1. Introduction

1.1. Overview

This article aims to elucidate the multiple variables that contribute to gender differences in financial inclusion in the United States. It dives into the complex interaction of structural, institutional, and cultural barriers that prevent women from having equal access to various financial services and products. This study also investigates the critical role of financial education and empowerment activities in closing these disparities and building a more inclusive financial landscape. It is impossible to stress the importance of tackling gender inequities in financial inclusion. Women's economic empowerment has been seen as a driver for more considerable societal improvement. As women acquire access to financial resources, there is the possibility of a cascading effect that affects many elements of their well-being. For example, improved child health and education results contribute to stronger future generations. Furthermore, such empowerment may spur communal development, resulting in a more egalitarian and prosperous society.

The United States has the potential to reap significant economic and social gains by concentrating on gender equality in financial participation. This initiative not only adheres to fairness and justice ideas, but it also adheres to economic rationality. Financial empowerment for women may boost economic development, inspire innovation, and boost overall productivity. In an era where social growth depends on inclusive practices, tackling gender inequities in financial inclusion is a critical step toward a more equitable and prosperous future.

1.2. Background of Gender Disparities in Financial Inclusion

Gender differences in financial inclusion are being recognized as a severe concern in the United States. Despite the country's position as an economic powerhouse and worldwide leader in technical developments, a deeper look finds continuing inequities that prevent women from having equal access to financial services and opportunities. Women have always faced institutional impediments that have hindered their financial inclusion [1, 2]. Wage discrepancies, occupational segregation, and a lack of participation in leadership roles have all led to income and wealth accumulation inequities. These inequities result in uneven access to financial goods, loans, and investment possibilities. Institutional issues, such as discriminatory lending policies and women's underrepresentation in the financial industry, have exacerbated these inequities.

Cultural norms and societal expectations can significantly impact women's financial participation. Women are frequently placed in caregiving tasks under traditional gender roles and obligations, which can impede their capacity to participate in the workforce and make financial decisions fully [3]. Furthermore, cultural perceptions of women's economic competence and risk tolerance may impact their access to credit and investing opportunities. Gender gaps in financial inclusion have far-reaching repercussions. These gaps not only limit women's economic possibilities and financial stability, but they also have far-reaching consequences for families, communities, and the economy. According to the article, financial empowerment for women can boost economic resilience, reduce poverty, and improve overall social well-being.

In recent years, efforts to rectify these inequities have gained traction. Gender equality in financial services and products is becoming increasingly important to organizations, politicians, and financial institutions [4]. To address the hurdles to women's financial inclusion, initiatives focused on promoting financial literacy, extending credit availability, and supporting women's entrepreneurship have been established. Given the complexities and interconnectedness of these discrepancies, the purpose of this study is to provide a complete examination of the numerous variables leading to gender gaps in financial inclusion in the United States. This article aims to offer successful policies and interventions that can lead to a more inclusive and equitable economic landscape for everyone by giving light on the complex interaction of structural, institutional, and cultural processes.

1.3. Significance of the Issue in the USA

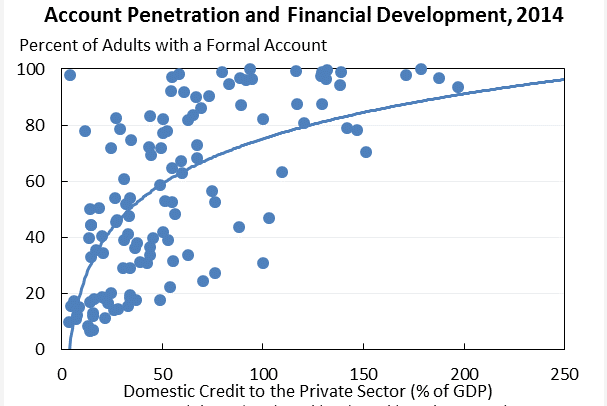

The problem of gender gaps in financial inclusion has essential economic and social repercussions for the United States. As shown in Figure 1. Despite the country's prominence as a worldwide financial center, a closer look uncovers a worrying reality: a significant gender disparity in access to financial services and resources continues. This disparity not only violates the concepts of equality and justice but also impedes individual and community advancement and well-being. Women's exclusion from financial services inhibits their ability to amass money, make educated investment decisions, and safeguard their financial destiny [5]. As a result, economic inequality persists, and the gender pay gap widens. Access to credit and loans for women limits their capacity to establish enterprises, invest in education, and pursue entrepreneurial ventures, impeding economic development and creativity. The lack of comprehensive financial education designed specifically for women exacerbates these issues, prohibiting them from fully participating in the financial world.

Figure 1: Account penetration and financial development, 2014 [6].

Source: Demirgüç-Kunt & Klapper [7].

Gender gaps in financial involvement significantly influence family dynamics, child development, and overall community welfare. When women are economically disadvantaged, the entire family unit suffers, limiting access to adequate healthcare, education, and housing [8]. As a result, cycles of poverty and social inequity are perpetuated. Furthermore, women's empowerment is connected to higher health and education results for children, which benefits future generations.

Addressing gender inequities in financial inclusion is a question of social fairness and economic need. Equal access for women to financial services and resources can contribute to more equitable economic growth, higher household savings, and improved community development. As the United States strives to strengthen its position as a global leader, it must address and remove barriers to women's financial inclusion, using the full potential of its diverse population to create long-term and fair growth.

2. The Landscape of Financial Inclusion

2.1. Importance of Equal Access to Financial Services

Equal access to financial services is critical for individuals and communities alike since it is critical in stimulating economic growth, eliminating inequality, and promoting social progress. Financial inclusion enables individuals, particularly women, to actively engage in economic activities, make educated financial decisions, and guarantee their financial well-being [9]. Individuals, regardless of gender, are better able to save, invest, and plan for the future when they have access to a wide variety of financial services, such as banking, credit, insurance, and investment options. This not only improves their financial resilience but also helps to maintain general economic stability. Furthermore, fair access to financial services can improve underprivileged populations by closing the financial divide between the financially excluded and the financially empowered.

Gender equality and women's empowerment are also impacted by financial inclusion. Women are more likely to engage in income-generating activities, entrepreneurship, and wealth-building when they have equal access to financial resources. This increases their economic independence and decision-making authority within homes and communities. Increased financial inclusion can also contribute to better health, education, and well-being outcomes for women and their families, ending intergenerational poverty. A more accessible financial system has more significant societal advantages beyond the individual level. It promotes economic growth by directing resources toward productive investments and entrepreneurial initiatives, providing jobs, and encouraging innovation. Furthermore, financial inclusion fosters establishing a resilient and flexible financial system capable of mitigating economic shocks and promoting long-term stability.

2.2. Current States of Financial Inclusion in the USA

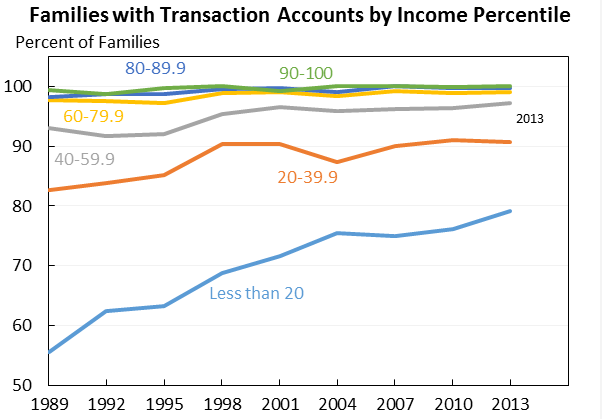

While significant progress has been achieved in increasing financial services and products in the United States, discrepancies in financial inclusion exist, notably along gender lines. As shown in Figure 2. Despite having a sophisticated economy, a significant segment of the population is nonetheless neglected or excluded from mainstream economic activity. According to recent article, there is a gender gap in financial inclusion, with women having particular barriers to obtaining and utilizing financial services. Women are more likely than males to be unbanked or underbanked, which means they have restricted access to fundamental banking services like savings accounts and credit. This disparity is due to various variables, including income discrepancies, caregiving obligations, and historical inequities.

Figure 2: Families with transaction accounts by income percentile [10].

Source: Federal Reserve Board survey of consumer finances (triennally, 1989-2013) [7].

Furthermore, the digital gap exacerbates gender differences in financial inclusion. Women, particularly those in underprivileged groups, may face challenges owing to inadequate digital literacy and access to technology as the financial sector increasingly relies on digital platforms for transactions and services. This divide inhibits them from fully using Internet banking, smartphone payments, and other digital financial technologies. Various programs focused on improving financial literacy, expanding access to inexpensive banking choices, and pushing for legislation that supports women's economic empowerment have been launched to address these gaps. To address the various obstacles that contribute to gender gaps in financial inclusion, a comprehensive strategy is necessary.

3. Unveiling Gender Disparities

3.1. Gender-Based Barriers and Challenges

3.1.1. The Wage Gap and Income Inequality

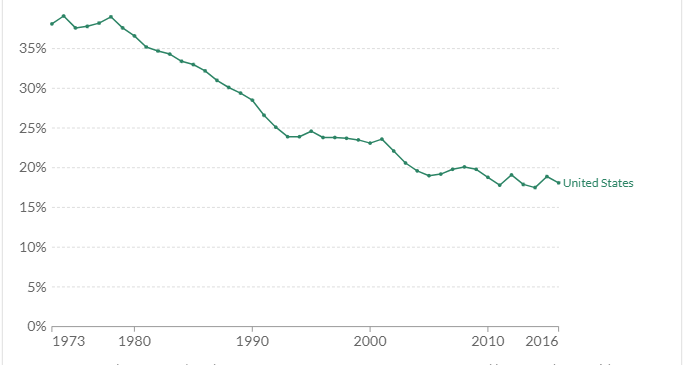

The ongoing pay gap and income inequality are important factors leading to gender differences in financial participation. As shown in Figure 3. Women continue to earn less than males for comparable positions, which directly influences their financial capacities. Women's lower incomes make it difficult to save, invest, and engage in long-term financial planning. The pay disparity is especially prominent among women of color, deepening the economic inequality and limiting their access to numerous financial services. Without proper income, women frequently have insufficient means to fully engage in the financial system, creating a cycle of economic disadvantage.

Figure 3: Gender wage gap in United States [8].

Source: OECD, gender wage gap (2017).

3.1.2. Limited Access to Credit Loans

Women typically face barriers to credit and loans, which are vital components of financial inclusion. Financial companies may implement demanding criteria, such as requiring higher credit ratings or collateral, that disproportionately harm women. Furthermore, a lack of credit history due to limited access to financial goods might make it difficult for them to get loans for education, entrepreneurship, or homeownership. This lack of credit limits women's economic options and reinforces gender-based financial inequality. Bridging this gap will necessitate rethinking lending policies and developing gender-sensitive lending criteria considering various financial conditions.

3.1.3. Lack of Financial Education and Awareness

Another critical issue is a lack of comprehensive financial education and awareness geared to the requirements of women. Many women may lack access to essential financial knowledge and skills to make educated decisions about saving, investing, and debt management. This information gap can result in inadequate financial choices, exposure to predatory financial products, and a general aversion to engaging with the formal financial system. Effective financial education programs should provide women with practical skills and a solid grasp of economic principles, allowing them to navigate the complicated financial world effectively.

3.2. Statistics Highlighting Gender Disparities in Financial Inclusion

Gender differences in financial inclusion are strikingly represented in various data indicators, emphasizing the critical need for proactive actions to correct these discrepancies.

1. Income disparities: According to the United States Census Bureau, women earn 82 cents for every dollar males earn. This salary disparity impacts women's current financial well-being and their capacity to save and invest for the future.

2. Limited Credit Access: According to a World Bank survey, just 58% of women in the United States have access to credit, compared to 67% of males. This disparity results from several variables, including poorer credit ratings, fewer collateral possibilities, and gender prejudices in lending procedures.

Figure 4: Comparison of limited credit access among men and women [3].

Source: Demirgüç-Kunt, Klapper, Singer & Van Oudheusden [10].

3. Savings Disparities: According to the National Institute on Retirement Security, women are 80% more likely than males to be destitute at 65 and beyond. This is partly due to reduced lifetime earnings and interrupted jobs, which result in insufficient retirement savings and increasing financial risk.

4. Investment Participation: According to a Sallie Mae article, males are more likely than women to participate in the stock market (55% vs. 41%). This investment gap can potentially influence wealth growth and long-term financial security.As shown in Figure 4.

5. Financial Literacy Gap: According to the Global Financial Literacy Excellence Center, women have lower levels of financial literacy than males, with just 18% of women deemed financially competent compared to 32% of men.

6. Entrepreneurship Difficulties: According to the U.S. Small Business Administration, women-owned enterprises experience difficulties getting money, with female entrepreneurs receiving only a quarter of venture capital investment as their male counterparts.

4. Factors Influencing the Disparities

4.1. Structural and Systematic Factors

Gender differences in financial inclusion are frequently the result of structural and systemic issues that result in uneven opportunities and outcomes. Women have historically been excluded in economic institutions, resulting in unequal distribution of wealth and power. Income gaps are exacerbated by occupational segregation, in which women are concentrated in lower-paying industries. Furthermore, family commitments and caregiver responsibilities might hinder women's capacity to work full-time or pursue entrepreneurial endeavors. To address these discrepancies, structural impediments must be removed, legislation promoting equal pay and parental leave must be advocated for, and social norms that perpetuate gender-based economic inequities must be challenged.

4.2. Institutional Biases and Practices

Gender gaps in financial inclusion are exacerbated further by institutional prejudices and practices inside financial organizations. Gender bias in lending choices can lead to women receiving less favorable credit conditions or being rejected for loans entirely [6]. Economic goods and services are frequently constructed without considering women's specific requirements and preferences, which contributes to reduced involvement and limited access. Furthermore, male-dominated leadership in financial institutions may result in a lack of diversity in decision-making processes, marginalizing women's economic issues further. To overcome these prejudices, gender-sensitive policies must be implemented, financial professionals must be trained, and diversity in leadership roles must be promoted.

4.3. Cultural and Societal Norms

Cultural and societal norms heavily influence gender differences in financial inclusion. Women's employment choices might be affected by traditional gender roles and expectations, restricting their access to higher-paying professions. Due to cultural conventions, women may be discouraged from actively participating in financial decision-making or exploring investing possibilities. Women's careers and economic freedom may suffer due to societal expectations of them as primary carers. To overcome these discrepancies, it is critical to question and modify harmful cultural norms, promote gender equality in education and workforce participation, and empower women to take charge of their financial futures.

5. Implications of Gender Disparities

5.1. Impact on Women's Economic Empowerment

Women's economic empowerment is hampered by gender gaps in financial inclusion, which impede their capacity to attain financial independence and upward mobility. Women's ability to create income and develop wealth is hampered by unequal access to credit, savings, and investment possibilities. This reinforces poverty cycles and stops them from reaching their full economic potential as engaged participants. Bridging these gaps is critical for promoting women's economic agency, allowing them to make educated financial decisions, invest in their education and skills, and engage in economic activities more meaningfully.

5.2. Consequences of Individual Financial Stability

Gender differences in financial inclusion have a direct impact on women's financial stability. Women are exposed to unexpected bills, crises, and economic shocks because they have limited access to financial services. They may turn to informal or exploitative borrowing techniques if they do not have appropriate savings or credit, aggravating their economic vulnerability. This might result in a lack of long-term financial planning and an increasing dependency on others for financial assistance. Closing the gender gap in financial inclusion is critical for improving women's capacity to weather economic storms, build resilience, and achieve a more secure financial future.

5.3. Societal and Economic Ramifications

Gender gaps in financial inclusion have far-reaching consequences that influence entire societies and economies not just individual women. When women confront financial inclusion restrictions, their ability to contribute to economic growth and development is limited. According to the article, improving women's access to financial services can positively affect household welfare, education, and healthcare results. By closing the gender gap in financial inclusion, society may tap into women's full human capital potential, promote sustainable economic development, and reduce poverty rates. Furthermore, greater gender equality in financial participation builds social cohesiveness and prepares the path for a more inclusive and just society.

6. Implications of Gender Disparities

6.1. Impact on Women's Economic Empowerment

Gender differences hamper women's economic empowerment in financial inclusion. Their capacity to attain financial independence and engage in education or enterprise is limited due to insufficient financial resources and opportunities. Empowering women may make educated financial decisions that benefit their families and communities.

6.2. Consequences for Individual Financial Stability

Women are financially vulnerable due to gender inequities since they lack access to official services and suitable savings choices. This might result in informal or exploitative borrowing, creating debt cycles. Financial illiteracy exacerbates these issues, making it difficult for women to prepare for the future and protect their financial stability.

6.3. Societal and Economic Ramifications

Gender gaps in financial inclusion influence overall economic growth. Increased access to financial services helps women by encouraging entrepreneurship and innovation. Gender-equal financial inclusion fosters social cohesiveness, lowers inequities, and creates a more equitable society, enabling long-term economic growth and prosperity.

7. Initiatives and Solutions

7.1. Financial Education and Empowerment Programs

Financial education activities are critical in closing gender gaps [11]. These programs encourage women to make educated financial decisions by teaching them about budgeting, saving, and investing. Workshops, seminars, and online tools may help women manage the complicated financial landscape and improve their economic well-being.

7.2. Role of Policy and Legislation

To overcome gender inequities in financial inclusion, effective policies, and regulations are required. Governments can impose restrictions encouraging equitable access to financial services, such as prohibiting discriminatory lending practices. Mandating the gathering of gender-disaggregated data can also show inequities, resulting in targeted interventions and informed policy choices.

7.3. Efforts by Financial Institutions to Promote Inclusivity

Financial institutions may contribute to increased inclusion by developing goods and services targeted to women's requirements. Offering flexible loan terms, fewer collateral requirements, and low-fee savings accounts can improve women's access to credit and savings. Furthermore, developing a gender-inclusive work culture inside these organizations can improve customer service and more excellent knowledge of women's financial choices and problems.

8. Success Stories and Best Practices

8.1. Highlighting Examples of Organizations Addressing Gender Disparities

In the United States, organizations such as Accion and the Women's Institute for Financial Education (WIFE) provide financial literacy seminars for women, boosting their awareness of money management and investing. The Association for Women's Business Centers (AWBC) assists female entrepreneurs in obtaining finance and business possibilities.

8.2. Demonstrating Positive Outcomes and Impact

According to an article conducted by the Global Banking Alliance for Women (GBA), gender-inclusive financial services can lead to higher savings and investment, hence helping to women's economic empowerment. Initiatives such as the Women-Owned Small Business Government Contracting Program have increased the involvement of women-owned firms in government contracts, significantly improving financial stability and growth. These examples show the possibility of focused measures to reduce gender inequities in economic participation in the United States.

9. Navigating the Way Forward

9.1. Call to Action for Policymakers, Financial Institutions and Society

Policymakers must adopt and implement gender-sensitive rules that encourage equitable access to financial services to alleviate gender inequities in financial inclusion in the United States. Financial institutions should provide inclusive goods and services that address women's specific requirements and preferences. Women's financial knowledge, entrepreneurship, and leadership must be encouraged. Collaboration among these parties is critical to breaking down existing obstacles and creating a more egalitarian economic landscape.

9.2. Importance of Collective Efforts in Achieving Gender Equality in Financial Inclusion

Gender equality in financial inclusion necessitates a concerted and coordinated effort. Working together, governments, financial institutions, and society may create an environment in which women have equal access to financial resources and economic security as men. Gender gaps restrict not just women's potential but also general economic growth and development. Recognizing the significance of different viewpoints and contributions, society can tap into women's latent potential to generate innovation, entrepreneurship, and long-term economic growth. By working together, the United States can set the path for a more inclusive and prosperous future.

10. Conclusion

Addressing gender inequities in financial inclusion is not just an issue of social fairness but also an essential step toward economic development and prosperity in the United States. Women face uneven access to financial services and opportunities due to the complex interaction of structural, institutional, and cultural constraints. These gaps have far-reaching consequences for women's economic empowerment, individual financial stability, and broader societal and economic well-being. To address the gender gap in financial inclusion, efforts must be multifaceted. Financial education and empowerment programs targeting their specific needs can improve women's financial literacy and decision-making abilities. Discriminatory practices should be eliminated, and policies and regulations should promote fair access to financial services. Financial institutions are critical in providing gender-sensitive goods and services that address women's different financial requirements.

Organizational success stories demonstrating good outcomes demonstrate the potential influence of gender-inclusive finance efforts. Collaboration among politicians, financial institutions, and society is critical for breaking down current obstacles and establishing a more inclusive financial landscape. The United States can harness the latent potential of women, encourage innovation, and create sustainable economic growth by recognizing the value of joint efforts and gender equality. Bridging the gender gap in financial inclusion is a moral necessity and a strategic investment that will result in a more fair and prosperous future for people, families, communities, and the nation as a whole.

References

[1]. Mndolwa, F.D. and Alhassan, A.L. (2020) Gender Disparities in Financial Inclusion: Insights from Tanzania. African Development Review, 32, 578-590.

[2]. Were, M., Odongo, M. and Israel, C. (2021) Gender Disparities in Financial Inclusion in Tanzania. WIDER Working Paper.

[3]. Ibourk, A. and Elouaourti, Z. (2023) Revitalizing Women's Labor Force Participation in North Africa: An Exploration of Novel Empowerment Pathways. International Economic Journal, 1-23.

[4]. Perekrestova, V. (2021) Women’s Empowerment Through Social Entrepreneurship and Impact Investing in Myanmar. Contemporary Issues in Sustainable Finance: Financial Products and Financial Institutions, 221-245.

[5]. Roy, P. and Patro, B. (2022) Financial Inclusion of Women and Gender Gap in Access to Finance: A Systematic Literature Review. Vision, 26, 282-299.

[6]. Cozarenco, A. and Szafarz, A. (2018) Gender Biases in Bank Lending: Lessons from Microcredit in France. Journal of Business Ethics, 147, 631-650.

[7]. Board of Governors of the Federal Reserve System. (2022). Survey of Consumer Finances (SCF). Retrieved from https://www.federalreserve.gov/econres/scfindex.htm

[8]. Demirgüç-Kunt, A. and Singer, D. (2017) Financial Inclusion and Inclusive Growth: A Review of Recent Empirical Evidence. World Bank Policy Research Working Paper, 8040.

[9]. Ofosu‐Mensah Ababio, J., Attah‐Botchwey, E., Osei‐Assibey, E. and Barnor, C. (2021) Financial Inclusion and Human Development in Frontier Countries. International Journal of Finance & Economics, 26, 42-59.

[10]. Demirgüç-Kunt, A., Klapper, L.F., Singer, D. and Van Oudheusden, P. (2015) The Global Findex Database 2014: Measuring Financial Inclusion around the World. World Bank Policy Research Working Paper, 7255.

[11]. Longobardi, S., Pagliuca, M.M. and Regoli, A. (2018) Can Problem-solving Attitudes Explain the Gender Gap in Financial Literacy? Evidence from Italian Students’ Data. Quality & Quantity, 52, 1677-1705.

Cite this article

Li,R. (2023). Gender Disparities in Financial Inclusion in United States. Advances in Economics, Management and Political Sciences,58,102-112.

Data availability

The datasets used and/or analyzed during the current study will be available from the authors upon reasonable request.

Disclaimer/Publisher's Note

The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of EWA Publishing and/or the editor(s). EWA Publishing and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content.

About volume

Volume title: Proceedings of the 2nd International Conference on Financial Technology and Business Analysis

© 2024 by the author(s). Licensee EWA Publishing, Oxford, UK. This article is an open access article distributed under the terms and

conditions of the Creative Commons Attribution (CC BY) license. Authors who

publish this series agree to the following terms:

1. Authors retain copyright and grant the series right of first publication with the work simultaneously licensed under a Creative Commons

Attribution License that allows others to share the work with an acknowledgment of the work's authorship and initial publication in this

series.

2. Authors are able to enter into separate, additional contractual arrangements for the non-exclusive distribution of the series's published

version of the work (e.g., post it to an institutional repository or publish it in a book), with an acknowledgment of its initial

publication in this series.

3. Authors are permitted and encouraged to post their work online (e.g., in institutional repositories or on their website) prior to and

during the submission process, as it can lead to productive exchanges, as well as earlier and greater citation of published work (See

Open access policy for details).

References

[1]. Mndolwa, F.D. and Alhassan, A.L. (2020) Gender Disparities in Financial Inclusion: Insights from Tanzania. African Development Review, 32, 578-590.

[2]. Were, M., Odongo, M. and Israel, C. (2021) Gender Disparities in Financial Inclusion in Tanzania. WIDER Working Paper.

[3]. Ibourk, A. and Elouaourti, Z. (2023) Revitalizing Women's Labor Force Participation in North Africa: An Exploration of Novel Empowerment Pathways. International Economic Journal, 1-23.

[4]. Perekrestova, V. (2021) Women’s Empowerment Through Social Entrepreneurship and Impact Investing in Myanmar. Contemporary Issues in Sustainable Finance: Financial Products and Financial Institutions, 221-245.

[5]. Roy, P. and Patro, B. (2022) Financial Inclusion of Women and Gender Gap in Access to Finance: A Systematic Literature Review. Vision, 26, 282-299.

[6]. Cozarenco, A. and Szafarz, A. (2018) Gender Biases in Bank Lending: Lessons from Microcredit in France. Journal of Business Ethics, 147, 631-650.

[7]. Board of Governors of the Federal Reserve System. (2022). Survey of Consumer Finances (SCF). Retrieved from https://www.federalreserve.gov/econres/scfindex.htm

[8]. Demirgüç-Kunt, A. and Singer, D. (2017) Financial Inclusion and Inclusive Growth: A Review of Recent Empirical Evidence. World Bank Policy Research Working Paper, 8040.

[9]. Ofosu‐Mensah Ababio, J., Attah‐Botchwey, E., Osei‐Assibey, E. and Barnor, C. (2021) Financial Inclusion and Human Development in Frontier Countries. International Journal of Finance & Economics, 26, 42-59.

[10]. Demirgüç-Kunt, A., Klapper, L.F., Singer, D. and Van Oudheusden, P. (2015) The Global Findex Database 2014: Measuring Financial Inclusion around the World. World Bank Policy Research Working Paper, 7255.

[11]. Longobardi, S., Pagliuca, M.M. and Regoli, A. (2018) Can Problem-solving Attitudes Explain the Gender Gap in Financial Literacy? Evidence from Italian Students’ Data. Quality & Quantity, 52, 1677-1705.