1. Introduction

Drugs and medical apparatus and instruments play a very important role in the medical field. A successful medical case is a combination of doctors' superb medical skills and effective drugs and medical devices. Due to the irreplaceable nature of drugs and medical equipment in ensuring human life and health, the research and experimental costs invested in this area are very high. In the epidemic era, Pfizer has achieved great success in the development and application of COVID-19 specific drugs. According to Wind data, Pfizer's operating costs in 2022 reached as high as $34.344 billion. Due to the high costs of pharmaceutical enterprises, in order to maintain normal business operations and social stability, the prices of drugs and instruments are also at a high level.

In China, most of public hospitals use the idea of "supporting doctors with drugs" to sell drugs because the development of the medical and health system is not perfect, and the development mode of medical institutions is restricted by many factors. Hospitals selling drugs at higher prices can make up for the loss of medical services caused by less financial investment [1]. However, from the perspective of patients and consumers, the high price of drugs and the increased price of hospitals have caused the phenomenon of "difficult to see a doctor", which is not conducive to the harmony of doctor-patient relationship and social stability.

In November, 2018, the document on centralized drug procurement in 4+7 cities was released, which marked the beginning of China's centralized purchase on pharmaceuticals industry. The core idea of centralized procurement is "exchange volume for price". Government selects high-quality and low-cost drugs through bidding to circulate in the market and objectively increase their market share. It is a macro-control means at the national level. At the same time, from the perspective of procurement mode, this policy has also created a new situation: responsibility from local government to the newly formed local alliance [2]. Previous studies have revealed the social impact of this policy. It not only curbed the phenomenon of "supporting medicine with drugs”, but also regulated the market, effectively restrained the vicious competition in the pharmaceutical industry, and narrowed the quality differences of non-curative effects of different drugs [3]. This is both an opportunity and a challenge for pharmaceutical enterprises. Undoubtedly, it has a certain impact on enterprise performance.

The biggest impact of centralized pharmaceutical purchase on the company comes from the sales side. The characteristic of centralized purchase is to significantly reduce the price of drugs. The price of drugs shortlisted by each enterprise has decreased by more than 50% on average. For the operation of the company, profitability is important indicator to measure the performance of enterprises. For enterprises with strong profitability, investors have a strong ability to obtain income from financial products such as stocks, which makes the market trust high and the amount of investment received will also increase. The increase of investment amount enables enterprises to better research and develop drugs and marketing, further enhance profitability and form a virtuous circle.

China's centralized pharmaceutical procurement has not been carried out for a long time, and the academic community is still lack of in-depth research on its impact on enterprise performance. In this paper, eight pharmaceutical enterprises in the fields of three main pharmaceutical sub fields of national centralized procurement: chemical medicine, high value consumables and biological products are selected as research cases. The enterprise profitability is analyzed through the analysis of their financial data within four years, and the impact of pharmaceutical centralized purchase on the performance of pharmaceutical enterprises is summarized.

2. Chemical Medicine

According to the data of the newly revised Chinese pharmacopoeia in 2020, 2712 chemicals have passed the quality and safety inspection and effectiveness inspection, accounting for 48% of the total number of drug varieties. In the market, chemical pharmaceutical enterprises also have a large scale [4]. According to the statistics of Frost Sullivan consulting company, the scale of the chemical pharmaceutical industry reached 846.6 billion yuan in 2021, accounting for 48.96% of the market scale, far exceeding the two major sectors of Chinese patent medicine and biological medicine [5].

Among them, according to Wind data, the market value of Hengrui Pharmaceutical is 276.3 billion, which is the leader of Chinese chemical pharmaceutical enterprises. The market values of Fosun Pharmaceutical and Kelun Pharmaceutical are 76.4 billion and 39.4 billion respectively. The above three enterprises are involved in most of branches of chemical medicine, and have participated in the centralized procurement of multiple batches of medicine. The short-term and long-term performance of enterprises are far-reaching affected by the policy.

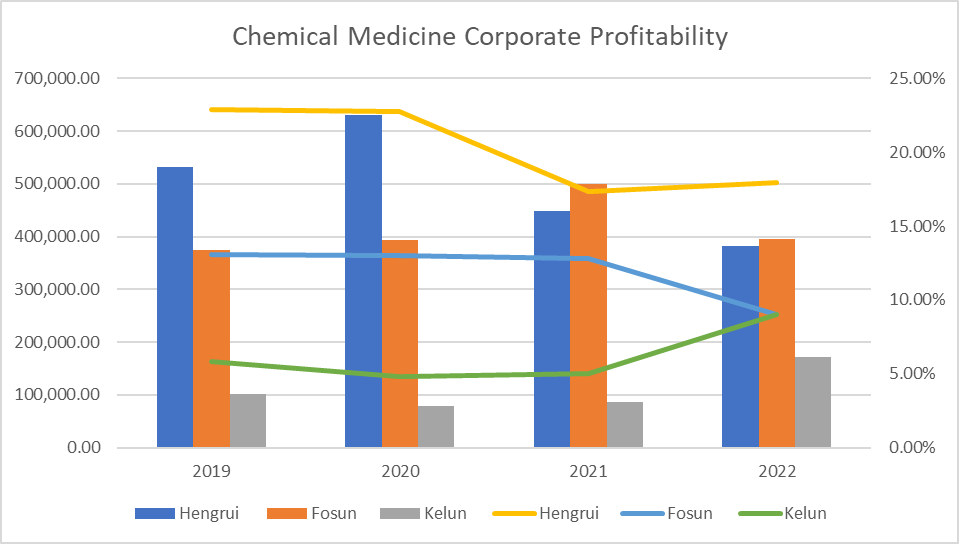

There are the line chart of net profit histogram and net profit margin on sales (net profit/sales revenue) of the three enterprises as shown in Figure 1.

Figure 1: Chemical medicine corporate profitability, data source: wind.

It can be seen from Figure 1 that the net profit margin on sales is in direct proportion to the net profit. The profitability of the three enterprises has declined to different degrees since the beginning of the centralized purchase of medicine. Hengrui Pharmaceutical has a large scale, and many varieties in many batches have been selected into the scope of national centralized procurement. According to the annual report of Hengrui Pharmaceutical in 2022, the company participated in the centralized procurement of 35 varieties, 22 of which won the bid, and the average price of the selected products fell by 74.5% compared with the original market price [6]. Since the company has already occupied a huge market share, centralized procurement has not brought significant market share improvement to Hengrui Pharmaceutical, and the sharp decline of revenue has led to the decline of profitability. After the centralized purchase of chemical drugs entered the normalization stage, the stable market share and the slightly increased drug price in the renewal of contract maintained the profitability of Hengrui Pharmaceutical at a relatively stable stage. Fosun Pharmaceutical also has a large proportion of market share. After the implementation of centralized procurement, its early performance increase, and its net profit in 2021 exceeded that of Hengrui Pharmaceutical. However, the profitability declined due to the impact of the centralized procurement policy. Compared with the first two enterprises, Kelun Pharmaceutical is smaller in scale, and its performance shows the obvious characteristics of "falling first and then rising". In the short term, due to the price decline, the profitability decline, but in the long term, the increase in market share brought by centralized procurement completely offset the disadvantage brought by the price decline, and the profitability of Kelun Pharmaceutical has been further improved.

In terms of time, the inhibition of centralized procurement on the profitability of chemical pharmaceutical enterprises is only a short-term feature, and the stable and continuously growing market share has a more positive effect on enterprise performance in the long term. In terms of scale, due to the huge demand for chemical drugs in the market, large-scale enterprises had a certain degree of monopoly on the market share before the implementation of centralized procurement, and relatively small-scale enterprises could benefit from the centralized procurement through the expansion of market share. At the same time, due to the strict procurement standards and fierce competition, actively participating in the centralized procurement of medicine has the effect of "innovation dividend". It can force enterprises to enhance their innovation ability, and the improvement of innovative technology is a more substantial advantage for enterprises in the centralized procurement competition [7]. In general, the advantages of chemical pharmaceutical enterprises' participation in pharmaceutical centralized procurement outweigh the disadvantages.

3. High Value Consumables

High value consumables are the important branches of the field of medical devices. Because they are mostly effective means of alleviating or treating serious diseases, the price of high-value consumables has been at a high level in the market. For many ordinary families, the high price has prevented them from using high-value consumables, and also objectively reduced its market demand. Since the first implementation of centralized procurement on high value consumables in 2021, the prices of many devices such as coronary stents decrease significantly. The average price of coronary stents was reduced from 13000 yuan to less than 1000 yuan, a decrease of 94.6%, and the unit profit decreases significantly [8].

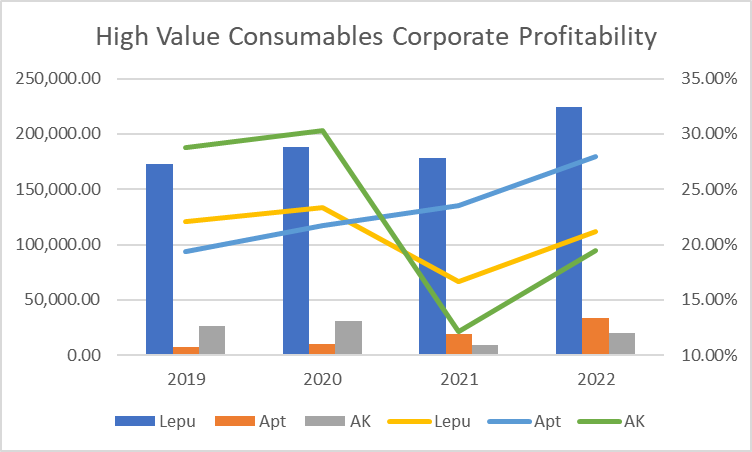

As the leader of high-value consumables in China, Lepu Medical Technology has a market value of 37.7 billion yuan, and its product sales structure is closely related to centralized purchase. Apt medical and AK medical also have a high degree of centralized purchase participation.

Figure 2: High value consumables corporate profitability, date source: wind.

As shown in Figure 2, before the implementation of centralized purchase, the profitability of the three enterprises showed a good upward trend. After the implementation of centralized purchase, the profitability of Lepu Medical Technology declined, and the net profit margin on sales of AK Medical dropped sharply from 30.32% to 12.15%, which was severely impacted by the centralized purchase policy. The sharp reduction of unit profit has a huge impact on the operating income of high-value consumables enterprises. However, Apt Medical gained revenue from centralized purchase and gained a large number of market share. According to the data of Frost Sullivan consulting company, the market share of Apt medical coronary artery access increased from 2% to 10%. Although the price of its coronary artery balloon products fell by 35%-40%, its sales volume increased by 300%-800%. The sales volume and market share were obviously increased and the scale effect further promoted the improvement of profitability [9]. Figure 2 shows that in 2022, the performance of the three enterprises increased to diverse degrees. Apt Medical continues to rise, while the other two enterprises have an obvious recovery trend. 2022 is the renewal year of centralized purchase of high-value consumables. Compared with the previous year, the price of the renewal year is relatively mild, and has a certain increase compared with the bid winning price. At the same time, in 2022, the price of newly launched centralized purchase of high-value consumables fell moderately, with an average price reduction of 49.35%. This makes high-value consumables enterprises perform well in 2022 [9].

Comprehensively, the single commodity of high value consumables has a significant decline, which has a negative impact on the operating income in the short term. But from a long-term perspective, the reduction in price makes high value consumables no longer expensive consumer goods for ordinary people, objectively increasing the market demand and expanding the market scale. On the other hand, companies participating in centralized purchase have gained a higher market share than before through centralized purchase. The above two directions have jointly increased the sales volume of enterprises participating in the centralized purchase of high value consumables. With the introduction of more national health reform policies, the positive impact of increased sales on enterprise performance is far greater than the loss of unit profit. At the same time, due to the intervention of the government at the macro level, the high value consumables market tends to be centralized, and the "non product advantages" of local enterprises due to local protection or marketing methods are further reduced [8]. According to the above reasons, high value consumables enterprises participating in centralized purchase will have better performance under the premise of high growth.

4. Biological Product (Insulin)

In the medical field, the effect of chemical treatment for some diseases is not significant enough, and the better response is to use biological products. The main components of biological products are usually carbohydrates, proteins and other biological macromolecules, and some biological products are composed of cells or living tissues. Biological products may be derived from humans, animals or microorganisms, so they have more significant effects in the treatment of diseases with low side effects [10]. In November 2021, the Chinese government launched a special intensive purchase of insulin, and all participating varieties were selected, with an average price reduction of 48%. Gan & Lee Pharmaceutical and Tonghua Dongbao Pharmaceutical are top enterprises in the production of insulin among China's local enterprises, and many of their products have entered the scope of national centralized procurement. Since May 2022, the national special centralized purchase of insulin has been formally implemented in various regions, which has brought a certain impact on the performance of the two enterprises.

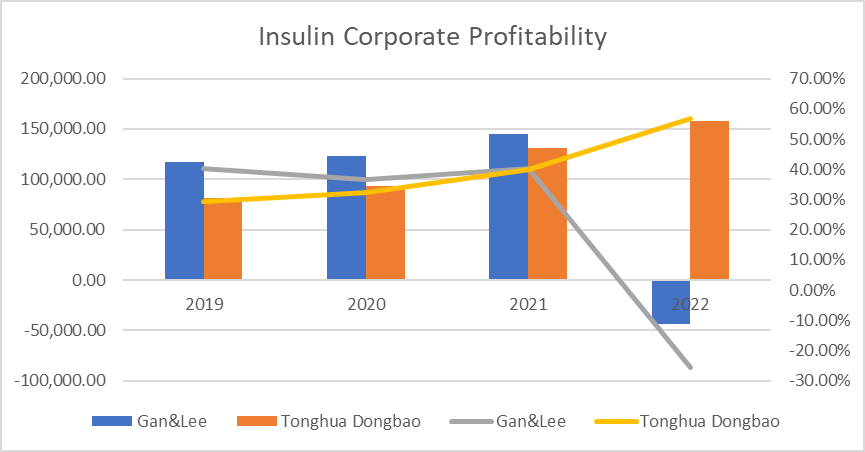

Figure 3: Insulin corporate profitability, date source: wind.

As shown in the Figure 3, the performance of the two enterprises showed an upward trend before the national special centralized procurement. After the formal implementation of centralized purchase in 2022, the performance of Gan & Lee Pharmaceutical was greatly affected by the policy, which was not only far lower than the previous average level and Tonghua Dongbao Pharmaceutical performance level, but even the company suffered a natural annual loss for the first time, and the net profit margin of sales also fell sharply to negative value. Although Tonghua Dongbao showed performance growth in terms of data, according to the annual report of Tonghua Dongbao Pharmaceutical in 2022, the company's operating income also decreased due to centralized procurement, a decrease of 14.98% compared with the same period of the previous year [11]. The increase in net profit came from the company's sale of some shares of Amoytop Biotech, resulting in an increase in investment income.

In fact, it is precisely because the insulin products of the two companies have been unanimously recognized by the market and the government that the price reduction of their main products has a great impact on their performance. From the social level, the two companies sacrificed themselves to bring benefits to the society. However, the product structure of the two enterprises is relatively single, and they rely too much on biological products for profits. Other alternative products in the industry pose a huge threat to enterprise performance [12]. The centralized purchase of medicine has objectively protected their market share and increased to a certain extent. According to the sales data of insulin in the magic cube of medicine, Tonghua Dongbao Pharmaceutical has a market share of 40% in China, which has surpassed the international brand, Novo Nordisk. The sales volume of insulin products in the whole market increased by 14.92% year on year, reaching 73.7578 million units. After the performance decline in 2022, the two companies are also actively looking for corresponding strategies. Gan & Lee Pharmaceutical began to expand its business and products in the field of cancer, while Tonghua Dongbao Pharmaceutical entered the field of endocrine for product research and development [12]. After entering 2023, the poor performance of Gan & Lee Pharmaceutical has recovered to some extent, and the advantage of increasing market share is gradually reflected. According to the first quarter report of 2023 Gan & Lee Pharmaceutical, the company's product sales in the first quarter of 2023 increased by 173.98% year on year, and the net profit reached 49.2232 million yuan [13].

For insulin companies with a single product structure, the impact of centralized purchase in the short term is much greater than that of companies with rich product structure previously studied, but in the long term, the positive impact of market share expansion will gradually offset the impact of price decline. It can be predicted that under the condition that the product structure of the company remains unchanged, the performance of insulin enterprises will also rebound significantly in the next few years.

5. Conclusion

Through the research, this paper found that although the centralized purchase of medicine has a certain impact on the performance of pharmaceutical enterprises in different sub industries in the short term, in the long-term strategic observation, the centralized purchase of medicine is very significant for the improvement of enterprise sales and market share, which can offset the negative impact of price decline. Pharmaceutical enterprises of different sub industries and sizes will be significantly affected by centralized procurement in the short term, which will be conducive to enterprise development in the long term. At the same time, centralized procurement has standardized the pharmaceutical market, forcing enterprises to increase competitiveness by enhancing their innovation ability, further centralize and integrate resources in the pharmaceutical field, and bring substantial contributions to the people and society. In the field of chemical drugs, the centralized procurement was carried out at the earliest time, with the largest number of batches and the largest number of drug types and enterprises involved. At present, a relatively mature system has been formed. The centralized purchase of high value consumables, insulin and other fields of medicine is also carried out in an orderly manner, and the pharmaceutical industry market is further rectified in an all-round way. This study is conducive to the decision-making of pharmaceutical enterprises in centralized procurement and the optimization of centralized procurement policies at the government level. Finally, due to the large number of pharmaceutical enterprises and the distinct individual differences of enterprises, the research conclusion may not be applicable to some enterprises. At the same time, because the research time scope is during the new crown epidemic, the restrictions of the epidemic in the pharmaceutical circulation and sales channels and the bull market in the pharmaceutical stock sector may affect the performance of enterprises. Academic circles will further summarize and study the impact of centralized pharmaceutical purchase on various indicators of enterprises.

References

[1]. Li, S. (2018) Discussion On "Supporting Doctors with Medicine”. China Health Industry, 15, 193-194.

[2]. Liu, W., Qi, G. and Li, Y. (2022) Drug Market with Volume Purchase (VP). International Journal of Frontiers in Sociology, 4, 90-96.

[3]. Zhang, Q. (2023) Research on the Impact of Volume Purchasing on the Performance of Pharmaceutical Enterprises from the Perspective of Dynamic Capability. Donghua University.

[4]. Lan, F., Hong, X., Song, Z. and Zhang, W. (2020) Basic Situation and Main Characteristics of “Chinese Pharmacopoeia” 2020 Edition. Chinese Drug Standards, 21, 185-188.

[5]. Forward Looking Economist. (2023). Foresight 2023: Panorama of China's Chemical Pharmaceutical Industry in 2023 (with Market Size, Competition Pattern and Development Prospects). Retrieved from https://baijiahao.baidu.com/s?id=1754962480791753125&wfr=spider&for=pc

[6]. Jiangsu Hengrui Pharmaceuticals Co., Ltd. (2022) 2022 Annual Report.

[7]. Zhang, J. and Peng, C. (2022) Exploring the Impact of Participating in Volume Procurement on Innovation in Pharmaceutical Enterprises: Taking A-share Listed Company Data as an Example. Enterprise Reform and Management, 17, 173-176.

[8]. Gao, S. (2022) Strategic Transformation of Medical Device Enterprises Under the Background of "Centralized Procurement" -- A Case Study of Coronary High Value Consumables Medical Device Manufacturers. China Management Accounting, 4, 84-94.

[9]. He, J. and Wang, Z., et al. (2023) Industry Changes and Strategic Adjustment of Listed Companies Under the Influence of Centralized Purchase of High Value Consumables (Update). China Securities.

[10]. Drug.com. (2022). What is a Biologic? Retrieved from https://www.drugs.com/medical-answers/biologic-3565613/

[11]. Tonghua Dongbao Pharmaceutical Co., Ltd. (2022) 2022 Annual Report.

[12]. Jiemian News Agency. (2023). Gan&Lee Pharmaceutical Turned Losses into Profits in the First Half of the Year, and Insulin Leaders Are Coming Out of the Pain of Centralized Purchase. Retrieved from https://baijiahao.baidu.com/s?id=1771380410796540358&wfr=spider&for=pc

[13]. Gan & Lee Pharmaceuticals. (2023) Quarterly report for the first quarter of 2023.

Cite this article

Wang,Z. (2023). Research on the Impact of Drug Centralized Purchase System on the Performance of Chinese Pharmaceutical Enterprises. Advances in Economics, Management and Political Sciences,50,190-196.

Data availability

The datasets used and/or analyzed during the current study will be available from the authors upon reasonable request.

Disclaimer/Publisher's Note

The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of EWA Publishing and/or the editor(s). EWA Publishing and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content.

About volume

Volume title: Proceedings of the 2nd International Conference on Financial Technology and Business Analysis

© 2024 by the author(s). Licensee EWA Publishing, Oxford, UK. This article is an open access article distributed under the terms and

conditions of the Creative Commons Attribution (CC BY) license. Authors who

publish this series agree to the following terms:

1. Authors retain copyright and grant the series right of first publication with the work simultaneously licensed under a Creative Commons

Attribution License that allows others to share the work with an acknowledgment of the work's authorship and initial publication in this

series.

2. Authors are able to enter into separate, additional contractual arrangements for the non-exclusive distribution of the series's published

version of the work (e.g., post it to an institutional repository or publish it in a book), with an acknowledgment of its initial

publication in this series.

3. Authors are permitted and encouraged to post their work online (e.g., in institutional repositories or on their website) prior to and

during the submission process, as it can lead to productive exchanges, as well as earlier and greater citation of published work (See

Open access policy for details).

References

[1]. Li, S. (2018) Discussion On "Supporting Doctors with Medicine”. China Health Industry, 15, 193-194.

[2]. Liu, W., Qi, G. and Li, Y. (2022) Drug Market with Volume Purchase (VP). International Journal of Frontiers in Sociology, 4, 90-96.

[3]. Zhang, Q. (2023) Research on the Impact of Volume Purchasing on the Performance of Pharmaceutical Enterprises from the Perspective of Dynamic Capability. Donghua University.

[4]. Lan, F., Hong, X., Song, Z. and Zhang, W. (2020) Basic Situation and Main Characteristics of “Chinese Pharmacopoeia” 2020 Edition. Chinese Drug Standards, 21, 185-188.

[5]. Forward Looking Economist. (2023). Foresight 2023: Panorama of China's Chemical Pharmaceutical Industry in 2023 (with Market Size, Competition Pattern and Development Prospects). Retrieved from https://baijiahao.baidu.com/s?id=1754962480791753125&wfr=spider&for=pc

[6]. Jiangsu Hengrui Pharmaceuticals Co., Ltd. (2022) 2022 Annual Report.

[7]. Zhang, J. and Peng, C. (2022) Exploring the Impact of Participating in Volume Procurement on Innovation in Pharmaceutical Enterprises: Taking A-share Listed Company Data as an Example. Enterprise Reform and Management, 17, 173-176.

[8]. Gao, S. (2022) Strategic Transformation of Medical Device Enterprises Under the Background of "Centralized Procurement" -- A Case Study of Coronary High Value Consumables Medical Device Manufacturers. China Management Accounting, 4, 84-94.

[9]. He, J. and Wang, Z., et al. (2023) Industry Changes and Strategic Adjustment of Listed Companies Under the Influence of Centralized Purchase of High Value Consumables (Update). China Securities.

[10]. Drug.com. (2022). What is a Biologic? Retrieved from https://www.drugs.com/medical-answers/biologic-3565613/

[11]. Tonghua Dongbao Pharmaceutical Co., Ltd. (2022) 2022 Annual Report.

[12]. Jiemian News Agency. (2023). Gan&Lee Pharmaceutical Turned Losses into Profits in the First Half of the Year, and Insulin Leaders Are Coming Out of the Pain of Centralized Purchase. Retrieved from https://baijiahao.baidu.com/s?id=1771380410796540358&wfr=spider&for=pc

[13]. Gan & Lee Pharmaceuticals. (2023) Quarterly report for the first quarter of 2023.