1. Introduction

Due to growing environmental issues in the twenty-first century, environmental economics has become a more popular subject for study. Since environmental economics utilizes empirical studies of the economic effects of global climate policies, many more people have noticed the importance of environmental economics for deciding on responses to environmental issues.

Nowadays, government officials, environmentalists, and economists work together to deal with and evaluate environmental issues, such as climate change, air pollution, water quality, solid waste, etc. To deal with climate change, specifically, many countries consider climate policies, which include market-based instruments, regulatory instruments, and voluntary instruments [1]. An example of market-based instruments is carbon pricing, in which carbon tax and cap and trade are two approaches to y carbon pricing. This paper examines the impact of carbon tax and cap and trade on occupations in the United States. Since environmental economics often employs cost-benefit analysis to evaluate an environmental economic action, this study is significant on behalf of environmental economics.

To its significance in environmental economics, the study explores this topic: the impact of climate policies, particularly market-based instruments, on occupations in the United States. This paper focuses on two market-based climate policies: carbon tax and cap and trade. This study is influential and unique in the field of environmental economics, since there are not many research papers specifically exploring the question of whether carbon tax and cap and trade eliminate occupations in the United States, though there are still some credible sources addressing the impact of carbon tax or cap and trade in a broader term in other countries or regions. In addition, this paper augments the costs of carbon tax and cap and trade, which is usually the opposite of the focus point for environmental economics to do research–environmental economists often set their sights on how climate policies can benefit the planet. Overall, this research paper is consequential in helping the public to comprehend whether both carbon tax and cap and trade, or just one, can negatively impact all types of occupations in the United States.

Enclosing the research question, this paper determines that five factors influence the amount of impact of carbon tax and cap and trade on occupations in the United States: an occupation’s greenness, an occupation’s level of skills, an occupation’s size, gender difference in different occupations, and differences in implementation of carbon tax and cap and trade in different states in the United States [2-5]. Furthermore, this article applies Porter Hypothesis, which states that climate policies promote economics, to data analysis and claims that if the prerequisites are met, carbon tax exhorts occupations.

The amount of impact of carbon tax and cap and trade on occupations is presented by the employment rate of the occupations that the article includes. Graphs and maps are another two important means of demonstrating the relationship between the carbon tax and cap and trade and each occupation.

This paper is constructed as follows. Section 2 first generalizes climate policies and then defines and describes carbon tax and cap and trade. Section 3 first points out the hypothesis and analysis of the research question and then depicts the process of founding basic elements, such as the research object and the environmental economic model. Then, the paper examines the impact of carbon tax and cap and trade on each of the five factors and visualizes it by graphs and maps.

2. Climate Policies

Climate policies are often enacted in countries or states when the government prioritizes the mitigation of climate change rather than economic production. The U.S. has produced 422 billion metric tons of carbon dioxide as of 2021 since the Industrial Revolution, and the U.S. ranks currently as the largest emitter of carbon dioxide in the world [6].

In response to this, the U.S. government enacted climate policies starting in the 1950s. A notable climate policy in the United States is carbon pricing, which is the amount that must be paid for the right to emit one ton of carbon dioxide. Carbon pricing aims to regulate the actions of emission-intensive industries and to capture the external costs of greenhouse gases. This paper examines the two main types of carbon pricing, carbon tax and carbon cap, to analyze the impact of climate policies on the employment of different types of occupations in the United States.

2.1. Carbon Tax

Carbon tax is a fee regulating firms that produce excessive carbon dioxide and other greenhouse gases through their operations. Carbon tax is used to reduce the usage of fossil fuels and to protect the environment from the effects of greenhouse gas emissions.

Carbon tax is usually regressive, meaning that lower-income households need to pay more than those paid by higher-income households, which negatively impacts the welfare of impoverished people and exacerbates disparity. Though, carbon tax has been a popular climate policy for the United States recently. In 2014, Adele Morris, an environmental economist, argued that a carbon tax in fiscal form can enhance the regressivity of a usual carbon tax [7]. As of 2019, more than half of the states in the U.S. have stated promising carbon tax considerations or implementation.

2.2. Cap and Trade

Cap and trade, a mechanism of emissions trading, sets a limit on emissions, giving firms a certain number of allowances consistent with those limits, and then permitting the firm polluters to buy and sell the allowances. If successful, cap and trade directly reduce the climate impact brought by emission-intensive firms and protects and simultaneously maintains trading between firms. Many environmental economists believe that cap and trade is a viable alternative to carbon tax. As of 2019, 17 U.S. states, including California and New York, have considered cap and trade, and cap and trade already exists in 14 of those 17 states.

3. Analysis on Employment

This paper examines the research question of if the two climate policies, carbon tax, and cap and trade, obliterate occupations. As mentioned in the introduction section, climate policies benefit our lives by mitigating climate change. However, this study expects to see that climate policies harm jobs, since companies usually need to bear the burden of a carbon tax or a permit price.

This study classifies occupations into two categories: green and non-green occupations and skilled and unskilled occupations. The study also finds that gender difference and firm size factor in the amount of impact of carbon tax and cap and trade on occupations. The paper compares the employment rate or unemployment rate visualized by maps and graphs between jobs in each category to determine whether the paper’s hypothesis is justified.

This article claims that climate policies can eliminate occupations. At first, the paper looks for data, especially the employment rate or unemployment rate for each occupation. Subsequently, the article takes into account Porter Hypothesis, which argues climate policies are beneficial for economics. From Porter Hypothesis, the paper claims that some environmental regulations can benefit some kinds of occupations. By combining Porter Hypothesis with previous sources, this study reintegrates its claim: climate policies harm occupations, but not all kinds.

While deciding which country to be the object of analysis, this study finds a map showing which states in the United States have been considering and implementing carbon tax, carbon cap, or both. The study also finds a map showing the unemployment rate in different states corresponding to either carbon tax or carbon cap or both. These two maps lead to the article’s decision on using the United States as the analysis object for their research, since states’ differences in implementing carbon tax or cap and trade or both can determine the amount of impact on occupations.

The method of hypothesizing on the paper’s research question has two benefits: first, it shows the paper’s interest in this topic of the relationship between environment and economics; second, it creates a feedback loop that allows the article to justify its hypothesis. Moreover, the investigation includes the benefits of climate policies to provide common perceptions on the research question and identify the paper’s evaluation of the climate policies and the importance of this research. The study points out that climate policies can incur costs, and by using Porter Hypothesis, the study expands knowledge on the research question and redresses the hypothesis.

3.1. Green and Non-Green Occupations

This article states that green occupations can mitigate climate change and non-green occupations can harm the planet. An example of a green occupation is renewable energy production and transport, and an example of a non-green occupation is fossil fuels energy production.

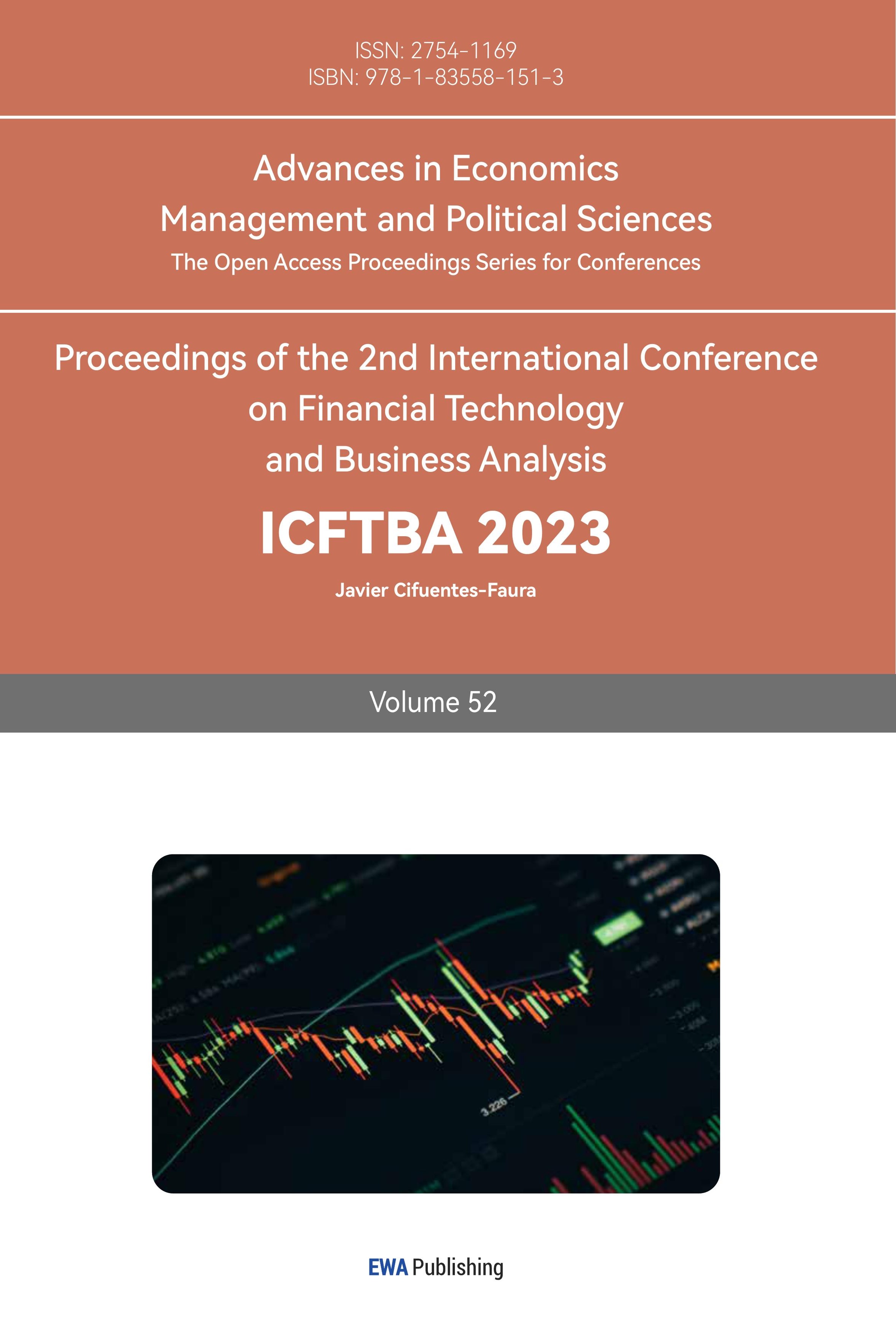

This study analyzes the impact of climate policies on the employment rate of green and non-green occupations. For green occupations, the article separates carbon tax and cap and trade onto two maps, as shown below in Figure 1, pointing out that 5 more states including Washington and Oregon proposed cap and trade between 2018-2019 and 10 more states including Vermont and Maine proposed carbon tax between 2018-2019 [8].

Figure 1: Existing and Proposed Cap and Trade and Carbon Tax 2018-2019 (Source: www.priceoncarbon.com).

However, as shown below in Figure 2, the investigation finds that there was a significant increase in the unemployment rate for renewable energy jobs from 2018 to 2019. This graph shows that renewable energy employment increased no less than 2 percent, excluding biomass.

Figure 2: Increase in Renewable Energy Employment, 2018-2019 (Source: acore.org).

For non-green occupations, one research paper argues that carbon tax destroys emission-intensive firms [2]. To reinforce this statement, this investigation finds a linear graph, as shown below in Figure 3, which shows the trend of employment of solar, a type of renewable energy, and oil and gas extraction and coal energy, three non-renewable energies (fossil fuels).

Figure 3: There are More Jobs in Solar than Oil and Gas, Coal Extraction in the U.S (Source: www.gwe2011.org).

This graph demonstrates a decreasing employment trend in oil and gas extraction and coal mining starting in 2014 and a steadily increasing employment trend in solar. Consequently, this paper claims that climate policies promote green occupations and damage non-green occupations.

3.2. Skilled and Unskilled Occupations

This article states that skilled occupations require certain training and unskilled occupations can start right away without certain skills. Examples of skilled occupations include economists and environmentalists, and an example of unskilled occupation is an extraction worker.

This study then analyzes the impact of climate policies on the employment of skilled and unskilled jobs. One research paper argues that climate policies are skill-biased against manual laborers [4]. To reinforce this statement, this study finds the projected rate of employment change in skilled occupations from 2012 to 2022 as shown in Figure 4 below.

Figure 4: Projected Rate of Employment Change (2012-2022) (Source: www.hcrnetwork.com).

Figure 4 shows that the employment rate’s change of health-related skilled occupations, including physician assistants and medical health services managers, was expected to increase by no less than 15 percent, excluding pharmacists.

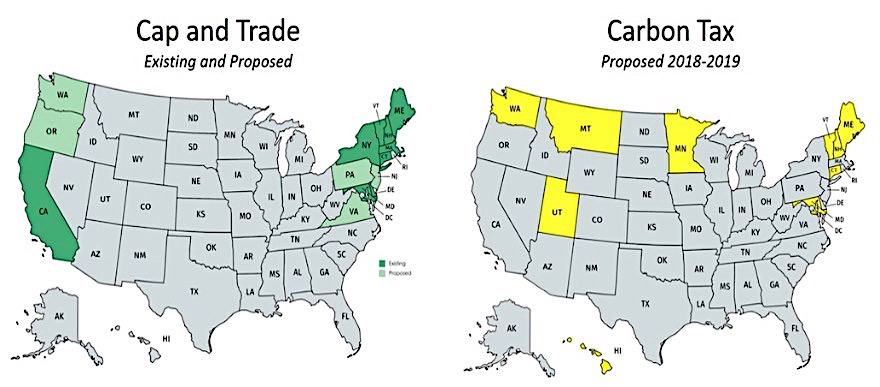

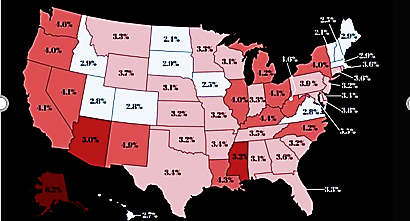

For unskilled occupations, this study generates the map, as shown below in Figure 5, to show the employment of extraction workers in the United States in May 2022 [9].

Figure 5: Employment of extraction workers, all other, by area, May 2022 (Source: www.bls.gov).

This map of the U.S. shows that there were no states left that had a higher employment area than 60 besides Nevada, Texas, and Louisiana. The whole of New England had no employment of extraction workers. Thus, this paper claims that climate policies promote skilled occupations and damage unskilled occupations.

3.3. Gender Difference

While searching for other factors that can influence the impact of carbon tax and cap and trade on occupations, this investigation finds that gender difference contributes to different employment rates. To reinforce this statement, this article refers to skilled and unskilled occupations. Specifically, this article utilizes technicians, a highly skilled occupation, to illustrate that companies will be more likely to bear the burden of a carbon tax or cap and trade for highly skilled male technicians than female technicians. In addition, this study interprets that two reasons can explain this phenomenon: companies find these highly skilled male technicians more valuable than female technicians; meanwhile, gender discrimination still exists in the workplace.

3.4. Firm Size

This paper indicates that firm size can also alter the impact of climate policies on jobs. This article first classifies firms into large firms and small and middle-sized firms, defining large firms as having at least 500 employees and small and middle-sized firms as having 50 to 250 employees. This study illustrates this definition by providing Google as an example of a large firm and early periods of startups as an example of small and middle-sized firms.

The article then compares the impact of climate policies on large firms and small and middle-sized firms, respectively. As shown below in Figure 6, 40 percent of the public believes that carbon tax will negatively impact small and middle-sized firms. To justify this graph, this investigation finds that larger businesses are more inelastic to carbon tax and cap and trade since they contribute a bigger part to the economy than those contributed by small and middle-sized firms [10]. Therefore, the paper claims climate policies favor large businesses and damage small and middle-sized firms.

Figure 6: Impact of the carbon tax on SMEs (Source: Sensis).

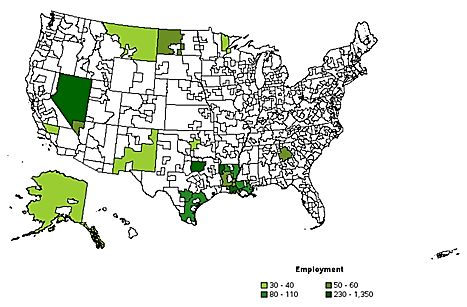

3.5. Politics of Climate Change Policies

This paper analyzes the politics of climate change policy in the United States. The study examines how states implementing carbon tax or carbon cap or both could contribute to different results.

The study first provides the map, as shown below in Figure 7, to show which state considered or implemented which corresponding policy [8].

Figure 7: Carbon Pricing Existing and Considered (Source: www.priceoncarbon.com).

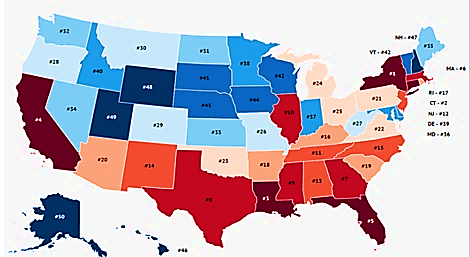

The findings from this map are that cap and trade (carbon cap) exclusively exists in California and Washington, and carbon tax exclusively exists in Texas and Montana, while states like New Hampshire, Vermont, and Maine consider both. Earlier, from the data from several research papers, this paper claims that carbon tax contributes to a lower unemployment rate. Consequently, the investigation finds this most recent map, as shown below in Figure 8.

Figure 8: Unemployment Rate by US State (2019) (Source: www.tonymappedit.com).

Combining findings from the politics of climate change policy map and the unemployment rate map, the article states that carbon tax justifying Porter Hypothesis incurs a lower unemployment rate than that for cap and trade for the United States. However, the article expects to see that other factors including disparity and immigration can also influence the unemployment rate. Subsequently, the study analyzes the map, as shown below in Figure 9, to show that disparity plays a big role in determining unemployment.

Figure 9: States with The Highest Levels of Income Inequality (Source: www.cnbcfin.com).

Corresponding with the previous unemployment map, due to high amounts of impoverished immigrants, New York and California have higher income inequality than most states, leading to their higher unemployment rates. Also, even though Louisiana is considering a carbon tax, the state unemployment rate is still very high due to high income inequality. Consequently, this paper claims that for a carbon tax to decrease the unemployment rate and protect jobs, fewer immigration flows and lower income inequality are the premises.

4. Conclusion

This research paper sets sights on whether the two climate policies, carbon tax and cap and trade, destroy occupations in the United States. Since research papers in the field of environmental economics usually discuss or expand on the environmental benefits of climate policies, this research paper is relatively new to the public. Demonstrating its importance in the field of environmental economics, this paper explicates the costs of carbon tax and cap and trade and helps the public to respond to environmental concerns more effectively. This article concludes that carbon tax and cap and trade do eliminate occupations, but not all types, claiming that carbon tax and cap and trade benefit green occupations, skilled occupations, and large-sized firms and damage non-green occupations, unskilled occupations, and small and middle-sized firms.

Meanwhile, this paper has its flaws. The study exclusively analyzes market-based instruments in different instruments of climate policies, and the impact of different instruments, such as prescription laws, of climate policies on occupations can differ from the results in this study. Moreover, the study exclusively focuses on the impact of climate policies on occupations in the United States, a federal state. Differences in the types of governments in different countries can also alter the amount of impact of climate policies on occupations.

Authors Contribution

All the authors contributed equally, and their names were listed in alphabetical order.

References

[1]. Stavins, R. N. (2003). Experience with market-based environmental policy instruments. In Handbook of environmental economics (Vol. 1, pp. 355-435). Elsevier.

[2]. Azevedo, D., Wolff, H., and Yamazaki, A. (2023). Do carbon taxes kill jobs? Firm-level evidence from British Columbia. Climate Change Economics, 14(02), 2350010.

[3]. Coglianese, C., Finkel, A. M., and Carrigan, C. (2014). Does regulation kill jobs?. University of Pennsylvania Press.

[4]. Marin, G., and Vona, F. (2019). Climate policies and skill-biased employment dynamics: Evidence from EU countries. Journal of Environmental Economics and Management, 98, 102253.

[5]. Domguia, E. N., Pondie, T. M., Ngounou, B. A., and Nkengfack, H. (2022). Does environmental tax kill employment? Evidence from OECD and non-OECD countries. Journal of Cleaner Production, 134873.

[6]. Cumulative CO2 emissions globally by country 1750-2021. Statista. Retrieved from https://www.statista.com/statistics/1007454/cumulative-co2-emissions-worldwide-by-country/, 2023.

[7]. Morris, A., & Mathur, A. (2014). A carbon tax in broader US fiscal reform: Design and distributional issues. Center for climate and energy solutions, May.

[8]. Priceoncarbon.org. (2023).U.S. State Carbon Pricing. Retrieved from https://priceoncarbon.org/wp-content/uploads/2020/09/U.S.-State-carbon-pricing.jpg, 2023.

[9]. U.S. Bureau of Labor Statistics. (2018). OES Maps. Retrieved from https://www.bls.gov/oes/current/map_changer.htm, 2023.

[10]. Kim, D., & Savagar, A. (2023). Firm revenue elasticity and business cycle sensitivity. Journal of Economic Dynamics and Control, 154, 104722.

Cite this article

Liu,Z.;Si,J.;Wang,W. (2023). Impact of Climate Policies on Occupations in the United States. Advances in Economics, Management and Political Sciences,52,100-108.

Data availability

The datasets used and/or analyzed during the current study will be available from the authors upon reasonable request.

Disclaimer/Publisher's Note

The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of EWA Publishing and/or the editor(s). EWA Publishing and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content.

About volume

Volume title: Proceedings of the 2nd International Conference on Financial Technology and Business Analysis

© 2024 by the author(s). Licensee EWA Publishing, Oxford, UK. This article is an open access article distributed under the terms and

conditions of the Creative Commons Attribution (CC BY) license. Authors who

publish this series agree to the following terms:

1. Authors retain copyright and grant the series right of first publication with the work simultaneously licensed under a Creative Commons

Attribution License that allows others to share the work with an acknowledgment of the work's authorship and initial publication in this

series.

2. Authors are able to enter into separate, additional contractual arrangements for the non-exclusive distribution of the series's published

version of the work (e.g., post it to an institutional repository or publish it in a book), with an acknowledgment of its initial

publication in this series.

3. Authors are permitted and encouraged to post their work online (e.g., in institutional repositories or on their website) prior to and

during the submission process, as it can lead to productive exchanges, as well as earlier and greater citation of published work (See

Open access policy for details).

References

[1]. Stavins, R. N. (2003). Experience with market-based environmental policy instruments. In Handbook of environmental economics (Vol. 1, pp. 355-435). Elsevier.

[2]. Azevedo, D., Wolff, H., and Yamazaki, A. (2023). Do carbon taxes kill jobs? Firm-level evidence from British Columbia. Climate Change Economics, 14(02), 2350010.

[3]. Coglianese, C., Finkel, A. M., and Carrigan, C. (2014). Does regulation kill jobs?. University of Pennsylvania Press.

[4]. Marin, G., and Vona, F. (2019). Climate policies and skill-biased employment dynamics: Evidence from EU countries. Journal of Environmental Economics and Management, 98, 102253.

[5]. Domguia, E. N., Pondie, T. M., Ngounou, B. A., and Nkengfack, H. (2022). Does environmental tax kill employment? Evidence from OECD and non-OECD countries. Journal of Cleaner Production, 134873.

[6]. Cumulative CO2 emissions globally by country 1750-2021. Statista. Retrieved from https://www.statista.com/statistics/1007454/cumulative-co2-emissions-worldwide-by-country/, 2023.

[7]. Morris, A., & Mathur, A. (2014). A carbon tax in broader US fiscal reform: Design and distributional issues. Center for climate and energy solutions, May.

[8]. Priceoncarbon.org. (2023).U.S. State Carbon Pricing. Retrieved from https://priceoncarbon.org/wp-content/uploads/2020/09/U.S.-State-carbon-pricing.jpg, 2023.

[9]. U.S. Bureau of Labor Statistics. (2018). OES Maps. Retrieved from https://www.bls.gov/oes/current/map_changer.htm, 2023.

[10]. Kim, D., & Savagar, A. (2023). Firm revenue elasticity and business cycle sensitivity. Journal of Economic Dynamics and Control, 154, 104722.