1. Introduction

In today's digital era, the booming development of financial technology (FinTech) is leading to revolutionary changes in the financial field. As a core industry of the financial system, the traditional banking industry is facing unprecedented opportunities and challenges. With the rapid progress of information technology, FinTech is profoundly reshaping the pattern of financial services with its innovative technology and business model. At the same time, the traditional banking industry is also facing urgent problems under the wave of digitalization. Driven by emerging technologies, FinTech is increasingly penetrating into all aspects of banking business, such as mobile payment, digital currency, lending and other fields, triggering a restructuring of business models. This paper will analyze and summarize the literature research and cases in the past five years, compare the business data related to banking and FinTech, discuss and study the core technology and application of FinTech, reveal its impact mechanism on traditional banking business in different fields, and the integration mode of fintech and traditional banking business. It is hoped that through in-depth research on the impact of FinTech on the traditional banking industry, this paper can provide useful reference for the industry and academia on financial innovation, business model transformation and regulatory policies, and reveal the future trend of FinTech, so as to provide appropriate strategies for the banking industry in the digital transformation to better adapt to the unpredictable financial market.

2. An Overview of FinTech

2.1. Definition and Scope of FinTech

FinTech integrates advanced technology in financial business. Its emergence can create more efficient, convenient and innovative financial services and business models. Supported by high-tech companies and based on a series of innovative technologies such as artificial intelligence, big data, cloud computing and blockchain, this technology is fully applied to six financial fields including payment and clearing, wealth management, retail, banking, insurance and transaction settlement, realizing a high degree of integration of "finance + technology" [1]. Over the past few years, FinTech has improved the accessibility, efficiency, and user experience of financial services through digitalization and automation.

2.2. The Evolution of FinTech

The development of FinTech has gone through a number of key stages. At first, FinTech mainly focused on digitizing financial services, such as online banking and electronic payments. The Alipay platform launched in 2004 is an important symbol of the birth of fintech in China [2]. It provides consumers with a more convenient way to manage funds and conduct transactions. With the popularity of mobile devices, mobile payment has become an important branch of FinTech, enabling people to make transactions anytime and anywhere. Further development, the integration of information and communication technology with the Internet as the core and finance has gradually expanded a number of commercial businesses, and a series of new financial forms of blockchain technology such as peer to peer lending(P2P), crowdfunding and third-party payment, have emerged. In 2013, FinTech began to develop rapidly, and related technologies were written in relevant reports issued by the People's Bank of China and the government for many times [2]. Subsequently, various related technologies began to develop, and FinTech steadily entered a standardized development mode.

3. Main Technologies and Applications of FinTech

Currently, there are three main technologies that are widely used in the FinTech field.

3.1. Mobile Payment and Digital Identity Verification

Mobile payment is an important part of modern finance. With the help of smartphones and apps, users can easily make payments, no longer limited to traditional paper money and bank card transactions. This convenience not only enhances the user experience, but also promotes an increase in consumption activities. At the same time, the application of digital identity verification technology also ensures the security and legality of transactions, effectively reducing the risk of fraud.

3.2. Blockchain Technology

Blockchain technology is of great significance to ensure the security of financial business and risk prevention [3]. Through a decentralized and distributed way, it eliminates the intermediary link in traditional financial transactions and improves the efficiency and security of transactions. The application of blockchain technology in financial scenarios can realize information sharing and data transmission among participants, and effectively reduce the problem of information asymmetry. At the same time, its application is tamper-proof, the transaction data between participants will be recorded in the blockchain and synchronized by nodes of the whole network [3].

3.3. Big Data Technology

Big data technology enables banks to gain insights into their customers' spending habits, preferences and risk tolerance. Through the analysis of massive amounts of data, banks can better understand customer needs, risk profiles, and market trends, so that they can make more informed decisions. This technology enables financial services to have better personalization, which can better enhance customer satisfaction.

4. The Impact of Fintech on Traditional Banking

4.1. Business Model and Current Situation of Traditional Banking Industry

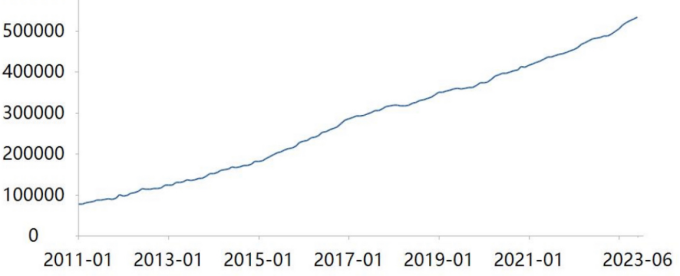

Traditional banking is the core component of the financial system, and the main business scope of traditional banking is wide, covering the following core areas. The first is the deposit business. Traditional banks are the main institutions for depositing savings and funds, accepting deposits from individuals and enterprises and offering various deposit accounts. Secondly, loan business, traditional banks provide loan services for individuals and enterprises, including personal consumption loans, commercial loans, etc., to meet customers' capital needs. At the same time, traditional banks provide payment and transfer services, such as checks and wire transfers, which are used to handle the flow of funds between individuals and businesses. Finally, various types of investment and wealth management products, as well as risk management tools, are also offered in commercial banks, such as savings accounts, securities investment, bond investment, etc., while insurance products and financial derivatives are used to help customers manage risks. The impact analysis below will also be carried out from these business aspects. As shown in Figure 1, from 2011 to 2023, the total assets of China's city commercial banks continue to rise at a rapid rate, occupying a very important position in the financial market.

Figure 1: Total assets of City Commecial Banks in China (100 Million yuan).

Under the business model of each business, banks mainly play an intermediary role, converting deposits into loans and promoting the flow of funds. Meanwhile, traditional banks have a huge geographical network, rely on the geographical branches of entities to provide face-to-face services, and make profits from the difference in related interest. In the digital era, the business of the above traditional banking industry gradually shows its lag, and customers have higher expectations for convenient and efficient financial services. Also, FinTech companies continue to emerge, challenging the position of traditional banks in various business fields. Traditional commercial banks show shortcomings such as low efficiency, geographical and time limitation and insufficient data processing capacity [4]. Below, we will first analyze the development of FinTech and the operation data of traditional banking business in recent years.

4.2. The Development of FinTech and the Operation Data of Traditional Banking Business in the Past 5 Years

First, FinTech has been in a state of rapid growth in the past five years. In terms of financing, financing continues to increase, with global investment in fintech up 14% in 2020 from 2019 to $44 billion, according to PWC's Global Fintech Report. In the past five years, global FinTech investment and financing increased from $64.9 billion to $150.3 billion, with an average annual growth rate of 23.4% [5]. However, the development of the banking industry in the corresponding financial market is not developing at the same time as fintech. The data selected in this paper is the data of A-share companies in Shenwan Industry in 2021. In the annual report data of the banking industry from 2018 to 2022, the ratio of net income from operating activities to total profit is used as the income quality index data. The income quality of the banking industry does not increase with the continuous development of financial technology, but fluctuates greatly, as shown in Table 1. There are even cases where the payoff is negative.

Table 1: Average growth rate of the rate of the ratio of net income from operating activities to total profit.

Year | Average of the growth rate(%) |

2018 | -17.94 |

2019 | -3.92 |

2021 | -3.13 |

2022 | 6.56 |

4.3. Changes Bring to Banking Business Mode by FinTech

The impact of FinTech on the banking industry will be analyzed in the following three most typical business scenarios.

4.3.1. Internet Banking and Mobile Payment

The rise of Internet banking and mobile payments is the emergence of more convenient financial services from the point of view of consumers. However, to a certain extent, it has a negative impact on the traditional banking business model. Traditional banks' business model with physical branch outlets at its core has taken a hit as more customers turn to online channels for banking. This has led to an increase in the operating costs of banks, and the services provided by online channels are also more attractive in some aspects. Now mobile payment can fully process payments of various amounts, replacing cash and checks, and it can also replace credit cards to bypass commercial banks for a variety of financial transaction services [6]. Affected by mobile payment, this is followed by a sharp decline in commercial banking business volume. The influx of FinTech companies has also further intensified competition in the banking business, with traditional banks having to make efforts to reduce fees and improve efficiency to maintain market share. This may result in the profitability of banks being affected as they need to invest more resources in changes to their services, which may result in the traditional profit model being challenged.

4.3.2. Digital Currency and Financial Derivatives Market

The rise of digital currencies and the digital transformation of financial derivatives markets have brought new uncertainties to traditional banking. First of all, more than 80% of the world's central banks have participated in the research and issuance of central bank digital currency to meet the public's demand for reliable digital payment methods [7]. The digital currency market is highly volatile, and its price and value may be affected by a variety of factors, such as regulatory policies and market sentiment. This uncertainty will lead to great challenges and risks for traditional banks in providing risk management and investment advice to customers, greatly reducing the amount and operation of such business. In addition, some traditional financial derivatives markets may be hit due to the introduction of blockchain technology. It is able to provide greater transaction transparency and traceability, which could change the way traditional derivatives markets are traded. Also, the pricing of derivative contracts, especially options, usually requires a lot of computing resources to complete [8]. In this case, the advantages of FinTech are extremely obvious, and it can completely replace the traditional derivatives trading market of commercial banks.

4.3.3. Lending and Lending Business

FinTech technology provides a more efficient online platform for lending business, which attracts a lot of borrowers and investors, increasing the competitive pressure of traditional banks in the lending market. Borrowers can access loans more quickly through online platforms, while investors can also invest in borrowing projects through these platforms, eliminating the role of traditional banks as intermediaries. This may lead to a decline in the lending volume of traditional banks, which in turn affects their lending income. In addition, FinTech platforms often attract borrowers with lower interest rates or meet their needs with more flexible loan terms, making it a big challenge for traditional banks.

5. Convergence of Fintech and Traditional Banking

5.1. Integrated Development of FinTech and Traditional Banks

The emergence of FinTech and related companies is a huge impact on traditional banking business, but when traditional banks cooperate with FinTech companies and adopt their own financial technology in their business models, their profitability will become higher [9]. The integrated development between the two is often the best development strategy in the digital era. Meanwhile, existing policies also encourage the joint development of commercial banks and fintech companies. China's banking industry is increasing the exploration and application of FinTech, laying a certain foundation for digital transformation. According to information published on the website of the China Banking and Insurance Regulatory Commission (CBRC), China's existing commercial banks have invested in the wave of digital transformation to accelerate the improvement of their core competitiveness. In 2020, the total investment in information technology of banking institutions was 207.8 billion yuan, with a year-on-year growth of 20% [10]. Together, policy support and case data prove that the future of the integrated development of FinTech and traditional banking industry has great potential.

5.2. Risks Posed by FinTech to the Traditional Banking Industry

5.2.1. Data Security and Privacy Issues

With the popularity of FinTech, vast amounts of financial transactions and personal information are digitized and stored in the cloud and servers. However, it also increases the risk of data breaches and security breaches. FinTech companies will involve a large amount of sensitive financial data, including personal identity information and financial information, etc. Such data is naturally of high value, and its storage and transmission methods are difficult to be differentiated from general data from the perspective of security [11]. FinTech companies vary in size and technology, and standards of data security measures are not uniform. Once such data is hacked or improperly used, it may lead to the disclosure of customer privacy, trigger a crisis of confidence, and even cause financial losses.

5.2.2. Complexity of Regulation

Similarly, technological innovation in FinTech often outpaces the ability of regulators to respond. The application of emerging technologies may lead to regulatory lags, thus making it difficult for regulators to keep up with changes in financial markets, generating certain risks. In addition, many FinTech companies are involved in transnational business, and different laws and regulatory standards in different countries will also make it difficult for regulators to achieve unified supervision and governance of FinTech companies.

6. Conclusion

This paper mainly discusses the impact of FinTech on the business model of traditional banking industry, and analyzes the development of FinTech, its impact on traditional banking business and related risks. The analysis finds that FinTech has brought negative impacts on traditional banking business, and the integrated development of the two will have better prospects, but data hidden dangers and regulatory problems also exist. Future research can further focus on the optimization of the regulatory framework, strengthen data privacy protection, and deeply explore the impact of FinTech on sustainable development.

References

[1]. Lan, X Y. Current situation, problems and countermeasures of commercial banks' application of financial technology [J]. Industrial Innovation Research,2023,(13):142-144.

[2]. Su, Q. & Lei, Haibo. Financial technology and family fund investment [J]. Statistics and Information Forum,2023,38(07):46-60.

[3]. SUN Xingyu. Application research of blockchain technology in finance and audit field [J]. Modern Business,2023,(10):111-114.

[4]. Tan, Z. Research on the Transformation of Traditional Commercial Banks under the Internet Finance Era [A]. Working Committee of International Association of Academicians of China Association for the Promotion of International Science and Technology, Nanyang Academy of Sciences. Proceedings of International Academic Forum on Finance and Management (I) [C]. 202:6-8

[5]. Gong Ailin. Financial impact on economic growth of our country of science and technology research [D]. Chongqing university, 2021. The DOI: 10.27713 /, dc nki. GCQGS. 2021.000386.

[6]. Niu, L W. Research on the impact of fintech on Commercial Bank performance: a Case study of mobile payment [J]. Modern Marketing (Next ten-day Issue),2022,(07):26-28.

[7]. Peng, T. & Yang, C. The Current situation and Prospect of China's Central bank Digital Currency research: based on bibliometric methods [J]. Journal of Hubei University of Technology,2023,38(03):36-40.

[8]. Zhang Kun, Ding Xiaole, Fan Zhongjin, Zhang Fan, Liu Hua. Application and prospect of fintech in OTC derivatives Business [J]. Financial Aspect,2023,(04):94-100.

[9]. Basdekis, C., Christopoulos, A., Katsampoxakis, I. et al. FinTech’s rapid growth and its effect on the banking sector. J BANK FINANC TECHNOL 6, 159–176 (2022). https://doi.org/10.1007/s42786-022-00045-w

[10]. He Xia. Digital economy under the background of digital transformation of commercial bank research [D]. Foreign economic and trade university, 2021. The DOI: 10.27015 /, dc nki. Gdwju. 2021.000678.

[11]. Yuan, K. & Cheng, Y. Data risk of fintech and its prevention and control strategy [J]. Journal of Beijing University of Aeronautics and Astronsutics (Social Science Edition),2023,36(02):46-58.

Cite this article

Wu,J. (2023). The Impact of the Development of Financial Technology on the Banking Industry. Advances in Economics, Management and Political Sciences,52,149-154.

Data availability

The datasets used and/or analyzed during the current study will be available from the authors upon reasonable request.

Disclaimer/Publisher's Note

The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of EWA Publishing and/or the editor(s). EWA Publishing and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content.

About volume

Volume title: Proceedings of the 2nd International Conference on Financial Technology and Business Analysis

© 2024 by the author(s). Licensee EWA Publishing, Oxford, UK. This article is an open access article distributed under the terms and

conditions of the Creative Commons Attribution (CC BY) license. Authors who

publish this series agree to the following terms:

1. Authors retain copyright and grant the series right of first publication with the work simultaneously licensed under a Creative Commons

Attribution License that allows others to share the work with an acknowledgment of the work's authorship and initial publication in this

series.

2. Authors are able to enter into separate, additional contractual arrangements for the non-exclusive distribution of the series's published

version of the work (e.g., post it to an institutional repository or publish it in a book), with an acknowledgment of its initial

publication in this series.

3. Authors are permitted and encouraged to post their work online (e.g., in institutional repositories or on their website) prior to and

during the submission process, as it can lead to productive exchanges, as well as earlier and greater citation of published work (See

Open access policy for details).

References

[1]. Lan, X Y. Current situation, problems and countermeasures of commercial banks' application of financial technology [J]. Industrial Innovation Research,2023,(13):142-144.

[2]. Su, Q. & Lei, Haibo. Financial technology and family fund investment [J]. Statistics and Information Forum,2023,38(07):46-60.

[3]. SUN Xingyu. Application research of blockchain technology in finance and audit field [J]. Modern Business,2023,(10):111-114.

[4]. Tan, Z. Research on the Transformation of Traditional Commercial Banks under the Internet Finance Era [A]. Working Committee of International Association of Academicians of China Association for the Promotion of International Science and Technology, Nanyang Academy of Sciences. Proceedings of International Academic Forum on Finance and Management (I) [C]. 202:6-8

[5]. Gong Ailin. Financial impact on economic growth of our country of science and technology research [D]. Chongqing university, 2021. The DOI: 10.27713 /, dc nki. GCQGS. 2021.000386.

[6]. Niu, L W. Research on the impact of fintech on Commercial Bank performance: a Case study of mobile payment [J]. Modern Marketing (Next ten-day Issue),2022,(07):26-28.

[7]. Peng, T. & Yang, C. The Current situation and Prospect of China's Central bank Digital Currency research: based on bibliometric methods [J]. Journal of Hubei University of Technology,2023,38(03):36-40.

[8]. Zhang Kun, Ding Xiaole, Fan Zhongjin, Zhang Fan, Liu Hua. Application and prospect of fintech in OTC derivatives Business [J]. Financial Aspect,2023,(04):94-100.

[9]. Basdekis, C., Christopoulos, A., Katsampoxakis, I. et al. FinTech’s rapid growth and its effect on the banking sector. J BANK FINANC TECHNOL 6, 159–176 (2022). https://doi.org/10.1007/s42786-022-00045-w

[10]. He Xia. Digital economy under the background of digital transformation of commercial bank research [D]. Foreign economic and trade university, 2021. The DOI: 10.27015 /, dc nki. Gdwju. 2021.000678.

[11]. Yuan, K. & Cheng, Y. Data risk of fintech and its prevention and control strategy [J]. Journal of Beijing University of Aeronautics and Astronsutics (Social Science Edition),2023,36(02):46-58.