1. Introduction

Decentralized finance, a crypto-asset-based financial network without the need for a central intermediary, is one of the prominent developments in the financial innovation that has evolved fast in recent years. Due to their effectiveness, accessibility, and potential for innovation, inclusivity, and openness, decentralized financial systems have garnered interest. The traditional financial system has been disrupted by cryptocurrencies, or virtual currency payment systems, which have developed in recent years to become a crucial way of international payments and currency exchange. However, it might be challenging for investors to adopt the best trading and investment strategies to maximize their gains due to the unpredictability of cryptocurrency price swings. Significant risks associated with cryptocurrency investments, such as exchange rate risk, operational risk, and security risk, have raised questions among investors about how to balance risk and return in this new asset class. In order to attain the ideal risk-return balance, diversification is employed to lower total risk, according to Modern Portfolio Theory (MPT), an investing approach that has been widely adopted in conventional asset markets [1]. As a result, although some investors would want to utilize the MPT theory to guide their investment selections, the theory may or may not be appropriate for new financial investment options. By reviewing the findings of earlier research on the analysis of the prospects for application in this developing field, as well as on the future research trends of the portfolio theory, the objective of this essay is to further investigate whether MPT can be successfully applied to financial assets such as cryptocurrencies. Using portfolio theory, both academics and investors may make better investment judgements.

The following is how the essay is set up: The methods utilized and the literature analysis are both presented in Section 2. Future study areas are emphasized in Section 3, which also analyzes the literature on the use of current portfolio theory with regard to novel financial assets like cryptocurrencies. The conclusions of this review are reported in Section 4 as a last step.

2. Methods and Samples

2.1. Methodology

This study is based on the guidelines of Eigelshoven for conducting a systematic literature review (SLR) in the field of modern portfolio theory and cryptocurrencies [2]. The systematic literature review methodology consists of three phases, which are identification, screening and analysis. By conducting the review with a representative sample of literature in the fields of cryptocurrencies, modern portfolios, and finance, the review focuses on identifying research results, theories, and applications. SLR integrated and systematized prior material, highlighted key concerns from a neutral standpoint, and organized it using a conceptual method. The review’s findings are applicable to specialists in the subject, generalists, and practitioners who are curious about cryptocurrencies but lack in-depth technical expertise.

2.2. Sample

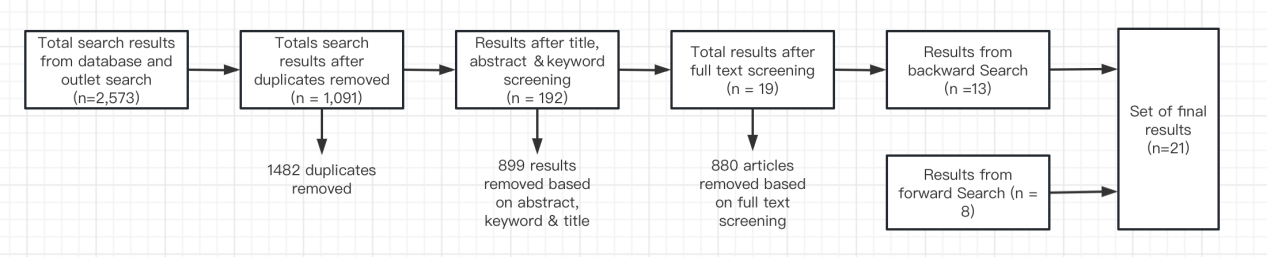

The process to select the candidate papers can be find in Figure 1. A keyword-centered approach was used to comprehensively cover the existing literature on the use of modern portfolios in novel financial assets. The following broad search strings were developed:

(Cryptocurrency OR modern portfolio OR block chain OR bitcoin OR financial assets OR assets) AND (Investment Portfolio Effectiveness OR modern financial market OR Opportunity)

The selection of keywords was based on an initial brief screening of important modern portfolio and cryptocurrency literature, followed by further refinement of the selection for the identification and search stages. In addition, multiple synonyms were used to ensure robust searches. In order to achieve representative coverage of relevant literature, according to Eigelshoven in order to assure the inclusion of pertinent sources that might not be academically indexed, a hybrid method was employed for the sources of SLR [2]. This modified the technique such that the literature is covered by both medium-specific and numerous academic databases across a wide variety of publication media. The selection of databases was conducted through Andrianto and Diputrap and the final database selection included three academic databases [3]. Google scholar and jstor databases were included for their focus on economics and social sciences, and Web of Science was included for its broad coverage of various research areas.

The second phase consists of screening the identified literature by applying search strings to selected channels and databases. The search was conducted between 2018 and 2023. A total of 2,753 search results were generated by the initial keyword search using preset search phrases and outlets. 1,091 search results were left after removing irrelevant results like editorials, book reviews, news, and duplicates. A first review of titles, abstracts, and author- or database-defined keywords was carried out to see if the clicked results meet the parameters of the research. Based on the inclusive criteria listed below, 192 results were determined to fulfil the screening criterion.

Figure 1: Flow of the search process.

The following filters were set to First, eligible publications had to focus in-depth on the topic of modern portfolios and/or cryptocurrencies; second, they had to be written in English. Third, publications without a complete list of references were excluded. The publication period was from 2018 to 2023. If a publication met all three criteria, it was accepted as the second final result and added to the dataset for further analysis. A forward and backward search was carried out using Google Scholar to make sure that the field had been thoroughly screened. The same eligibility procedures and standards that applied to the keyword search also applied to the selection of extra final results obtained via this search. During the forward and backward searches, important ideas, citations, and cross-references frequently appeared, indicating that the review had attained the necessary saturation [4].

Finally, 13 final results were extracted from the literature basket. In addition, 8 additional final results were identified during the screening of 624 references and 322 citations. Overall, SLR resulted in 21 unique final results. The final results were then analyzed from a concept-centric perspective to extract the use of modern portfolio theory in cryptocurrencies.

3. Discussion and Analysis

This literature review discusses the application of modern portfolio theory to cryptocurrencies. In this literature series, we identify the significant differences that support cryptocurrency markets from traditional asset markets, including high price volatility, uncertain trading, and lack of regulation. These characteristics complicate the application of Modern Portfolio Theory (MPT), but with proper asset allocation, investors can still achieve a balance of risk and return [3, 5]. A contemporary portfolio is a collection of securities and other assets that are managed together in order to accomplish a certain goal. A portfolio can contain any asset, including gold, real estate, stocks, and options. According to Saksonova and Kuzmina-Merlino, the process of creating and managing a portfolio entail carrying out the following steps: establishing goals and choosing the best portfolio type, analyzing the investment’s target, creating the portfolio, choosing and putting into practice portfolio management strategies, and assessing the portfolio’s effectiveness [6]. Evidence demonstrates that while creating an investment portfolio, the fundamental guidelines of maximizing profitability and reducing risk should be followed Yen and Cheng [7]. Therefore, the investing methods and predetermined objectives should be followed by the portfolio. A growth portfolio, for instance, comprises of assets that enable the realization of a high growth rate of invested capital and is characterized by considerable risk [8]. This depends on the investment objectives and the trade-off between profitability and risk. Since cryptocurrencies are hazardous investments with high potential for appreciation, the majority of them are probably part of growth portfolios.

Secondly, there is evidence that portfolios should be sufficiently diversified and not depend on one or two economic factors [8, 9]. The investor must spread his funds among several assets in order to generate a profit and avoid losing money during the investment process. The basic goal of diversification is to lessen the danger of a catastrophic loss of money as well as to generate acceptable and predictable returns. Investors first aim to diversify across several asset classes [10-12]. (e.g., stocks, bonds, cryptocurrencies, commodities, financial derivatives, etc.)

MPT emphasizes the importance of diversification for risk reduction and the fact that the introduction of cryptocurrency introduction of portfolios to increase diversity has also been discussed in the cryptocurrency literature, and With Bitcoin playing a significant role in return and volatility spillovers among the main cryptocurrencies, discover evidence of growing dependency across cryptocurrencies and, as a result, contagion risk [13]. In theory, investors’ ability to diversify their portfolios may be constrained if they solely invest in cryptocurrencies. The exchange rates of cryptocurrencies, on the other hand, may be adversely connected when individuals transfer money between them if there is fierce rivalry among them. Portfolios of cryptocurrencies ought to most likely be a component of an investor’s overall investment plan. In this case, even if the connection is substantial, a portfolio of cryptocurrencies would outperform a single coin, at least until one cryptocurrency achieves enough market domination. Therefore, the primary goal of a portfolio investment is to gain properties from a variety of investment assets that are not possible to receive from a single asset. To attain the ideal balance of risk and return, a portfolio has to be built. When the assets in the portfolio are sufficiently uncorrelated, risk is often minimized. That is, diversification should result in the portfolio’s overall worth not declining much when the value of its constituent assets diminishes. Thus, investing in a diversified portfolio might help investors reduce their exposure to risks associated with particular cryptocurrencies, like as hacking attempts, the failure of significant exchanges, etc. Overall, in order to select the greatest portfolio, one must optimize it. Investors may identify the appropriate percentage of assets to deploy to various cryptocurrencies in order to reap the most rewards by employing portfolio optimization strategies.

4. Conclusion

In conclusion of the discussion and analysis, modern portfolio theory has some applicability in the cryptocurrency market. The principles of diversification, risk-return trade-off and portfolio optimization remain applicable to cryptocurrency investments. However, investors must carefully consider market uncertainties and risks and pay close attention to market dynamics. MPT can be a useful tool to help investors construct effective portfolios in the cryptocurrency market, but risk management is still crucial. Cryptocurrency, as an emerging field, brings new challenges and opportunities for portfolio theory and practice. A variety of difficulties and restrictions arise when Modern Portfolio Theory (MPT) and cryptocurrency are combined.

Here are some restrictions and ideas for more study: 1) A lack of historical data: To calculate asset returns, volatility, and correlation, MPT needs previous data. Since cryptocurrencies are still relatively new, there may not be enough historical data to calculate these values with precision. Future studies should concentrate on approaches to successfully integrate the limited historical data or investigate alternate data sources like sentiment analysis and on-chain indicators. 2) Lack of Market Integration: Compared to traditional financial markets, cryptocurrency markets are more decentralized and less regulated. The presence of risk-free assets and other MPT presumptions may be affected by this lack of integration. Taking into consideration variations in market structure, research might examine how MPT can be used to portfolios that contain both conventional assets and cryptocurrencies. 3) Extreme price volatility and susceptibility to tail events are two characteristics that make cryptocurrencies popular. The focus MPT places on volatility as a risk indicator may not adequately account for the special risk features of cryptocurrency. To better adapt to severe occurrences, future research may concentrate on adding tail risk factors or creating modified risk metrics. 4) Behavioral Factors: More so than traditional markets, cryptocurrency prices are affected by behavioral factors, news emotion, and social media trends. Bitcoin returns, real volatility, surges, and trade volume may all be predicted by negative sentiment. The integration of behavioral finance theories into portfolio optimization models to account for market sentiment may be the subject of future study.

Overall, I may anticipate further study and practice in the future to improve methods and techniques for investing in cryptocurrencies. Transparency, morality, and strict risk management will always be essential success components.

References

[1]. Letho, L., Chelwa, G., & Alhassan, A. L. (2022). Cryptocurrencies and portfolio diversification in an emerging market. China Finance Review International, 12(1), 20-50.

[2]. Almeida, J., & Gonçalves, T. C. (2022). Portfolio diversification, hedge and safe-haven properties in cryptocurrency investments and financial economics: A systematic literature review. Journal of Risk and Financial Management, 16(1), 3.

[3]. Andrianto, Y., & Diputra, Y. (2017). The effect of cryptocurrency on investment portfolio effectiveness. Journal of finance and accounting, 5(6), 229-238.

[4]. Leedy, P. D. (2019). Practical Research: Planning and Design, (12 ed.). NJ, USA: Pearson Education

[5]. Pham, H., Nguyen, B., & Bui, M. (2021). Modern portfolio theory in the age of cryptocurrency. Australian Journal of Applied Finance (formerly JASSA), (5), 41-48.

[6]. Saksonova, S., & Kuzmina-Merlino, I. (2019). Cryptocurrency as an investment instrument in a modern financial market. Вестник Санкт-Петербургского университета. Экономика, 35(2), 269-282.

[7]. Yen, K. C., & Cheng, H. P. (2021). Economic policy uncertainty and cryptocurrency volatility. Finance Research Letters, 38, 101428.

[8]. Mazanec, J. (2021). Portfolio optimalization on digital currency market. Journal of Risk and Financial Management, 14(4), 160.

[9]. Charfeddine, L., Benlagha, N., & Maouchi, Y. (2020). Investigating the dynamic relationship between cryptocurrencies and conventional assets: Implications for financial investors. Economic Modelling, 85, 198-217.

[10]. Kumah, S. P., & Odei-Mensah, J. (2021). Are Cryptocurrencies and African stock markets integrated?. The Quarterly Review of Economics and Finance, 81, 330-341.

[11]. Jang, J., & Seong, N. (2023). Deep reinforcement learning for stock portfolio optimization by connecting with modern portfolio theory. Expert Systems with Applications, 218, 119556.

[12]. González, M. D. L. O., Jareño, F., & Skinner, F. S. (2021). Asymmetric interdependencies between large capital cryptocurrency and Gold returns during the COVID-19 pandemic crisis. International Review of Financial Analysis, 76, 101773.

[13]. Platanakis, E., & Urquhart, A. (2020). Should investors include bitcoin in their portfolios? A portfolio theory approach. The British accounting review, 52(4), 100837.

Cite this article

Chen,S. (2023). The Implementation of Modern Portfolio Theory on New Financial Assets: Evidence from Cryptocurrencies. Advances in Economics, Management and Political Sciences,56,209-213.

Data availability

The datasets used and/or analyzed during the current study will be available from the authors upon reasonable request.

Disclaimer/Publisher's Note

The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of EWA Publishing and/or the editor(s). EWA Publishing and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content.

About volume

Volume title: Proceedings of the 2nd International Conference on Financial Technology and Business Analysis

© 2024 by the author(s). Licensee EWA Publishing, Oxford, UK. This article is an open access article distributed under the terms and

conditions of the Creative Commons Attribution (CC BY) license. Authors who

publish this series agree to the following terms:

1. Authors retain copyright and grant the series right of first publication with the work simultaneously licensed under a Creative Commons

Attribution License that allows others to share the work with an acknowledgment of the work's authorship and initial publication in this

series.

2. Authors are able to enter into separate, additional contractual arrangements for the non-exclusive distribution of the series's published

version of the work (e.g., post it to an institutional repository or publish it in a book), with an acknowledgment of its initial

publication in this series.

3. Authors are permitted and encouraged to post their work online (e.g., in institutional repositories or on their website) prior to and

during the submission process, as it can lead to productive exchanges, as well as earlier and greater citation of published work (See

Open access policy for details).

References

[1]. Letho, L., Chelwa, G., & Alhassan, A. L. (2022). Cryptocurrencies and portfolio diversification in an emerging market. China Finance Review International, 12(1), 20-50.

[2]. Almeida, J., & Gonçalves, T. C. (2022). Portfolio diversification, hedge and safe-haven properties in cryptocurrency investments and financial economics: A systematic literature review. Journal of Risk and Financial Management, 16(1), 3.

[3]. Andrianto, Y., & Diputra, Y. (2017). The effect of cryptocurrency on investment portfolio effectiveness. Journal of finance and accounting, 5(6), 229-238.

[4]. Leedy, P. D. (2019). Practical Research: Planning and Design, (12 ed.). NJ, USA: Pearson Education

[5]. Pham, H., Nguyen, B., & Bui, M. (2021). Modern portfolio theory in the age of cryptocurrency. Australian Journal of Applied Finance (formerly JASSA), (5), 41-48.

[6]. Saksonova, S., & Kuzmina-Merlino, I. (2019). Cryptocurrency as an investment instrument in a modern financial market. Вестник Санкт-Петербургского университета. Экономика, 35(2), 269-282.

[7]. Yen, K. C., & Cheng, H. P. (2021). Economic policy uncertainty and cryptocurrency volatility. Finance Research Letters, 38, 101428.

[8]. Mazanec, J. (2021). Portfolio optimalization on digital currency market. Journal of Risk and Financial Management, 14(4), 160.

[9]. Charfeddine, L., Benlagha, N., & Maouchi, Y. (2020). Investigating the dynamic relationship between cryptocurrencies and conventional assets: Implications for financial investors. Economic Modelling, 85, 198-217.

[10]. Kumah, S. P., & Odei-Mensah, J. (2021). Are Cryptocurrencies and African stock markets integrated?. The Quarterly Review of Economics and Finance, 81, 330-341.

[11]. Jang, J., & Seong, N. (2023). Deep reinforcement learning for stock portfolio optimization by connecting with modern portfolio theory. Expert Systems with Applications, 218, 119556.

[12]. González, M. D. L. O., Jareño, F., & Skinner, F. S. (2021). Asymmetric interdependencies between large capital cryptocurrency and Gold returns during the COVID-19 pandemic crisis. International Review of Financial Analysis, 76, 101773.

[13]. Platanakis, E., & Urquhart, A. (2020). Should investors include bitcoin in their portfolios? A portfolio theory approach. The British accounting review, 52(4), 100837.