1. Introduction

1.1. Research Background

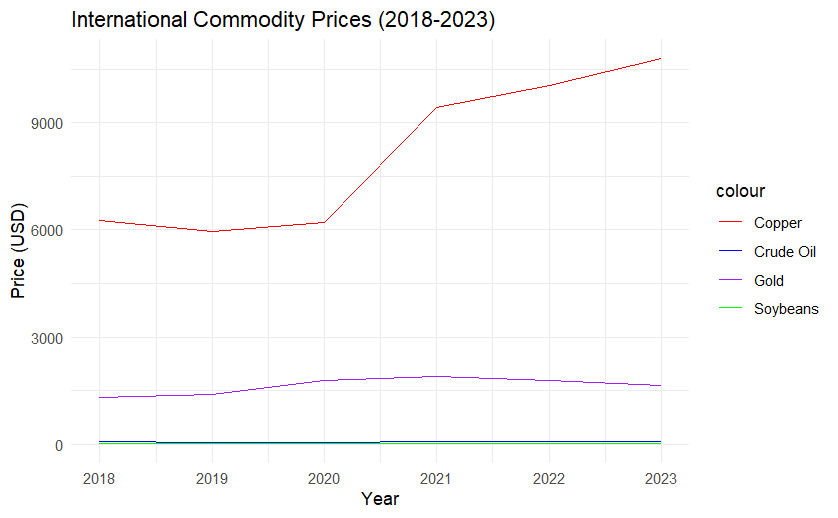

Inflation is the most important variable affecting the global economy and finance in 2022, and the market is highly sensitive to major economies such as the United States and Europe. Inflation is at a record high and faces great challenges. International commodities play a vital role in national development, and international commodity prices can quickly predict macroeconomic development in social and economic operation, and can quickly reflect the implementation effectiveness of government policies, is a "barometer" function. Thus, this paper is to analyze the relationship between international commodity prices and inflation.

Figure1: International Commodity Prices (2018-2023) (Photo credited: orginal).

1.2. Literature Review

Han Liyan and Yin Libo, Zhang Junxiao and Tan xiaofen believe that speculative demand, market liquidity and the US dollar exchange rate are the three main channels through which financial markets affect commodity prices [1-3]. The spillover effect of the US Federal Reserve's policy changes on China's inflation from the non-linear perspective of structural sudden change and argued that the US dollar, as the pricing and settlement currency of major international commodities, was flooded with liquidity, resulting in "too many currencies chasing too few commodities", which led to the rapid rise of commodity prices priced in US dollars. America's own inflation is transmitted to other countries through the "price mechanism". A 10% increase in international commodity prices would lead to a 1.2% increase in domestic PPI and a 0.24% increase in domestic CPI three months later. The import prices and domestic median prices have significant pass-through effects on inflation, especially international energy prices. This paper measures and analyzes the volatility spillover effect between China's commodity market and stock market. It is believed that the volatility spillover effect of Chinese stock market and commodity market in general is strong and correlated. China's stock market is the main recipient of volatility spillover effect.

1.3. Content and Framework

This paper is divided into five chapters: The first chapter is the introduction. This paper introduces the purpose of writing, the background of writing and the meaning of writing. Literature review mainly summarizes and sorts out relevant literature, and summarizes methods and experience to make further preparation for the following writing. The research content, methods and technical roadmap can clarify the general context of the paper for readers. Chapter two is the theoretical basis. The second section is the theoretical basis of the formation of inflation, mainly summarizes the theoretical research of Keynesian school and neoclassical school on inflation, and points out how to apply these theories in the theoretical analysis of this paper.

The third chapter is about the influence of domestic and foreign commodity markets on China's inflation. The theoretical analysis of the way that international commodity prices affect China's inflation, coupled with the analysis of the current situation of international commodity prices affecting China's inflation, combined with China's CPI and PPI. The fourth and fifth chapters are recommendations and conclusions. This chapter mainly combines the analysis of the theory and the current situation and draws the final conclusion of this paper, and makes judgment on the conclusion to put forward the corresponding policy suggestions and concrete measures.

2. Practical Basis and Theoretical Analysis

Neoclassical theory of inflation “The Middle East oil crisis of the 1970s” led to the phenomenon of "stagflation" in most Western economies, that is, high unemployment and high inflation [4]. The occurrence of this phenomenon made the economic circle begin to doubt the realistic validity of the traditional Keynesian theory, and the neoclassical school began to stand on the historical stage and openly challenge the authority of the traditional Keynesian school. The modern quantity theory of money by Friedman, the leader of monetarism in the neoclassical school, pointed out that inflation is actually a monetary phenomenon, and the fundamental cause of inflation is the change of money supply, and the growth of money supply cannot match the growth of real economic output, resulting in actual inflation [5]. The "natural rate hypothesis" theory of Friedman did not completely deny the relationship between unemployment and inflation. He believed that the substitution relationship between unemployment and inflation in the short term was valid [5]. However, because of the existence of natural unemployment rate in the medium and long term, there is no inevitable connection between inflation and unemployment. Keynes's macro-control policies can only continue to cause inflation in the medium and long term, but cannot effectively stimulate economic growth.

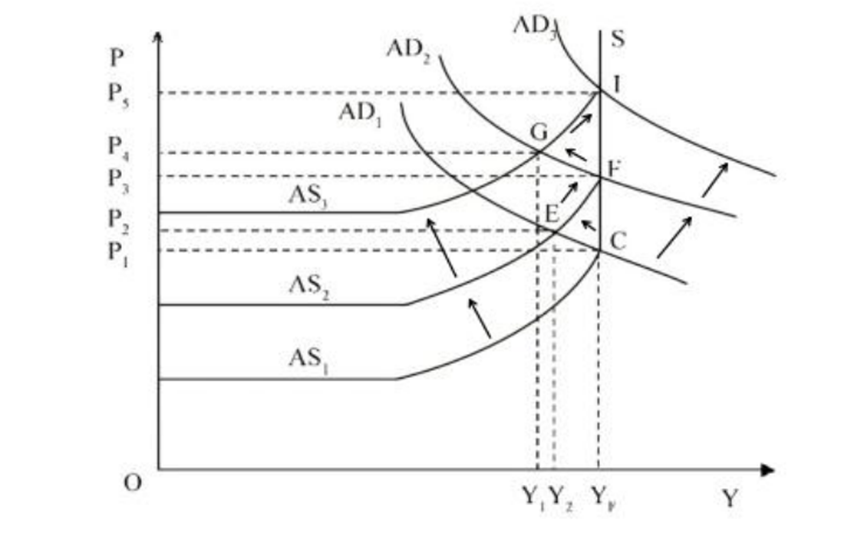

Figure 2: The formation path of inflation [5].

As shown in Figure 2, the process from equilibrium point C to equilibrium point E to equilibrium point F to equilibrium point G and finally to equilibrium point I can be described as the short-term change path of inflation, in which the change of the price level of the nominal variable also affects the change of the output level of the real variable. The change of equilibrium point C to F to I can be called the medium- and long-term process of inflation. The change of equilibrium point will only increase the price of the nominal variable and will not affect the change of the output level of the real variable.

As an exogenous shock, the impact of commodity prices on the inflation of importing countries is related to its exchange rate level. When commodity prices rise and the local currency depreciates, it will exacerbate domestic inflationary pressures. On the contrary, the domestic currency rises. The value can play a certain alleviating role. For example, in 2022, due to a series of influential factors such as the sharp rise in commodity prices, the inflation level in the United States is high, after several rounds of interest rate hikes, the domestic physical demand in the United States is suppressed, and the appreciation of the dollar has not completely alleviated the inflationary pressure, which has an impact on the global economy and buried risks for future governance [6,7].

3. Analysis

3.1. International Transmission Stage

3.1.1. Channels for Linkage of Commodity Prices at Home and Abroad

The price linkage channel is an important way for international commodity prices to affect the international transmission stage of China's inflation. The price linkage channel means that the pricing power of most commodities such as crude oil and copper is in foreign countries. When foreign countries release a large amount of liquidity or the imbalance between supply and demand of commodities, international commodity prices will rise [8,9]. As China is a major importer and exporter of commodities and the arbitrage space in the international commodity trading market is very small, China's commodity prices will rise in tandem. Then, through the transmission of domestic production channels and diffusion channels, the prices of most commodities in China rise, thus driving China's PPI and CPI, and eventually evolving into imported inflation between countries.

International commodity prices affect China's inflation through the linkage between China's commodity futures prices and China's commodity spot prices. The linkage between international commodity prices and China's commodity futures prices is manifested in that the rise in international commodity prices in the current period will send a signal to Chinese enterprises and residents that China's commodity prices will rise in the future. With the expected increase, enterprises will increase their hedging operations on the commodity futures trading market in order to prevent the cost of raw materials from rising in the future. Individual households will also increase their speculative trading of commodities for their own wealth gains, so this greatly increases the demand for China's commodity forward contracts, and the price of China's commodity futures will rise with the increase in aggregate demand. The linkage between international commodity prices and China's commodity spot prices is manifested in that the rise in international commodity prices during the current period will greatly promote the import costs of China's foreign trade enterprises, and foreign trade enterprises will certainly increase the spot prices of China's commodities in order to maintain the same profit margin. This is equivalent to the upward pressure on international commodity prices being passed on to China through trade.

Since commodity futures and spot market are mutually reinforcing, the futures market has the function of price discovery, and the spot market can ensure the stability of commodity prices. Therefore, China's commodity futures prices will also interact with each other, which greatly increases the possibility of rising international commodity prices imported into China [10].

3.1.2. Other Channels

In addition to the channels of commodity price linkage at home and abroad, Chen Yucai pointed out that the exchange rate and status of a country would also indirectly affect the possibility of import of rising international commodity prices into China. The rise in international commodity prices will force the United States to raise interest rates in order to suppress its own inflation. A substantial increase in interest rates in the United States will lead to the appreciation of the US dollar and the depreciation of China's exchange rate against the United States, which will be conducive to China's export of commodities but not conducive to the import of commodities, and eventually reduce the supply of commodities in China and increase the demand for commodities to stimulate the price rise. Therefore, the rise in international commodity prices indirectly triggered the rise in China's commodity prices through the depreciation of the exchange rate.

3.2. The Domestic Transmission Stage

The production channel refers to the process in which the production enterprises further transfer the upward pressure on the prices of imported and locally purchased commodities to other commodities along the industrial chain, resulting in the general continuous rise of commodity prices in the industrial chain, which is a "vertical" transmission mode. Chen Yucai (2011) pointed out that the production channel is the most important transmission mode in the domestic transmission stage, and the continuous promotion of commodity costs in the industrial chain is the main reason for the transmission of production channels [9].

Crude oil and copper are the upstream of most commodities, and their rising prices can push the prices of downstream commodities fuel oil, rubber, plastics, copper alloys, and finally into consumer markets such as automobiles. The transmission of production channels is generally one-way, such as the rise in crude oil prices can directly lead to the rise in plastic prices, but the rise in plastic prices cannot directly lead to the rise in crude oil prices. Therefore, commodities in the upstream of production are more likely to cause overall inflation than other middle and downstream commodities, and the more middle and downstream commodities corresponding to upstream commodities, the faster the price upward pressure will spread, and the greater the probability of driving up PPI and CPI. It can be seen that the rise in the price of a single commodity can affect other unrelated commodities, just as the rise in the price of crude oil can affect the rise in the price of soybeans. Therefore, the cross-sector commodity price transmission is not a simple "vertical" transmission along the production chain before, but a similar "network" transmission path. The "network" transmission path spreads the price rise of a single commodity or commodity along a single industrial chain. The price diffusion of different industry sectors is not instantaneous or completed in a very short period of time, but requires a certain period of transmission, which often occurs in the later period of commodity price rises. Thus, the spread of large commodity price increases is likely to mean that full-blown inflation is on the horizon [10].

4. Suggestion

4.1. Maintain Low Interest Rates and Strictly Control Inflation

There is a close relationship between China's financial market and national commodity prices, and fluctuations have a strong impact on interest rates and inflation. Commodity price fluctuations are the internal driving force for changes in interest rates and inflation, and their changes are significantly affected by commodity price fluctuations. If we are to prevent and defuse systemic financial risks by maintaining low interest rates and keeping inflation under strict control, it is very necessary to closely monitor and effectively manage commodity price fluctuations.

4.2. Create Relevant Monitoring Mechanisms

In the process of the development of China's financial market, it is also necessary to attach great importance to the issue of international commodity prices, and improve the attention and analysis of various commodity price fluctuations. For relevant departments, relevant monitoring mechanisms can be built according to the characteristics of international commodities and their price fluctuations. For the international commodity price fluctuations, real-time monitoring and accurate and detailed records. Regularly summarize monitoring information to form detailed records. And pay attention to do a good analysis of the relevant situation, for a period of time, the overall change trend of commodity prices analysis. For different types of commodities, the price fluctuations are analyzed in different categories, and more accurate and detailed segmentation results are obtained, providing more reliable reference data for different industries.

4.3. Attach Importance to the Analysis of the Value centers of Various Commodities

In the future price management, it is also necessary to attach importance to the analysis of the value centers of various commodities, and to accurately estimate their intrinsic value, so as to determine the benchmark problem of price management, that is, to maintain and control the price of commodities at an appropriate and scientific level. We will continue to improve the level of price management in China, better cope with price fluctuations of various commodities, and avoid systemic risks in the financial market. In addition, China should continue to improve the international status of the renminbi (SDR), and gradually enhance China's bargaining power and pricing power over commodities.

5. Conclusion

Commodity price fluctuations have a significant impact on inflation. International commodities have both commodity and financial investment attributes, and their price fluctuations are larger than those of ordinary commodities, which will not only affect the real economy, but also affect the prices of other financial assets. As the financialisation of commodities has deepened, so has its impact on financial markets. Commodity price volatility is a powerful driver of inflation movements.

From the perspective of financial market, the development of this market will greatly affect other markets, and at the same time, the development of other markets can also provide various conditions and opportunities for the development of financial markets. In the market of means of production, commodity is a very important leading trading variety. In view of the very close relationship between financial market and other markets, it is not difficult to find that as the leading trading variety of means of production market, commodity price fluctuations will inevitably have a certain impact on the development of financial market. The commodity market is the most important component of the production factor market, and the fluctuations of commodity prices will inevitably be transmitted to all kinds of commodity prices through various ways, which will effectively affect and even determine the commodity market. In order to control the rapid rise of inflation, major economies have tightened monetary policies to curb inflation, and the prospects for global economic recovery have gradually deteriorated. With the escalation of the conflict between Russia and Ukraine, the market has intensified concerns about the supply of commodities, energy commodities, gold, agricultural products and other prices have soared. In the domestic market, including rapeseed, palm oil and other agricultural commodities are also affected, of which palm oil futures prices soared from 8,500 yuan/ton to 12,000 / ton at the beginning of the year, the market fluctuation range of nearly 70% throughout the year. Affected by the gradual recovery of the global economy, the mismatch of supply and demand under the epidemic, the loose monetary and fiscal policies maintained by the United States and Europe, frequent extreme weather, and financial speculation, the international commodity prices as a whole fluctuated sharply from January to November 2021. From January to November 2021, the CRB commodity index averaged 207.4 points, up 41.5% year-on-year, among which crude oil futures prices showed an oscillating upward trend, copper futures prices showed a trend of rising first and then pressure, soybean and corn prices showed a trend of rising first and then pressure, and wheat prices showed a fluctuating upward trend. Due to the supply chain chaos caused by the epidemic and the impact of the Russia-Ukraine conflict, international commodity prices have soared for two consecutive years, and the international market rose by nearly 40% in 2021. Up to now, the CRB index has retreated after hitting a record high, but it is still at a high level. As of August 30, 2022, the CRB commodity index was at 293.58 points, a cumulative increase of 7.44% from the stage low of 273.26 points set on July 14. In addition, since 2022, the BDI index, which has always been known as the "weather vane of commodities", has experienced six consecutive weeks of decline.

To sum up, changes in international commodity prices are affected by supply and demand, financialization, interest rates, exchange rates and other factors, among which the imbalance of supply and demand in the international commodity market is the main factor affecting commodity price changes, and also the fundamental and decisive factor influencing the trend of commodities. From the price point of view, when the price of international commodities has been at a high level, it will increase the production cost of manufacturers and enterprises, resulting in rising prices, forming cost-driven inflation. Through the import and export of commodities, the impact on China's commodity prices will be formed, resulting in a rise in domestic prices, which will lead to inflation. The linkage between international commodity prices and Chinese commodity futures prices does exist. The rise of international commodity prices can be imported into China through the way of price linkage, and then affect the occurrence of inflation in China through the transmission of China's production channels and diffusion channels. Secondly, the rise in the general level of international commodity prices will have a certain impact on China's inflation in the short term. Among them, in the first 1-2 months, it can effectively drive China's overall price level to rise, and after 2 months, its influence gradually weakens and can only last for 6 months at most.

References

[1]. Han Liyan & Yin Libo.(2012). Speculation or Actual Demand? -- Analysis of factors affecting international commodity prices from a broad perspective. Economic Research (12),83-96.

[2]. Zhang, J & Tan, X. (2015). International Commodity price volatility: Fundamentals or Speculative factors: An analysis based on full-sample VAR and rolling VAR models from 2003 to 2014. Financial Review (03),59-74+124.

[3]. Tan Xiaofen, Liu Yang & Zhang Ming.(2014). International Commodity price Volatility: How important is the China Factor: An empirical study based on quarterly data and VECM model from 1997 to 2012. Research in International Finance (10),75-86.

[4]. Friedman, M. (1968). The Role of Monetary Policy. American Economic Review.

[5]. Zhang Ying & Li Jianyu (2023) Study on the impact of Abnormal Global Commodity price Fluctuations on the Systemic risk of China's Financial Market and its prevention Mechanism. Price monthly.

[6]. Yuan Zhigang & Guo Chunlin.(2022). Causes and Trends of global economic inflation. Development Research (08),1-13.

[7]. Zhang Tianding&Zhou.(2022). The impact of International commodity price shocks on China's stock market. Nankai economic research (11), 59-74 + 114. Doi: 10.14116 / j. kes. 2022.11.004.

[8]. Xiao Yihuan. (2022). Federal Reserve monetary Policy and International Commodity price pass-through effect: An empirical analysis based on ARDL-ECM model. Hainan Finance (10),3-10.

[9]. Guan, JiaMian. (2023). A study on Volatility spillover effect between China's commodity market and stock market. China Collective Economy (20),40-43.

[10]. Zhou Zchao.(2023). Study on the Impact of International Commodity Prices on China's Inflation (Master's Thesis, Yunnan University of Finance and Economics)

Cite this article

Wang,Y. (2023). Analyze the Impact of International Commodity Prices on Inflation. Advances in Economics, Management and Political Sciences,50,84-90.

Data availability

The datasets used and/or analyzed during the current study will be available from the authors upon reasonable request.

Disclaimer/Publisher's Note

The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of EWA Publishing and/or the editor(s). EWA Publishing and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content.

About volume

Volume title: Proceedings of the 2nd International Conference on Financial Technology and Business Analysis

© 2024 by the author(s). Licensee EWA Publishing, Oxford, UK. This article is an open access article distributed under the terms and

conditions of the Creative Commons Attribution (CC BY) license. Authors who

publish this series agree to the following terms:

1. Authors retain copyright and grant the series right of first publication with the work simultaneously licensed under a Creative Commons

Attribution License that allows others to share the work with an acknowledgment of the work's authorship and initial publication in this

series.

2. Authors are able to enter into separate, additional contractual arrangements for the non-exclusive distribution of the series's published

version of the work (e.g., post it to an institutional repository or publish it in a book), with an acknowledgment of its initial

publication in this series.

3. Authors are permitted and encouraged to post their work online (e.g., in institutional repositories or on their website) prior to and

during the submission process, as it can lead to productive exchanges, as well as earlier and greater citation of published work (See

Open access policy for details).

References

[1]. Han Liyan & Yin Libo.(2012). Speculation or Actual Demand? -- Analysis of factors affecting international commodity prices from a broad perspective. Economic Research (12),83-96.

[2]. Zhang, J & Tan, X. (2015). International Commodity price volatility: Fundamentals or Speculative factors: An analysis based on full-sample VAR and rolling VAR models from 2003 to 2014. Financial Review (03),59-74+124.

[3]. Tan Xiaofen, Liu Yang & Zhang Ming.(2014). International Commodity price Volatility: How important is the China Factor: An empirical study based on quarterly data and VECM model from 1997 to 2012. Research in International Finance (10),75-86.

[4]. Friedman, M. (1968). The Role of Monetary Policy. American Economic Review.

[5]. Zhang Ying & Li Jianyu (2023) Study on the impact of Abnormal Global Commodity price Fluctuations on the Systemic risk of China's Financial Market and its prevention Mechanism. Price monthly.

[6]. Yuan Zhigang & Guo Chunlin.(2022). Causes and Trends of global economic inflation. Development Research (08),1-13.

[7]. Zhang Tianding&Zhou.(2022). The impact of International commodity price shocks on China's stock market. Nankai economic research (11), 59-74 + 114. Doi: 10.14116 / j. kes. 2022.11.004.

[8]. Xiao Yihuan. (2022). Federal Reserve monetary Policy and International Commodity price pass-through effect: An empirical analysis based on ARDL-ECM model. Hainan Finance (10),3-10.

[9]. Guan, JiaMian. (2023). A study on Volatility spillover effect between China's commodity market and stock market. China Collective Economy (20),40-43.

[10]. Zhou Zchao.(2023). Study on the Impact of International Commodity Prices on China's Inflation (Master's Thesis, Yunnan University of Finance and Economics)