1. Introduction

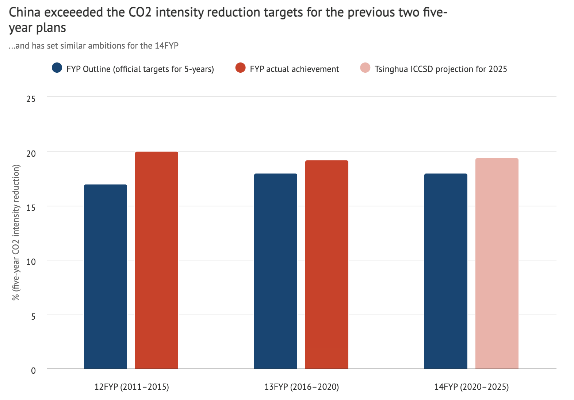

“Lucid waters and lush mountains are invaluable assets” [1], the famous talk was introduced by Xi Jinping early in 2005, as a leading instruction promoting environmental protection. Nowadays, climate change has raised increasingly high attention from major countries global wide, and the Chinese government has enacted pivotal policies, including the 2015 Dual Control of Energy Consumption policy and the 13th and 14th Five-Year Plan. As illustrated below, China was successfully in achieving the CO2 intensity reduction targets of the previous two five year plans, and even outperformed them. A series of policies have been landed to ensure carbon goals could be met in the future:

• in 2015, the government decided to grant subsidies to new-energy vehicles;

• in 2016, the law to impose environmental protection taxes was passed, and initiated implementation since 2018;

• in 2017, the NEV programme was introduced, which enabled new-energy vehicle producers to accumulate carbon points [2].

Tragedy of production happened multiple times in history, including famous events and periods such as the Thames River pollution in 1958, the London’s Great Smog in 1952 and the Photochemical Smog in Los Angeles from 1940 to 1960 [3]. Since the commencement of Industrial Time, indicators show that while global GDP has increased significantly, carbon and greenhouse gas emissions have risen in almost the same pattern; accompanied by global warming in the contemporary period.

Figure 1: CO2 intensity targets are shown in blue in the 12FYP, 13FYP and 14FYP versus actual performance shown in red. For the 14FYP, a projection of expected performance is shown in pink.

Source: 2011, 2016, 2021 State Council and Tsinghua ICCSD 2020. Produced by Carbon Brief using Highcharts.

History is always strikingly similar; the question is clear – To be or not to be? What should we choose, maintaining the key supply chains, or sticking to carbon emission goals? Should production necessarily result in climate degradation? How could the government improve on its current policies to address the problem?

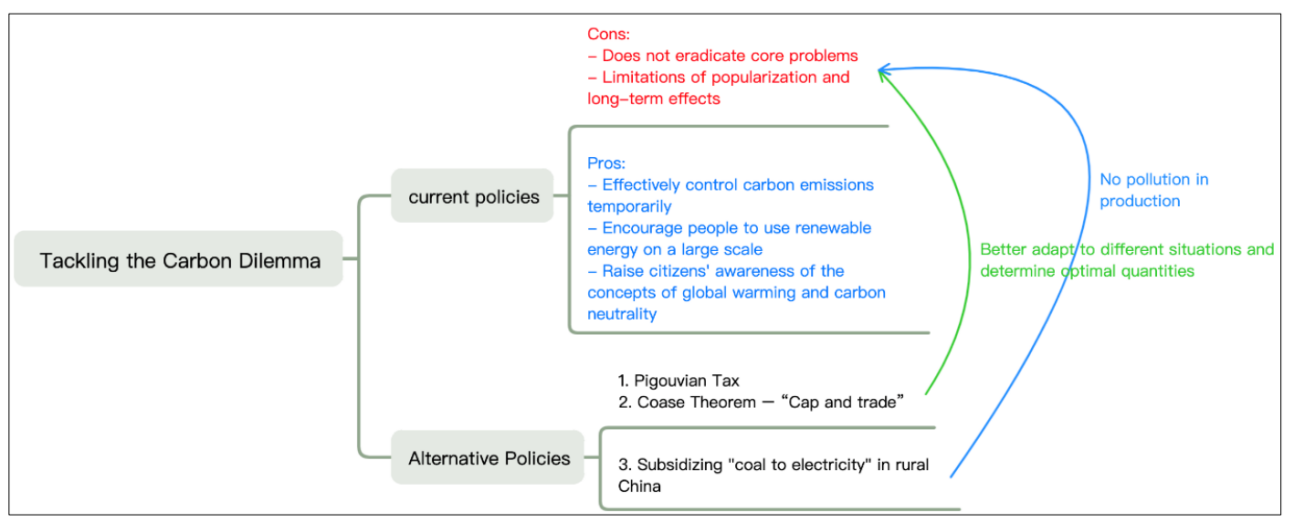

The key to achieving the two conflicting goals is to find the balance between containing carbon emissions and keeping supply chains. This essay would focus on the discussion of current policies and make policy recommendations, using cost-benefit analysis. We propose the following policies to be implemented: 1. Promoting CAP; 2. Developing new energy and expanding current green energy scale; 3. Strengthening subsidies to encourage “coal to electricity” transition; 4. Enhancing awareness campaign.

Figure 2: The brief bare bones for the whole essay.

2. Current Policies

A series of policies have been put forward which can be categorized into three main pillars:

1.Movement emission reduction [4]: drastic supply-side industry reform, which usually at a provincial level in order to radically phase out high carbon emission industries, namely steel, cement, chemicals, etc.

2.Subsidy focused renewable energy promotion policy: promotion of technology innovation and advancement in order for fast adoption of renewable energy through massive spending from both public and private sectors

3.Event-driven green awareness campaign [5]: organizing low carbon emission or even carbon-neutral international events, such as the Beijing Winter Olympics 2022, to enhance awareness among Chinese citizens.

2.1. Movement Emission Reduction: Temporary Restrictions Unable to Eradicate the Core Problem

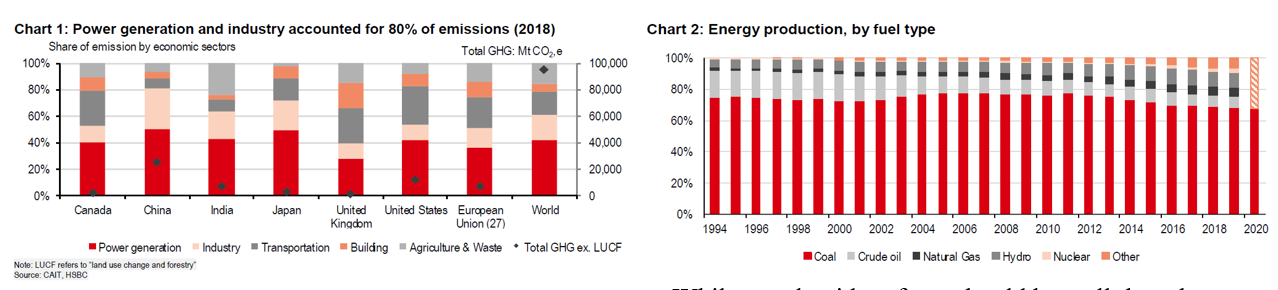

China is the largest emitter of carbon dioxide and also an inferior mix of energy production with its energy infrastructure heavily focused on coal and fossil fuel. Also, other industries, such as a burgeoning construction industry and industrial manufacturing contribute heavily to carbon emissions. As such, supply-side reform to phase out high carbon emission industries is a strategic imperative for the central government.

Figure 3: The proportion of carbon emissions used by different industries in different countries and energy production by fuel type from 1994 to 2020.

While supply-side reform should be well thought-after and sustainable, some provincial governments have taken various drastic moves to curb outdated high carbon emission steel mills and power plants, with a combined 60% above of total China CO2 emissions. These initiatives range from the restriction of new capacity, charging higher electricity power fees on high carbon emission manufacturers, and even temporarily shutting down electrical power supply between 3-6 months.

In the short run, these policies were very effective to instantly lower carbon emission. However, they have also some negative impacts on the provincial level economy. Economic growth rate in provinces with significant steel and chemical production explore slowed down significantly. Structural unemployment went up inevitably. Downstream industries were also affected with raw material supply shortage and hard to increase prices which led to inflation.

2.2. Subsidy Focused Renewable Energy Promotion Policy

China has been pushing aggressively on renewable energy over the past two decades. Government subsidy to solar and wind power industry have been enormous and effective [6]. These supportive policies have brought great benefits to these industries and the domestic economy as a whole. China leads world in total installed solar power capacity for nine straight years and 18 out of the top 20 solar companies by revenues are from China.

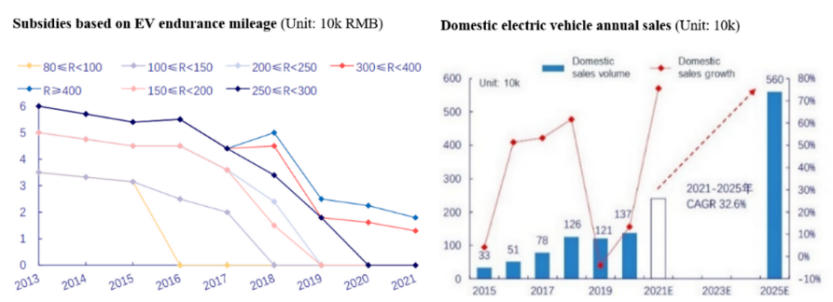

Figure 4: Electric vehicle mileage subsidy per 10,000 CNY from 2013 to 2021 (left) and domestic electric vehicle sales in unit 10k from 2015 to 2025 forecast(right).

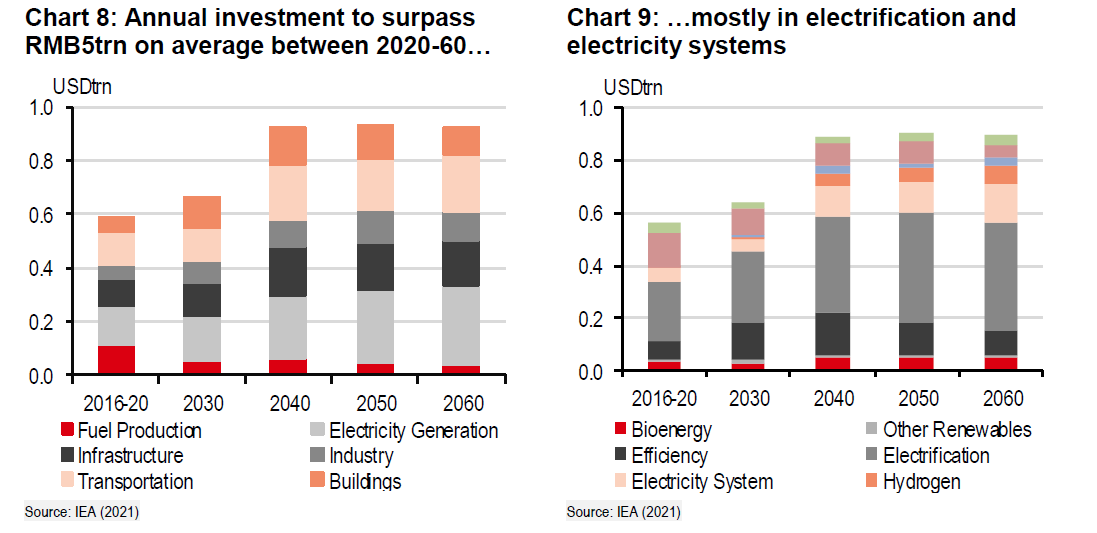

Riding the policy triumph in the aforementioned renewable sectors, the government currently emphasizes the policy towards the electric vehicle industry also on direct subsidy. The Chinese government started to provide massive subsidies over CNY 35,000 per car to EV car manufacturers as early as 2013. Over the years, the government gradually shifts the subsidy towards EV with longer endurance mileage, which effectively drives the automakers to research and manufacture for vehicles with higher power and more energy efficient. By 2020, domestic EV sales volume reached 1.37 million and is expected to grow at 32.6% CAGR over the next five years. While direct subsidies to EV manufacturers/consumers boost short-term sales of EVs, the long term recognition of EVs among Chinese citizens remain questionable [7]. Unlike solar and wind sectors which are mainly B2B, electrical vehicles are consumer products. According to the figures provided by Alternative Fuels Data Centre, the number of charging stations in China is only about 2.2 million, which is far less than in some developed countries such as the United States with 22 million stations. Without the build-up of the corresponding power charging infrastructure, EV owners will opt for traditional gasoline vehicles eventually as indicated by researchers at the Shanghai Jiao Tong University [8]. According to the report, among 4,000-plus households surveyed, 18% EV and 20 percent PHEV owners ended up returning to gasoline vehicles. More than a third of the cumulative reductions in China’s target is associated with technologies not commercially available today. Therefore, massive investment is required in the development and large-scale deployment of frontier technologies. The IEA in 2021 estimated more than 5 trillion CNY of new investment annually from now to 2060. By area of technology, electrification and electricity systems will be the largest driver of investment, account for a combined 30% total investment.

Figure 5: The estimated average annual investment in investments spanning the period of 2016 to 2060.

The government is in the process of reforming energy taxes and establishing appropriate regulatory frameworks. For example, carbon pricing, either in the form of a carbon tax or an emissions trading system, which is known as ETS, is a valuable instrument in the policy toolkit to help accelerate the green transformation. China launched its national carbon ETS for the power sector in July 2021 and plans to expand it to cover multiple sectors in the near future. In terms of direct public funding, governments will provide loan guarantees to ensure a predictable flow of bankable projects that can be financed privately. Green finance will be an accelerator in this process. As of end-2020, China’s green loans were estimated about USD1.8 trillion and green bonds outstanding was USD125 billion, were the largest and second-largest in the world, respectively, but the efforts are predominantly top-down.

2.3. Event-driven Green Awareness Campaign

The Chinese government has shown its resolution to achieve carbon neutral through multiple global events it organized. Beijing Winter Olympics 2022 is the best example and the 'carbon neutral template' for future global events. The Beijing Winter Olympics is "carbon neutral" with hydrogen fueling the Olympic torch and powering over 800 vehicles. Its 100% renewable energy plant was to support the event venues and has 1.7 million carbon credits to offset emissions. During these events, the government organized awareness campaigns to educate the basics of renewable energy products, such as affordability, range, battery life, and charging station accessibility of EV and hydrogen-energy vehicles.

3. Policy Recommendation

3.1. Pigouvian Tax

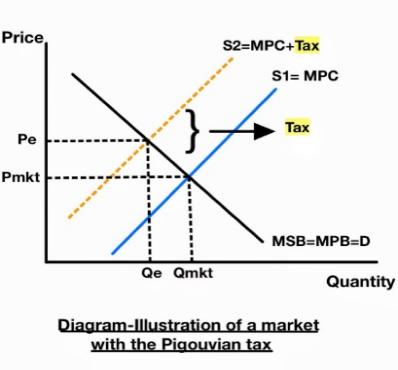

The Pigouvian tax is devised to control the negative externalities of environmental pollution proposed by welfare economist Pigouvian, also referred to as the environmental protection tax. When there is a negative production externality, the government could impose a Pigouvian tax equal to the marginal external cost, to help achieve the socially optimum quantity of the good. Here the socially optimal quantity is reached [9].

The Pigouvian tax is an indirect tax imposed on every pollutant unit. The factory that emits more units of air pollutants will be exerted a higher tax, which can internalize the negative production externality, which provides an incentive for firms to switch to alternative, less polluting resources. A side benefit is that the government might collect more tax revenue, which could then subsidize green energy users.

Figure 6: Diagram-illustration of a market with the pigouvian tax.

According to the logic implicit in the Pigouvian tax's premise, the Pigouvian tax's optimal pricing should equal the difference between private and social costs. However, the information burden for developing an effective Pigouvian tax is so enormous that it is impossible to calculate an effective Pigouvian tax that, even if sufficient information were available, could lead to a better emissions policy than a tax policy. Therefore, the Pigouvian tax has many defects in practice.

3.2. Coase Theorem – “Cap and Trade”

In order to overcome the defects of Pigouvian tax, Coase, an economist who was also born in England, proposed that since the daily commodity exchange can be regarded as an exchange of property rights, the right to pollution can also be exchanged, so that the pollution can be minimized through market transactions. Later scholars expressed this idea of Coase as: as long as the market transaction cost is zero, no matter how the initial property rights are allocated, the market transaction can consistently achieve the optimal allocation of resources [10].

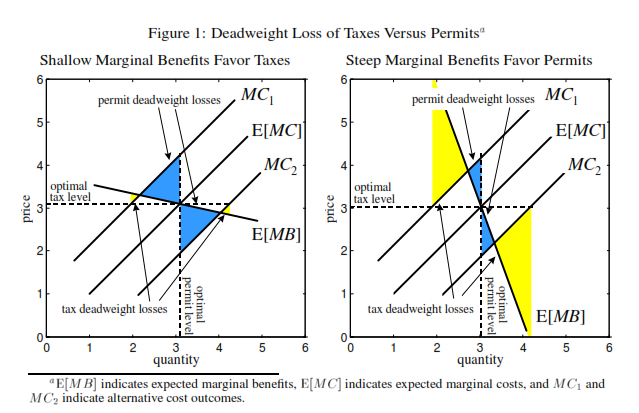

Figure 7: Deadweight loss of taxes versus permits.

When it comes to practical use, a cap and trade program can effectively implement the Coase Theorem at a large scale. Cap and trade is the column of emissions, as the government issues a set amount of permits to companies that comprise a cap on allowed carbon dioxide emissions.

The analysis is based on the model raised by William A. Pizeris [11]. When the elasticity of the demand curve is relatively elastic, changes in prices will have a considerable impact on the production of negative externalities, thereby ensuring that pollution levels are suppressed at the same time. Namely, the policy of tax will be more effective under this scenario. However, when the elasticity of the demand is relatively inelastic, price control is not effective anymore, as the increase in the price cannot effectively alleviate people's desire to buy it, which potentially deposit hazards to our environment. Therefore, confinements in quantity produced will be more effective in minimizing deadweight loss in this case, which caters for the utilization of cap and trade.

3.3. Subsidizing “Coal to Electricity” in Rural China

The efficiency of coal burning in rural areas are not only far lower than that of electric heating, but also will cause serious environmental pollution. China consumes about 700-800 million tons of bulk coal every year, which is mainly used for coal-fired heating in rural life, accounting for about 20% of the total coal consumption. It is difficult to imagine what people will be like living in an impure environment. In addition, the heat island effect caused by coal burning is a problem that can not be ignored. The rising air flow makes harmful gases accumulate in the sky and form serious air pollution. How to ensure people's health has become a great problem. However, in the same economically developed North and South regions, why is the pollution degree in the South far lower than that in the north? According to the survey, the most polluted cities in northern China have 140 micrograms of pollutants per cubic meter, while the cleanest cities in southern China have only 38 micrograms per cubic meter [12]. In fact, this is because central heating is implemented in northern cities, while decentralized heating is implemented in southern cities. Therefore, improving the technology of power generation with renewable energy is different from the commonly understood centralized heating-dominated by coal-fired boilers. It not only has no pollution but also can effectively improve the energy utilization rate and achieve green, low-carbon, energy conservation and emission reduction, which is also in line with the energy use direction encouraged by the state.

4. Conclusion

To sum up the essay, climate change has led to wide attention from major countries around the world, and China has implemented some policies to achieve the carbon goals, including fiscal policies which constrained high carbon emission industries, investment in renewable energy, and event-driven green campaign. We presume multiple drawbacks and deficiencies of the current policies and propose improvement and alternative policies which may raise the efficiency in achieving the twin aims as to reach China’s carbon pledges and maintain key supply chains: to modify the existing pollution tax system and introduce the carbon tax; cap-and-trade or tax could be implemented according to different elasticities of demand; promote the “coal to electricity” policy by subsidies in rural China.

References

[1]. Xi Jinping, "Speech during inspection tour of Anji County," Zhejiang Province, China, Aug. 2005.Bootorabi, F., Haapasalo, J., Smith, E., Haapasalo, H. and Parkkila, S. (2011) Carbonic Anhydrase VII—A Potential Prognostic Marker in Gliomas. Health, 3, 6-12.

[2]. M. Kendall, “Fuel cell development for New Energy Vehicles (NEVs) and clean air in China,” Progress in Natural Science: Materials International, vol. 28, no. 2, pp. 113-120, 2018.

[3]. E. T. Wilkins, “Air pollution aspects of the London fog of December 1952,” Quarterly Journal of the Royal Meteorological Society, vol. 80, no. 344, pp. 267-271, 1954.

[4]. P. MacNaughton et al., “Energy savings, emission reductions, and health co-benefits of the green building movement,” J. Expo. Sci. Environ. Epidemiol, vol. 28, no. 4, pp. 307-318, 2018.

[5]. N. M. Suki, “Green awareness effects on consumers' purchasing decision: Some insights from Malaysia,” International Journal of Asia-Pacific Studies, vol. 9, no. 2, 2013.

[6]. J. Yan et al., “City-level analysis of subsidy-free solar photovoltaic electricity price, profits and grid parity in China,” Nature Energy, vol. 4, no. 8, pp. 709-717, 2019.

[7]. H. Hao et al., “China’s electric vehicle subsidy scheme: Rationale and impacts,” Energy Policy, vol. 73, pp. 722-732, 2014.

[8]. Shanghai Jiao Tong University, the survey, 2022.

[9]. D. W. Carlton and G. C. Loury, “The limitations of Pigouvian taxes as a long-run remedy for externalities,” The Quarterly Journal of Economics, vol. 95, no. 3, pp. 559-566, 1980.

[10]. R. D. Cooter, “The coase theorem,” in Allocation, Information and Markets, London: Palgrave Macmillan UK, 1989, pp. 64-70.

[11]. B. C. Murray, R. G. Newell, and W. A. Pizer, “Balancing cost and emissions certainty: An allowance reserve for cap-and-trade,” Review of Environmental Economics and Policy, 2009.

[12]. X. Shuxue et al., “‘Coal-to-electricity’ project is ongoing in north China,” Energy, vol. 191, p. 116525, 2020.[1]

Cite this article

Shi,C.T. (2023). Reconciling Development and Decarbonization: An Examination of China's Policy Options for Curbing Emissions While Sustaining Supply Chains. Advances in Economics, Management and Political Sciences,51,289-295.

Data availability

The datasets used and/or analyzed during the current study will be available from the authors upon reasonable request.

Disclaimer/Publisher's Note

The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of EWA Publishing and/or the editor(s). EWA Publishing and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content.

About volume

Volume title: Proceedings of the 2nd International Conference on Financial Technology and Business Analysis

© 2024 by the author(s). Licensee EWA Publishing, Oxford, UK. This article is an open access article distributed under the terms and

conditions of the Creative Commons Attribution (CC BY) license. Authors who

publish this series agree to the following terms:

1. Authors retain copyright and grant the series right of first publication with the work simultaneously licensed under a Creative Commons

Attribution License that allows others to share the work with an acknowledgment of the work's authorship and initial publication in this

series.

2. Authors are able to enter into separate, additional contractual arrangements for the non-exclusive distribution of the series's published

version of the work (e.g., post it to an institutional repository or publish it in a book), with an acknowledgment of its initial

publication in this series.

3. Authors are permitted and encouraged to post their work online (e.g., in institutional repositories or on their website) prior to and

during the submission process, as it can lead to productive exchanges, as well as earlier and greater citation of published work (See

Open access policy for details).

References

[1]. Xi Jinping, "Speech during inspection tour of Anji County," Zhejiang Province, China, Aug. 2005.Bootorabi, F., Haapasalo, J., Smith, E., Haapasalo, H. and Parkkila, S. (2011) Carbonic Anhydrase VII—A Potential Prognostic Marker in Gliomas. Health, 3, 6-12.

[2]. M. Kendall, “Fuel cell development for New Energy Vehicles (NEVs) and clean air in China,” Progress in Natural Science: Materials International, vol. 28, no. 2, pp. 113-120, 2018.

[3]. E. T. Wilkins, “Air pollution aspects of the London fog of December 1952,” Quarterly Journal of the Royal Meteorological Society, vol. 80, no. 344, pp. 267-271, 1954.

[4]. P. MacNaughton et al., “Energy savings, emission reductions, and health co-benefits of the green building movement,” J. Expo. Sci. Environ. Epidemiol, vol. 28, no. 4, pp. 307-318, 2018.

[5]. N. M. Suki, “Green awareness effects on consumers' purchasing decision: Some insights from Malaysia,” International Journal of Asia-Pacific Studies, vol. 9, no. 2, 2013.

[6]. J. Yan et al., “City-level analysis of subsidy-free solar photovoltaic electricity price, profits and grid parity in China,” Nature Energy, vol. 4, no. 8, pp. 709-717, 2019.

[7]. H. Hao et al., “China’s electric vehicle subsidy scheme: Rationale and impacts,” Energy Policy, vol. 73, pp. 722-732, 2014.

[8]. Shanghai Jiao Tong University, the survey, 2022.

[9]. D. W. Carlton and G. C. Loury, “The limitations of Pigouvian taxes as a long-run remedy for externalities,” The Quarterly Journal of Economics, vol. 95, no. 3, pp. 559-566, 1980.

[10]. R. D. Cooter, “The coase theorem,” in Allocation, Information and Markets, London: Palgrave Macmillan UK, 1989, pp. 64-70.

[11]. B. C. Murray, R. G. Newell, and W. A. Pizer, “Balancing cost and emissions certainty: An allowance reserve for cap-and-trade,” Review of Environmental Economics and Policy, 2009.

[12]. X. Shuxue et al., “‘Coal-to-electricity’ project is ongoing in north China,” Energy, vol. 191, p. 116525, 2020.[1]