1. Introduction

At present, China is in a stage of rapid economic development, the demand for further optimisation and improvement of the capital market is becoming stronger and stronger, and it has gradually become the wish of the majority of investors for the relevant authorities to improve the relevant system of information disclosure of listed companies, and for companies to disclose information in strict accordance with the standards and consciously accept the supervision. Therefore, true, accurate, complete, timely and fair disclosure of information should be the basic requirements to be met by major listed companies during their operation. However, in practice, very few companies are really able to fully implement these requirements. At present, most of the studies on the consequences of listed companies’ information disclosure violations involve the negative impact of information disclosure violations on corporate development. Based on past studies, this paper takes Guangdong Bobaolon Co., Ltd. as the research object and analyses its information disclosure violations from 2021 to the present through short-term time study method and other methods, focusing on the changes in share price, financial indicators, follow-up information, and analysts’ evaluations of the listed companies after information disclosure violations. The main focus is on the stock price, financial indexes, quality of subsequent information disclosure and analysts’ evaluation of the changes in the value of the listed company’s information disclosure violations, in order to explore the consequences of the listed company’s information disclosure violations on the enterprise itself, in order to explore the necessity of disclosure in accordance with the law and the end of the paper puts forward the relevant methods of coping with information disclosure violations.

2. Literature Review

This paper examines the significance of information disclosure for listed companies with reference to many literatures. Bijalwan and Madan argue that the degree of information disclosure and corporate transparency of listed companies is crucial to the overall governance of the company [1]. Huang and Wu prove through practice that the improvement of information transparency is conducive to the improvement of the quality of listed companies’ surplus and correctly guides the effective allocation of capital in the securities market [2]. Luan and Tien believe that corporate disclosure will have a certain impact on investor behaviour [3]. Albu and Flyverbom believe that qualified disclosure of information and moderate transparency of the company are conducive to the protection of the rights and interests of the relevant shareholders and can help the company to improve its performance [4].

Although it is very important for listed companies to make qualified disclosure, in fact, there are many disclosure problems at present. This paper also compiles some of the causal factors of disclosure violations. By studying the Luckin Coffee’s Incident, Han et al. found that the main triggers of the crisis of Chinese stocks are financial fraud, corporate governance and business ethics issues, and disclosure violations are also related to these three triggers [5]. According to Xiao et al, China’s capital market is still relatively young, there is still the problem of imperfect transfer mechanism, retail investors account for the largest proportion of investors, and relatively large-scale, organised institutional investors are fewer; at the same time, China’s listed company disclosure regulatory system is still relatively immature, dominated by the state organs, and the social level of participation is relatively small; thirdly, asymmetric information always exists, and some companies are driven by interests to exploit the bull’s-eye and disturb the rules, which makes investors unable to obtain and analyse information in a timely and effective manner, and also affects their judgement and behaviours afterwards [6].

Xu et al. found that in some industries compared with normal disclosure of listed companies, disclosure violations of the company showed lower net profit margin of total assets, net asset growth rate and so on [7]. It can be seen that disclosure violations can have a greater impact on the development of the company. In order to improve the information disclosure system, many articles have also mentioned measures to deal with information disclosure violation events. This article draws on the viewpoint of Hou, and since information disclosure does not have special legislation in China, and standards vary in countries around the world, the nature of information disclosure is recognised as a low-intensity administrative regulatory initiative only from the theoretical point of view [8]. In order to deal with the situation of imperfect or inaccurate information disclosure of listed companies, listed companies should pay attention to their own problems and improve the quality of information disclosure from the perspectives of “truthfulness, timeliness, and completeness”; at the same time, listed companies should also choose suitable agents to ensure the stable operation of the company, and they should actively cooperate with the supervision of the Securities and Futures Commission (SFC).In addition, listed companies should choose suitable agents to ensure stable operation of the company, and should actively cooperate with the supervision of the Securities and Futures Commission (SFC) to regulate their own behaviours in the limited regulatory system. Liu also mentioned that the lack of uniform standards for the content of information disclosure of each listed company, the existence of certain ambiguity and evasiveness in the information disclosed by listed companies, the lack of clarity in the identification of the responsible body for the disclosure of internal control information and the lack of practical experience in research and practice of disclosure of relevant stakes, leading to the disclosure of information mostly in the form of distortion, are the main problems, which should be dealt with to gradually improve the overall environment [9]. In addition, Xu et al. found that digital transformation is conducive to improving the quality of information disclosure of listed companies in China [10].

According to the previous literature review, it can be found that qualified disclosure has a positive effect on the future development of enterprises, while disclosure violations can lead to the emergence of the enterprise’s own crisis. At the same time, there is a large amount of previous literature analysing the reasons for the occurrence of listed companies’ disclosure violations and the ways to cope with them. In this paper, we will explore the consequences of disclosure violations through a case study to prove the possible negative impacts on enterprises, and based on this and the previous literature, we will propose methods and measures to deal with disclosure violations.

3. Background of Information Disclosure by Listed Companies

On 1 March 2020, the new Securities Law came into effect, which presents information disclosure in the form of an important dedicated chapter.

This article is based on the relevant content of the new Securities Law and the relevant articles in Securities Daily.

Firstly, the new Securities Law clearly stipulates the obligatory subjects of information disclosure, and more stakeholders are linked to information disclosure, which is conducive to guaranteeing all-round fine information disclosure. At the same time, the bill clearly delineates the scope of information disclosure obligations of directors, supervisors, controlling shareholders and de facto controllers, which is more conducive to safeguarding the authenticity of information disclosure.

Secondly, the principles and requirements of information disclosure have been further refined. Truly qualified information disclosure should not vary from person to person, but rather enable all stakeholders to have a clear understanding of the company’s operation at a certain period of time. The addition of simultaneous disclosure requirements at home and abroad further ensures the accuracy, timeliness and fairness of information disclosure.

Third, the definition of “material events” has been broadened, and for bond-listed companies, disclosure should also be made of significant changes in the company’s shareholding structure or production and operating conditions, as well as changes in bond information ratings.

Fourth, with the encouragement of the relevant agencies, major listed companies should proactively disclose information and comply with the relevant laws, or face harsher penalties.

4. Overview of Disclosure Breaches by Listed Companies

4.1. Introduction of Guangdong Bobaolon Co., Ltd.

Guangdong Bobaolon Co.,Ltd. was founded in 2006, through the unique business model of providing customers with one-stop services such as fabric research and development, organisation and production, quality control, etc., successfully transformed and upgraded, and developed into a domestic listed enterprise mainly focusing on apparel design, and landed on the Shenzhen Stock Exchange in 2015, the stock abbreviation is: Bobolon, the stock code is 002776, and the issuance price is RMB 23.29 per share, with an issue volume of 26.22 million shares. The issue price is RMB 23.29 per share, and the issue volume reaches 26.22 million shares.

4.2. Brief Description of Disclosure Breaches

On 30 January 2021, Bobaolon released its earnings announcement, indicating for the first time that the company had suffered a massive loss. The day after the announcement, i.e. 1 February 2021, the SZSE issued a letter of concern to Bobaolon, requesting an explanation of the reasons for the loss and a description of its own operation. 5 February 2021, Guangdong Bobaolon Co., Ltd. issued its first announcement on the postponement of the reply to the SZSE’s inquiry letter, and shortly thereafter issued its second postponement of the reply announcement. 6 March 2021, Guangdong Bobaolon Co., Ltd. issued a reply announcement and firmly stated that its financial data were completely accurate. On 6 March 2021, Guangdong Bobaolon Co., Ltd. issued a reply announcement and also firmly stated in the announcement that the company’s financial data was completely accurate.

On 19 March 2021, Guangdong Bobaolon Co., Ltd. released an announcement that it had received a Notice of Investigation from the CSRC on 18 March, and was under investigation by the CSRC for suspected information disclosure violations.

On 19 April 2022, Guangdong Bobaolon Co., Ltd. received the “Decision on Administrative Penalty” ([2022] No. 18) and “Decision on Market Ban” ([2022] No. 6) issued by the CSRC. It was found that Bobaolon had the following illegal facts: first, Bobaolon’s initial public offering prospectus, 2016 non-public offering of shares in the issuance of quotations; and secondly, Bobaolon failed to disclose information as it should be in its annual reports for the years 2017 Secondly, in the annual reports from 2017 to 2019, Bergeron failed to truthfully disclose the items in the statement of “other non-current assets”, and in the annual report of 2018, Bergeron failed to truthfully disclose the use of fund-raising funds; thirdly, from 2018 to 2020, Bergeron failed to fulfil the approval procedures and information disclosure obligations for external guarantees. The SFC made the relevant disciplinary decisions based on the facts, nature, circumstances and degree of social harm of the parties’ violations and in accordance with the provisions of Article 197(2) of the Securities Law.

On 5 May 2022 Bobaolon was disclosed to be ST due to its inability to disclose its 2021 annual report within the statutory deadline.

5. Consequence Analysis of Information Disclosure Violations by Listed Companies

5.1. Analyses of Stock Price Changes Using Event Study Methodology

This paper mainly uses the event study method to investigate the stock price changes before and after Guangdong Bobaolon Co., Ltd. receives the formal disciplinary action for information disclosure violation from the Shenzhen Stock Exchange (SZSE).

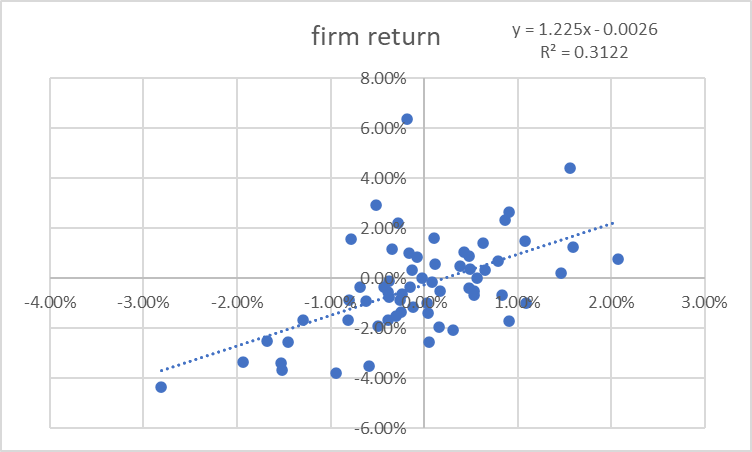

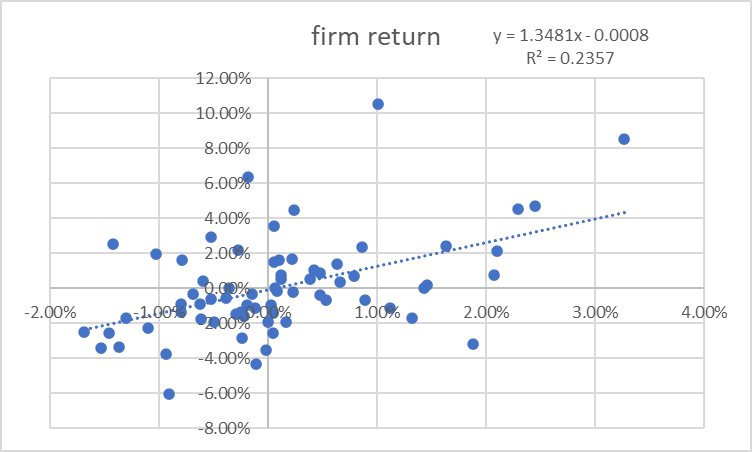

This article uses a market model to anticipate the expected return of Guangdong Bobaolon Co., Ltd., where Ri, t denotes the actual return of the stock, and (αi+βiRm,t) denotes the expected return determined by the excess return αi, the market-based risk βi, and the market return Rm, t. The abnormal return (AR) can be expressed as ARi, t = Ri, t - (αi+βiRm, t). In the article, the AMAC Textile and Apparel Index is selected as the actual return while focusing on the dates of two events, i.e., 1 February 2021 and 19 March 2021, and the event windows of 25 January 2021 to 8 February 2021, a total of 11 trading days are selected and 16 March 2021 to 24 March 2021, a total of 7 trading days are selected, respectively; 12 October 2020 to 8 January 2021 and 19 November 2020 to 4 March 2021 were selected as estimation windows, respectively, and scatter plots were generated from EXCEL as Figure 1 and Figure 2, respectively:

Figure 1: Scatterplot of Individual Stock Returns versus Market Returns I.

Figure 2: Scatterplot of Individual Stock Returns versus Market Returns II.

The parametric equations for the final market model are derived as shown in Table 1:

Table 1: Data related to Events I & II.

Event | Estimation window | Parametric equations | α | β |

Guangdong Bobaolon Co., Ltd. received a letter of concern from the Shenzhen Stock Exchange (Event I) | 2020-10-12 to 2021-1-8 | y=1.225x-0.0026 | -0.0026 | 1.225 |

Guangdong Bobaolon Co., Ltd. under investigation by CSRC for suspected information disclosure violations (Envent II) | 2020-11-19 to 2021-3-4 | y=1.3481x-0.0008 | -0.0008 | 1.3481 |

From the value of β, the daily return Ri,t of Guangdong Bobaolon Co., Ltd. and the market return Rm,t both show positive correlation, and it can be concluded that the trend of *ST Guangdong Bobaolon Co., Ltd.’s share price changes in these two periods of time has a certain degree of correlation with the trend of the whole market’s share price changes.

Based on the above parametric equations, the expected rate of return ARi,t of Guangdong Bobaolon Co., Ltd. during the time window can be calculated respectively, and then the difference between the actual rate of return and the normal rate of return and the abnormal rate of return can be calculated, and the cumulative abnormal rate of return can be obtained after adding up over many days.

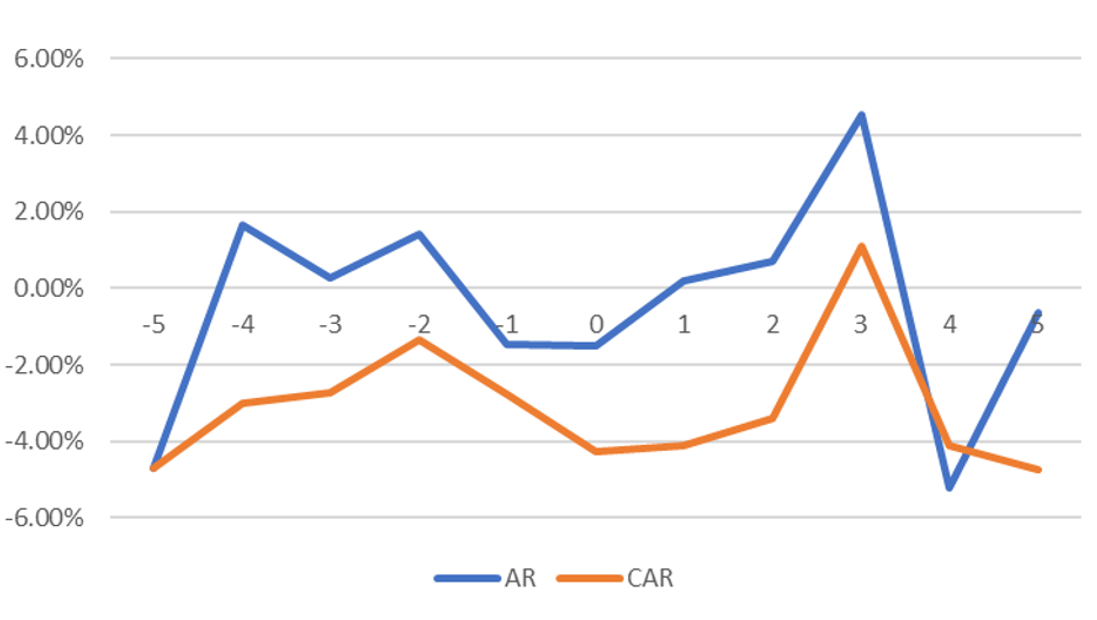

The expected return, abnormal return, and cumulative abnormal return for Event I based on the event window period are shown in Table 2, Figure 3:

Table 2: Excess Returns Form I.

Date | Dealing Day | Expected Return % | Abnormal Return % | Cumulative Abnormal Return % |

2021-2-8 | 5 | -1.61% | -0.64% | -4.74% |

2021-2-5 | 4 | 2.04% | -5.21% | -4.09% |

2021-2-4 | 3 | -2.00% | 4.53% | 1.12% |

2021-2-3 | 2 | -0.69% | 0.69% | -3.41% |

2021-2-2 | 1 | -0.18% | 0.18% | -4.10% |

2021-2-1 | 0 | 1.50% | -1.50% | -4.28% |

2021-1-29 | -1 | -1.94% | -1.45% | -2.78% |

2021-1-28 | -2 | -0.98% | 1.41% | -1.34% |

2021-1-27 | -3 | -0.90% | 0.28% | -2.75% |

2021-1-26 | -4 | 0.01% | 1.67% | -3.02% |

2021-1-25 | -5 | -1.37% | -4.69% | -4.69% |

Figure 3: Excess Returns Line Chart I.

Table 2 and Figure 3 show that from 1 February to 4 February 2021, i.e., within four days when Guangdong Bobaolon Co., Ltd. received the letter of concern from the Shenzhen Stock Exchange and did not reply, the company’s actual rate of return was better than the expected rate of return; however, on 5 February, when Guangdong Bobaolon Co., Ltd. firstly announced the delay in replying to the letter of concern, the share price on that day plummeted compared to the expected rate of return, and made the cumulative abnormal rate of return, which had been positive, fall to negative, and the situation improved a little on the following day. day the situation improved slightly. The impact of a listed company receiving a relatively mild and less severe letter on the change in share price volatility is smaller and shorter in duration compared to a serious situation such as being subject to a filing or disciplinary action. If the company makes an action with some hesitation or delay during this period, it may have a more severe negative impact on the stock on that day. However, the receipt of the letter may also have a lasting impact on the subsequent company’s share price, which may make investors suspicious of the company’s financial status and make the company’s subsequent share price less relevant to the relevant domestic index in the long term.

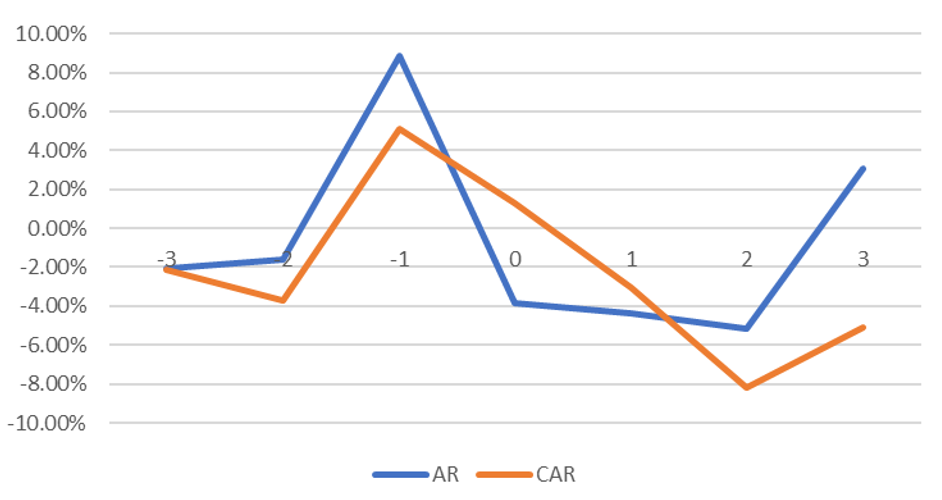

The expected return, abnormal return, and cumulative abnormal return for Event I based on the event window period are shown in Table 3, Figure 4:

Table 3: Excess Returns Form II.

Date | Dealing Day | Expected Return % | Abnormal Return % | Cumulative Abnormal Return % |

2021-3-24 | 3 | -0.25% | 3.06% | -5.12% |

2021-3-23 | 2 | -2.00% | -5.14% | -8.18% |

2021-3-22 | 1 | 2.40% | -4.34% | -3.04% |

2021-3-19 | 0 | -0.48% | -3.81% | 1.30% |

2021-3-18 | -1 | 1.40% | 8.84% | 5.11% |

2021-3-17 | -2 | 0.08% | -1.63% | -3.73% |

2021-3-16 | -3 | 3.40% | -2.10% | -2.10% |

Figure 4: Excess Returns Line Chart I.

As can be seen from Table 3 and Figure 4, although the stock volatility of Guangdong Bobaolon Co., Ltd. before the event is somewhat different from the overall market’s stock change volatility, on the day of the event as well as the two days after the event, the daily stock abnormal return is negative, and compared to the company’s expected return, both of them are large gaps, which also leads to the cumulative abnormal benefit ratio, which was originally positive, to fall from a positive value to a negative value , and increasing. However, on the third day after the occurrence of the event, the abnormal rate of return of Guangdong Bobaolon Co., Ltd. became positive, and the cumulative abnormal rate of return also narrowed as a result, indicating that the company’s share price situation has turned for the better.

For listed companies with certain fluctuations in share price in the previous period, the information disclosure violation incident may make investors who were originally in a wait-and-see state become skeptical and not easily invest in the company, thus causing the company’s own share price to suffer a certain impact, resulting in a large negative abnormal rate of return, which will last for a period of time. However, after a period of time, the company’s share price may change for the better as a result of the company’s cooperation in resolving the issue, active disclosure, and good public relations.

5.2. Analysis of Changes in Financial Performance

This paper examines the annual financial statements of Guangdong Bobaolon Co., Ltd. from 2019 to 2022 and collects selected data to analyse the financial performance of *ST Guangdong Bobaolon Co., Ltd. before and after the event from two perspectives.

Table 4: The Annual Financial Statements Debt Solvency Data for 2019 to 2022.

2022-12-31 | 2021-12-31 | 2020-12-31 | 2019-12-31 | |

Current Ratio | 0.142 | 0.656 | 2.08 | 2.818 |

Quick Ratio | 0.111 | 0.618 | 2.013 | 2.747 |

Asset-liability Ratio | 225.604 | 86.616 | 37.787 | 29.028 |

Firstly, from the analysis of the company’s solvency, it can be seen that although from 2019 to 2022, the company’s current ratio and quick ratio are decreasing year by year, but in 2021, the value plummets to less than 1, indicating that the company’s short-term solvency is sharply weakened in this year; while the company’s balance sheet ratio, although also increasing year by year, the growth in 2021 becomes bigger, and 2022 It also increases sharply in 2021 and 2022, indicating that the long-term solvency of the company becomes significantly weaker in 2021 and beyond. The solvency of enterprises will indeed decline to a certain extent under the influence of information disclosure violations, and scandals of concealment disclosure and false disclosure of corporate financial information will not only fail to change the fact that listed companies are in poor financial condition, but also lose the trust of investors.

Table 5: The Annual Financial Statements Profitability Data for 2019 to 2022 (Unit: $10,000).

2022-12-31 | 2021-12-31 | 2020-12-31 | 2019-12-31 | |

Total Profit | -76478.97 | -152964.23 | -38332.89 | 13793.48 |

Income Tax | 5778.38 | 2587.5 | -6562.86 | 2015.99 |

Net Profit | -82257.35 | -155551.73 | -31770.03 | 11777.49 |

Total Asset | 52908.58 | 117574.36 | 275537.72 | 285064.8 |

Return on Total Assets(ROA) | -1155.47% | -132.30% | -11.53% | 4.13% |

Owners’ Equity | -66455.41 | 15736.11 | 171421.06 | 205199.69 |

Equity Multiplier | 7.471628 | 1.6073738 | 1.3892068 | |

Equity Net Profit(ROE) | -988.50% | -18.53% | 5.74% |

Secondly, from the level of profitability of listed companies, according to the formula, calculate the total return on assets, and ROA, in order to measure the overall profitability of enterprises using all assets. It can be seen that from 2019 to 2022 the ROA of the enterprise is decreasing year by year, and in 2020 it has become negative, indicating that the enterprise’s ability to generate revenue from total assets in 2020 is already low, and from 2020 to 2021, the ROA value is even sharply reduced to less than negative 100 per cent, indicating that disclosure of irregularities may have a greater negative impact on the enterprise’s ability to generate revenue from total assets. negative impact. Since the negative value of Bobaolon’s ownership interest in 2022, i.e., the situation of “insolvency”, so it is not included in the discussion. According to the formula, equity multiplier and net equity ROE are calculated to reflect the profitability of invested capital. The results in Table 5 show that Bobaolon’s equity multiplier increases year by year, and increases abruptly in FY2021; ROE decreases year by year, and decreases abruptly in FY2021. This shows that the company’s riskiness is increasing year by year, while the return for shareholders is decreasing year by year. However, the disclosure violations that occurred in Bobaolon during this period of time have led to a serious amplification of the originally relatively small changes in the company’s profitability, which may cause the company to fall into a crisis in its subsequent operation and development.

5.3. Analysis of Changes in the Quality of Disclosure

The information disclosure appraisal results of Guangdong Bobaolon Co.,Ltd. on the Shenzhen Stock Exchange were B grade in 2015-2018, downgraded to C grade in 2019, and D grade in both 2020 and 2021. Although the information disclosure rating for 2022 is still not available, it can still be seen that the quality of Bobaolon ‘s disclosure is declining.

On 31 May 2022 Bobaolon was filed by CSRC for allegedly failing to disclose its annual report on time. In the second half of 2022, Bobaolon relatively actively disclosed part of the information about penalties, use of proceeds, etc., and the frequency of information disclosure improved compared to the first half of the year.

However, on 9 April 2023, the auditing intermediary of Guangdong Bobaolon Co.,Ltd., received an annual report inquiry letter from the Shenzhen Stock Exchange, and Bobaolon disclosed an announcement on the postponement of the response to the inquiry letter of the Shenzhen Stock Exchange three times on 19 May, 26 May and 2 June respectively, and applied to the Shenzhen Stock Exchange to apply for an extension to 9 June 2023 to disclose the content of the reply.

On the evening of 8 June, Bobaolon disclosed an announcement on abnormal stock trading volatility. At the same time, the company has an internal control audit report with negative opinion for the latest year, and according to the relevant regulations, the company’s shares will be superimposed with other risk warnings. The Company’s shares have been put on “delisting risk warning” since 4 May 2023.

It seems that the quality of information disclosure of Guangdong Bobaolon Co.,Ltd. has not been improved significantly because of the previous sanctions, and basically, it is a large number of disclosures that should have been disclosed in a timely manner after the warning from the relevant authorities, but the quality of information disclosure will still decline in the long term. The high mobility of the senior staff of *ST Parklane and the company’s long-term mode of operation may be the cause of this phenomenon. However, this also reflects the fact that subsequent proactive, complete and positive disclosure of information by most listed companies that have experienced disclosure violations is still a major challenge that requires supervision and management by the relevant agencies.

5.4. Analysis of Changes in Analysts’ Evaluations

Guangdong Bobaolon Co.,Ltd. is followed by a large number of analysts in 2020 and before, and most of the analysts have rated it as “Cautious Recommendation” based on its unique “by design” operating model. However, due to a series of disclosure violations, the number of analysts tracking Bobaolon has decreased significantly in 2021 and beyond.

6. Discussion and Suggestions on Response Measures to Information Disclosure Violations of Listed Companies

6.1. Establishment of Correct Awareness of Information Disclosure

Internal directors and employees should establish correct awareness of information disclosure, and proactively and honestly carry out the company’s information disclosure work. At the same time, the company’s internal corporate culture should also consider the content of information disclosure, improve and reshape. Accept guidance with an open mind and strictly control the process of information disclosure.

6.2. Clarify the New Standard of Information Disclosure

Listed companies should familiarise themselves with the relevant legal provisions on information disclosure, fulfil their obligations under the new Securities Law, and clarify and familiarise themselves with the new standards of information disclosure. It should make true, accurate, complete, timely and fair information disclosure without concealment or detour, in accordance with the process, compliance and legality. At the same time, listed companies should also combine the requirements of disclosure standards within the relevant industry for disclosure, rather than borrowing professional terminology, professional indicators, etc., to deceive investors.

6.3. Proactively Accept the Supervision and Correct Errors in a Timely Manner

China Securities Regulatory Commission (CSRC) and relevant exchanges should improve the relevant systems and regulations according to the current information disclosure status of listed companies, so as to improve the information disclosure environment and promote the sustainable development of the market. At the same time, listed companies should actively accept the supervision of the relevant platforms, respond to enquiry letters in good faith, disclose information within the prescribed time, admit their own omissions and errors, and correct them in a timely manner.

7. Conclusion

Information disclosure violations by listed companies will affect the company’s own rights and interests, causing abnormal fluctuations in the company’s share price within a certain period of time, and reducing the company’s performance; at the same time, such behaviour also infringes on the rights and interests of investors. Despite the impact of disclosure violations on the company’s operations, some companies are still unable to proactively carry out qualified disclosure, and may even receive a letter of enquiry from the Exchange or disciplinary action from the SFC after a certain period of time for such disclosure violations. Therefore, in order to promote the sustainable development of the market and encourage listed companies to make qualified disclosures, the listed companies should reshape their corporate culture, so that leaders and employees can establish a correct awareness of disclosure, and also carefully interpret the relevant laws and regulations to make clear the new disclosure standards; and also take the initiative to accept the supervision of the relevant platforms, so that they can make up for the omissions and rectify the mistakes in a timely manner.

The research in this paper only analyses the impact of the information disclosure violation incident of Guangdong Bobaolon Co.,Ltd. on 19 March 2021 on the company itself, but does not completely and accurately exclude the impact of other factors on the company’s operation and development during this period, and the accuracy of the relevant assessment indexes also needs to be improved. At the same time, the methods proposed at the end of this paper for listed companies to cope with disclosure violations need to be improved from more perspectives.

References

[1]. Bijalwan, J. G., Madan, P. (2014). Corporate governance practices, transparency and performance of Indian companies. IUP Journal of Corporate Governance, 12(3), 45–79.

[2]. Huang, Z., Wu, G.P. (2014) The Effect of Information Transparency on Capital Allocation Efficiency Empirical Evidence from Listed Companies in China’s Manufacturing Industry. The Theory and Practice of Finance and Economics, 5, 40-45.

[3]. Luan, C. J., Tien, C. (2020). The roots of corporate transparency: A mediated moderation model to predict foreign institutional investment. Emerging Markets Finance and Trade, 56(5), 1024–1042.

[4]. Albu, O. B., Flyverbom, M. (2019). Organizational transparency: Conceptualizations, conditions, and consequences. Business & Society, 58(2), 268–297.

[5]. Han, H. L., Chen, S. D., Chen, X. W., (2020). The Luckin Coffee’s Incident and the Crisis of Chinese Stocks - Basic Triggers, Regulatory Reactions and Expectation Gap. Finance and Accounting Monthly, 18, 3-8.

[6]. Xiao, Y., Jiang, S., Liu, S. (2023). Discussion on the Regulation and Governance of Information Disclosure of Listed Companies--Taking Brilliance Group as an Example. China Market, 1138(03), 37-39.

[7]. Xu, J., Tan, Z. L., Su, J. L. (2023). Research on the Classification and Supervision of Information Disclosure of Listed Companies. Statistics and Decision, 39(13), 172-176.

[8]. Hou, X. D. (2023). Theoretical Traceability and Implementation of Information Disclosure System. Journal of Sichuan College of Administration, 140(02), 5-16+101.

[9]. Liu, Q. L. (2023). Problems and Countermeasures of Internal Control Information Disclosure of Listed Companies. Market Modernization, 982(01), 60-63.

[10]. Xu, Z. Y., Pang, Y. W., Zhang, S.L. (2023). Does Digital Transformation Improve the Quality of Disclosure of Listed Companies?. Journal of Nanjing Audit University, 20(2), 33-42.

Cite this article

Ju,P. (2024). Impact of Disclosure Violations on Information of Listed Companies -- Taking Guangdong Bobaolon Co., Ltd. as an Example. Advances in Economics, Management and Political Sciences,57,166-177.

Data availability

The datasets used and/or analyzed during the current study will be available from the authors upon reasonable request.

Disclaimer/Publisher's Note

The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of EWA Publishing and/or the editor(s). EWA Publishing and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content.

About volume

Volume title: Proceedings of the 2nd International Conference on Financial Technology and Business Analysis

© 2024 by the author(s). Licensee EWA Publishing, Oxford, UK. This article is an open access article distributed under the terms and

conditions of the Creative Commons Attribution (CC BY) license. Authors who

publish this series agree to the following terms:

1. Authors retain copyright and grant the series right of first publication with the work simultaneously licensed under a Creative Commons

Attribution License that allows others to share the work with an acknowledgment of the work's authorship and initial publication in this

series.

2. Authors are able to enter into separate, additional contractual arrangements for the non-exclusive distribution of the series's published

version of the work (e.g., post it to an institutional repository or publish it in a book), with an acknowledgment of its initial

publication in this series.

3. Authors are permitted and encouraged to post their work online (e.g., in institutional repositories or on their website) prior to and

during the submission process, as it can lead to productive exchanges, as well as earlier and greater citation of published work (See

Open access policy for details).

References

[1]. Bijalwan, J. G., Madan, P. (2014). Corporate governance practices, transparency and performance of Indian companies. IUP Journal of Corporate Governance, 12(3), 45–79.

[2]. Huang, Z., Wu, G.P. (2014) The Effect of Information Transparency on Capital Allocation Efficiency Empirical Evidence from Listed Companies in China’s Manufacturing Industry. The Theory and Practice of Finance and Economics, 5, 40-45.

[3]. Luan, C. J., Tien, C. (2020). The roots of corporate transparency: A mediated moderation model to predict foreign institutional investment. Emerging Markets Finance and Trade, 56(5), 1024–1042.

[4]. Albu, O. B., Flyverbom, M. (2019). Organizational transparency: Conceptualizations, conditions, and consequences. Business & Society, 58(2), 268–297.

[5]. Han, H. L., Chen, S. D., Chen, X. W., (2020). The Luckin Coffee’s Incident and the Crisis of Chinese Stocks - Basic Triggers, Regulatory Reactions and Expectation Gap. Finance and Accounting Monthly, 18, 3-8.

[6]. Xiao, Y., Jiang, S., Liu, S. (2023). Discussion on the Regulation and Governance of Information Disclosure of Listed Companies--Taking Brilliance Group as an Example. China Market, 1138(03), 37-39.

[7]. Xu, J., Tan, Z. L., Su, J. L. (2023). Research on the Classification and Supervision of Information Disclosure of Listed Companies. Statistics and Decision, 39(13), 172-176.

[8]. Hou, X. D. (2023). Theoretical Traceability and Implementation of Information Disclosure System. Journal of Sichuan College of Administration, 140(02), 5-16+101.

[9]. Liu, Q. L. (2023). Problems and Countermeasures of Internal Control Information Disclosure of Listed Companies. Market Modernization, 982(01), 60-63.

[10]. Xu, Z. Y., Pang, Y. W., Zhang, S.L. (2023). Does Digital Transformation Improve the Quality of Disclosure of Listed Companies?. Journal of Nanjing Audit University, 20(2), 33-42.