1. Introduction

In the middle and late last century, traditional financial theory was challenged, and efficient market hypothesis could not explain market phenomena. Scholars tried to construct new theories, and behavioral finance became the focus. The noise trading model is its representative, which emphasizes that "unknown noise traders deviate from the true value of assets, resulting in abnormal prices of risky assets". China's stock market has been established for 33 years, and although it has improved, its effectiveness and price transmission are not as good as those of developed countries. On the one hand, the Chinese stock market has long deviated from price and value, and it is believed that "value investment is not applicable in China". On the other hand, Chinese investors, especially individuals, lack trading skills and trade at high risk, exacerbating market anomalies. There is "noise trading" in the Chinese market, which causes asset prices to deviate from their true value. In this environment, the signals transmitted by corporate announcements are affected, and the actual utility deviates from the expectation. Noise trading affects the signal transmission effect of corporate announcements in the Chinese stock market. Since the 1980s, behavioral finance has emerged, challenging traditional financial theory, and the noise trader model is representative. Black studied noise trading and believed that noise trading affected the market and the asset price deviated from the real value. Noise trading increases the trading volume and depth of the market, and weakens the market's ability to adapt to new information [1]. The academia has deeply studied the mechanism of noise trading. Trueman proved that uninformed fund managers still have a positive trading tendency to gain further investment from investors [2]. Cipriani and Bloomfield conducted experiments on noise trading and found that irrationality explained part of the market noise trading [3]. De Long building such as "efficient market" model, analytical "sophisticated investors and noise traders' investment behavior, stress diffusion effect, the noise traders behavior lead to further price deviating from the true value, bring the" noise trader risk " [4]. Early studies suggest that noise trading is negative, but subsequent studies suggest that its impact is complex. Greene and Smart argued that noise trading affects liquidity, and the results depend on a variety of factors [5]. In some cases, the increase of noise trading can reduce information asymmetry. It is found that the presence of uninformed traders can improve the trading efficiency under non-extreme conditions. However, Wang argue that speculative trading liquidity enhancement, noise lower price efficiency [6]. The impact of noise trading on the market seems to be non-simple linear.

The rise of the Chinese stock market until the end of the 20th century prompted scholars to explore the financial theory of "noise trading." Gan Yu posited that noise trading stems from information asymmetry, false information, and risk preference disparities [7]. Yang substantiated that noise trading in China far surpasses Western markets [8]. Developing a measurement method for noise trading, especially applicable to China, became a focal point. Su used the constituents of the SSE 50 Index to study the relationship between noise trading and market quality [9]. Yin used the Noise Trader Risk (NTR) to gauge noise trading, with other methods evolving from this foundation [10].

In recent years, scholars have delved into the logic behind capital market anomalies, particularly in the securities market, using the lens of behavioral finance. They moved beyond the confines of the "efficient market" and "rational agents," focusing on the impact of investor sentiment. Bu found that sentiment affects market volatility and prices [11]. Yao confirmed that noise trading leads to market volatility [12]. However, research on the relationship between noise trading and market signal transmission remains nascent. Li suggested that improving information quality reduces noise trading components [13]. Wang Mingtao studied information efficiency from the perspectives of trader rationality, information, and noise, proposing an information market contribution index [14].

Although the theory of noise trading has been gradually improved and the research is in-depth, the research on the impact of noise trading on corporate signal release is still insufficient. This study helps to clarify the relationship between noise trading and market performance.

2. Research Design

2.1. Selection of Sample Stocks and Matching Stocks

The measurement of noise trading degree in this study follows the theoretical model of Su [9]. After excluding financial companies and some companies with missing data, 13 A-share listed companies including Sinopec are selected as the sample stocks. The industries of the sample stocks cover many fields, such as public utilities, national defense technology and food and beverage.

After that, corresponding to the 13 sample stocks, the author takes the top ten companies in the same industry (including the sample companies) as the preliminary selection of matching stocks, and calculates the Y value of all the alternative matching stocks of sample stock J according to Formula (1):

\( {Y_{j,l}}={[\frac{p_{j}^{o}-p_{j,l}^{c}}{\frac{(p_{j}^{o}+p_{j,l}^{c})}{2}}]^{2}}+{[\frac{M_{j}^{o}-M_{j,l}^{c}}{\frac{(M_{j}^{o}+M_{j,l}^{c})}{2}}]^{2}}+{[\frac{BM_{j}^{o}-BM_{j,l}^{c}}{\frac{(BM_{j}^{o}+BM_{j,l}^{c})}{2}}]^{2}}+{[\frac{DA_{j}^{o}-DA_{j,l}^{c}}{\frac{(DA_{j}^{o}+DA_{j,l}^{c})}{2}}]^{2}} \) (1)

Where and are the closing prices of sample stock j and its 9 pre-allocated pairs L on the last trading day of the study period; \( p_{j}^{o}p_{j,l}^{c}M_{j}^{o} \) And the total market value of sample stock j and matching stock L on the same day respectively; \( M_{j,l}^{c}BM_{j}^{o} \) And is the book-to-market ratio (1/ price-to-book ratio) of sample stock j and matching stock L; \( BM_{j,l}^{c}DA_{j}^{o} \) And are the annual asset-liability ratio of sample stock j and matching stock L in the study period, respectively. \( DA_{j,l}^{c} \) Through the calculation of Formula (1), the 13 sample stocks j respectively obtain the 3 peers with the lowest value as the matching stocks. \( {Y_{j,l}} \) According to the above operation, the matching stocks obtained will have roughly the same systemic risk as sample stock j, so this study establishes a control sample and forms 13 matching portfolios.

2.2. Measurement of Noise Trading Degree Sequence

This paper extracts the opening price (the first transaction price) and closing price (the last transaction price) of sample stock j and its matching portfolio every 15 minutes in the study period to calculate the time-share rate of return:

\( r_{j,t}^{O}=10000×(ln{P_{j,t}^{O,C}}-ln{P_{j,t}^{O,O}}) \) (2)

\( r_{j,t}^{C}=10000×[\frac{\sum _{l=1}^{L}M_{j,t}^{C}×(ln{P_{j,l,t}^{C,C}}-ln{P_{j,l,t}^{C,O}})}{\sum _{l=1}^{L}M_{j,l}^{C}}] \) (3)

Where and are the logarithmic returns of sample stock j and the matching portfolio (including 2-3 matching stocks) in time t, respectively; \( r_{j,t}^{O}r_{j,t}^{C}P_{j,t}^{O,C} \) And are the closing price and opening price of sample stock j every 15 minutes during the study period; \( P_{j,t}^{O,O}P_{j,l,t}^{C,C} \) And are the closing price and opening price of matching stock L every 15 minutes during the study period; \( P_{j,l,t}^{C,O}M_{j,l}^{C} \) Represents the total market value of matching stock L. Equation (3) shows that the return of the matching portfolio is equal to the weighted average of the return of the matching shares, and the weight is the market value of the matching shares. (t = 1, 2, 3... 16)

The noise trading sequence of sample stock j is estimated by regression as follows:

\( r_{j,t}^{O}={α_{j}}+{β_{j}}r_{j,t}^{C}+{γ_{j}}r_{j,t+1}^{C}+{ε_{j,t}} \) (4)

Since the matching stock portfolio selected by Equation (1) and sample stock j have similar market price, enterprise market value scale, book-to-market ratio and asset-liability ratio, we can roughly consider that sample stock j and the matching stock portfolio have similar fundamental factors. As pairs contain more than one individual stocks, including noise trading factors of individual stocks in more than (3) the weighted average of the offset can be regarded as, after namely matching stock portfolio yield can be considered as a simple fundamentals control variables. Therefore, through the regression of (4), the influence of fundamental factors on the returns of sample stocks will be reflected through, while the influence of non-fundamental factors, namely the noise trading part of the market, will be reflected through the residual error. \( {α_{j}}+{β_{j}}r_{j,t}^{C}+{γ_{j}}r_{j,t+1}^{C}{ε_{j,t}} \) On this basis, this study uses the square of residual (that is, the return volatility orthogonal to the fundamentals) to measure the degree of noise trading:

\( {Noise_{j,t}}=\frac{\hat{ε}_{j,t}^{2}}{100} \) (5)

2.3. Regression Estimation of the Impact of Noise Trading on Corporate Signaling Utility

Starting from the perspective of feasibility and simplification in research, this paper selects two types of corporate announcements, namely "Profit distribution" and "mergers/acquisitions/significant contracts," from a pool of 13 sample stocks within the study period as research cases. The two categories of corporate announcement cases are denoted as follows:

Profit distribution : i1

Merger and Acquisition/significant contracts: i2

As corporate signals encompass both positive and negative signals, where negative signals lead to a negative abnormal return (AR), in order to maintain a consistent measure of abnormal returns, the absolute value of the abnormal return is employed for research purposes:

\( |AR_{j}^{i1}|,|AR_{j}^{i2}|, \)

\( AR_{j}^{i} \) Is the excess return of sample firms at time \( N=±2 \) t under class i announcement window. In this study, the announcement window is set as, that is,2 trading days before and after the announcement, and every 15 minutes of the 4 trading days is set as a time point t (t=1,2,3... 64),

This study proposes hypothesis 1: the noise trading of individual stocks affects the signaling utility of enterprises, that is, it is related to the deviation of excess returns.

The following model is used for regression analysis: \( AR_{j}^{i} \)

\( AR_{L,t}^{i}=\frac{\sum _{l=1}^{L}M_{j,t}^{C}×AR_{l,t}^{i}}{\sum _{l=1}^{L}M_{j,l}^{C}} \) (6)

\( |AR_{j,t}^{i}|=α_{j,t}^{i}+β_{j,t}^{i}|AR_{L,t}^{i}|+e_{j,t}^{i} \) (7)

\( AR_{L,t}^{i} \) For sampled stocks of matching window period in the event of excess returns and characterization in t based on the fundamentals of excess earnings, formula (6) shows that pairs of excess yields pairing is equal to the excess yields of the weighted average, weight for each matching stock market value; \( β_{j}^{i} \) Is the measurement multiple of the change of the excess return based on the announcement; The residual series of excess returns is obtained by Equation (6), and the residual value can be identified as the deviation degree of excess returns caused by factors other than announcement, enterprise fundamentals and market fundamentals. \( e_{j,t}^{i} \) If there is a relationship between the degree of noise trading and the residual value, we can infer the impact of noise trading on the level of announcement effectiveness.

In this study, the following models are used for stepwise regression analysis:

\( e_{j,t}^{2}={α_{j,0}}+\sum _{x=1}^{X}{φ_{j,x}}{Noise_{j,t-x}}+ε \) (8)

X=3, that is, the influence of noise from the current period to three lagged periods on the fluctuation of effectiveness level is investigated.

This study proposes hypothesis 2: there is a positive relationship between noise trading in the event window and the utility multiples of corporate announcements.

By summing up the noise trading degree data of the sample stocks on the same trading day, the noise trading degree of the enterprise on the D day is:

\( {Noise_{j,D}}=\sum _{t=1}^{16}{Noise_{j,t}} \) (9)

Next, the author integrates all the sample stock data under the same type of announcement event, including,, the shareholding ratio of institutional investors Inst, and the shareholding ratio of Top ten shareholders Top (subject to the data of the last financial announcement in the event window); \( β_{j}^{i}Noise_{j,D+k}^{i}{Noise_{j,D+K}} \) Is the noise trading degree at the time of i signal release and D, that is, the noise trading of 4 days, represented by n1, n2, n3 and n4. \( (D-2, D)∪(D, D+2) \)

This paper investigates the impact of noise trading on the utility multiple of enterprise announcement by examining the correlation between sequence and sequence. \( Noise_{j,D+k}^{i}β_{j}^{i} \) The correlation test of Spearman correlation coefficient method, Spearman correlation coefficient to non-parametric statistical method, the distribution of test statistic correlation form has nothing to do with the original data, is suitable for the quantitative variables or sequencing the correlation analysis between the two, two variables of rank size is used as the linear correlation analysis.

3. The Empirical Study

The study period was selected from December 31, 2018 to December 31, 2019.

3.1. Measurement of Noise Trading Degree Series

We computed a total of 3904 segments of noise trading intensity data for each of the 13 sample stock companies over 244 trading days at 15-minute intervals during the year 2019.

The stationary properties of the noise trading intensity time series were examined using the Augmented Dickey-Fuller (ADF) unit root test. The results indicate that for all 13 sets of noise trading intensity time series, at the 0th order of differencing, the significance p-value is 0.000***, demonstrating statistical significance at a high level. As a result, the null hypothesis is rejected, confirming that all sequences are stationary time series. The findings are illustrated using the example of Poly Development and Nari Technology Co.,Ltd in Tables 1 and 2, respectively.

Table 1: ADF Test Table of Noise Trading Series of Poly Development. | ||||

Variables | Difference order | t | P | |

noise | 0 | 13.301 | 0.000 * * * | |

1 | 20.557 | 0.000 * * * | ||

2 | 21.427 | 0.000 * * * | ||

Note: ***, ** and * represent the significance level of 1%, 5% and 10%, respectively. | ||||

Table 2: ADF Test Table of Noise Trading Series of Nari Technology Co.,Ltd. | ||||

Variables | Difference order | t | P | |

noise | 0 | 8.874 | 0.000 * * * | |

1 | 19.706 | 0.000 * * * | ||

2 | 21.345 | 0.000 * * * | ||

Note: ***, ** and * represent the significance level of 1%, 5% and 10%, respectively. | ||||

The noise trading time series of these 13 sample stocks exhibit evident characteristics of peakedness and right-skewness in their distributions. This confirms a higher probability of occurrence for low-intensity noise trading, representing a significant portion of the overall noise trading instances. However, simultaneously, instances of extremely high-intensity noise trading are also present. The observed distribution patterns of noise trading intensity data align closely with the dynamics of the Chinese stock market trading arena. Specifically, the coexistence of frequent low-intensity abnormal fluctuations and sporadic high-intensity abnormal fluctuations is consistent with the findings of Li Xuefeng [15].

3.2. Noise Trading Has an Amplifying Effect on the Utility of Enterprise Signal Transmission

To simplify the research, this study selects “profit distribution” and “merger and acquisition/significant contracts” announcements as the research cases of corporate signaling.

By searching all the corporate announcements of the above 13 sample stocks in 2019, a total of 17 cases of “profit distribution” and 29 cases of “merger and acquisition/significant contracts” were obtained.

Firstly, the 17 cases of “Profit distribution” are analyzed one by one: through Formula (7), the residual series of excess returns is obtained, and the stationarity test is carried out on the square term series of the residual value. This study adopts ADF test. \( e_{j,t}^{i} \) The test results reject the null hypothesis of unit root at the level of 1% except for “Haier Smart Home Co.,Ltd 5.30”, that is, the series is stationary at the level of 1%, and the square of the residual calculated by Formula (9) can be identified as stationary series. Table 3 China Northern Rare Earth (6.11) and Table 4 SAIC Motor Group (7.5) are taken as examples.

Table 3: China Northern Rare Earth 6.11 ADF Test Table. | |||||

Variables | Difference order | t | P | ||

res2 | 0 | 2.644 | 0.084 * | ||

1 | 7.431 | 0.000 * * * | |||

2 | 5.854 | 0.000 * * * | |||

Note: ***, ** and * represent the significance level of 1%, 5% and 10%, respectively. | |||||

Table 4: SAIC 7.5 ADF Test Table. | |||||

Variables | Difference order | t | P | ||

res | 0 | 5.208 | 0.000 * * * | ||

1 | 6.981 | 0.000 * * * | |||

2 | 6.36 | 0.000 * * * | |||

Note: ***, ** and * represent the significance level of 1%, 5% and 10%, respectively. | |||||

After verifying the stationarity of the sequence, an incremental linear regression model can be employed for empirical analysis. The regression equation is formulated as equation (8), and regression computations are performed using SPSSPRO.

The regression results indicate the following: Analysis of the F-test results reveals a significant p-value of 0.000***, demonstrating a high level of significance. Concerning the collinearity of variables, all Variance Inflation Factors (VIF) are below 10, indicating the absence of multicollinearity issues in the model construction. The specifics of the analysis are as follows:

Firstly, except for the cases of " Anhui Conch Cement Company Limited. 3.22", " Kweichow Moutai Co., Ltd. 6.24", and " China Petroleum & Chemical Corporation 9.9", the noise sequences for the current period and up to three lag periods in the remaining cases all exhibit at least one significant establishment in the respective estimation equations at the 5% or 1% level. The scenario where none of the variables are significant is absent. These three non-significant cases are distributed across different sample enterprises, lacking an aggregation within the same enterprise. They can be reasonably regarded as incidental discoveries that do not impact the conclusions drawn in this study. These results suggest that the noise sequence significantly influences the variable of "noise trading excess returns," further illustrating the impact of noise trading on the effectiveness of announcements, using " Nari Technology Co.,Ltd 7.17" and " Sany Heavy Industry Co., Ltd. 7.11" as examples.

Secondly, significant noise sequences in the regression primarily manifest in three scenarios: the noise sequence for the current period being individually significant, both the current period noise sequence and the lag 1 noise sequence being significant (in three cases), and both the current period noise sequence and the lag 2 noise sequence being significant (in two cases).

Thirdly, coefficients of the statistically significant noise variables are positive, with the current period noise sequence exhibiting relatively larger coefficient values. Even in cases where multiple lagged noise sequences are jointly significant, the coefficient of the current period noise sequence remains significantly greater than that of the lagged noise sequences. These regression results suggest that, from the perspective of high-frequency trading, the current period noise sequence plays a substantial amplifying role in transmitting signals related to profit allocation within enterprises.

Table 5: Nari Technology Co.,Ltd 7.17 Stepwise Regression Results. | ||||||

Methods | Backwards | |||||

Total variable situation | n, n(-1), n(-2), n(-3) | |||||

Keep variables | n | |||||

Drop variables | n(-1), n(-2), n(-3) | |||||

| Coefficient of | t | P | VIF | R² | F |

Beta | ||||||

Constant | 0 | 0.061 | 0.952 | - | 0.733 | F=74.035, P=0.000*** |

n | 0.856 | 8.604 | 0.000 * * * | 1 | ||

Table 6: Sany Heavy Industry Co., Ltd.7.11 Stepwise Regression Results. | ||||||

Methods | Backwards | |||||

Total variable situation | n, n(-1), n(-2), n(-3) | |||||

Keep variables | n, n(-2) | |||||

Discard variables | n(-1), n(-3) | |||||

| Coefficient | t | P | VIF | R² | F |

Beta | ||||||

Constant | 0 | 3.491 | 0.002 * * * | - | 0.839 | F=67.698, P=0.000*** |

n | 0.901 | 11.451 | 0.000 * * * | 1 | ||

n(-2) | 0.173 | 2.2 | 0.037 * * | 1 | ||

Subsequently, the same methodology was employed to investigate the 29 cases falling under the " Mergers&Acquisitions/ /significant contracts" category, yielding preliminary data results. It was found that apart from the cases of "Haier Smart Home Co., Ltd. 7.2" and "AECC Aviation POWER Co., Ltd. 8.5", the squared residual sequences for the remaining 27 cases passed the ADF test at the 1% significance level. After excluding these two non-stationary cases, the research proceeded to the next empirical stage.

The regression results reveal the following:

Firstly, among the studied cases, only in "AECC Aviation POWER Co., Ltd. 12.20", " LONGi Green Energy Technology Co., Ltd. 8.8", and " China Tourism Group Duty Free Corporation Limited 3.11", the noise sequences from the current period to three lags did not exhibit significance after the stepwise regression.

Secondly, the majority of regression outcomes align with the results of the "profit distribution" study. Specifically, three patterns emerged: isolated significance of the current period noise sequence (13 cases), significance of both the current period and lag 1 noise sequences (2 cases), and significance of both the current period and lag 2 noise sequences (4 cases). Additionally, two cases demonstrated significance for both the current period and lag 3 noise sequences. Furthermore, unique scenarios were observed: significance only in lagged periods (1 case), and significance in both the current period and lag 1 and 2 periods (1 case).

Thirdly, coefficients of the statistically significant current period noise variables were consistently positive. In cases of significance across multiple lagged noise sequences, the coefficients of the current period noise sequences were greater than those of the lagged sequences, or their significance levels were higher by an order of magnitude. This pattern indicates that the primary enhancement and amplification of signal transmission for "acquisitions/mergers/significant contracts" within enterprises stem from the current period noise sequences.

Table 7: LONGi Green Energy Technology Co., Ltd. 5.16 Stepwise Regression Results. | ||||||

Methods | Backwards | |||||

Total variable situation | n, n(-1), n(-2), n(-3) | |||||

Keep variables | n | |||||

Drop the variable | n(-1), n(-2), n(-3) | |||||

| Coefficient | t | P | VIF | R² | F |

Beta | ||||||

Constant | 0 | 1.229 | 0.23 | - | 0.921 | F=315.114, P=0.000*** |

n | 0.96 | 17.751 | 0.000 * * * | 1 | ||

Table 8: Shanghai Fosun Pharmaceutical (Group) Co., Ltd.7.9 Stepwise Regression Results. | ||||||

Methods | Backwards | |||||

Total variable situation | n, n(-1), n(-2), n(-3) | |||||

Keep variables | n, n(-2) | |||||

Discard variables | n(-1), n(-3) | |||||

| Coefficient | t | P | VIF | R² | F |

Beta | ||||||

Constant | 0 | 2.341 | 0.027 * * | - | 0.93 | F=173.4, P=0.000*** |

n | 0.965 | 18.598 | 0.000 * * * | 1.004 | ||

n(-2) | 0.112 | 2.167 | 0.040 * * | 1.004 | ||

In conclusion, this study posits that from the perspective of high-frequency trading, the current period noise trading plays a distinct and pronounced role in amplifying the utility of corporate announcements related to "profit distribution" and "acquisitions/mergers/significant contracts." This amplification generates "noise returns" different from the "excess returns" based on corporate announcement signals, thereby causing deviations in the anticipation of excess returns. Furthermore, it can be inferred that market participants tend to exhibit a bias towards overreacting to corporate announcement signals, leading to an additional magnification of the absolute value of excess returns attributable to the signal-induced effects in the current period. Consequently, stock prices are influenced by noise trading from irrational traders, causing unexpected deviations from expected intrinsic volatility following the release of corporate signals.

3.3. Robustness Test

In view of the small data series in the research case of a single enterprise announcement, in order to enhance the robustness and reliability of the empirical analysis results, the author chooses Ridge regression for robustness test.

In this study, SPSSPRO is used to conduct ridge regression test. The results show that the significant announcement research samples in the above empirical analysis are basically significant in Ridge regression, and the goodness of fit of the model is good. \( {R^{2}} \) The significance of coefficients in the regression results, especially the significance of current noise, is basically consistent with the above empirical analysis.

3.4. Enterprise Noise Trading on the First Day has a Positive Relationship with the Utility Multiple of Enterprise Announcement

In this study, the Spearman correlation coefficient method is used to test the correlation between the utility multiple of enterprise announcement, the shareholding ratio of institutional investors Inst and the shareholding ratio of Top ten shareholders. \( β_{j}^{i}Noise_{j,D+k}^{i} \)

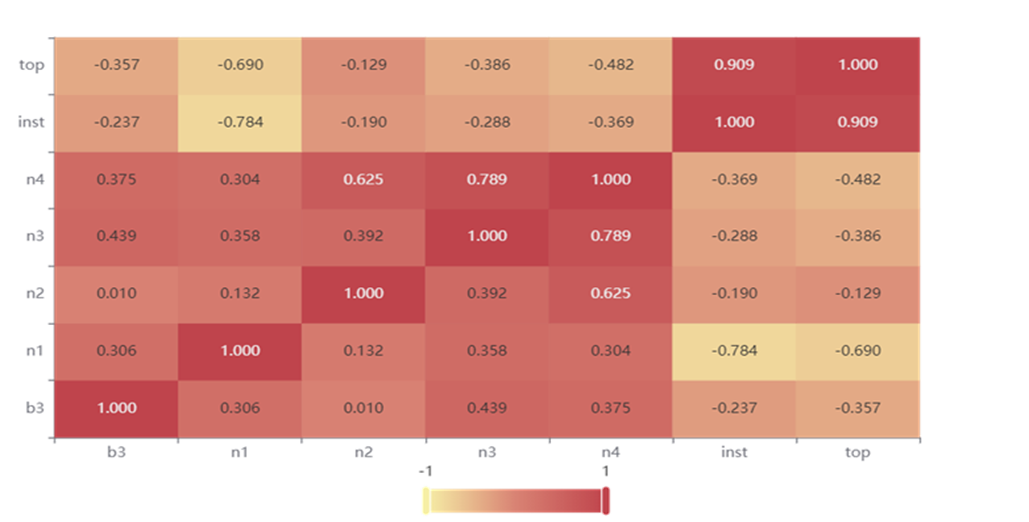

For the study of "profit distribution" enterprise announcements, the results are shown in Table 9 and Figure 3:

Figure 1: Profit distribution: correlation coefficient heat map.

The results show that n3, the degree of all-day noise trading on the third day of the event window, that is, the first trading day after the announcement, has a significant positive correlation with the utility multiple of enterprise announcement at the level of 10%. Although it is not significant at the level of 5%, its coefficient is an order of magnitude higher than that of n1/n2/n4. \( β_{j}^{i} \) Considering the small number of samples in this study, we can accept the hypothesis that the noise trading on the first trading day after the announcement will affect the utility multiple of the enterprise announcement.

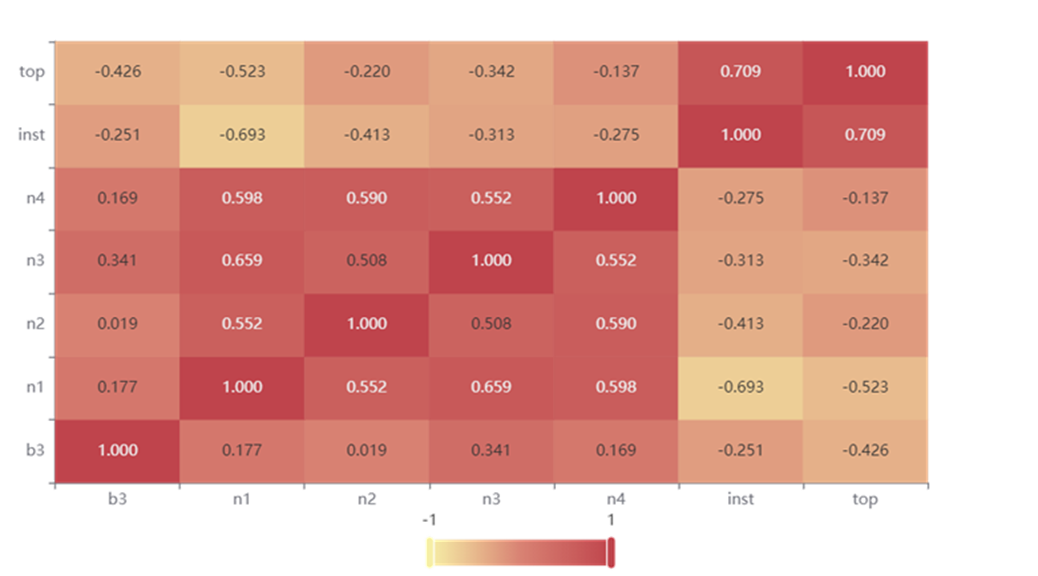

For the research on "merger and acquisition/significant contracts" enterprise announcements, the results are shown in Table 10 and Figure 4:

Figure 2: M&A/significant contractss: thermal table of correlation coefficients.

From the results found that the same as the "profit distribution", n3 throughout the degree of noise trading and corporate announcements utility ratio has significant positive correlation in the level of 10%, also found that the top, the top ten shareholders ownership significantly positively related to under 5% level. \( β_{j}^{i} \) It can be considered that the shareholding ratio of the top ten shareholders also has a relevant impact on the utility multiple of the enterprise announcement. The following speculation is as follows: the stock with a high shareholding ratio of the top ten shareholders has a lower investor dispersion, so the degree of noise trading is suppressed, and thus has a different impact on the utility of the enterprise announcement compared with other enterprises; \( β_{j}^{i} \) The stocks with high shareholding ratio of the top ten shareholders are more likely to be affected by insider information trading, so the utility of corporate announcement is affected.

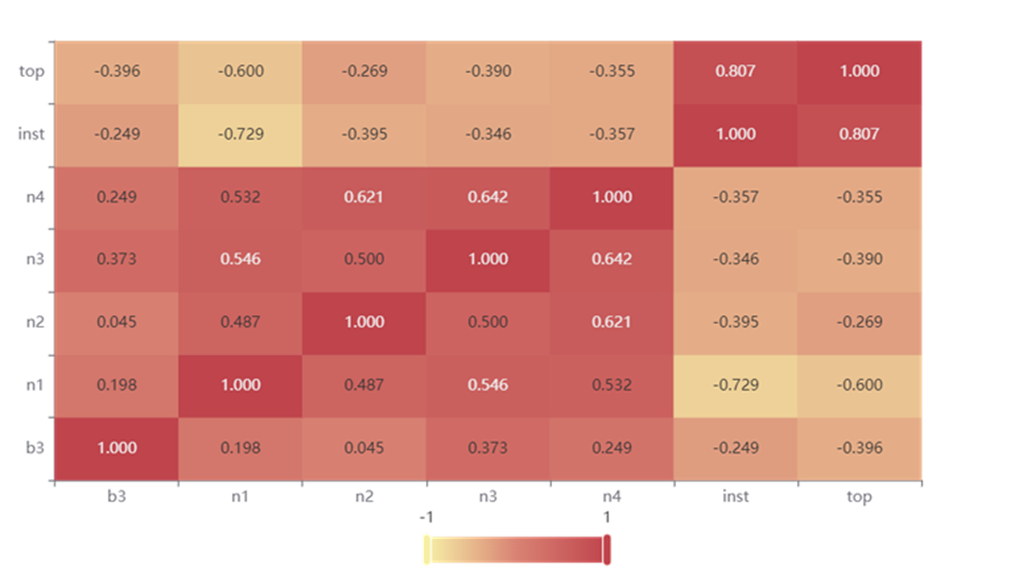

We combined all the data of "profit distribution" with all the data of "mergers and acquisitions/significant contractss" to conduct correlation test, and the results are shown in Table 11 and Figure 5:

Figure 3: Merger: thermal table of correlation coefficients.

It can be found that when the amount of data increases, the two variables of n3 and top have a significant positive correlation with the utility multiple of enterprise announcement at the level of 1%, which can basically identify the first transaction after the release of enterprise announcement signal \( β_{j}^{i} \)

The daily noise transaction will affect the utility multiple of enterprise announcement; \( β_{j}^{i} \) The shareholding ratio of the top ten shareholders also has a positive impact on the utility multiple of corporate announcements.

4. Conclusion

This paper adopts the existing measurement method of noise trading combined with the innovative model construction of the relationship between noise trading and enterprise signal transmission utility, initially selects the components of SSE 50 index as the research enterprise object, and finally takes 13 of them in 2019, a total of 43 enterprise announcement cases as the research case samples. Based on this, the empirical research of this paper finds that:

First, according to the results, high-frequency trading can basically confirmed that the noise of the current fair to "profit distribution" and "merger and acquisition/significant contracts" the effectiveness of the two companies announced significant enhancement and amplification effect, resulting in a so-called "noise" returns, and this is based on enterprise announcement signals "excess returns" is different, Which makes the expected excess return after the announcement deviate from the expected excess return;

Secondly, there is a positive correlation between the noise trading on the first trading day after the announcement and the utility multiple of the announcement.

References

[1]. Black, F. (1986). Noise. The journal of finance, 41(3), 528-543.

[2]. Trueman, B. (1988). A theory of noise trading in securities markets. The Journal of Finance, 43(1), 83-95.

[3]. Cipriani, M., & Guarino, A. (2005). Noise trading in a laboratory financial market: a maximum likelihood approach. Journal of the European Economic Association, 3(2-3), 315-321.

[4]. De Long, J. B., Shleifer, A., Summers, L. H., & Waldmann, R. J. (1990). Noise trader risk in financial markets. Journal of political Economy, 98(4), 703-738.

[5]. Greene, J., & Smart, S. (1999). Liquidity provision and noise trading: Evidence from the “investment dartboard” column. The Journal of Finance, 54(5), 1885-1899.

[6]. Wang, F. A. (2010). Informed arbitrage with speculative noise trading. Journal of Banking & Finance, 34(2), 304-313.

[7]. Gan, Y., Wu, J. & Xie, C. (1999). The Formation Mechanism, Consequences and Governance of financial market noise. Financial theory and practice, (5), 33-35.

[8]. Yang S G. (2002). Behavioral Finance, noise trading and the behavior characteristics of Chinese securities market entities. Economic Review, (4), 83-85.

[9]. Su Dongwei. (2008). Noise trading and market quality. Economic Research (09),82-95.

[10]. Yin H. (2010). The empirical study of noise trading affect stock market efficiency. Chinese journal of management sciences, newsroom. (eds.), the 12th China management science academic essays (pp. 337-342)..

[11]. Bu Hui, Xie Zheng, Li Jiahong & Wu Junjie.(2018). The impact of investor sentiment on Stock market based on Stock review. Journal of Management Science (04),86-101.

[12]. Yao Yuan, Zhong Qi, & Yao Beibei. (2019). A study on the relationship between investor sentiment and stock market volatility: An analysis of the relationship between noise trading and irrational stock market price volatility. Price Theory and Practice, (2), 92-95.

[13]. Li Zhanqi. (2021). Sensitivity analysis of noise traders to corporate information quality. Journal of Finance and Accounting, 869(8), 77-81.

[14]. WANG Mingtao & Sun Ximing... Trader limited rationality, information noise relationship and financial market information efficiency. Operation research and management.

[15]. Li Xuefeng, Wang Zhaoyu, & Li Jiaming. (2013). Noise trading and market progressive efficiency. Economics (Quarterly Journal), (2), 913-934.

Cite this article

Lan,T. (2023). Unexplored Market Risks? The Impact of Noise Trading on the Transmission of Corporate Signal Utility — A Study Based on the Chinese Market. Advances in Economics, Management and Political Sciences,53,139-150.

Data availability

The datasets used and/or analyzed during the current study will be available from the authors upon reasonable request.

Disclaimer/Publisher's Note

The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of EWA Publishing and/or the editor(s). EWA Publishing and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content.

About volume

Volume title: Proceedings of the 2nd International Conference on Financial Technology and Business Analysis

© 2024 by the author(s). Licensee EWA Publishing, Oxford, UK. This article is an open access article distributed under the terms and

conditions of the Creative Commons Attribution (CC BY) license. Authors who

publish this series agree to the following terms:

1. Authors retain copyright and grant the series right of first publication with the work simultaneously licensed under a Creative Commons

Attribution License that allows others to share the work with an acknowledgment of the work's authorship and initial publication in this

series.

2. Authors are able to enter into separate, additional contractual arrangements for the non-exclusive distribution of the series's published

version of the work (e.g., post it to an institutional repository or publish it in a book), with an acknowledgment of its initial

publication in this series.

3. Authors are permitted and encouraged to post their work online (e.g., in institutional repositories or on their website) prior to and

during the submission process, as it can lead to productive exchanges, as well as earlier and greater citation of published work (See

Open access policy for details).

References

[1]. Black, F. (1986). Noise. The journal of finance, 41(3), 528-543.

[2]. Trueman, B. (1988). A theory of noise trading in securities markets. The Journal of Finance, 43(1), 83-95.

[3]. Cipriani, M., & Guarino, A. (2005). Noise trading in a laboratory financial market: a maximum likelihood approach. Journal of the European Economic Association, 3(2-3), 315-321.

[4]. De Long, J. B., Shleifer, A., Summers, L. H., & Waldmann, R. J. (1990). Noise trader risk in financial markets. Journal of political Economy, 98(4), 703-738.

[5]. Greene, J., & Smart, S. (1999). Liquidity provision and noise trading: Evidence from the “investment dartboard” column. The Journal of Finance, 54(5), 1885-1899.

[6]. Wang, F. A. (2010). Informed arbitrage with speculative noise trading. Journal of Banking & Finance, 34(2), 304-313.

[7]. Gan, Y., Wu, J. & Xie, C. (1999). The Formation Mechanism, Consequences and Governance of financial market noise. Financial theory and practice, (5), 33-35.

[8]. Yang S G. (2002). Behavioral Finance, noise trading and the behavior characteristics of Chinese securities market entities. Economic Review, (4), 83-85.

[9]. Su Dongwei. (2008). Noise trading and market quality. Economic Research (09),82-95.

[10]. Yin H. (2010). The empirical study of noise trading affect stock market efficiency. Chinese journal of management sciences, newsroom. (eds.), the 12th China management science academic essays (pp. 337-342)..

[11]. Bu Hui, Xie Zheng, Li Jiahong & Wu Junjie.(2018). The impact of investor sentiment on Stock market based on Stock review. Journal of Management Science (04),86-101.

[12]. Yao Yuan, Zhong Qi, & Yao Beibei. (2019). A study on the relationship between investor sentiment and stock market volatility: An analysis of the relationship between noise trading and irrational stock market price volatility. Price Theory and Practice, (2), 92-95.

[13]. Li Zhanqi. (2021). Sensitivity analysis of noise traders to corporate information quality. Journal of Finance and Accounting, 869(8), 77-81.

[14]. WANG Mingtao & Sun Ximing... Trader limited rationality, information noise relationship and financial market information efficiency. Operation research and management.

[15]. Li Xuefeng, Wang Zhaoyu, & Li Jiaming. (2013). Noise trading and market progressive efficiency. Economics (Quarterly Journal), (2), 913-934.