1. Introduction

Interest rate and exchange rate has been a widely discussed topic and the linkage of the two variables are closely studied in empirical research in both developed and developing countries. Both topics are closely related to the macroeconomy and the entire financial market because those two factors could have a substantial impact on many important real and nominal economic variables such as the real interest rate, real output, investment, domestic and global inflation rate, etc. For instance, the interest rate is closely related to various monetary and exchange rate policies, and the exchange rate is closely linked to export and import terms in GDP.

In specific, this study aims to investigate the correlation and interaction mechanism between interest rate hikes and the exchange rate of the US and China using empirical analysis and real case analysis. As the two most influential players in the global economy, the interest rate and exchange rate are key monetary policy tools that central banks would use to manage their respective economies. Thus, understanding how the two variables interact can assist policymakers in formulating appropriate policies to achieve monetary goals including economic stability, balance growth, and manage inflation. Meanwhile, the interest rate and exchange rate would determine the direction of capital flows and investment, and the competitiveness of trade[1]. The conclusion of this study is expected to reflect how the pattern of capital flows and trade balances of each country changes after interest hikes in the U.S., which could provide not only policymakers but also investors and businesses with some insights.

2. Interest Rate Hike and the Deciding Process

2.1. Definition of Interest Rate Hike

An "interest rate hike" is an action when the central bank decides to increase the benchmark interest rate. It is a deliberate policy that typically aims to tighten the market liquidity or refrain the heated economy [2]. When the monetary authority increases the interest rates, several other borrowing and lending rates in the market would also be affected including consumer credit rate, mortgage rates and business loan rates. This is because the interest rate set by the monetary authority serves as a benchmark for all other market rates, so increasing the benchmark rate would rise the overall interest rate and hamper economic activities such as consumption and investment. As a result, economic growth will be slowed down, inflationary pressures and price stability can be within control.

2.2. Historical Background of Interest Hike

The United States has gone through several rounds of interest rate hikes characterized by various economic and monetary policy events. Early interest hike goes back to the 1970s in response to high inflation. Paul Volcker, the Chairman of the Federal Reserve at that time, implemented a series of interest rate hikes [3]. At that time, the general interest rate even reach a ceiling of 21.5% in December 1980 so as to control inflation and dampen the heated economy. Between the late 1990s and early 2000s, the economy expanded rapidly during the dot-com bubble. The Fed conducted the second round of massive interest rate hike to curb excessive speculation and maintain price stability. The third round of interest rate hikes started in June 2004 in order to cool down the overheated U.S. housing market and the potential inflation, but those actions failed to prevent the subprime mortgage crisis and the subsequent global financial crisis. The most recent round of interest rate hike took place in 2021 to remove the rising inflation pressure [4]. To stimulate the economy and recover it from the impact of COVID-19, the Fed has lowered the interest rate to a near-zero level and also used other unconventional measures such as directional quantitative easing to boost the economy and provide liquidity into the market. Till now, the Fed Reserve has implemented a series of interest rate hike, which increased the interest level to a near 5% level and posed a significant impact on the global financial market.

2.3. Role of Federal Reserve and Its Decision-making Process

As the main authority to achieve the nation’s monetary goals, the primary role of the Federal Reserve is to implement monetary policy for the purpose of promoting the stability and growth of the U.S. economy. In specific, the Federal Reserve is supposed to keep the “dual mandate”: to reach maximum employment and to keep its price stability. The achievement of the two objectives can be considered impossible theoretically. The Philips Curve showed a historically inverse relationship between inflation and unemployment based on empirical studies, so it would be hard to keep the price stable and the inflation rate low while also keeping the unemployment rate at a relatively low level. The reasoning behind the inverse relationship is that, when unemployment decreases in the labor market, workers could get more bargaining power which contributed to higher wage demands and increased wages accordingly. The production costs for businesses rise and are likely to be passed on to consumers in the form of higher prices for consumer goods. The inflation rate increases as a consequence [5]. As a result, there will always be a trade-off between inflation and full employment for the policymakers in the Federal Reserve to carefully consider about.

Aside from the “dual mandate”, the Federal Reserve also take other external factors including global economic conditions, collaboration with fiscal policies, potential risk in the financial system, and market reactions into consideration when evaluating the appropriation of their action. Overall, the decision-making process is designed to be data-driven, forward-looking, and responsive to changes in both domestic and external economic conditions. Whenever the Federal Reserve decides on whether to continue implementing an interest rate hike, it would conduct a thorough analysis of the current economic conditions based on indicators. This contains lagging indicators like unemployment conditions, GDP growth, business investment, consumption, and financial stability. Based on the evaluation result, the Federal Open Market Committee (FOMC) would hold meetings to discuss whether further interest rate hike should be taken. Afterward, the Federal Reserve would express the decision and rationale through public statements, press conferences, or meeting minutes to keep the transparency of their actions. Meanwhile, the Federal Reserve would assess the market reaction and expectations so as to keep their policy-making process forward-looking and flexible to changes [6].

3. Interaction of Interest Rate Hike and the Exchange Rate

3.1. Impact of Interest Rate Hike on Exchange Rate

The interest rate hike could affect the exchange rate through several channels. The first channel is its effect on global capital flows. Muneeb in their study discovered that higher interest rate tends to alter the pattern of global capital flows so as to seek better returns for their investments. When the interest rate increases in a country, the foreign capital would enter that market to get higher investment returns such as higher bond yield. Subsequently, the demand for domestic currency would increase and outweighs the supply, leading to an appreciation of the currency [7].

The second channel that affects the exchange rate is arbitrage on investment. Theoretically, the exchange rate between countries is determined by the Interest Rate Parities. But in reality, due to the restrictions and manipulation of some currency values, the Interest Rate Parity would be violated and create potential benefits for interest rate arbitrage. The arbitrage activities would boost the demand for the higher interest rate country, leading to appreciation in the exchange rate as well. Rogoff showed that arbitrages in interest rate differentials play a critical role in exchange rate movements [8].

Aside from financial investment activities, interest rate hikes also affect the exchange rate through economic growth and trade dynamics. In this case, a rise in interest rate would slow down economic activity such as domestic investment and consumption, leading to a decrease in imports and a smaller deficit in the current account. As the net export increases, the exchange rate becomes stronger. Studies by Mishkin and Obstfeld, and Taylor emphasized that interest rates would exert an impact on exchange rate movements through economic activities and trade patterns [9].

3.2. Detailed Impact of Interest Rate Hike on USD-CNY Rate

3.2.1. Impact of Interest Rate Hike of China on Exchange Rate.

Tie and Chien used the rolling-window method to examine the non-linear relationship between interest rates and exchange rates between China and the United States. Their findings suggested that when the Chinese central bank decided to enter an interest rate hike period, RMB generally appreciate against the USD. Although the Interest Rate Parity may not work for the entire sample period, the theory is still effective in some sub-periods. Meanwhile, changes in U.S. interest rate would have a slightly stronger effect on the CNY-USD exchange rate than the changes in Chinese interest rate. In other words, the monetary policy of the Federal Reserve has a dominant influence on the CNY/USD nominal exchange rate. However, the study also showed that the difference in the impacts is narrowing in the recent couple of years due to the process of EMB internationalization and the opening up of the RMB capital account [10].

3.2.2. Impact of Interest Rate Hike of the United States on Exchange Rate.

The interest rate hike in the United States would impose a much more profound impact on the Chinese and global economies. At present, the United States is still the largest import and exporter of Chinese goods and services, the two countries account for 40% of the world's GDP and about 35% of the global investment capital. Empirical evidence found that higher interest rate differentials between the United States and China would lead to the appreciation of USD and the depreciation of RMB in most cases. The mechanisms of the phenomena can be attributed to the global capital flow and the changes in trade. As one of the most promising emerging financial markets, the Chinese global market has attracted numerous global investors with its relatively high investment return. Typically, the interest rate in China is around 4%-5% while the interest rate in the U.S. is only about 2%-3%. Investment tools that heavily rely on interest rates such as fixed income products are considered as a appealing asset in normal periods. But as the interest rate hikes in the U.S., the interest rate gap becomes closer to zero and the signal could even become negative when the monetary policy of the two countries contradicts. Thus, capital would flee out of the Chinese market, leading depreciation of the Chinese Yuan. In addition, the interest rate hike in the U.S. is related to high inflation in most cases, which reduces the amount of imports from China, the worsening of current accounts is also a main reason for exchange rate depreciation [11].

3.3. Case Analysis: Effects of Interest Rate Hike on USD-CNY Rate

In this section, this paper would use real data to analyze how the interest rate hike affects the exchange rate between China and the United States in the past. The data were downloaded from Wind Terminal. As shown in Table 1, China has a higher interest rate than the US at most times except in the year 2022, when the world entered another era of interest rate hikes to control inflation.

Table 1:Interest Rate Differentials between U.S and China.

Maturity | 2016 | 2017 | 2018 | 2019 | 2020 | 2021 | 2022 | Average | |

3 months | China | 2.65 | 3.94 | 2.61 | 2.00 | 2.28 | 2.00 | 1.80 | 2.43 |

US | 0.51 | 1.39 | 2.45 | 1.55 | 0.08 | 0.06 | 0.89 | 0.48 | |

Differential | 2.14 | 2.55 | 0.16 | 0.45 | 1.99 | 1.94 | 0.91 | 1.95 | |

2Y | China | 2.70 | 3.78 | 2.71 | 2.48 | 2.72 | 2.37 | 2.3 | 2.79 |

US | 1.20 | 1.89 | 2.48 | 1.58 | 0.13 | 0.73 | 2.62 | 0.88 | |

Differential | 1.50 | 1.89 | 0.23 | 0.90 | 2.59 | 1.64 | -0.32 | 1.91 | |

5Y | China | 2.85 | 3.84 | 2.97 | 2.89 | 2.95 | 2.61 | 2.58 | 3.14 |

US | 1.93 | 2.20 | 2.51 | 1.69 | 0.36 | 1.26 | 2.91 | 1.55 | |

Differential | 0.92 | 1.64 | 0.46 | 1.20 | 2.59 | 1.35 | -0.33 | 1.59 | |

10Y | China | 3.01 | 3.88 | 3.22 | 3.13 | 3.14 | 2.78 | 2.81 | 3.42 |

US | 2.45 | 2.40 | 2.69 | 1.92 | 0.93 | 1.52 | 2.99 | 2.28 | |

Differential | 0.56 | 1.48 | 0.53 | 1.21 | 2.21 | 1.26 | -0.18 | 1.14 | |

30Y | China | 3.58 | 4.37 | 3.70 | 3.71 | 3.73 | 3.33 | 3.29 | 4.00 |

US | 3.06 | 2.74 | 3.02 | 2.39 | 1.65 | 1.93 | 3.12 | 3.02 | |

Differential | 0.52 | 1.63 | 0.68 | 1.32 | 2.08 | 1.4 | 0.17 | 0.98 | |

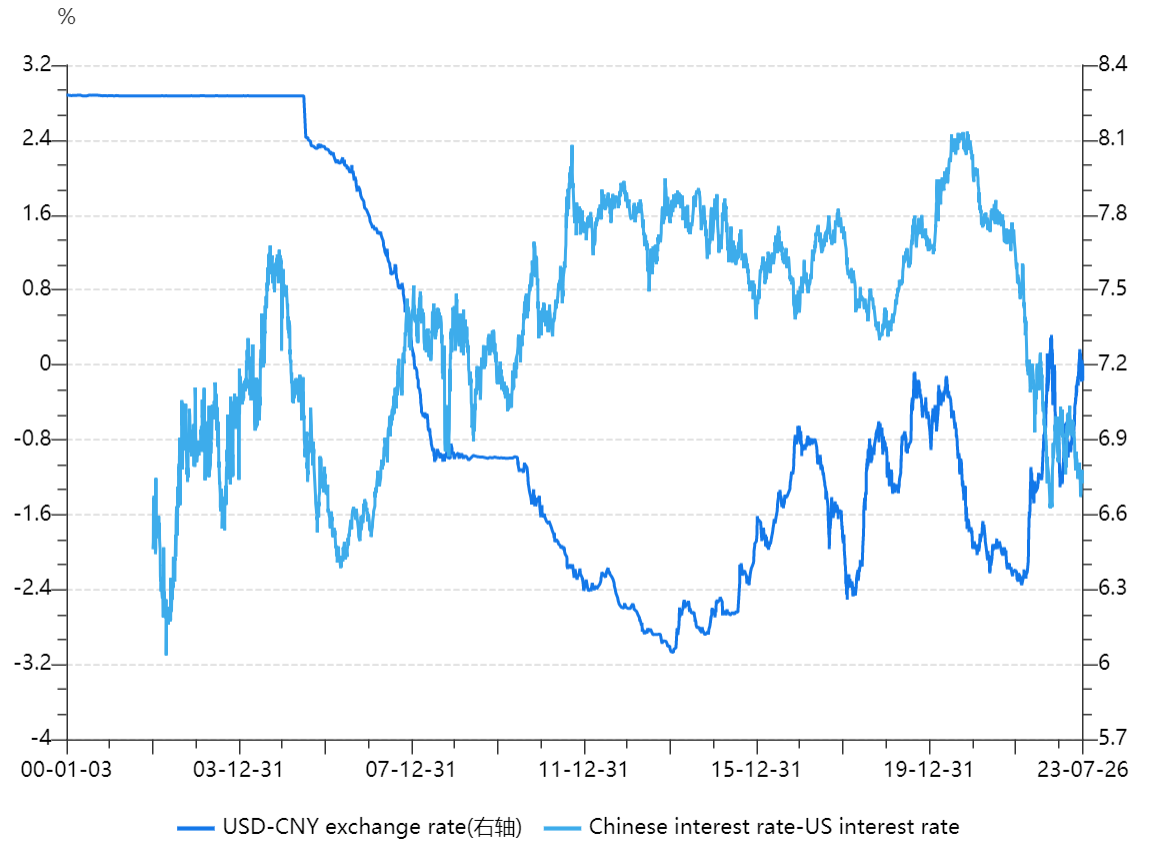

Figure1:Interest rate differentials and CNY exchange rate(light blue refers to interest rate differentials and dark blue line refers to exchange rate).

Figure 1 showed the relationship between USD-CNY exchange rate and the interest rate differentials between the two countries. Among the 4 major U.S interest rate hike period, three of them is accompanied by an appreciation of the USD and a depreciation of RMB. The exchange rate remain unchanged and even appreciate in the first case, but this is because the exchange rate system in China had just changed from a fixed rate system to a floating one. Meanwhile, the current round of exchange rate changes influenced by interest rates are significantly smaller than in previous rounds. Besides, among all the channels that lead to the changes in the exchange rate, the net outflow of securities investment is the major channel that makes RMB depreciate under a narrowing interest rate differential. Other capital flows like FDI, and other trade activities only have a limited impact.

4. Conclusion

This paper reviewed how interest rate hikes would impose an effect on the exchange rate between the United States and China, which are the most important economies around the globe. By gathering empirical research and conducting case studies, it is found that the effect of the U.S. interest rate hike on the Chinese exchange rate has outpaced the inverse effect on the US exchange rate. Meanwhile, the severity of the impact depends on many issues including the relative inflation rate, the economic status, the monetary policy and the exchange rate policy of the two regions. There are two patterns that are certain. One is that, after China removed its “fixed” exchange rate policy after entering the WTO in the early 2000s, the exchange rate is negatively and strongly related to the interest rate differentials. The second trend is that the negative effect of U.S. interest rate hikes on the Chinese exchange rate is gradually growing smaller compared to the previous era, the reason can be attributed to a more independent monetary policy than a trade-oriented monetary policy, and a more international RMB. However, the research still has some limitations. One of the most prominent is the lack of quantitative data analysis to measure the real effect of interest rate hikes. Meanwhile, it is recommended to add a comparison with other emerging Asian economies.

References

[1]. Ahmad, M., Maochun, Z., & Sattar, A. (n.d.). Impact of Interest Rate and Exchange Rate on Stock Returns. AGATHOS, Volume 10, Issue 1 (18): 259-266. Retrieved July 26, 2023, from https://www.agathos-international-review.com/issue10_1/29.Ahmad%20et.%20China.pdf

[2]. Sánchez, Marcelo (2005) : The link between interest rates and exchange rates: do contractionary depreciations make a difference? ECB Working Paper, No. 548, European Central Bank (ECB), Frankfurt a. M. Retrieved July 26, 2023, from https://www.econstor.eu/bitstream/10419/152982/1/ecbwp0548.pdf

[3]. Kwan Chow, H. (2023). The Empirical Relationship between Exchange Rates and Interest Rates in Post-Crisis Asia . Smu.edu.sg. https://ink.library.smu.edu.sg/cgi/viewcontent.cgi?article=1784&context=soe_research

[4]. Jiang, C. (2018). Research on the Fluctuation Relationship between Interest Rate, Exchange Rate and Stock Price. RA Journal of Applied Research, 04(06). https://doi.org/10.31142/rajar/v4i6.01

[5]. Dooley, M., Cho, D., & West, K. (2003). Title: Managing Currency Crises in Emerging Markets Title: Interest Rates and Exchange Rates in the Korean, Philippine, and Thai Exchange Rate Crises. Publisher, 0–226. https://www.nber.org/system/files/chapters/c9645/c9645.pdf

[6]. Liu, T., & Lee, C. (2020). Exchange rate fluctuations and interest rate policy. International Journal of Finance & Economics, 27(3). https://doi.org/10.1002/ijfe.2336

[7]. Aliber, R. Z. (1973). The Interest Rate Parity Theorem: A Reinterpretation. Journal of Political Economy, 81(6), 1451. https://doi.org/10.1086/260137

[8]. Rogoff, K. S. (2017). Exchange rates and global finance. Princeton University Press, 257-287.

[9]. Obstfeld, M., Shambaugh, J. C., & Taylor, A. M. (2008). Financial stability, the trilemma, and international reserves. American Economic Review, 98(2), 76-80

[10]. Lothian, J. R., & Taylor, M. P. (2008). Real Exchange Rates Over the Past Two Centuries: How Important is the Harrod‐Balassa‐Samuelson Effect? The Economic Journal, 118(532), 1742–1763. https://doi.org/10.1111/j.1468-0297.2008.02188.x

[11]. McKinnon, R., & Schnabl, G. (2012). China and Its Dollar Exchange Rate: A Worldwide Stabilising Influence?1. The World Economy, 35(6), 667–693. https://doi.org/10.1111/j.1467-9701.2011.01416.x

Cite this article

Jia,Z. (2023). Analysis of Interest Rate Hikes and Exchange Rate Between U.S. and China. Advances in Economics, Management and Political Sciences,49,291-296.

Data availability

The datasets used and/or analyzed during the current study will be available from the authors upon reasonable request.

Disclaimer/Publisher's Note

The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of EWA Publishing and/or the editor(s). EWA Publishing and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content.

About volume

Volume title: Proceedings of the 2nd International Conference on Financial Technology and Business Analysis

© 2024 by the author(s). Licensee EWA Publishing, Oxford, UK. This article is an open access article distributed under the terms and

conditions of the Creative Commons Attribution (CC BY) license. Authors who

publish this series agree to the following terms:

1. Authors retain copyright and grant the series right of first publication with the work simultaneously licensed under a Creative Commons

Attribution License that allows others to share the work with an acknowledgment of the work's authorship and initial publication in this

series.

2. Authors are able to enter into separate, additional contractual arrangements for the non-exclusive distribution of the series's published

version of the work (e.g., post it to an institutional repository or publish it in a book), with an acknowledgment of its initial

publication in this series.

3. Authors are permitted and encouraged to post their work online (e.g., in institutional repositories or on their website) prior to and

during the submission process, as it can lead to productive exchanges, as well as earlier and greater citation of published work (See

Open access policy for details).

References

[1]. Ahmad, M., Maochun, Z., & Sattar, A. (n.d.). Impact of Interest Rate and Exchange Rate on Stock Returns. AGATHOS, Volume 10, Issue 1 (18): 259-266. Retrieved July 26, 2023, from https://www.agathos-international-review.com/issue10_1/29.Ahmad%20et.%20China.pdf

[2]. Sánchez, Marcelo (2005) : The link between interest rates and exchange rates: do contractionary depreciations make a difference? ECB Working Paper, No. 548, European Central Bank (ECB), Frankfurt a. M. Retrieved July 26, 2023, from https://www.econstor.eu/bitstream/10419/152982/1/ecbwp0548.pdf

[3]. Kwan Chow, H. (2023). The Empirical Relationship between Exchange Rates and Interest Rates in Post-Crisis Asia . Smu.edu.sg. https://ink.library.smu.edu.sg/cgi/viewcontent.cgi?article=1784&context=soe_research

[4]. Jiang, C. (2018). Research on the Fluctuation Relationship between Interest Rate, Exchange Rate and Stock Price. RA Journal of Applied Research, 04(06). https://doi.org/10.31142/rajar/v4i6.01

[5]. Dooley, M., Cho, D., & West, K. (2003). Title: Managing Currency Crises in Emerging Markets Title: Interest Rates and Exchange Rates in the Korean, Philippine, and Thai Exchange Rate Crises. Publisher, 0–226. https://www.nber.org/system/files/chapters/c9645/c9645.pdf

[6]. Liu, T., & Lee, C. (2020). Exchange rate fluctuations and interest rate policy. International Journal of Finance & Economics, 27(3). https://doi.org/10.1002/ijfe.2336

[7]. Aliber, R. Z. (1973). The Interest Rate Parity Theorem: A Reinterpretation. Journal of Political Economy, 81(6), 1451. https://doi.org/10.1086/260137

[8]. Rogoff, K. S. (2017). Exchange rates and global finance. Princeton University Press, 257-287.

[9]. Obstfeld, M., Shambaugh, J. C., & Taylor, A. M. (2008). Financial stability, the trilemma, and international reserves. American Economic Review, 98(2), 76-80

[10]. Lothian, J. R., & Taylor, M. P. (2008). Real Exchange Rates Over the Past Two Centuries: How Important is the Harrod‐Balassa‐Samuelson Effect? The Economic Journal, 118(532), 1742–1763. https://doi.org/10.1111/j.1468-0297.2008.02188.x

[11]. McKinnon, R., & Schnabl, G. (2012). China and Its Dollar Exchange Rate: A Worldwide Stabilising Influence?1. The World Economy, 35(6), 667–693. https://doi.org/10.1111/j.1467-9701.2011.01416.x