditure and thus shrink tax revenues from consumption tax and VAT. Compared to younger age groups, the older population has lower relative incomes and is more inclined to save and spend conservatively. In turn, the increased pressure of dependency on the elderly reduces the purchasing power and disposable income of young people, which reduces social consumption expenditure and leads to a reduction in indirect tax revenues such as consumption tax and VAT. In addition, as the population ages, the Chinese government may gradually introduce special tax policies and exemptions to reduce the financial burden on the elderly, such as the old-age tax credit and the pension tax exemption. This will put some pressure on the tax system and reduce revenues.

6. Conclusion

In the long run, an aging population will be detrimental to the steady growth of the Chinese economy. In the labor market, the aging of the population will directly lead to a reduction in the actual supply of labor in the Chinese market by reducing the number of workers and lowering the labor force participation rate. In addition, the increase in the proportion of the elderly population will also reduce the efficiency of labor productivity, which is not conducive to industrial upgrading due to various factors such as physical and functional conditions. The impact of aging on China's human capital will be twofold. On the one hand, an aging population will crowd out investment in educational human capital, to the detriment of the accumulation of educational human capital and the improvement of human capital per capita; on the other hand, an aging population will enhance China's health human capital. Thus, the ultimate impact of aging on human capital will depend on the relative magnitude of these two effects. On the investment demand side, the aging population has had a dampening effect on investment demand in the Chinese market. This is partly because the relative reduction in labor supply caused by aging raises the price of labor, forcing firms to invest more in productive capital. This situation will not be conducive to attracting investment due to diminishing marginal returns. On the other hand, aging will be detrimental to the development of new industries, as risk aversion is more prevalent among the aging population. In addition, the increased demand for health services in an aging society will crowd out some productive investments.

In terms of the balance of payments, an aging population will have a negative impact on both China's current account and international capital account. On the current account, aging will lead to an increase in China's imports and a decrease in its exports, leading to a deterioration in the current account balance; on the international capital account, aging will increase the pressure of capital outflows from China and will not be conducive to attracting foreign direct investment. Therefore, the deepening of aging will most likely lead to a double deficit in China's balance of payments. In terms of fiscal balance, China's aging population is likely to exert greater fiscal pressure. On the one hand, the aging population will further increase the pressure on China's fiscal expenditure in terms of pension expenditure, pension protection expenditure, and social security expenditure. On the other hand, the aging population is likely to further reduce the Chinese government's tax revenues from personal income tax, corporate income tax, consumption tax, and VAT.

References

[1]. Zhong, T. N. (2020). The impact of population aging on China's macroeconomy. Guangxi Quality Supervision Herald, 2020(12), 79-80.

[2]. Li, C., & Zhang, Y. (2019). The impact of population aging on macroeconomics in China. China Social Work, 2019(35), 28-29.

[3]. Wu, W. (2018). Exploration of the relationship between population aging and macroeconomics. Popular Investment Guide, 2018(15), 8.

[4]. Zhang, Z. (2011). Age differences in labor productivity and the Lewis turning point. China Rural Economy, 2011(08), 12-21+32.

[5]. Lehman, H. C. (2017). Age and achievement. Princeton University Press.

[6]. Li, B., & Bi, F. (2018). Research on the number of labor force, human capital and economic growth dynamics mechanism. Social Science Front, 2018(01), 246-250.

[7]. Su, L. (2020). Statistical analysis of the impact path of population aging on economic growth in China [Doctoral dissertation, Tianjin University of Finance and Economics].

[8]. Bao, G. (2019). The impact of population aging on changes in China's balance of payments. Beijing Financial Review, 2019(04), 57-61.

[9]. Xu, Z. (2020). Research on the impact of working-age population change on attracting foreign direct investment in China [Doctoral dissertation, Zhejiang University of Technology and Business].

[10]. Guo, K. (2023). The impact of delayed retirement on the sustainability of basic pensions in China. Journal of Economic Research, 2023(03), 99-102.

[11]. Dai, Z., Du, P., & Dong, J. (2023). Re-estimation of old-age dependency ratio and population aging trend in China. Population Studies, 47(03), 94-107.

Cite this article

Lang,Y. (2023). The Impact of Population Aging on China's Macroeconomy. Advances in Economics, Management and Political Sciences,47,249-257.

Data availability

The datasets used and/or analyzed during the current study will be available from the authors upon reasonable request.

Disclaimer/Publisher's Note

The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of EWA Publishing and/or the editor(s). EWA Publishing and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content.

About volume

Volume title: Proceedings of the 2nd International Conference on Financial Technology and Business Analysis

© 2024 by the author(s). Licensee EWA Publishing, Oxford, UK. This article is an open access article distributed under the terms and

conditions of the Creative Commons Attribution (CC BY) license. Authors who

publish this series agree to the following terms:

1. Authors retain copyright and grant the series right of first publication with the work simultaneously licensed under a Creative Commons

Attribution License that allows others to share the work with an acknowledgment of the work's authorship and initial publication in this

series.

2. Authors are able to enter into separate, additional contractual arrangements for the non-exclusive distribution of the series's published

version of the work (e.g., post it to an institutional repository or publish it in a book), with an acknowledgment of its initial

publication in this series.

3. Authors are permitted and encouraged to post their work online (e.g., in institutional repositories or on their website) prior to and

during the submission process, as it can lead to productive exchanges, as well as earlier and greater citation of published work (See

Open access policy for details).

References

[1]. Zhong, T. N. (2020). The impact of population aging on China's macroeconomy. Guangxi Quality Supervision Herald, 2020(12), 79-80.

[2]. Li, C., & Zhang, Y. (2019). The impact of population aging on macroeconomics in China. China Social Work, 2019(35), 28-29.

[3]. Wu, W. (2018). Exploration of the relationship between population aging and macroeconomics. Popular Investment Guide, 2018(15), 8.

[4]. Zhang, Z. (2011). Age differences in labor productivity and the Lewis turning point. China Rural Economy, 2011(08), 12-21+32.

[5]. Lehman, H. C. (2017). Age and achievement. Princeton University Press.

[6]. Li, B., & Bi, F. (2018). Research on the number of labor force, human capital and economic growth dynamics mechanism. Social Science Front, 2018(01), 246-250.

[7]. Su, L. (2020). Statistical analysis of the impact path of population aging on economic growth in China [Doctoral dissertation, Tianjin University of Finance and Economics].

[8]. Bao, G. (2019). The impact of population aging on changes in China's balance of payments. Beijing Financial Review, 2019(04), 57-61.

[9]. Xu, Z. (2020). Research on the impact of working-age population change on attracting foreign direct investment in China [Doctoral dissertation, Zhejiang University of Technology and Business].

[10]. Guo, K. (2023). The impact of delayed retirement on the sustainability of basic pensions in China. Journal of Economic Research, 2023(03), 99-102.

[11]. Dai, Z., Du, P., & Dong, J. (2023). Re-estimation of old-age dependency ratio and population aging trend in China. Population Studies, 47(03), 94-107.