1. Introduction

As the largest developing country and the largest developed country in the world, the economies of China and the United States have always affected the lifeblood of the global economy, and their trends have a profound impact on the development of economic globalization. Some scholars pointed out that the US-China economic relationship since the beginning of the 21st century is the most typical asymmetric interdependence relationship, and there is a "symbiotic" relationship between the two economies, that is, China has promoted economic growth and employment increase through export-oriented economic growth strategy. The United States, on the other hand, achieved low savings and high consumption through imports from China, and maintained low interest rates and a stable investment rate.

However, in recent years, economic globalization has encountered countercurrents, protectionism and unilateralism are prevailing, and the economic and trade relations between the two countries have suffered setbacks. Since the Trump administration took office, in order to curb China's development momentum in the field of high-tech and promote the reflow of relevant industrial chains, the United States has provoked trade frictions with China. The scale of bilateral trade between China and the US has shown a downward trend in recent years, and the risk of trade decoupling has initially emerged. The Biden administration continues the policy orientation of the Trump administration to contain China's rise. Trade decoupling has become one of the strategies of the United States to compete with China. US-China relations are in an unstable development process driven by the interlocking of political and economic interests.

Since the US started a trade war and sought the decoupling of US-China trade, the US economic and financial situation has taken a sharp turn. Against the background of persistently high inflation, the Federal Reserve has continued to raise interest rates to curb inflation, and many US banks have fallen into crisis one after another. Financial turmoil has intensified the risk of US economic recession. How has decoupling from the Chinese market affected the U.S. economy? What role does US-China trade play in the US economic system? This paper will study the relationship between US-China trade data and US inflation.

2. Literature Review

In recent years, many scholars have analyzed the influencing factors of inflation, and pointed out that the price index of imported commodities is one of the important factors affecting inflation. From the perspective of macroeconomic structure, by establishing a vector error correction model, pointed out that an important factor affecting inflation in the United States is the price index of imported commodities, taking South Korea as an example, explored the relationship between import prices and domestic inflation in the past 20 years, verified the close relationship between import prices and inflation by using regression decomposition method, and pointed out that when the price of imported goods rose by 10 percentage points, inflation would increase by 3.4 percentage points correspondingly [1,2].

During the COVID-19 pandemic, international trade is restricted and circulation bottlenecks are severe, and many scholars' analyses have once again confirmed the important impact of trade links on inflation, then analyzed the trade data from 2020 to 2021 and used the model calibration method to point out that the supply chain bottleneck caused by the epidemic is one of the important reasons leading to inflation, also explored the connection between transportation cost and inflation from the perspective of the impact of COVID-19 on global supply chain, and pointed out that the increase of import and export trade cost has a statistically significant relationship with the rise of inflation [3,4].

As the world's two largest economies, the relationship between China and the United States has attracted much attention from scholars, and many scholars have analyzed inflation based on the perspective of Sino-US trade, studied the cross-border price spillover effect in the Asia-Pacific region and pointed out that for economies with high trade intensity, the relationship between import input cost and inflation rate is closer, then studied the impact of Chinese goods on US inflation by using price and consumption data at the level of a single commodity, and pointed out that from 2004 to 2015, imports of Chinese goods could promote the annual decline of US consumer price index by 0.19 percentage points [5,6].

The research of domestic scholar Tan Xiaofen also pointed out that trade globalization will increase the sensitivity of the inflation cycle of various countries (or regions) to international commodity prices, and form the linkage of the inflation cycle of various countries through the trade network [7]. Trade imbalance is an important channel for global value chain division to affect inflation [8]. And value chain trade has a significant positive impact on PPI inflation coordination [9]. Inflation has an international transmission relationship [10].

3. Analysis of the Relationship between US-China Trade and US Inflation

3.1. Current Situation Analysis

Since China's accession to the WTO, US-China trade has entered a golden period of development, with a high growth rate of trade scale, an increasing volume of import and export trade, and an increasing degree of economic interdependence.

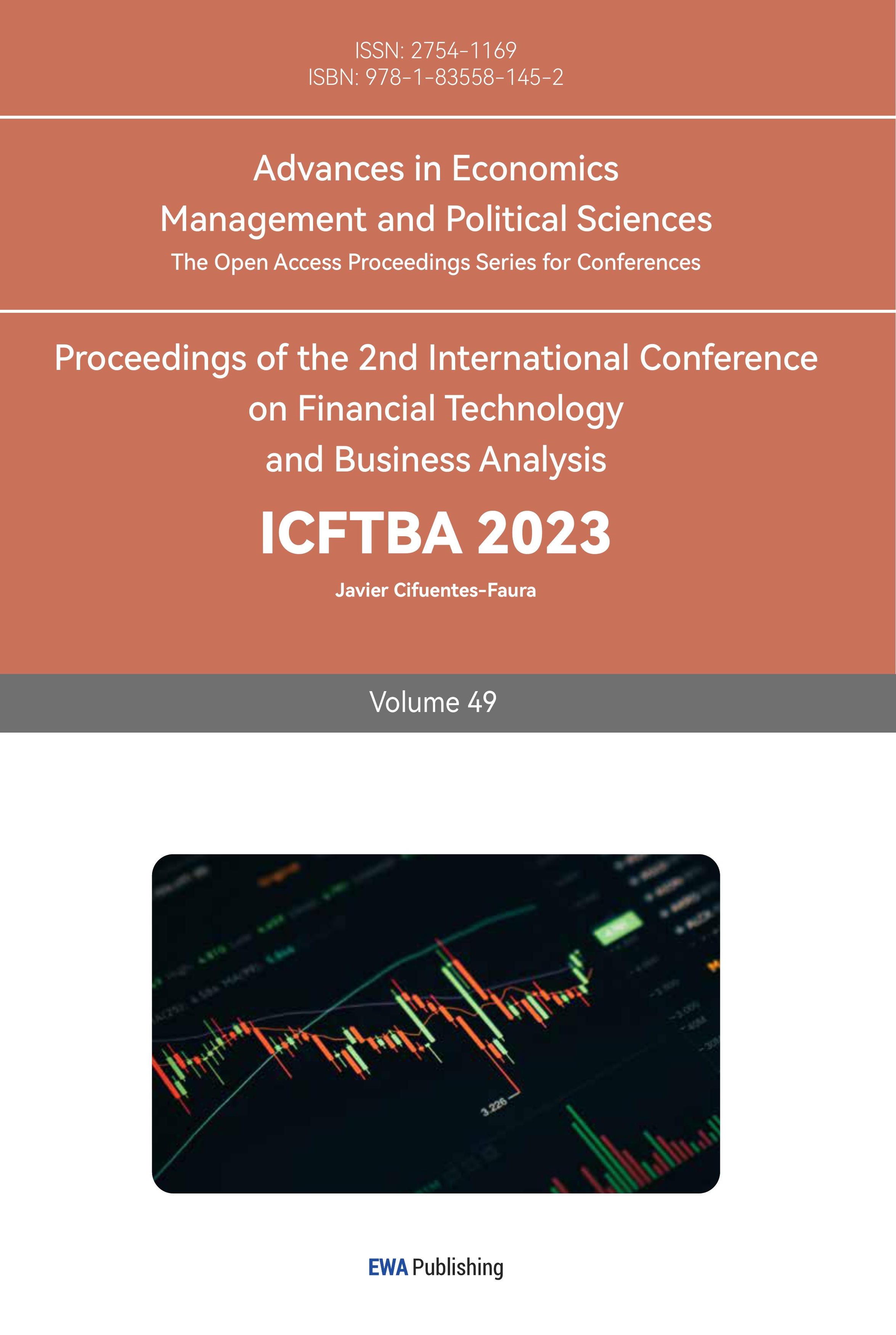

Figure 1: Percentage of U.S. goods imports by value.

As can be seen from Figure 1, China has been the largest trading partner of the United States in the 10 years since 2009. However, since the trade war, especially the continuation of the trade decoupling policy after the Biden administration took office, the proportion of China's exports in the total US imports has declined significantly. By April 2023, the proportion has dropped to 13.2%, lower than the EU, Mexico and Canada, making it the fourth largest trading partner of the US.

In recent years, China's manufacturing industry has been an important source of global "de-inflation" by virtue of its own cost advantage.

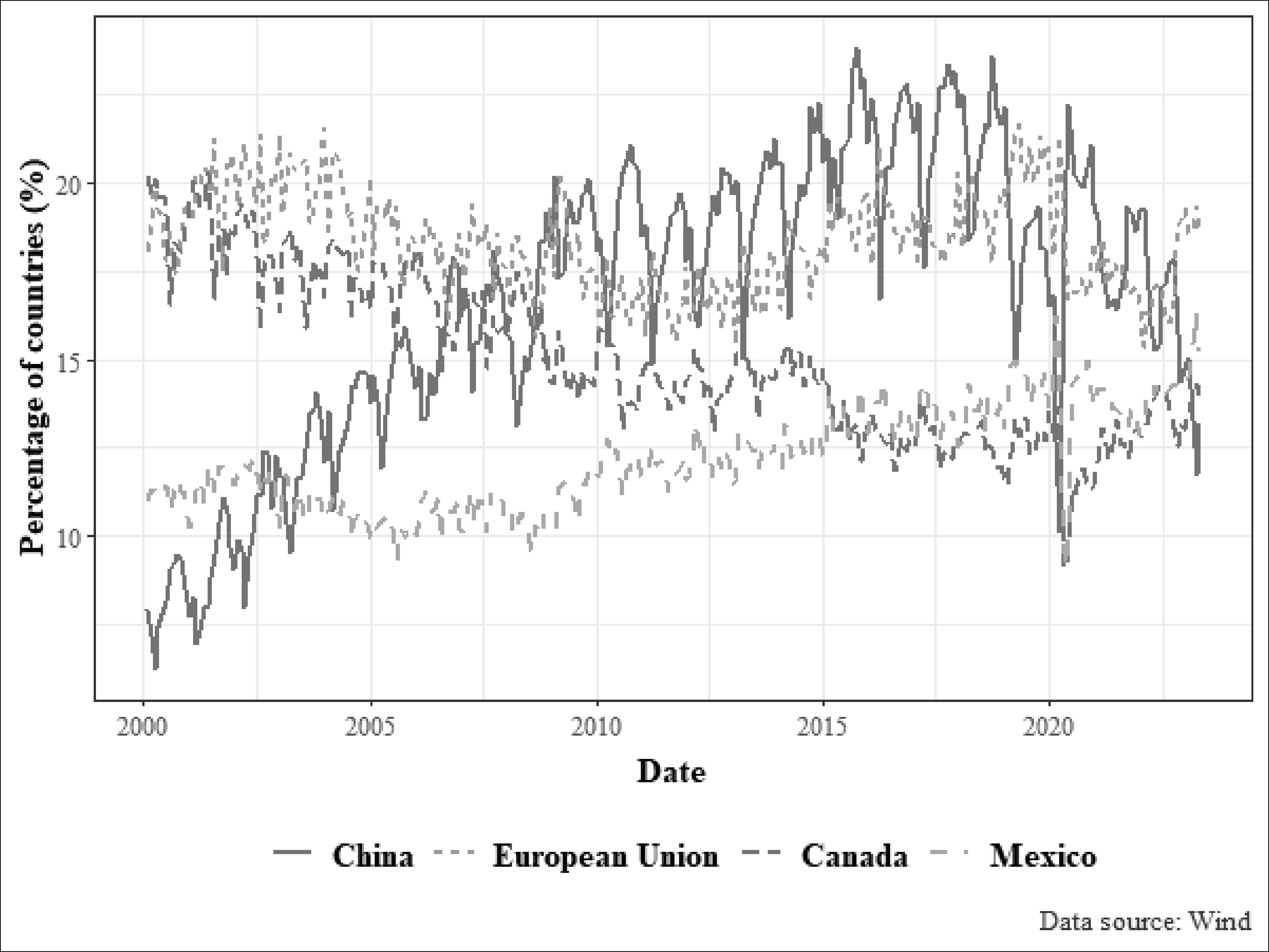

Figure 2: China Exports Price Index and U.S. CPI (YoY).

It can be seen from Figure 2 that there is a relatively close relationship between China's export price index and the monthly year-on-year data of the US CPI, which is consistent in the long run, once again confirming the "symbiotic" relationship between the Chinese and US economies. Around 2020, due to the implementation of the US trade decoupling policy, imports from China decreased significantly, and the impact of the epidemic, China's export price index rose sharply, along with the monthly year-on-year data of the US CPI.

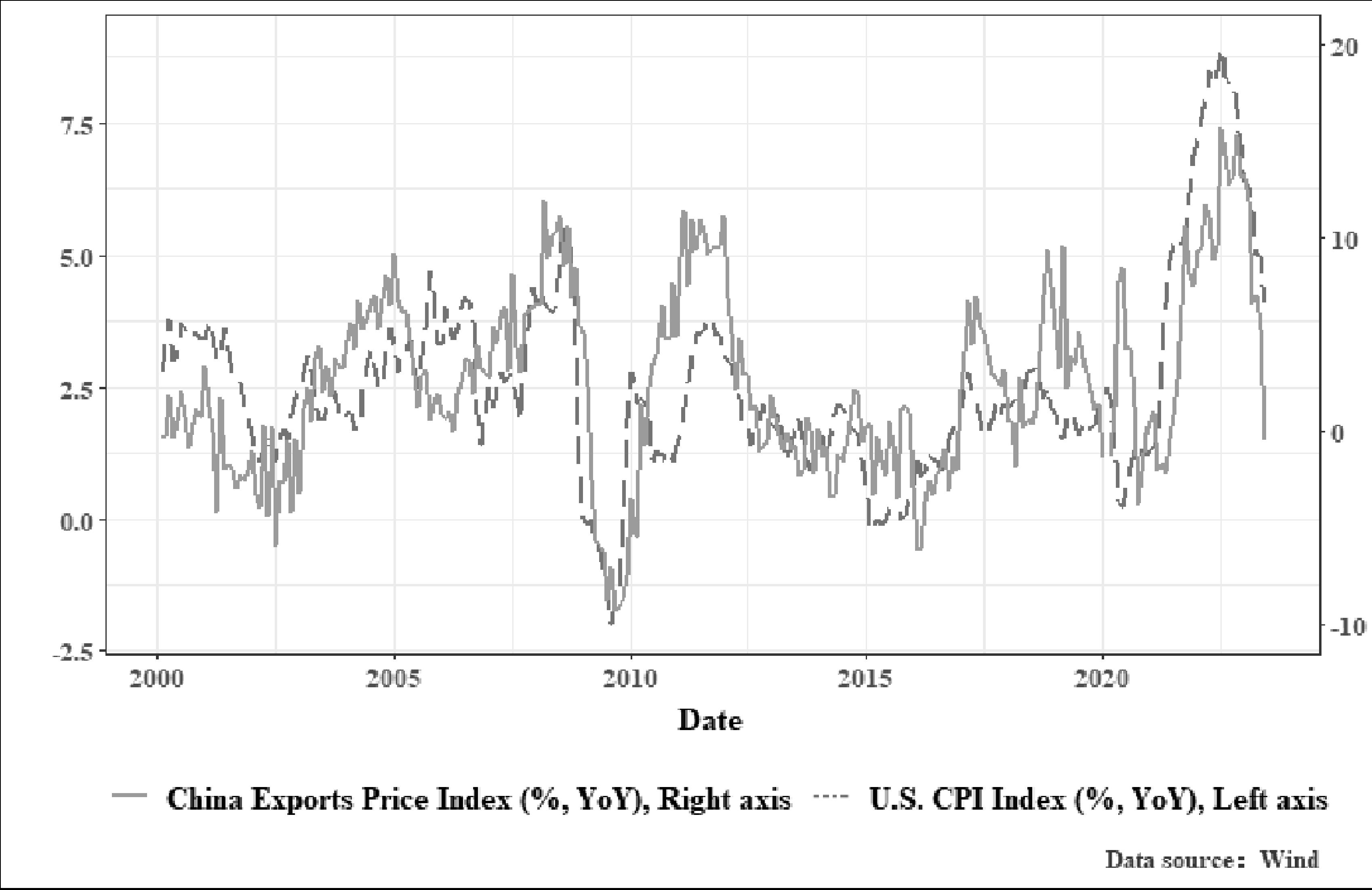

In contrast to the United States, China's CPI is currently relatively low year-on-year, and the difference with the United States CPI is around historic lows (see Figure 3).

Figure 3: CPI Index over China and U.S.(YoY).

To some extent, when major economies around the world are suffering from high inflation, China, as the "world factory", is injecting "disinflation" vitality into the global economies including the United States with low level of inflation. In particular, at the end of 2022, China's economy stabilized and recovered, and the production side restarted significantly. China's export price index fell sharply, and low-cost goods were "disinflationary" for the US through exports. The US CPI also reached a turning point year-on-year, beginning the process of decline.

3.2. Predictive analysis based on ARIMA mode

Intuitively, China's export price index has a strong positive correlation with the US CPI, reflecting the internal connection between the Chinese and US economies. This paper will establish an Autoregressive Integrated Moving Average model for the year-on-year data of China's export price index and the US CPI to further quantitatively analyze the relationship between them. The ARIMAX model is essentially a regression model that include Autoregressive Integrated Moving Average error term, which can quantitatively analyze the internal connection between time series variables.

This paper uses the year-on-year data of China's export price index since January 2000 as the independent variable, and the year-on-year data of the US CPI since January 2000 as the dependent variable to establish the ARIMAX model. The ARIMAX model requires that the variables used must be cointegrated.

Since the impact between economic variables usually has a lag, that is, the impact of the current period may appear behind time, this paper establishes four ARIMAX models for different lag orders and selects the optimal model by comparing the AICc values of the fitted models. The AICc values of the fitted model are as follows:

Table 1: AICc values for ARIMAX with different lag orders.

Lag Order | 0 | 1 | 2 | 3 |

AICc | 220.6407 | 222.1489 | 189.5715 | 191.7042 |

The results show that the ARIMAX model with second-order lag term has the best fitting effect, and the fitting effect of this model is as follows:

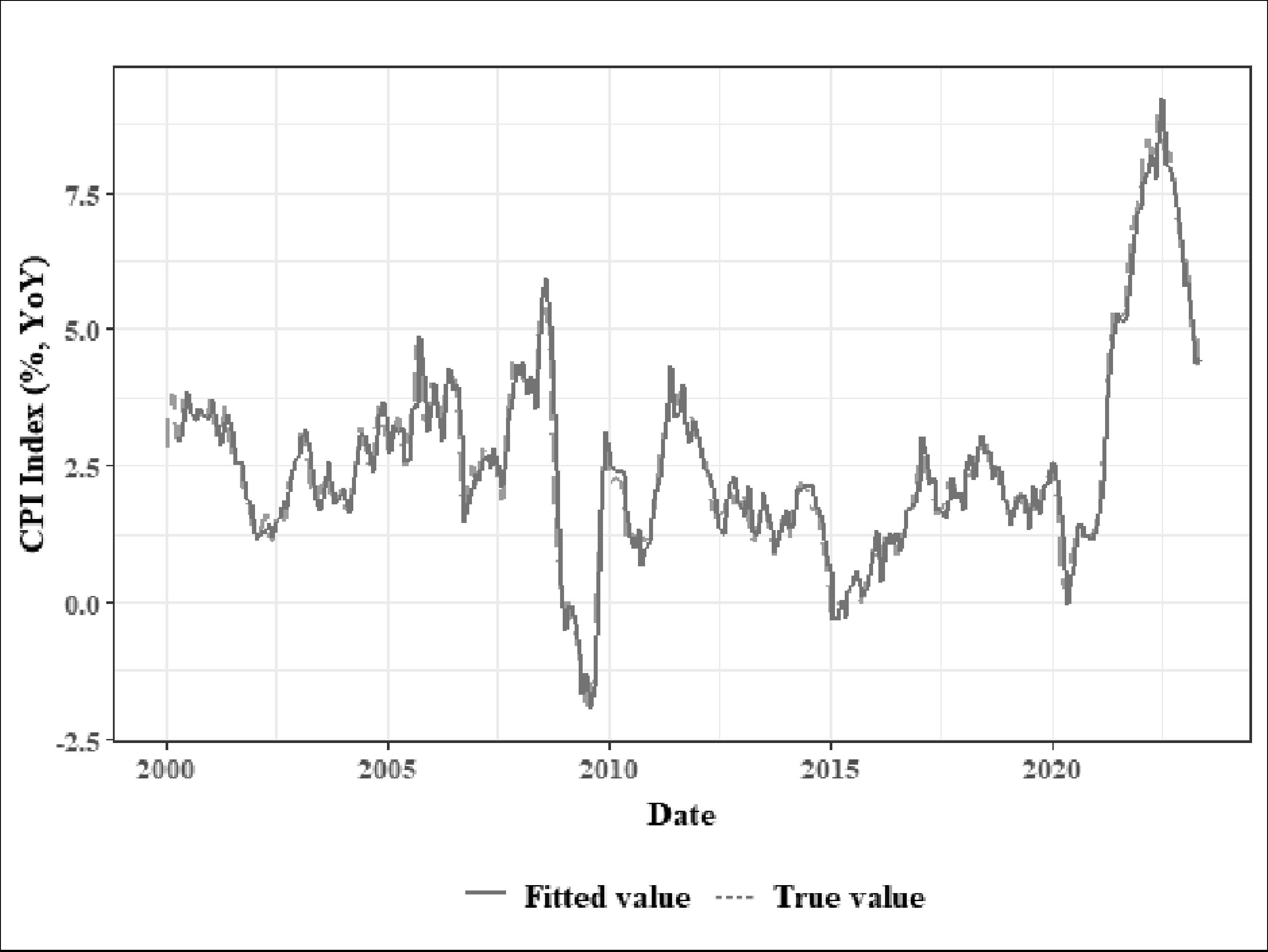

Figure 4: ARIMAX fit effect of U.S. CPI Index (YoY).

It can be seen from the fitting effect diagram that the model can well capture the pattern information in the data and describe the fluctuation of the data (Figure 4). The result of residual analysis of ARIMAX model are show in Figure 5.

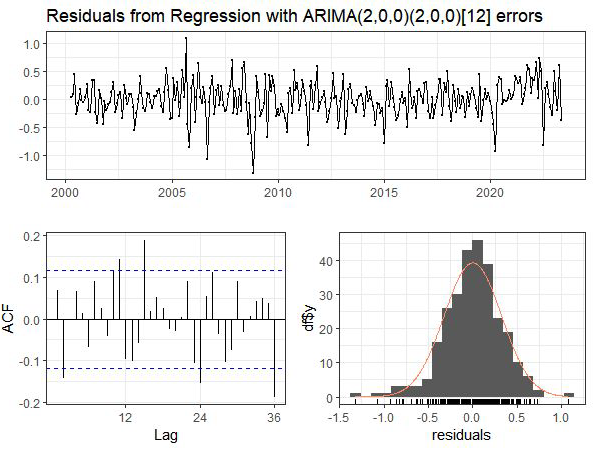

Figure 5: Residual analysis of ARIMAX model.

The residual of the model basically follows the normal distribution, there is no large lag correlation in the auto correlogram, and the residual sequence diagram does not show obvious heteroscedasticity, the residual basically follows the white noise distribution. These are all represented in Figure 5.

The parameter estimation results of the model are show in Table 2:

Table 2. Parameter estimation of ARIMAX.

Parameter | Result |

China Exports Price Index(0 lag order) | 0.0123 |

China Exports Price Index(1 lag order) | 0.0145 |

China Exports Price Index(2 lag order) | 0.0078 |

AR1 | 1.4318 |

AR2 | -0.4437 |

SAR1 | -0.7376 |

SAR2 | -0.3920 |

From the results of the parameter estimates, as can be seen from Figure 2 that the parameter estimates of China's export price index are all positive, indicating that China's export price index has a significant positive correlation with the US CPI. By comparing the size of the parameters, it can be concluded that China's export price index has a lagged effect on the monthly US CPI, with a lag period of 1-2 months, and the one-month lag has the greatest impact on the US CPI.

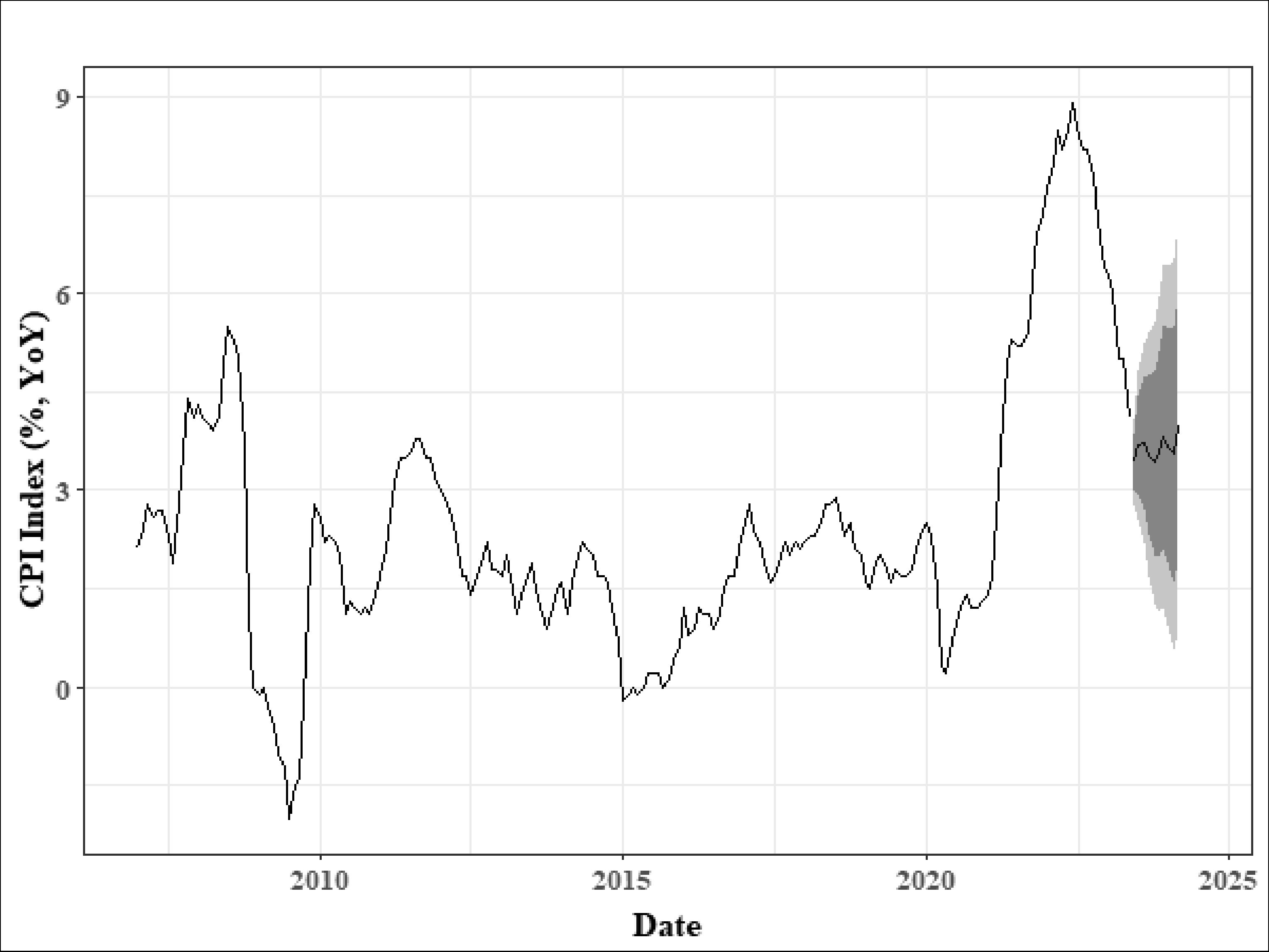

Using the model to forecast the monthly year-on-year value of the US CPI over the next six months, the forecast results are show in Figure 6:

Figure 6: ARIMAX forecast results of U.S. CPI Index (YoY).

The forecast results of Figure 6 show that under the condition that policy factors and external conditions remain unchanged, the US CPI will be in the range of 3%-4.5% year-on-year in the next six months, and still have an upward trend.

4. Conclusion

This paper empirically analyzes the relationship between China-US trade and US inflation by building an ARIMAX model. The results show that there is a significant positive correlation between China's export price index and the US CPI in the same month, indicating that China and the US are important stakeholders to each other. At the same time, the model prediction results show to a certain extent that in the short term, the easing of US inflation is only temporary. After the bottom of this downturn, if the US does not change the current tough decoupling trade policy against China, the affected prices of Chinese exports will once again become the "booster" for the upward trend of US inflation.

This paper analyzes the economic ties between China and the United States from the perspective of Sino-US trade, but there are still shortcomings. In the subsequent research, we can consider adding market index, production index, employment index and other indicators to establish a more comprehensive model, analyze the influence relationship between the two economies from more perspectives, and draw more systematic conclusions.

As the world's two largest economies, the economic and trade relations between China and the US are not only of great significance to the two countries, but also play a pivotal role in the global economic development. Over the decades, economic globalization has promoted the expansion of industrial, value and supply chains, and the global flow of production factors. China has provided a strong driving force for the world economy to disinflation. As the world's largest manufacturing country, China has huge economies of scale and a complete industrial chain, and has obvious advantages in production capacity, supply chain integration and technological level. In the short term, China's status as the fourth largest trading partner of the US cannot be shaken, and the impact of Chinese exports on the US economy is still not to be underestimated.

The US blindly pursues decoupling, which will only harm the interests of its enterprises and people, and is essentially "decoupling" from opportunities and the future. If China and the United States are in harmony, they will both benefit and if they fight, they will all suffer. China-us economic cooperation is a win-win for both countries and a key engine for world economic growth.

References

[1]. Di Giovanni, J., Kalemli-Özcan, Ṣ., Silva, A., & Yildirim, M. A. (2022). Global supply chain pressures, international trade, and inflation. National Bureau of Economic Research.

[2]. Taylor, L., & Barbosa-Filho, N. H. (2021). Inflation? It’s Import Prices and the Labor Share! International Journal of Political Economy, 50(2), 116-142.

[3]. Carrière-Swallow, Y., Deb, P., Furceri, D., Jiménez, D., & Ostry, J. D. (2023). Shipping costs and inflation. Journal of International Money and Finance, 130, 102771.

[4]. Auer, R. A., & Mehrotra, A. (2014). Trade linkages and the globalisation of inflation in Asia and the Pacific. Journal of International Money and Finance, 49, 129-151.

[5]. Ahn, J., & Lee, J. (2023). The role of import prices in flattening the Phillips curve: Evidence from Korea. Journal of Asian Economics, 86, 101605.

[6]. Bai, L., & Stumpner, S. (2019). Estimating US consumer gains from Chinese imports. American Economic Review: Insights, 1(2), 209-224.

[7]. Tan, Xiaofen, Wang, Xinkang, and Yang, Yahan. (2023). Globalization and Inflation. China's industrial economy (05), 24-42.

[8]. Wei Ruqing & Zheng Lekai. (2022). The impact of global value chain division on inflation and its mechanism analysis. Exploration of Economic Problems (06),134-148.

[9]. Shao Jun, Shi Xiusong, and Huang Qunhui. (2022). Global value chain embeddedness, international coordination of Inflation and divergence of price index. The world economy (02), 33-61.

[10]. Liu H J, Shao M J & Wang Y H. (2020). Research on the International transmission network of inflation. Current Economic Science (06),1-12.

Cite this article

Zhang,K. (2023). US Inflation Analysis and Forecast Based on US-China Trade Perspective. Advances in Economics, Management and Political Sciences,49,77-83.

Data availability

The datasets used and/or analyzed during the current study will be available from the authors upon reasonable request.

Disclaimer/Publisher's Note

The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of EWA Publishing and/or the editor(s). EWA Publishing and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content.

About volume

Volume title: Proceedings of the 2nd International Conference on Financial Technology and Business Analysis

© 2024 by the author(s). Licensee EWA Publishing, Oxford, UK. This article is an open access article distributed under the terms and

conditions of the Creative Commons Attribution (CC BY) license. Authors who

publish this series agree to the following terms:

1. Authors retain copyright and grant the series right of first publication with the work simultaneously licensed under a Creative Commons

Attribution License that allows others to share the work with an acknowledgment of the work's authorship and initial publication in this

series.

2. Authors are able to enter into separate, additional contractual arrangements for the non-exclusive distribution of the series's published

version of the work (e.g., post it to an institutional repository or publish it in a book), with an acknowledgment of its initial

publication in this series.

3. Authors are permitted and encouraged to post their work online (e.g., in institutional repositories or on their website) prior to and

during the submission process, as it can lead to productive exchanges, as well as earlier and greater citation of published work (See

Open access policy for details).

References

[1]. Di Giovanni, J., Kalemli-Özcan, Ṣ., Silva, A., & Yildirim, M. A. (2022). Global supply chain pressures, international trade, and inflation. National Bureau of Economic Research.

[2]. Taylor, L., & Barbosa-Filho, N. H. (2021). Inflation? It’s Import Prices and the Labor Share! International Journal of Political Economy, 50(2), 116-142.

[3]. Carrière-Swallow, Y., Deb, P., Furceri, D., Jiménez, D., & Ostry, J. D. (2023). Shipping costs and inflation. Journal of International Money and Finance, 130, 102771.

[4]. Auer, R. A., & Mehrotra, A. (2014). Trade linkages and the globalisation of inflation in Asia and the Pacific. Journal of International Money and Finance, 49, 129-151.

[5]. Ahn, J., & Lee, J. (2023). The role of import prices in flattening the Phillips curve: Evidence from Korea. Journal of Asian Economics, 86, 101605.

[6]. Bai, L., & Stumpner, S. (2019). Estimating US consumer gains from Chinese imports. American Economic Review: Insights, 1(2), 209-224.

[7]. Tan, Xiaofen, Wang, Xinkang, and Yang, Yahan. (2023). Globalization and Inflation. China's industrial economy (05), 24-42.

[8]. Wei Ruqing & Zheng Lekai. (2022). The impact of global value chain division on inflation and its mechanism analysis. Exploration of Economic Problems (06),134-148.

[9]. Shao Jun, Shi Xiusong, and Huang Qunhui. (2022). Global value chain embeddedness, international coordination of Inflation and divergence of price index. The world economy (02), 33-61.

[10]. Liu H J, Shao M J & Wang Y H. (2020). Research on the International transmission network of inflation. Current Economic Science (06),1-12.